PakAlumni Worldwide: The Global Social Network

The Global Social Network

HSBC 2018: Pakistan Among World's Fastest Growing Economies Till 2030

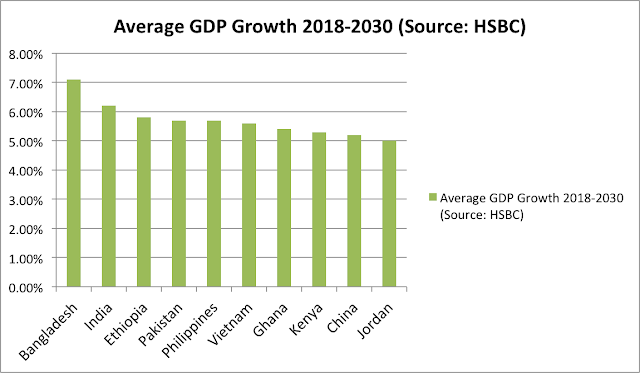

Recently released HSBC report titled "The World in 2030" says that "five Asian economies will be among the world’s six fastest-growing economies – Bangladesh, India, Philippines, Pakistan and Vietnam". HSBC ranks Pakistan at number 4 in terms of GDP growth till 2030 and expects Pakistan to rise from the world's 40th biggest economy in 2018 in nominal terms to the world's 30th largest economy by 2030. Pakistan economy does face some short-term headwinds because of its balance of payments crisis requiring an IMF bailout. However, longer term prospects for growth look good.

American business publication Wall Street Journal has produced a short video explaining how its staff sees what it describes as "US-China conflict brewing in Pakistan". What is at stake in the battle between China and the United States in Pakistan is the prize of global superpower status. Whoever wins in Pakistan will become the number one global superpower, says the Wall Street Journal.

Pakistan 4th Among Top 10 Fastest Growing Economies. Source: HSBC |

The HSBC report authors look at 75 economies in developing, emerging and frontier markets to make long-term projections of their growth potential and changes in global rankings. They conclude that emerging economies will account for roughly 50 per cent of global GDP by 2030 – a "seismic shift from half of that in 2000".

The report forecasts that Asia will continue to be the biggest driver of global economic growth and highlights that "China will be the world’s largest economy in 2030, overtaking the US, while India - currently the seventh biggest - will be third, pushing Germany and Japan down a position".

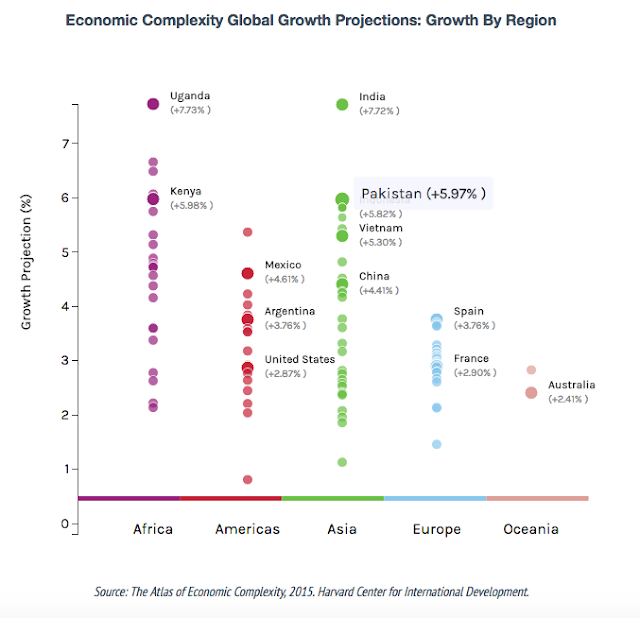

An earlier 2017 report by Harvard University's Kennedy School's Center for International Development (CID) at Harvard University forecast Pakistan's annual GDP growth to average 5.97% over the next 8 years, ranking it as the world's 6th fastest growing economy.

The Harvard growth projections are a bit more optimistic that other short, medium and long-term GDP growth forecasts for Pakistan offered by HSBC's 5% through 2050, IMF's 5.5% till 2020, World Bank's 5.8% until 2019 and The Economist EIU's 5.7% in 2017

Among the top 10 fastest growing economies, the CID projects Uganda to grow the fastest at 7.73%, followed by India 7.72%, Tanzania 6.66%, Senegal 6.49%, Madagascar 6.07%, Kenya 5.98%, Pakistan 5.97%, Indonesia 5.82%, Mali 5.75%, Turkey 5.64% and Philippines 5.43%.

Among Pakistan's other neighbors, Harvard Kennedy School forecast China to grow at 4.41%, Sri Lanka at 3.77% and Bangladesh at 2.82%.

