PakAlumni Worldwide: The Global Social Network

The Global Social Network

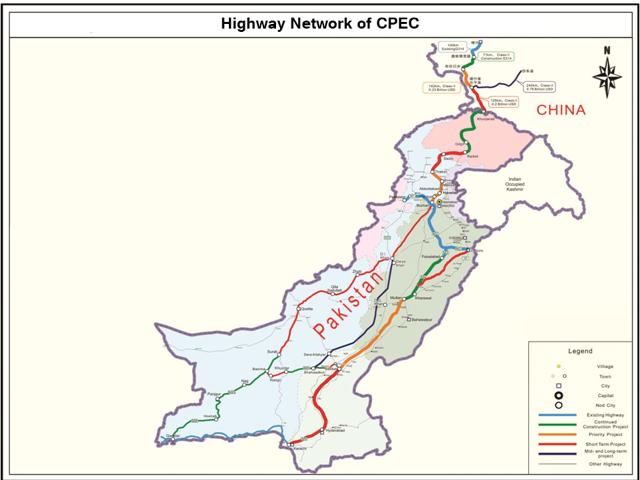

Chinese FDI Soars as CPEC Projects Begin in Pakistan

Pakistan is seeing soaring foreign direct investment (FDI) with improving security and the start of several major energy and infrastructure projects as part of China-Pakistan Economic Corridor (CPEC), according to the UK's Financial Times business newspaper.

A New High in FDI:

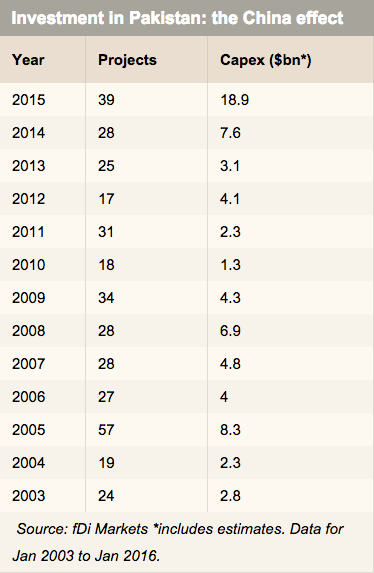

The year 2015 was a bumper year for foreign investment pouring into Pakistan, says the Financial Times. The country saw 39 greenfield investments adding up to an estimated $18.9 billion last year, according to fDi Markets, an FT data service. This is a big jump from 28 projects for $7.6 billion started in 2014, and marks a new high for greenfield capital investment into the country since fDi began collecting data in 2003.

The number of projects in 2015 is the largest since Pakistan attracted 57 greenfield projects back in 2005 on President Musharraf's watch. China is now the top source country for investment into the country, surpassing the second-ranked United Arab Emirates, primarily due to its investments in power.

|

| Top 10 Destinations of Chinese FDI 2012-14. Source: UNESCAP |

Major CPEC Projects:

