PakAlumni Worldwide: The Global Social Network

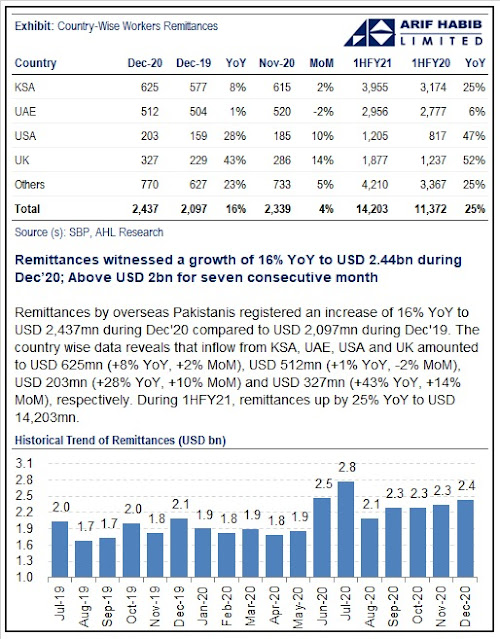

Pakistani diaspora sent home $14.2 billion in remittances in July-December 2020, up 25% from the same period in 2019. Pakistanis settled in the United Kingdom and the United States increased their remittances by 52% and 47% respectively in this period, helping Pakistan achieve a record $1.8 billion current account surplus in the first 6 months of the ongoing fiscal year 2020-21.

|

| Remittances From Pakistani Diaspora. Source: Arif Habib |

While Pakistan's exports increased a modest 5.1%, the remittances from overseas Pakistanis jumped a hefty 25% in response to an appeal by Prime Minister Imran Khan who remains very popular among them. He drew nearly 30,000 Pakistani-Americans to a rally during his Washington D.C. visit in 2019.

|

| Pakistan Trade 1H of FY 2020-21. Source: Arif Habib |

Pakistan's imports increased 5.5%, more than the 5.1% increase in exports, during the first half of the current fiscal year 2020-21. This resulted in $12.4 billion trade deficit, a 5.9% increase. Without the 25% jump in remittances, Pakistan would most likely have a current account deficit rather than a surplus in this period.

The modest 5.1% increase in Pakistan's exports is still commendable in the midst of the global economic devastation caused by COVID19 pandemic. What is even more commendable is the 19% jump in exports in December 2020 over the same month in 2019, indicating a strong upward trend.

|

|

|

Pakistani diaspora is the world's 5th largest with more than half a million Pakistanis migrating every year to work overseas. Over 11 million Pakistanis have left home for employment in Europe, America, Middle East and elsewhere since 1971, according to Pakistan Bureau of Emigration. The pace has particularly picked up over the last 10 years. This phenomenon has helped reduce unemployment in a country where about 2 million young people are entering the job market each year. It has also helped remittances soar nearly 28X since the year 2000.

Related Links:

Haq's Musings

South Asia Investor Review

Pakistan is the 7th Largest Source of Migrants in OECD Nations

Pakistanis Mini-Invasion of China

Inspirational Story of Karachi Rickshaw Driver's Daughters

Pakistan Remittance Soar 21X

Pakistan's Growing Human Capital

Two Million Pakistanis Entering Job Market Every Year

Pakistan Most Urbanized in South Asia

Hindu Population Growth Rate in Pakistan

Do South Asian Slums Offer Hope?

Riaz Haq

Despite COVID-19, remittance flows remained resilient in 2020, registering a smaller decline than previously projected. Officially recorded remittance flows to low- and middle-income countries reached $540 billion in 2020, just 1.6 percent below the 2019 total of $548 billion, according to the latest Migration and Development Brief.

https://www.worldbank.org/en/news/press-release/2021/05/12/defying-...

https://www.knomad.org/publication/migration-and-development-brief-34

------------------

Inward remittance flows to South Asia rose by about 5.2 percent in 2020 to $147 billion, driven by surge in flows to Bangladesh and Pakistan. In India, the region’s largest recipient country by far, remittances fell by just 0.2 percent in 2020, with much of the decline due to a 17 percent drop in remittances from the United Arab Emirates, which offset resilient flows from the United States and other host countries. In Pakistan, remittances rose by about 17 percent, with the biggest growth coming from Saudi Arabia followed by the European Union countries and the United Arab Emirates. In Bangladesh, remittances also showed a brisk uptick in 2020 (18.4 percent), and Sri Lanka witnessed remittance growth of 5.8 percent. In contrast, remittances to Nepal fell by about 2 percent, reflecting a 17 percent decline in the first quarter of 2020. For 2021, it is projected that remittances to the region will slow slightly to 3.5 percent due to a moderation of growth in high-income economies and a further expected drop in migration to the GCC countries. Remittance costs: The average cost of sending $200 to the region stood at 4.9 percent in the fourth quarter of 2020, the lowest among all the regions. Some of the lowest-cost corridors, originating in the GCC countries and Singapore, had costs below the SDG target of 3 percent owing to high volumes, competitive markets, and deployment of technology. But costs are well over 10 percent in the highest-cost corridors.

