PakAlumni Worldwide: The Global Social Network

The Global Social Network

Misery Index: Who's Less Miserable? India or Pakistan?

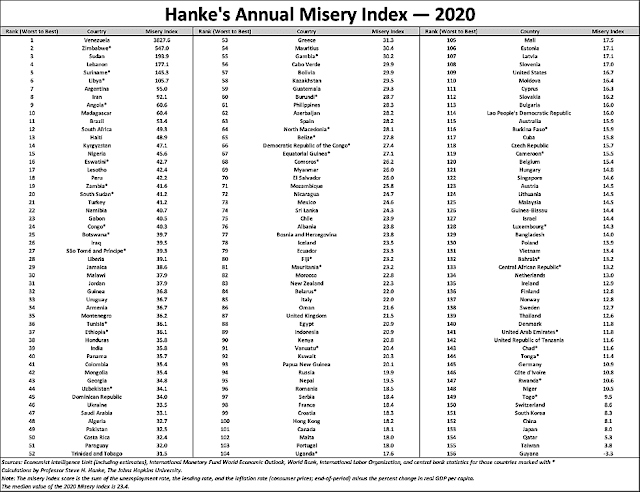

Pakistanis are less miserable than Indians in the economic sphere, according to the Hanke Annual Misery Index (HAMI) published in early 2021 by Professor Steve Hanke. With India ranked 49th worst and Pakistan ranked 39th worst, both countries find themselves among the most miserable third of the 156 nations ranked. Hanke teaches Applied Economics at Johns Hopkins University in Baltimore, Maryland. Hanke explains it as follows: "In the economic sphere, misery tends to flow from high inflation, steep borrowing costs, and unemployment. The surefire way to mitigate that misery is through economic growth. All else being equal, happiness tends to blossom when growth is strong, inflation and interest rates are low, and jobs are plentiful". Several key global indices, including misery index, happiness index, hunger index, food affordability index, labor force participation rate, ILO’s minimum wage data, all show that people in Pakistan are better off than their counterparts in India.

Hanke's Misery Index:

Hanke's Annual Misery Index (HAMI) ranks Pakistan 49th (32.5) and India 39th (35.8) most miserable for year 2020. Bangladesh is significantly better than both India and Pakistan with a misery index of 14 and rank of 129. Venezuela ranks number 1 as the world's most miserable country followed by Zimbabwe 2nd, Sudan 3rd, Lebanon 4th and Suriname 5th among 156 countries ranked this year. The rankings for the two South Asian nations are supported by other indices such as the World Bank Labor Participation data, International Labor Organization Global Wage Report, World Happiness Report, Food Affordability Index and Global Hunger Index.

|

| Hanke's Annual Misery Index 2021. Source: National Review |

Employment and Wages:

Labor force participation rate in Pakistan is slightly above 50% during this period, indicating about 2% drop in 2020. Even before COVID pandemic, there was a steep decline in labor force participation rate in India. It fell from 52% in 2014 to 47% in 2020.

|

| Labor Force Participation Rates in Pakistan (Top), India (bottom). ... |

The International Labor Organization (ILO) Global Wage Report 2021 indicates that the minimum wage in Pakistan is the highest in South Asia region. Pakistan's minimum monthly wage of US$491 in terms of purchasing power parity while the minimum wage in India is $215. The minimum wage in Pakistan is the highest in developing nations in Asia Pacific, including Bangladesh, India, China and Vietnam, according to the International Labor Organization.

|

| Monthly Minimum Wages Comparison. Source: ILO |

The impact on livelihoods of workers in developing nations during the COVID pandemic has varied depending on the size of the informal work forces, according to The Economist magazine.

|

| Workers in Informal Economy of Selected Developing Countries. Sourc... |

Most countries with large informal work forces have recovered but India's jobs crisis has only deepened since the start of the COVID19 pandemic. Latest CMIE data indicates that employment rate in India was just 37.34% in November, 2021.

