PakAlumni Worldwide: The Global Social Network

The Global Social Network

Chinese FDI to Solve Energy Crisis, Revive Economy in Pakistan

China's state-owed banks will finance Chinese companies to fund, build and operate $45.6 billion worth of energy and infrastructure projects in Pakistan over the next six years, according to Reuters.

Major Chinese companies investing in Pakistan's energy sector will include China's Three Gorges Corp which built the world's biggest hydro power project, and China Power International Development Ltd.

|

| Prime Minister Nawaz Sharif and President Xi Jinping |

Under the agreement signed by Chinese and Pakistani leaders at a Beijing summit recently, $15.5 billion worth of coal, wind, solar and hydro energy projects will come online by 2017 and add 10,400 megawatts of energy to the national grid. An additional 6,120 megawatts will be added to the national grid at a cost of $18.2 billion by 2021.

|

| Total Foreign Direct Investment Source: World Development Indicators |

Starting in 2015, the Chinese companies will invest an average of over $7 billion a year until 2021, a figure exceeding the previous record of $5.5 billion foreign direct investment in 2007 in Pakistan.

|

| FDI As Percentage of GDP. Source: World Development Indicators |

With over $7 billion a year, it will still, however, barely match the prior record of 3.75% of GDP set in 2007.

The biggest upside of this investment will be the generation of over 16,000 MW of additional electricity which should revitalize Pakistan's business and industry sectors and significantly boost its GDP.

The deal can be win-win for both if the Chinese companies coming in as independent power producers (IPPs) enjoy significant returns of 17% to 27% a year on their investment while Pakistan actually alleviates the nation's crippling electricity crisis to get its economy moving again. The assumption here is that Pakistan has learned from and corrected the prior mistakes in its existing cost-plus IPP contracts which guarantee significant profits to IPPs regardless of costs, efficiency and amount of power supplied to the grid.

Rapid increase in power generation is a well understood pre-requisite for accelerating industrialization and major improvements in productivity in this day and age. Pakistan needs sustained sharp focus on increasing electricity availability to improve productivity and living standards of its people.

Related Links:

Haq's Musings

US-Pakistan Ties and New Silk Route

IPPs Enjoy Record Profits While Pakistan Suffers

Can Pakistan Say No to US Aid?

Obama's Pakistan Connections

Seeing Bin Laden's Death in Wider Perspective

China's Investment and Trade in South Asia

China Signs Power Plant Deals with Pakistan

Soaring Imports from China Worry India

China's Checkbook Diplomacy

Yuan to Replace Dollar in World Trade?

China Sees Opportunities Where Others See Risk

Chinese Do Good and Do Well in Developing World

Can Chimerica Rescue the World Economy?

-

Comment by Riaz Haq on April 9, 2015 at 8:21am

-

China’s state-owned Power Construction Corporation and Qatar’s Al Mirqab Capital are to jointly invest in a $209m coal-firedpower plant project in Pakistan, the firms have announced.

The plant is to feature two 660 MW supercritical units and will be built in Karachi, at Pakistan’s second-largest port, Port Qasim. The bulk of the fuel is to be shipped in from Indonesia. Power Construction Corporation, which is set to build the project, aims to complete it in 32 months.

Of the $521m project capital, 51 per cent is to be invested by Power Construction Corporation and 49 per cent by Al Mirqab Capital, with the remaining $1.56bn to come from loans. The companies said the plant will be constructed and run on a build-own-operate model.

In a statement, Power Construction Corporation said: “The Pakistan Port Qasim power project is a large energy project of great political and economic importance between the two countries, as a high-priority project of the China-Pakistan Economic Corridor. This project fits the company’s development strategy and investment direction”.

Pakistan currently suffers from an energy shortfall of around 5 GW. The 3000 km, $45.6bn Economic Corridor project, which aims to connect Pakistan’s southern Gwadar Port with China’s northwestern Xinjiang region, includes plans for a gas pipeline from Iran to Pakistan, on which construction work has already begun although a formal deal won't be signed until later this month. According to reports, the pipeline could eventually provide Pakistan with enough fuel to generate around 4.5 GW of power.

In February Pakistan shelved a planned 6.6 GW coal-fired power project after Chinese investors backed out, citing lack of adequate infrastructure.

http://www.powerengineeringint.com/articles/2015/04/chinese-and-qat...

