PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan's Actual GDP Estimated at $401 Billion in 2012

Even with the run-up (in KSE-100), Andrew Brudenell, manager of the HSBC Frontier

Markets fund (HSFAX) in London, says Pakistan is one of the cheapest

markets he follows, at about seven times earnings. He notes that

earnings growth has kept pace with the market. The firms, he adds, are

typically cash-rich, boast strong return on equity levels in the 20%

range, and pay good dividends. In Pakistan, the informal, cash-based economy for goods and services is larger than the formal economy. Barron's, November 17, 2012

Growing gap between dismal official economic statistics and consumption boom coupled with strong corporate profits in Pakistan is a challenge for many analysts around the world. Most believe that Pakistan's GDP is, in fact, much larger and growing faster than the government data indicates.

Informal Economy Estimates:

M. Ali Kemal and Ahmed Waqar Qasim, economists at Pakistan Institute of Development Economics (PIDE), have published their research on estimates of the size of Pakistan's informal or underground economy.

Kemal and Qasim explore several published different approaches for sizing Pakistan's underground economy and settle on a combination of PSLM (Pakistan Social and Living Standards Measurement) consumption data and mis-invoicing of exports and imports to conclude that the country's "informal economy was 91% of the formal economy in 2007-08". Here are the figures offered by the authors for 2007-8:

1) Formal Economy: Rs. 10,242 billion= $170 billion (using Rs.60 to a US dollar)

2) Informal Economy: Rs. 9,365 billion = $156 billion

3) Total Economy (Sum of 1 & 2): Rs. 19,608 billion = $326 billion

Assuming that the ratio of formal and informal economy remained the same in 2011-12, here are the figures for Pakistan's total economy as of the end of last fiscal year which ended in June, 2012 :

1) Formal Economy: $210 billion

2) Informal Economy: $191 billion

3) Total Economy: $401 billion

|

| Hypermart Lahore |

Naween Mangi of Businessweek in her piece titled "The Secret Strength of Pakistan's Economy" described how Pakistan's informal cash-based economy evades government's radar, illustrating it with the story

of a tire repair shop owner Muhammad Nasir. Nasir steals water and

electricity from utility companies, receives cash from his customers in

return for his services and issues no receipts, pays cash for his cable

TV connection, and pays off corrupt police and utility officials and

local politicians instead of paying utility bills and taxes.

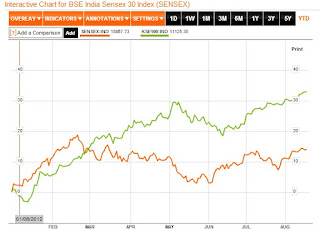

Karachi Stock Market:

|

| Comparing Karachi and Mumbai Share Indexes |

A string of strong earnings announcements by Karachi Stock Exchange

listed companies and the Central Bank's 1.5% rate cut have helped the KSE-100 index exceed 16,000 level, a gain of 42.1% (33.2% in US dollar terms) year to date. In spite of this run-up in KSE-100, Andrew Brudenell, manager of the HSBC Frontier

Markets fund (HSFAX) in London, remains bullish on Pakistani equities, according to Barron's. Pakistan is one of the cheapest

markets he follows, at about seven times earnings. He notes that

earnings growth has kept pace with the market. The firms, he adds, are

typically cash-rich, boast strong return on equity levels in the 20%

range, and pay good dividends.

Conclusion:

While Pakistan's public finances remain shaky, it appears that the country's economy is in fact healthier than what the official figures show. It also seems that the national debt is much less of a problem given the debt-to-GDP ratio of just 30% when informal economy is fully comprehended. Even a small but serious effort to collect more taxes can make a big dent in budget deficits. My hope is that increasing share of the informal economy will become documented with the rising use

of technology. Bringing a small slice of it in the tax net will make a

significant positive difference for public finances in the coming years.

