PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistani Stock Market Still Offers Great Value After Stellar Performance in 2016

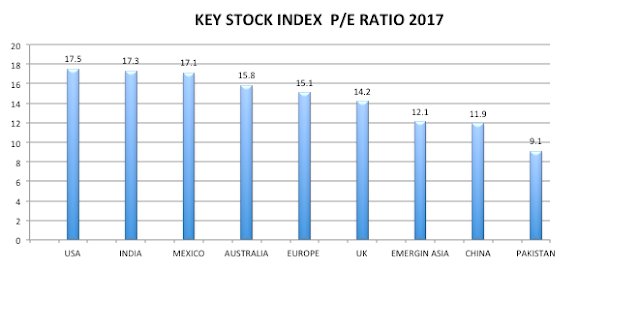

Pakistan's KSE-100 continues to offer attractive valuations for investors in 2017. Its equities are trading at a forward price-earnings ratio of just 9.1, according to Pakistani brokerage firm Arif Habib Limited.

Pakistani shares are on offer at a deep discount to the Indian shares trading at 17.3 price-earnings multiple. While India's stock market is among the world's most expensive, the Pakistani market is among the cheapest. Pakistani shares are now trading at 47.3% discount to Indian shares.

In spite KSE-100's major run up of 46% in 2016, far outpacing India's Sensex's 2.57% rise and MSCI emerging market's 8.42% increase, Pakistani equities (PE ratio 9.1) are still cheaper than Asian emerging markets (12.1) and China (11.9), according to published data.

Pakistani shares are now trading at 47.3% discount to Indian shares, 31% discount to Asia Emerging Market index and 23.5% discount to Chinese shares.

Consumer confidence index in Pakistan jumped five point from the prior quarter to reach 106 in Q4/2016, according to Nielsen’s global survey of consumer confidence for 63 countries released recently.

Here's an excerpt of Nielsen's report Africa/Middle East region that includes Pakistan:

"Consumer confidence in the Africa/Middle East region declined in the fourth quarter, falling four points to 83, the lowest level in more than three years. Confidence was highest in United Arab Emirates, which held steady from the third quarter at 108. Pakistan was the only country where consumer confidence moved in a positive direction, rising five points from the third quarter to 106, the highest score for the country since it was added to the survey in 2008."

The share of Pakistani respondents worried about job security dropped to 21%. 51% of Pakistanis said they are optimistic about better job opportunities in the next 12 months, according to the survey.

“The findings of the consumer confidence reflect a favorable atmosphere in Pakistan. The set of factors that influence the confidence levels of Pakistani consumers goes beyond economics and business, and is reflective of improved security conditions, increased energy availability and low inflation rates,” reported the survey.

“China-Pakistan Economic Corridor (CPEC) has also led to a higher activity in large-scale manufacturing and construction, opening more investment opportunities,” said Nielsen Pakistan Managing Director Quratulain Ibrahim, according to Pakistan's Express Tribune newspaper. “We hope to see this optimism among Pakistani consumers during the coming months.”

Pakistani banks have boosted lending to businesses and consumers. Large-scale manufacturing sector borrowed Rs. 225 billion in 2016, up from Rs 119 billion in 2015. Consumer loans have jumped from Rs. 29 billion in 2015 to Rs. 70 billion in 2016. Auto financing soared 32% to Rs 30.7 billion in 2016, according to the State Bank of Pakistan as reported by Daily Times.

Pakistani consumers and businesses are feeling increasingly confident with improved overall security, rising foreign and domestic investments and better employment prospects. They are earning, borrowing and spending more to further stimulate the economy thereby creating a virtuous cycle. Low oil prices and relatively subdued inflation are also helping. It's now up to Pakistan's political, economic and military leadership to maintain this growth momentum.

Related Links:

Pakistan's Economy and Security in 2016

Credit Suisse Global Wealth Report 2016

Pakistan's Middle Class Larger and Richer Than India's

Pakistan Translates GDP Growth to Citizens' Well-being

Rising Motorcycle Sales in Pakistan

China Pakistan Economic Corridor

-

Comment by Riaz Haq on April 12, 2017 at 4:33pm

-

One of the world’s best known investment gurus, Jim Rogers of Rogers Holdings and Beeland Interests, admitted in an interview that he may have been too hasty in exiting India in 2015, but says he won’t enter it now when the markets are at record highs. He says he was surprised that the government managed to get the legislation for the goods and services tax (GST) through. “It is a historic move as this has been a very contentious issue among Indian politicians for several years,” he added.

