PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan Among Top 5 Countries to Discover Oil and Gas in 2017

Pakistan made two key oil and gas discoveries in the third quarter and another three discoveries in the fourth quarter of 2017. These discoveries may have prompted the US-based Exxon-Mobil to join off-shore drilling efforts in Pakistan. American energy giant's entry in Pakistan brings advanced deep sea drilling technology, its long experience in offshore exploration and production and its deep pockets to the country. US Energy Information Administration (EIA) estimates that Pakistan has technically recoverable deposits of 105 trillion cubic feet (TCF) of gas and 9.1 billion barrels of oil. Exxon-Mobil is expected to accelerate exploration and lead to more discoveries and increased domestic oil and gas production.

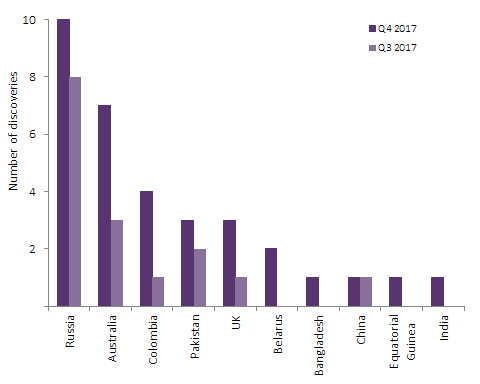

Top Countries Discovering Oil and Gas:

Russia led with 10 discoveries, followed by Australia with seven discoveries and Colombia with four discoveries. Pakistan and the UK each had three discoveries in the fourth quarter of 2017, according to Global Oil and Gas Discoveries Review.

In fourth quarter of 2017, the Former Soviet Union leads with 12 discoveries, followed by Asia with eight discoveries, and Oceania with seven discoveries. Europe and South America had five discoveries each, followed by North America with two discoveries, while the Middle East and Africa had one discovery each in the quarter, according to Offshore Technology website.

|

| Top 3 Offshore Drilling Sites in Asia-Pacific. Source: Bloomberg |

Exxon-Mobil's Entry in Pakistan:

American energy giant Exxon-Mobil has joined the offshore oil and gas exploration efforts started by Oil and Gas Development Corporation (OGDC), Pakistan Petroleum Limited (PPL) and Italian energy giant ENI, according to media reports.

Each company will have 25% stake in the joint venture under an agreement signed at the Prime Minister’s Secretariat in May among ExxonMobil, Government Holdings Private Limited (GHPL), PPL, ENI and OGDC.

Exxon-Mobile's entry in Pakistan brings deep offshore drilling technology, its long experience and financial resources to the country. It is expected to accelerate exploration and more discoveries.

Pakistan Oil Basins:

A Pakistan Basin Study conducted in 2009 found that the country has six onshore and two offshore basins; offshore basins being the Indus basin and the Makran basin in the Arabian Sea.

The Indus offshore basin is a rift basin that geologists say developed after the separation of the Indian Plate from Africa in the late Jurassic period. It is believed to be the second largest submarine fan system in the world after the Bay of Bengal with high probability of hydrocarbon discoveries.

The Makran Offshore basin is separated from the Indus Offshore basin by Murray ridge, according to Syed Mustafa Amjad's report in Dawn. It is an oceanic and continental crust subduction zone with deepwater trenches and volcanic activity. The basin consists of oceanic crust and periodic emergence of temporary mud islands along the coast suggesting strong evidence of large hydrocarbon deposits.

Pakistan Hydrocarbon Potential:

The United States Energy Information Administration (EIA) estimates that Pakistan has 586 TCF (trillion cubic feet) of gas in Pakistan of which 105 TCF is technically recoverable.

In addition to gas deposits, US EIA estimates there are 227 billion barrels of oil in Pakistan with 9.1 billion barrels being technically recoverable.

Pakistan also has 185 billion tons of coal deposits in Thar desert which are just beginning to be extracted by Sindh Engro Coal Mining Corporation.

Oil and Gas exploration and production companies are currently planning to drill 90 wells in different parts of the country. Under the plan, as many as 50 exploratory and 40 development wells would be drilled in a bid to make the country self-sufficient in the energy sector, according to media reports.