Related Links:

Haq's Musings

Investment Analysts Bullish on Pakistan

Precise Estimates of Pakistan's Informal Economy

Pak Consumer Boom Fuels Underground Economy

Rural Consumption Boom in Pakistan

Pakistan's Tax Evasion Fosters Aid Dependence

Poll Finds Pakistanis Happier Than Neighbors

Pakistan's Rural Economy Booming

Pakistan Car Sales Up 61%

Resilient Pakistan Defies Doomsayers

Land For Landless Women in Pakistan

Pakistan's Circular Debt and Load-shedding

Hypermart Pakistan

-

Comment by Riaz Haq on January 27, 2013 at 6:57pm

-

Here's an ET piece by economist Shahid Javed Burki:

On my way from Pakistan to Washington, I had a chance meeting with a Pakistani economist of considerable repute. We met at Karachi airport’s departure lounge. I have known him for years and have highly valued his work on the Pakistani economy. He surprised me by suggesting that the country was in a much better shape than suggested by some of my writings and those of several others who thought like me. He was of the view that the situation did not warrant the kind of pessimism reflected in our assessments. “Macro numbers may look bad but the real economy is doing reasonably well — in fact very well”, he said. ...

-----------

He told me of a recent visit he and some other economists had taken to Faisalabad — arguably the hub of Punjab’s industrial economy — and came across extraordinary enthusiasm about the future of the country and its economy. “The industrialists and traders we met at the city’s Chamber of Commerce were looking forward to the opening of the economy with India. There was nothing but good in that for them and the country”. But it was not only the entrepreneurs operating in large urban centres of the country that look upon Pakistan’s economic future with hope. “The countryside was booming with consumer durables being sold at rates never seen before”, said my economist friend. “I have traveled up and down the country in recent months and seen with my own eyes what numbers don’t tell. The recent commodity boom in the international market place has done wonders for the Pakistani producers in the countryside and also for rural consumers. There is palpable prosperity in the country’s towns and villages”.

----------

For the last five years, Pakistan has had a representative form of government but the representatives people have sent to the various legislative assembles have served mostly vested interests. Would that change? The tens of thousands of people who followed the preacher-politician Tahirul Qadri to Islamabad did so in the hope of widening the system by including those who are prepared to work for others.http://tribune.com.pk/story/499385/on-the-eve-of-the-third-real-ele...

-

Comment by Riaz Haq on February 22, 2013 at 9:21pm

-

Here's a Dawn Op Ed by Economist Sakib Sherani on Pak informal economy:

NEW estimates indicate that Pakistan’s informal economy is larger than previously approximated, and is expanding at a rapid pace. On the other hand, the formal sector appears to be on the retreat.

Indications to this effect have been around for several years. These indicators have included, among others, a rising share of informal jobs in total employment, a static share of output and employment of the formal manufacturing sector, a growing level of cash transactions in the economy, and an increase in estimates of the “tax gap”.

In addition, firm-level behaviour has also provided clues to the underlying trend in the economy. There are fewer listings on the stock exchanges, and some prominent de-listings, while a fairly significant number of previously formal small and medium enterprises have chosen to become Association of Persons over the past few years, according to some tax experts. Finally, according to some reports, the number of firms on the tax register (for income as well as sales tax) has declined in the past five years.

In fact, anecdotal evidence suggests that in the past few years, there have been instances of even large manufacturing units that have either completely or partially “shifted” production to the underground economy. Evidence to this effect has come from the Federal Board of Revenue (FBR) in the case of at least one significant sector of the economy — cigarettes — where a sharp dip in federal excise duty collection in 2009-10 was attributed to this phenomenon.

-------------

Having set up and run my own small business in the formal sector for the past two years has given me some unparalleled insights. While Jamil Nasir in his article in January (in another newspaper) believes the tax structure is not a big contributor, and the regulatory burden is a bigger factor, my own experience suggests that it is both, the tax and regulatory burden, that are either preventing informal businesses from formalising, or are driving already documented firms into the informal economy.Here’s how. For starters, a formally registered firm filing an income tax return has a 20 per cent disadvantage compared to an enterprise that is operating in the undocumented sector (the tax arbitrage for informal firms). But this is not the end of it. The direct costs of maintaining books, having the firm’s accounts externally audited by a professional auditor, hiring tax consultants and an accountant etc. are not insignificant.

More annoying from my perspective is the opportunity cost of devoting roughly 10-15 per cent of my management time to tax and SECP-related issues, not least of which are chasing up on tax deduction certificates and acting as a withholding tax agent for the government.