Rogers said that in addition to GST, he has also been tracking the Indian market, the best performer among the world’s 10 largest stock markets thus far in 2017. “Yes, I am impressed, and I see that the markets are at an all-time high, currency is going up—they are making new highs without me, and that does not make me happy.”

Keen as he is to enter India, Rogers says he will wait because it doesn’t make sense to enter a market when it is on a high. “I don’t want to jump on to a moving train. When you jump on to a moving train, you’ll get hurt.”

http://www.livemint.com/Money/jH7oortdw0GvOodZvQhgTO/Jim-Rogers-cha...

-

Comment by Riaz Haq on April 13, 2017 at 7:58am

-

Indian Stock Optimism Is All Hype to Goldman Sachs's Jain

https://www.bloomberg.com/news/articles/2017-04-12/indian-stock-opt...

Scant evidence to justify growth, earnings optimism, he says

‘The non-performing loan situation is pretty unnerving’

Rajiv Jain can’t understand Indian stock bulls.

There’s scant evidence to justify the optimism over the country’s growth outlook and company earnings, said the former star asset manager at Vontobel Holding AG who now manages funds for Goldman Sachs Group Inc.

The nation’s shares and currency are also overvalued, said Jain, whose Goldman Sachs GQG Partners International Opportunities Fund has returned 9.3 percent this year to beat 91 percent of its peers.

The S&P BSE Sensex Index has advanced 11 percent this year, the most among Asian emerging-market gauges after the Philippine Stock Exchange Index.

Jain, who oversees around $2.5 billion from Fort Lauderdale, Florida, spoke in a phone interview:

Why the negativity on Indian stocks?

“India is the single most expensive market globally. It’s more expensive than the U.S. The currency is also overvalued, and earnings estimates have been declining the most among any market this year.”

“Top-down, from a political perspective, it looks good, but I think from a bottom-up, company-wise scenario, it’s not good at all in terms of where the general banking system is, where credit growth is, where the yield curve is.”

“People are usually either too pessimistic or too optimistic on India” and they’re too optimistic at the moment, he said.

How’s the macroeconomic backdrop looking?

“The non-performing loan situation in India is pretty unnerving. Non-performing loans are running at 12 to 13 percent, which is higher than the Chinese.”

“What could go wrong, for example, if oil goes higher? That will be a negative and the current-account deficit will get worse, not better, from this level if the currency stays there. Interest rates are already low. I don’t know how they will go lower from here.”

“Indian credit growth is down 5 to 6 percent. That’s the lowest in decades. The only engine firing is retail lending.”

“Interest rates are low and they should head higher as inflation ticks up during the second half. Job creation in IT services could slow meaningfully from here. Cement sales declined over the last 12 months for example. Real estate markets are still pretty slow, but paint companies are selling at 35 to 40 times earnings.”

-

Comment by Riaz Haq on April 13, 2017 at 8:16am

-

(ADB's) Turner said that effectiveness of transportation system is directly related to the trade and economic activities. He said that inefficiencies in the performance of the transport sector of Pakistan costs economy by 4pc to 6pc of the GDP annually. He said that Asian Development Bank has been assisting Pakistan to address this issue but investment in transportation infrastructure must be backed by the institutional improvement.

On China Pakistan Economic Corridor (CPEC), he said that it is important project that would help connect Iran, Turkey, Central Asian States and Afghanistan etc. He said that to get good result from CPEC, good transportation system is a must for the movement of trading goods.

http://nation.com.pk/business/13-Apr-2017/inefficiencies-in-transpo...

-

Comment by Riaz Haq on April 19, 2017 at 5:40pm

-

Sleepy #Pakistan Village of #Gwadar Rises as #China's Gateway to the Middle East. #CPEC

https://www.voanews.com/a/pakistani-village-gwadar-china-gateway-to...

