PakAlumni Worldwide: The Global Social Network

The Global Social Network

AdAsia 2019: Asia's Biggest Advertising Industry Conference in Lahore, Pakistan

On December 2, 3, 4 and 5, 2019, Pakistan played host to AdAsia 2019 after a gap of 30 years. It is the largest and most prestigious advertising industry conference in Asia – organized bi-annually by the Asian Federation of Advertising Associations (AFAA). It drew attendees from all over the world to Lahore, Pakistan. This conference has taken place at a time when Pakistan's 88 billion rupee media industry is in the midst of a major shakeout after a long period of rapid double-digit growth since the turn of the century. The only advertising segment still hot and growing at double digit rates is digital.

Pakistan President Arif Alavi delivered the closing keynote address. Other speakers included Sir Martin Sorrell, Founder, WPP; Philip Thomas, CEO, Cannes Lions; Randi Zuckerberg, CEO, Zuckerberg Media and former Director Market Development, Facebook; Kaveri Khullar, Marketing Director, Mastercard Southeast Asia; Fernando Machado, Global CMO, Burger King; Asad J. Malik, an artist specializing in augmented reality; Piyush Pandey, CCO Worldwide and Executive Chairman India, Ogilvy; Marcus Peffers, Global CEO, M and C Saatchi World Services; Stefan Sagmeister, Co-Founder Sagmeister and Walsh; Richard Quest of CNN Business; and Yasuharu Sasaki, ECD, the Dentsu Network.

Digital Advertising:

Sessions on digital advertising were packed at the conference. This segment of advertising is growing rapidly amidst declining total ad spend in Pakistan.

Randi Zuckerberg, former executive at Facebook and sister of Mark Zuckerberg, was a featured speaker to talk about digital marketing. She shared her experience of how digital media became a powerful force for marketers. “15 years ago, my marketing budget for a whole year was one box of t-shirts,” she told the audience as she talked about her years at Facebook. “It’s really amazing to see how far the world can come in time,” she added.

Zuckerberg praised Pakistan as a country that honors women. “Pakistan has given us women such as Malala Yousafzai and Benazir Bhutto,” she said. “This shows that Pakistan is a country that really honors its women.”

Zuckerberg was followed by Tom Goodwin, head of innovation at Zenith Media. He focused on how our lives have been transformed by ongoing Digital Revolution. “Smartphones have become like fireplaces to people. People gather around their devices and their connection to the world becomes what gives them warmth,” Goodwin said.

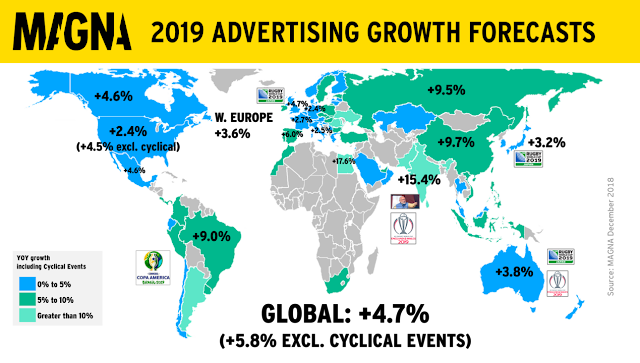

Growth of broadband access in Pakistan is changing the country's media landscape. Digital advertising revenue is forecast to grow by 32% in 2019 to Rs. 10.8 billion ($103 million), 12% of total national advertising revenue (NAR), according to Magna Advertising. Digital marketing expert Lars Anthonisen believes Pakistan is quickly becoming a "digital first country". Anthonisen sees "new opportunities for brands to reach and engage with consumers who may have previously been overlooked". Overall ad spend in Pakistan is expected to rise by 15% in 2019 to Rs. 88.3 billion ($840 million) following a steep decline (-11%) in 2018, according to a Branding in Asia report. Growing availability of smartphones, tablets and mobile broadband is extending the reach of advertisers to digital media where it is possible to precisely target prospective customers.