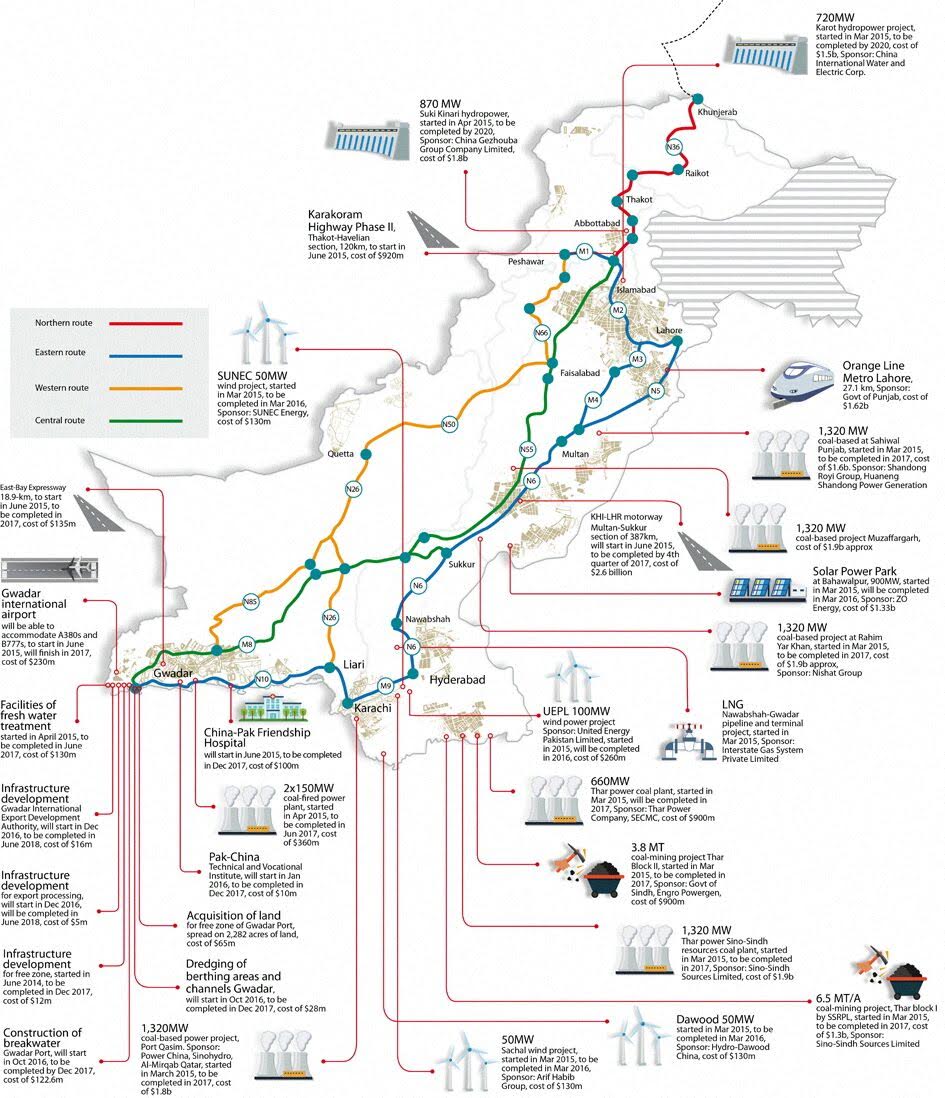

China's Shanghai Electric, a power generation and electrical equipment manufacturing company, announced plans last year to establish a 1,320 megawatt coal-based power project in Thar desert using domestic coal, scheduled to launch in 2017 or 2018. Traditional energy and power projects made up two-thirds of last year’s total greenfield investment into Pakistan at $12.9 billion with alternative energy bringing in a further $1.8 billion.

CPEC Projects |

Among the more notable projects, UAE-based Metal Investment Holding Corporation announced plans to partner with Power China E & M International to invest $5 billion to build three coal-fired plants at Karachi’s Port Qasim. In addition, the transportation sector is also showing promise, with 12 projects totaling $3 billion being announced or initiated last year.

Special Economic Zones:

Beyond the initial phase of power and road projects, there are plans to establish special economic zones in the Corridor where Chinese companies will locate factories. Extensive manufacturing collaboration between the two neighbors will include a wide range of products from cheap toys and textiles to consumer electronics and supersonic fighter planes.

The basic idea of an industrial corridor is to develop a sound industrial base, served by competitive infrastructure as a prerequisite for attracting investments into export oriented industries and manufacturing. Such industries have helped a succession of countries like Indonesia, Japan, Hong Kong, Malaysia, South Korea, Taiwan, China and now even Vietnam rise from low-cost manufacturing base to more advanced, high-end exports. As a country's labour gets too expensive to be used to produce low-value products, some poorer country takes over and starts the climb to prosperity.

Once completed, the Pak-China industrial corridor with a sound industrial base and competitive infrastructure combined with low labor costs is expected to draw growing FDI from manufacturers in many other countries looking for a low-cost location to build products for exports to rich OECD nations.

Key Challenges:

While the commitment is there on both sides to make the corridor a reality, there are many challenges that need to be overcome. The key ones are maintaining security and political stability, ensuring transparency, good governance and quality of execution. These challenges are not unsurmountable but overcoming them does require serious effort on the part of both sides but particularly on the Pakistani side. Let's hope Pakistani leaders are up to these challenges.

Summary:

Pak-China economic corridor is a very ambitious effort by the two countries that will lead to greater investment and rapid industrialization of Pakistan. Successful implementation of it will be a game-changer for the people of Pakistan in terms of new economic opportunities leading to higher incomes and significant improvements in the living standards for ordinary Pakistanis. It will be in the best interest of all of them to set their differences aside and work for its successful implementation.

Related Links:

Chinese to Set New FDI Record For Pakistan

Pak Army Completes Half of CPEC Western Route

IPPs Enjoy Record Profits While Pakistan Suffers

Can Pakistan Say No to US Aid?

Pak-China Defense Industry Collaboration Irks West

President Musharraf Accelerated Human & Financial Capital G...

China's Investment and Trade in South Asia

China Signs Power Plant Deals with Pakistan

Soaring Imports from China Worry India

Yuan to Replace Dollar in World Trade?

-

Comment by Riaz Haq on April 23, 2016 at 7:43am

-

#Pakistan’s Enormous Long-Term #Growth Potential. Young #demographics, expanding #economy, #CPEC http://www.barrons.com/articles/pakistans-enormous-long-term-growth... … via @barronsonline

To Western eyes, building a business in Pakistan seems nearly impossible with the country’s history of political turmoil and bouts of deadly terrorism committed by Islamic extremists.

But there is a long-term growth story in the frontier market, where the economy is expanding at a roughly 4.5% annual pace. As part of a $6.6 billion loan package, the International Monetary Fund got the country to raise taxes and cut subsidies—notably for electric power. But the IMF program expires this year, a key risk. Still, the IMF noted in a recent review that Pakistan has shored up foreign reserves thanks to low oil prices, and it praised the creation of an independent monetary-policy committee. It also acknowledged that restructuring or privatizing ailing public enterprises has been disappointingly slow.

The key to long-term growth is Pakistan’s population. At roughly 190 million, it is the sixth largest in the world. Importantly, more than half of Pakistan’s citizens are under age 25, eager for education and interested in success, says Najeeb Ghauri, CEO and founder of NetSol Technologies (ticker: NTWK), a California software company with a Pakistani campus.

“Contrary to the negative headlines,” says T. Rowe Price frontier markets portfolio manager Oliver Bell, “Pakistan has been slowly progressing on a much more stable path; we saw successful elections and the peaceful handover of power in 2013, and the new government has shown a commitment to adhere to the IMF program.” Bell adds that Pakistan’s aggressive privatization of companies “is creating liquidity and buying opportunities” in its stock market.

ONE OF THE BEST WAYS for retail investors to access this growth—a decidedly long-term bet—is the Global X MSCI Pakistan exchange-traded fund (PAK). The year-old ETF’s total return is negative 11% since inception. But that’s better than the iShares MSCI Frontier Market ETF (FM) and the iShares MSCI Emerging Markets ETF (EEM), which each fell 18%.

