PakAlumni Worldwide: The Global Social Network

The Global Social Network

India's Crony Capitalism: Modi's Pal Adani's Wealth Grows at the Expense of Ordinary Bangladeshis and Indians

Prime Minister Shaikh Hasina has agreed to buy expensive electricity from India in spite of a power glut in Bangladesh, according to a report in the Washington Post. The newspaper quotes B.D. Rahmatullah, a former director general of Bangladesh’s power regulator, as saying, "Hasina cannot afford to anger India, even if the deal appears unfavorable." “She knows what is bad and what is good,” he said. “But she knows, ‘If I satisfy (Gautam) Adani, Modi will be happy.’ Bangladesh now is not even a state of India. It is below that.” The Washington Post report says: "Facing a looming power glut, Bangladesh in 2021 canceled 10 out of 18 planned coal power projects. Mohammad Hossain, a senior power official, told reporters that there was “concern globally” about coal and that renewables were cheaper".

|

| Gautam Adani (L) and Narendra Modi |

|

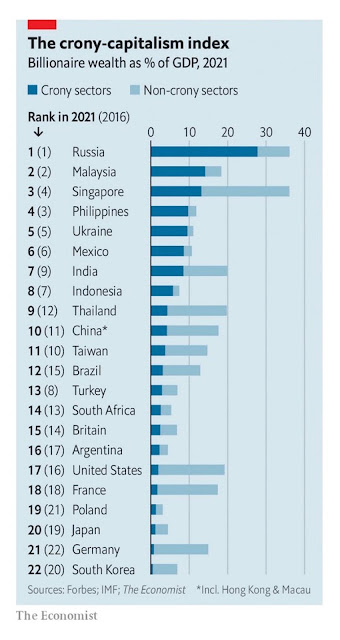

| India Ranks High on Crony Capitalism Index. Source: Economist |

Hasina recently visited New Delhi to seek political and economic assistance from the Indian Prime Minister Narendra Modi. This summit was preceded by Bangladesh Foreign Minister Abdul Momen's trip to India where he said, "I've requested Modi government to do whatever is necessary to sustain Sheikh Hasina's government". Upon her return from India, Sheikh Hasina told the news media in Dhaka, "They (India) have shown much sincerity and I have not returned empty handed". It has long been an open secret that Indian intelligence agency RAW helped install Shaikh Hasina as Prime Minister of Bangladesh, and her Awami League party rely on New Delhi's support to stay in power. Bangladesh Foreign Minister Abdul Momen has described India-Bangladesh as one between husband and wife. In an interview with Indian newspaper 'Ajkal,' he said, "Relation between the both countries is very cordial. It's much like the relationship between husband and wife. Though some differences often arise, these are resolved quickly." Both Bangladeshi and Indian officials have reportedly said that Sheikh Hasina "has built a house of cards".

|

| Shaikh Hasina (L) with Narendra Modi |

The Washington Post reports that the Modi government has changed laws to help Adani’s coal-related businesses and save him at least $1 billion. After a senior Indian official opposed supplying coal at a discount to Adani and other business tycoons, he was removed from his job by the Modi administration, according to the paper. Modi has continued to support Adani's business with discounted coal even after telling the United Nations he would tax coal and ramp up renewable energy. India is the world's third largest carbon emitter.

|

| World's Top 5 Carbon Emitters. Source: Our World in Data |

While the coal prices have declined to the level before the start of the Ukraine War, Adani’s power would still cost Bangladesh 33% more per kilowatt-hour than the publicly disclosed cost of running Bangladesh’s domestic coal-fired plant, according to Tim Buckley, a Sydney-based energy finance analyst.

|

| India's Crony Capitalism: Adani Enterprises Stock Up 56,000% on Modi's Watch |

Gautam Adani has become India's richest and the world's second richest person (after Elon Musk) since the election of Prime Minister Narendra Modi in 2014. Financial Times calls Adani "Modi's Rockefeller". Adani's rise owes itself to India's crony capitalism, according to France's Le Monde. Here's an excerpt of a Le Monde story on Adani:

"Adani has not invented some revolutionary technology or disruptive business model. His meteoric success cannot be attributed to innovation. In each sphere of activity among his conglomerates – airports, ports, mining, aerospace, defense industry – the Indian state plays a significant role, whether in allocating licenses or signing contracts. He is known as a close friend of Indian Prime Minister Narendra Modi, who also hails from Gujarat, a state in western India".