Pakistan Media Industry:

Pakistan's 88 billion rupee media industry is in the midst of a major shakeout after a long period of rapid double-digit growth since the turn of the century. Hundreds of journalists and other staff have lost their jobs. At least one TV channel, Waqt News, has closed while several others are downsizing. While such consolidation was long overdue after nearly two-decade long period of explosive growth, the PTI government's decision to reduce advertising budget, which constitutes nearly a quarter of all ad spending in the country, appears to be the main trigger. Those affected by consolidation are accusing the government of exercising press censorship by cutting its ad spending.

Rapid Media Growth:

Rising buying power of rapidly expanding middle class in Pakistan drove the nation's media advertising revenue up 14% to a record Rs. 76.2 billion 2016 and another 12% to Rs. 88 billion in 2017, making the country's media market among the world's fastest growing media markets.

Industry Shakeout:

Massive commercial media growth in Pakistan has been most apparent in terms of private TV channels growing from just one in Year 2000 to over 100 today after President Musharraf's deregulation of electronic and other media.

Explosive growth with many new entrants is the fundamental business reason for the recent wave of consolidation and shakeout. Shakeout is a business term used to describe the consolidation of an industry or sector after it has experienced a period of rapid growth in demand followed by oversupply.

At least one TV channel, Waqt News owned by Nawai-Waqt Media Group, has closed while several others are downsizing. “We are trying to compile exact figures of the affected media persons. So far, we can say that around 1,000-1,500 workers have lost their jobs or faced cuts in salaries in the past few weeks,” Muhammad Afzal Butt, president of one the main factions of Pakistan Federal Union of Journalists (PFUJ) told The News Sunday (TNS) this week.

Government Spending:

About a quarter of Rs. 80 billion ad revenue comes from federal and provincial government ads in the media. Some of the TV channels receive as much as 50% of their revenue from the government.

"The government has cut its media spend by more than 70% and companies by almost 50%", according to a leading advertising agency owner who spoke to Dawn.

"The (federal) government used to spend some Rs. 10 billion on advertisements annually, which was increased up to Rs35 billion in the last years of the (Nawaz Sharif's PMLN) government," Fawad Chaudhry, federal minister of information, told The News Sunday (TNS). This tax-payers’ money, says the minister, was used by the previous government to bribe the media for favorable coverage.

Summary:

Pakistan has recently hosted AdAsia after a gap of 30 years. It is the largest and most prestigious advertising industry conference in Asia – organized bi-annually by the Asian Federation of Advertising Associations (AFAA). It drew attendees from all over the world to Lahore, Pakistan. This conference has taken place at a time when Pakistan's 88 billion rupee media industry is in the midst of a major shakeout after a long period of rapid double-digit growth since the turn of the century. One bright spot is digital advertising which is growing rapidly amidst the declining total ad spend in Pakistan. Significant reduction in government spending on advertising has triggered a long-overdue shakeout after almost two decades of rapid media growth in Pakistan. About a quarter of Rs. 80 billion ad revenue comes from federal and provincial government ads in the media. Some of the TV channels receive as much as 50% of their revenue from the government. Hundreds of journalists and other staff have lost their jobs. At least one TV channel, Waqt, has closed while several others are downsizing. Those affected by consolidation are accusing the government of exercising press censorship by cutting its ad spending.

Here's a video discussion on Pakistani media business with Misbah Azam, Sabahat Ashraf and Riaz Haq.

Related Links:

Advertising Revenue in Pakistan

The Other 99% of Pakistan Story

-

Comment by Riaz Haq on June 14, 2021 at 4:40pm

-

APAC ad markets to be buoyed by China in 2021, India in 2022 Latest Magna global advertising forecast predicts 12.8% APAC growth in 2021 led by China, with India predicted to outpace all global markets next year.

Read more at: https://www.campaignasia.com/article/apac-ad-markets-to-be-buoyed-b...

