PakAlumni Worldwide: The Global Social Network

The Global Social Network

India's Crony Capitalism: Modi's Pal Adani's Wealth Grows at the Expense of Ordinary Bangladeshis and Indians

Prime Minister Shaikh Hasina has agreed to buy expensive electricity from India in spite of a power glut in Bangladesh, according to a report in the Washington Post. The newspaper quotes B.D. Rahmatullah, a former director general of Bangladesh’s power regulator, as saying, "Hasina cannot afford to anger India, even if the deal appears unfavorable." “She knows what is bad and what is good,” he said. “But she knows, ‘If I satisfy (Gautam) Adani, Modi will be happy.’ Bangladesh now is not even a state of India. It is below that.” The Washington Post report says: "Facing a looming power glut, Bangladesh in 2021 canceled 10 out of 18 planned coal power projects. Mohammad Hossain, a senior power official, told reporters that there was “concern globally” about coal and that renewables were cheaper".

|

| Gautam Adani (L) and Narendra Modi |

|

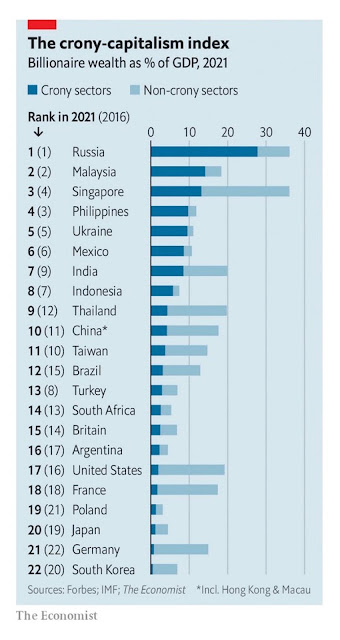

| India Ranks High on Crony Capitalism Index. Source: Economist |

Hasina recently visited New Delhi to seek political and economic assistance from the Indian Prime Minister Narendra Modi. This summit was preceded by Bangladesh Foreign Minister Abdul Momen's trip to India where he said, "I've requested Modi government to do whatever is necessary to sustain Sheikh Hasina's government". Upon her return from India, Sheikh Hasina told the news media in Dhaka, "They (India) have shown much sincerity and I have not returned empty handed". It has long been an open secret that Indian intelligence agency RAW helped install Shaikh Hasina as Prime Minister of Bangladesh, and her Awami League party rely on New Delhi's support to stay in power. Bangladesh Foreign Minister Abdul Momen has described India-Bangladesh as one between husband and wife. In an interview with Indian newspaper 'Ajkal,' he said, "Relation between the both countries is very cordial. It's much like the relationship between husband and wife. Though some differences often arise, these are resolved quickly." Both Bangladeshi and Indian officials have reportedly said that Sheikh Hasina "has built a house of cards".

|

| Shaikh Hasina (L) with Narendra Modi |

The Washington Post reports that the Modi government has changed laws to help Adani’s coal-related businesses and save him at least $1 billion. After a senior Indian official opposed supplying coal at a discount to Adani and other business tycoons, he was removed from his job by the Modi administration, according to the paper. Modi has continued to support Adani's business with discounted coal even after telling the United Nations he would tax coal and ramp up renewable energy. India is the world's third largest carbon emitter.

|

| World's Top 5 Carbon Emitters. Source: Our World in Data |

While the coal prices have declined to the level before the start of the Ukraine War, Adani’s power would still cost Bangladesh 33% more per kilowatt-hour than the publicly disclosed cost of running Bangladesh’s domestic coal-fired plant, according to Tim Buckley, a Sydney-based energy finance analyst.

|

| India's Crony Capitalism: Adani Enterprises Stock Up 56,000% on Modi's Watch |

Gautam Adani has become India's richest and the world's second richest person (after Elon Musk) since the election of Prime Minister Narendra Modi in 2014. Financial Times calls Adani "Modi's Rockefeller". Adani's rise owes itself to India's crony capitalism, according to France's Le Monde. Here's an excerpt of a Le Monde story on Adani:

"Adani has not invented some revolutionary technology or disruptive business model. His meteoric success cannot be attributed to innovation. In each sphere of activity among his conglomerates – airports, ports, mining, aerospace, defense industry – the Indian state plays a significant role, whether in allocating licenses or signing contracts. He is known as a close friend of Indian Prime Minister Narendra Modi, who also hails from Gujarat, a state in western India".