-

Comment by Riaz Haq on May 9, 2015 at 7:39pm

-

Recent pictures of the Chinese President Xi Jinping's aircraft being escorted by eight made-in-China Pakistani JF-17 Thunder fighter jets as it entered the Pakistani airspace reflect the expanding relationship of the two countries. On his two-day visit to Islamabad in April, Xi committed $46 billion of investments in Pakistan. This is roughly three times the foreign direct investment Pakistan has received in the last decade. This is also more than the $31 billion Pakistan got in US aid since 2002, according to the US-based Congressional Research Service. Clearly, Xi's visit has larger geopolitical ramifications. And for India, it could be a cause for concern.

The investment would go into building the China-Pakistan Economic Corridor. This would include a road connecting Gwadar port in Balochistan with Kashgar in Xinjiang province of China via Pakistan-occupied Kashmir. The 3,000-km corridor would have industrial parks and 10.4 GW of power projects worth $15.5 billion. China is already upgrading the 1,300-km Karakoram Highway despite Indian opposition. The highway, being built by state-owned China Road & Bridge Corporation, is expected to be ready by September this year. China's help in developing infrastructure in the disputed part of Kashmir is seen as its support to Pakistan's claim on this region.

Another reason to worry for India is that China has the rights to operate the Gwadar port, which increases Beijing's influence in the Arabian Sea. The new road and the Gwadar port would help China boost trade with Europe, West Asia and Africa. This will also give China easier access to West Asian oil, especially from Iran. China is one of the biggest consumers of Iranian oil and this route would help it transport oil before it completes a pipeline from Gwadar to Kashgar. Beijing is also helping Islamabad complete the Iran-Pakistan gas pipeline at a cost of $2 billion.

The growing engagement between China and Pakistan may prove to be a stumbling block for India's ambitious plans to boost ties with Afghanistan and Iran. India had committed $100 million to develop the Chabahar port in Iran, but the project is stuck. The port is important for India to access Afghanistan by bypassing Pakistan. Islamabad has already rejected New Delhi's proposal on the SAARC motor vehicle pact that would have allowed seamless transit to vehicles from South Asian countries. Pakistan's refusal makes it impossible for Indian transporters to use the land route to Afghanistan. Prime Minister Narendra Modi, on April 28, told the visiting Afghan President Ashraf Ghani that India was ready to receive Afghan trucks at the Integrated Check Post at Attari, on the India-Pakistan border. But that won't be enough.

Meanwhile, the infrastructure projects Chinese companies are executing in Pakistan will allow free movement to vehicles of the two countries. And while China's relations with India are also improving - Xi visited India in September last year and Modi is heading to China in May - New Delhi will still be wary of Beijing's growing clout in the region.

http://businesstoday.intoday.in/story/china-investments-in-pakistan...

-

Comment by Riaz Haq on May 20, 2015 at 4:13pm

-

China-Punjab Economic Corridor? by Adnan Amir

Out of the $28 billion worth projects, Punjab gets $11 billion, Khyber Pakhtunkhwa (KP) $2.5 billion and Balochistan gets nothing. That’s right, not a single penny out of $28 billion would be spent in Balochistan which is the most backward province in Pakistan. Sindh would get $9 billion from these projects; however the major chunk of that amount would be for the Lahore-Karachi Motorway, a project meant for Lahore. There is no justifiable reason whatsoever which can be floated to defend this unjust division of projects among the four federating units of Pakistan.

During the agreement signing ceremony that took place in Prime Minister House on April 20, only the Punjab Chief Minister was present. The other three chief ministers were not invited. It’s not just about invitations, no person from Balochistan and KP was chosen for the workgroups that finalized the details of CPEC with Chinese officials. It would not be an exaggeration to say that Prime Minister Nawaz Sharif and his brother Shehbaz Sharif orchestrated the show only to benefit their support base in Punjab.

This deal that was supposed to bring prosperity to Pakistan has become controversial from the outset. The KP Chief Minister, Pervez Khattak has openly criticized the federal government for preferring Punjab over other provinces. The legislators of Balochistan Assembly dubbed the agreements between Pakistan and China as between Lahore and Beijing. Shah Mahmood Qureshi, Vice president of PTI, who also belongs from Punjab, has criticized the federal government for its Punjab-centric approach in distribution of CPEC projects.

