PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan's Fiscal Year 2022 GDP Reaches $1.62 Trillion in Purchasing Power Parity (PPP) Terms

Economic Survey of Pakistan 2021-22 confirms that the nation's GDP grew nearly 6% in the current fiscal year, reaching $1.62 Trillion in terms of purchasing power parity (PPP). It first crossed the trillion dollar mark in 2017. In nominal US$ terms, the size of Pakistan's economy is now $383 billion. In terms of the impact of economic growth on average Pakistanis, the per capita average daily calorie intake jumped to 2,735 calories in FY 2021-22 from 2,457 calories in 2019-20. Pakistan experienced broad-based economic growth across all key sectors in FY 21-22; manufacturing posted 9.8% growth, services 6.2% and agriculture 4.4%. The 4.4% growth in agriculture is particularly welcome; it helps reduce rural poverty. The country's per capita income is $1,798 in nominal terms and $7,551 in PPP dollars. These figures do not yet show up in Google searches. Under former Prime Minister Imran Khan's leadership, Pakistan succeeded in achieving outstanding economic growth and nutritional improvements in spite of surging global food prices amid the Covid19 pandemic. Increasing energy consumption and soaring global energy prices have rapidly depleted Pakistan's forex reserves, forcing the country to seek yet another IMF bailout. History tells us that these bailouts have been forced whenever Pakistan's GDP growth has exceeded 5%. The best way for Pakistan to accelerate its growth beyond 5% in a sustainable manner is to boost its exports by investing in export-oriented industries, and by incentivizing higher savings and investments.

|

| Pakistan Economic Data. Source: IMF April 2022 |

The IMF (International Monetary Fund) has updated its website in April, 2022 with data reported for FY 2020-21. It's not unusual for the IMF data reporting to lag by a year or more. Pakistan's Economic Survey 2021-22 was published in June, 2022.

|

| Sector-wise Economic Growth. Source: Economic Survey of Pakistan 20... |

Pakistan experienced broad-based economic growth across all key sectors in FY 21-22; manufacturing posted 9.8% growth, services 6.2% and agriculture 4.4%. The 4.4% growth in agriculture is particularly welcome; it helps reduce rural poverty.

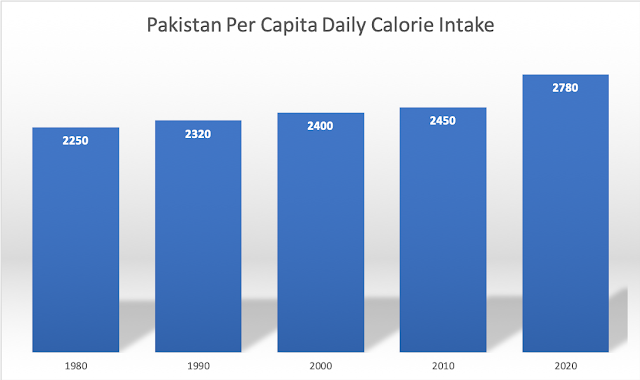

In terms of the impact of economic growth on average Pakistanis, the per capita average daily calorie intake jumped to 2,735 calories in FY 2021-22 from 2,457 calories in 2019-20. The biggest contributor to it is the per capita consumption of fresh fruits and vegetables which soared from 53.6 Kg to 68.3 Kg, less than half of the 144 Kg (400 grams/day) recommended by the World Health Organization. Healthy food helps cut disease burdens and reduces demand on the healthcare system. Under former Prime Minister Imran Khan's leadership, Pakistan succeeded in achieving these nutritional improvements in spite of surging global food prices amid the Covid19 pandemic.

|

| Pakistan Per Capita Daily Calorie Consumption. Source: Economic Surveys of Pakistan |

