PakAlumni Worldwide: The Global Social Network

Hundreds of Pakistanis and Pakistani-Americans attended Pakistan Tech Summit 2020 at Draper University in San Mateo, California on February 15, 2020. It was organized by Arzish Azam of Ejad Labs with sponsorships from JS Bank, Netsol, VisionX, Pakistan IT ministry, Pakistan National IT Board and Pakistan Software Exports Board. This event came after a recent report in Germany's Deutsche Welle (DW) by Miriam Partington who wrote in a story titled "Pakistan: The next big Asian market for tech startups?" that "Pakistan's young and tech-savvy population, market of over 220 million people and increasing levels of local capital are creating opportunities for tech entrepreneurs".

Pakistan Tech Summit:

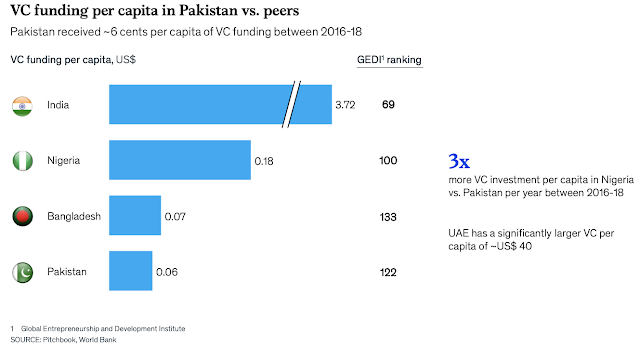

At this conference, I was really encouraged by the presence of many young Pakistan entrepreneurs eager to realize the vision of Digital Pakistan. Enthusiasm is necessary but not sufficient. What is missing is serious attention to attract more risk capital to support these young enthusiastic entrepreneurs. Unfortunately, I did not see any known Silicon Valley venture capitalists (VC) at the event. Recent McKinsey report on Pakistani startup ecosystem noted that per capita venture capital is just 6 cents, lower than 7 cents in Bangladesh and only a third of 18 cents in Nigeria. What Pakistan needs is a venture capital initiative along with digitization initiative.

Founders or cofounders of several Pakistani startups pitched their companies hoping to attract venture investors. Among the attendees were many young enthusiastic techies.

Najeeb Ghauri, Chairman of Netsol Technologies, made a pitch that focused on the opportunities presented to investors by Pakistan's growing young enthusiastic talent pool and large aspirational middle class population. JS Bank's Noman Azhar talked about his bank's fund that invests in Pakistani startups taking advantage of the government's Digital Pakistan Initiative. An example of their investment is e-challan systems in Islamabad and Peshawar.

Morning keynote speaker was Farrukh Mahboob of VisionX which offers custom-built digital products and mobile applications for businesses. Their digital solutions are tailored to clients’ needs and are powered by emerging technologies including artificial intelligence (AI), augmented and virtual reality (AR, VR). VisionX clients includes Fortune 500 companies.

A number of startup pitches followed. Founders or co-founders of DontPort, Integry, Kumlaudi, SafePay, JoyCo and Social Pie pitched their ideas.

Examples of VC Funded Startups:

McKinsey report "Starting up: Unlocking entrepreneurship in Pakistan" has cited Daraz, Zameen, PakWheels, Tez Financial, Patari, AugmentCare and Sastaticket. Monis Rahman, CEO of Rozee.pk, says this is an incomplete list. He personally knows about funds raised by the following companies that are missing from the McKinsey list:

Rozee.pk -- $9 Million across 3 rounds

Finja -- $4.5 Million seed + bridge (working on $15 Million round)

Airlift -- $12 Million Series A (working on $20 Million round)

Lack of Venture Capital:

It was great to see many young Pakistan entrepreneurs eager to realize the vision of Digital Pakistan. Enthusiasm is necessary but not sufficient. What is missing is an enabling environment for startups to attract more risk capital to support these young enthusiastic entrepreneurs. Unfortunately, I did not see any known Silicon Valley venture capitalists (VC) at the event. Recent McKinsey report on Pakistani startup ecosystem noted that per capita venture capital is just 6 cents, lower than 7 cents in Bangladesh and only a third of 18 cents in Nigeria. India's level of per capita is at $3.72 and UAE's $40 per capita VC investment is more than 10X India's.

