PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan ETF PAK Launched in New York

A new country Exchange Traded Fund (symbol PAK) started trading on New York Stock Exchange (NYSE) this week. The ETF will track the price and yield performance of the MSCI (Morgan Stanley Composite Index) All Pakistan Select 25/50 Index.

Pakistan ETF:

The new Pakistan ETF launch coincided with Chinese President Xi Jinping's visit to Pakistan where he announced massive $46 billion investment in Pakistan's energy and infrastructure. The sectors expected to benefit most initially from the Chinese investment are: energy, cement and financial services.

Pakistan Outperforms Emerging, Frontier Markets Source: Economist |

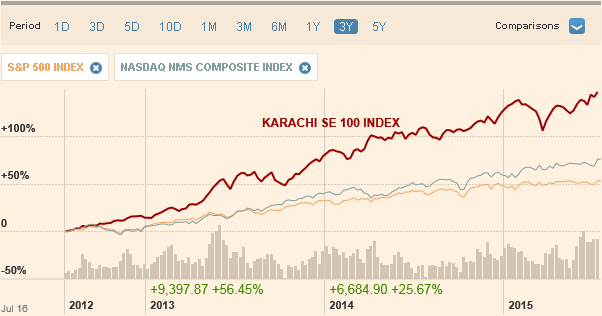

Although the ETF launch timing was fortuitous, it was actually planned well before the Chinese leader's visit. It caters to individual investors seeking outsize returns in Karachi where KSE-100 index has been outperforming both emerging and frontier markets for several years.

|

| Pakistan GDP, CAD Source: Economist |

In 2014, the KSE-100 Index gained 6,870 points thereby generating a handsome return of 27% (31% return in US$ terms), making Pakistan's KSE world's third best performing market. Total offerings in the year 2014 reached 9 as compared to 3 in the year 2013. After a gap of seven years, Rs 73 billion were raised through offerings in 2014 as compared to a meager Rs 4 billion raised in 2013. Foreign investors, that hold US$ 6.1 billion worth of Pakistani shares -which is 33% of the free-float (9% of market capitalization)-remained net buyers in 2014.

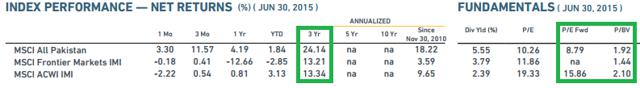

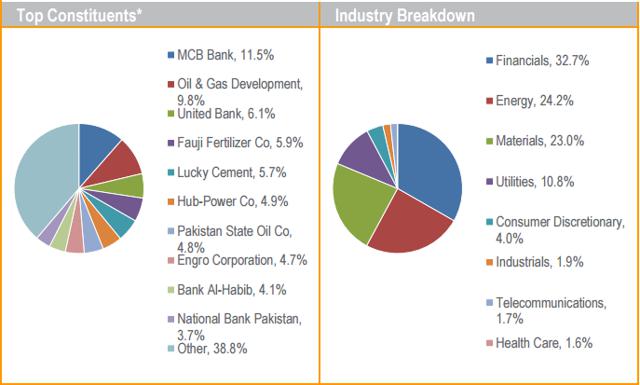

The ETF fact sheet shows that the index has 31 holdings in it. Also, the industry weightings are concentrated in financials (32.7%), energy (24.2%), materials (23%) and utilities (10.8%) — roughly 90% in four sectors alone.

