PakAlumni Worldwide: The Global Social Network

The Global Social Network

Modi's India Busting Western Sanctions, Funding Russia's War On Ukraine

India, a western ally, is openly buying Russian coal, oil and weapons worth tens of billions of dollars at deep discounts. These actions amount to busting western sanctions and financing President Vladimir Putin's war on Ukraine. Many smaller developing countries, including Bangladesh and Pakistan, are abiding by these sanctions and suffering from the consequences in terms of high prices of fuel and food. Why these double standards? Do these policy contractions serve the broader US interests in the Asia region?

|

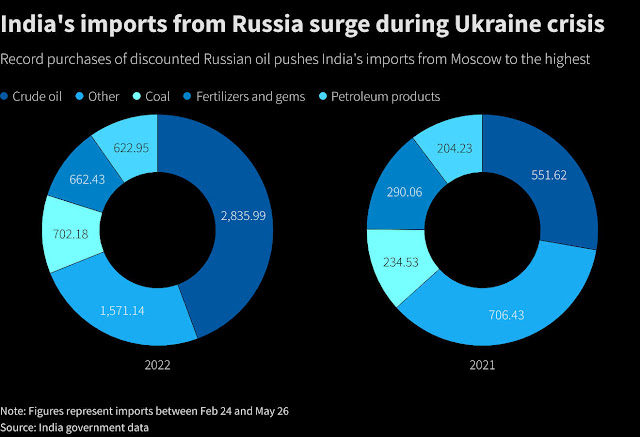

| India's Russian Imports Soaring Since the Start of Ukraine War. Source: Reuters |

India's Russian coal imports are up 6-fold from May 27 to June 15, 2022, according to Reuters. Delhi's Russian oil buying has jumped 31-fold in this period. Bulk shipments of Russian thermal coal to India began in the third week of May, 2022.

India is defying western sanctions to buy millions of barrels of discounted Russian crude oil, hiding their origin and exporting refined petroleum products with a big markup to make a huge profit. China has yet to increase its oil imports from Russia, according to news reports. Meanwhile, India's neighbors Bangladesh and Pakistan are abiding by western sanctions and paying much higher market prices to buy oil for their domestic needs, and hurting their people. Such double standards are not going unnoticed.

|

| India's Refined Petroleum Exports.Source: MarketWatch |

India is importing large amounts of deeply discounted Russian crude, running its refiners well above capacity, and capturing the economic rent of sky-high crack spreads and exporting gasoline and diesel to Europe, according to MarketWatch. “As the EU weans from Russian refined products, we have a growing suspicion that India is becoming the de facto refining hub for Europe,” said Michael Tran, global energy strategist at RBC Capital Markets, in a Tuesday note. Here’s how the puzzle pieces fit together, according to Tran:

"India is buying record amounts of severely discounted Russian crude, running its refiners above nameplate capacity, and capturing the economic rent of sky-high crack spreads and exporting gasoline and diesel to Europe. In short, the EU policy of tightening the screws on Russia is a policy win, but the unintended consequence is that Europe is effectively importing inflation to its own citizens. This is not only an economic boon for India, but it also serves as an accelerator for India’s place in the new geopolitically rewritten oil trade map. What we mean is that the EU policy effectively makes India an increasingly vital energy source for Europe. This was historically never the case, and it is why Indian product exports have been clocking in at all-time-high levels over recent months".

Bangladesh and Pakistan are afraid to buy Russian oil for fear of western sanctions while American ally India feels free to do so. Pakistan's Imran Khan sought to buy Russian oil and gas before he was removed from power in early April. Pakistani Finance Minister Miftah Ismail told CNN's Becky Anderson in a recent interview, “It is very difficult for me to imagine buying Russian oil. At this point I think that it would not be possible for Pakistani banks to open LCs or arrange to buy Russian oil". Similarly, Bangladeshi foreign minister AK Abdul Momen said, “Russia has offered to sell oil and wheat to us, but we can’t do it out of fears of sanctions. We asked [India] how they did it [import oil from Russia]. They [India] said they have found some tricks,” Momen added.