Financials account for a third of the Pakistan ETF, and Bell likes banks. A favorite is Pakistan’s largest lender, Habib Bank (HBL.Pakistan), which the government took public last year. A high percentage of Pakistan’s population don’t use banks, and Bell expects expanded loan growth. China’s investment in Pakistan’s infrastructure, especially power plants, should boost long-term growth. Earnings on Friday beat analysts’ expectations. Bell thinks the bank’s return on equity can expand to 25% in 2018 from 17% in 2013. But he doesn’t think the stock is expensive, at 1.4 times book value, given its growth and 8% yield.

Of note: Habib Bank’s New York branch got an enforcement order from U.S. authorities in December, after they found repeated “significant breakdowns” in anti-money-laundering efforts.

Multinationals are taking notice of Pakistan’s strides. Coca-Cola (KO) is expanding its Pakistan operations, which boasted double-digit growth in the latest quarter, says Curt Ferguson, president of Coke’s Middle East and North Africa business. He told Barron’s last week, “Pakistan is growing again. We just made a huge investment near the India-Pakistan border, in Mutan, which has a gorgeous new airport. Pakistan would really surprise people.”

Perhaps, but not everyone wants the risk. Paul Christopher, global strategist at Wells Fargo, told us that Pakistan is among the frontier markets whose volatility makes it “not investible.”

-

Comment by Riaz Haq on April 25, 2016 at 10:09pm

-

#Pakistan's rising volume of lending a positive sign- all economic indicators up except exports down double digits

http://www.khaleejtimes.com/business/economy/pakistans-rising-volum...

The latest trend of rising volume of commercial lending to the private sector coupled with larger industrial output and better energy supply and rising FDI inflows are now signalling a significant uptick of the Pakistani economy in FY-2017 that starts from July 1. Commercial banks' lending to the private sector rose by Rs352.3 billion so far in FY-16 as compared to Rs222.3 billion in the same period of FY-15, the latest statistics by Stat Bank of Pakistan (SBP) showed.

"A significant part of this credit was availed by the private sector businesses. There was a high credit off-take in December 2015 which was enough to compensate for the lower cumulative flow during the earlier months of FY-16," the SBP said. The demand for the private sector credit was high due to lower cost of credit and better market conditions. The cost of borrowing declined to six per cent - an all time low in last 12 years - as a result of SBP's easy money policy.

At the same time, there was a "high deposit growth, and a lower government budgetary borrowing," which created a surplus with the banks that was lent to the private sector. "The improvement in credit to the private sector over the previous year, primarily, was due to larger borrowing by the manufacturing sector, followed by commerce and trade, construction and electricity."

The SBP also reported that with the exception of ship breaking which received Rs13.4 billion credit that was lower than the sectors past borrowing, the improvement in larger credits to other sector was broad-based. While credit for working capital and fixed investment categories, showed higher growth. But credit for trade financing was lower. One of the reasons for larger lending to the private sector was that government borrowing to cover its big budgetary deficit was lower than last year. In fact, government was funding its requirements by launching its longer - term investment bonds, rather than short-term and more expensive borrowing from the commercial banks which also had squeezed the bank credit for the private sector.

That covers the broad spectrum of the commercial lending. Does it also indicate in which direction is the economy moving?

Another key factor for a potentially good omen for the economy to grow faster is expansion of the large-scale manufacturing (LSM) sector. Its output growth rose 4.35 per cent year-on-year in the first eight months July-February of FY-16. In February, 2016 alone the LSM sector growth was 2.83 per cent higher as compared to the like month of FY-15, according to the SBP report. The key sub-sectors which contributed to the LSM growth in the first eight months of FY-16 were: automobiles 27.67 per cent, fertiliser 16.95 per cent, chemicals 11.26 per cent, leather products 11.51 per cent, rubber products 11.64 per cent, and non-metallic mineral products 8.61 per cent.

In the same period, iron and steel sector produced 19.76 per cent more billets and ingots. The capacity of the sector also expanded in this period in order to feed lager exports. The automobiles sector expanded as production of trucks rose 44.23 per cent, buses 77.54 per cent, cars and jeeps 37.10 per cent, light commercial vehicles (LCVs) 104.45 per cent, and motorcycles was up 17.1 per cent. However, tractor production was down 44.65 per cent.

In the electronics sector, production of air conditions rose 28.05 per cent, switch gear by 28.14 per cent, electric transformers 1.8 per cent, TV sets 1.74 per cent and storage batteries 2.89 per cent, besides various rises in production of other electronics.

-

Comment by Riaz Haq on May 18, 2016 at 5:02pm

-

#Pakistan #ETFs In Focus On Growing Prospects. #CPEC #China #FDI #FII http://seekingalpha.com/article/3975926-pakistan-etf-focus-growing-... … $FM $FRN $PAK

Pakistan represents an untapped Asian market for U.S. investors. The country's equity market had a bad start to 2016, thanks to the global sell-off and foreign investment outflow primarily from the oil & gas sector.

However, the country is working on a turnaround. Its economy is growing at a decent rate of approximately 4.5% per annum. As per a California software company, NetSol Technologies (NASDAQ:NTWK), the country's 190 million population, with more than 50% being under 25 years of age, could also act as a key catalyst to long-term growth.

In a review of Pakistan's economic program, the IMF positively stated that the country is on a growth trajectory and is expected to benefit from low oil prices and strong investment due to the implementation of the China-Pakistan Economic Corridor (CPEC). The aim of CPEC is to boost Pakistan's infrastructure and its industrial sector.

However, as a caveat, we would like to remind investors that like many other frontier markets, Pakistan is also fraught with political tensions, which might hurt the stock market's potential to outperform at any given time. Additionally, stocks in frontier markets in developing countries generally have smaller market capitalization and lower levels of liquidity than those in large emerging markets. So, investors planning to invest in this market should have a relatively high risk tolerance.