The top equity holdings with weightings in the ETF are as follows: MCB Bank, 11.5% Oil and Gas Development (OGDC), 9.8% United Bank, 6.1% Fauji Fertilizer, 5.9% Lucky Cement, 5.7% Hub-Power, 4.9% Pakistan State Oil, 4.8% Engro, 4.7% Bank Al-Habib, 4.1% National Bank Pakistan, 3.7%

Pakistani Shares Valuation:

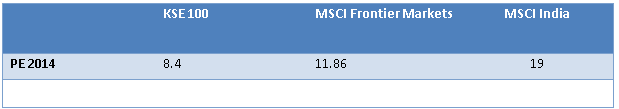

Even after outperforming both emerging and frontier market indices, Pakistani shares can be bought at deep discounts which make them very attractive, according to Renaissance Capital’s chief economist Charles Robertson. MSCI (Morgan Stanley Composite Index) Pakistan trades at only 8.4 times forward earnings, a 17% discount to MSCI Frontier Markets. For comparison purposes, fellow frontier south Asia markets Sri Lanka and Bangladesh trade at 13.4x and 21.4x respectively. India, included in the emerging market index, trades at 16.8 times.

Key Sectors:

Chinese investment in energy and infrastructure will help stimulate all sectors of Pakistani economy. But the sectors benefiting most from the $46 billion investment will likely include banks, energy and building materials, the sectors which are the favorites of Pakistani billionaire investor Mian Mohammad Mansha.

Being close to the ruling Sharif family makes Mansha the ultimate insider. Beyond his investments in banking, cement, energy and textiles, Mansha is also starting to invest in consumer products sector benefiting from rising incomes, growing middle class and increasing jobs created in Pakistan by the massive Chinese investment. Mansha owns a big chunk of Muslim Commercial Bank (MCB) shares. He has recently been pumping more money into energy, cement and dairy businesses. Mansha's DG Khan Cements has announced plans to build a $300 million cement plant near Karachi. In additions, his Nishat Dairies has imported thousands of dairy cows for a dairy farm in Lahore.

Summary:

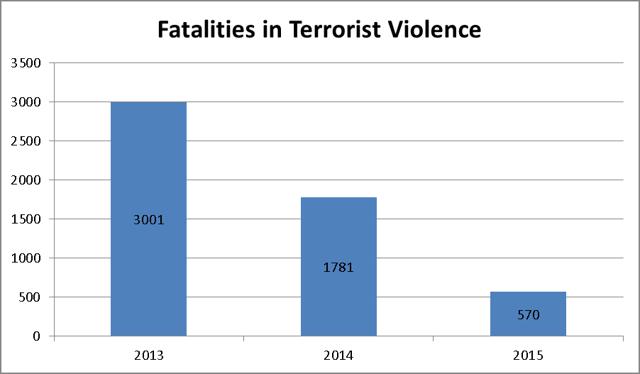

The $46 billion Chinese investment in energy and infrastructure has brought attention to tremendous investment opportunities in Pakistan, a nation of nearly 200 million people with rising middle class and growing consumption. Pakistani military's recent successes against the terrorists and China's massive investment commitments are expected to boost investor confidence in the country. Higher confidence will help draw other significant investors to invest in Pakistan over the next several years.

Full Disclosure: I have personally invested in PAK ETF.

Related Links:

China Deal to Set New FDI Records in Pakistan

Post Cold War Realignment in South Asia

Haier Pakistan to Expand Production From Home Appliances to Cellpho...

Pakistan Bolsters 2nd Strike Capability With AIP Subs

Pakistan Starts Manufacturing Tablets and Notebooks

-

Comment by Riaz Haq on June 14, 2015 at 9:22am

-

World Bank Report: #Pakistan attracting millions of foreign workers from abroad

http://www.asiadespatch.org/2015/06/14/pakistan-providing-a-doorway... …

A report by the World Bank (WB) and International Fund for Agricultural Development (IFAD) reveals that, Asia and the Pacific are on the onset of new economic growth patterns, countries like Hong Kong, Japan, Singapore are on the lead to attract the foreign workers . Like wise Malaysia and Thailand are now “net importers” of labour, countries like Pakistan and India are also attracting millions of workers from abroad

-

Comment by Riaz Haq on June 25, 2015 at 12:08pm

-

After years of boosting global growth, developing economies now a major drag on world economyI

Slump in growth: Exports and imports suffer across key emerging markets

t was only five years ago, but it feels like a different era. Roger Agnelli, the then chief executive of Vale, the Brazilian mining company, had just taken delivery of the first of an order of 35 Valemax ships, the biggest dry bulk carriers ever built. The vessels, bought primarily to ship iron ore to a voracious China, were so large that each one could carry iron ore sufficient for the steel to build the Golden Gate Bridge in San Francisco three times over.