During the last five years, the sources said the exploration and production companies drilled 445 new wells, out of which 221 were exploratory, adding that the increased exploration activities resulted in 116 new oil and gas discoveries.

Current Account Deficits:

Energy imports make up a big chunk of Pakistan's total imports. Rising oil prices worsen the current account deficit and put pressure on Pakistan's reserves, forcing the country to seek periodic IMF bailouts.

Pakistan’s current account deficit has jumped by 50% to a record high of $14.03 billion in the first 10 months of the current fiscal year 2018, according to the State Bank of Pakistan. The country imported $12 billion worth of energy in 2017. The bill is likely to grow with increasing demand and rising prices in 2018.

Reducing energy imports by increasing domestic production will likely ease Pakistan's current account deficits and reduce its chances of going back to the IMF again and again.

Summary:

Pakistan made 2 key oil and gas discoveries in 3rd quarter and another 3 discoveries in the 4th quarter of 2017. These discoveries appear to have prompted US-based Exxon-Mobil to join off-shore drilling efforts in Pakistan. American energy giant's entry in Pakistan brings advanced deep sea drilling technology, its long experience in offshore exploration and financial resources to the country. It is expected to accelerate exploration and lead to more discoveries. US Energy Information Administration (EIA) estimates that Pakistan has technically recoverable deposits of 105 trillion cubic feet (TCF) of gas and 9.1 billion barrels of oil. Reducing energy imports by increasing domestic production will likely ease Pakistan's current account deficits and reduce its need to seek repeated IMF bailouts.

Related Links:

US EIA Estimates of Oil and Gas in Pakistan

Methane Hydrate Release After Balochistan Quake

-

Comment by Riaz Haq on January 16, 2019 at 10:38am

-

At Kekra I, 143 miles from #Karachi coast, gas flows can be as big as Sui field at 3 to 8 trillion cubic feet (TCF), or 25-40 percent of #Pakistan’s total #gas reserves.Well diameter is 18 to 24 inches. Current depth of 1900 feet. Good news by April. https://www.thenews.com.pk/latest/419865-kekra-i-gas-flows-can-be-a...

Ghulam Sarwar Khan, Federal Minister for Petroleum met Mr. Irtiza Syed, CEO, EXXON Mobil on Wednesday at his office.

Irtiza briefed minister about progress at Indus G Block.

According to a press release issued by the petroleum ministry, Ghulam Sarwar Khan said 2019 will be good year for all of us. Exxon Mobil has started spud in.

The well’s diameter is 18 to 24 inches. Right now they are at depth of 1900 feet, hence its ultra-deep exploration. It will give its first good news in March or April.

Exxon Mobil has given the target depth of 5500 feet. In March, Exxon Mobil will send a specimen to Houston for examination.

Similarly ENI will send the specimen to Milan in March. From April to May there will be a reasonable idea that this well contains oil or gas.

The discovery is anticipated to yield gas flows which can be as big as Sui field, with estimated reserves of 3 to 8 trillion cubic feet (TCF), or 25-40 percent of Pakistan’s total gas reserves.

Pakistan Exploration and Production (E&P) companies along with international partners have ventured into offshore territory of underexplored but promising Indus G Block for deep sea drilling endeavor.

The operator of the block, ENI has chartered, Saipem, a rig ship to drill the exploration well , located 230 kms South West of Karachi. ENI is an Italian company working in Pakistan since 2000.

This endeavor is a joint venture (JV) formed by ENI, Exxon Mobil, OGDCL and PPL to spud Kekra I exploration well in Indus G Block.

The exploration cost is estimated at 75 million dollars. Right now more than 200 people are working at the ship. After exploration, employment will be generated. If it will be a successful discovery, then for next 25 to 30 years, Pakistan can use this gas.

After its success, Exxon Mobil will spud in more wells. Till 2021 to 2022, a facility will be made here. Ghulam Sarwar Khan also invited Exxon Mobil for on shore exploration. He said that he will make ways easy for international investment.

For this purpose duties and taxes have been waived off on import of drilling equipment. During meeting, Stephen, Vice President, Exxon Mobil was also present.