Keeping these points in mind, we highlight the sole ETF tracking Pakistan - the MSCI Pakistan ETF (NYSEARCA:PAK). This ETF looks to track the MSCI All Pakistan Select 25/50 Index, which holds about 37 securities in its portfolio. The fund charges 92 basis points a year. The portfolio is heavy in financials, at 31% of assets, while basic materials (28%) and energy (20%) round off the top three. The top three companies of the fund have almost one-third exposure. The fund has total assets of $5.4 million, with paltry volumes of 3,000 shares. It has gained 6.3% so far this year as of April 29, 2016.

Investors can also consider other ETFs like the Guggenheim Frontier Markets ETF (NYSEARCA:FRN) and the iShares MSCI Frontier 100 Index ETF (NYSEARCA:FM) having significant exposure of 10.2% and 10%, respectively, to Pakistan (see Broad Emerging Market ETFs here).

FRN

FRN seeks to match the performance of the BNY Mellon New Frontier DR Index. BNY Mellon defines frontier market countries based on GDP growth, per capita income growth, inflation rate, privatization of infrastructure and social inequalities. With 62 stocks in its basket, the fund has about 43% of assets in the top 10 companies, while financial services has the highest exposure at 42%. With total assets of $38.8 million, it has average volume of 25,000 shares and an expense ratio of 71 basis points. FRN has returned 4.6% so far this year.

FM

FM, holding 107 stocks, is based on the MSCI Frontier Markets 100 Index. The fund has AUM of $16.9 million and trades in average volumes of 388,000. The fund is well diversified, with none of the stocks holding more than 4.7% weight except the top one with 6.3%. Financials dominates in terms of sector exposure, accounting for a whopping 50.2% of total assets. The fund charges an expense ratio of 79 basis points. It has lost 1% in the year-to-date period.

-

Comment by Riaz Haq on May 21, 2016 at 8:54am

-

#Pakistan misses GDP goal for 2015-16. Actual 4.7% vs target 5.5%. #Service sector grows 5.7%. #Agri shrinks 0.19%

http://www.dawn.com/news/1259741/pakistan-misses-economic-growth-ta...

The country missed the economic growth target for the current financial year by a wide margin mainly because of widespread dismal performance by the agriculture sector. The gross domestic product (GDP) grew by 4.7 per cent against the target of 5.5pc.

At a meeting on Friday of the national accounts committee comprising senior representatives from the four provinces and regions and technical experts, the performance of all economic sectors was added up that showed higher than targeted growth by the industrial sector. The services sector achieved its growth target of 5.7pc.

But the most worrying aspect of the year was a 0.19pc negative growth by agriculture as a whole against the target of 3.9pc.

Cotton output led the freefall in the agriculture sector, considered the backbone of the national economy, as it posted a negative growth of 27pc. The cotton output stood at 10.1 million bales against the target of 13.96m bales. Last year, its output stood at 13.9m bales with a 9.5pc growth.

As a result, cotton ginning declined by 21pc against the target of 5pc. Important crops output fell by 7.18pc against the target of 3.2pc, while other crops fell by 6.2pc against the target of 4.5pc.

Wheat production grew by a meager 0.61pc to 25.47 million tonnes.

The livestock sector grew by 3.63pc, but remained short of the 4.1pc target, while fisheries increased by 3.3pc, surpassing the 3pc target. Forestry was the only saving grace in the agriculture sector as it grew by 8.8pc against the target of 4pc.

On an overall basis, industry grew by 6.8pc against the target of 6.4pc. It was supported by the construction and electricity sectors — the linchpins of the Pakistan Muslim League-Nawaz government’s development focus.

Last year, industry had grown by 3.6pc.

The mining and quarrying sector grew by 6.8pc against the target of 6pc, but the overall manufacturing sector could not meet growth expectations. The manufacturing sector posted a growth of 5pc, but remained short of the 6.1pc target. It had grown by 3.2pc last year.

The most important sector in industrial domain — large scale manufacturing (LSM) — also could not meet its growth target of 6pc. It grew by 4.6pc. LSM had improved by only 2.4pc last year. Small and household manufacturing grew by 8.2pc against the target of 8.3pc.

The construction sector grew by 13.1pc as it went beyond the 8.5pc target, while electricity generation and gas distribution improved by 12.2pc against the target of 6pc.

The services sector could meet the target of 5.7pc, but this was mainly supported by an increase in the salary of government employees. This was evident from an 11.13pc growth in general government services against the target of 6pc.

Transport, storage and communication services grew by 4.1pc against the target of 6.1pc, while wholesale and retail trade improved by 4.57pc against the target of 5.5pc.

The finance and insurance sector exceeded the target of 6.5pc with a 7.1pc growth. Housing services stood at 3.99pc against the target of 4pc.

Likewise, other private services improved by 6.64pc against the target of 6.4pc.

-

Comment by Riaz Haq on May 22, 2016 at 12:14pm

-

'ICBC is positive on #Pakistan's future,' CEO, Industrial & Commercial Bank of #China #CPEC | Business Recorder

http://www.brecorder.com/br-research/brief-recordings/0:/47533:icbc...

BRR: How important will CPEC be for ICBC?

HS: CPEC is the landmark of trade and economic cooperation between China and Pakistan. We cannot praise more of its significance to the governments and commercial sectors of both countries. As the only Chinese commercial bank that has set up branches in Pakistan, ICBC of course plays an indispensable role in the development of CPEC. Firstly, CPEC brings mega infrastructure and energy projects to Pakistan and ICBC, with its global financial capacity, is undoubtedly the natural partner for the finance of these big projects.

Secondly, along with CPEC, more and more Chinese enterprises are coming to Pakistan and seeking for business opportunities. ICBC, as the local Chinese commercial bank, will serve as an important channel for such clients to understand better the environment of investment in Pakistan. In addition, CPEC also sets a sound foundation for the usage of cross-border RMB settlement and ICBC is an incomparable expert in providing quality services to our customers in this area.