The West, particularly the United States, is turning a blind eye to India's actions when it comes to busting sanctions on Russia. Indian Prime Minister Narendra Modi is openly funding the war in Ukraine by buying weapons and energy from Russia. At the same time, India's smaller neighbors feel intimidated by the threat of western sanctions if they follow Modi's example. Such double standards are not going unnoticed.

Related Links:

Pakistani-American Banker Heads SWIFT, the World's Largest Interban...

Pakistani-Ukrainian Billionaire Zahoor Sees "Ukraine as Russia's Af...

Ukraine Resists Russia Alone: A Tale of West's Broken Promises

Ukraine's Lesson For Pakistan: Never Give Up Nuclear Weapons

Can the Chinese Yuan Replace the US Dollar?

Russia Sanction: India Profiting From Selling Russian Oil

Ukraine's Muslim Billionaire Akhmetov Holds Balance of Power

-

Comment by Riaz Haq on September 15, 2022 at 10:47am

-

The big picture: The SCO is a political, economic and security organization designed to counter U.S. influence, which Beijing and Moscow founded in 2001.

https://www.axios.com/2022/09/15/xi-putin-meeting-samarkand

It comprises leaders from India and Central Asia, including Kazakhstan, which was Xi's first stop on his three-day trip to Central Asia. Indian Prime Minister Narendra Modi attended the summit as well.

-----------

China's President Xi Jinping met with Russia's leader Vladimir Putin in Samarkand, Uzbekistan, on the sidelines of the Shanghai Cooperation Organization (SCO) summit Thursday.

Why it matters: Their first in-person encounter since Russian forces launched their Feb. 24 invasion of Ukraine marks a show of diplomatic support for the Russian president after Ukrainian troops forced his forces to retreat from much of Ukraine's northeast, even as Putin acknowledged that Beijing may have "questions and concerns" regarding the war.

Xi is aiming to bolster his standing as a geopolitical statesman in his first trip outside China since early in the COVID-19 pandemic before October's Communist Party leaders' meeting, when he's expected to secure a third term in office.

What they're saying: “We highly appreciate the balanced position of our Chinese friends in connection with the Ukrainian crisis,” Putin said in his opening remarks at the meeting, the New York Times reported.

“We understand your questions and concerns in this regard. During today’s meeting, of course, we will explain in detail our position on this issue, although we have spoken about this before," he added.

Putin also referred to Xi as a “dear and longtime friend," adding that Russia supports the One China principle and condemns the U.S.' "provocations" in Taiwan, per the Washington Post.

Xi did not comment on Ukraine or the perceived threat from NATO in his remarks at the meeting.

However, China released a statement after the meeting noting that it was "ready to work with Russia in extending strong support to each other on issues concerning their respective core interests," per the Times.

Worth noting: The Kremlin claimed in a statement ahead of Putin's trip to Samarkand that a senior official from the ruling Chinese Communist Party said during a visit to Russia last week that Beijing "understands and supports Russia," in particular "on the situation in Ukraine."

The state-run Xinhua News Agency said Li Zhanshu, the third-ranking member of the CCP, met with Putin, but it did not mention comments about Ukraine. It said Li pledged to "continue to work with Russia to firmly support each other on issues concerning each other's core interests and major concerns."

The big picture: The SCO is a political, economic and security organization designed to counter U.S. influence, which Beijing and Moscow founded in 2001.

It comprises leaders from India and Central Asia, including Kazakhstan, which was Xi's first stop on his three-day trip to Central Asia. Indian Prime Minister Narendra Modi attended the summit as well.

Iran announced earlier this week it would join the SCO, underscoring the growing alignment between the U.S.'s top adversaries.

Flashback: Xi and Putin last met in early February in Beijing, where they jointly announced a "no limits" partnership and the arrival of a "new era" of global politics — just weeks before Putin's invasion of Ukraine.

The Chinese leader backed the Russian president in warning against Western "interference" and a NATO expansion — which Putin later blamed in his attempts to try and justifying his forces' unprovoked invasion of Ukraine.