The trend of higher per capita daily calorie consumption has continued since the 1950s. It has risen from about 2,078 in 1949-50 to 2,400 in 2001-02 and 2735 in 2021-22. The per capita per day protein intake in grams increased from 63 to 67 to about 75 during these years. Health experts recommend that women consume at least 1,200 calories a day, and men consume at least 1,500 calories a day, says Harvard Health Publishing. The global average has increased from 2360 kcal/person/day in the mid-1960s to 2900 kcal/person/day currently, according to the Food and Agricultural Organization (FAO). The USDA (United States Department of Agriculture) estimates that most women need 1,600 to 2,400 calories, while the majority of men need 2,000 to 3,000 calories each day to maintain a healthy weight. Global Hunger Index defines food deprivation, or undernourishment, as consumption of fewer than 1,800 calories per day.

|

| Share of Overweight or Obese Adults. Source: Our World in Data |

The share of overweight or obese adults in Pakistan's population is estimated by the World Health Organization at 28.4%. It is 20% in Bangladesh, 19.7% in India, 32.3% in China, 61.6% in Iran and 68% in the United States.

|

| Major Food Items Consumed in Pakistan. Source: Economic Survey of P... |

The latest edition of the Economic Survey of Pakistan estimates that per capita calories come from the annual per capita consumption of 164.7 Kg of cereals, 7.3 Kg of pulses (daal), 28.3 Kg of sugar, 168.8 liters of milk, 22.5 Kg of meat, 2.9 Kg of fish, 8.1 dozen eggs, 14.5 Kg of ghee (cooking oil) and 68.3 Kg of fruits and vegetables. Pakistan's economy grew 5.97% and agriculture outputs increased a record 4.4% in FY 2021-22, according to the Economic Survey. The 4.4% growth in agriculture has boosted consumption and supported Pakistan's rural economy.

The minimum recommended food basket in Pakistan is made up of basic food items (cereals, pulses, fruits, vegetables, meat, milk, edible oils and sugar) to provide 2150 kcal and 60gram protein/day per capita.

The state of Pakistan's social sector is not as dire as the headlines suggest. There are good reasons for optimism. Key indicators show that nutrition and health in Pakistan are improving but such improvements need to be accelerated.

South Asia Investor Review

Pakistan's Expected Demographic Dividend

Pakistan's Social Sector

World Bank: Pakistan Reduced Poverty, Grew Economy During Covid19 P...

Surging Global Food Prices Amid Covid Pandemic

Pakistan's Balance of Payments Crisis

Panama Leaks in Pakistan

Olive Revolution in Pakistan"

Nay Pakistan Sehat Card: A Giant Step Toward Universal Healthcare

Prime Minister Imran Khan's Effectiveness as Crisis Leader

India in Crisis: Unemployment and Hunger Persists After Waves of Covid

Riaz Haq's Youtube Channel

-

Comment by Riaz Haq on July 13, 2022 at 8:14am

-

#Pakistan Reaches Agreement With #IMF to Resume Loan. $1.2 billion loan disbursement expected in August 2022. #economy https://www.bloomberg.com/news/articles/2022-07-13/pakistan-said-to...

---------

ISLAMABAD: In a major development, Pakistan and the International Monetary Fund (IMF) on Wednesday finally reached a staff-level agreement that revived the $6 billion Extended Fund Facility (EFF) programme for the country, Bloomberg reported.

https://www.thenews.com.pk/latest/973365-pakistan-imf-reaches-staff...

The move comes after the coalition government adhered to all "tough" conditions set by the global lender, including an increase in the price of petroleum products and energy tariffs, among others.

Sources told Geo.tv that the official announcement in this regard is expected soon.

The staff-level agreement will pave way for a $1.2 billion disbursement, which is expected in August.

Bloomberg reported that the disbursal would offer relief to Islamabad as the country's foreign-exchange reserves are depleting so much so that they can only cover less than two months of imports.

In June, Pakistan and the Fund staff achieved substantial progress to strike a consensus on budget 2022-23 after which the IMF shared a draft Memorandum of Economic and Financial Policies (MEFP).

-

Comment by Riaz Haq on July 15, 2022 at 7:39am

-

Arif Habib Limited

@ArifHabibLtd

Yearly auto sales reached an all-time high of 279.7K units (+54% YoY) during FY22.

https://twitter.com/ArifHabibLtd/status/1547933166648033280?s=20&am...

---------------

Arif Habib Limited

@ArifHabibLtd

Monthly auto sales reached an all-time high during Jun'22.