May 16, 2021

Riaz Haq

Remittances in March rise to $2.5bn — highest since August 2022

Analysts attribute monthly increase in the remittances to the Ramadan factor

https://www.thenews.com.pk/latest/1059219-remittances-in-march-rise...

Remittances sent by overseas Pakistani workers, a major source of foreign exchange, rose to a seven-month high of $2.5 billion in March 2023 — an encouraging sign for the cash-strapped country.

The State Bank of Pakistan (SBP), in its monthly bulletin, on Monday stated that the inflow of workers’ remittances was 27% higher compared to the prior month of February; however, it was 11% lower compared to March 2022.

Arif Habib Limited Head of Research Tahir Abbas told TheNews.com.pk that the monthly increase in the remittances is due to the Ramadan factor which usually fetches higher flows due to family commitments, welfare, charity etc.

"The flows in the upcoming months are expected to remain elevated due to another Eid [Eid ul Adha] falling by the end of this fiscal year," he maintained.

Historical trends suggested that overseas Pakistanis sent record-high remittances ahead of Eid festivals every year.

Moreover, inflows remained comparatively high as non-resident Pakistanis used legal channels to send funds to their family members due to the shrinking gap between rates in the interbank and open market.

Samiullah Tariq, head of research at Pakistan-Kuwait Investment Company, termed the increase a “good omen”, elaborating that the difference between the kerb and interbank rates was minimal.

“Remittances number is highest for past seven months; however, this year Ramadan has started earlier which is why remittance inflow increased earlier than last year,” he explained.

The Ministry of Finance has projected that the remittances will “further improve due to positive seasonal and Ramadan factor”.

Meanwhile, the central bank stated that with the cumulative inflow of $20.5 billion during the first nine months of the fiscal year 2022-23, the remittances decreased by 10.8% as compared to the same period last year.

It should also be noted that with remittances widely surpassing the Pakistan Bureau of Statistics (PBS) trade deficit data this month, the possibility of a current account surplus has increased to a great extent.

It should be noted that the SBP trade deficit data point is usually even lower than the PBS trade deficit.

In its monthly outlook report, the Ministry of Finance also mentioned that the current account deficit is likely to remain on the lower side keeping in view the economic factors contributing to the numbers.

Country-wise data

Pakistanis residing in Saudi Arabia remitted the largest amount of $563.9 million in March. However, it was 24.04% lower than the $454.6 million received in February.

Expatriates in the UAE sent home 25.52% more amount as receipts increased from $406.7 million to $324 million.

Remittances from overseas Pakistanis in the UK increased 33.12% to $422 million. They sent $317 million in February.

Moreover, remittances from other Gulf Cooperation Council (GCC) countries decreased by 10.33% to $297.6 million and a 21.72% increase was recorded in inflows from European countries, which clocked in at $298.6 million in the month under review compared to February.

Apr 13, 2023

Riaz Haq

Country’s brain drain situation accelerated in 2022

Official documents showed more than 765,000 educated youth leave country for employment overseas

https://tribune.com.pk/story/2390704/countrys-brain-drain-situation...

According to the official documents from the Bureau of Emigrants, this year 765,000 young people went abroad. The documents also showed that the number of emigrants had risen after registering a fall in two consecutive years, following 625,000 emigrations in 2019.

According to the documents, those who left the country in 2022, included more than 92,000 graduates, 350,000 trained workers and the same number of untrained labourers went abroad. The documents also showed that 736,000 people went to the Gulf states.

The emigrating educated youth included 5,534 engineers, 18,000 associate electrical engineers, 2,500 doctors, 2,000 computer experts, 6,500 accountants, 2,600 agricultural experts, over 900 teachers, 12,000 computer operators, 1,600 nurses and 21,517 technicians. The group of unskilled workers comprised 213,000 drivers.

According to the data, over 730,000 youth went to the Gulf States, nearly 40,000 went to European and other Asian countries. The country-wise break down of the data showed 470,000 Pakistanis headed to Saudi Arabia for employment, 119,000 to UAE, 77,000 to Oman, 51,634 to Qatar and 2,000 to Kuwait.

Also, according to the official documents, 2,000 Pakistanis went to Iraq, 5,000 to Malaysia, 602 to China, 815 to Japan, and 136 to Turkey. The documents also revealed that 478 Pakistan went to Sudan in Africa in search of employment.

The highest number of people emigrating to a European country was 3,160 youth, going to Romania. It was followed by 2,500 to Great Britain, 677 to Spain, 566 to Germany, 497 to Greece, and 292 to Italy. The Bureau of Emigrants also registered 700 people going to the United States.

More than half of those leaving the country were from Punjab. The documents said 424,000 emigrants this year were from Punjab, 206,000 from Khyber-Pakhtunkhwa plus 38,000 from newly-merged tribal districts, 54,000 from Sindh, 27,000 from Azad Kashmir, 7,000 from Balochistan and 6,000 from Islamabad.

Jun 19, 2023