|

| Asian Employment Rates. |

|

| History of Inflation in Pakistan. Source: Statista |

|

| Hunger Trends in South Asia. Source: Global Hunger Index |

Amid the COVID19 pandemic, Pakistan's World Happiness ranking has dropped from 66 (score 5.693) among 153 nations last year to 105 (score 4.934) among 149 nations ranked this year. Neighboring India is ranked 139 and Afghanistan is last at 149. Nepal is ranked 87, Bangladesh 101, Pakistan 105, Myanmar126 and Sri Lanka129. Finland retained the top spot for happiness and the United States ranks 19th.

|

| Pakistan Happiness Index Trend 2013-2021 |

One of the key reasons for decline of happiness in Pakistan is that the country was forced to significantly devalue its currency as part of the IMF bailout it needed to deal with a severe balance-of-payments crisis. The rupee devaluation sparked inflation, particularly food and energy inflation. Global food prices also soared by double digits amid the coronavirus pandemic, according to Bloomberg News. Bloomberg Agriculture Subindex, a measure of key farm goods futures contracts, is up almost 20% since June. It may in part be driven by speculators in the commodities markets. These rapid price rises have hit the people in Pakistan and the rest of the world hard. In spite of these hikes, Pakistan remains among the least expensive places for food, according to recent studies. It is important for Pakistan's federal and provincial governments to rise up to the challenge and relieve the pain inflicted on the average Pakistani consumer.

Pakistan's Real GDP:

Many economists believe that Pakistan’s economy is at least double the size that is officially reported in government's Economic Surveys. The GDP has not been rebased in more than a decade. It was last rebased in 2005-6 while India’s was rebased in 2011 and Bangladesh’s in 2013. Just rebasing the Pakistani economy will result in at least 50% increase in official GDP. A research paper by economists Ali Kemal and Ahmad Wasim of PIDE (Pakistan Institute of Development Economics) estimated in 2012 that the Pakistani economy’s size then was around $400 billion. All they did was look at the consumption data to reach their conclusion. They used the data reported in regular PSLM (Pakistan Social and Living Standard Measurements) surveys on actual living standards. They found that a huge chunk of the country's economy is undocumented.

Pakistan's service sector which contributes more than 50% of the country's GDP is mostly cash-based and least documented. There is a lot of currency in circulation. According to the State Bank of Pakistan (SBP), the currency in circulation has increased to Rs. 7.4 trillion by the end of the financial year 2020-21, up from Rs 6.7 trillion in the last financial year, a double-digit growth of 10.4% year-on-year. Currency in circulation (CIC), as percent of M2 money supply and currency-to-deposit ratio, has been increasing over the last few years. The CIC/M2 ratio is now close to 30%. The average CIC/M2 ratio in FY18-21 was measured at 28%, up from 22% in FY10-15. This 1.2 trillion rupee increase could have generated undocumented GDP of Rs 3.1 trillion at the historic velocity of 2.6, according to a report in The Business Recorder. In comparison to Bangladesh (CIC/M2 at 13%), Pakistan’s cash economy is double the size. Even a casual observer can see that the living standards in Pakistan are higher than those in Bangladesh and India.

Related Links:

Haq's Musings

South Asia Investor Review

Pakistan Among World's Largest Food Producers

Food in Pakistan 2nd Cheapest in the World

Pakistan's Pharma Industry Among World's Fastest Growing

Pakistan to Become World's 6th Largest Cement Producer by 2030

Pakistan's 2012 GDP Estimated at $401 Billion

Pakistan's Computer Services Exports Jump 26% Amid COVID19 Lockdown

Coronavirus, Lives and Livelihoods in Pakistan

Vast Majority of Pakistanis Support Imran Khan's Handling of Covid1...

Pakistani-American Woman Featured in Netflix Documentary "Pandemic"

Incomes of Poorest Pakistanis Growing Faster Than Their Richest Cou...

Can Pakistan Effectively Respond to Coronavirus Outbreak?

How Grim is Pakistan's Social Sector Progress?