China, the world's second largest ad market behind the US, is leading the way with a phenomenal 16.1% growth rate that Magna says will result in ~$13 billion of incremental spending in 2021. This can't even be considered a 'rebound' as China was one of the few markets to grow in 2020 thanks to a strong digital performance. Other APAC markets, meanwhile are set to enjoy similar levels of rapid advertising growth, namely the Philippines (+16%), Hong Kong (+15%), and Malaysia (+15%), while the slowest growth rates are recorded in Pakistan (+5%), Singapore (+7%), New Zealand (+8%), and Vietnam (+8%), Magna predicts.

Pakistan Linear advertising revenues are anticipated to merely stabilize this year following the erosion of -6% in 2020. Digital growth slowed in 2020, +19%, but will re-accelerate in 2021, rising +24% to reach 19.3 billion rupees ($120 million) by the end of the year. Pakistan is a mobile-first digital ad market, with over 70% of digital dollars going to mobile formats.

India Ad market recovery will be delayed in India compared to other large market, due to the late and protracted COVID crisis. Indian net ad sales revenue will grow +11% in 2021 to reach $8.4 billion (below global and regional averages). However ad spend growth is expected to accelerate in 2022, fuelling advertising revenues increase of +13% (way above APAC average of 6%). But India’s second COVID wave, which has persisted through the spring of 2021, is likely to have scarring effects in the medium term and could weigh on long-term growth. Net ad revenues across digital formats will rise +11% to reach $2.4 billion in 2021, while linear ad sales will grow by +11% from a very low comp following the decline of -30% in 2020. Despite the 11% growth this year, linear ad sales will remain 23% lower than pre-COVID levels, while digital ad sales will be 15% above 2019 levels.

-

Comment by Riaz Haq on June 14, 2021 at 4:44pm

-

The economic recovery from the coronavirus pandemic will lead to a record 14 percent gain in global advertising spending this year to a record $657 billion, according to the latest forecast from media investment and intelligence company Magna.

https://www.hollywoodreporter.com/business/business-news/advertisin...

That would be above the 12.5 percent gain recorded in 2000, and a significant increase from Magna’s previous forecast for an 8 percent increase.

“In the U.S., media companies’ net advertising revenues will reach a new all-time high of $259 billion in 2021,” growing 15 percent, the strongest growth rate in 40 years, the firm said in a summary of its projections.

The predicted global ad gain of $78 billion in 2021 follows a decline of 2.5 percent in 2020. “The marketplace will continue to grow in 2022,” Magna said, estimating a 7 percent gain. “Advertising activity is fueled by economic recovery (global GDP +6.4 percent) benefitting key ad-spending verticals severely hit by COVID-19 last year (automotive, travel, entertainment, restaurants), stronger-than-ever organic drivers to digital marketing and international sports events (Tokyo Olympics, UEFA Euro).”

Digital ad formats will capture most of the growth with ad sales here expected to rise 20 percent to $419 billion, 64 percent of total ad sales, according to Magna’s report. “Linear ad sales are slower to recover but will stabilize full-year (+3 percent to $238 billion).”

All 70 ad markets it monitors will grow this year, with expected increases in China (16 percent) and the UK (17 percent) being among the largest, Magna said.

The U.S. ad gain of $34 billion this year will come as digital ad sales will grow 20 percent and non-political linear ad sales will rise 4 percent, Magna said. In 2022, it expects further U.S. growth of 8 percent to $280 billion,” thanks to continued economic growth (GDP growth between 3.5 and 4.3 percent) and more cyclical drivers (Winter Olympics in the first quarter, mid-term elections in the fourth quarter 2022).”