Between the lines: Both Putin and Xi are now in more precarious situations than they were in February. The Russian economy is increasingly isolated by a tough Western-led sanctions regime, and the Russian army has recently suffered major setbacks in Ukraine after a successful counteroffensive by the Ukrainian military.

-

Comment by Riaz Haq on September 16, 2022 at 8:22am

-

Russian President Vladimir Putin told India's Narendra Modi on Friday that he understood New Delhi's concerns about the conflict in Ukraine and wanted it to end "as soon as possible", according to a readout of a bilateral meeting published by the Kremlin.

https://news.yahoo.com/putin-tells-modi-understands-indias-14230101...

The Indian prime minister told Putin on the sidelines of a regional security bloc summit in Uzbekistan: "I know that today's era is not an era of war, and I have spoken to you on the phone about this." He said democracy, diplomacy and dialogue kept the world together.

But Putin said Kyiv had rejected negotiations and was set on achieving its own objectives "on the battlefield".

"I know your position on the conflict in Ukraine, your concerns that you constantly express," he told Modi on the sidelines of a summit of the Shanghai Cooperation Organisation in Samarkand, Uzbekistan.

"We will do everything to stop this as soon as possible. Only, unfortunately, the opposing side, the leadership of Ukraine, announced its rejection of the negotiation process and stated that it wants to achieve its goals by military means."

Russia controls around a fifth of Ukraine after sending its armed forces into its neighbour's territory from several directions in February.

It says that what it calls a "special military operation" was necessary to prevent Ukraine being used as a platform for Western aggression, and to defend Russian-speakers.

Kyiv and its Western allies dismiss these arguments as baseless pretexts for an imperial-style war of acquisition, and have urged Russia to withdraw unconditionally.

Putin had made similar comments to Chinese leader Xi Jinping on Thursday, saying he understood Beijing's concerns about the conflict.

Russia is trying to forge closer ties with both China and India as Moscow faces isolation and onerous sanctions from the West over its invasion of Ukraine.

Both countries have stepped up their purchases of Russian energy - trading at a discount on world markets as Western countries buy less - and talked about building closer economic ties.

(Reporting by Reuters; Editing by Kevin Liffey)

-

Comment by Riaz Haq on September 21, 2022 at 7:51am

-

Senators seek secondary sanctions on Russian oil purchases that could irk India, China

https://worldoil.com/news/2022/9/20/u-s-senators-seek-secondary-san...

(Bloomberg) — A bipartisan pair of senators is pressing the Biden administration to use secondary sanctions to enforce a cap on the price of Russian oil.

The push comes as the US and Group of Seven nations seek to limit Russian President Vladimir Putin’s ability to fund his war in Ukraine.

Senators Chris Van Hollen, a Maryland Democrat, and Pennsylvania Republican Pat Toomey are working on legislation that would impose secondary sanctions on foreign firms that facilitate the trade of Russian oil and on countries that increase their purchases of the commodity.

The pair worked together before and co-sponsored the Senate version of the Hong Kong Autonomy Act that imposed sanctions on Chinese officials involved in the crackdown on dissent in the territory and was signed into law by Donald Trump.

“We have yet to effectively cut off funding to Putin’s war machine by diminishing Russia’s revenues from energy sales,” Van Hollen and Toomey, who are both members of the Banking Committee, said in a statement. “In order to successfully enforce the price cap, it’s clear the administration requires new authority from Congress.”

The legislation sets up a clash with the Biden administration, which has previously rejected secondary sanctions as a way to enforce the oil price cap. Biden’s team argues that the economic incentives of a cap are sufficient to induce cooperation and secondary sanctions would create tensions with nations such as India, which continue to buy Russian oil.

Buyer Incentives

“I don’t think you need secondary sanctions for this to work,” Deputy Treasury Secretary Wally Adeyemo said in a Sept/ 6 interview with Bloomberg reporters in New York. “The incentives of buyers are aligned with the incentives of the countries that are putting in place the price cap.”