-

Comment by Riaz Haq on March 14, 2019 at 11:30am

-

#Pakistan Aims To Become A Natural Gas Hotspot. It has estimated conventional #gas reserves of 20 trillion cu ft and #shale gas reserves exceed 100 trillion cu ft, making it attractive to foreign #energy investors. #FDI OilPrice.com https://oilprice.com/Energy/Natural-Gas/Pakistan-Aims-To-Become-A-N... #oilprice

Pakistan is eager to open up its gas deposits to foreign energy companies in a bid to boost domestic production amid soaring demand, two government officials told media this week. The country has trillions of cubic feet in natural gas reserves, and although some of these have been exploited, the last decade has seen an outflow of foreign energy investors because of Islamist violence. Is the worst over?

Pakistan, a country with a fast-rising population, has recently been plagued with power outages largely resulting from a shortage of fuel necessary to keep its power stations going. Imports of gas and LNG are on the rise, but Imran Khan’s government seems to be aware that domestic production is almost invariably cheaper.

As a result, Pakistan is now preparing to start tendering gas blocks to all parties interested in exploration.

“I expect in the second half of this year we will be auctioning at least 10, if not 20 blocks for exploration,” the head of the government’s task force for an energy reform, Nadeem Babar, told Reuters earlier this week. He added that the government was in the process of making changes to its natural gas exploration and production regulations and drafting the country’s first ever shale resource policy.

“Pakistan provides a level playing field for all the E&P companies and even state-owned companies also have to participate in bidding rounds and compete with other companies,” said the country’s Minister for Petroleum and Natural Resources as quoted by The News International.

Pakistan imports nearly 80 percent of energy requirements from the international market. The country’s demand for energy has been increasing by 8 percent a year,” Ghulam Sarwar Khan also said, adding the government was doing its best to make Pakistan a more investor-friendly country as part of efforts to change the status quo in energy supply and demand.

Pakistan has estimated conventional gas reserves of 20 trillion cu ft and shale gas reserves exceed 100 trillion cu ft, which certainly makes the country an attractive destination for gas drillers as long as the security situation remains stable.

So far, the authorities have delineated more than 30 gas blocks, all onshore, Babar also told Reuters. If these attract sufficient interest, they could go a considerable way towards reducing the gas shortage plaguing the country, where demand for gas for 2017/18 was calculated at 6.9 billion cu ft daily, exceeding production by almost 3 billion cu ft.

With such demand levels—and rising, too—Pakistan is naturally an attractive destination for gas exploiters. Russia, Iran, and Qatar are all large suppliers. Earlier this week, Pakistani media reported government officials were negotiating an increase in Qatari LNG imports from 500 billion cu ft daily to 700 billion cu ft daily. Last month, the government inked an import deal with Gazprom for 500 million to 1 billion cu ft daily.

The country also recently completed two LNG import terminals but the super-cooled fuel is more expensive than Islamabad would like, especially given its level of import dependency.

According to Nadeem Babar, Aramco, Gazprom, and Exxon have already expressed interest in some of the blocks to be auctioned later this year. Italy’s Eni is already active in Pakistan and may join the bidders along with others attracted by the underexplored resources in the country where one of three wells yields commercial gas.

-

Comment by Riaz Haq on March 26, 2019 at 10:26am

-

#ImranKhanPrimeMinister has seen high-confidence data indicating large #oil, #gas reserves. There's "kick pressure" from oil/gas in drilling. It was strong kick pressure that forced #ExxonMobil to stop #drilling for more mud to prevent blow-out. #Pakistan https://www.thenews.com.pk/latest/448666-largest-oil-gas-reserves-e...

-

Comment by Riaz Haq on March 27, 2019 at 9:39am

-

#Pakistan #oil good for whole region. Reserves will result in large cross-border capital flows, infrastructure #investment, energy #trades, and people-to-people exchanges. Development/utilization of reserves to be pillar of #economic integration, stability http://www.globaltimes.cn/content/1143525.shtml#.XJuh24zOLig.twitter By Hu Weijia

Pakistan may soon hit the oil jackpot, and that will be good news for not only the country itself but all of South Asia as well as China and Gulf nations.

Pakistani Prime Minister Imran Khan was quoted by local media outlet Dawn as saying that "there's a strong possibility that we may discover a very big (oil) reserve in our waters." If his prediction comes true, the discovery will help the South Asian country tackle its economic problems.