Adani has lent his personal airplanes to Modi for BJP's election campaigns. Adani has also recently taken over NDTV, the only Indian major TV channel known for its independence from the BJP government. This takeover has forced Prannoy and Radhika Roythe, the channel's founding couple, to step down. It has also forced out Ravish Kumar, a harsh critic of the Modi regime who hosted a number of popular shows like Hum Log, Ravish ki Report, Des Ki Baat, and Prime Time.

|

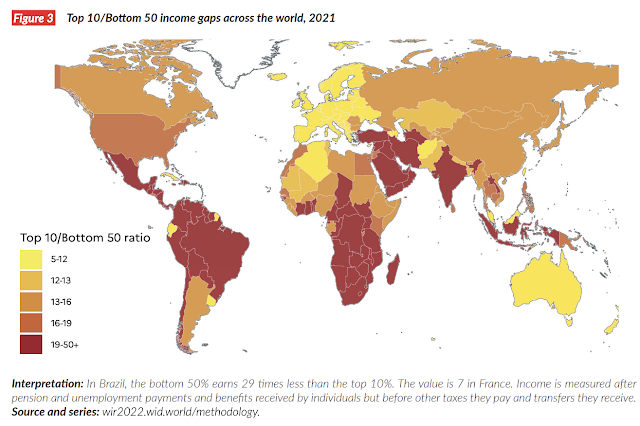

| Income Inequality Map. Source: World Inequality Report 2022 |

India is one of the most unequal countries in the world, according to the World Inequality Report 2022. There is rising poverty and hunger. Nearly 230 million middle class Indians have slipped below the poverty line, constituting a 15 to 20% increase in poverty. India ranks 94th among 107 nations ranked by World Hunger Index in 2020. Other South Asians have fared better: Pakistan (88), Nepal (73), Bangladesh (75), Sri Lanka (64) and Myanmar (78) – and only Afghanistan has fared worse at 99th place. Meanwhile, the wealth of Indian billionaires jumped by 35% during the pandemic.

Related Links:

Haq's Musings

South Asia Investor Review

India Among World's Most Unequal Countries

Shaikh Hasina Seeks Modi's Help to Survive

Food in Pakistan 2nd Cheapest in the World

Indian Economy Grew Just 0.2% Annually in Last Two Years

Pakistan to Become World's 6th Largest Cement Producer by 2030

India: World's Biggest Oligarchy?

Pakistan's Computer Services Exports Jump 26% Amid COVID19 Lockdown

Coronavirus, Lives and Livelihoods in Pakistan

Vast Majority of Pakistanis Support Imran Khan's Handling of Covid1...

Pakistani-American Woman Featured in Netflix Documentary "Pandemic"

Incomes of Poorest Pakistanis Growing Faster Than Their Richest Cou...

How Grim is Pakistan's Social Sector Progress?

Pakistan's Sehat Card Health Insurance Program

Trump Picks Muslim-American to Lead Vaccine Effort

COVID Lockdown Decimates India's Middle Class

COP27: Pakistan Demands "Loss and Damage" Compensation

Pakistan's Balance of Payments Crisis

How Has India Built Large Forex Reserves Despite Perennial Trade De...

India's Unemployment and Hunger Crises"

PTI Triumphs Over Corrupt Dynastic Political Parties

Strikingly Similar Narratives of Donald Trump and Nawaz Sharif

Nawaz Sharif's Report Card

Riaz Haq's Youtube Channel

-

Comment by Riaz Haq on December 11, 2022 at 4:41pm

-

Hasina Seeks Modi's Help to Survive Bangladesh's Economic Crisis

https://www.southasiainvestor.com/2022/09/hasina-seeks-modis-help-t...