Adani has lent his personal airplanes to Modi for BJP's election campaigns. Adani has also recently taken over NDTV, the only Indian major TV channel known for its independence from the BJP government. This takeover has forced Prannoy and Radhika Roythe, the channel's founding couple, to step down. It has also forced out Ravish Kumar, a harsh critic of the Modi regime who hosted a number of popular shows like Hum Log, Ravish ki Report, Des Ki Baat, and Prime Time.

|

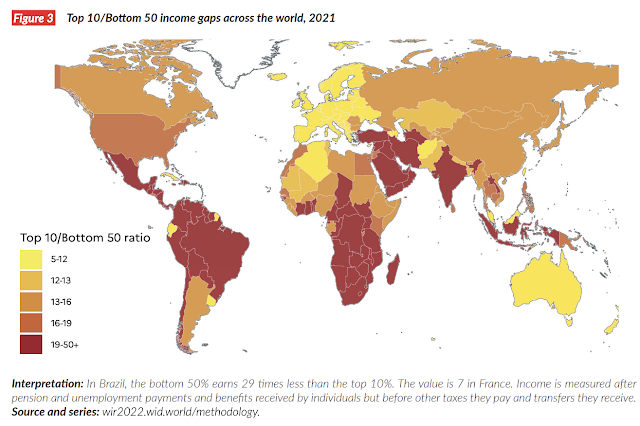

| Income Inequality Map. Source: World Inequality Report 2022 |

India is one of the most unequal countries in the world, according to the World Inequality Report 2022. There is rising poverty and hunger. Nearly 230 million middle class Indians have slipped below the poverty line, constituting a 15 to 20% increase in poverty. India ranks 94th among 107 nations ranked by World Hunger Index in 2020. Other South Asians have fared better: Pakistan (88), Nepal (73), Bangladesh (75), Sri Lanka (64) and Myanmar (78) – and only Afghanistan has fared worse at 99th place. Meanwhile, the wealth of Indian billionaires jumped by 35% during the pandemic.

Related Links:

Haq's Musings

South Asia Investor Review

India Among World's Most Unequal Countries

Shaikh Hasina Seeks Modi's Help to Survive

Food in Pakistan 2nd Cheapest in the World

Indian Economy Grew Just 0.2% Annually in Last Two Years

Pakistan to Become World's 6th Largest Cement Producer by 2030

India: World's Biggest Oligarchy?

Pakistan's Computer Services Exports Jump 26% Amid COVID19 Lockdown

Coronavirus, Lives and Livelihoods in Pakistan

Vast Majority of Pakistanis Support Imran Khan's Handling of Covid1...

Pakistani-American Woman Featured in Netflix Documentary "Pandemic"

Incomes of Poorest Pakistanis Growing Faster Than Their Richest Cou...

How Grim is Pakistan's Social Sector Progress?

Pakistan's Sehat Card Health Insurance Program

Trump Picks Muslim-American to Lead Vaccine Effort

COVID Lockdown Decimates India's Middle Class

COP27: Pakistan Demands "Loss and Damage" Compensation

Pakistan's Balance of Payments Crisis

How Has India Built Large Forex Reserves Despite Perennial Trade De...

India's Unemployment and Hunger Crises"

PTI Triumphs Over Corrupt Dynastic Political Parties

Strikingly Similar Narratives of Donald Trump and Nawaz Sharif

Nawaz Sharif's Report Card

Riaz Haq's Youtube Channel

-

Comment by Riaz Haq on January 26, 2023 at 8:40pm

-

Top #Investor Bill Ackman says #Hindenburg's report on #India's #Adani Group 'highly credible'. Shares in seven listed group companies of #Modi's pal Adani lost $10.73 billion in market capitalization in India on Wednesday after Hindenburg report release. https://www.businesstoday.in/latest/corporate/story/bill-ackman-say...

Billionaire investor William Ackman in a tweet on Thursday said that he found short-seller Hindenburg Research's report on Adani Group "highly credible and extremely well researched."

Shares in seven listed group companies of Adani lost $10.73 billion in market capitalisation in India on Wednesday after Hindenburg released the report, which accused the conglomerate of improper use of offshore tax havens and also said it held short positions in the company through its U.S.-traded bonds and non-Indian-traded derivative instruments.

"We are not invested long or short in any of the Adani companies... nor have we done our own independent research," Ackman said in a tweet.

https://twitter.com/BillAckman/status/1618790427339137024?s=20&...