As a matter of fact, ICBC is already playing an indispensable role in CPEC, being one of the major finance providers to the major projects. During Chinese President Xi's visit to Pakistan last year, ICBC signed four contracts worth $4.5 billion. So far, the international syndications led by ICBC for projects such as Thar Coal mine and Power station, Dawood Wind Power and Sachal Wind Power have reached financial closure and started drawing down. Other projects such as SK Hydropower Station and Sahiwal Coal Power Station are also soon to reach financial closure. In the mean time, ICBC are also acting as agent bank and custodian bank for many projects of CPEC, ensuring the safety and convenience of the fund management.

BRR: What is your view on Pakistan's economy?

HS: Pakistan is one of the major developing economies with great geographical advantages and her importance as an economy in South Asia cannot be exaggerated. It is of great significance to maintain fast and sustainable economic development of Pakistan for the overall regional economy. ICBC holds a firm and positive view on the future development of Pakistan economy.

A country with the sixth largest population in the world, Pakistan shows huge potential for economic development and is drawing greater attention from international investors. As we shall see, with CPEC going further, Pakistan will benefit a great deal from future investment and infrastructure construction. It is based on such a positive view that ICBC has adopted a long term strategy for the business in Pakistan. ICBC Lahore Branch, the third ICBC branch in Pakistan, was formally inaugurated with the witness of Chinese President Xi Jinping and Pakistani prime minister Mr Muhammad Nawaz Sharif in April 2015, as a high praise of ICBC's presence in Pakistan as well as an indicator of the level of friendly commitment between the two nations. The set-up of Lahore Branch also proves ICBC's long term view and commitment to the local market.

BRR: Will your bank have a role to play with the CPEC investment coming in?

HS: As I have mentioned above, as the largest commercial bank in China, ICBC will primarily focus on facilitating and boosting the trade and economic cooperation between China and Pakistan. It is not just our commitment but also our business foundation to give support to the smooth development of CPEC related projects. With the fast development of local economy, ICBC will be more confident in business operation in Pakistan. For the mutual benefits of China and Pakistan, ICBC will continue to bring her global advantages to Pakistan, give funding and advisory support to local and Chinese enterprises, and make memorable contributions to CPEC.

-

Comment by Riaz Haq on May 23, 2016 at 8:51am

-

#Pakistan stock exchange expects $1 bln of #power IPOs in 2017 and 2018. #loadshedding #energycrisis http://dailym.ai/1TyKvKL via @MailOnline

Pakistan's stock exchange could see initial public offerings of power sector projects amounting to some $1 billion in 2017 and 2018, the bourse's managing director said on Monday.

He also said he also expected Pakistan to regain its stock index emerging market status this year.

Referring to IPOs in the power sector, Nadeem Naqvi told Reuters in an interview:

"The projects that have had financial close and are under construction now, the tendency is that - once they get commissioned - that is the time they come onto the market to restructure their debt-equity ratio, so about $1 billion will come in."

Index provider MSCI said in March it was seeking feedback from investor on reclassifying Pakistan stocks to emerging market status from its current frontier market status - a less liquid and riskier subset of stocks.

The decision to move Pakistan back to the emerging category - from which it was dropped in 2008 - is due in June 2016.

Naqvi said he expected Pakistan to regain its emerging market status soon, if not in June then in December, adding he expected to see money coming in from abroad in anticipation of the decision.

"We saw that in the case of Qatar or the United Arab Emirates, approximately $400 million came in within 6-8 months of the announcement, and the market there is relatively narrow," he said, speaking on the sidelines of a Renaissance Capital investment conference.

"Our market is much more broader, but given Pakistan's risk factor ... I will be very happy if we get about $200-250 million to come in - now this would be the initial arbitragers which would position themselves for the index flows."

Currently, around 30 percent of the freefloat listed on the country's stock exchange was held by international institutional portfolio investors, said Naqvi, adding this would inevitably rise once Pakistan was reclassified.

"Anywhere between 40-45 percent (of foreign ownership) would be a number I would be comfortable with, anything beyond that it becomes risky because the volatility will increase."

He also expects the market capitalisation, currently at $71 billion, to rise above $100 billion in the next five years, thanks to IPOs and share valuations.

"Pakistan's discount against emerging markets is huge, and I think we will be seeing a narrowing of that discount, so even though the global valuations are not going to expand, Pakistan's discount is going to narrow, and there we are going to see that in the market cap."

-

Comment by Riaz Haq on May 25, 2016 at 12:57pm

-

Financial Times: #Pakistan closes in on #MSCI upgrade. #Economy up 4.5%, #Terrorism deaths down 74%. Shares cheap. http://on.ft.com/1qH5eBX

Terrorism-related deaths have fallen 74 per cent from their 2010 peak, economic growth has accelerated to a solid 4.5 per cent, inflation has fallen sharply to around 3.3 per cent and the fiscal deficit has narrowed markedly to around 4.1 per cent of gross domestic product.Charles Robertson, global chief economist at Renaissance Capital, an emerging market-focused investment bank, says, on a per capita basis, the likelihood of being killed by a gun in the US is now higher than that of dying as a result of terrorism in Pakistan.

But now the country may be about to be get some potentially bad news — an upgrade from frontier to emerging market status by MSCI.

The index provider is due to rule on whether Pakistan has done enough to be promoted to EM status on June 14. And while this would be seen by many as a feather in Pakistan’s cap, at least one analyst believes it would have a sting in its tail — a partial exodus by foreign investors.