British Indian analyst Dr. Avinash Paliwal explains Shaikh Hasina's current dilemma as follows: "Politically reliant on New Delhi, she (Hasina) is finding it increasingly difficult to manage the ramifications of India's turn towards Hindu nationalism that misuses migration from Bangladesh and the Rohingya crisis for domestic electoral gain". Justice Surendra Kumar Sinha, Bangladesh's former Chief Justice, has said India is backing Sheikh Hasina's autocratic government for its own interest. Here's how prominent Indian journalist SNM Abdi explains Indian intelligence agency RAW's influence in Bangladesh: "India wields more influence in Bangladesh than the Security Council’s five permanent members put together. The Research and Analysis Wing (RAW) is the most dreaded outfit in the neighboring country surpassing even the brutally unforgiving RAB (Rapid Action Battalion). Hasina lives in mortal fear of RAW. She knows that she will be toppled if she displeases India. So she has adopted the policy of pleasing India to retain power at any cost".

Bangladesh has received wide acclaim for its remarkable economic success under the authoritarian leadership of Shaikh Hasina over the last decade. She has jailed many of her political opponents and hanged others. She has tamed the country's judiciary and gagged Bangladeshi mainstream media. What has helped her retain power is the fact she has New Delhi's support and she has succeeded in delivering rapid economic growth that has helped improve the lives of ordinary Bangladeshis. However, a combination of current global inflation and the resulting economic crisis is threatening to unravel this formula.

-

Comment by Riaz Haq on December 12, 2022 at 8:05am

-

Japan Needs Indian Tech Workers. But Do They Need Japan?

Recruiters call the push a crucial test of whether the world’s third-largest economy can compete with the U.S. and Europe for global talent.

https://www.nytimes.com/2022/12/12/business/japan-indian-tech-worke...

Mr. Puranik said fellow Indians often called him for help with emergencies or conflicts — the wandering father with dementia who ends up in police custody, the daughter mistakenly stopped by border agents at the airport. He once even fielded a call from a worker who wanted to sue his Japanese boss for kicking him.

His own son, he said, was bullied in a Japanese school — by the teacher. Mr. Puranik said he repeatedly talked to the teacher, to no avail. “She would always try to make him a criminal,” he said, adding that some teachers “feel challenged if the kid is doing anything differently.”

A similar dynamic can sometimes be found in the workplace.

Many Indian tech workers in Japan say they encounter ironclad corporate hierarchies and resistance to change, a paradox in an industry that thrives on innovation and risk-taking.

“They want things in a particular order; they want case studies and past experience,” Mr. Puranik said of some Japanese managers. “IT doesn’t work like that. There is no past experience. We have to reinvent ourselves every day.”

---------

As it rapidly ages, Japan desperately needs more workers to fuel the world’s third-largest economy and plug gaps in everything from farming and factory work to elder care and nursing. Bending to this reality, the country has eased strict limits on immigration in hopes of attracting hundreds of thousands of foreign workers, most notably through a landmark expansion of work visa rules approved in 2018.

The need for international talent is perhaps no greater than in the tech sector, where the government estimates that the shortfall in workers will reach nearly 800,000 in the coming years as the country pursues a long-overdue national digitization effort.

The pandemic, by pushing work, education and many other aspects of daily life onto online platforms, has magnified the technological shortcomings of a country once seen as a leader in high tech.

Japanese companies, particularly smaller ones, have struggled to wean themselves from physical paperwork and adopt digital tools. Government reports and independent analyses show Japanese companies’ use of cloud technologies is nearly a decade behind those in the United States.

“As it happens to anyone who comes to Japan, you fall in love,” said Shailesh Date, 50, who first went to the country in 1996 and is now the head of technology for the American financial services company Franklin Templeton Japan in Tokyo. “It’s the most beautiful country to live in.”

Yet the Indian newcomers mostly admire Japan from across a divide. Many of Japan’s 36,000 Indians are concentrated in the Edogawa section of eastern Tokyo, where they have their own vegetarian restaurants, places of worship and specialty grocery stores. The area has two major Indian schools where children study in English and follow Indian curricular standards.

Nirmal Jain, an Indian educator, said she founded the Indian International School in Japan in 2004 for children who would not thrive in Japan’s one-size-fits-all public education system. The school now has 1,400 students on two campuses and is building a new, larger facility in Tokyo.

Ms. Jain said that separate schools were appropriate in a place like Japan, where people tend to keep their distance from outsiders.