GWADAR, PAKISTAN —

Over the last six months, the skyline over the sleepy fishing city of Gwadar has been transformed by machines that dredge the Arabian Sea and cranes that set up shipping berths in what is projected to become Pakistan’s biggest international port.

Infrastructure developments have enabled the hammer-shaped Gwadar peninsula to emerge as the centerpiece of China’s determined effort to shorten its trade route to the Persian Gulf and obtain access to the rich oil reserves there.

A mini-“Chinatown” has appeared, with prefabricated living quarters, a canteen and a karaoke center. After hours, the workers have the grounds to play their favorite game, badminton.

---

Prior to that, he said, China had sailed materials through the South China Sea and the Indian Ocean to reach Gwadar.

The Chinese propose to cut down that 12,000-kilometer sea route by about one-fourth once they adopt the land route from the northwestern province of Xinjiang to Gwadar.

So eager is China to save on distance, time and expense — and the challenge posed by the U.S. Navy in the South China Sea — that it has weathered Pakistan’s unstable law-and-order situation to build its economic corridor.

Small wonder that the Chinese spokesman omitted an incident — related by locals to VOA — that the test convoy came under fire in Hoshab, Baluchistan, despite protection from a special security force.

Since then, Pakistan has enhanced its 12,000-plus security force to protect the Chinese. That has turned Gwadar into a military zone, with strict checks of vehicles and ID cards, plus an encampment of intelligence officials.

----

The Chinese, for their part, have taken heart from the security provided by Islamabad to plan ahead. A prefabricated coal plant will be brought from China to Gwadar to fire up its energy needs. Moreover, China will finance Gwadar international airport, according to the spokesman.

Distances inside Pakistan have shortened as the Frontier Works Organization builds a 3,000-km network of roads funded by Chinese investment.

----------

Gwadar Port Authority Chairman Dostain Jamaldini explains to delegations arriving daily from across the country that revenue generation is the key to uplifting the area.

He showed off a huge quadrangle in the center of Gwadar that “can even be seen on Google Earth.” There, he has recommended to Islamabad that a multipurpose lighthouse be constructed to guide incoming ships and generate revenue.

Until that happens, the fishermen who build wooden boats along Gwadar beach will likely lose their livelihood as their shanty homes are removed.

Already, the vacant plots in Gwadar’s Sinjhaar area overlooking the sea have been repossessed by the Pakistan Navy and earmarked for sale to military officials and politicians.

For the well-connected, a real estate boom is on the horizon. Trader Abbas Rashanwala said he waited for years for peace to come to Gwadar. Now his real estate business has taken off, with investors flocking in to buy land.

Many realtors are betting on Gwadar as on the stock market — making deals online or on the phone. Several sit in the Punjab, selling property they have never seen in Gwadar, all on speculation that prices will soon skyrocket.

Meanwhile, China’s investment in Gwadar is helping control maritime crime. Officials tell how traffickers from Africa and the Middle East used to dock on the beach at night to swap slaves for narcotics.

In February, 36 nations, including the U.S. and Russia, participated in the Pakistan Navy’s multinational patrolling of the Arabian Sea in a global recognition of China’s role in making the waterways safer.

-

Comment by Riaz Haq on April 20, 2017 at 7:46am

-

#Pakistan shares market rallies after #PanamaVerdict; Ends up 2.4% for the day as #NawazSharif dodges bullet #KSE100

https://www.bloomberg.com/politics/articles/2017-04-20/pakistan-cou...

Pakistan’s top court ordered further investigation into corruption charges against Prime Minister Nawaz Sharif, for now taking off the immediate prospect of a potential disqualification as his government continues efforts to boost an economy hit for years by power outages and terrorism.

In a three-two split decision by the five-member bench, the Supreme Court ordered a “joint investigation team” to probe allegations that Sharif and his children brought foreign assets illegally, Justice Asif Saeed Khosa, said in Islamabad, the capital, on Thursday. The investigative unit should submit its report within 60 days, he said.

“A special bench will be constituted to look into the matter after the final report and whether the prime minister’s disqualification can be considered,” Khosa said.