Jun’22: 28,493 units +107% YoY; +24% MoM

FY22: 279,720 units, +54% YoY

https://twitter.com/ArifHabibLtd/status/1547928839556194305?s=20&am...

-

Comment by Riaz Haq on July 15, 2022 at 1:50pm

-

Annual percentage growth rate of GDP at market prices based on constant local currency. Aggregates are based on constant 2010 U.S. dollars. GDP is the sum of gross value added by all resident producers in the economy plus any product taxes and minus any subsidies not included in the value of the products. It is calculated without making deductions for depreciation of fabricated assets or for depletion and degradation of natural resources.

India gdp growth rate for 2021 was 8.95%, a 15.54% increase from 2020.

India gdp growth rate for 2020 was -6.60%, a 10.33% decline from 2019.

India gdp growth rate for 2019 was 3.74%, a 2.72% decline from 2018.

India gdp growth rate for 2018 was 6.45%, a 0.34% decline from 2017.

https://www.macrotrends.net/countries/IND/india/gdp-growth-rate

--------

Annual percentage growth rate of GDP at market prices based on constant local currency. Aggregates are based on constant 2010 U.S. dollars. GDP is the sum of gross value added by all resident producers in the economy plus any product taxes and minus any subsidies not included in the value of the products. It is calculated without making deductions for depreciation of fabricated assets or for depletion and degradation of natural resources.

Pakistan gdp growth rate for 2021 was 6.03%, a 7.36% increase from 2020.

Pakistan gdp growth rate for 2020 was -1.33%, a 3.83% decline from 2019.

Pakistan gdp growth rate for 2019 was 2.50%, a 3.65% decline from 2018.

Pakistan gdp growth rate for 2018 was 6.15%, a 1.72% increase from 2017.

https://www.macrotrends.net/countries/PAK/pakistan/gdp-growth-rate

-

Comment by Riaz Haq on July 19, 2022 at 10:52am

-

Arif Habib Limited

@ArifHabibLtd

Highest ever oil import bill during FY22 amid a 71% YoY jump in Arab Light prices along with 19% YoY volumetric growth.

https://twitter.com/ArifHabibLtd/status/1549436102188081153?s=20&am...

---------------

Arif Habib Limited

@ArifHabibLtd

Balance of Trade FY22

Historic high trade deficit during FY22, up by 56% YoY

Exports: $ 31.79bn; +26% YoY

Imports: $ 80.18bn; +42% YoY

Trade Deficit: $ 48.38bn; +56% YoY

https://twitter.com/ArifHabibLtd/status/1549433873347579904?s=20&am...

-----------------

Arif Habib Limited

@ArifHabibLtd

Historic high textile exports during FY22, increased by 26% YoY to USD 19.33bn

https://twitter.com/ArifHabibLtd/status/1549430609520508931?s=20&am...

-

Comment by Riaz Haq on July 23, 2022 at 7:37am

-

Pakistan's IMF deal offers economic pain relief but no panacea

Political instability threatens to derail efforts to regain confidence of key lenders

https://asia.nikkei.com/Economy/Pakistan-s-IMF-deal-offers-economic...

Pakistan stepped away from the brink of bankruptcy by striking a deal with the International Monetary Fund to resume a $6 billion loan program this month. But experts warn that there is much more work to do, and that political instability poses a major obstacle to a true economic revival.

Islamabad on July 14 reached a staff-level agreement with the IMF to restart their stalled Extended Fund Facility. Pakistan will get a first tranche of $1.17 billion from the IMF in the coming weeks, which could pave the way for securing further loans from other lenders.

Nevertheless, the country is facing heavy foreign exchange pressure, with troubling echoes of the crisis that has gripped South Asian neighbor Sri Lanka this year.

Pakistan needs $41 billion in foreign exchange over the next 12 months, according to Finance Minister Miftah Ismail. "We have to repay $21 billion loans, need $12 billion current-account deficit financing and another $8 billion to maintain foreign exchange reserves," Ismail said during a budget seminar last month.