“We are living through our best days . . . I strongly believe that even better days are ahead of us,” said Mr Agnelli in 2010. But Vale’s fortunes would soon begin to fade. Mr Agnelli was ousted a year later, and China temporarily banned the ships from its ports on safety grounds. In the first quarter of this year, the company reported its worst financial performance in six years.

Vale’s problems are symptomatic of a broader malaise, with emerging markets slumping in the first quarter to their weakest performance since the 2008-09 crisis. China’s appetite for metal ores and other resources is on the wane, Brazil’s once-buoyant economy is in recession, Russia is in crisis and several smaller countries are also suffering declining growth and capital outflows.

Developing nation growth slowing, warns World Bank

Developing countries are facing a “structural slowdown” likely to last for years and are ceding their role as the world’s growth engine to more mature economies such as the US, according to the World Bank.

The Washington-based bank on Wednesday lowered its forecast for global growth this year to 2.8 per cent, partly because the much-anticipated benefits of lower oil prices have been limited.

The worry is that these problems are no longer contained within emerging market economies; they are spreading to the developed world too. The dependable boost that the global economy has derived from the youthful dynamism of its developing countries for well over a decade — with the exception of during the global financial crisis — has recently become an outright drag. The Bric countries (Brazil, Russia, India and China) — long seen as the world’s growth engine — are now a particular burden.

Adam Slater, economist at Oxford Economics, a research company, says this slowdown could create “an EM-induced recession for the global economy”. He notes that the Brics account for a fifth of global gross domestic product. “Two [of them] are already in recession and one is slowing sharply,” he says.

Trade is the mechanism through which robust demand has been transmitted to other economies, including Europe and the US. But, according to an analysis by Oxford Economics, a slump in import demand in the first quarter of this year turned emerging markets from contributors to global trade growth to detractors for the first time since 2009.

The size of the switch is stark. In aggregate, the 17 largest developing economies reduced world trade values by 0.9 percentage points in the first quarter, down sharply from the average 2.5 percentage points they added to trade growth annually between 2000 and 2014, when their share of global trade was 43.3 per cent of the total, according to Oxford Economics.

Early indications are that the slowdown in trade has continued into the second quarter. China’s exports shrank by a further 2.5 per cent year on year in May, their third month of decline, while its imports were down 17.6 per cent in dollar terms.

“Emerging markets have shifted from being a major support to world trade growth to a significant drag,” says Mr Slater. “The slowdown in China and other emerging markets represents a significant negative shock to world growth.

“We would be more confident that the world could ride this out if it were not for the fact that growth in advanced economies is still rather moderate,” Mr Slater adds.

After the crisis, emerging markets bounced back quickly to average annual GDP growth of about 6 per cent, compared with about 2 per cent in developed countries. But this engine of global growth has stuttered.

Bhanu Baweja, global head of emerging markets strategy at UBS, says growth in these markets has already slid to an average of 3.5 per cent during the first quarter of this year, its lowest level since the crisis. Even more emphatic is the fact that if the contribution of China is stripped out, the average gross domestic product growth of emerging markets in US dollar terms “may be close to 0 per cent in 2015”, Mr Baweja says.

At the same time international capital appears to be heading for perceived safety. The floods of money that made their way into emerging markets in the period of low interest rates since the global financial crisis are, in most countries, either slowing to a trickle or reversing course. In the three quarters to the end of March, these markets suffered bigger net capital outflows than they did during the crisis, according to NN Investment Partners. This week, t he Institute of International Finance reported the biggest monthly sell-off in emerging bonds since the “taper tantrum” of 2013 when the markets feared the US was going to reduce the scale of its quantitative easing programme.