Making his verdict as hundreds of riot police and paramilitary troops were deployed within a five kilometer (3.1 mile) radius of the court, Khosa concluded the hearing of petitions by opposition leader and former cricket star, Imran Khan, who brought the case against Sharif and his family before elections next year. Immediately after the ruling the nation’s benchmark stock index advanced as much as 4 percent, the largest jump in more than two years, before paring gains to 2.4 percent at the close of trading.

The court took up the case in November following a report by the International Consortium of Investigative Journalists showed Sharif’s three children either owned or have signing rights to authorize transactions of four offshore companies in the British Virgin Islands. Those holdings were alleged to have been used to make property purchases in London. Sharif’s political opponents doubted the premier’s family obtained those assets legally.

The decision eases an immediate political crisis for Sharif ahead of the 2018 national vote amid opposition calls for him to step down. After the release of the report based on leaked documents of Panama-based law firm Mossack Fonsecca in April, Sharif had pledged to resign if charges were proved.

Sharif’s government will probably now “go ahead and complete its term,” Burzine Waghmar, a member of the Centre for the Study of Pakistan at the School of Oriental and African Studies in London, said by phone. “The administration will ride” the investigation out.

-

Comment by Riaz Haq on May 10, 2017 at 7:08pm

-

#China investment brightens #Pakistan’s future. #PSX #KSE #CPEC https://www.ft.com/content/6fa73c2a-33f2-11e7-99bd-13beb0903fa3 … via @FT

Late last year, three Chinese exchanges jointly submitted the highest bid for a 40 per cent stake in the Pakistan Stock Exchange. They paid almost Rs9bn, or $85m. Weeks after the deal, the market hit an all-time high.

This year has been a good time to be a broker in Karachi, especially after index provider MSCI announced last summer it was restoring the country to emerging market status after downgrading it to frontier status after the financial crisis. In March, local brokers with stakes in the PSX received cheques when the Chinese transaction closed. Since then, they have been sending roadshows to financial capitals to sing the praises of the Pakistani market.

The Chinese investment in the the Pakistan stock market is not officially part of the China Pakistan Economic Corridor (CPEC), which is itself part of the broader, One Belt, One Road initiative designed to strengthen trade links between China and Europe. Yet the biggest reason to be optimistic about Pakistan is the Chinese investment that is pouring into the country.

More than $55bn is expected to come into the country in the next five years, according to a forecast from the Pakistan Business Council. Beijing is doing for Pakistan what the country cannot seemingly do for itself — provide functioning infrastructure. The most critical of these involves building power plants to solve the country’s perennial energy shortage, which has become one of the biggest constraints on economic growth.

Last year investors latched on to what Chinese investment might mean for Pakistan. The stock market is up more than 40 per cent over the past 12 months, and touched a record high in January. However, its momentum has slowed, rising only about 3 per cent this year.

Investors must decide whether China will be a long-term game changer for corporate Pakistan — or whether China itself will be the biggest beneficiary of CPEC. Will local steel, cement and heavy chemical companies see a huge uptick in orders? Will Chinese capital invest in the Pakistani cement and steel industry, where being local is an advantage given high transport costs. Or will Chinese companies see a boost to revenues as a result of Chinese investment?

“With the China connection, it is difficult to go wrong; that is key,” argues Mark Mobius, executive chairman of Templeton Emerging Markets Group. “Three years ago, we went big in Pakistan when everyone was down on it.”

Yet the evidence so far is mixed. Many contracts are not public, but Chinese companies that have received contracts to help construct some of the power plants have been guaranteed equity returns from the projects. Moreover, until the Pakistani business community rose in revolt, Chinese steel imports were duty-free.

Chinese investment is not the only reason to buy Pakistan. Law and order has improved, although progress seems fragile. Growth, which came in at under 5 per cent last year, is expected to rise to 5.2 per cent this year, according to the Asian Development Bank. Consumer spending is strong. The cost of capital is at a 43-year low, according to data from the Pakistan Business Capital. Pakistani management talent — whether at multinationals such as Unilever or local companies such as Engro or National Foods — is impressive.

But reasons to be bearish are not hard to find. The country’s exports are declining, while those at competitors such as Vietnam and Bangladesh are growing. Manufacturing as a percentage of GDP is shrinking, and is a mere 13 per cent today. Remittances are down, while the balance of payments is under pressure.