Pakistan Fares Marginally Better Than India On Disease Burdens

Trump Picks Muslim-American to Lead Vaccine Effort

Democracy vs Dictatorship in Pakistan

Pakistan Child Health Indicators

Pakistan's Balance of Payments Crisis

Panama Leaks in Pakistan

Conspiracy Theories About Pakistan Elections"

PTI Triumphs Over Corrupt Dynastic Political Parties

Strikingly Similar Narratives of Donald Trump and Nawaz Sharif

Nawaz Sharif's Report Card

Riaz Haq's Youtube Channel

-

Comment by Riaz Haq on November 21, 2021 at 9:58pm

-

The currency in circulation (CIC) has increased to over Rs. 7 trillion in Pakistan, representing the growth in the size of the economy and the traditional use of cash among the citizens as money.

https://propakistani.pk/2021/11/01/pakistans-currency-in-circulatio...

According to the State Bank of Pakistan (SBP), the currency in circulation has increased to Rs. 7.4 trillion by the end of the financial year 2020-21 as compared to the previous level of the last financial year in which it stood at Rs. 6.7 trillion, showing a double-digit growth of 10.4 percent year-on-year.

The currency in circulation is the overall currency consisting of various denominations of banknotes being used as money in an economy for the exchange of goods and services and informal savings, excluding the financial sector.

The size of Pakistan’s economy has increased significantly, which showed the double-digit growth in currency in circulation, said Tahir Akbar, Head of Research at Arif Habib Limited. It is pertinent to mention here that Pakistan’s GDP grew by 3.94 percent, which was well above the target set for the financial year 2020-21 of 2.1 percent, and COVID-19 induced contraction of 0.47 percent in FY20.

Accordingly, the banking regulator issued currency notes in order to meet the requirements of the local economy. The banknote printing charges of SBP increased to Rs. 15.762 billion in FY21 from Rs. 13.325 billion in FY20, thereby registering an increase of 18 percent mainly due to larger volumes of printing and an increase in printing rates.

The CIC of the country stands from 28 to 30 percent viz-a-viz the volume of broad money size, he further said. This is the average percentage of CIC when Pakistan is compared with similar economies. On the other hand, the CIC percentage is less than 20 percent of the broad money in most of the developed countries, where the digitization of the economy is much higher than in Pakistan.

Besides, the currency in circulation stands at Rs. 7.4 trillion, the value of money deposits maintained by the banking system of the country stood at Rs. 19.2 trillion, which is in addition to the value of assets and investments made by the country.

Financial Inclusion and Digitization of Banking System

The higher currency in circulation also means that the size of Pakistan’s undocumented economy is huge. Besides, the cash available in the economy also causes a factor of money-led inflation.

Since the last decades, the banking regulator along with the private sector has been working aggressively towards the financial inclusion of the economy through introducing various new avenues such as branchless banking, mobile and internet banking, payment cards, payment gateway operators, POS operators, digital wallets, QR payments, etc.

The use of digital means for the transaction of money has increased tremendously, but there is a big room for improvement, which needs customers’ confidence over these tools on the one hand, whereas the literacy of electronic banking is also needed on the other hand.

A senior banker and founder of branchless banking in Pakistan, Nadeem Hussain, told ProPakistani,

Yes, the cash in circulation is increasing because the parts of our economy which are not under the tax net usually accept cash and the volumes are growing. This means the service sector especially real estate , Kiryana stores, freelancers , plumbers/dentists/electricians,

He pointed out that the country’s service sector constitutes 50 percent of the economy and the bulk of it is cash-based.

In FY20, the volume of paper-based transactions within the banking sector stood at Rs. 151 billion as compared to transaction volume through electronic or digital banking standing at Rs.86 billion. The electronic banking transactions registered year-on-year growth of 31.1 percent, which implies an increase in the adoption of digital means for payments.

-

Comment by Riaz Haq on November 22, 2021 at 12:50pm

-

Aakar Patel | No good news: It’s difficult to be an optimist in India today

India’s economic growth has been falling for 42 months now, but the government has not spoken about why that is so and what went wrong

https://www.deccanchronicle.com/opinion/columnists/220621/aakar-pat...

It is not easy to find good news in India and has not been easy for a long time now. A recent report said that the Indian economy is contracting again in this quarter, between April and June, by more than double digits.