Bigger players

If emerging market economies continue to falter this year, the impact on the developed world could be profound.

The last time a serious emerging markets-led global slowdown occurred in 1999, in the aftermath of the Asian financial crisis, the developing world was a more marginal presence in the global economy.

Now it accounts for just over 52 per cent of global GDP in purchasing power terms and some 35 per cent in nominal terms. This compares with just 38 per cent and 23 per cent respectively at the time of the Asian crisis. “So weakness in EMs has a bigger global impact now,” says Mr Slater. “If we think about the old refrain from the global financial crisis that ‘it started in America’, then we may note that the US accounted for 24 per cent of world GDP [at that time].”

The contribution of these countries to growth, and particularly to trade growth, outstripped their weight in the global economy. Thus, the Brics accounted for 15 per cent of world trade between 2000 and 2014, but contributed 23 per cent of its growth during the same period. The loss of this outsized contribution is being keenly felt.

There is also a greater financial symbiosis that intertwines the fate of developing economies and the rest of the world in a way that did not really exist at the time of the Asian crisis. According to figures from the Bank for International Settlements, the exposure of its members lending across borders to recipients in emerging markets reached $6tn at the end of 2014, about double the level of 1999, Mr Slater says.

Policy makers are starting to sound the alarm. Choi Kyung-hwan, South Korea’s finance minister, told the Financial Times last week that the slowdown in global growth, at a time of unprecedented monetary laxity, posed a challenge similar in complexity to those faced during the 2008 crisis.

He criticised leading economies for not doing enough to stimulate growth and warned that “the advanced economies will again see spillovers from the negativity in emerging markets” if they do not do more.

His comments came as the Organisation for Economic Co-operation and Development slashed its forecast for global growth to 3.1 per cent for 2015, down from November’s forecast of 3.7 per cent. South Korea has not been spared the broader global slowdown, with exports sliding 10.9 per cent in May from the same month a year earlier and imports falling 15.3 per cent.

The Fed effect

Mr Baweja believes that the collapse in trade is the biggest threat facing the emerging world today — much more significant than the prospect of rising interest rates at the US Federal Reserve.

“Exports are contracting and the only mechanism of correcting countries’ external imbalances is import contraction,” he says. But such a correction is not the solution. “If you increase exports your economy is growing. If you kill demand, growth will be much lower. In obsessing about the Fed, people are missing the fact that we will see much less trade, which will lead to much lower EM growth.”

The effects are already being seen. The premium of emerging market growth over that in the developed world is now at its lowest level in 15 years. In dollar terms — the standard way of measuring trade and economic output — the same is true of real growth in developing economies.

Call for diversification

Those countries that benefited first from the China-led commodities boom and second from cheap global credit are struggling to find a plan C.

“It is hard to see how free trade can help,” says Mr Baweja. For much of the past 20 years, each percentage point of growth in global economic output led to more than two percentage points of growth in global trade volumes — traditionally the source of a boost in output for many emerging markets. He predicts this 2:1 ratio of trade to output will stabilise closer to 1.3:1.

It is not only commodity exporters that are suffering. Figures compiled by UBS show that exporters of manufactured goods are also performing badly. Nor is it all a matter of dollar valuations, as the weakness in trade is also apparent when it is measured in local currencies.

Mr Baweja argues that the “South-South” concept of trade between developing economies as a driver of global growth has always been an exaggeration. “It is a big supply chain with its focal point in China.”

Many commodity exporters have tried to diversify what they produce and who they sell to. But if Mr Baweja is correct, there will be little comfort for countries such as Chile, which has found that fine wines are no match for King copper.

43%

Share of trade for 17 largest developing economies

This may lead some countries to turn to fiscal or monetary stimulus. Mr Choi says South Korea has room to do either or both; his ministry is planning to announce a “comprehensive package” of pro-growth measures in July.