The route of CPEC rail and road link was the first thing that triggered the controversy. The original route of CPEC would pass from the center of the country. It would start from Gwadar-Ratodero-Dear Allah Yar-Dera Ghazi Khan-D.I Khan-Hassanabdal and all the way to Kashghar. PML-N government has created confusion over the original route. They have come up with a mindboggling concoction that the CPEC would not be one road but a network of roads. That’s wildly untrue because as per the original plan, there would be one main route, ranging from 2 to 6 lanes. During the agreement signing ceremony, the government of Pakistan agreed with China on the eastern route that would take the Gwadar-Ratodero-Sukkur-Lahore-Islamabad-Abbotabad route. Clearly this route is meant to benefit Lahore at the expense of two backward provinces of Pakistan, Balochistan and KP.

Coming to the inaugurated projects, Lahore already has a Metro Bus service, but the government of Pakistan is establishing an Orange Line Mass Rail transit system in the city. China would provide $1.6 billion for this project. A branch of Industrial and Commercial Bank of China would be established in Lahore. And where would the China Cultural Centre be established? No prizes for guessing. Would it not be fair if these projects were divided equally among all four provincial capitals? I guess it would not be acceptable to the Punjab centric agenda of PML-N.

Protests have already erupted against what is being termed as China-Punjab economic corridor. Right and left wing parties in both KP and Balochistan are on the same page on this issue, which is a rare occurrence. Federal Minister Ahsan Iqbal has already given his verdict on the protestors and he is in the process of distributing certificates of treachery. He said, “Hidden hands, some politicians, and also India are trying to make the multi-billion dollar framework [CPEC] controversial.” According to the criteria set forth by Mr. Ahsan Iqbal, this article must also be the work of hidden hands to sabotage the interests of Pakistan. Fortunately, for PML-N government, a draconian cybercrime bill is in the pipeline that would be used to crush any dissent to anti-federation policies of their government on internet.

http://nation.com.pk/blogs/24-Apr-2015/china-punjab-economic-corridor

-

Comment by Riaz Haq on May 28, 2015 at 10:16am

-

Political parties on Thursday hammered out a consensus on the route of Pak-China Economic Corridor during an All Parties Conference chaired by Prime Minister Nawaz Sharif.

The APC agreed that the western route of the corridor would be completed first, which would be built from Hasan Abdal to Gwadar, passing through Mianwali, Dera Ismail Khan and Zohb.

The prime minister told the meeting that a parliamentary committee would be formed to monitor the project while working groups would also be formed to address the concerns of all the provinces.

The prime minister said China had provided a unique opportunity in the form of economic corridor.

During the meeting, Federal Minister for Planning and Development Ahsan Iqbal said no new road would be built as part of the project instead different roads would be connected to link them with Khunjrab.

He dispelled the notion about a change in the original route of the Pak-China Economic Corridor.

The minister told the participants of the APC that the Pak-China corridor was not only the name of a road rather it was a portfolio consisted of different projects, including infrastructure, energy, Gwadar port and industrial cooperation.

This was the second APC to be called on the CPEC project. The first APC took place on May 13. The conference has been called to build consensus among political parties and remove any concerns they have regarding the mega project.

"I hope this becomes a tradition that even in the future we sit together to bring about consensus to move forward on national issues," said Sharif in his opening address to the attendants of the meeting.

http://www.geo.tv/article-186230-Political-parties-evolve-consensus...

-

Comment by Riaz Haq on June 7, 2015 at 12:04pm

-

Chinese Ambassador Sun Weidong said that Pakistan and China would make greater efforts to develop the Karakorum Highway (KKH) Phase II (Takot to Havelian section), Gwadar Port Eastbay Expressway, New Gwadar International Airport, Karachi-Lahore Motorway (Multan-Sukkur section) and other priority cooperation and energy projects.

-------

Ambassador Weidong said that the outcome in terms of MoUs signed during this visit is encouraging, but the more important part is to implement these agreements and deliver results. Action speaks louder than words, he said, adding the China Pakistan Economic Corridor (CPEC) is a historical opportunity for bilateral cooperation and future development. He said there is a lot of potential to further develop bilateral relations and opportunities always belong to those with vision and action.

He said the Chinese government would continue to encourage Chinese enterprises to invest in Pakistan in support of Pakistan’s economic and social development. China’s support for Pakistan is sincere, down-to-earth and mutually beneficial. Recalling that the year 2015 is the Year of China-Pakistan Friendly Exchanges, he said both the countries will arrange various activities to promote broad exchanges in culture, education, local administration, youth, think tanks and media.