“I mean, they are nice people, everything is perfect, but when it comes to person-to-person relationships, it’s kind of not there,” she said.

-

Comment by Riaz Haq on December 18, 2022 at 8:52pm

-

Princeton Economist Ashoka Mody: How India’s growth bubble fizzled out

https://www.livemint.com/news/india/how-india-s-growth-bubble-fizzl...

The slowdown is not a short-term disruption. What can replace India’s finance-construction growth model?

As the finance-led growth model collapses, India must invest in its future. India will need at least a generation to build necessary human capital alongside more productive urban spaces

India’s gross domestic product (GDP) growth has slowed sharply from 8% a year last year to 5% in the second quarter this year. Optimists, Indian and international, say growth will pick up soon. The International Monetary Fund (IMF) projects the Indian economy will hum at 7.5% a year by 2021. Such optimism is dangerous.

----------

’Shining India’ years

Domestic policymakers and international observers celebrated the high headline growth numbers. Indian software producers gained disproportionate spotlight as markers of success. In March 1999, the Bengaluru-based Infosys became the first Indian-registered company to be listed on the Nasdaq stock exchange. In March 2000, the then US President Bill Clinton visited India, making a stop in Hyderabad, dubbed “Cyberabad" under the tech-savvy chief minister Chandrababu Naidu. Clinton spoke in awe of India’s dazzling diaspora in the US Silicon Valley; he applauded India’s young multimillionaires.

Some months before Clinton’s visit, in October 1999, a BJP-led coalition had gained a stable majority in the Lok Sabha. But the essential philosophy established by Manmohan Singh—more open markets, financial deregulation—remained unchanged.

India now decisively missed the second wave of global competition in labour-intensive products. When, on 11 December, 2001, China became a member of the World Trade Organization, Chinese exporters powered into the new markets opened up to them.

India’s finance-construction growth model continued apace. In 2003 and 2004, two new private banks, Kotak Mahindra and Yes Bank, joined the crowded financial field. The BJP built more highways, which created more need for private finance and gave more fillip to construction. The barely hidden nexus of politician, bureaucrat, and financier became tighter. India steadily became one of the world’s most unequal economies. The BJP’s 2004 Lok Sabha campaign with the slogan “Shining India" felt hollow and cynical to far too many people.

Human capital

Losing to international competition in this second wave failed again to bring home the message that India lacked a core ingredient of success: human capital. From the time of the industrial revolution in the late 18th century, economic growth and human capital development had been closely related. Each round of successful new entrants on to the global stage had pushed the human development frontier further.

The Americans achieved near-universal high school education in the early 20th century and they followed it up after the Second World War with the spread of state-financed universities. The East Asians understood this historical lesson well.

Even for labour-intensive manufacturing, quality and timely production required a high degree of industrial literacy. East Asian—including by now Chinese—schools got steadily better; the governments there began the task of building world-class universities.

In India, the illusion continued. The years 2003 to 2008 were heady. Although China was chewing up export market shares, it was also a major importer of raw materials and industrial products. Thus, the Chinese boom fuelled extraordinary global trade volumes. The entire world rode that rising global tide—and so did India.

-

Comment by Riaz Haq on December 18, 2022 at 8:52pm

-

India’s economic activity looks set to slow as resilience wanes

https://www.livemint.com/news/india/indias-economic-activity-looks-...

India’s economy appeared to slow rather than accelerate last month, as high-frequency indicators tracked by Bloomberg signaled worsening business and consumption activity.

Although a dial measuring so-called animal spirits showed activity was steady for a fifth straight month in November, the needle was just one bad data point away from swinging to the left. Exports, a key growth lever in the past year, was among three of eight metrics that performed poorly. The rest were unchanged.

Bloomberg’s dashboard reflects a broadly grim outlook for 2023 as tighter global interest rates take a toll on demand. The gauge uses a three-month weighted average to smooth out volatility in single-month readings.

Below are more details:

Business Activity

Purchasing managers’ surveys for November showed that activity across the services and manufacturing sectors improved, though the three-month weighted average was still weak. New orders expanded at faster rates in both sectors, while output prices rose at the quickest pace in three months.