Others will be more constrained. Brazil is battling to restore confidence in its fiscal accounts by cutting spending and raising taxation, even as the country faces deep recession. It is also raising interest rates to fight inflation and attract foreign capital.

At the other extreme, Hungary and Thailand are cutting interest rates in the face of deflation. But they may not be able to do that for much longer if the Fed raises rates later this year as it would expose them to the risk of destabilising outflows and currency devaluations.

17.6%

Fall in Chinese imports in May, in dollar terms

Conventional wisdom suggests that a Fed rate rise will be traumatic for emerging markets, especially for the enormous number of companies that have issued dollar-denominated debt over the past decade. But some analysts believe it does not have to be too painful.

“There is no question of a balance of payments crisis,” says Mr Baweja, who points to improvements in balance sheets over the past 15 years to support his argument. “Emerging markets don’t have the ingredients for a blow-up, but neither do they have the ingredients for growth.”

He notes that the big themes of this century — low US interest rates, the rise of China and globalisation — have all been beneficial to developing nations. But with those trends all in reverse, it is hard to see the next driver of growth for these countries or the world economy.

http://www.ft.com/intl/cms/s/2/2a6c3d6a-0f62-11e5-897e-00144feabdc0...

-

Comment by Riaz Haq on July 23, 2015 at 7:38am

-

Summary

- Developed and current emerging markets are not offerings returns as high as frontier markets.

- Pakistan’s economic outlook is improving, thanks to China’s investment, low oil prices and rate cuts.

- MSCI Pakistan is a decent bet for a frontier market exposure; it’s cheap on relative valuation.

Developed equity markets continue to trend higher. It is hard to predict the end of the current bull market, but the returns would be limited going forward. S&P trades at a PE of 21.24 while NASDAQ composite is trading around 23 times the trailing earnings. European markets are also rising but the upside seems limited given high multiples. Emerging markets are witnessing aslowdown in growth. High return investments are not easily found in the above mentioned markets under current circumstances. However, there are alternatives for investors with a high risk-appetite: the frontier markets.

Frontier markets are small to be classified under emerging markets but they often entail a higher return at a higher risk. One such frontier market is Pakistan, which has started to look attractive. Equity market of Pakistan is trading at a substantial discount and can bring considerable gains to investors. Detailed thesis follows:

Status of Pakistan might be upgraded to an emerging market.

Pakistan is up for consideration to be included in emerging markets. MSCI will review for a potential upgrade in June 2016. According to WSJ, Pakistan is liquid and deep enough to be considered as an emerging market. KSE 100 index is one of the best performing equity markets since the financial crisis of 2008. Note that Pakistan meets most of MSCI's emerging market requirements. It is highly likely that Pakistan will be upgraded to the emerging market status. If that happens, the PE multiple of Pakistan's equities will expand resulting in substantial gains for investors.

KSE 100 is one of the best performing equity markets trading at a discount.

In 2013, KSE 100 rose 37%, in dollar terms, topping S&P 500 and every other benchmark in Europe. It was the third best performing market in 2014 with a31% return. The index is up ~19% during the trailing twelve months. Despite the run, the index trades at 8.3 times forward earnings, an 18% discount to MSCI's frontier markets.

Source: FT.com Source: Yahoo Finance, MSCI, AHL Research

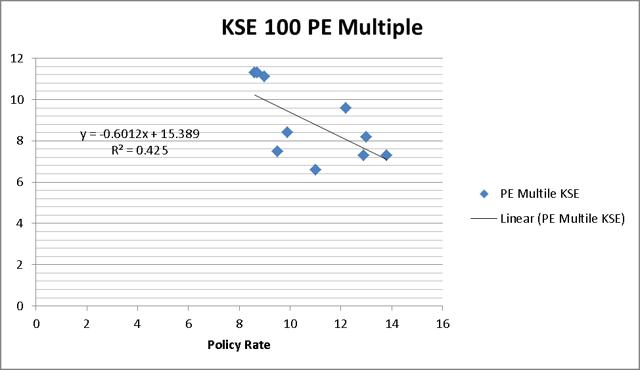

Source: Yahoo Finance, MSCI, AHL ResearchThe charts depict that after a decent run, KSE 100 is still trading at quite a discount. Further, the expected benchmark rate is 8%, which is equal to the rate back in 2006. KSE was trading at 11.3x at that time. This indicates that the index is undervalued by more than 20%. According to AHL research,