The ambassador said that China has set up a cultural centre in Islamabad to encourage mutual learning and exchanges in the fields of culture and art. In next five years, he added, China will provide 2,000 training opportunities for Pakistan and train 1,000 Chinese language teachers for Pakistan, to support Pakistan in strengthening human resource development and language teaching.

The two countries, he emphasised, should continue with youth and media exchange visits. “We will translate and publish more quality publications from each other. We will hold a photo exhibition on China-Pakistan friendship history. We will also organise receptions for Pakistani friends from all circles in order to reunite with old friends while making new friends,” he added.

Weidong said that President Xi’s recent visit has been quite fruitful with regard to CPEC. It will cover all the provinces of Pakistan, benefit all Pakistani people, create new job opportunities and help upgrade the overall economic strength of Pakistan. China, he further said, has decided to provide free assistance to support FATA reconstruction and related livelihood projects. He said that China would also provide assistance to promote Gwadar community welfare. These measures will effectively promote economic development in the mid-western part of Pakistan and improve people’s livelihood. It is hoped that a good use would be made of the Chinese assistance so as to produce positive results as soon as possible, he added.

During President Xi’s visit, he said, both sides agreed to formulate the 1+4 cooperation structure ie to take CPEC at the centre and take Gwadar Port, energy, transport infrastructure and industrial cooperation as the four keys. Both sides agreed to increase the bilateral trade volume to $20 billion within the next 3 years, he added. The Silk Road Fund will collaborate with a Chinese company to invest in the clean energy projects such as Karot Hydropower Station. This is the first investment project of the Silk Road Fund since its establishment.

That ambassador said that China also announced to provide assistance for reconstruction activities and well-being projects in FATA so as to improve the people’s livelihood. Both countries have also decided to establish China-Pakistan Joint Research Centre for Small Hydropower, Joint Cotton Bio-Tech Laboratory and Joint Marine Research Centre. CCTV News and documentary channels will be broadcast in Pakistan soon, he said. Three pairs of cities between the two countries have established sister-city relations.

http://www.dailytimes.com.pk/national/06-Jun-2015/support-for-pak-i...

-

Comment by Riaz Haq on July 11, 2015 at 8:33am

-

Pakistan government is not offering any sovereign guarantees for projects being built by Chinese companies on build-operate-transfer (BOT) basis which is the bulk of the the $45 billion CPEC investments. These projects are being financed by three Chinese banks as explained by Financial Times below:Financial Times on China Investment in Pakistan:

The details emerged as President Xi Jinping began a visit to Pakistan bearing promises of more than $45bn in infrastructure investment.

It follows Beijing’s diplomatic success in securing the support of 50 countries for the China-led Asia Infrastructure Investment Bank, despite US objections.

Extra financing for infrastructure could help support China’s weakening economy and the majority of foreign construction projects will most likely be undertaken by Chinese companies.

Increased foreign currency lending would likely also help China boost financial returns on its forex reserves, which are now mainly invested in low-yielding US treasuries.

China’s three state-owned non-commercial lenders — China Development Bank, Export-Import Bank of China, and Agricultural Development Bank of China — are collectively known as “policy banks” because they are explicitly devoted to financing infrastructure and other policy priorities within China and abroad.

Respected financial magazine Caixin reported on its website on Monday that the cabinet’s plan involves the central bank injecting $32bn in forex reserves into CDB and an additional $30bn into Ex-Im Bank. The capital injections will come in the form of entrusted loans that convert to equity, the magazine reported. The Ministry of Finance will inject a further unspecified amount directly into Agricultural Development Bank.

“For CDB and Ex-Im Bank to support ‘One Belt, One Road’ they need a source of stable foreign-exchange funding,” Caixin quoted a senior CDB source as saying.

China’s boost to its export credit agency stands in stark contrast to the US where the US Export-Import Bank is fighting for survival amid a push by some Republicans to shut it down once funding runs out in June.

GE’s top international executive warned at the weekend that the closure of the US Ex-Im Bank would add to sense that Washington was stepping back from international economic leadership.

China’s forex reserves stood at $3.7tn by the end of March, according to official data.

China Development Bank has provided funding for many of the country’s most ambitious financial diplomacy initiatives, including loans-for-oil to Russia, Brazil and Venezuela. Both CDB and Ex-Im Bank also provide trade credit to support Chinese exports.