Pollyanna De Lima, economics associate director at S&P Global Market Intelligence, said the latest results are good news, even if the trend for inflation is somewhat concerning. “Evidence of stubborn inflation may prompt further hikes to the policy rate at a time when global economic challenges could negatively impact" India’s growth, she said.

Exports barely improved last month, increasing 0.6% from a year ago after declining 16.7% in October, data released by the trade ministry showed. Only half of the 30 sectors posted growth. The government attributed the tepid performance to weak demand for engineering and iron ore products.

Imports climbed 5.4 percent, keeping India’s trade gap above $20 billion for the eighth consecutive month. That adds pressure to the country’s current account deficit, a key vulnerability for the economy and the rupee, the worst-hit major Asian currency this year after the Japanese yen.

Consumer Activity

Demand for bank credit remained healthy at 17.2 percent, even amidst tighter liquidity conditions and higher borrowing costs, Reserve Bank of India data showed. Goods and services tax collection, which helps measure consumption in the economy, rose 11 percent, a modest performance compared to October’s 24 percent jump.

Market Sentiment

Electricity consumption, a widely used proxy to gauge demand in the industrial and manufacturing sectors, was weak, with the peak requirement last month rising to 162 gigawatts from 155 gigawatts in October. India’s unemployment rate climbed to 8 percent, according to data from the Centre for Monitoring Indian Economy Pvt.

-

Comment by Riaz Haq on December 24, 2022 at 6:13pm

-

#India opposition’s ‘unity march’ against #hate reaches #NewDelhi. Rahul Gandhi: "Hindu-Muslim hatred (by #BJP/#Modi) is being spread twenty-four-seven to divert your attention from real issues” #BharatJodoYatraInDelhi @RoflGandhi_ https://aje.io/fkl3hb via @AJEnglish

The cross-country march enters the capital where Congress leader Rahul Gandhi attacks Modi’s BJP for ‘spreading Hindu-Muslim hatred’.

A cross-country march led by Indian opposition leader Rahul Gandhi has reached the capital New Delhi after passing through eight states, hoping to regain some of the popularity it lost to the ruling Hindu nationalist party.

Tens of thousands of people have joined Gandhi’s “Unite India March” against “hate and division”, which aims to turn the Congress party’s fortunes around after its drubbing by the Bharatiya Janata Party (BJP) in two successive national elections.

“Hindu-Muslim hatred is being spread twenty-four-seven to divert your attention from real issues,” Gandhi said in his speech at the Mughal-era Red Fort in the Indian capital.

“They will spread hate. We will spread love,” he said, referring to Prime Minister Narendra Modi’s BJP.

Hindu nationalism has surged under Modi and his party, which have been criticised over rising hate speech and violence against Muslims in recent years. Opponents say Modi’s silence emboldens right-wing groups and threatens national unity, but his party has denied this.

“There are concerns about the plight of minorities, the shrinking space for dissent, as well as the government’s handling of the pandemic and the economy,” said Al Jazeera’s Pavni Mittal, reporting from New Delhi.

“Analysts say the Congress’s inability to be an effective opposition and hold the government accountable has contributed to the BJP’s unprecedented success,” she added.

The Nehru-Gandhi family has controlled the Congress party for decades but has also overseen its recent decline. The party currently governs just three of India’s 28 states.

Rahul Gandhi resigned as Congress president after the last general election. The next national polls are due by 2024.

Plagued by a leadership crisis and series of electoral routs, the Congress in October elected Mallikarjun Kharge, its first non-Gandhi president in 24 years, in an attempt to shed the image of being run by a single family.

Kharge on Saturday wrote on Twitter the march is “against the politics of inflation, unemployment, inequality, and hatred”.

“[This] national mass movement has gathered the hopes of crores [millions] of people by reaching the throne of power,” he posted.

The march will take a nine-day break in New Delhi before starting its final leg on January 3 towards Srinagar, the main city in Indian-administered Kashmir in the north.

Congress leader Jairam Ramesh told journalists on Saturday the march – which is broadcast live on a website – has completed nearly 3,200km (1,988 miles) so far in nine states.

Gandhi’s mother and former Congress president Sonia Gandhi, his sister and party leader Priyanka Gandhi Vadra and her husband Robert Vadra joined Saturday’s march in the capital.