Need For Venture Investment Initiative:

Pakistan needs to have a venture capital initiative to ensure that Pakistani startups fully participate in Digital Pakistan Initiative. Part of the venture capital initiative should create legal and policy framework to protect investors and facilitate their exit strategies. Pakistan government should invite venture capitalists and offer to participate as a significant investor in professionally VC funds that invest in Pakistani startups. Experienced Pakistani VCs and entrepreneurs like Asad Jamal and Monis Rahman can be used as a resource to establish this venture investment initiative.

Summary:

Recent "Pakistan Tech Summit 2020" at Draper University in San Francisco Bay Area attracted dozens of enthusiastic tech savvy young men and women ready with their startup pitches. It confirmed what Deutsche Welle's Miriam Partington recently reported in a story titled "Pakistan: The next big Asian market for tech startups?" in which she wrote: "Pakistan's young and tech-savvy population, market of over 220 million people and increasing levels of local capital are creating opportunities for tech entrepreneurs". Unfortunately, I did not see any known Silicon Valley venture capitalists (VC) at the event. Recent McKinsey report on Pakistani startup ecosystem noted that per capita venture capital is just 6 cents, lower than 7 cents in Bangladesh and only a third of 18 cents in Nigeria. India's level of per capita is at $3.72 and UAE's $40 per capita VC investment is more than 10X India's. Pakistan needs to have a venture capital initiative to ensure that Pakistani startups fully participate in Digital Pakistan Initiative. Part of the venture capital initiative should create legal and policy framework to protect investors and facilitate their exit strategies. Pakistan government should invite venture capitalists and offer to participate as a significant investor in professionally managed VC funds that invest in Pakistani startups. Experienced Pakistani VCs and entrepreneurs like Asad Jamal and Monis Rahman can be used as a resource to establish this venture investment initiative.

Related Links:

Pakistani-American VC Asad Jamal Invested Early in Baidu

Pakistani Students Win First Place in Stanford Design Contest

Pakistanis Win AI Family Challenge in Silicon Valley

Pakistani Gamer Wins ESPN E-sports Player of the Year Award

Pakistan's Expected Demographic Dividend

Pakistan's Research Output Growing Fastest in the World

AI Research at NED University Funded By Silicon Valley NEDians

Pakistan Hi-Tech Exports Exceed A Billion US Dollars in 2018

Rising College Enrollment in Pakistan

Pakistani Universities Listed Among Asia's Top 500 Jump From 16 to 23 in One Year

Pakistani Students Win Genetic Engineering Competition

Human Capital Growth in Pakistan

Riaz Haq

Digital technologies are set to transform the way people live and work in Pakistan. As we saw in the GSMA 2020 Digital Societies Report, which tracks the progress of 11 focus countries in Asia Pacific, Pakistan is advancing its societal, economic and digital ambition, as outlined in Digital Pakistan Vision. Indeed, our report’s digital society index tracked Pakistan in achieving one of the highest increases in its overall score.

https://dailytimes.com.pk/798868/pakistans-digital-transformation-2/

A whole of government approach in Pakistan creates the start of a predictable investment and flexible regulatory environment. These measures, needed to achieve the goals of Digital Pakistan, include tax reforms as well as efforts to implement Right-of-Way (RoW) infrastructure policies. The success of these efforts will be measured by their implementation, along with the growth they support in the future.

Implementing tax reforms for industry growth and infrastructure policy Pakistan recently approved tax reforms that will stimulate mobile industry growth. These include gradually reducing Advance Income Tax from 12.5% to 10% in the next financial bill (FY2021-22); further reducing to 8% in the 2022-23 Finance Bill; approval of harmonization /uniform rate of taxes on telecom service; withdrawal of SIM issue tax; simplification of and exemptions for withholding tax to ease doing business; reduction of minimum tax for telecom services from 8 to 3%.