Earlier this month China’s cabinet approved a plan to reform the three policy lenders but provided few details. For years the government has said it intends to transform the institutions into commercial entities, but progress has been slow.

The policy banks do not take deposits and fund themselves mainly by selling bonds that carry an explicit sovereign guarantee. The banks sell both renminbi bonds within China and USD bonds in the offshore market.

Experts have warned that the banks are undercapitalised. The Ministry of Finance and China Investment Corporation each own 50 per cent stakes in CDB, but the bank has not received a capital injection since 2008.

The Financial Times reported last year that CDB had asked several foreign clients to delay drawing down lines of credit previously offered, apparently due to funding strains.

CDB’s capital adequacy ratio stood at 11.28 per cent at the end of 2013, according to the bank’s most recent annual report. That compares to 13.18 per cent for China’s banking system as a whole at the end of 2014.

http://www.ft.com/intl/cms/s/0/0e73c028-e754-11e4-8e3f-00144feab7de...

-

Comment by Riaz Haq on July 12, 2015 at 8:57pm

-

Chinese Ambassador Sun Weidong has said that China would establish Bio‑Tech Research Laboratory in Pakistan under a joint venture programme to promote agriculture sector in the country.

The lab would offer excellent opportunities to carry out joint study and research and also enhance maximum cooperation between scientists of both countries, he said.

He called for maximum cooperation between the two countries in the fields of science, technology, agriculture and power sector.

Meanwhile Chinese Embassy sources here in Islamabad said Ambassador Sun paid a productive visit to Multan on July 10 and 11. He met Asad Ullah Khan, Commissioner of Multan and exchanged views on strengthening friendship and bilateral cooperation.

He paid site-visits to Fatima 2x60MW Bagasse Power Plant and encouraged the Chinese companies to participate in the construction of power projects in Pakistan. The Fatima 2x60MW Bagasse Power Plant constructed by Chinese contractor is applying advanced and environment-friendly technology, which will become a high-efficiency biomass power plant and add electricity to the Pakistani grid when being completed in 2016.

Ambassador Sun visited a Chinese Cotton Ginning Company and Multan Cotton Research Station. The Chinese Company aims to build a cotton industrial chain in Multan. The Multan Cotton Research Station is part of the China-Pakistan Joint Bio-Tech Laboratory. Chinese President Xi Jinping and Pakistani Prime Minister Nawaz Sharif witnessed the signing of the MoU of this Joint Laboratory in April this year.

The Research Station has bred 16 cotton varieties of antivirus, heat and drought tolerant species. The Ambassador said, Chinese side would like to seek the possibility to expand the agriculture cooperation between the two countries.

He reiterated China’s support to the China-Pakistan Economic Corridor, including infrastructure construction and production capacity cooperation. He called for cultural and people-to-people exchanges. He said that the Chinese side will provide Chinese government scholarship for students in Multan to study in China. He is fully convinced that the deep-rooted friendship between the two countries will be passed on from generation to generation.

Ambassador Sun also visited the culture and historical sites in Multan during his tour.

http://www.pakistantoday.com.pk/2015/07/13/city/islamabad/china-to-...

-

Comment by Riaz Haq on August 19, 2015 at 12:41pm

-

For industrial cooperation, the two countries China and Pakistan) are planning industrial parks (along CPEC). According to local media, the Pakistani government has proposed 29 industrial parks and 21 mineral economic processing zones in all four provinces. A joint working group would decide and identify the industrial parks, said Pakistani Minister for Planning, Development and Reform Ahsan Iqbal, who hailed the CPEC as a "game changer" and a once-in-a- lifetime opportunity for Pakistan.

--------

Last month Pakistan's Chief of Army Staff Gen. Raheel Sharif inspected the under-construction road network as part of the CPEC. According to the army, 502 km out of the 870-km road network linking the Gwadar Port with the rest of the country have been completed by Frontier Works Origination (FWO). During the inspection, the army chief also vowed that the CPEC "will be built at all costs."

The Gwadar Port started its long-awaited operations on May 11 as the first private container vessel docked at the deep-sea port. Local fish was exported to the international market through containerized shipment. Speaking at the commencement ceremony, Pakistani Ports and Shipping Minister Kamran Michael said a new dimension was added to the history of the Gwadar Port.