A Treasury Department spokesperson declined to comment. A person familiar with the matter, who asked not to be identified discussing private deliberations, said Treasury had been briefed on the framework.

But Congress has repeatedly steered the administration toward harder-line policies on Russia since its Feb. 24 invasion. The most prominent example was when the administration, under pressure from lawmakers, reversed its opposition to cutting off some Russian banks from the SWIFT financial messaging system.

Bilateral Strains

If passed, the legislation could provoke a major fight with countries such as India and China, which have ramped up their purchases of Russian oil and have reacted coolly to the idea of a price cap. The US has been careful in its interactions with India on the price cap, pitching it as a way to negotiate lower prices from Russia but steering clear of threatening penalties for failing to join the scheme.

Under the two senators’ proposal, the US and its allies would be required to impose a cap on the price of Russian seaborne oil by March 2023. The cap would then be reduced by one-third every year until it reaches the break-even price within three years, depriving Putin of any revenue above the price of production. The president can waive the price reduction if the administration determines it would cause the global price of oil to spike.

The cap would be enforced by secondary sanctions on any firms involved in the sale or transportation of Russian oil, including banks, insurance and re-insurance companies and brokerages.

The legislation, which has not yet been introduced, would also penalize countries found to be importing Russian oil, oil products, gas and coal above their pre-war levels.

Van Hollen and Toomey said secondary sanctions would give the administration the tools it needs to “hold accountable the financial institutions supporting those countries involved in rampant war profiteering from Russian exports.”

-

Comment by Riaz Haq on October 3, 2022 at 5:52pm

-

#Russia becomes #India’s 2nd-largest crude #oil supplier after #SaudiArabia. India’s September imports of Russian oil rose 18.5% from August reaching 879,000 barrels per day (bpd) of #Russian oil in September 2022.

https://economictimes.indiatimes.com/industry/energy/oil-gas/russia...

India’s September imports of Russian oil rose 18.5% from August after falling for two months, making it the country’s second-largest crude supplier after Saudi Arabia, according to energy cargo tracker Vortexa. The import of 879,000 barrels per day (bpd) of Russian oil in September is the second highest in a month ever for India after June’s 933,000 bpd.“India may consider importing more Russian crude this quarter as refiners ramp up runs to meet the seasonal rise in domestic demand an ..

-

Comment by Riaz Haq on October 3, 2022 at 9:15pm

-

Suhasini Haidar

@suhasinih

Russia is India's second largest oil supplier, contribution to Indian imports now 21% , up from 1% before Ukraine warhttps://www.business-standard.com/article/international/russia-boun...

https://twitter.com/suhasinih/status/1577124600399659008?s=20&t...

-

Comment by Riaz Haq on October 10, 2022 at 11:07am

-

Pakistan, Ukraine, And The Race For Third-Party Ammunition

In the rush to source artillery rounds, Ukraine and its allies turned to Pakistan and an air bridge provided by military cargo planes.

BY

ELISABETH GOSSELIN-MALO

| PUBLISHED OCT 6, 2022 7:11 PM

https://www.thedrive.com/the-war-zone/pakistan-ukraine-and-the-race...

In a plea for assistance in June of this year, Ukraine’s Deputy Head of Military Intelligence, Vadym Skibitsky, told reporters that the conflict with Russia “is now an artillery war that we are losing, [as] Ukraine has one artillery piece to 10-15 Russian artillery pieces and we have almost used up all of our ammunition.” Although the United States and allies in Europe were already delivering shells to Ukraine, they themselves found their stocks also decreasing at an alarming rate. In a surprising development, Pakistan emerged as an important source and an air bridge was established to bring much-needed ammunition to Ukraine.

In a war where artillery has become king, both Russia and Ukraine have been looking for any means to refill their ammunition reserves. Russia's losses of major weapons storage areas, especially to precision strikes from Ukraine's U.S.-supplied High Mobility Artillery Rocket Systems (HIMARS), only accelerated its need for fresh ammunition.

Ukraine had burned through its Soviet-era artillery stocks just a handful of months into the war and was gobbling up whatever its allies could give it. These concerns seem to have effectively warranted a boost in the capacity and creativity of both manufacturers and states, as both Russia and Ukraine have turned to unforeseen partners for answers.