In addition, the number of corporate and tax-related filings that the company has to make each month, every quarter, and then on an annual basis is absurd. To incentivise informal sector players to formalise, both the Federal Board of Revenue (FBR) and the Securities and Exchange Commission of Pakistan (SECP) will have to reduce the number of filings, while the transactional relationship with FBR will need to be converted to “arm’s length” via the use of automation.

Finally, the government should consider a system of tax credits and rebates on investment and hiring by small registered businesses, and an initial lower income tax rate for newly corporatised firms as a powerful incentive.

At the other end of the spectrum, the tax and regulatory burden on large, formal firms also needs to be reduced by a comprehensive broad-basing of the tax regime.

-

Comment by Riaz Haq on March 3, 2013 at 12:20am

-

Here's a Dawn Op Ed on hidden economy west of Indus:

GOING by the numbers alone, it would appear that no significant economic activity takes place west of the Indus. Look at the provincial GDP numbers, the revenue figures and you see no movement, no activity on any significant scale.

More detailed metrics of economic activity also show great ‘tranquillity’ in the west. Detailed figures on consumption of electricity by industrial and commercial categories of consumer, for instance, show very little change over the years.

---------

But take a closer look and you’ll find something odd. The State Bank has a data series on its website that shows something enormous, of truly gigantic proportions, stirring beneath the tranquillity suggested by the formal macroeconomic data.Here is what the data reveals: the amount of money passing through the clearing houses of Quetta and Peshawar is so large that it rivals the amounts in clearing houses of cities like Faisalabad, Multan and Rawalpindi.

----

The State Bank operates 16 clearing houses in cities all over the country. Every month it releases data on how many cheques were presented for clearing in each of these, and what the total amount cleared by cheques was.If you take this data, which stretches back to 1999, and plot it for each city in Pakistan, you notice something very interesting. Remove the cities of Karachi and Lahore from the sample for the time being, because these are global cities in a sense with long-distance connections. Compare only the regional cities and here is what you’ll find.

Following 9/11, half the cities in the total sample will show a sharply rising trend in the amount of money going through their clearing houses. For the other half, the line is flat.

The cities that show a rising trend are led by Peshawar, with Faisalabad, Multan, Rawalpindi and Quetta in close succession. For Peshawar, the amount of money being cleared via cheque in the year 2011 crosses Rs1.3 trillion! For Quetta, in the same year, the amount is just under Rs900 billion, meaning between them these two regional cities are seeing almost Rs2tr going through their clearing houses in one year alone.

This figure compares with Faisalabad at Rs1.3tr, Rawalpindi at Rs1.4tr, and Multan at Rs826bn. Cities that show a flat trend over the entire reporting period include Sukkur, Hyderabad, Sialkot and D.I. Khan.

What the data shows is a steep intensification of transactions being cleared by cheque in some cities, and no change in others, meaning the pace of economic activity accelerated unevenly over the decade, sweeping some along its path and leaving others behind.

But what are Peshawar and Quetta doing on this list? With Faisalabad and Multan, it’s easy to understand. These are regional hubs, productive centres, large seats of agrarian operations.

---

In fact, after Karachi and Lahore, it is Multan, Faisalabad and Rawalpindi that account for the bulk of transactions in branchless banking, which shows the intensification of activity in the clearing houses of these cities is accompanied by an overall deepening of the financial sector.But in Peshawar and Quetta, there is no other accompanying trend, not in branchless banking, TT transfers, bulk consumption of electricity. There is only one lone spike, showing an increase in clearing house transactions that keeps pace with the agricultural and industrial heartland of the country.

The obvious question is: what is driving this spike in Quetta and Peshawar? Where is the economic activity that is sending such spectacular sums of money through the clearing houses of these two cities? And why does this money leave no trace on any other economic indicator of the city or the province?

---

Here’s another explanation: these cities are engulfed by a very large hidden economy, from where a massive river of transactions briefly appears on the official record, then disappears from view again....

-

Comment by Riaz Haq on March 23, 2013 at 10:02pm

-

Here's an interesting Op Ed by Mazur Ejaz in Friday Times:

The condition of an economy is often confused with the financial health of its government. Pakistan's economy is perceived to be in a deep hole because of its near-bankrupt fiscal conditions. Similarly, America's inability to settle on a national budget is taken to be an indicator of the collapse of the US Empire.