In order to fully realise the benefits of these tax recommendations, the Financial Bill (FY 2021-22) must be enacted into law. Similarly, we recommend policy makers implement Right of Way (RoW)and other policies that impact the infrastructure supporting digital and mobile access. Recently, a significant milestone was reached when policy makers in Pakistan approved, for the first time, RoW infrastructure policy. We commend this move and urge that these policies are implemented quickly. As technology evolves, unforeseen challenges can arise that may not have occurred to policy makers during their inception.

Spectrum roadmap and digital inclusion

Along with these crucial policies and regulatory modernisation initiatives, there are additional steps needed as Pakistan continues to build itself into a digital society. In particular, the development and implementation of a five-to-seven-year spectrum roadmap. Spectrum is the foundation for mobile services. Sufficient spectrum allows mobile networks to reach even more citizens in Pakistan and offer a better quality of service.

Digital Pakistan also includes digital inclusion as one of its policy objectives. Currently, it has a 54% mobile broadband usage gap , as defined by people who live within the footprint of a mobile broadband network but do not use mobile internet. A spectrum roadmap provides stability and certainty as it helps to create a more investment-friendly environment for mobile operators looking to build 5G and 4G mobile networks.

Industry and government stakeholders

A holistic, whole-of-Government approach speeds digitization and the adoption of new technologies in a more efficient manner. By removing barriers caused by siloed efforts from different ministries, Pakistan could more efficiently harness the capabilities of its existing 4G networks, while preparing for 5G. Another key piece in the digitization effort will be the solicitation of input from industry stakeholders. A transparent consultation process that offers parties the ability to submit thoughtful input has the potential to lead to an enabling regulatory framework primed for new technologies.

Jul 30, 2021

Riaz Haq

Pakistan’s Airlift raises $85 million for its quick commerce startup, eyes international expansion

https://techcrunch.com/2021/08/17/pakistans-airlift-raises-85-milli...

A one-year-old startup that is attempting to build the railroads for e-commerce in Pakistan has just secured a mega round of funding in a major boost to the South Asia nation’s nascent startup ecosystem.

Airlift operates a quick commerce service in eight cities including Lahore, Karachi, and Islamabad in Pakistan. Users can order groceries, fresh produce, other essential items including medicines as well as sports goods from Airlift website or app and have it delivered to them in 30 minutes.

The startup said on Wednesday that it has raised $85 million in its Series B financing round at a valuation of $275 million. Harry Stebbings of 20VC and Josh Buckley of Buckley Ventures co-led the financing round, which is by far the largest for a Pakistani startup.

Sam Altman, former president of Y Combinator, Biz Stone, co-founder of Twitter and Medium, Steve Pagliuca, co-chairman of Bain Capital, Jeffrey Katzenberg, ex-chief executive of Disney and Quibi, and Taavet Hinrikus, founder and chief executive of TransferWise also participated in the new round, which brings the startup’s to-date raise to $110 million.

Stanley Tang, co-founder of DoorDash, Simon Borrero, founder and chief executive of Rappi, Baastian Lehman, founder and chief executive of Postmates, Quiet Capital and Indus Valley Capital also participated in the new round.

Airlift started as a transit business, building a service similar to Uber for air conditioned-buses in Pakistan. The startup quick amassed traction, clocking over 35,000 rides a day. And then the pandemic arrived, disrupting all mobility in the country.

That’s when Usman Gul, the founder and chief executive of Airlift, took the call to pivot to quick commerce, he told TechCrunch in an interview.

“This entire space of quick commerce is on the brink of global transformation. Airlift is in the forefront for leading that transformation in Asia and Africa,” he said. Gul said he plans to expand the service to many international markets in the next few months.

“Airlift’s early traction in Pakistan is a window into the future for how quick commerce will play out in the developing world,” said Altman in a statement.

Airlift today operates over 30 dark stores and processes hundreds of thousands of orders each month.

Gul said the startup has found that setting up these fulfillment centers is the most efficient way to serve the market. “The more middlemen you introduce in this chain between the items and the customers, you begin to compromise the experience,” he said.

Within the first twelve months of launch, Airlift has been able to reduce its cost of blended customer acquisition to $5 and unit costs to $2.50, it said.