This report from one agency was carried in multiple media outlets but it was not refuted or commented upon by others, including by the government. It was just assumed to be true. After 24 months of slowdown starting in January 2018 before the Covid-19 pandemic, and then 18 months of collapse since January 2020, we have turned into the world’s worst performing economy.

India’s economic growth has been falling for 42 months now, but the government has not spoken about why that is so and what went wrong or what it plans to do to correct it. Former Prime Minister Manmohan Singh in an interview last year offered five points to correct course, but he also added that a course-correction was possible only after one had acknowledged that there was a problem.

Since we have not accepted that anything is wrong, we will continue.

CMIE, the only body offering regular employment data (the Narendra Modi government has little data and says that it is conducting some surveys, whose results will come around the end of the year) says that unemployment in India is at 11 per cent, higher than Pakistan and Bangladesh.

Inflation is high though demand is low, and wholesale prices are at their highest since 1992. Petrol is around Rs.100 a litre, diesel is almost there and the price of crude oil is expected to rise another 20 per cent by the end of the year. Exports are at the same level as they were in 2014 and in seven years under Narendra Modi have shown no growth, though in the same period Bangladesh and Vietnam have grown and China has held onto its share.

Eighty crore Indians are being given free food for seven months from May till November. Five kilos of wheat or rice per person per month and one kilo of dal. In May, 16 lakh tonnes of wheat and 15 lakh tonnes of rice was distributed.

Sixty per cent of Indians depend on free food. This should tell you more than enough about the state of poverty in India today.

When Mr Modi took over in 2014, he said MGNREGA was a monument to the failure of the Manmohan Singh government. He would give people real jobs, and not MGNREGA jobs. The MGNREGA programme’s size last year was three times what it was under UPA rule because crores of people have lost their jobs and fallen into poverty and now depend on MGNREGA and free foodgrains. The Gujarat government put out a statement last week which said that MGNREGA was a lifesaver.

Elsewhere, it has been a year since the clash in Ladakh. China has stopped its disengagement. This means India has to keep tens of thousands of troops in that area almost permanently.

China has also told us that it is demoting the level of talks, and now only area commanders will discuss specific issues rather than general disagreement. Our soldiers still cannot patrol in the Depsang Plain but the government has not acknowledged that or held a single press briefing on Ladakh since the crisis began a year ago. Opacity is the hallmark of dictatorships and not democracies, but this is the status of our national security.

India was supposed to be the Vaccine Guru and Vaccine Factory for the world. Instead, India has wrecked the world’s vaccination programme by stopping the delivery of vaccines others already paid for in advance and which were manufactured in India. Our government has begun taking over those stocks while the world waits. Even with that, India has only managed to fully vaccinate only three per cent of its population against the world’s average of nine per cent.

https://youtu.be/HozHH4sD8Pg

-

Comment by Riaz Haq on November 22, 2021 at 12:57pm

-

A base year is a benchmark with reference to which national account figures such as GDP, gross domestic saving and gross capital formation are calculated.

According to the new base year, Bangladesh was an economy of Tk 34,840 billion in current prices in FY21, up 15.7 per cent from Tk 30,111 billion as per the previous base year.

https://www.thedailystar.net/business/economy/news/gdp-size-growth-...

"The size of our economy is huge, and the new base year will reflect it," he said, adding that a real scenario would allow the government to make more informed policy decisions.

Zahid Hussain, a former chief economist of the World Bank's Dhaka office, also welcomed the new base year.

He said timely revisions to data on GDP and its components determine the accuracy of national account estimates and their comparability across countries.

With the finalisation of the new series, Bangladesh will be ahead of all other Saarc countries in terms of the recency of the national account's base year.

Only the Maldives (2014) and India (2011-12) come close, while Pakistan (2005-06) and Sri Lanka (2010) are well behind.

"Improved data sources increase the coverage of economic activities as new weights for growing industries reflect their contributions to the economy more accurately," said Hussain.

The last revision was done in 2013.

The size of the agriculture, industry and services sectors has expanded as per the new base year.

The new base year uses data on about 144 crops while computing the contribution of the agriculture sector to the GDP, which was 124 crops in the previous base year.