Pakistan currently has a weight of 8.8 per cent in the MSCI Frontier index (making it the fourth largest country after Kuwait, Argentina and Nigeria) but is only likely to account for around 0.19 per cent of admittedly much more widely followed MSCI EM index if promoted.

As a result, Hasnain Malik, regional head of frontier markets equity strategy at Exotix Partners, an investment bank focused on smaller markets, believes that, in theory at least, “in terms of potential funds flow, the ‘upgrade’ to MSCI EM would be a negative event”.

Admittedly, Mr Malik says this calculation is based on a “simplistic” assumption that all frontier funds currently holding Pakistani stocks would sell as the new wave of EM funds moves in, which may or may not happen.

Others disagree, however, believing that an upgraded Pakistan would attract net inflows from foreign funds, even though it would have the second-lowest weighting in the 24-nation MSCI EM index, above only the Czech Republic.

“Frontier funds are quite index agnostic and I believe would be in no hurry at all to sell,” says Daniel Salter, head of emerging market equity strategy at Renaissance Capital. “They are often able to hold off-index countries such as Saudi, UAE, Qatar and Egypt.”

When it comes to attracting fresh cash from actively managed EM funds, which of course would not need to buy even in the event of Pakistan’s promotion, Mr Salter believes their nose for a bargain will play a role.

The MSCI Pakistan index currently trades at 8.9 times 12-months’ forward earnings, according to Bloomberg estimates, below the 9.7 times of the Frontier market as a whole, the 11.3 times of the MSCI EM index and the 16.7 times of neighbouring India, as the first chart shows.

Among existing constituents of the EM index, only Russia and Turkey are cheaper.

Moreover, liquidity is decent. The $80m daily turnover of the Karachi stock exchange renders Pakistan the second-most liquid market in the frontier world, Mr Salter says.

On the downside, though, actively managed funds benchmarked to the MSCI Frontier index are currently very overweight Pakistan, according to data provider EPFR, as the second chart shows.

This potentially strengthens the argument that Pakistan could witness significant selling if it is upgraded, although as the chart also shows, some frontier funds are happy to invest in the UAE, Egypt and Saudi Arabia, which are no longer in their universe.

Renaissance Capital estimates that a promoted Pakistan would attract $675m of money from actively and passively managed EM funds, outweighing the $570m it estimates actively managed frontier funds hold. Exotix Partners puts the latter figure at anywhere between $1.8bn and $4.4bn.

The general consensus appears to be that Pakistan will be reclassified by MSCI next month, with the upgrade coming into effect at the end of May 2017.

“Our assessment is that, based on the number, size and liquidity of stocks, Pakistan should qualify to enter the EM Index, and that market accessibility is also sufficient,” says Mr Salter.

While there are still shortcomings around stock lending, short selling and the stability of the country’s institutional framework, Mr Salter says, these deficiencies are shared by some countries that have been admitted to EM status, such as Chile, Russia and Greece.

Mr Malik notes that MSCI itself has commented on Pakistan’s institutional improvements, in areas such as reporting and compliance, and improved liquidity.

Mr Malik adds that compared with previous upgrades, “MSCI’s public consultation papers appear more specific in terms of simulating a list of stocks for inclusion and the implied country weight”.

Nevertheless, he fears that the index provider could be faced with the “commercial reality” that the frontier index could become “excessively weighted towards Kuwait [20 per cent of the index] and Argentina [14 per cent]” should Pakistan be upgraded, particularly given the ongoing doubts about the status of Nigeria, the index third-largest constituent, with a weighting of 13 per cent, which is at risk of ejection due to its imposition of capital controls.

More broadly, Mr Malik argues the whole debate reflects a degree of “dissatisfaction” with the selection criteria for the Frontier index.

He says most investors want an index focused on frontier countries, that is those in an early stage of development or with low sector diversification. Instead, he says, the MSCI index focuses on countries whose stock markets are at an early stage of development.

“They recognise that MSCI has a difficult job, but no one meeting a fund allocator ever says ‘buy my fund because I’m 20 per cent invested in Kuwait’.”

-

Comment by Riaz Haq on May 27, 2016 at 8:38am

-

Excerpts of Seeking Alpha travel report on meeting Pakistani companies at investors conference in Dubai:

http://seekingalpha.com/article/3978199-asia-frontier-capitals-trav...Summary

China Pakistan Economic Corridor "CPEC" - part of China's "One Belt - One Road" initiative will entice massive infrastructure investments in Pakistan.

Pakistan might be upgraded from MSCI Frontier Index to MSCI Emerging Market Index. Decision will be announced by MSCI on 14th June 2016.

MSCI Pakistan ETF one of the few options to invest in Pakistan.

Dubai/Pakistan Travel Report - April 2016

In line with our process of being on the ground in the countries we invest in, Thomas Hugger and Ruchir Desai traveled to Dubai to attend a Pakistan Investor Conference.

Though we usually write travel reports when we visit one of the countries we invest in, this time we traveled to Dubai to meet Pakistani companies. Not that we would not like to visit Pakistan (which we have done in the past) as the investor conference was a good way to meet a number of companies in a span of two days.

Before writing more about Pakistani companies or about the country, Dubai is quite a well-organised place (think Singapore) and the Dubai International Financial Centre "DIFC" where the conference was held is very conveniently located which is about a twenty minute drive from the airport. The DIFC has attracted a fair number of businesses to set up shop there and one can see a pretty big expat population at the DIFC. Dubai gets a large number of tourists so there are more than enough hotels to choose from. The Burj Khalifa and the adjoining Dubai Mall are amongst the major attractions, the former because of it being the tallest building in the world and the latter because it is so huge! Also, construction activity on new buildings was quite evident in the areas close the DIFC and the Dubai Metro seems to be a good way to get around although we did not get a chance to use it since our hotel was walking distance from the venue and luckily at this time of the year the weather was extremely pleasant to walk in.