In some ways, the condition of the economy and the financial health of the government are separate matters. Major stock market indexes at Karachi Stock Exchange and the Wall Street are at their highest level, but both governments are facing serious financial problems. Most of the countries around the world are facing similar dichotomous situations. So how does one solve the riddle of the corporate sector making record profits while governments around the world are in serious financial jeopardy?

The phenomenon needs to be analyzed at grass-roots level. A shopkeeper from my village comes to mind. He told me that he sells PTCL internet cards grossing about Rs 9,000 every day. There are several other such shops in the village. That means that just in one village, the total sale of PTCL internet cards is up to 50,000 rupees. This consumer item was not present five years ago, which means hundreds of computers have been bought in the village recently. Furthermore, if such luxury products are making such huge profits for village shops, traders throughout the country must be making much larger profits selling essentials every day. One of the indicators of booming business in our village is that the United Bank branch in the village is doing very well, according to its manager.

There are thousands of such villages in the country, and that gives one an idea of the mammoth growth of rural markets. Such an undocumented economy is not even factored in estimating the economic growth of the country. From these supposedly marginal markets, one can extrapolate the profits of the corporate sector in towns and cities.

It may be astounding for some that Pakistan's banking sector is considered fourth in profitability in the entire world. Producers of other major industrial and agricultural products are also making huge profits. Cement, fertilizer, automobile, construction and telecommunication industries are doing extremely well. Other than the textile industry, which has been hit by power shortages, there is hardly any manufacturer or importer/exporter of any kind of goods who is not making money. The stock markets look at the profits of these industries and price them accordingly. Therefore the claims of Pakistan's economic growth are not a fairy tale. The evidence is out there in the market.

The government is also like a large corporation whose income depends mainly on tax revenue. Most of the goods and services (such as roads, defense, education and health) provided by the government are public goods which are not priced directly. The government has to price its public goods through direct taxes on income and sales, or indirectly. Following a certain brand of capitalism, countries like Pakistan and the US are not collecting enough taxes to cover the cost of public goods. They have failed mainly in collecting direct taxes on income. While Pakistan cannot implement an appropriate tax collection mechanism because of corruption, the US has leaned towards favoring high income groups and ended up in a jam. The net result is the same: the rich are getting richer, appropriating most of the new wealth generated....

http://www.thefridaytimes.com/beta3/tft/article.php?issue=20130322&...

-

Comment by Riaz Haq on April 29, 2013 at 8:03pm

-

Here's an Express Tribune report on rebasing Pak GDP from fiscal 2000 to 2006 adding another Rs. 557 billion to GDP:

A new rebasing exercise has been carried out by the Pakistan Bureau of Statistics (PBS), aimed at shifting the base (reference) year for calculation of economic statistics from fiscal 2000 to fiscal 2006. The share of services and agriculture in the overall size of the economy has resultantly increased, while the industrial sector has significantly shed its value. The exercise has resulted in gross value addition of 7.8% or Rs557 billion to the total size of the economy.

Headed by Dr Shahid Amjad, adviser to the prime minister on finance, the PBS Governing Council approved the change on Monday.

“The overall size of the economy from 2006 onwards will now be calculated afresh and presented to the National Accounts Committee (NAC) for approval,” Chief Statistician of Pakistan Asif Bajwa told The Express Tribune. The NAC meeting will also give approval to this year’s official growth rate. It is scheduled to meet on May 3.

As a result of the shift, the total size of the economy in fiscal 2006 will now be considered as Rs7.72 trillion, higher by Rs557 billion than the size of the economy in fiscal 2000.

The current size of the economy, estimated as Rs23.6 trillion in 2012-13, has been calculated keeping the base year as fiscal 2000. Experts say its size will increase after new calculations, which will not only add additional value to this year’s growth rate, but also lower the budget deficit in percentage terms.

Taking the new base year as 2005-06, the size of the agricultural sector now stands at 23% of total Gross Domestic Product (GDP), as against the earlier 20.3%. Due to the rebasing, Rs318 billion has been added to the value of the agriculture sector, taking its total size to Rs1.78 trillion.