The gross value addition by the agriculture sector rose to Tk 4,061 billion in current prices in the last fiscal year, up from Tk 3,846 billion in the old estimate, the BBS document showed.

The industrial sector saw the addition of the data on the outputs of Ashuganj Power Station Company, North-West Power Generation Company, Rural Power Company, cold storage for food preservation, Rajshahi Wasa, and the ship-breaking industry.

-

Comment by Riaz Haq on November 23, 2021 at 5:00pm

-

#India has 46, #China 42, #Pakistan 6 & #Bangladesh 4 cities among the top 100 most polluted cities in the world. #Lahore ranks third behind #Dhaka, the capital of #Bangladesh, and #Mongolia’s capital #Ulaanbaatar on the #pollution index. #AirQuality https://www.aljazeera.com/news/2021/11/22/infographic-the-worlds-10...

https://twitter.com/haqsmusings/status/1463309813983571972?s=20

Every year, a thick smog covers India’s capital New Delhi. Last week, it got so bad for the 20 million residents that authorities shut schools.

New Delhi’s concentration of PM2.5 particles, which damage people’s lungs, is 34 times the World Health Organization’s (WHO) acceptable levels. The toxic haze is especially bad during the winter as farmers burn stubble left in their fields.

Air quality is determined by the levels of air pollutants PM2.5, PM10, ozone, nitrogen dioxide, sulfur dioxide, and carbon monoxide.

Particulate matter (PM) comprises tiny particles that negatively impact health. PMs vary in size, most damaging are PM2.5 and PM10 – with a diameter of less than 2.5 μm and 10μm respectively. A human hair’s diameter is 50-70 μm.

PM2.5 levels lower than 12 are considered good, 55-150 unhealthy and 250 or above is hazardous.

In 2020, India had 46 of the world’s 100 most polluted cities, followed by China (42), Pakistan (6), Bangladesh (4), Indonesia (1), and Thailand (1), according to air quality tracker IQAir. All these cities had a PM2.5 air-quality rating of more than 50.

Nine out of the top 10 most polluted cities are in India.

Hotan, in western China’s Xinjiang, had the worst average air quality in 2020, with 110.2.

In 2019, 1.67 million deaths in India were caused by air pollution, according to the Lancet.

While replacing solid fuels with alternatives has lowered deaths linked to household air pollution since 1990, deaths related to ambient PMs have increased.

Fifteen of the 20 most polluted cities are in India, mostly in the north. Stubble burning spikes pollution in autumn and winter. Vehicle emissions, industry, and burning rubbish also contribute to high levels of PM2.5 and other pollutants.

Some Indian and Chinese cities have installed smog towers to try to tackle air pollution

New Delhi installed two after an order by India’s Supreme Court – one is in a busy shopping area.

The $2m 25-metre (82-foot) high tower’s 40 fans take in particle-laden air at 1,000 cubic metres (35,000 cubic feet) per second and pass it through filters.

The smog tower works within a one kilometre (0.6-mile) radius, supposedly cutting PM2.5 levels by 50 percent. But questions remain over how efficient they really are.

According to the WHO, some 7 million people die annually as a result of air pollution. More than 90 percent of the world’s population lives in areas where air pollution exceeds WHO limits.

Air pollution is linked to a number of illnesses including asthma, diabetes, and heart disease.

-

Comment by Riaz Haq on November 24, 2021 at 8:02am

-

"Pakistan’s ..demonstrated access to external financing...offset rising external risks from a widening current-account deficit..reforms...could create positive momentum for the sovereign’s ‘B-’ rating, which we affirmed in May 2021 with a Stable Outlook"

https://www.fitchratings.com/research/sovereigns/reforms-financial-...

Fitch Ratings-Hong Kong-24 November 2021: Fitch Ratings believes Pakistan’s recent policy adjustments and demonstrated access to external financing, as well as its commitment to a market-determined exchange rate, offset rising external risks from a widening current-account deficit. Ongoing reforms, if sustained, could create positive momentum for the sovereign’s ‘B-’ rating, which we affirmed in May 2021 with a Stable Outlook.