With Pakistan's economy in the doldrums, the cash-strapped country may have a more urgent need for foreign investment if massive oil reserves are indeed discovered. According to Dawn, US oil giant Exxon Mobil and Italy's ENI have been involved since January in drilling an ultra-deep oil well.

There may be more international companies wanting to participate in related projects ranging from exploration to refining and logistics. The related investment will help Pakistan maintain its growth momentum.

China has sound cooperation in energy with Pakistan. A big oil find would stimulate investment enthusiasm among Chinese companies. China is willing to support Pakistan's efforts to seize the development opportunity such a find might bring, and handle any challenges.

The China-Pakistan Economic Corridor (CPEC) was originally conceived as a strategic project with oil and gas pipeline links between Northwest China's Xinjiang Uyghur Autonomous Region and Pakistan's Gwadar port.

If Pakistan discovers massive oil reserves, that will be a motivation to extend Pakistan's pipeline network further into Iran and India, and also to enhance energy cooperation with Gulf nations such as Saudi Arabia.

Not only China but also the whole region will benefit from economic integration through energy connectivity.

Using those reserves will likely result in large cross-border capital flows, infrastructure investment, energy trades, and people-to-people exchanges. The region will see the development and utilization of oil reserves as a pillar of economic integration and stability.

As for India, Pakistan's potential oil reserves will increase the country's attractiveness for Indian companies, as oil imports rise in India due to higher fuel demand despite bilateral disputes.

The geopolitical picture in Asia has long been complex and uneven, but Pakistan's potential oil reserves are likely be a game-changer for the region, with economic cooperation in energy.

Hopefully India and Gulf nations won't ignore the opportunities to enhance energy cooperation with Pakistan and help fostering an energy network in Asia.

-

Comment by Riaz Haq on March 28, 2019 at 9:24am

-

#Pakistan’s massive #oil and #gas discovery report expected in April 2019. Experts believe huge hydrocarbon deposits offshore, enough for 25 to 30 years. Estimated gas reserves are 3 to 8 trillion cubic feet (TCF), 25-40% of country’s total gas reserves. https://gulfnews.com/world/asia/pakistan/pakistans-massive-oil-and-...

Dubai: Pakistan will announce the discovery of massive oil and gas reserves in the next three weeks, said an official.

A consortium of four leading companies led by US-based ExxonMobil, which has started drilling in ultra-deep waters offshore Karachi, is likely to submit its report by April, Pakistan’s official news agency APP reported on Thursday.

The consortium has claimed it has discovered massive oil and gas reserves offshore Indus G-Block called Kekra-I some 230-km off the Karachi coast.

Gulf News earlier reported that the location of the reserves is near Iran borders. On Monday, Pakistan Prime Minister Imran Khan had also hinted at finding ‘massive’ oil reserves off the coast of Karachi.

He said he would soon share good news with the nation. He had said Pakistan would not need to import oil after the offshore reserves are found.

“Steady drilling is in progress and there are ‘good symptoms’ about the success of the project. Currently, more than 4,000 metres of vertical drilling has been completed. Drilling is under way horizontally against the target of around 5,500 metres,” the official said.

Experts believe that there are huge hydrocarbon deposits, sufficient for the country’s needs for 25 to 30 years. The energy scarce nation is anxiously waiting for good news.

The official said exploration activity is continuing round-the-clock by a highly skilled team of more than 200 professionals with periodical tests of specimens conducted after almost every 1,000-metre drill.

The well’s diameter is 18 to 24 inches and companies had set the target depth of 5,500 metres, the official said, adding that the discovery is anticipated to yield gas flows which could be ‘as big as Sui field’. Estimated reserves are three to eight trillion cubic feet (TCF), or 25-40 per cent of the country’s total gas reserves.

The official said the country is in dire need of a big discovery as existing hydrocarbon reserves are depleting fast and its reliance on imported gas and oil is increasing with each passing day.

According to data of a recent study, existing deposits in Pakistan will further deplete 60 per cent by the year 2027. It underlined the need to step up exploration in potential areas on a war-footing.