“As economic recovery is stronger and faster than anticipated in several of the world’s largest ad markets – U.S., U.K. and China, in particular – and consumption accelerates, brands need to reconnect with consumers,” explained Vincent Létang, executive vp, global market research at Magna. “At the same time, the acceleration in e-commerce and digital marketing adoption that started during COVID, continues full speed into 2021, fueling digital advertising spending from consumer brands as well as small and direct-to-consumer businesses. This unique combination of cyclical, organic and structural drivers will lead to the strongest advertising annual growth ever monitored by Magna.”

The firm also addressed recent media mega-mergers. “Linear ad sales still represent the bulk of ad revenues for traditional media owners and their continued stagnation will trigger a wave of consolidation in the media industry, aimed at competing with digital media players,” it said. “Traditional media companies have no choice but to grow in scale in order to compete with digital media giants and invest in cross-platform advertising solutions. Traditional media owners are moving now as they believe antitrust authorities are ready to consider market shares in the broader media market and thus approve horizontal consolidations that would have been unthinkable just five years ago.:

-

Comment by Riaz Haq on November 23, 2022 at 8:32am

-

Pakistan: Newspapers fight for survival as sales plunge

Jamila Achakzai Islamabad

11/22/2022November 22, 2022

Print journalism subscriptions and readership have been plummeting as people increasingly get their information from digital sources.

https://www.dw.com/en/pakistans-newspapers-fight-for-survival-as-sa...

Mujahid Hussain, a news hawker in Islamabad, says he is afraid of losing his job amid a downturn in newspaper sales in Pakistan, where people are increasingly getting their information from digital and social media platforms.

"My employer often talks about a slump in newspaper sales and a possible business shutdown. So even if he doesn't close shop, my job is definitely on the line," the 42-year-old father of three told DW.

Hussain pointed out he has already experienced massive pay cuts over the past three years and that his family is struggling to make ends meet.

Many other news vendors in the South Asian country share similar woes.

It was not always like this, however.

Even until a decade ago, the newspaper industry thrived in the country. Daily newspapers, weeklies and magazines used to be a must in offices, living rooms and cafes.

But print publications were first eclipsed by the dozens of private TV news channels that were launched during the presidency of General Pervez Musharraf between 2001 and 2008.

Then came affordable smartphones, social media networks and widespread internet connectivity, which further dented newspaper sales as more and more people began to consume news on online platforms.

Hawkers' lives hit hard

Since the downturn in the newspaper industry has particularly affected hawkers, who mostly work part-time for meager wages, these low-paid workers are taking on other informal jobs to make ends meet.

"Successive governments haven't taken interest in the welfare of newspaper hawkers, so they are generally disheartened, insecure and always on the lookout for better options to make money," said Aqeel Abbasi, the general-secretary of the Newspaper Hawkers Union.

He explained that before Musharraf's government liberalized the broadcast media and telecom sector, Rawalpindi had around 1,600 newspaper vendors and Islamabad 700.

But with the plunge in sales, the number of vendors has dropped to 900 and 480 respectively, he said, stressing that the COVID-19 pandemic and ongoing economic crisis had accelerated the trend.

Another problem compounding the woes of newspapers is their reliance on government advertizing for economic survival.Outlets that are critical of government and military policies have had a tough time generating enough advertizing revenue in recent years.

Will they survive?

News hawker Hussain warned that if the fall in sales did not stop, the print media would have no other option but to get rid of most of its workforce.

Some senior journalists share a similar view.

Salim Bokhari, who once edited the leading English-language newspapers The News and The Nation and currently heads the digital media team at the City News broadcast network, said that "no one wanted to spend time reading through newspaper columns" given "the ocean of information available on mobile phones."

He said newspapers might disappear if the trend continued, although he did not believe that this would happen that soon.

"The electronic media era will ultimately make newspapers' doom. The advertizers have diverted their money to TV channels and even the government prefers electronic media for advertisements," he pointed out.

Hassan Gillani, a media development professional, was more optimistic.

"Newspaper readership might have declined after the emergence and development of electronic media but it's unfair to suggest that print media could soon become a thing of the past," he said.

