PakAlumni Worldwide: The Global Social Network

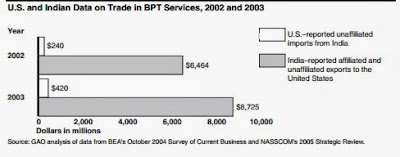

A 2005 study by US General Accounting Office (GAO) found that Indian government's figures for software and technology exports to the United States were 20 times higher than the US figures for import of the same from India.

U.S. General Accounting Office looked at the 2003 data showing the United States reported $420 million in unaffiliated imports of BPT (business, professional, and technical) services from India, while India reported approximately $8.7 billion in exports of affiliated and unaffiliated BPT services to the United States.

|

| US-India IT Trade Discrepancy Source: GAO |

The GAO found at least five definitional and methodological factors that contribute to the difference between U.S. and Indian data on BPT services. First, India and the United States follow different practices in accounting for the earnings of temporary Indian workers residing in the United States. Second, India defines certain services, such as software embedded on computer hardware, differently than the United States. Third, India and the United States follow different practices for counting sales by India to U.S.-owned firms located outside of the United States. The United States follows International Monetary Fund standards for each of these factors. Fourth, BEA (Bureau of Economic Analysis) does not report country-specific data for particular types of services due to concerns about the quality of responses it receives from firms when they allocate their affiliated imports to detailed types of services. As a result, U.S. data on BPT services include only unaffiliated imports from India, while Indian data include both affiliated and unaffiliated exports. Fifth, other differences, such as identifying all services importers, may also contribute to the data gap.

In theory, India follows what is known as BPM 6 (MSITS) reporting method for software and information-enabled technology services (ITES) which counts sales to all multinationals, earning of overseas offices, salaries of non-immigrant overseas workers as India's exports. In practice, India violates it. BPM 6 allows the salaries of first year of migrant workers to be included in a country's service exports. India continuously and cumulatively adds all the earnings of its migrants to US in its software exports. If 50,000 Indians migrate on H1B visas each year, and they each earn $50,000 a year, that's a $2.5 billion addition to their exports each year. Cumulatively over 10 years, this would be $25 billion in exports year after year and growing.

There has neither been any acknowledgement nor any correction of the Indian government's methodology for reporting software and IT services exports since the GAO report was published in 2005. This raises serious questions about the accuracy of India's claims of $60 billion to $70 billion IT software and service exports being currently reported. If the 20X exaggeration still persists, the Indian IT exports could be as little as $3 billion to $4 billion today based on the US methodology.

|

| Pakistan IT Exports BPM 5 Method Source: State Bank of Pakistan |

Unlike the Reserve Bank of India's claimed BPM 6 methodology, the State Bank of Pakistan uses a much more conservative BPM 5 reporting system which does not include sales to multinationals located in Pakistan and earning of overseas offices and salaries of non-immigrant Pakistani overseas workers in Pakistan's exports figures. If the State Bank switched to BPM 6 method, Pakistan's software and IT exports of $294 million for 2012-2013 could easily become at least $5 billion.

Related Links:

Haq's Musings

Pakistan Third Most Popular Among Outsourcing Countries

Upwardly Mobile Pakistan

Pakistan Among Top Outsourcing Destinations

Pakistan's IT Industry

Indian Code Coolies

Pakistan's Software Prodigy

Biotech and Genomics in Pakistan

India-Pakistan Comparison Update 2011

India and Pakistan Contrasted in 2010

Eating Grass-The Making of Pakistani Bomb

Educational Attainment Dataset By Robert Barro and Jong-Wha Lee

Quality of Higher Education in India and Pakistan

Developing Pakistan's Intellectual Capital

Intellectual Wealth of Nations

Pakistan's Story After 64 Years of Independence

Pakistan Ahead of India on Key Human Development Indices

Riaz Haq

India's Infosys tumbles 15% on downbeat revenue outlook

https://www.nasdaq.com/articles/indias-infosys-tumbles-15-on-downbe...

BENGALURU, April 17 (Reuters) - Infosys Ltd INFY.NS shares slumped nearly 15% on Monday and dragged stocks of peers, after the IT services exporter's dismal revenue outlook highlighted the impact of banking turmoil in major markets, the United States and Europe.

Infosys' outlook followed a disappointing quarterly report from larger rival Tata Consultancy Services TCS.NS, highlighting worries for the sector which earns more than 25% of its revenue from just the U.S. and European banking, financial, services and insurance sector.

The collapse of two mid-sized U.S. lenders in March had left the financial ecosystem shaken and driven an extraordinary government effort to reassure depositors and backstop the system.

Infosys saw its biggest intraday percentage drop since October 2019, and dragged other IT stocks, with the Nifty IT index .NIFTYIT dropping as much as 7.6%.

India's second-largest IT services firm on Thursday said it expects revenue growth of 4%-7% for the fiscal year ending March 2024, well below analysts' expectations of 10.7% growth, as clients deferred spending due to growing fears of a recession. The previous slowest growth was a 5.8% increase in fiscal 2018.