-

Comment by Riaz Haq on January 27, 2023 at 9:46am

-

History's Biggest Stock Scam in India: Modi's Pal Adani Loses $50 Billion in 3 Days

Business empire of #Asia’s richest man and #Modi’s pal #Adani hit by sell-off after fraud report. Shares fall 20% after the release of #Hindenburg #research report. #India #cronycapitalism #BJP

Business empire of Asia’s richest man hit by sell-off after fraud report

The sell-off came after Hindenburg Research in New York accused Adani of artificially boosting his share prices over the course of several decades.

By Gerry Shih

https://www.washingtonpost.com/world/2023/01/27/india-adani-fraud-h...

By the end of Friday, shares in Adani Enterprises, the group’s umbrella holding company, fell by more than 18 percent, while several other subsidiaries, including Adani’s renewable energy and electricity transmission businesses, fell by 20 percent. The seven publicly traded Adani companies lost roughly a combined $50 billion in market capitalization this week, according to Bloomberg News.

-

Comment by Riaz Haq on January 27, 2023 at 10:05am

-

India market regulator increases scrutiny of Adani group - sources

https://finance.yahoo.com/news/india-market-regulator-increases-scr...

India’s market regulator has increased scrutiny of deals by the Adani Group over the past year and will study a report issued by short-seller Hindenburg Research to add to its own ongoing preliminary investigation into the group’s foreign portfolio investors, according to two sources aware of the matter.

On Wednesday, the U.S. short-seller said it held short positions in the Indian conglomerate, accusing it of improper use of offshore tax havens and flagging concerns about high debt, leading to a massive sell-off of India-listed shares of the conglomerate's companies.

“SEBI has been increasingly examining all the transactions that Adani Group has been undertaking in the listed space," said the first of the two sources, who declined to be identified as the matter is confidential. SEBI has been increasingly asking for disclosures that it ordinarily does not.

Adani earlier this week dismissed the Hindenburg report as baseless and said it is considering whether to take legal action against the New York-based firm.

SEBI spokespersons did not offer any immediate comments saying they do not discuss company specific matters and ongoing probes.

In the case of Adani Group’s acquisition of Switzerland-based Holcim Ltd's stake in India's Ambuja Cements Ltd and ACC Ltd, the regulator examined the offshore special purpose vehicle (SPV) used for the transaction, the first source said.

The use of this SPV was disclosed by the group as part of the acquisition announcement in May 2022. The regulator had found as many as 17 foreign offshore entities involved in the funding of the transaction.

The regulator had sought clarity from the group on these entities when the group approached it for regulatory clearance last year. These responses are under regulatory examination, sources said.

Hindenburg's report on the Adani group comes amid a $2.45 billion secondary share sale by the group's flagship company Adani Enterprises. On Friday, shares of Adani Enterprises fell below the price at which shares are being offered as part of the issue.

In July, the regulator had initiated a probe of little-known offshore funds based out of Mauritius which had large holdings in Adani's Group's listed companies, which potentially raised concerns about stock price manipulation.

At the time, the regulator's investigation hit a wall due to lack of information from jurisdictions where these funds were domiciled.

Some issues raised in the Hindenburg report point to concerns similar to what the regulator had regarding movement of funds between parties related to the Adani Group through offshore funds back into local companies, sources said.

-

Comment by Riaz Haq on January 27, 2023 at 8:41pm

-

Skeletons in #Modi's Closet: #Adani Scam, 2002 Anti-#Muslim Pogrom in #Gujarat. #Hindutva #Islamophobia #Adaniscam #GujaratFiles #India #BBCDocumentary https://www.newslaundry.com/2023/01/27/cartoon-skeletons-in-the-closet

https://twitter.com/haqsmusings/status/1619192934091603969?s=20&...

-

Comment by Riaz Haq on January 28, 2023 at 4:37pm

-

Jawhar Sircar

@jawharsircar

I know from 40 years in Govt that LIC’s big investments need a nod from FM or PM. Don’t know why they’re out to destroy an excellent institution that caters to middle class!https://twitter.com/jawharsircar/status/1619041716182433796?s=20&am...

------------

Jawhar Sircar

@jawharsircar

Swiss Credit Sights had warned long ago. Modi Govt did not listen. Our banks will now sink — your money, my money will go down — while Adani goes away scot free!https://twitter.com/jawharsircar/status/1619217523504988161?s=20&am...