For industrial cooperation, the two countries are planning industrial parks. According to local media, the Pakistani government has proposed 29 industrial parks and 21 mineral economic processing zones in all four provinces. A joint working group would decide and identify the industrial parks, said Pakistani Minister for Planning, Development and Reform Ahsan Iqbal, who hailed the CPEC as a "game changer" and a once-in-a- lifetime opportunity for Pakistan.

The Pakistani government has shown strong willingness to push forward the construction of the CPEC. During a high-level meeting held in Islamabad on July 27 to review the pace of work on CPEC projects, Prime Minister Sharif directed that projects under the CPEC be put on fast-track through mobilization of resources and completion of financial and technical formalities.

His endorsement for the projects is also shared by Pakistani President Mamnoon Hussain, who said in his message on the country' s 69th Independence Day on Aug. 14 that the CPEC "will lead to economic revival in Pakistan."

http://news.xinhuanet.com/english/2015-08/19/c_134534217.htm

-

Comment by Riaz Haq on September 28, 2015 at 8:28pm

-

It may very well sound like a cliché, but Samad Dawood – the 32-year-old CEO of Dawood Hercules – made a valid point.

“Why is there so much negativity in what we read about Pakistan,” he asked. “Why is it that the good things about business and the economy don’t get the same amount of coverage?”

Samad sounded upbeat for a man whose family business, by its own standards, went down post 1960s.

The Dawoods were either the first or the third richest business family in Pakistan in terms of assets owned, as per two separate researches cited by Stanley A. Kochanek in his extensive book “Business and Politics in Pakistan”.

They were everywhere – from the production and distribution of textiles, paper, rayon, chemicals and fertiliser to banking and shipping. But the nationalisation of the 1970s and division among family interests relegated them to the sidelines.

Their re-emergence came about when the family branch, led by Hussain Dawood, acquired a controlling stake in Engro Corporation, one of Pakistan’s largest private sector conglomerates.

But that came at a price that saw them re-invent themselves and forgo legacy.

Even after the nationalisation, Dawood Group kept a few businesses with itself – the Dawood Hercules Fertiliser and textile units, which included Burewala Textile Mills, Dawood Lawrencepur and Dillon, which were their mainstay for years.

It is said that Burewala owes its development to Ahmed Dawood, the group’s founder, who established massive textile mills in the city.

But now they are not in the textile business and Dawood Hercules’s fertiliser has been sold off. “We had a choice to make as far as textile operations were concerned. They required significant amount of capital to be globally competitive,” said Samad, Hussain’s youngest son.

Another option was to pump additional liquidity into Engro. They opted for the latter.

Since the mid-2000s, Engro has expanded massively – first came a $1.1-billion investment in a new urea plant, then the launch of a food division with Olper’s packaged milk, a unique 217MW power plant that uses permeate gas, building the country’s first LNG terminal and finally, the $2-billion investment plan to develop a coal mine and power plant in Tharparkar.

Dawood Hercules, the holding company, which has a majority stake in Engro, also has substantial shareholding and management control of Hub Power Company, another cash-cow.

Most of its focus is on energy projects.

“Why should a small SME entrepreneur invest in a generator?”

“Good businesses have to solve large problems … and better the solution the more value gets created for stakeholders.”

Dawood’s three power projects in the pipeline include two 660MW plants that will be built by Hubco and will use imported coal, the Thar power plant and a 50MW wind farm.

http://tribune.com.pk/story/964022/the-dawoods-growing-bet-on-pakis...

-

Comment by Riaz Haq on October 20, 2015 at 12:10pm

-

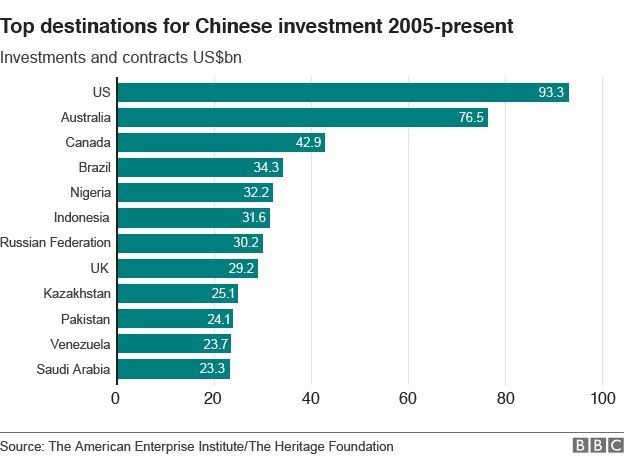

What does #China own in the #UK? #Pakistan 10th largest recipient of #Chinese investment ($24 billion) since 2005 http://www.bbc.com/news/business-34542147 …

China may be the world's second-largest economy behind the US, but it has more money in the bank than any other country.