Increases in global energy prices and a strong domestic recovery from the initial Covid-19 pandemic shock have put additional strains on Pakistan’s external position. The current-account deficit in the fiscal year to June 2022 is set to be wider than our previous forecast of 2.2%. The State Bank of Pakistan (SBP) on 19 November 2021 raised its policy rate by a significant 150bp to 8.75%, pointing to rising risks related to the balance of payments and inflation.

We think external liquidity pressures should be manageable in the near term, despite the wider current-account deficit, given Pakistan’s adequate foreign-exchange reserves and success in accessing financing.

Official reserve assets nearly doubled to USD24.1 billion by end-September 2021 from USD12.6 billion two years ago. However, liquid foreign-exchange reserves have dropped since mid-September, which we believe may partly reflect debt repayment.

Pakistan’s near-term financing efforts have been supported by Saudi Arabia, which plans to place USD3 billion on deposit with the SBP and provide an additional USD1.2 billion oil-financing facility under a one-year support package. Its foreign reserves also received a USD2.8 billion boost in August from the IMF’s one-off global allocation of Special Drawing Rights.

Funding from these sources followed Pakistan’s successful international debt issuance through a USD2.5 billion bond in March 2021 and a follow-on USD1 billion bond as part of its global medium-term note programme. Pakistan aims to tap debt markets more regularly through the scheme, which could reduce the costs of coming to market. The authorities also plan new sukuk issuance in 2021.

-

Comment by Riaz Haq on November 24, 2021 at 4:59pm

-

The country’s economy rebounded during the fiscal year 2021-21 with real GDP growth rising to 3.9%, reported the State Bank of Pakistan (SBP).

https://www.geo.tv/latest/384001-pakistans-economy-rebounded-during...

Pakistan’s economy rebounded during FY21: SBP

In its annual report titled ‘State of Pakistan’s Economy’ — which reviewed FY21 — the central bank stated that the expansion in economic activity was accompanied by a 10-year low current account balance that contributed to a significant build-up in foreign exchange reserves.

“The fiscal deficit also edged down despite COVID-related spending, leading to an improvement in the public debt-to-GDP ratio, unlike the experience of most countries across the world,” a statement issued by the SBP read.

Inflation eased

Per the report, headline inflation — based on the consumer price index (CPI) — also eased during the year mainly due to “relatively stable prices of non-food and non-energy items.” However, overall price levels, especially of food items, remained high owing to supply-side challenges.

Furthermore, average headline CPI inflation fell to 8.9% in FY21 — within the SBP’s forecast range of 7-9%.

“The resurgence in domestic demand did not translate into inflationary pressures amidst the presence of some spare capacity in the economy,” it stated.

It is pertinent to mention here that the inflation remained volatile during the year, because of the impact of the increase in fuel prices and power tariffs.

The report notes that the economic turnaround was facilitated by management of the COVID health pandemic, as well as a prompt and targeted monetary and fiscal response to counter its impact on economic growth and livelihoods.

The SBP’s liquidity support amounted to around 5% of GDP by the end of FY21, featuring a combination of policy rate cuts as well as several targeted and time-bound measures, such as the Temporary Economic Refinance Facility (TERF) for promotion of new investment, Rozgar payroll financing scheme to prevent layoffs, the Refinance Facility to Combat COVID to provide concessional financing to construct hospitals and facilities to fight against COVID, and temporary loan deferments and restructurings to provide temporary liquidity relief to small and big businesses as well as individual borrowers.

The report highlights that a broad-based recovery in real GDP growth was recorded. Led by the favourable supply and demand dynamics as well as a low base effect from the COVID-led contraction in FY20, large-scale manufacturing posted a 14.9% increase in FY21.

It further revealed that although the growth in agriculture was slightly lower than in FY20, the production of wheat, rice and maize rose to historic levels.

“The cumulative increase in the production of these crops offset the decline in cotton production," it noted.

"The improvement in the commodity-producing sectors and a surge in imports led to a sharp recovery in wholesale and trade services in FY21,” the statement read.