"When the policy rate stood at almost at the same level in 2006 as today i.e. 8.5%, and the earnings growth also being in close vicinity as today i.e. 10%, the market PE stood at 11.3x then, compared to 8.3x today, showing a substantial 27% discount, which the KSE100 is currently trading at (barring all other factors i.e. level and risk of macros and the market between two different times)."

See the following graph to witness the correlation of interest benchmarks to the KSE 100 index.

(click to enlarge)

Focus Equity Estimates and AHL ResearchThe graph clearly mentions that KSE 100 is negatively correlated to the interest rates. As Government is pursuing aggressive rate cuts, PE multiple is expected to expand. To review, Pakistan's equity market is trading at a substantial discount based on historical PE levels; it's also cheap relative to comparable indexes and markets.

The economy is in a turnaround mode; related indicators are positive.

Economy is getting a boost from several developments. Falling oil prices are a big positive that are keeping a check on inflation. This, in turn, is allowing for rate cuts, which will give a boost to economic activity and the stock market. Pakistan is a net importer of oil; prices of oil are not expected to go up any time soon, think recent U.S.-Iran deal. Oil prices will continue to have a positive impact on the economy of Pakistan. As mentioned above, low interest will also boost the economy. Interest rates are cut by 1% to drop to 7%. The Government is pursuing aggressive rate cuts; they are down from 10% in November 2014 to 7%currently.

Other favorable factors include pro-business government and favorable demographics; 54% of the population of Pakistan is under 25 years. The current Government is heavily investing in infrastructure; a $500 million Metro transport project is recently completed in twin cities, Islamabad and Rawalpindi. Other construction projects are expected to boost materials and construction industry. Elimination of circular debt by the Government bodeswell for power producers. Further, consumer spending is increasing; 26% p.a. increase in spending was recorded (pdf) during 2010-2012 as compared to Asia's 7.7% growth. Analysts' expect the GDP to grow at 4.6% p.a. through 2019.

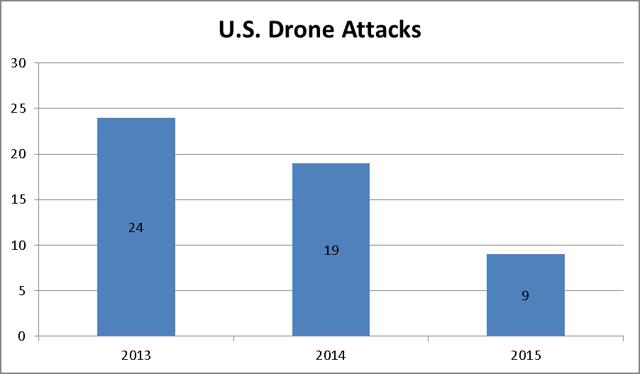

Pakistan's security forces' operation against terrorism is proving to be fruitful. Number of civilian casualties has declined by 81% since 2013. Number of drone attacks by the U.S. in Pakistan has decreased 62% since 2013 indicating that terrorist element is being eliminated efficiently.

(click to enlarge)

Source: South Asia Terrorism PortalRegarding the stock market, it was among the best performing markets in 2013 and 2014. In 2013, the market performed better than 2014 as mentioned somewhere else in the report. The point is that investors' sentiment is not strongly correlated to the security related issues. Drone attacks and terrorism related causalities were higher in 2013 compared to 2014 yet the market performance in 2013 was better than 2014. Now, the security situation is getting better. This will boost investors' confidence and will help the stocks rally in 2015 and beyond.