Indeed three of the world's 10 biggest sovereign wealth funds are Chinese, together holding more than $1.5tn (£988bn) in assets.

And despite the slowdown in the Chinese economy in the past five years, the government has been putting this money to good use, particularly so since it recovered from the global economic slowdown sparked by 2008's financial crisis.

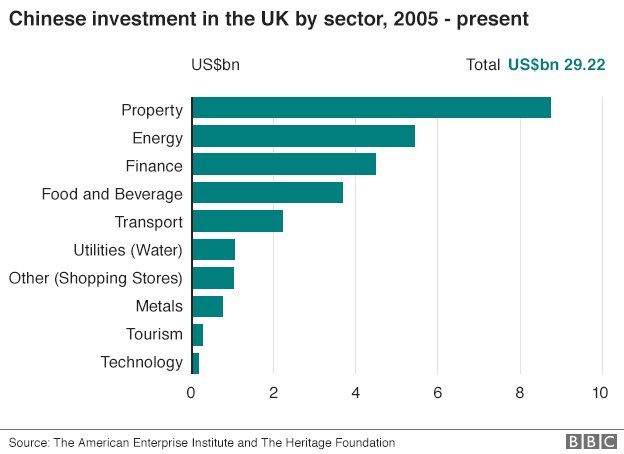

In fact, overseas investments have grown from $20bn in 2005 to $171bn last year. And, as the chart below shows, the UK is one of China's favourite places to invest.

In the first half of this year, Chinese investment in the UK fell sharply - just $1.8bn compared with more than $8bn in the whole of 2014.

But this figure is likely to be boosted significantly this week with the announcement of a number of deals while President Xi Jinping and his delegation visit Britain. Backing for a new nuclear power plant at Hinkley Point in Somerset could well be announced, while a separate deal for another nuclear plant at Bradwell in Essex has also been mooted.

If these and other deals like them don't come off, then the UK could well slip behind Italy - which has seen huge inflows of Chinese cash in the past two years - as China's favoured European investment destination.

Almost half of all China's global investments have been in the energy sector, many of them designed specifically to provide power for the Chinese. While the country's overall population may not grow significantly beyond its current 1.4 billion, an explosion in the middle class as wealth increases will see demand for energy rocket.

And as China develops technologies to satisfy this demand, it will become increasingly keen to export them. This is precisely why China is so keen to showcase its nuclear technologies in the UK.

But energy has not been China's primary interest in the UK. In fact, property investments far outweigh those in energy. The motivation here is far more straightforward - profit. The Chinese simply see UK commercial property as a good bet. Unsurprisingly, this is also the main motivation behind the huge sums of money China has pumped into the UK's financial sector.

One such investment is in Barclays bank - all $3bn of it. This is by far the largest single investment in the UK by the Chinese government or a Chinese company, in this case China Development Bank.

Sovereign Wealth Fund Assets ($bn) Launched China Investment Corporation (CIC) 746.7 2007 SAFE Investment Company 547 1997 National Social Security Fund 236 2000 Source: SWFI As you will see from the chart below, when it comes to a massive global bank such as Barclays, not even $3bn gives you much of a stake.

The same is the case with oil giant BP, in which the SAFE sovereign wealth fund has invested more than $2bn.

But other investments in far smaller companies have given Chinese investors either outright ownership, in the case of Pizza Express, or a controlling interest, in the case of House of Fraser, Weetabix and Sunseeker yachts.

This chart is not exhaustive, and does not include some property investments. You can download the full data from the American Enterprise Institute.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

Agriculture, Caste, Religion and Happiness in South Asia

Pakistan's agriculture sector GDP grew at a rate of 5.2% in the October-December 2023 quarter, according to the government figures. This is a rare bright spot in the overall national economy that showed just 1% growth during the quarter. Strong performance of the farm sector gives the much needed boost for about …

ContinuePosted by Riaz Haq on March 29, 2024 at 8:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network