-

Comment by Riaz Haq on January 28, 2023 at 4:55pm

-

Behind The #Adani Group’s ‘House Of Cards’: Juicy Fees For #US Wall Street #Investment Banks. The Adani Group companies and Adani-owned #offshore shell companies lend each other money as a way to #launder money and cook their books. #moneylaundering https://www.forbes.com/sites/johnhyatt/2023/01/26/behind-the-adani-...

Global investment banks have cashed in on the Adani Group’s voracious appetite for debt. Now their client is accused of pulling off ‘the largest con in corporate history’

Last summer, after the Adani Group completed its $10.5 billion leveraged buyout of a cement business from Swiss firm Holcim, Gautam Adani, the conglomerate’s mastermind and then world’s fifth richest man, boasted to the Economic Times that his “relationship banks” – Barclays, Deutsche Bank and Standard Chartered Bank – had “fully funded” the deal.

Those relationships may come under strain, following the publication of short seller Hindenburg Research’s explosive 32,000-word report, which alleges that the Adani Group and its principals have engaged in a years-long scheme of fraud and stock market manipulation. (The Adani Group has denied all wrongdoing and says it is considering legal action against the investment firm.)

Founded in the 1980s as a commodities trading firm, the Adani Group has grown into a $23 billion (annual sales) conglomerate with seven publicly-traded firms involved in energy, industrial and logistics businesses across India. The family-run enterprise has close ties to Prime Minister Narenda Modi, and its access to loans from Indian banks has largely funded the firm’s acquisition-driven growth.

In recent years however, U.S and European-based investment banks have stepped up to help the Adani Group raise billions of dollars through equity sales, refinancings and U.S. dollar debt offerings. In addition to the Adani Group’s “relationship” banks, J.P. Morgan, Bank of America Merrill Lynch and Credit Suisse have all brokered deals on behalf of Adani-owned companies.

Between 2015 and 2021, six different Adani Group companies raised about $10 billion through U.S-dollar-denominated bond sales that were underwritten by U.S. and European investment banks, according to financial market data provider Refinitiv. Of these 18 bond offerings, 14 were done between May 2019 and September 2021. One of these companies, Adani Ports & Special Economic Zone - which receives preferential tax treatments - was responsible for half the debt raised.

These figures do not include the Adani Group’s debt issued in Rupees and other currencies. The conglomerate had about $27 billion in outstanding liabilities as of March 2022. The State Bank of India provided funding for about 40% of debt Adani firms issued between 2020 and 2022.

Leverage is at the heart of Hindenburg Research’s fraud allegations. The Adani Group companies and Adani-owned offshore shell companies lend each other money as a way to launder money and cook their books, Hindenburg alleges. Hindenburg homed in on several loans between Adani entities, including a $253 million loan from a Mauritius-based shell company – which appears to be controlled by Guatam Adani’s brother, Vinod Adani – to a private Adani-owned entity, which then lent $138 million to Adani Enterprises, a publicly traded company. In another instance, Emerging Market Investment DMCC, a United Arab Emirates-based entity with virtually no online presence, inexplicably had $1 billion, which it lent to Mahan Energen, a subsidiary of Adani Power.

“It’s a house of cards, it’s all fueled on debt,” one anonymous employee of Elara India Opportunities, a London-based company that manages various funds invested in Adani companies, told Hindenburg.

-

Comment by Riaz Haq on January 28, 2023 at 4:56pm

-

Behind The #Adani Group’s ‘House Of Cards’: Juicy Fees For #US Wall Street #Investment Banks. The Adani Group companies and Adani-owned #offshore shell companies lend each other money as a way to #launder money and cook their books. #moneylaundering https://www.forbes.com/sites/johnhyatt/2023/01/26/behind-the-adani-...

Concerns about the Adani Group’s debt load have long shadowed the company. In 2019, Indian news outlet Scroll.in published an investigation on Adani Group’s web of related party deals, including how Adani-owned entities “saw multiple transfers of money between themselves in the form of loans and repayments.” Fitch Group’s CreditSights group published a report last year warning that the Adani Group is “deeply overleveraged.”

Adani has a knack for securing investor funds. “My projects are immensely bankable," he told Forbes Asia back in 2014. The conglomerate’s focus on real infrastructure projects – with their reliable cash flows – were part of the draw. “Banks are willing to take a long-term view as these are much required assets for the country with assured returns," K. Shankar, a power analyst at Edelweiss Capital, a financial services firm in Mumbai, told Forbes at the time.