The contribution of the services sector to total GDP, meanwhile, has increased to 56% against its earlier share of 52.8%. The value of the services sector in absolute terms has been reassessed as Rs4.4 trillion – higher by Rs547 billion.

At the same time, the industrial sector has shed its value by Rs308 billion, while its share in GDP has shrunk to 20.9%, against an earlier share of 26.8%. Its total value has reduced to Rs1.62 trillion due to major contractions in the sizes of the sub-sectors of large and small scale manufacturing.

Rebasing exercises usually increase the size of the economy due to the addition of new goods and services into the calculation. The government had carried out 223 studies for the last time the economy was rebased, which had been debated extensively in technical committees overseeing the matter.

Bajwa said the technical committee constituted for the recent exercise reviewed every subsector of the economy item-by-item, and had the exercise vetted by experts. Thus, he said, there are no chances of error. The PBS Governing Council was also informed that double counting, omissions and errors have also been rectified as a result of the rebasing.

The rebasing has been done in the light of improvements in international statistical systems, say officials. The availability of new data sources through censuses, surveys and studies, updated prices and industry bases have all been utilised in the exercise.

A similar exercise aimed at rebasing the economy was conducted last year, which immediately ran afoul of analysts as it resultantly reduced the overall size of the economy by Rs2.5 trillion of its value. The exercise had sent waves in the corridors of economic power, as it necessitated a revision of all major economic indicators over the preceding five years..

http://tribune.com.pk/story/542169/calculation-of-economic-statisti...

-

Comment by Riaz Haq on August 18, 2013 at 10:10pm

-

Here's Daily Times review of "Pakistan: Moving Economy Forward":

Ultimately the economic or material base of a society determines its politics and other societal forms and manifestations. Most certainly this adage is as true today as it was in the past, and nobody put it better than Bulleh Shah:

Panj rukan Islam de te cheyaan tukk/Cheyaan jai na hovey te panje jaande mukk.

(Islam comprises five pillars of faith, but the sixth is food/If the sixth is not available the five pillars crumble.)

Two of Pakistan’s senior most economists, Rashid Amjad and Shahid Javed Burki, have in cooperation with a galaxy of respected experts — Parvez Hasan, Afia Malik, Hamna Ahmed, Naved Hamid, Mahreen Mahmud, Hafiz A Pasha, Aisha Ghaus-Pasha, Ehtisham Ahmad, Shahid Amjad Chaudhry, Ishrat Husain, Khalil Hamdani, M Irfan, G M Arif, Muhammad Imran, Sara Hayat, Eric Manes, Azam Chaudhry, Theresa Chaudhry, Muhammad Haseeb, Uzma Afzal, Akmal Hussain and Khalid Ikram — taken up cudgels on behalf of the citizens of Pakistan for a programme of change and transformation. This if pursued with sincerity and discipline can help Pakistan achieve the necessary break with the sordid past of missed opportunities and spoilt chances of the last 66 years. No doubt Pakistan is in dire straits at present.

The book under review is a comprehensive, all-round evaluation of the Pakistani economy. It identifies its weaknesses and bottlenecks as well as proposes practical solutions imperative for sustainable recovery. The clarion call is for fundamental structural change. I have yet to see something comparable in terms of quality scholarship assembled in a brief that favours the primacy of economics over vain ideological state building.

I was pleasantly surprised to learn that even in the worst of circumstances the Pakistani economy had been growing at 5.2 percent annually during 1960-2010. The situation is bad since then but there are some impressive developments. Pakistan is performing better than even Bangladesh when it comes to microfinance while private initiative is helping education go forward significantly.

However, investment has fallen dismally. Therefore, the investment climate and the constraints imposed by a woefully bad energy crisis have to be tackled with determination in order to attract foreign and domestic investment. The article on energy is rigorous and informative, but the need to tap alternative renewable energy sources is not sufficiently emphasised. Pakistan should be ideally suitable for solar energy technology. Needless to say, proverbial corruption and mismanagement of our meagre resources are a great shame. Defence expenditure has to be reduced. It is a huge drain on national resources. A very strong emphasis is laid by the experts on the rule of law, transparency and institution building. Equally, a very powerful argument is developed in favour of inclusive growth by Akmal Hussain.