The central bank’s report also notes that the economic rebound was achieved without a worsening of macroeconomic imbalances, as the overall policy mix was “still prudent”.

The current account deficit reduced substantially amid record-high workers’ remittances and export receipts and contributed to the $5.2 billion increase in the SBP’s foreign exchange reserves during the year. The country also retained access to sizable external financing, with inflows received from the IMF and other multilateral and bilateral creditors; the issuance of Eurobonds after a long hiatus; and deposits and investments from non-resident Pakistanis via the Roshan Digital Accounts.

The central bank points out that the recovery in exports was driven by the “continued adherence to the market-based exchange rate system; provision of subsidised inputs; lower duties on imported raw materials; and the fast-tracking of GST refunds”.

-

Comment by Riaz Haq on November 24, 2021 at 5:00pm

-

The country’s economy rebounded during the fiscal year 2021-21 with real GDP growth rising to 3.9%, reported the State Bank of Pakistan (SBP).

https://www.geo.tv/latest/384001-pakistans-economy-rebounded-during...

During FY21, the higher exports partially offset a significant rise in import payments, which surged amidst the upswing in economic activity; supply-side challenges in wheat, sugar and cotton; and elevated international commodity prices.

“These pressures became more prominent towards the end of the year, leading to a 3% depreciation of the Pakistani rupee against the US dollar during the fourth quarter (July-March),” the central bank reported, noting that the local currency had appreciated 10%, mainly due to the “accumulated current account surpluses”.

Meanwhile, the fiscal deficit reduced to 7.1% of GDP, from 8.1% in FY20. “Restrained non-interest current expenditures allowed for undertaking spending on social safety nets, the economic stimulus package and provision of targeted support to various sectors of the economy,” said SBP.

Tax collection improved

On the revenue side, the Federal Board of Revenue’s tax collection improved sharply, in the wake of the economic rebound, a surge in imports, and efforts to streamline tax administration.

The report noted that with the containment of the twin deficits and currency appreciation, the public debt-to-GDP ratio declined to 83.5% in FY21.

-

Comment by Riaz Haq on November 27, 2021 at 9:07pm

-

Modi’s Reform Momentum Has Hit a Wall in #India. Big chunks of #Modi’s #economic agenda could get delayed or scrapped. The reversal of #FarmLaws and a possible stalling of the new #labor codes could be the beginning of two years of inertia. #economy #BJP

https://www.bloomberg.com/opinion/articles/2021-11-25/modi-s-reform... https://twitter.com/haqsmusings/status/1464822103346061312?s=20

Investors must be wondering what promise New Delhi will break next as the ruling party tries to win upcoming state elections. First, the government made a U-turn on the three laws that Prime Minister Narendra Modi wanted to use to shake up the stagnant farm economy. Next, he may delay implementing the four codes that have been billed as the “biggest labor reforms in independent India,” as Bloomberg News reported. Has the Modi momentum finally come up against a wall? Take the labor laws passed by parliament in September last year. So far, only 10 out of India’s 28 states have followed through by finalizing rules on industrial relations, wages, social security and workplace safety. Considering Modi’s party is in power in 17 states, politicians clearly fear resistance. It’s been a longtime demand by the business community that industrial units with fewer than 300 workers shouldn’t require government permission to fire employees. (The federally mandated limit currently affects factories employing more than 100 workers, acting as a perverse incentive against growth, though some states have relaxed the rules.) Still, codifying this concession won’t exactly win votes. Similarly, giving a legal boost to retirement nest-eggs — as the new rules demand — will ultimately benefit employees. Yet they won’t be thrilled if it means lower take-home pay now. Why is it so hard for a powerful — and, after more than seven years in the top job, still highly popular — leader to enforce his will? Modi promised sweeping, productivity-enhancing changes to factors of production — land, labor and capital. He also pledged a revamp of crucial commodity markets like food. In each instance, being perceived as pro-big business was the undoing of his policies. The first setback was land. The previous government, battling popular anger for allowing land grabs in the name of special economic zones, had passed an acquisition law in 2013 that big business found too restrictive. Within a year of becoming prime minister, Modi tried to tilt the balance so that village plots could be acquired more easily for infrastructure or affordable housing. But opposition leader Rahul Gandhi mocked him in parliament for favoring crony capitalists dressed in “suits and boots.” Modi gave up the idea. Ditto the controversial agriculture laws. Modi backed them to the hilt against relentless protests by farmers. But since the overall package gave the impression that the state was going to retreat from grain procurement, leaving farmers at the mercy of large business groups, it became too hot a potato to hold through next year’s state elections in Uttar Pradesh and Punjab. So Modi dropped his ambitious plan, closing the door at least for some years on reforms of the subsidy-ridden farm and food economy. Now it looks like the new labor codes are going into cold storage, too. Meanwhile, reforms to improve capital allocation in the economy are a mixed bag. Despite opposition from bank employees’ unions, a bill — to be introduced in the upcoming winter session of parliament — will pave the way for privatizing two state-run lenders. Investors will pay attention to the fate of this law. They should also closely watch the government’s 6 trillion rupees ($80 billion) asset recycling plan. This, too, could potentially become a political minefield.