The agreement with the IMF was finalized at a time when -- due to a combination of political instability and the strong U.S. dollar -- the Pakistani rupee has been hitting all-time lows against the greenback. Ratings agency Fitch downgraded Pakistan's outlook from "stable" to "negative" earlier this week, after which the rupee touched a low of about 225 to the dollar.

Experts say the IMF agreement is a critical step toward unlocking external financing that Pakistan needs to avoid a default.

The deal "provides some level of comfort to the market that the country will have the necessary support from the IMF, and by extension from other multilateral and bilateral creditors, to meet its financing needs in the coming weeks," Uzair Younas, director of the Pakistan Initiative at the Atlantic Council's South Asia Center, told Nikkei Asia.

Younas added that it is important to follow up with policies that moderate growth and minimize the current-account deficit. The government "needs to proactively build buffers and reduce aggregate demand in the economy to slow down the dollar needs in the economy," he said.

Pakistan cannot solve its problems without structural reforms, according to experts.

"Pakistan needs to increase exports, widen the tax net, increase energy production and reduce circular debt," said Ahmed Naeem Salik, a research fellow at the Institute of Strategic Studies Islamabad. "If we do not carry out these reforms, then in the future the IMF will be extremely tough on Pakistan and might not extend loans."

At the same time, IMF loans alone will not be enough to meet the country's external financing needs. Pakistan will have to borrow from friendly countries.

Mosharraf Zaidi, chief executive of Tabadlab, a think tank based in Islamabad, agreed that the most crucial next steps for stability will be obtaining loans and grants from Saudi Arabia, China and the United Arab Emirates. "These three partners have, in the past, been more enthusiastic supporters of Pakistan's economic stability than they are now," Zaidi told Nikkei. He stressed that Pakistan will need to regain the confidence of Riyadh, Beijing and Abu Dhabi.

But the growing threat of political instability could make all of this more difficult for the government of Prime Minister Shehbaz Sharif.

The unexpected victory of ousted Prime Minister Imran Khan's Pakistan Tehreek-e-Insaf (PTI) party in by-elections in Punjab Province has raised fresh questions about the longevity of Sharif's government. The result showed that Khan's politics still resonate with a large segment of the population.

-

Comment by Riaz Haq on July 23, 2022 at 7:38am

-

Pakistan's IMF deal offers economic pain relief but no panacea

Political instability threatens to derail efforts to regain confidence of key lenders

https://asia.nikkei.com/Economy/Pakistan-s-IMF-deal-offers-economic...

Since his removal in a no-confidence vote in April, Khan has been demanding early national elections, while Sharif appears intent on holding the next vote on schedule in the second half of 2023.

Experts say the Punjab outcome does not alter the economic fundamentals but does cast doubt on the prospects for political stability -- considered a prerequisite for economic stability. "Unlike Sri Lanka, where an economic collapse has triggered political bedlam, the crisis of the Pakistani rupee is a consequence of Pakistani politics," argued Tabadlab's Zaidi.

Younas agreed that the political dynamics in Pakistan are the biggest risk to the economy. "A government gearing up for elections or facing protests from the PTI will find it difficult to impose austerity, given that such decisions erode its political capital," he said.

Younas suggested that it is crucial for the country to reach a consensus on the timing of elections and the need for economic stability. "Populist decisions such as the cut to petrol prices last week will only create further risks, and the government must continue making tough choices to achieve stability, even if this comes at a loss of political capital," he said.

Sharif said his government was passing on lower international prices to consumers by reducing the cost of fuel.

The Institute of Strategic Studies' Salik, on the other hand, argued for holding elections sooner rather than later: "The only way to get out of the political instability amid the economic crisis is to hold general elections in Pakistan as soon as possible."

-

Comment by Riaz Haq on July 23, 2022 at 1:06pm

-

Pakistan is in big trouble

Another emerging-market crisis looms

By Noah Smith

https://noahpinion.substack.com/p/pakistan-is-in-big-trouble

Many of the particular root causes of Pakistan’s situation are different than in Sri Lanka — they didn’t ban synthetic fertilizer or engage in sweeping tax cuts. The political situations of the two countries, though both dysfunctional, are also different (here is a primer on Pakistan’s troubles). But there are enough similarities at the macroeconomic level that I think it’s worth comparing and contrasting the two.