Attention is also given to the menace of unbridled population growth. Strong emphasis on an effective taxation policy is also made. Regional disparities need to be addressed in the light of the 18th Constitutional Amendment, which presupposes a greater role of provincial economic managers, argues Khalid Ikram. Shahid Amjad Chaudhry highlights the urgent need to tackle the issue of water scarcity and replenish the Indus Water Irrigation System, the “heartthrob of the Pakistan economy”. This is a most timely intervention indeed....

http://www.dailytimes.com.pk/default.asp?page=2013%5C08%5C18%5Cstor...

-

Comment by Riaz Haq on May 27, 2014 at 9:42pm

-

Ratio of informal (shadow) to formal (documented) entrepreneurs:

Indonesia 131

India 127

Philippines 126

Pakistan 109

Egypt 103

In a study of 68 countries, Professor Erkko Autio and Dr Kun Fu from Imperial College Business School estimated that business activities conducted by informal entrepreneurs can make up more than 80 per cent of the total economic activity in developing countries. Types of businesses include unlicensed taxicab services, roadside food stalls and small landscaping operations.

In a study of 68 countries, Erkko Autio and Kun Fu of London's Imperial College Business School found that after Indonesia, India has the second highest rate of shadow entrepreneurs.

This is the first time that the number of entrepreneurs operating in the shadow economy has been estimated.

Shadow entrepreneurs are individuals who manage a business that sell legitimate goods and services but they do not register their businesses. They do not pay tax and operating in a shadow economy where business activities are performed outside the reach of government authorities.

Indonesia has 131 shadow businesses to every business that is legally registered compared to India's 127.

Philippines have 126, Pakistan has 109 and Egypt has 103 shadow businesses to every legally registered business.

Experts say the shadow economy results in loss of tax revenue, unfair competition to registered businesses and also poor productivity - factors which hinder economic development.

As these businesses are not registered it takes them beyond the reach of the law and makes shadow economy entrepreneurs vulnerable to corrupt government officials.

The researchers said, "If India improved the quality of its democratic institutions to match that of Malaysia for example, it could boost its rate of formal economy entrepreneurs by up to 50% while cutting the rate of entrepreneurs working in the shadow economy by up to a third. This means that the government could benefit from additional revenue such as taxes."

The UK exhibits the lowest rate of shadow entrepreneurship among the 68 countries surveyed, with a ratio of only one shadow economy entrepreneur to some 30 legally registered businesses.

Autio said, "Understanding shadow economy entrepreneurship is important for developing countries because it is a key factor affecting economic development. We found that government policies could play a big role in helping shadow economy entrepreneurs transition to the formal economy. This is important because shadow economy entrepreneurs are less likely to innovate, accumulate capital and invest in the economy, which hampers economic growth."

http://timesofindia.indiatimes.com/India/India-has-2nd-highest-no-o...

http://www3.imperial.ac.uk/newsandeventspggrp/imperialcollege/newss...

-

Comment by Riaz Haq on January 18, 2015 at 11:05pm

-

Pakistan’s true economic output is not reflected in the official gross domestic product (GDP) and this is the reason why.

It fails to include important industries that have sprung up since the last census of the manufacturing base was conducted nine years ago.

The State Bank of Pakistan (SBP) highlighted this anomaly in its annual report on The State of the Economy 2013-14, mentioning economic contributors not incorporated in the Large Scale Manufacturing (LSM) and agricultural data.

Manufacturing has a 11% share in economic output, but experts have been going on for years, saying that tens of thousands of establishments from Karachi to Faisalabad are the real drivers of the economy but remain unreported.

The last Census of Manufacturing Industries (CMI) was carried out by the Pakistan Bureau of Statistics (PBS) in fiscal 2005-06 on the basis of response received from 6,417 factories — a number much smaller than the actual size of the industrial base.

Some very large businesses are not covered by the PBS at all.

Engro Polymer and Chemicals, which meets over one-third of the domestic demand for caustic soda, is a glaring example.

Caustic soda holds the largest chunk in the 11 categories of chemicals reported by PBS. Excluding Engro distorts actual output of the industry, the SBP said.