The offshore drilling is a joint venture of ENI, Exxon Mobil, Oil and Gas Development Company Limited and Pakistan Petroleum Limited. In December 2018, Exxon Mobil had announced that it would reinvest in the Pakistani market after a gap of nearly three decades.

According to media reports, if oil deposits are discovered as expected, Pakistan will be among top 10 oil-producing countries.

Pakistan currently meets only 15 per cent of its domestic petroleum needs with crude oil production of around 22 million tons; the other 85 per cent is met through imports.

The country is facing a huge current account deficit of up to $18 billion and is spending a substantial amount of foreign exchange reserves on import of oil. The import bill of Pakistan rose by to $12.928 billion in the July-May 2017-18 period of the last fiscal year.

-

Comment by Riaz Haq on April 9, 2019 at 9:03am

-

2019 #Oil and #Gas Exploration Off to Flying Start. Eni’s Kekra well in #Pakistani waters has pre-drill prospective resource estimates of 1.5 billion barrels of oil equivalent. #exxonmobil #Pakistan #offshore | Rigzone https://www.rigzone.com/news/2019_oil_and_gas_exploration_off_to_fl... via @rigzone

Oil and gas exploration is off to a flying start in 2019, according to independent energy research and business intelligence company Rystad Energy.

Global discoveries of conventional resources in the first quarter reached 3.2 billion barrels of oil equivalent (boe), Rystad revealed Monday in a statement sent to Rigzone. Most of the gains were recorded in February, which saw 2.2 billion barrels of discovered resources, Rystad highlighted.

Majors reported more than 2.4 billion boe of the discovered resources for the quarter, Rystad outlined in the statement. ExxonMobil was the most successful, with three offshore discoveries accounting for 38 percent of total discovered volumes.

“If the rest of 2019 continues at a similar pace, this year will be on track to exceed last year’s discovered resources by 30 percent,” Rystad Upstream Analyst Taiyab Zain Shariff said in the company statement.

The total volume of global conventional discoveries in 2018 was 9.1 billion boe, according to Rystad. Total global conventional discoveries were 10.3 billion boe in 2017 and 8.4 billion boe in 2016.

No Signs of Slowing Down

In the statement, Rystad said the push for “substantial” new discoveries shows no signs of slowing down, with another 35 “high impact” exploration wells expected to be drilled this year, both onshore and offshore.Rystad highlighted that three such wells are already underway; the Shell-operated Peroba well off Brazil - with pre-drill prospective resource estimates of 5.3 billion boe, Eni’s Kekra well in Pakistani waters -with pre-drill prospective resource estimates of 1.5 billion boe and the Total-operated Etzil well off Mexico -with pre-drill prospective resource estimates of 2.7 billion boe.

“If these wells prove successful, 2019’s interim discovered resources will be the largest since the downturn in 2014,” Shariff stated.

Earlier this year, Rystad said improved market conditions and lower well costs had led exploration and production players to “ramp up” their 2019 exploration activities in all parts of the world.

“Renewed optimism in exploration activities is anticipated in 2019, with operators from various segments aiming for multiple high-impact campaigns – both onshore and offshore – in essentially all corners of the world,” Rystad Energy Senior Analyst, Rohit Patel, said in a company statement back in February.

“These include wells targeting large prospects, play openers, wells in frontier and emerging basins and operator communicated high impact wells,” Patel added.

Rystad is headquartered in Oslo and has locations in Houston, Singapore, London, New York, Sydney, Moscow, Stavanger, Rio de Janeiro, Tokyo, Dubai and Bangalore. The company traces its roots back to 2004.

-

Comment by Riaz Haq on April 27, 2019 at 10:33am

-

More delay in #Pakistan offshore drilling due to concerns about blow-out from huge #oil and #gas field estimated to have to over 1.5 billion barrels of oil. Exxon fixing blow-out preventer (BOP) to prevent oil fire from blow-out from kick pressure #Karachi https://www.thenews.com.pk/print/462934-kekra-drilling-process-hits...

The spudding, that was to kick start on April 20, 2019 at Kekra-1 well in G-bloc, Pakistan’s ultra-deep sea after pause of 12 days, could not take off as it has hit another serious snag.

The blow out preventer (BOP) that prevents from any blow out or any kick pressure that can result into eruption of fire, has gone out of order and its repair is underway.