-

Comment by Riaz Haq on February 11, 2023 at 8:23pm

-

Ad revenue in Pakistan

https://aurora.dawn.com/news/1144596#:~:text=OOH%20ad%20revenue%20i...(5%25).

Total Ad Revenue Rs. 88.73 billion in 2021-22

Total ad spend (revenue) has increased by Rs 13.09 (17%); in FY 2020-21, it increased by 17.04 (29%).

---------

In FY 2020-21, the combined revenues of Facebook, Google and YouTube accounted for 85% of the total ad spend on digital; this year, they account for 87%.

----------

TV ad revenue increased by Rs 4.64 billion (14%).

Digital ad revenue increased by Rs 3.15 billion (19%).

Print ad revenue increased by Rs 0.21 billion (2%).

OOH ad revenue increased by Rs 3.7 billion (44%).

Brand Activation/POP ad revenue increased by Rs 1.26 billion (50%).

Radio ad revenue increased by Rs 0.07 billion (5%).

Cinema ad revenue increased by Rs 0.06 billion (60%).

TV percentage share decreased by 1.4.

Digital percentage share increased by 0.27.

Print percentage share decreased by 2.19.

OOH percentage share increased by 2.51.

Brand Activation/POP percentage share increased by 0.93.

Radio percentage share decreased by 0.17.

Cinema percentage share increased by 0.05.

------

TV percentage share decreased by 1.4.

Digital percentage share increased by 0.27.

Print percentage share decreased by 2.19.

OOH percentage share increased by 2.51.

Brand Activation/POP percentage share increased by 0.93.

Radio percentage share decreased by 0.17.

Cinema percentage share increased by 0.05.

-----------------

Compared to FY 2020-21, the rankings of the Top Three newspapers remain the same.

Most newspapers have registered slight increases in their revenues.

-------

Compared to FY 2020-21, the Top Five channels have retained their positions.

In FY 2020-21, Radio Awaz Network was #7; this year it is #9.

In FY 2020-21, FM 105 was #9; this year it is #7.

-----------

Compared to FY 2020-21, the rankings of the Top Seven channels remain unchanged.

In FY 2020-21, PTV Home was #8 and Samaa was #9. This year, their positions are inverted.

In FY 2020-21, PTV Sports was #14. This year, it is #10.

-------

In FY 2020-21, the combined revenues of Facebook, Google and YouTube accounted for 85% of the total ad spend on digital; this year, they account for 87%.

-------------

Compared to FY 2020-21, the rankings of Lahore (#1), Karachi (#2) and Hyderabad (#8) remain the same.

In FY 2020-21, Rawalpindi, Faisalabad, Gujranwala, Islamabad and Multan were #3, #4, #5, #6 and #7, respectively. This year, they are #4, #5, #7, #3 and #6.

---------

Product categories that were introduced this year are Real Estate (#1) and Retail/Online (#5).

In FY 2020-21, Beverages, FMCGs and Telecoms were #1, #2 and #3, respectively. This year they are #2, #3 and #4.

In FY 2020-21, Fashion and Electronic Appliances were #4 and #5 respectively. This year, they are #6 and #7.

----------

Compared to FY 2020-21, the rankings of all the elements remain the same.

-

Comment by Riaz Haq on February 12, 2023 at 10:41am

-

TV Viewership Trends

FY 2021-22

https://aurora.dawn.com/news/1144667/tv-vieweship-trends-fy-2022-23

Compared to the previous fiscal year, the average number of viewership hours decreased by 14%.

Viewership ranges between 3.3 and 2.7 hours a day; it is highest in Karachi (3.3 hours) and lowest in Non-Metro Punjab and Urban Balochistan (2.7 hours).

Compared to the previous fiscal year, viewership has decreased across Pakistan, except in Non-Metro Sindh.

Entertainment channels (40%), unmatched channels (26%), and news channels (19%) have the highest market share. Last year, unmatched channels had the highest share (40%), followed by entertainment channels (36%) and news channels (14%), respectively.