While the production of caustic soda posted a 8.4% year-on-year decline in 2013, Engro Chemicals reported a 5.6% increase in production this year. “The inclusion of this company could have offset the reported decline in caustic soda,” SBP said.

When it comes to automobiles, PBS relies on data provided by the members of Pakistan Automotive Manufacturers Association (Pama). This leaves out leading bus and truck manufacturers like Afzal Motors and Al-Haj Faw Motors that entered the market later.

Textile and food

Similarly, the weightage of cotton yarn and cotton cloth is one of the highest in CMI, together holding 17%. Yet PBS leaves out 90% of the manufacturers as it covers only mill-related activity, which is based on units registered with the Ministry of Textiles.

As a matter of fact, data of wearing apparels and dressing, publishing, printing products and recorded media, fabricated metal products, computers, medical precision and optical instruments, and other industries, is not included as part of LSM, stated the SBP.

“In the food sector as well, demand and production of a number of processed food items like packaged milk, yogurt, dairy items, pastas cereals, has grown in past few years. But the production of these items is not included in LSM data,” it noted.

This basically leaves out manufacturers like Unilever, Kolson, Nestle, Engro Foods and National Foods, it noted.

The story is the same with cosmetics and personal care goods produced by FMCGs like Unilever and P&G that are also not part of the LSM.

Plastic sector

Another sector, which has emerged as an important contributor to the economy, and ignored in CMI, is plastics. The Pakistan Plastic Manufacturing Association (PPMA) has around 6,000 upstream and downstream units, employing 0.6 million people.

----------

Plastic sector has a weight of 0.75% in CMI while data is collected from only 142 units. As per PBS’ own numbers, in 2013-14, Pakistan exported 253, 896 tons of plastics products valued at $350.7 million, which was a 7% decrease compared with plastics exports in the previous year.

SBP also pointed out that while exports are down, imports of raw materials witnessed 26.4% growth in this year, which indicates robust growth in manufacturing in this segment.

The last CMI recorded 3,590 factories in Punjab, 1,825 in Sindh, 673 in Khyber-Pakhtunkhwa (K-P) and 212 in Balochistan.

At basic prices, textile sector had the highest contribution to GDP of 27.41%, food products and beverages 15.82%, chemicals and chemical products 14.83%, and non-metallic mineral products 7.52%.

http://tribune.com.pk/story/823774/misrepresented-and-misunderstood/

-

Comment by Riaz Haq on January 20, 2015 at 10:46pm

-

LSM posted 3.9 percent growth in fiscal year 2014 (FY14) compared to 4 percent in FY13; however the SBP while disagreeing with figures believed actual growth in LSM was better than what was reported by Pakistan Bureau of Statistics (PBS). Reasoning for its contradiction of PBS’s figures, the SBP said the existing LSM index was based on Census of Manufacturing Industries (CMI) that was conducted in FY06 while constructing LSM index, only those sectors were included which had significant value addition to Gross Domestic Product (GDP) at the time of census.

Meanwhile, manufacturing activity in a number of sectors has been enhanced and many new manufacturing units have started operating in country in recent past. Hence, an expanded data coverage exercise of manufacturing units and new categories is required, to present a more realistic picture of LSM in the country, it added.

In annual report for FY14, the SBP said LSM data was not being compiled in Pakistan according to International Standard Industrial Classification (ISIC) of United Nations Statistics Division’s defined 22 broad categories of manufacturing.

As in Pakistan, the coverage of LSM pertains to only 15 sectors identified by the ISIC while data pertaining to manufactures of wearing apparels and dressing, publishing, printing products and recorded media, fabricated metal products (except machinery and equipment), office and accounting machinery and computers, medical precision and optical instruments and recycling of metal and non-metal waste scrap, is not included as part of Pakistan’s LSM.

Pointing out main concerns, the SBP said LSM data for cotton cloth and cotton yarn was collected by Ministry of Textile, which only covered mill sector activity. The non-mill sector, which entails over 90 percent of overall production of cotton cloth in country, is not included in the data set. While the growth in manufacturing textiles posted a slowdown in FY14, the export quantum of almost all textile categories (with the exception of cotton yarn) posted an increase in the year. In fact, the provision of generalised system of preferences plus status from the European Union (EU) suggests strong growth prospects of this sector.