Quite a bit of construction activity in Dubai

We met a diverse set of thirteen companies across the auto, banking, cement, consumer staple, insurance, media and power sectors and the mood amongst the corporates and other investors regarding the Pakistani economy in general was positive. There are a few reasons for this positive mood. Lower crude oil prices has been a huge positive for Pakistan as crude oil accounted for ~26% of total imports before the drop in oil prices and this has helped bring down the country's import bill and strengthen its foreign reserves position. Foreign reserves currently stand at about USD 20.3 billion which is an import cover of ~5.5 months. This is a much more healthy position than mid-2013 when foreign reserves covered only around 2 months of imports.

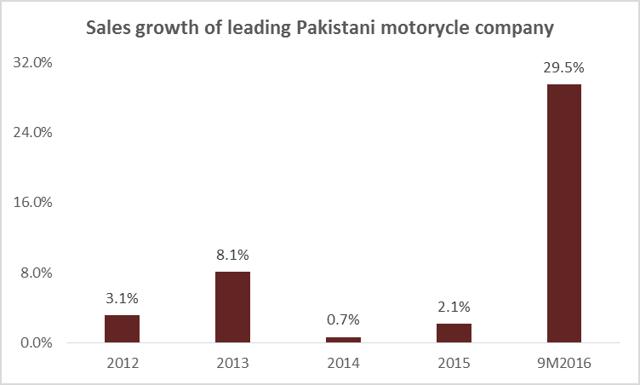

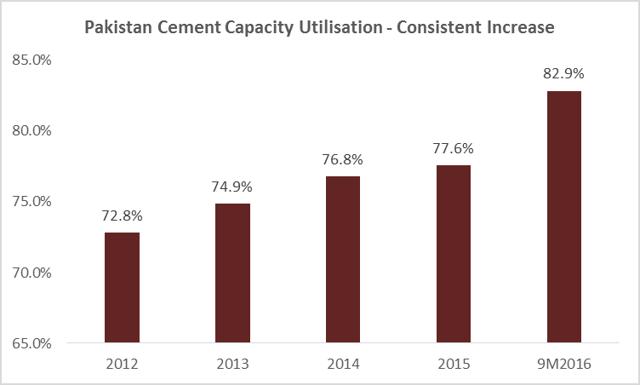

Lower crude oil prices and that of commodities in general has helped bring down inflation and interest rate to record lows and this has led to an increase in sales of consumer discretionary goods as consumer disposable incomes have improved. Further, the low interest rate environment has led to a pick-up in construction activities which has led to a double-digit growth in cement volumes over the past nine months.

Macro Positives for Pakistani Consumer Discretionary and Cement Companies

Source: Pakistan Automotive Manufacturers Association, All Pakistan Cement Manufacturers Association

Besides these positive tailwinds for the economy, another long-term positive for Pakistan could be the China Pakistan Economic Corridor "CPEC" which will eventually connect Gwadar in Southwest Pakistan with the Xinjiang province in Northwest China. The CPEC is a part of China's One Belt One Road initiative and it consists of investing a total of USD 45 billion over a fifteen year period in power, road and port projects. The majority of investment is expected to be in the power sector with a total of ~USD 34 billion to be spent on putting up new power capacity primarily using coal-based power plants. These new power projects are expected to lead to an increase of ~17,000 megawatts in generation capacity and this can go a long way in resolving the power deficit that Pakistan currently faces. Any improvement in the power situation will only be a positive for economic growth as there is a power deficit at present due to the mismatch between generation capability and demand.

The other CPEC-related investments are linked to infrastructure projects such as highways, rail networks and ports. An important infrastructure initiative within the CPEC is the Gwadar port related project which besides further developing the port also includes an international airport and a highway. The CPEC could be a big positive for the Pakistani economy and though there is execution risk, the project is expected to be geopolitically important to both China and Pakistan.

Source: Planning Commission of Pakistan

Some of the companies we met were existing holdings and some we were meeting for the first time. From our existing holdings, the company which we like and which we met with is "The Searle Company Ltd.," a pharmaceutical company which focuses on generic products. It is amongst the Top 10 pharmaceutical companies in the country in terms of revenue and it has a strong presence in the cardio vascular, gastro and cough syrup space. Revenues and profits for the company have grown at a CAGR of 17% and 30% over the last five financial years respectively. This company is the fund's second biggest position and has been amongst the top performers for the fund over the past two years. The other sector which we find interesting is the cement sector and both the cement companies we met were extremely positive about the outlook and this is not surprising given the growth in cement sales as mentioned previously. The fund is currently invested in two Pakistani cement companies and one of them has been a leading contributor to performance over the past year.

Another interesting company we met was "Shifa Intl. Hospitals," a hospital chain company which currently operates a hospital in Islamabad and Faisalabad and plans to expand capacity into Lahore. Besides this, the company also has a laboratory business which it could expand in the future. The fund is currently invested in this company. There was one bank present at the conference and the outlook for the Pakistani banking sector is soft as their margins are expected to come under pressure due to the reinvestment risk they face as a large portion of their government bonds are expected to mature in 2016. Having said that, most Pakistani banks are fundamentally sound in terms of loan loss coverage ratios and capital adequacy ratios.

We also met with one of the leading auto companies in Pakistan, "Indus Motor Company Ltd." and their sales growth over the past year has been in double digits leading to capacity constraints which they plan to overcome in the short run but they would need new capacity in the long run. The Pakistan automobile market does hold a lot of potential as car penetration in Pakistan at 13 per 1,000 people is lower than India which is 18 per 1,000 people. A new auto policy recently passed by the government could bring more investment into the country and may also lead to more competition which could possibly lead to new model launches by the existing players and this can be positive for overall growth of the industry.