For NATO states, employing standard calibers enables them to further share ammunition stores. But several months into the conflict, the West had to think outside the box to replenish Ukrainian artillery stockpiles, which by then comprised of a mix of Soviet-era and NATO calibers and types.

Beginning on August 6, open-source intelligence began to reveal that a U.K. Royal Air Force (RAF) C-17 Globemaster III aircraft (serial ZZ143) was conducting almost daily flights from Romania’s Cluj International Airport or RAF Akrotiri in Cyprus to Pakistan’s Nur Khan Air Base. This development came days after Britain announced it would be supplying Ukraine with more than 50,000 Soviet-type artillery shells. Over the course of 15 days, the C-17 Pakistan-Romania airlift effort completed a total of 12 trips, leading many analysts to assume that the United Kingdom was transporting military supplies for the Ukrainians. No flights have been tracked between these destinations since August 22.

While we don't know exactly what those aircraft were carrying, evidence of 122mm HOW HE-D30 artillery shells manufactured by the Pakistan Ordnance Factories (POF) in Ukrainian hands subsequently emerged. In one video gone viral on social media, seen below, where the POF 122-mm shells are seen being unpacked, it is possible to identify them based on several elements including the specific British-style steel-box packaging typically used by the company and the LIU-4 type fuzes that are also distinctive to POF’s Soviet-type 122mm artillery.

-

Comment by Riaz Haq on October 10, 2022 at 11:08am

-

Pakistan, Ukraine, And The Race For Third-Party Ammunition

In the rush to source artillery rounds, Ukraine and its allies turned to Pakistan and an air bridge provided by military cargo planes.

https://www.thedrive.com/the-war-zone/pakistan-ukraine-and-the-race...

While no flights have been tracked between these destinations since August 22, it appears that the Pakistan-made projectiles are now in the hands of Ukrainian troops. In a video gone viral on social media, where the POF 122-mm shells are seen being unpacked, it is possible to identify them based on several elements including the specific British-style steel-box packaging typically used by the company and the LIU-4 type fuzes that are also distinctive to POF’s Soviet-type 122mm artillery.

Since the appearance of this footage on the battlefield, no formal confirmation has been given by either Pakistani or British authorities. When reached for comment, a senior POF employee told The War Zone that “he was told not to answer any of the questions related to this matter.” Similarly, the only remark the U.K. MoD has given on the issue is that the country “remains steadfast in its support for Ukraine and it is working with a range of allies and partners to ensure it has what it needs to defend itself against Russia’s brutal invasion.” More recently, the RAF’s C-17 aircraft has been active but only within Europe making regular trips from and to Poland’s Rzeszow Air Base, which serves as an entry point to ship military aid into Ukraine.

The POF’s 122mm HOW HE-D30 projectiles are semi-fixed ammunition for howitzers, with a maximum range of 9.5 miles and a muzzle velocity (the speed at which projectile leaves the barrel) of 2,270 feet per second (690 meters/s.) The complete weight of the round, taking into account the projectile and shell, is about 28 pounds.

It is important to note that the entry of Pakistani ordnance into the conflict would never turn the tide of the war, given also that the number of rounds sent remains unknown. But it may have played a significant role in bridging the gap between the delivery of more Western artillery systems and Ukraine's wind-down of using Soviet-era ones.

Although it may be surprising to see British authorities turn to POF for these supplies, the two actually share a long-standing history. The POF was established in 1951 by the Pakistani government with collaboration from the British Royal Ordnance Factory (an ensemble of U.K. munition factories established during and after World War II). Public British Parliament documents further show that in the 1970s, under licensed production deals, Britain provided training for the engineers and POF staff as well as a technology transfer for the manufacturing of 105mm L64 Tungsten ammunition. The POF is also one of the main manufacturers still producing large amounts of Soviet-style artillery ammunition.