Gul said the startup, which today employs over 100 people, plans to expand to more categories including electronics. “The idea is to expand to new categories and build the railroads to move consumer goods from manufacturers to consumers,” said Gul.

He left his job at DoorDash and moved back to Pakistan to start Airlift. “The idea was to create impact at the base of the pyramid and solve problems that would enrich millions of lives — for whom change is desperately needed. That drove my transition frankly,” he said.

“Transparently, when I first met Usman, I knew this was an entrepreneur who was going to create an industry-defining company. Humble, ambitious and strategic, Usman will be one of the great founders of this generation,” said Stebbings in a statement.

Aug 18, 2021

Riaz Haq

#Karachi-based #startup Bazaar completes series A round. #Pakistan's B2B marketplace and digital ledger platform Bazaar has raised $30 million led by #SiliconValley-based early stage VC Defy Partners & #Singapore-based Wavemaker Partners. https://tcrn.ch/3j9oAyj via @techcrunch

A one-year-old startup that is building a business-to-business marketplace for merchants in Pakistan and also helping them digitize their bookkeeping is the latest to secure a mega round in the South Asian market.

Bazaar said on Tuesday it has raised $30 million in a Series A round. The new financing round — the largest Series A in Pakistan — was led by Silicon Valley-based early stage VC Defy Partners and Singapore-based Wavemaker Partners.

Scores of other investors including current and former leaders of Antler, Careem, Endeavor, Gumroad, LinkedIn and Notion as well as new investors Acrew Capital, Japan’s Saison Capital, UAE’s Zayn Capital and B&Y Venture Partners and existing investors Indus Valley Capital, Global Founders Capital, Next Billion Ventures, and Alter Global also participated in the new round.

One way to think about Bazaar is — especially if you have been following the Indian startup ecosystem — that it’s sort of a blend between Udaan and KhataBook. “That’s a good way to describe us,” said Hamza Jawaid, co-founder of Bazaar in an interview. “We had this benefit of hindsight to not just look at India but other emerging markets,” he said.

“We saw lots of synergies between these two. If you look at commerce, you have to acquire every single merchant in every single category differently. Whereas with Khata, merchants in any city and category can download it. So effectively, it’s a great customer acquisition tool for you,” he said on a WhatsApp call, adding that this also provides greater insight into businesses.

Bazaar’s business-to-business marketplace, which provides merchants with the ability to procure inventories at a standard price and choose from a much larger catalog, is currently available in Karachi and Lahore, the nation’s largest cities, while Easy Khata is live across the country.

At stake is a booming $170 billion retail market in the world’s fifth-most populous nation that is yet to see much deployment of technology, said Saad Jangda, Bazaar’s other co-founder. Both of them have known each other since childhood and reconnected in Dubai a few years ago. At the time, Jawaid was at McKinsey & Company while Jangda was working with Careem as a product manager for ride-hailing and food delivery products.

There are about 5 million micro, small, and medium-sized businesses in Pakistan. Like India, even as a significant portion of the population has come online, most merchants remain unconnected, said the founders, who surveyed shops going door-to-door.

“We’ve been investing in FMCG B2B marketplaces across the region since 2017. After working with Hamza and Saad over the past year, we’ve been impressed by their customer-centric approach to product development and the speed of their learning and execution,” said Paul Santos, Managing Partner at Wavemaker Partners, in a statement.

“It’s no surprise that they’ve received glowing reviews from their customers and partners. We’re excited to support Bazaar as they solidify their market leadership and digitize Pakistan’s retail ecosystem,” he added.

The startup said it has amassed over 750,000 merchants since launch last year. And it appears to have solved a problem that many of its South Asian peers are still grappling with: Retention. Bazaar said it has a 90% retention rate.

I asked Jangda if he plans to expand to the ‘dukaan’ category. Several startups in Asia are currently building tools to help merchants set up online presence and accept digital orders. He said the market is currently not ready for a dukaan product just yet. “The B2C market is still developing, so there is not so much demand from the consumer side yet,” he added.

Aug 24, 2021