Wall Street only began to really warm up to Adanis when he sought financing for Adani Green Energy, the conglomerate’s renewable energy subsidiary, according to Tim Buckley, a former investment banker at Citigroup and director at Australia-based Climate Energy Finance, who has been studying the Adani Group for over a decade. Money raised by Adani Green Energy or Adani Ports may “just get transferred to Adani Power and Adani Enterprises, and then goes towards building more coal fired power plants or more coal mines,” Buckley says.

As of June 2021, over $420 million of Adani Green Energy shares were owned by a Cyprus-based entity, New Leaina Investments, which allegedly is owned by Adani Group executives, according to Hindenburg. That offshore holding effectively allowed Adani Green to skirt Indian regulations that require listed companies to maintain a non-promoter public float of at least 25%, alleges Hindenburg.

The Adani Group’s plan to develop the world’s largest coal mine in Australia provoked the Stop Adani campaign. J.P. Morgan, Bank of America Merrill Lynch, Credit Suisse, Barclays, Standard Chartered and Deutsche Bank have all sworn off financing the controversial project, though all appear to still be doing business with the parent group.

“Adani’s involvement in massive new thermal coal mines in the midst of the climate crisis hasn’t been enough to convince some major banks such as Deutsche Bank, Standard Chartered and Barclays to cut ties,” says Pablo Brait, a campaigner at Australian environmental finance organization Market Forces. “Hopefully these significant allegations will finally help all banks wake up to the risks of financing Adani.”

It remains to be seen how bankable Adani will be in the months ahead. Barclays, Deutsche Bank, JP Morgan and Bank of America all declined to comment on their relationship to the Adani Group. Standard Chartered Bank said it doesn’t comment on client relationships due to confidentiality. And Credit Suisse had not responded at the time of publication.

-

Comment by Riaz Haq on January 29, 2023 at 9:35pm

-

#Adani Bond Plunge Accelerates as #Hindenburg Rebuttal Fails to Stem Concern. #Modi #Cronycapitalism #India #fraud - Bloomberg

https://www.bloomberg.com/news/articles/2023-01-30/adani-bond-plung...

A plunge in dollar bonds of Adani Group companies quickened on Monday after a rebuttal by the Indian conglomerate failed to ease concerns following a scathing report last week by short seller Hindenburg Research.

Adani Ports & Special Economic Zone Ltd.’s 2027 note dropped 7.1 cents on the dollar to 72 cents in Hong Kong, hitting a fresh low following an 11 cent tumble last week, Bloomberg-compiled data show. The selloff in billionaire Gautam Adani’s corporate empire had already erased more than $50 billion of equity market value as Asia’s richest man struggles to contain the fallout.

At least eight other Adani corporate bonds dropped by more than two cents on the dollar Monday in volatile trading, as the value of the company’s debt has plunged by hundreds of millions of dollars in less than a week.

The Adani group published a 413-page rebuttal of allegations of fraud by Hindenburg on Sunday as its flagship company seeks to complete a share sale. Hindenburg Research said in response that the rebuttal has failed to specifically answer most of the questions it posed, and the group “largely confirmed or attempted to sidestep our findings.”

“US investors had been selling Friday and that has fed into today’s price action,” said Kaveh Namazie, a credit strategist at Australia & New Zealand Banking Group Ltd. “Investors are also likely waiting for more clarity on the Adani Enterprises follow-on-public offering and whether there are any delays or price adjustments to the institutional portion that was completed last week.”

Shorting Bonds

Hindenburg said last week that it had taken a short position in Adani’s companies through US-traded bonds and non-Indian-traded derivative instruments.

In Adani’s rebuttal published Sunday, the group said that some 65 of the 88 questions have been addressed in its public disclosures, describing the short seller’s conduct as “nothing short of a calculated securities fraud under applicable law.” The conglomerate reiterated it will “exercise our rights to pursue remedies to safeguard our stakeholders before all appropriate authorities.”

The lengthy response comes in the last leg of a share offer by Adani Enterprises, which received overall subscriptions of 1% for the institutional and retail portion on Friday.

While investors in Indian public offerings typically wait until the last day of the sale to place bids, there were concerns that Hindenburg’s attack on the country’s richest man would sour sentiment. The sale to anchor investors, which includes Abu Dhabi Investment Authority, was priced at the upper end of the band.