In my post about Sri Lanka, I made a checklist of eight features that made that country’s crisis so “textbook”:

An import-dependent country

A persistent trade deficit

A pegged exchange rate

Lots of foreign-currency borrowing

Capital flight

An exchange rate crash (balance-of-payments crisis)

A sovereign default

Accelerating inflation

-----

Fuel is the biggie here — more than a quarter of Pakistan’s total import bill goes to pay for fuel. In recent years it has become a lot more dependent on imports of liquified natural gas.

Food doesn’t look to be as big of a problem — Pakistan imports a fair amount of food, but it also exports a fair amount. That said, Pakistan’s population is pretty poor and malnourished, so even small disruptions to food imports could cause a lot of suffering there. And a cutoff of fuel imports would probably disrupt local agriculture quite a bit, which could cause output to crash and force Pakistanis to rely on imported food that they suddenly couldn’t afford.

In other words, if Pakistan’s currency (the Pakistani rupee) crashes in value and it suddenly can’t afford imports, its economy is in big trouble.

-----------

Remember that the reason a currency crash represents a crisis for an import-dependent country is that when the currency crashes, it’s a lot harder for a country to buy the foreign currency (“foreign exchange”) that it needs to buy imports.

There’s another way to get foreign exchange — by exporting. When you export, you get paid in foreign currency. But if a country runs a large and persistent trade deficit, then it doesn’t have a cushion to fall back on.

So that’s bad news for Pakistan. It means that when the Pakistani rupee crashes, it will have to borrow to get foreign exchange — at a time when borrowing will suddenly have gotten a lot more expensive.

-

Comment by Riaz Haq on July 23, 2022 at 1:07pm

-

Pakistan is in big trouble

Another emerging-market crisis looms

By Noah Smith

https://noahpinion.substack.com/p/pakistan-is-in-big-trouble

Remember, foreign-currency borrowing makes a country more vulnerable to a big crash in its exchange rate. If Pakistani banks or companies borrow in dollars, it means that they have to pay a certain number of dollars back each year. If the rupee falls in value, that makes those dollar repayments much more expensive. And this comes at the worst possible time — right when a country needs to borrow more money to pay its suddenly expensive import bills! Borrowing in foreign currency is thus a dangerous game.

And Pakistan has, unfortunately, been playing this game. Here’s a chart from Bloomberg showing how much dollar debt is coming due in the next few years:

Now this isn’t as bad as Sri Lanka. The amounts of dollar debt Pakistan needs to pay back in the next couple of years are about the same as for Sri Lanka, but its economy is almost four times as large. So this isn’t as catastrophic, but it’s still pretty bad.

Who has Pakistan been borrowing from? Well, a lot of people — the World Bank, the Asian Development Bank, the IMF, Saudi Arabia, and Japan. But Pakistan’s biggest foreign creditor is China.

Just like Sri Lanka, Pakistan has been borrowing heavily from China in order to fund domestic infrastructure projects, largely as part of China’s Belt and Road scheme. In fact, Pakistan has received more Belt and Road investment than any other country. But as in most countries, the Belt and Road projects have not been an economic success, due to various local factors that the Chinese planners either didn’t expect or didn’t care about. As with Sri Lanka, Pakistan has been left holding the bag.

Pakistan has been slowing down its Belt and Road projects and begging China for debt relief for years now. But while China has allowed Pakistan to roll the debt over, it has not canceled any of the debt yet — Pakistan is still on the hook. This outcome should give pause to all the people who pooh-pooh the danger of Chinese “debt traps”.

Even without China, though, Pakistan has simply borrowed too much in foreign currencies. In a previous post about Pakistan’s long-term growth, I called it a “low-income consumption society” — Pakistan borrows from abroad just to keep its desperately poor citizenry alive.

Capital flight is generally what precipitates a currency crisis. When people try to get their money out of a country, they have to sell that country’s currency in order to do it, which puts downward pressure on the exchange rate. Suddenly everyone is dumping rupees, so the rupee gets cheaper. Pakistan, unfortunately, is highly prone to capital flight. And this time is no exception — people are rushing to get their money out, and the government is trying to implement capital controls to stop them from getting their money out.