The government appears to be keen to reform as it looks to privatise certain state run entities, improve the law and order situation and reduce the power deficit through greater investment via the CPEC. Though these are longer-term themes, in the near term, the country is in a better position relative to 2013 given low commodity prices, inflation and interest rates which are expected to have a positive impact on the cement and consumer discretionary sectors. We do worry though about the impact of overseas worker remittances from the Middle East as these account for ~65% of total remittances. Pakistan received ~USD 19 billion of remittances and a significant slowdown would be negative not only for its current account deficit but could also dampen consumer spending.

We recommend to invest via MSCI Pakistan ETF (NYSEARCA:PAK) or through the AFC Asia Frontier Fund, which has currently 20.6% of the fund invested in Pakistan.

-

Comment by Riaz Haq on May 29, 2016 at 3:52pm

-

#Pakistan Per capita income up 2.9pc to $1561 in 2015/16 https://www.geo.tv/latest/106496-Per-capita-income-up-29pc-to-1561-... …

The country’s per capita income rose 2.9 percent to $1,561 in the current fiscal year, a document revealed on Monday, as the stable exchange rate kept the growth nominal.

“As the exchange rate largely remained stable so the per capita income also showed a nominal growth in the current fiscal compared to the last year,” said a source.

The document, available with The News, said the per capita income was calculated at $1,517 for last fiscal year.

The ministry of finance will release the figure of per capita income along with the upcoming Economic Survey (2015-16) before the announcement of the budget for the fiscal 2016-17.

The per capita income grew 9.4 percent to $1,513 in 2014/15 over the preceding fiscal year.

The latest per capita income was based on the population growth rate of 1.94 percent in the current fiscal year as compared to 1.98 percent in the previous fiscal year. The document further showed that investment to GDP ratio slightly declined in the outgoing fiscal year despite significant investment inflows from China under the $46-billion China-Pakistan Economic Corridor (CPEC).

The investment to GDP ratio came down to 15.2 percent from the revised figure of 15.5 percent a year ago. This was mainly due to a downtrend in private investments. “The private sector investment dropped to 9.8 percent of GDP in the current fiscal year of 2015/16 from 10.2 percent in 2014/15,” said an official. “This also indicated that the private sector is still reluctant to go for the new investments in modernising.”

The State Bank of Pakistan (SBP) said foreign private investment in the country fell 64.7 percent to $635 million in July-April. It was $1.8 billion in the corresponding period of the last fiscal year. Foreign direct investment (FDI) and portfolio investments are the major components of the total foreign investment. In July-April 2015/16, the portfolio investment outflows amounted to $381.2 million as compared to inflows of $836.8 million in the same period a year ago.

Chinese investment in the country jumped one-and-half time to $550 million, more than half of FDI in the first 10 months of the current fiscal year. The SBP said the FDI inflows from China amounted to $218 million in the corresponding months of 2014/15.

The overall FDI posted a growth of 5.4 percent to $1.016 billion in July-April 2015/16 over the same period a year earlier.

Sector-wise analysis revealed that power sector was the main recipient of FDI during the period under review. The inflows of FDI towards the sector posted a sharp growth of 208 percent to $518 million.

The country is attracting foreign companies in various sectors. It attracted substantial amount of foreign investment in mid 2000s in banking and telecommunication sectors.

The official data showed that the public sector investment was up to 3.8 percent of GDP in 2015/16 from 3.7 percent in 2014/15. It further showed that the savings to GDP ratio also declined slightly as it was down to 14.5 percent in 2015-16 from 14.7 percent.

-

Comment by Riaz Haq on May 30, 2016 at 12:52pm

-

#Pakistan achives 4.7% #GDP growth in 2015/16, misses target by 0.8%, sets 5.7% target for 2016/17 http://reut.rs/22uhSlF via @ReutersIndia

Pakistan achieved GDP growth of 4.7 percent in the fiscal year ending in June 2016, missing its target of 5.5 percent, the prime minister's office announced on Monday.

The government has set a growth target of 5.7 percent for the next fiscal year, according to a statement. Pakistan's financial year runs from July to June.

Nawaz Sharif's announcement comes ahead of Friday's presentation of his government's budget for the 2016-17 financial year.

The government has set a growth target of 3.5 percent for the agricultural sector, 7.7 percent for the industrial sector and 5.7 percent for the services sector for the coming year.

Friday's budget will include 1,675 billion rupees ($15.98 billion) in National Development Outlay, including 800 billion rupees ($7.63 billion) in federal funds and 875 billion rupees ($8.35 billion) in funds to the provinces, the statement said.

Pakistan's economy, despite its missed targets, grew at its highest rate for eight years this year. It remains plagued by chronic power shortages, poor infrastructure and flagging exports, however.

On May 21, Pakistan's central bank cut its key policy rate by 25 basis points to 5.75 percent, mainly over concern at the missed GDP growth target.

In April 2015, China announced it would invest $46 billion in the China Pakistan Economic Corridor, a project that would link western China to the Arabian Sea through Pakistan, creating a major new trade route.

"CPEC has the capacity for further contributing to GDP and will have far-reaching effect in consolidating the economic outlook of the country in years ahead," said Monday's statement.

Comment

- ‹ Previous

- 1

- 2

- 3

- 4

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

Agriculture, Caste, Religion and Happiness in South Asia

Pakistan's agriculture sector GDP grew at a rate of 5.2% in the October-December 2023 quarter, according to the government figures. This is a rare bright spot in the overall national economy that showed just 1% growth during the quarter. Strong performance of the farm sector gives the much needed boost for about …

ContinuePosted by Riaz Haq on March 29, 2024 at 8:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network