-

Comment by Riaz Haq on November 29, 2021 at 1:49pm

-

#Saudi Fund for Development signs 2 deals with #Pakistan worth $4.2 billion, including $ 3 billion deposit to the State Bank of Pakistan to bolster its reserves and $1.2 billion to finance Pakistan's #oil imports. #economy #currency #energy #SaudiArabia https://www.arabnews.com/node/1977671/business-economy

The Saudi Fund for Development on Monday signed two agreements worth $4.2 billion with Pakistan. The deals aim to support the Pakistani economy.

The first agreement includes a $ 3 billion deposit to the State Bank of Pakistan to support the country’s foreign currency reserve levels and mitigate the impact of the coronavirus disease pandemic. The second deal seeks to support Pakistan in financing oil derivatives trade with $1.2 billion.

-

Comment by Riaz Haq on November 29, 2021 at 2:03pm

-

Heartland misery: Four states hosting 30% of Lok Sabha seats are among the poorest. That’s a message for India

The South appears better placed. In 1991, on economic reform-eve, Bihar and Tamil Nadu were nearly at par in per capita GDP. Three decades later, TN has whittled down its multidimensionally poor to 4.9% of population while Bihar languishes at 51.9%. Jharkhand follows with 42%, UP 38% and MP 37%. The cruel governance irony of these numbers is that the four laggard states cumulatively account for 30% of seats in Lok Sabha and their electoral outcomes play a decisive role in national government formation. https://timesofindia.indiatimes.com/blogs/toi-editorials/heartland-...

The heavy poverty burden, despite tremendous political heft and massive welfare funding, indicts heartland netas. Poor states cannot afford their enduring obsession with identity politics, but a shift in discourse towards economic development looks unlikely. Meanwhile, farm laws’ reversal makes poverty eradication in villages harder. Accounting for nearly 5 crore of India’s 12.5 crore unviable agricultural land holdings under 2 hectares, the failure of these four states to call out the subsidised big farmers and lead the clarion call for agri-reforms was another missed opportunity for their political economy.The multidimensional poverty index constructed on health, education, and standard of living indicators like nutrition, years of schooling, and amenities like cooking fuel, electricity, pucca housing, sanitation, household assets etc, claims to better the erstwhile methodology of pegging a poverty baseline in monetary terms. Performance here depends to an extent on India’s sprawling welfare state, which has admittedly gained more mastery in delivering household amenities to the poor. But NFHS-5 findings of 60% women and young children facing malnutrition uncovers the limitations of welfarism, and conversely, the importance of economic growth to create enough jobs. Over to Nitish, Soren, Yogi, Shivraj, Akhilesh, Tejashwi and Kamal Nath.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

Agriculture, Caste, Religion and Happiness in South Asia

Pakistan's agriculture sector GDP grew at a rate of 5.2% in the October-December 2023 quarter, according to the government figures. This is a rare bright spot in the overall national economy that showed just 1% growth during the quarter. Strong performance of the farm sector gives the much needed boost for about …

ContinuePosted by Riaz Haq on March 29, 2024 at 8:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network