--------

The story of Pakistani artillery shells making their way to Ukrainian artillery is something of a metaphor for how the push to supply Kyiv with the weapons it needed to hold off the Russian war machine. These efforts, which appear to have been clandestine, at least in part, look to have been an 'all hands on deck' scramble. Old relationships, modern airlifter logistics, plenty of money, and the will to make it happen proved integral in helping save Ukraine from being completely overrun by Russian forces.

-

Comment by Riaz Haq on October 27, 2022 at 7:41pm

-

NEW DELHI, Oct 27 (Reuters) - India's oil imports from the Middle East fell to a 19-month low in September while Russian imports rebounded although refining outages hit overall crude imports, data from trade and shipping sources showed.

https://www.reuters.com/business/energy/indias-russian-oil-binge-se...

Iraq remained the top supplier while Russia overtook Saudi Arabia as the second biggest after a gap of a month, the data showed.

India's total oil imports in September fell to a 14-month low of 3.91 million barrels per day (bpd), down 5.6% from a year earlier, due to maintenance at refiners such as Reliance Industries (RELI.NS) and Indian Oil Corp (IOC.NS), the data showed.

India's imports from the Middle East fell to about 2.2 million bpd, down 16.2% from August, the data showed, while imports from Russia increased 4.6% to about 896,000 bpd after dipping in the previous two months.

Russia's share of India's oil imports surged to an all-time high of 23% from 19% the previous month while that of the Middle East declined to 56.4% from 59%, the data showed.

The share of Caspian Sea oil, mainly from Kazakhstan, Russia and Azerbaijan, rose to 28% from 24.6%.

India has emerged as Russia's second biggest oil buyer after China, taking advantage of discounted prices as some Western entities shun purchases over Moscow's invasion of Ukraine.

"The discount on Russian oil has narrowed now but when you compare its landed cost with other grades such as those from the Middle East, Russian oil turned out to be cheaper," said a source at one of India's state refiners.

Imports for Saudi Arabia fell to a three-month low of about 758,000 bpd, down 12.3% from August, while imports from Iraq plunged to 948,400 bpd, their lowest level in a year, the data showed.

Imports from the United Arab Emirates declined to a 16-month low of about 262,000 bpd.

Higher intake of Caspian Sea oil has hit the share of other regions in India's imports in April-September, the first half of the fiscal year, and also cut OPEC's market share in the world's third biggest oil importer and consumer to its lowest ever.

In the first half of this fiscal year, Indian refiners also reduced purchases of African oil, mostly bought from the spot market. However, supply from the Middle East rose from a low base last year when the second wave of the coronavirus cut fuel demand.

-

Comment by Riaz Haq on November 4, 2022 at 5:38pm

-

#Russia Becomes #India’s Top Crude Oil Supplier, Overtaking OPEC Heavyweights #Iraq & #SaudiArabia. India received record-breaking 946,000 barrels per day (bpd) of #Russian crude in October. #UkraineWar #Modi #Putin | OilPrice.com https://oilprice.com/Latest-Energy-News/World-News/Russia-Becomes-I... #oilprice

Before the Russian invasion of Ukraine, India was a small marginal buyer of Russian crude oil. After Western buyers started shunning crude from Russia, India became a top destination for Russian oil exports alongside China.

Indian refiners haven’t expressed hesitation to deal with Russia—their primary incentive to buy has been the much cheaper Russian oil than international benchmarks and similar grades from the Middle East and Africa.

According to Vortexa’s estimates, India—the world’s third-largest crude oil importer—shipped in a record 946,000 bpd of crude from Russia last month, up by 8% compared to September. Total Indian imports increased by 5% month on month in October, Vortexa data cited by the Economic Times showed.

Of note was that Russia surpassed both Iraq and Saudi Arabia to become the number-one crude oil supplier to India. Russian crude accounted for 22% of all Indian imports last month, while Iraq’s share was at 20.5% and Saudi Arabia’s—at 16%.

Going forward, there will be a lot of uncertainties among buyers over Russia’s oil exports when the EU embargo enters into force on December 5.