All Genres:

Viewership has decreased among all SECs:

SEC A: Viewership has decreased by 13%.

SEC B: Viewership has decreased by 12%.

SEC C: Viewership has decreased by 9%.

SEC D: Viewership has decreased by 15%.

SEC E: Viewership has decreased by 19%.

Viewership is highest in SEC E; this was the case last year.

Entertainment Channels:

Viewership has increased or decreased among most SECs:

SEC A: Viewership has increased by 2%.

SEC B: Viewership has decreased by 3%.

SEC C: Viewership has increased by 1%.

SEC D: Viewership has decreased by 9%.

SEC E: Viewership has decreased by 9%.

Viewership is highest in SEC C; last year it was highest in SEC E.

Unmatched Channels:

Viewership has decreased among all SECs:

SEC A: Viewership has decreased by 49%.

SEC B: Viewership has decreased by 47%.

SEC C: Viewership has decreased by 38%.

SEC D: Viewership has decreased by 45%.

SEC E: Viewership has decreased by 41%.

Viewership is highest in SEC E; this was the case last year.

News Channels:

Viewership has increased among all SECs:

SEC A: Viewership has increased by 15%.

SEC B: Viewership has increased by 17%.

SEC C: Viewership has increased by 17%.

SEC D: Viewership has increased by 35%.

SEC E: Viewership has increased by 11%.

Viewership is highest in SEC B; this was the case last year.

Children's channels:

Viewership has increased or stayed the same among most SECs:

SEC A: No change

SEC B: No change

SEC C: Viewership has increased by 22%

SEC D: Viewership has increased by 12%

SEC E: Viewership has decreased by 8%

Viewership is highest in SEC E; this was the case last year.

Sports Channels:

l Viewership has increased among all SECs:

SEC A: Viewership has increased by 167%.

SEC B: Viewership has increased by 120%.

SEC C: Viewership has increased by 100%.

SEC D: Viewership has increased by 150%.

SEC E: Viewership has increased by 125%.

l Viewership is highest in SEC B; last year it was the highest in

SECs B and C.

Movie Channels:

Viewership has stayed the same among most SECs:

SEC A: No change.

SEC B: No change.

SEC C: No change.

SEC D: No change.

SEC E: Viewership has decreased by 33%.

Viewership is highest in SECs B, C, D and E; last year it was the highest in SEC E.

Regional Channels:

Viewership has decreased or stayed the same among all SECs:

SEC A: No change.

SEC B: Viewership has decreased by 50%.

SEC C: No change.

SEC D: Viewership has decreased by 50%.

SEC E: No change.

Viewership is highest in SEC E; Last year, it was the highest

in SECs C, D and E.

Cooking Channels:

Viewership has stayed the same compared to the previous year.

Music Channels:

Viewership has decreased or stayed the same among

most SECs:

SEC A: Viewership has decreased by 33%.

SEC B: No change.

SEC C: No change.

SEC D: Viewership has decreased by 50%.

SEC E: No change.

Viewership is highest in SEC A; this was the case last year.

Religious Channels:

Viewership has decreased in all SECs by 100%.

NB:

Figures in this section are based on data collected from Medialogic’s Hybrid Panel which covers 100+ cities and towns and 3,000+ reported households.

Cable penetration in Pakistan’s urban areas stands at 97%.

The data is primarily based on urban regions in Pakistan, and the target audience is limited to C&S individuals only

Numbers have been rounded up in certain instances.*

Comment

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

Agriculture, Caste, Religion and Happiness in South Asia

Pakistan's agriculture sector GDP grew at a rate of 5.2% in the October-December 2023 quarter, according to the government figures. This is a rare bright spot in the overall national economy that showed just 1% growth during the quarter. Strong performance of the farm sector gives the much needed boost for about …

ContinuePosted by Riaz Haq on March 29, 2024 at 8:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network