The wave of Chinese investment will make a huge difference to Pakistan. That much is not in dispute.

But it is possible that alongside the power plants, roads and ports, China’s investment will leave a trail of bad debts. For now, of course, Karachi brokers will be hoping Beijing’s interest lifts the domestic stock market to new highs.

-

Comment by Riaz Haq on May 25, 2017 at 7:17am

-

Economic Survey of Pakistan 2016-17

http://www.finance.gov.pk/survey/chapters_17/overview_2016-17.pdf

Per Capita Income in dollar terms has witnessed

a growth of 6.4 percent in FY 2017 as

compared to 1.1 percent last year. The per

capita income in dollar terms has increased

from $ 1,531 in FY 2016 to $ 1,629 in FY

2017. Main contributing factors for the rise in

per capita income are higher real GDP, growth,

low population growth and stability of Pak

Rupee.

------------------

Real GDP growth was above

four percent in 2013-14 and has smoothly

increased during the last four years to reach

5.28 percent in 2016-17, which is the highest in

10 years.

----

The agriculture sector met

its growth target of 3.5 percent, helped by

government supportive policies and by

increased agriculture credit disbursements.

During 2015-16, the agriculture credit

disbursement was close to Rs 600 billion while

during 2016-17, the target was raised to Rs 700

billion. During July-March 2016-17, the

disbursement was observed to be 23 percent

higher as compared to the previous year. These

developments, along with the Prime Minister’s

Agriculture Kissan Package together with other

relief measures have started yielding positive

results.

The large-scale manufacturing output is

primarily based on Quantum Index

Manufacturing (QIM) data, which show an

increase by 5.06 percent from July 2016 to

March 2017. Major contributors to this growth

are sugar (29.33 percent), cement (7.19

percent), tractors (72.9 percent), trucks (39.31

percent) and buses (19.71 percent). High

growth of sugar is based on production of 73.9Million Tons of Sugarcane as compared to 65.5

million tons last year, which represents an

increase by 12.4 percent.

Large Scale Manufacturing growth has picked

up momentum and posted a strong 10.5 percent

growth in the month of March 2017 compared

to 7.6 percent in March 2016. The YoY growth

augurs well for further improvement in growth

during the period under review.

On average, the LSM growth stood at 5.06

percent during July-March FY 2017 compared

to 4.6 percent in the same period last year. The

sectors recording positive growth during JulMar

FY 2017 are textile 0.78 percent, food and

beverages 9.65 percent, pharmaceuticals 8.74

percent, non-metallic minerals 7.11 percent,

cement 7.19 percent, automobiles 11.31

percent, iron & steel 16.58 percent, fertilizer

1.32 percent, electronics 15.24 percent, paper &

board 5.08 percent, engineering products 2.37

percent, and rubber products 0.04 percent.

Pakistan is bestowed with all kinds of resources

which also include minerals. Pakistan possesses

many industrial rocks, metallic and nonmetallic,

which have not yet been evaluated. In

the wake of the 18th Amendment, provinces

enjoy great freedom to explore and exploit the

natural resources located in their authority, with

the result that they are currently undertaking a

number of projects using their own resources,

or in collaboration with the federal government

or with donors to tap and develop these

resources.

The services sector recorded a growth of 5.98

percent and surpassed its target which was set

at 5.70 percent. Wholesale and retail trade

sector grew at a rate of 6.82 percent. The

growth in this sector is bolstered by the output

in the agriculture and manufacturing sectors.

The share of Agriculture, Manufacturing and

Imports in Wholesale and Retail Trade growth

is 18 percent, 54 percent and 15 percent

respectively. The Transport, Storage and

Communication sector grew at a rate of 3.94

percent. Finance and insurance activities show

an overall increase of 10.77 percent, mainly

because of rapid expansion of deposit formation

(15 percent) and demand for loans (11 percent).

-

Comment by Riaz Haq on June 1, 2017 at 1:13pm

-

#Pakistan ETF (NYSE: PAK) In Focus As Country Regains #MSCI #EM Status

https://etfdailynews.com/2017/05/30/pakistan-etf-pak-in-focus-as-co...