Sher Afgan, Additional Secretary and spokesman for Petroleum Division, confirmed the development saying the blow out preventer that is attached with valves at the end of rig has developed serious problems owing to which the drilling could not start on time.

Up till now, the official said, drilling is virtually stopped for the last 18 days and the status will last till the repair process of BOP is completed. However, Ghulam Mustafa, expert of oil and gas exploration and production, did not accept that the blow out preventer takes four to five days for repair, arguing that the BOP cannot be repaired, rather it can be upgraded by changing its affected spare parts and this process does not take more than one hour. He said the drilling machine may have developed other problem that is not being shared.

Earlier, the drilling got stalled on April 8 at the depth of 4,810 meters because of cementing and casing process which took almost 12 days to get completed. Now the issue of blow out preventer has emerged which according to the official of Petroleum Division is being coped with. And once the BOP’s repair is completed, the Mobile Exxon with ENI as operator at Kekra-1 well will start the drilling of the remaining 650-800 meters under second side tracking.

GA Sabri, former secretary of Petroleum Ministry, opined that BOP is one of the important tools that prevents the rig and whole apparatus from any blow out that is caused because of pressure kick that also may lead to eruption of fire. He said that BOP ensures the safety of the machine (rig and whole apparatus). When asked what will happen to the drilling as in May, the sea will turn rough because of high tide, Sabri said according to new weather forecast, monsoon has delayed so the chances of sea to turn rough have got minimised in May which is a good news.

Once the BOP issue is sorted, Kekra-01 well will enter a phase where the operator will, for the first time, begin to receive information that would help determine the well prospects. This would include results from LWD (logging while drilling), salinity testing, potential hydrocarbon traces in mud and rock samples and hydrocarbon kicks.

Time required to drill the remaining depth will depend upon the rate of penetration (RoP). The penetration rate is significantly slower for northern region of Pakistan than the southern region.

“We don’t yet have precedents to form a reliable estimate for the RoP for offshore Indus-G, where Kekra-01 is being drilled. An RoP of 10 meters per hour (generally considered low) would mean that it would take 80 hours or a little more than three days to reach the target depth.’’

After completion of drilling, the operator will likely do wire line logging which could take another three or four days. This will likely be followed by another casing and cementing exercise that can take four to six days. At this stage a substantial amount of information regarding the well prospects will be known, however, the results (discovery or dry well) will require completion of proper testing.

-

Comment by Riaz Haq on May 9, 2019 at 10:04pm

-

160 oil and gas reservoirs discovered in Pakistan in last 10 years

https://dnd.com.pk/160-oil-and-gas-reservoirs-discovered-in-pakista...

ISLAMABAD, Pakistan: The Minister for Energy (Petroleum Division) Omar Ayub Khan has said that a total of 160 oil and gas reservoirs have been discovered in Pakistan during the last 10 years.

In a written reply submitted in the National Assembly, Omar Ayub said that the discovered reservoirs are in different stages of appraisal and development, therefore, the estimated volume and value may vary based on actual production and its recovery factor.

The province wise break up of aforesaid discoveries during the year 2008-2018:160 oil and gas reservoirs discovered in Pakistan in last 10 years

Furthermore, the minister for energy told the House that at present total annual requirement of oil of the country is around 25.8 million tons per annum.Required purchase and sale rates of petroleum products in Pakistan:

Sindh 131, Punjab 13, Balochistan 3, KPK 13

The minister said that the prices of petroleum products in the Country are linked with the International Arab Gulf market prices which fluctuate on daily basis and not in the control of government. Accordingly, the domestic oil prices are increased/decreased by including notified taxes and other cost components incurred on the supply of oil across the country.Omar Ayub said that the government takes steps from time to time for providing relief to the consumers by adjusting any hike in international oil prices through reduction in the rate of taxes.

Petrol/Liter: Purchase Price Rs 62.55, Distribution/Transportation: Rs. 9.84, Taxes: Rs. 26.50. Total/Liter Rs. 98.89The province wise break up of aforesaid discoveries during the year 2008-2018:

Furthermore, the minister for energy told the House that at present total annual requirement of oil of the country is around 25.8 million tons per annum.