Sharing a picture of himself hugging his mother during the rally, Gandhi tweeted: “The love I have received from her is what I am sharing with the country.”

Actor-turned-politician Kamal Haasan also joined the march on Saturday.

Passing through hundreds of villages and towns, the march has attracted farmers worried about rising debt, students complaining about increasing unemployment, civil society members and rights activists who say India’s democratic health is in decline.

In multiple impassioned speeches during the march, Gandhi often targeted Modi and his government for doing very little to address the growing economic inequality in India, the rising religious polarisation, and the threat posed by China.

The armies of India and China are locked in a bitter standoff in the mountainous Ladakh region since 2020. Despite over a dozen rounds of talks at military, political and diplomatic levels, the standoff has protracted.

-

Comment by Riaz Haq on January 25, 2023 at 10:39am

-

#Modi's Pal #Adani, The World’s 3rd Richest Man, Is Pulling The Largest Con In Corporate History. He has engaged in a brazen #stocks #manipulation and accounting #fraud scheme over the course of decades. #Hindutva #BJP #CronyCapitalism #India #economy https://hindenburgresearch.com/adani/

By Hindenburg Research

Today we reveal the findings of our 2-year investigation, presenting evidence that the INR 17.8 trillion (U.S. $218 billion) Indian conglomerate Adani Group has engaged in a brazen stock manipulation and accounting fraud scheme over the course of decades.

Gautam Adani, Founder and Chairman of the Adani Group, has amassed a net worth of roughly $120 billion, adding over $100 billion in the past 3 years largely through stock price appreciation in the group’s 7 key listed companies, which have spiked an average of 819% in that period.

Our research involved speaking with dozens of individuals, including former senior executives of the Adani Group, reviewing thousands of documents, and conducting diligence site visits in almost half a dozen countries.

Even if you ignore the findings of our investigation and take the financials of Adani Group at face value, its 7 key listed companies have 85% downside purely on a fundamental basis owing to sky-high valuations.

Key listed Adani companies have also taken on substantial debt, including pledging shares of their inflated stock for loans, putting the entire group on precarious financial footing. 5 of 7 key listed companies have reported ‘current ratios’ below 1, indicating near-term liquidity pressure.

The group’s very top ranks and 8 of 22 key leaders are Adani family members, a dynamic that places control of the group’s financials and key decisions in the hands of a few. A former executive described the Adani Group as “a family business.”

The Adani Group has previously been the focus of 4 major government fraud investigations which have alleged money laundering, theft of taxpayer funds and corruption, totaling an estimated U.S. $17 billion. Adani family members allegedly cooperated to create offshore shell entities in tax-haven jurisdictions like Mauritius, the UAE, and Caribbean Islands, generating forged import/export documentation in an apparent effort to generate fake or illegitimate turnover and to siphon money from the listed companies.

Gautam Adani’s younger brother, Rajesh Adani, was accused by the Directorate of Revenue Intelligence (DRI) of playing a central role in a diamond trading import/export scheme around 2004-2005. The alleged scheme involved the use of offshore shell entities to generate artificial turnover. Rajesh was arrested at least twice over separate allegations of forgery and tax fraud. He was subsequently promoted to serve as Managing Director of Adani Group.

Gautam Adani’s brother-in-law, Samir Vora, was accused by the DRI of being a ringleader of the same diamond trading scam and of repeatedly making false statements to regulators. He was subsequently promoted to Executive Director of the critical Adani Australia division.

Gautam Adani’s elder brother, Vinod Adani, has been described by media as “an elusive figure”. He has regularly been found at the center of the government’s investigations into Adani for his alleged role in managing a network of offshore entities used to facilitate fraud.

Our research, which included downloading and cataloguing the entire Mauritius corporate registry, has uncovered that Vinod Adani, through several close associates, manages a vast labyrinth of offshore shell entities.

We have identified 38 Mauritius shell entities controlled by Vinod Adani or close associates. We have identified entities that are also surreptitiously controlled by Vinod Adani in Cyprus, the UAE, Singapore, and several Caribbean Islands.