China's $46 billion investment in Pakistan makes the bull case a no brainer.

China is investing in Pakistan for an economic corridor. $46 billion in investment is expected. Most of the investment will be used for power and infrastructure related development. Financial services, materials and power companies will be the primary beneficiaries of the investment. According to Barrons, Beijing's investment is expected to boost Pakistan's GDP by over 15%. The investment will, in time, put an end to Pakistan's electricity woes, another positive from a business perspective. 10GW capacity is expected to beadded by 2018. The economic corridor will link China to the markets in Central Asia and South Asia.

'If 'One Belt, One Road' is like a symphony involving and benefiting every country, then construction of the China-Pakistan Economic Corridor is the sweet melody of the symphony's first movement.'

-Wang Yi, China's foreign minister

All in all, China's investment bodes well for the economic growth of Pakistan and its capital markets. For further insight into China-Pakistan economic corridor, see this (pdf) report.

There is a turnaround in analysts' sentiment about Pakistan.

David M. Darst, Chief investment strategist at Morgan Stanley, thinks that the rise of Pakistan is just a matter of time. He further points out that Pakistan is among the nine countries in Asia that will add another China in the next 35 years. Commenting on Pakistani stocks he said,

"What is important is that the stocks in Pakistan are still very cheap compared to the markets in the industrialised world and they are performing better than many markets in terms of returns,"

IMF thinks that Pakistan has succeeded in stabilizing its economy; growth of 4.3% is expected during 2015. World Bank expects expansion of 4.4% during the current year. Goldman Sachs has included Pakistan in "Next 11" list of economies, which will be a key source for economic growth in years to come. Pakistan is an overlooked reform story without reform valuations, saysRenaissance Capital.

According to CIA Factbook 2015,

"Pakistan is one of the larger, more liquid frontier markets and has advantageous demographics. These factors make it an attractive investment destination for investors looking beyond traditional emerging markets, which have been demonstrating slowing growth."

To review, Pakistan's outlook is getting positive. A rise of status from a frontier a market to an emerging market will be catalytic for the growth of the stock market. Economic growth supported by low oil prices, low interest rate environment and diminishing security problem will add to the capital market's growth. More importantly, China's investment in the country will steer Pakistan's economy in an upward direction going forward.

How to Invest?

Investors can get exposure to this frontier market through MSCI Pakistan ETF (NYSEARCA:PAK). This ETF is designed to represent the performance of broad Pakistan equity universe. The ETF offers access to the highly liquid equities in Pakistan. The ETF was launched in 2014. However, the equities in the ETF posted a CAGR of 18% during 2011-2015. The ETF trades at a forward PE of 8.79 making it a cheap proposition. The ETF also compares favorably to other alternatives.

(click to enlarge)

Source: MSCIAnother important factor is the weightage of sectors. PAK ETF is concentrated among financials, materials and energy. See the chart below:

(click to enlarge)

Source: Global X FundsAs mentioned above, financials, energy and materials will be the largest beneficiary of China's investment in Pakistan. Consequently, this ETF will outperform the market due to dominant weightage of these sectors. Further, the current Government is also focused on infrastructure development, which is another bullish indicator for the ETF. For fiscal year 2015/2016, the government has increased infrastructure expenditure by 27%. Low oil prices will continue to support the energy sectors and the ETF's growth

Another, relatively low-risk/low-return alternative is to invest in MSCI Frontier 100 ETF (NYSEARCA:FM). Pakistan makes up 10.6% of this ETF. Kuwait, Nigeria and Argentina are the three largest countries in this ETF.