Similarly in automobiles, the PBS reported production of units registered with Pakistan Auto Manufacturers Association only while some leading bus and truck manufacturers namely Afzal Motors and Al-Haj FAW Motors were not included by the PBS. The PBS reports data for 11 categories of chemicals, with caustic soda claiming the largest share. For caustic soda, production of Engro Chemicals, which caters to one-third of the entire domestic demand of caustic soda, is not included in LSM data. The demand and production of a number of processed food items has grown in the past few years (eg packaged milk and products, dairy items, yogurt, pastas, cereals, frozen and ready to cook items etc). The production of these items, however, is not included in LSM data which leaves out large and vibrant manufacturers like Unilever, Kolson, Nestle, Efoods and National Foods.

Similarly, non-food Fast Moving Consumers Goods (FMCGs) products like cosmetics, personal care products and toiletries, which are produced by prominent brands like Unilever, Medicam and Procter and Gamble are also not captured by LSM. The production of plastics is completely absent from LSM data set.

According to Pakistan Plastic Manufacturing Association there are around 6,000 upstream and downstream units operating in the country, employing 0.6 million people. This sector is producing a broad range of products ranging from household items, industrial containers, medical and surgical items, auto parts, stationery items, PVC pipes etc. Yet they are not covered in LSM.

http://www.dailytimes.com.pk/business/14-Dec-2014/sbp-shows-dissati...

-

Comment by Riaz Haq on January 20, 2015 at 10:47pm

-

http://www.sbp.org.pk/reports/annual/arFY14/Real.pdf

Another important issue pertains to the coverage of sectors and manufacturing units, which are

included in LSM by the Pakistan Bureau of Statistics (PBS). The existing LSM index is based on the

Census of Manufacturing Industries (CMI) that was conducted in FY06. 32

While constructing LSM

index, only those sectors were included which had significant value addition to GDP at the time of

census. Our assessment is that not only has manufacturing activity in a number of sectors been

enhanced, many new manufacturing units have started operating in the country in the recent past.

Hence, an expanded data coverage exercise of manufacturing units and new categories is required, to

present a more realistic picture of large scale manufacturing in the country. We believe the actual

growth in LSM is better than what is reported by PBS (Box 2.2).

Box 2.2: Coverage Issues Undermining LSM Growth

Large scale manufacturing data is compiled across countries, according to the International Standard Industrial Classification

( ) of the United Nations Statistics Division, which has defined 22 broad categories of manufacturing.33

In the case of

Pakistan, however, the coverage of LSM pertains to only 15 sectors identified by the ISIC. Data pertaining to manufactures

of wearing apparels & dressing; publishing, printing products & recorded media; fabricated metal products (except

machinery & equipment); office & accounting machinery and computers; medical precision & optical instruments; and

recycling of metal and non-metal waste scrap, is not included as part of Pakistan’s LSM.34

The current LSM index is based

on the Census of Manufacturing Industries (CMI) conducted in FY06.

32 PBS conducted the CMI in 2006 to collect information about industrial activity in the country. Providing this information

by production units, is obligatory under Section 9 & 10 of General Statistics Act 1975, and Section 5 & 6 of Industrial

Statistics Act,1942. PBS is currently engaged in conducting a fresh CMI.

33 http://unstats.un.org/unsd/cr/registry/regcst.asp?Cl=17

34 The manufacturing data as reported by India contains all categories identified in the ISIC. Source:

http://mospi.nic.in/Mospi_New/upload/iip_11_july2014.pdf

35 Similarly in the case of glass, production of one of the leading manufacturers is not captured by LSM index.

http://www.sbp.org.pk/reports/annual/arFY14/Real.pdf

Comment

- ‹ Previous

- 1

- 2

- 3

- 4

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

Agriculture, Caste, Religion and Happiness in South Asia

Pakistan's agriculture sector GDP grew at a rate of 5.2% in the October-December 2023 quarter, according to the government figures. This is a rare bright spot in the overall national economy that showed just 1% growth during the quarter. Strong performance of the farm sector gives the much needed boost for about …

ContinuePosted by Riaz Haq on March 29, 2024 at 8:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network