PakAlumni Worldwide: The Global Social Network

The Global Social Network

Shining India Story Unravels as BRIC Man O'Neill Expresses Disappointment

For at least two years in a row, BRIC has, in the words of SGS's Albert Edwards, stood for Bloody Ridiculous Investment Concept, not an acronym for populous emerging markets of Brazil, Russia, India and China as Goldman Sachs' Jim O'Neill saw it ten years ago.

In fact, O'Neill has himself expressed disappointment in India, one of the BRICs, a designation that has boosted foreign investment in India and helped accelerate its economic growth since 2001.

"All four countries have become bigger (economies) than I said they were going to be, even Russia. However there are important structural issues about all four and as we go into the 10-year anniversary, in some ways India is the most disappointing," said O'Neill as quoted by Reuters.

Noting India's significant dependence on foreign capital inflows, Jim O'Neill went further and raised a concern about the potential for current account crisis. "India has the risk of ... if they're not careful, a balance of payments crisis. They shouldn't raise people's hopes of FDI and then in a week say, 'we're only joking'". "India's inability to raise its share of global FDI is very disappointing," he said.

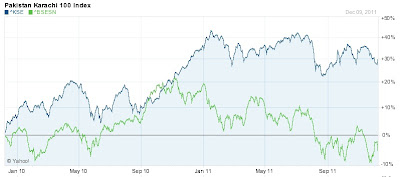

United Nations data shows that India received less than $20 billion in FDI in the first six months of 2011, compared to more than $60 billion in China while Brazil and Russia took in $23 billion and $33 billion respectively. Stocks in all four countries have underperformed relative to the broader emerging markets equity index, as well as the markets in the developed nations. Pakistan's KSE-100 has significantly outperformed all BRIC stock markets over the ten years since BRIC was coined.

As India's twin deficits continue to grow and the Indian rupee hits record lows relative to the US dollar, there is pressure on Reserve Bank of India to defend the Indian rupee against currency speculators who may precipitate a financial crisis similar to the Asian crisis of 1997.

In addition to Jim O'Neill, a range of investment bankers are turning bearish on India. UBS sent out an email headlined "India explodes" to its clients. Deutsche Bank published a report on November 24 entitled, "India's time of reckoning."

"Suddenly everything seems to be coming to a head in India," UBS wrote. "Growth is disappearing, the rupee is in disarray, and inflation is stuck at near-record levels. Investor sentiment has gone from cautious to outright scared."

India's current account deficit swelled to $14.1 billion in its fiscal first quarter, nearly triple the previous quarter's tally. The full-year gap is expected to be around $54 billion.

Its fiscal deficit hit $58.7 billion in the April-to-October period. The government in February projected a deficit equal to 4.6 percent of gross domestic product for the fiscal year ending in March 2012, although the finance minister said on Friday that it would be difficult to hit that target.

As explained in a series of earlier posts here on this blog, India has been relying heavily on portfolio inflows -- foreign purchases of shares and bonds -- as a means of covering its rising current account gap. Those flows are called "hot money" and considered highly unreliable.

Indian policy makers face a significant dilemma. If they do nothing to defend the Indian currency, the downward spiral could make domestic inflation a lot worse than it already is, and spark massive civil unrest. If they intervene in the currency market aggressively by buying up Indian rupee, the RBI's dollar reserves could decline rapidly and trigger the balance of payment crisis Goldman Sachs' O'Neill hinted at.

Related Links:

Karachi Tops Mumbai in Stock Performance

India Returning to Hindu Growth Rate

-

Comment by Riaz Haq on February 27, 2014 at 10:52pm

-

Excerpts of a piece by Nobel Laureate Joseph Stiglitz:

Foreign investment is not one of the three main pillars of the Washington Consensus,but it is a key part of the new globalization. According to the Washington Consensus, growth occurs through liberalization, "freeing up"markets. Privatization, liberalization, and macrostability are supposed to create a climate to attract investment, including from abroad. This investment creates growth. Foreign business brings with it technical expertise and access to foreign markets, creating new employment possibilities. Foreign companies also have access to sources of finance, especially important in those developing countries where local financial institutions are weak. Foreign direct investment has played an important role in many—but not all—of the most successful development stories in countries such as Singapore and Malaysia and even China.

----------------

Having said this, there are some real downsides. When foreign businesses come in they often destroy local competitors, quashing the ambitions of the small businessmen who had hoped to develop homegrown industry. There are many examples of this. Soft drinks manufacturers around the world have been overwhelmed by the entrance of Coca-Cola and Pepsi into their home markets.Local ice cream manufacturers find they are unable to compete with Unilevers ice cream products.

---------------

Perhaps of greatest concern has been the role of governments, including the American government, in pushing nations to live up to agreements that were vastly unfair to the developing countries, and often signed by corrupt governments in those countries. In Indonesia, at the 1994 meeting of leaders of APEC (Asia-Pacific Economic Cooperation) held at Jakarta, President Clinton encouraged American firms to come into Indonesia. Many did so, and often at highly favorable terms (with suggestions of corruption "greasing" the wheels—to the disadvantage of the people of Indonesia). The World Bank similarly encouraged private power deals there and in other countries, such as Pakistan. These contracts entailed provisions where the government was committed to purchasing large quantities of electricity at very high prices (the so-called take or pay clauses). The private sector got the profits; the government bore the risk. That was bad enough. But when the corrupt governments were overthrown (Mohammed Suharto, in Indonesia in 1998, Nawaz Sharif in Pakistan in 1999), the U.S. government put pressure on the governments to fulfill the contract, rather than default or at least renegotiate the terms of the contract. There is, in fact, a long history of "unfair" contracts, which Western governments have used their muscle to enforce.