Indian Oil Corporation and Bharat Petroleum Corporation Limited (BPCL), two of the biggest state-owned importers of Russian crude oil in India, have reportedly stopped looking for spot Russian crude oil supply set to arrive after December 5, as they await more clarity on the EU sanctions regime ahead of the deadline, including on the possibility of secondary sanctions on buyers of Russian crude.

India will also further diversify its oil imports to better prepare for future OPEC+ production cuts that raise oil prices and tighten supply, its Petroleum Minister Hardeep Singh Puri said last month.

-

Comment by Riaz Haq on November 13, 2022 at 2:06pm

-

Russia’s gross international reserves (GIR) were up by $3.6bn in a week to $571.2bn as of August 5, the Central Bank of Russia (CBR) reported, at the same time as individuals are buying record amounts of foreign currency.

https://www.intellinews.com/russia-s-international-reserves-up-3-6b...

Russia’s international reserves increased by 0.6% (or $3.6bn) in one week, the central bank reported on August 11. The CBR stopped reporting the monthly reserves figures at the end of January when total GIR stood at $630.2bn. (chart)

"International reserves amounted to $574.8bn as of August 5, up by $3.6bn, or by 0.6%, in one week due to positive revaluation," the regulator said on its website.

Foreign exchange is pouring into the CBR coffers after the current account surplus of Russia's balance of payments hit a new all-time high of $166bn in the first seven months of this year – triple its level in the same period a year earlier that was already a record high. Sanctions intended to reduce Russia’s revenue from energy exports have backfired, and after they sent prices soaring the Kremlin is earning more money than ever. Ironically, the highly effective bans on exports of equipment and technology to Russia have worked against the leaky energy sanctions as they have dramatically reduced imports to Russia that have only bolstered the current account surplus further.

Some $300bn worth of gold and foreign currency CBR reserves were frozen shortly after the invasion of Ukraine in February, but the soaring revenues from oil exports will cover a large share of that money by the end of this year, say economists.

Russians buy record amounts of FX on MOEX

The crisis-scarred population have also been reacting to the sanctions on currency transactions by moving their cash savings out of the traditional dollars and euros into other currencies of the “friendly” countries.

Individual purchases of currency on MOE overtook transactions by bankers for the first time ever in the second half of July, the CBR said in its latest financial market risks review.

Net purchases of currency by individuals increased 1.3-fold from RUB176.1bn ($2.9bn) in June to RUB237.1bn ($3.9bn) in July – a new record, according to the CBR.

Individuals mainly bought foreign currency at banks that could then send the money to accounts overseas.

The outflow of currency has also been visible in the ruble-dollar exchange rate, as the ruble weakened and was trading at RUB60.6 at the time of writing, down from its recent high of almost RUB50 to the dollar. As imports recover, further growth of foreign currency demands can be expected for market players, the central bank said.

The “yuanisation” of the Russian economy continues as a result of the Western sanctions imposed on Russia. The yuan became the third most traded currency in terms of volume of foreign exchange trading on the Moscow Exchange in July and will soon take second place, The Bell reported on August 8, as companies and individuals rush to get out of the dollar and into non-sanctioned currencies.

Banks have been building up large amounts of dollars and euros they can’t spend due to sanctions and have been actively trying to swap them for other currencies.

The government has been doing the same thing, signing trade deals with its partners in local currency and using other non-traditional currencies for international trade. Russia oil exports to India are now being settled in Chinese yuan, Hong Kong dollars and UAE dinars, according to reports.

Ordinary Russians have been moving their savings out of dollars. Balances at retail bank accounts in foreign currency declined in July by $3bn, the CBR reports. Just before the war there was only one Russian bank that offered deposit accounts in yuan; now there are 20, according to The Bell.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

Agriculture, Caste, Religion and Happiness in South Asia

Pakistan's agriculture sector GDP grew at a rate of 5.2% in the October-December 2023 quarter, according to the government figures. This is a rare bright spot in the overall national economy that showed just 1% growth during the quarter. Strong performance of the farm sector gives the much needed boost for about …

ContinuePosted by Riaz Haq on March 29, 2024 at 8:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network