Bottom Line

Developed and current emerging markets are not offerings returns as high as frontier markets. However, the returns from frontier markets come with added risks. These investments are only suitable for investors with high appetite for risk. Anyhow, Pakistan's economy is in a recovery mode, thanks to China's investment, pro-business government, falling oil prices and interest rate cuts. Equity market of Pakistan is an attractive investment option given that the market outperformed developed markets even with worse security and economic conditions. Now, as the economic and security situation is stabilizing, high gains will certainly follow. MSCI Pakistan ETF is looking good amid high concentration in financials, materials and energy. Further, the valuation is cheap as compared to emerging markets. All in all, we rate MSCI Pakistan ETF a buy with more than 30% upside; the valuation is based on historic correlation of interest rate benchmarks to the PE multiples of the market.Risks

- Low trading volumes and liquidity concerns attached to frontier markets

- Highly volatile political conditions

- Re-ignition of the terrorist elements

Over 1.7 million people get email alerts from Seeking Alpha.Get email alerts on PAK »Share this article with a colleague

http://seekingalpha.com/article/3343675-msci-pakistan-add-a-little-...

-

Comment by Riaz Haq on September 21, 2015 at 7:57pm

-

Dolmen City REIT, #Pakistan's First Real Estate Investment Trust) posts net profit of Rs169.9m http://tribune.com.pk/story/961071/maiden-earnings-dolmen-city-reit... …

KARACHI: In its maiden earnings announcement following the public listing in June, the management company of Pakistan’s first real estate investment trust (REIT) scheme said on Monday its net profit amounted to Rs169.9 million for the period ending on June 30.

Trading of the units of Dolmen City REIT, which is run by Arif Habib Dolmen REIT Management, began on the Karachi Stock Exchange on June 26, although the announced profit is for the period starting on January 20 and ending on June 30.

REITs are collective investment schemes that pool investors’ funds for onward investment in real estate.

No year-on-year comparison of Dolmen City REIT can be made because of the unavailability of comparable data.

Traditionally, small investors have been unable to take part in real estate investments in Pakistan, as the property market is considered highly illiquid and capital intensive. There are few publicly listed property developers in Pakistan while REITs had practically been non-existent so far.

However, as the first-of-its-kind investment avenue in Pakistan, Dolmen City REIT offers small investors the opportunity to take advantage of a booming real estate market by trading in REIT units.

Besides being the first REIT in Pakistan, Dolmen City REIT is also the first publicly listed trust of its kind in South Asia.

REITs operate like close-end funds, as pooled capital is invested in real estate and its units are listed on the stock exchange that investors can buy and sell every day just like ordinary stocks.

The underlying assets of Dolmen City REIT are the two components of the Dolmen City project: Dolmen Mall Clifton and the Harbor Front building, which are located on the Karachi seafront.

The property was originally owned by International Complex Project (ICP). The Arif Habib Group controlled 20% shares in ICP while 80% ownership rested with the Dolmen Group before the public listing. The monetary value of the total fund of Dolmen City REIT is Rs22.2 billion.

The property generates rental income that is distributed by the REIT scheme among unit holders in the shape of dividends. The first profit announcement was accompanied with a final cash dividend of Rs0.08 per unit for the period ended June 30.

Speaking to The Express Tribune, Arif Habib Dolmen REIT Management CEO Muhammad Ejaz said the trust was registered on January 20, but the rental income started accruing to Dolmen City REIT from June 1. Therefore, the rental income of Rs193.6 million, which resulted in the net profit of Rs169.9 million, was generated in the month of June alone, Ejaz said.

In a pre-IPO interview, Ejaz had said unit subscribers should expect a 9.25% dividend yield in the first year of operation.

Comment

- ‹ Previous

- 1

- 2

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

Agriculture, Caste, Religion and Happiness in South Asia

Pakistan's agriculture sector GDP grew at a rate of 5.2% in the October-December 2023 quarter, according to the government figures. This is a rare bright spot in the overall national economy that showed just 1% growth during the quarter. Strong performance of the farm sector gives the much needed boost for about …

ContinuePosted by Riaz Haq on March 29, 2024 at 8:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network