Pakistan economy does face some short-term headwinds because of its balance of payments crisis requiring an IMF bailout. However, longer term prospects for growth look good. Improved security situation and rising investments, particularly the China Pakistan Economic Corridor or CPEC-related investments led by China, are helping accelerate the economic growth in the country. It is the fear of CPEC's success that appears to be driving a growing campaign of fear, uncertainty and doubt (FUD) waged by Pakistan's detractors in South Asia region and around the world. American business publication Wall Street Journal has produced a short video explaining how its staff sees what it describes as "US-China conflict brewing in Pakistan". What is at stake in the battle between China and the United States in Pakistan is the prize of global superpower status. Whoever wins in Pakistan will become the number one global superpower, says the Wall Street Journal.

Related Links:

-

Comment by Riaz Haq on October 10, 2018 at 8:06am

-

The Economic Complexity Index (ECI) and the Product Complexity Index (PCI) are, respectively, measures of the relative knowledge intensity of an economy or a product. ECI measures the knowledge intensity of an economy by considering the knowledge intensity of the products it exports. PCI measures the knowledge intensity of a product by considering the knowledge intensity of its exporters. This circular argument is mathematically tractable and can be used to construct relative measures of the knowledge intensity of economies and products (see methodology section for more details).

ECI has been validated as a relevant economic measure by showing its ability to predict future economic growth (see Hidalgo and Hausmann 2009), and explain international variations in income inequality (see Hartmann et al. 2017.

India ranks 51, Pakistan 91 and Bangladesh 111 on economic complexity index ranking 131 countries.

Japan tops the rankings, UK is at 8, US at 9 and China 26.

https://atlas.media.mit.edu/en/rankings/country/eci/

-

Comment by Riaz Haq on October 12, 2018 at 10:00am

-

Asia Frontier Capital - Pakistan Travel Report

https://seekingalpha.com/article/4211292-asia-frontier-capital-paki...

Most of the meetings were held at the Movenpick Hotel in Karachi and I was looking forward to our final two meetings which were with a food/snack company not far from the hotel and a pharmaceutical company, based in one of the industrial areas situated near the Karachi Port. The drive to the pharmaceutical company was unique as in the middle of the congested roads it is still possible to come across carts pulled by horses, donkeys and even camels. Also, very unique to Pakistan are the colourful painted buses and trucks which dominate the roads in busy Karachi.

“Lots of optimism but also realism”

Obviously in almost every conversation with C-level executives the topic of the new government under the leadership of the newly elected and former cricket player, Imran Khan, came up. Imran Khan assumed office on 18th of August 2018 and his government is already meeting a lot of high expectations from the public. Khan needs to quickly resolve some pressing economic issues like the low US Dollar reserves that are currently just 9 billion USD due to a chronic current account deficit which puts the Pakistani Rupee under further devaluation pressure as well. Khan already increased the gas prices for individuals and industries in order to reduce the subsidies and it is further expected that the price for electricity will be increased soon too. The new government is continuing to implement an existing policy introduced by the previous government which requires passenger car buyers to provide their tax filing number when purchasing a car in order to bring in more individuals to the tax net.

Generally, it is expected that interest rates will rise further, back to double digit levels, and that the Pakistani Rupee needs to devalue further against the USD from the current level of 124 to about 135 to 145 in order to make the country competitive again for exports [mainly textiles at the moment].

One of the most important and urgent economic tasks for Imran Khan’s government is the decision of how to finance the ever-growing current account deficit [due to higher imports and stagnant exports] and to stock up on their depleted foreign exchange reserves. Khan has basically two options: go to the IMF [again for the 22nd time in the history of Pakistan] or ask for additional loans from China and/or Saudi Arabia. In this respect, everybody I asked was of the same opinion: bite the bullet and go to the IMF. Therefore, it is not surprising that the government has just announced that they plan to begin talks with the IMF for a loan program.

One CFO of a diversified conglomerate described the expectation of the new government as “lots of optimism but also realism”: voters are optimistic that the Imran Khan-led government can change the country’s course towards a better future, but the same people are also realistic that it will be a huge challenge to overcome the current financial situation Pakistan faces at the moment.

Investors can gain exposure to Pakistan via an ETF such as the Global X MSCI Pakistan ETF (PAK) or through the London listed GDR's of OGDC (Oil & Gas Development Corp.), UBL (United Bank), and Lucky Cement. The Global X MSCI Pakistan ETF (PAK) is primarily made up of large cap Pakistani companies with large exposure to banks [30%] and energy [26%] stocks and has a total 36 holdings. This ETF currently has around USD 39 million of assets under management and trades at a P/E of 7.5x and since inception of the ETF on 22nd April 2015, it has returned -31.9% while the KSE Index has returned +7.2% in USD terms during the same period.

Comment

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

Agriculture, Caste, Religion and Happiness in South Asia

Pakistan's agriculture sector GDP grew at a rate of 5.2% in the October-December 2023 quarter, according to the government figures. This is a rare bright spot in the overall national economy that showed just 1% growth during the quarter. Strong performance of the farm sector gives the much needed boost for about …

ContinuePosted by Riaz Haq on March 29, 2024 at 8:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network