-

Comment by Riaz Haq on January 25, 2023 at 11:03am

-

#Modi's Pal #Adani, The World’s 3rd Richest Man, Is Pulling The Largest Con In Corporate History. He has engaged in a brazen #stocks #manipulation and accounting #fraud scheme over the course of decades. #Hindutva #BJP #CronyCapitalism #India #economy https://hindenburgresearch.com/adani/

Suspected Stock Parking Entities Accounted For As Much As 30%-47% Of ‘Delivery Volume’ In Adani Stocks, Reinforcing Concerns Of Circuitous Trading & Market Manipulation

“That Would Be Alarming…Being 40% Delivery…Is Too Much. More Like Cornering The Stock”—Institutional Trader Of Indian Stocks

The stock parking entities bought and sold stock in the market, sometimes in a synchronized manner, according to exchange data and disclosures in the annual reports of Adani listed companies.[31]

We analyzed these disclosures as a percentage of delivery volumes – a unique, daily data point provided by Indian exchanges that captures large institutional flows and excludes day-trading activity.[32] The data point captures trading among Foreign Portfolio Investors (FPIs), such as the suspect Mauritius entities, which are not allowed to day trade in the cash market in India.

Using the top ten shareholder disclosures by Adani listed companies, which display granular detail on purchase and sale activities of these shareholders, we analyzed the activity of the stock parking entities – Monterosa, Elara, and New Leaina[33] – and also constructed a wider dataset which included four other Mauritius shareholders with portfolios having suspiciously concentrated holdings in Adani stocks. These suspicious offshore entities are EM Resurgent Fund, Asia Investment Corporation, Emerging India Focus, and Capital Trade and Investment.

The trading patterns suggest that the stock parking entities and the suspicious offshore entities may have artificially inflated the volume and/or price of some Adani listed companies.

Suspicious Trading Pattern #1: Adani Transmission—Up To 47% Of Delivery Volume Was Through Stock Parking Entities And Suspicious Offshore Entities

The stock parking entities accounted for 30%, 2%, and 8% of the delivered volume in Adani Transmission for each of 2018, 2019, and 2020. [34]

--------------

The second former Elara (India Opportunities Fund) employee further stated:

“That´s precisely the advantage of, you know, these kind of vehicles. So that you have the illusion of float but there is no float. There is no float, and the price can be really anything, right. I mean, you can take the price up to whatever you want it. And after a while, you don´t even have to do that. There are guys in the market who will do it for you.”

They also expressed a strong belief that the Elara India Opportunities fund was owned by the Adani promoter group:

“I think this is definitely held by the Adani Group…Because no one else would want to buy [it]. I mean, as any investor why would you invest with Adani Group? Because you know that the stock is inflated, you know that they cannot be trusted.”

“And then, you know, looking at the business, I mean it’s a house of cards, it´s all fueled on debt. And, you know, if the Modi government goes out of power, maybe the whole thing will come crashing down. And I think that this is really how brazen this is happening. It´s like, almost like the Russia of the late 90s, that´s what´s happening.”

-

Comment by Riaz Haq on January 25, 2023 at 12:56pm

-

Adani Under Fire From Hindenburg for Conglomerate's Business Practices

https://www.wsj.com/livecoverage/stock-market-news-today-01-25-2023...

Shares in several companies linked to India's richest man, Gautam Adani, fell after U.S. short-selling firm Hindenburg Research released a lengthy report that alleged fraud at the billionaire's namesake conglomerate.

The seven India-listed companies, which include Adani Enterprises and Adani Transmission, fell between 1.5% and 8.9% on Wednesday.

Prices of dollar-denominated debt owed by some Adani-affiliated companies dropped after publication of the report. Adani Green Energy's 4.375% bonds due 2024 traded at 80.1 cents on the dollar Wednesday, down from 92 on January 11, the last reported trade, according to MarketAxess.

Hindenburg said it conducted a two-year investigation into Mr. Adani's business practices, and has taken a short position in the group's companies through U.S.-traded bonds and non-Indian-traded derivative instruments.

"We are shocked that Hindenburg Research has published a report ...without making any attempt to contact us or verify the factual matrix," Jugeshinder Singh, Adani Group's chief financial officer, said in a statement. He said the report contained misinformation and "baseless and discredited allegations."