--------

The international financial institutions tended to ignore the problems I have outlined. Instead,the IMF's prescription for job creation—when it focused on that issue—was simple: Eliminate government intervention (in the form of oppressive regulation), reduce taxes, get inflation as low as possible, and invite foreign entrepreneurs in. In a sense, even here policy reflected the colonial mentality described in the previous chapter: of course, the developing countries would have to rely on foreigners for entrepreneurship. Never mind the remarkable successes of Korea and Japan, in which foreign investment played no role. In many cases,as in Singapore, China, and Malaysia, which kept the abuses of foreign investment in check, merit played a critical role, not so much for the capital(which, given the high savings rate, was not really needed) or even for the entrepreneurship, but for the access to markets and new technology that it brought along.

http://www.scribd.com/doc/184656067/47999746-Globalization-and-Its-...

-

Comment by Riaz Haq on March 15, 2020 at 7:51am

-

Jim O’Neill, ex Goldman Sachs investment banker who coined "BRICs", praises #China government’s #coronavirus response: ‘Thank God this didn’t start in somewhere like India’. His comments anger #Indian officials. #India #Modi #BJP #CowUrine #COVIDー19 https://www.cnbc.com/2020/03/11/thank-god-this-didnt-start-in-india...|twitter&par=sharebar

Jim O’Neill, the chair of U.K. think tank Chatham House, on Wednesday commended the “fast, aggressive” Chinese response to the coronavirus outbreak, suggesting western countries should follow suit.

“Thank God this didn’t start in somewhere like India, because there’s absolutely no way that the quality of Indian governance could move to react in the way that the Chinese have done,” O’Neill, the former Goldman Sachs chief economist, told CNBC’s “Squawk Box Europe” on Wednesday.

“That’s the good side of the Chinese model, and I think you could probably say the same about Brazil too,” he added.

-------

On one hand, O’Neill acknowledged that the dominance of President Xi Jinping and the diminished responsibility of officials in Wuhan, where the virus originated, may have enabled COVID-19 to initially spread quicker.

“That said — and it’s often like a lot of other things when China got hit with a crisis over the last 30 years — once they realized the scale of it, the system seems to be capable of dealing with it pretty quickly, relative to other places, and pretty decisively,” O’Neill contended.

Chinese authorities suppressed early warnings from doctors and citizens in Wuhan and forced them to apologize for spreading “lies” and in turn failed to contain the outbreak in its infancy. The government has been widely criticized for its delayed response at the outset, with Raymond James analysts likening the situation to the Soviet Union’s handling of the Chernobyl nuclear disaster.

Ophthalmologist Li Wenliang sounded the alarm in December when he told a group of doctors on Chinese social media about seven cases he saw. He and seven other whistleblowers were reprimanded by the Wuhan police in January for spreading “illegal and false” information.

Chinese authorities shut down vast swathes of the country’s travel infrastructure and industrial production last month, causing a profound short-term shock to the Chinese and global economy. However, new cases of the virus in greater China have now slowed to a trickle, while Italy deals with a rapid escalation in new infections and a spiking death toll.

Negi highlighted that the Indian government supplied 15 tons of medical assistance comprising masks, gloves and other emergency medical equipment to China on 26 February 2020.

The outbreak is now a global pandemic while new cases in China have begun to slow, and Beijing is now attempting to cast doubt over whether the virus actually originated in China at all.

A ‘globalized people’

O’Neill, the former commercial secretary to the U.K. Treasury suggested that western governments dealing with outbreaks of their own, such as Italy and the U.K., should look to emulate China, South Korea and Singapore in the swift deployment of aggressive containment measures.

He also argued that finance and economic policymakers must begin treating health policy more seriously and think of it in the same way as other investment spending, and criticized the protectionist agenda of the U.S. and other nations on international trade.

“Unless we get rid of all forms of communication, we are globalized people and we need to think and learn from each other about the right solutions at any moment in time for all of us,” O’Neill concluded.

-

Comment by Riaz Haq on June 30, 2021 at 8:12am

-

#India's Current Account #Deficit Grows to $8.1 billion, or 1% of #GDP in Jan-March 2021. Net foreign portfolio #investment was $7.3 billion, compared with a decline of $13.7 billion a year ago, mostly reflecting purchases of #Indian stocks. #economy #Modi https://mail.google.com/mail/u/0/?ogbl#inbox/FMfcgzGkZGdGQmzDbCKPzX...

India’s current-account deficit widened more than expected as the trade gap expanded and the country saw lower private transfers from abroad.

The shortfall in the current account, the broadest measure of overseas trade, was $8.1 billion, or 1% of gross domestic product, in January-March, the Reserve Bank of India said in a statement Wednesday. That compares with a median estimate of $7.5 billion in a Bloomberg survey of 15 analysts.

Key Insights

India’s balance of payments surplus last year hit a record, according to data going back almost a decade, as the Covid-19 pandemic decimated trade

Wednesday’s data, which covers a period before India’s second wave of cases, saw net services income rise on the back of higher earnings from computer, transport and business services, the RBI said

The underlying reason for the deficit was “primarily on account of a higher trade deficit and lower net invisible receipts than in the corresponding period of the previous year,” the RBI said

Get More

Imports were higher during the quarter from a year ago while exports lagged

Net foreign portfolio investment was $7.3 billion, compared with a decline of $13.7 billion a year ago, mostly reflecting purchases of Indian stocks

Comment

- ‹ Previous

- 1

- 2

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

Agriculture, Caste, Religion and Happiness in South Asia

Pakistan's agriculture sector GDP grew at a rate of 5.2% in the October-December 2023 quarter, according to the government figures. This is a rare bright spot in the overall national economy that showed just 1% growth during the quarter. Strong performance of the farm sector gives the much needed boost for about …

ContinuePosted by Riaz Haq on March 29, 2024 at 8:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network