The re-entry into the emerging market block after nine years was made possible by the country’s improving liquidity and growth. Pakistan lost this position in late 2008, following a period of market turmoil that halted trading for months in the Karachi exchange.

Pakistan is the first country to get the frontier-to-emerging promotion after Qatar and the United Arab Emirates several years ago. MSCI will add Pakistan to the Emerging Market Index effective May 31, at the market close, with a weight of just 0.2% (read: Can Emerging Market ETFs Retain Their Mojo in 2017?).

The reclassification is making investors bullish about Global X MSCI Pakistan ETF (PAK – Free Report) – the ETF targeting Pakistani equity markets. The fund will likely lure a wider class of investors thereby injecting huge amounts of money into the country. In fact, the fund is on track for the biggest monthly inflow since its inception two years ago. The ETF has gathered $11.8 million in capital so far this month, propelling its asset base to $48.5 million. According to Bloomberg, the bearish bets have also fallen to the lowest level since December. Over $1 million short positions have been cut over the past six weeks.

PAK in Focus

The product offers exposure to 43 Pakistani equities by tracking the MSCI All Pakistan Select 25/50 Index. The top two firms – Habib Bank and Lucky Cement – dominate the fund returns with a double-digit exposure each. Other firms hold less than 7.2% of the assets. From a sector look, financials and materials occupy the top two positions at 33% and 28%, respectively, followed by energy (18%).

The ETF is expensive relative to many emerging market funds, charging 91 bps in fees and expenses. Additionally, it trades in small volumes of about 35,000 shares resulting in additional cost in the form of wide bid/ask spread.

PAK has been outperforming the broad emerging funds, returning investors 33.5% over the past one-year period compared with gains of 29% for (EEM – Free Report) . It has a Zacks ETF Rank of 3 or ‘Hold rating with a Medium risk outlook, suggesting more room for upside (read: Pakistan ETF Hits New 52-Week High).

The outperformance is likely to continue given the country’s GDP growth, falling poverty, and bourgeoning middle class. After falling to below 4% growth in 2008, Pakistan GDP growth hit a 10-year high of 5.28% for fiscal year 2016–17. However, terrorist attacks, bombings, other incidents of violence and brutal state retaliation continue to weigh on the country’s growth and the ETF performance.

The Global X MSCI Pakistan ETF (NYSE:PAK) was unchanged in premarket trading Tuesday. Year-to-date, PAK has gained 7.49%, versus a 8.13% rise in the benchmark S&P 500 index during the same period.

PAK currently has an ETF Daily News SMART Grade of A (Strong Buy), and is ranked #39 of 77 ETFs in the Emerging Markets Equities ETFs category.

-

Comment by Riaz Haq on June 3, 2017 at 7:43am

-

Pakistanis among smartest people in the world, says Swedish investor

https://www.geo.tv/latest/144428-pakistanis-among-smartest-people-i...

Swedish investor Mattias Martinsson said that Pakistanis are among the smartest people in the world while was speaking on Geo Pakistan early Saturday morning.

Pakistan’s specialty is its people. Many people want to work hard and get education. They will prove to be important assets for the country, he remarked.

His involvement in the Pakistan stock market bears testament to the foreign investors’ trust on the country’s market.

In 2011, when no one was willing to invest in Pakistani market it was Martinsson who established the country’s first foreign equity fund.

No investor was willing to invest in the equity fund, but Martinson and his partner invested a million dollars into it. Today, the fund is worth $100 million.

He remarked that he has been working with Pakistan stock market since 2005. “It has impressed me a lot.”

“I think differently from the rest. Don’t pay attention to what the other investors are thinking. Pakistan is one of the most important markers,” he said.

Pakistan’s market has the potential to progress as much as Indian market. However, many investors are still tremble at the thought of investing in Pakistan. If they start investing then the equity fund would be worth a lot more, he added.

Comment

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

Agriculture, Caste, Religion and Happiness in South Asia

Pakistan's agriculture sector GDP grew at a rate of 5.2% in the October-December 2023 quarter, according to the government figures. This is a rare bright spot in the overall national economy that showed just 1% growth during the quarter. Strong performance of the farm sector gives the much needed boost for about …

ContinuePosted by Riaz Haq on March 29, 2024 at 8:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network