"Given the uncertain environment in the near term, growth can be back ended for Infosys, in our view," PhillipCapital said in a note.

The Bengaluru-based company's net profit of 61.28 billion rupees ($748.21 million) in the January-March quarter also missed analysts' expectations of 66.24 billion rupees, according to Refinitiv IBES.

Apr 17, 2023

Riaz Haq

In the high-stakes race for supremacy in the burgeoning field of generative AI, India’s technology ecosystem is facing an uphill battle to catch up to global leaders. Despite being home to one of the world’s largest startup ecosystems, the South Asian economy has yet to make a material impact in the rapidly advancing AI arena.

https://techcrunch.com/2023/05/03/where-is-india-in-the-generative-...

No homegrown Indian contenders have emerged to challenge the dominance of large language model titans such as OpenAI’s ChatGPT, Google Ventures–backed Anthropic, or Google’s Bard.

“While there are over 1500 AI-based startups in India with over $4 billion of funding, India is still losing the AI innovation battle,” say analysts at Sanford C. Bernstein.

To their credit, many of India’s major startups are using machine learning to enhance aspects of their business operations. For instance, e-commerce giant Flipkart uses machine learning to refine customer shopping experiences, while Razorpay utilizes AI to combat payment fraud. Unicorn edtech Vedantu recently integrated AI into its live classes, making them more accessible and affordable.

Industry insiders attribute India’s dearth of AI-first startups in part to a skills gap among the nation’s workforce. Now the advent of generative AI could displace many service jobs, analysts warn.

“Among its over 5 million employees, IT in India still has a high mix of low-end employees like BPO or system maintenance. While AI isn’t at the level of causing disruptions, the systems are improving rapidly,” Bernstein analysts said.

Dev Khare, a partner at Lightspeed Venture Partners India, recently assessed the disruptive potential of AI and warned that jobs and processes in industries such as market research, content production, legal analysis, financial analysis, and various IT services jobs could be impacted.

However, for India, this disruption also presents an opportunity. A rapid gain in agriculture sector, which employs over 40% of the country’s workforce, is challenging, and similarly automation in the manufacturing industry may be unnecessary due to the abundant and affordable labor force.

May 3, 2023

Riaz Haq

In the high-stakes race for supremacy in the burgeoning field of generative AI, India’s technology ecosystem is facing an uphill battle to catch up to global leaders. Despite being home to one of the world’s largest startup ecosystems, the South Asian economy has yet to make a material impact in the rapidly advancing AI arena.

https://techcrunch.com/2023/05/03/where-is-india-in-the-generative-...

With timely upskilling and resource optimization, the services sector stands to benefit the most. Indian consultancy giants are already recognizing it. Infosys, for example, revealed last month that it is working on several generative AI projects to address specific aspects of clients’ businesses. TCS, on the other hand, is exploring cross-industry solutions to automate code generation, content creation, copywriting, and marketing.

In response to this landscape, New Delhi has declared that India will not regulate the growth of AI, taking a different approach from many other countries.

“AI is a kinetic enabler of the digital economy and innovation ecosystem. Government is harnessing the potential of AI to provide personalized and interactive citizen-centric services through digital public platforms,” India’s Ministry of Electronics and IT said last month.

Glimmer of hope

With the more established segment of India’s startup ecosystem staying muted in the generative AI race, young firms are stepping up to the occasion.

Startups like Gan, which enables businesses to repurpose videos at scale; TrueFoundry, which assists in building ChatGPT with proprietary data; and Cube, which facilitates AI-powered customer support on social media, are among those leading the charge.

The surge of interest has prompted nearly all venture funds in India to develop investment strategies in the emerging space.

Anandamoy Roychowdhary, partner at Surge, Sequoia India & Southeast Asia, pushed back that Indian startups have just started to explore applications around generative AI, saying several have been working on this space for many years.

“What cannot be denied though is the spectacular pace of projects and startup creation post the launch of ChatGPT. The Sequoia India and SEA team have been early to this trend, having partnered with 7 to 8 AI companies across earlier Surge cohorts,” he told TechCrunch.

Sequoia India and SEA is evaluating at least five firms in this space each week, he said.

Accel, another high-profile venture firm that has been operating in India for over a decade, said Wednesday that AI is one of the two main themes across the new cohort of its early-stage venture program.

However, some founders expressed concerns that these AI startups are unlikely to focus on creating their own large language models due to the lack of funding and conviction from investors to support such high compute and other infrastructure expenses.

An investor, who requested anonymity to speak candidly, cautioned that the current frenzy around AI deals somewhat echoes aspects of the crypto craze in 2021.

“Everyone wants to do genAI but no one knows how/what to do. This is the crypto arms race all over again,” the person said. “I doubt most Indian VCs ever really dug deep and understood crypto, because otherwise they wouldn’t have made so many utterly crap investments.”

May 3, 2023