-

Comment by Riaz Haq on July 23, 2022 at 1:07pm

-

Pakistan is in big trouble

Another emerging-market crisis looms

By Noah Smith

https://noahpinion.substack.com/p/pakistan-is-in-big-trouble

Capital flight is putting downward pressure on the Pakistani rupee. There hasn’t been as dramatic a crash as in Sri Lanka, but the rupee has lost around 30% of its value since 2021, and the decline seems to be accelerating:

This isn’t yet a full-on currency crisis, but it’s getting there.

7. A sovereign default ❓

Remember, a currency crash makes a sovereign default likely when a country has a lot of foreign-currency debt. Pakistan hasn’t defaulted on its sovereign debt yet, as Sri Lanka has. But Pakistan’s bond yields have skyrocketed to 27%. This means that people are charging a very, very high price to lend Pakistan money. Why? Because people think there’s a high probability that Pakistan will soon default.

8. Accelerating inflation ❓

If a country has a lot of foreign-currency debt that it suddenly can’t afford to pay back, it can default, and/or it can print local currency to pay back the foreign-currency debt (even though this drives the exchange rate even lower). Printing a bunch of rupees would cause high inflation, as it has in Sri Lanka. So far, Pakistan’s inflation rate hasn’t spiked to the degree Sri Lanka’s has, but it’s not looking good:

So to sum up, Pakistan shares a lot in common with Sri Lanka. It doesn’t have a pegged exchange rate, it’s not as dependent on imported food, and it doesn’t have quite as much foreign-currency debt. But the basic ingredients for a slightly more drawn-out version of the classic emerging-markets crisis are there, and there are some indications that the crisis has already begun.

Pakistan’s long-term problems

Because Pakistan didn’t peg its exchange rate and didn’t borrow quite as much in foreign currencies as Sri Lanka, it made fewer macroeconomic mistakes than its island counterpart. But in terms of long-term economic mismanagement, it has done much worse than Sri Lanka. No, it didn’t ban synthetic fertilizers — that was an especially bizarre and boneheaded move. But one glance at the income levels of Sri Lanka and Pakistan clearly shows how much the development of the latter has lagged:

-

Comment by Riaz Haq on July 23, 2022 at 1:10pm

-

Pakistan is in big trouble

Another emerging-market crisis looms

By Noah Smith

https://noahpinion.substack.com/p/pakistan-is-in-big-trouble

Pakistan went from 3/4 as rich as Sri Lanka in 1990 to only about 1/3 as rich today. That’s an incredibly bad performance on Pakistan’s part.

Assessing just why Pakistan has failed so badly for so long is difficult. I wrote a post about it a year ago, but that only scratched the surface:

Basically, Pakistan invests very little of its GDP, so it can’t build up capital over time. Low investment is probably a result of various bad economic policies, but it’s also probably due to political instability — Pakistan frequently alternates between military and civilian control, and civilian administrations tend to be chaotic and fractious (as in the current turmoil). That’s not a very good climate to invest in!

Instead of investing, Pakistan keeps its population on life support with constant external borrowing — from international organizations, from China, from Saudi Arabia, from whoever will loan it money. It uses these loans to fund consumption of basics like fuel. Mian discusses how this has resulted in a perverse fuel subsidy — a pretty common practice for governments that want to keep their populations pacified, but one that Pakistan is particularly ill-equipped to afford.

So Pakistan constantly limps along at the knife-edge of desperate poverty, decade after decade, as generals and politicians fight over who gets to be in charge. Currency crisis or no currency crisis, that is a long-term recipe for disaster.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

Agriculture, Caste, Religion and Happiness in South Asia

Pakistan's agriculture sector GDP grew at a rate of 5.2% in the October-December 2023 quarter, according to the government figures. This is a rare bright spot in the overall national economy that showed just 1% growth during the quarter. Strong performance of the farm sector gives the much needed boost for about …

ContinuePosted by Riaz Haq on March 29, 2024 at 8:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network