Required purchase and sale rates of petroleum products in Pakistan:

The minister said that the prices of petroleum products in the Country are linked with the International Arab Gulf market prices which fluctuate on daily basis and not in the control of government. Accordingly, the domestic oil prices are increased/decreased by including notified taxes and other cost components incurred on the supply of oil across the country.

-

Comment by Riaz Haq on July 14, 2020 at 10:15am

-

#Hydrocarbon reserves discovered in Kohat. Improved security in ex #FATA paved the way for Drill Stem Test (DST) at Lockhart & Hangu formations. It found 3,240 barrels/day of condensate (#oil), 16.12 MMscf/day of #gas & 48 barrels/day of water. #energy https://www.brecorder.com/news/40004954

Pakistan Oilfields Limited (POL), the country’s leading oil and gas exploration and production company has discovered oil and gas reserves in Kohat region, Khyber Pakhtunkhwa, it was learned on Tuesday.

"As per the information received from MOL, the operator of TAL Block, hydrocarbons have been encountered in exploratory well Mamikhel South-01, which has been drilled and is currently under testing phase,” informed POL, in its filing to the bourse.

As a result Drill Stem Test (DST) conducted at the well to test the Lockhart and Hangu formations, the well has tested 3,240 barrels per day of condensate, 16.12 MMscf per day of gas and 48 barrels per day of water.

The pre-commerciality working interest of POL is 25 percent.

Back in March, POL has tested hydrocarbons from its Development Well Pindori-10, located in district Rawalpindi, Punjab. Meanwhile, back in January, OGDCL announced the discovery of gas and condensate at an exploratory well in Ranipur Block, in Sindh. The well has tested 1.85 million cubic feet per day of gas, six barrels per day of condensate.

-

Comment by Riaz Haq on July 14, 2020 at 6:39pm

-

MOL Discovers Significant #Oil-#Gas Reserves in #Pakistan. Mamikhel South-1 exploratory well in TAL Block achieved a flow rate of 6,516 barrels of oil a day.

This is the #Hungarian Co's 13th discovery in Pak, 10th discovery in TAL since 2000 https://www.rigzone.com/news/mol_discovers_significant_reserves_in_... via @rigzone

MOL revealed Tuesday that it has discovered “significant” gas and condensate reserves in Pakistan.

The Mamikhel South-1 exploratory well, which is located in Pakistan’s TAL Block, achieved a flow rate of 6,516 barrels of oil equivalent per day during testing, according to the company, which noted that further testing of the well is currently ongoing.

Mamikhel South-1 marks MOL’s 13th discovery in Pakistan and the 10th discovery in the TAL Block. MOL’s 13 oil, gas and condensate finds have all been made since the year 2000.

“I am delighted to announce that we have made another discovery in Pakistan,” Berislav Gaso, MOL Group’s exploration and production EVP, said in a company statement.

“This new discovery has de-risked an exploration play in deeper reservoir in the TAL Block, leading to new upside opportunities. The Mamikhel South-1 discovery will also help to improve the energy security of the country from indigenous resources,” he added.

“We are thankful to our Joint Venture partners as well as the Government of Pakistan for their continued support,” Gaso continued.

MOL is the operator of the TAL Block. The company is Pakistan’s second largest producer of LPG, crude oil and condensate and currently addresses around nine percent of the natural gas needs, 25 percent of the oil and condensate needs and 22 percent of the LPG needs of Pakistan, according to its website.

Back in March this year, MOL announced that it had discovered oil and gas in an offshore field located about 120 miles west of Stavanger in the Norwegian part of the North Sea. The potential resources discovered in the main formation of the asset were said to be between 12 and 71 million barrels of oil and gas equivalent.

MOL describes itself as an integrated, international oil and gas company. The business is headquartered in Budapest, Hungary, but is active in over 40 countries.

Comment

- ‹ Previous

- 1

- 2

- 3

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

Agriculture, Caste, Religion and Happiness in South Asia

Pakistan's agriculture sector GDP grew at a rate of 5.2% in the October-December 2023 quarter, according to the government figures. This is a rare bright spot in the overall national economy that showed just 1% growth during the quarter. Strong performance of the farm sector gives the much needed boost for about …

ContinuePosted by Riaz Haq on March 29, 2024 at 8:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network