-

Comment by Riaz Haq on January 30, 2023 at 7:47am

-

Markets reject Adani's defense! Selling of #Adani shares continued on Monday and has lowered the #market value of the 7 companies in the group by around $64 billion. #Hindenburg #India #Modi #Scam #BJP #Fraud #Hindutva #Islamophobia https://www.barrons.com/articles/adani-trouble-problem-india-stock-...

Shares of companies linked to Gautam Adani 541450 –19.99% , India’s richest person, have been tumbling following allegations from a short seller, allegations Adani has denied. The selloff, though, could have an impact on the broader Indian stock market.

Stocks linked to Adani, including Adani Total Gas 542066 –20.00% (ATGL.India) and Adani Green Energy (ADANIGREEN.India), have slumped since Hindenburg Research released a short seller report about the Indian billionaire’s companies. Adani Enterprises 512599 +4.21% , his energy and infrastructure group, published a 413-page response on Sunday—it called the allegations “nothing but a lie.” Adani Enterprises didn’t immediately respond to Barron’s request for further comment on Monday.

The selling continued on Monday, however, and has lowered the market value of the seven companies in the group by around $64 billion, FactSet data showed. In fact, Adani stocks have slumped so much that they appear to be weighing on the Indian stock market, according to Gavekal Research. The MSCI India Index has fallen 3.4% since the report was released on Jan. 24, while the MSCI Emerging Markets Index has gained 1.2%.

That wouldn’t be a big deal, except that India had a much better year than emerging markets as a whole in 2022. The iShares MSCI India ETFINDA +0.09% (INDA) fell just 9% last year, while the iShares MSCI Emerging Markets ETFEEM –1.61% (EEM) dropped 21%. Indian stocks also trade at a premium to emerging markets, with the India ETF trading at 21.4 times to the Emerging Market ETF’s 12.5 times.

And that valuation differential alone might be enough for investors to consider how much exposure they want to India stocks, Gavekal said.

“Whether the allegations of fraud at the Adani Group prove well founded or

not, expect them to lead to closer scrutiny of Indian asset valuations,” wrote Gavekal’s Udith Sikand.

-

Comment by Riaz Haq on January 30, 2023 at 7:48am

-

Markets reject Adani's defense! Selling of #Adani shares continued on Monday and has lowered the #market value of the 7 companies in the group by around $64 billion. #Hindenburg #India #Modi #Scam #BJP #Fraud #Hindutva #Islamophobia https://www.barrons.com/articles/adani-trouble-problem-india-stock-...

Shares of companies linked to Gautam Adani 541450 –19.99% , India’s richest person, have been tumbling following allegations from a short seller, allegations Adani has denied. The selloff, though, could have an impact on the broader Indian stock market.

Stocks linked to Adani, including Adani Total Gas 542066 –20.00% (ATGL.India) and Adani Green Energy (ADANIGREEN.India), have slumped since Hindenburg Research released a short seller report about the Indian billionaire’s companies. Adani Enterprises 512599 +4.21% , his energy and infrastructure group, published a 413-page response on Sunday—it called the allegations “nothing but a lie.” Adani Enterprises didn’t immediately respond to Barron’s request for further comment on Monday.

The selling continued on Monday, however, and has lowered the market value of the seven companies in the group by around $64 billion, FactSet data showed. In fact, Adani stocks have slumped so much that they appear to be weighing on the Indian stock market, according to Gavekal Research. The MSCI India Index has fallen 3.4% since the report was released on Jan. 24, while the MSCI Emerging Markets Index has gained 1.2%.

That wouldn’t be a big deal, except that India had a much better year than emerging markets as a whole in 2022. The iShares MSCI India ETFINDA +0.09% (INDA) fell just 9% last year, while the iShares MSCI Emerging Markets ETFEEM –1.61% (EEM) dropped 21%. Indian stocks also trade at a premium to emerging markets, with the India ETF trading at 21.4 times to the Emerging Market ETF’s 12.5 times.

And that valuation differential alone might be enough for investors to consider how much exposure they want to India stocks, Gavekal said.

“Whether the allegations of fraud at the Adani Group prove well founded or

not, expect them to lead to closer scrutiny of Indian asset valuations,” wrote Gavekal’s Udith Sikand.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

Agriculture, Caste, Religion and Happiness in South Asia

Pakistan's agriculture sector GDP grew at a rate of 5.2% in the October-December 2023 quarter, according to the government figures. This is a rare bright spot in the overall national economy that showed just 1% growth during the quarter. Strong performance of the farm sector gives the much needed boost for about …

ContinuePosted by Riaz Haq on March 29, 2024 at 8:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network