Mr. Adani, 61 years old, is an industrialist who saw his fortunes rise over a few decades as he built his business empire across green energy, power and gas distribution. He is currently ranked fourth on the Bloomberg Billionaires Index, with an estimated net worth of $119 billion.

Mr. Adani’s business interests touch the lives of millions of Indians on a daily basis: his coal mines and power plants provide electricity to huge swaths of the country, while his companies also sell the piped gas and edible oils that families use to cook meals. Last year, Adani Group struck a deal of up to $10.5 billion to buy two Indian-listed cement companies, turning his conglomerate into one of the country’s biggest producers of cement.

Hindenburg Research was founded by Nathan Anderson. Previous targets of its skeptical research include Nikola Corp., the electric truck maker whose founder Trevor Milton was later convicted of securities fraud.

-

Comment by Riaz Haq on January 26, 2023 at 7:31am

-

Hindenburg’s Short Sell Call Shaves $12 Billion Off Adani Stocks

US firm takes short position, claims corporate malpractice

Two-year probe by Hindenburg uncovers web of Adani shell firms

https://www.bloomberg.com/news/articles/2023-01-25/adani-group-stoc...

Shares in Adani Group companies lost $12 billion in market value after US investor Hindenburg Research said it was shorting the conglomerate’s stocks and accused firms owned by Asia’s richest person of “brazen” market manipulation and accounting fraud.

Bonds and shares of Adani-related entities slumped after Hindenburg, an investment research firm that specializes in short-selling, made wide-ranging allegations of purported corporate malpractice following a two-year investigation into Gautam Adani’s companies.

-

Comment by Riaz Haq on January 26, 2023 at 8:23pm

-

The #Adani Short Sale Puts #Investor Trust in #India in Doubt. More than anything else, it is this threat of darkness creeping up on India’s #markets that should worry investors in the #Hindenburg-Adani saga. #Modi #CronyCapitalism #Fraud #Corruption https://www.washingtonpost.com/business/energy/the-adani-short-sale...

By Andy Mukherjee Bloomberg

-----------

If Hindenburg is right, then a network of shadowy operators has placed itself right in the middle of those conflicting impulses, and is exerting outsize influence over India’s markets from overseas in cahoots with corporate honchos back home. Meanwhile, within India, ever-rising stock prices have become a symbol of muscular national pride. And that, more than the allegations about Adani stocks, is what should worry global investors: Are India’s public markets trustworthy?

To borrow a phrase from development scholar Lant Pritchett, the Securities and Exchange Board of India ensures perfect isomorphic mimicry. Regulated entities tick much the same boxes they would in a developed market. As in the West, a growing number of these requirements deal with corporate governance. But scratch the surface of disclosures and unsavory characters show up: “briefcase investors,” masquerading as Mauritius-domiciled funds, available to any company boss who wants a little buzz in their stock.

The Indian regulator is busy chasing technical yardsticks, such as beating the US on the speed of the local market’s settlement cycle. But exchange of assets is only partly about efficiency. Above all, it’s about trust, and exemplary punishment — like in the case of Enron Corp. and Bernie Madoff — for those who break it. Is SEBI waiting for a public outcry to go in and clean up the market?

Proximity of family-controlled businesses to political power is an old problem, and by no means unique to India. But the rise of jingoistic nationalism in recent years is adding a new element of impunity to the behavior of some corporate chiefs. Who needs a share prospectus when a yoga guru can tell his followers in an open meeting that anyone buying into his edible-oil company will become wealthy. To project oneself as the flagbearer of a proud, self-reliant India is increasingly seen as a ticket to avoiding scrutiny by the media, regulators or environmental groups, all of whom can be denounced for not being on board with the chauvinistic chest-thumping.

More than anything else, it is this threat of darkness creeping up on India’s markets that should worry investors in the Hindenburg-Adani saga.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

Agriculture, Caste, Religion and Happiness in South Asia

Pakistan's agriculture sector GDP grew at a rate of 5.2% in the October-December 2023 quarter, according to the government figures. This is a rare bright spot in the overall national economy that showed just 1% growth during the quarter. Strong performance of the farm sector gives the much needed boost for about …

ContinuePosted by Riaz Haq on March 29, 2024 at 8:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network