PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan's Choice: CAREC or SAARC or Both?

Ideally, Pakistan should be a major player in both vibrant regions. However, Indian Prime Minister Narendra Modi's policy of attempting to isolate Pakistan has essentially forced it to choose.

First, Mr. Modi decided to boycott this year's SAARC summit that was scheduled to take place in Islamabad, Pakistan. Then, he unsuccessfully attempted to hijack the BRICS economic summit in India to use it as a political platform to attack and isolate Pakistan. The signal to Pakistan was unmistakable: Forget about SAARC.

Central Asia Regional Economic Cooperation (CAREC):

CAREC is a growing group of nations that is currently made up of 11 members, including China and a list of STANs. The current membership includes Afghanistan (joined CAREC in 2005), Azerbaijan (2003), People's Republic of China (1997), Georgia (2016), Kazakhstan (1997), Kyrgyz Republic (1997), Mongolia (2003, Pakistan (2010), Tajikistan (1998), Turkmenistan (2010) and Uzbekistan (1997).

The last ministerial meeting of CAREC nations was held in Islamabad in October, 2016. The conference theme was “Linking connectivity with economic transformation".

Welcoming fellow ministers, Pakistan's Finance Minister Ishaq Dar talked about the importance of the China-Pakistan Economic Corridor (CPEC) to improve trade flow within the region and with the rest the rest of the world.

Dar said CPEC offered a massive opportunity for connectivity between Central Asia, Middle East and Africa and was bound to play a defining role in economic development of the regions.

Dar said improving the transport corridor was not an end in itself but it was an investment in establishing sound infrastructure and complementary frameworks for shared prosperity of the present and future generations in the region, according to a report in Pakistani media.

CAREC Corridors:

CAREC region is building six economic corridors to link Central Asian nations. Six multi-national institutions support the CAREC infrastructure development, including the Asian Development Bank (ADB), United Nations Development Program (UNDP), International Monetary Fund (IMF), World Bank, Jeddah-based Islamic Development Bank and European Bank for Reconstruction & Development, according to Khaleej Times.

Out of the total $27.7 billion CAREC infrastructure investment so for, $9.9 billion or 36 per cent was financed by ADB, a senior officer of the Manila-based multinational bank told Khaleeej Times.

He said other donors had invested $10.9 billion while $6.9 billion was contributed by CAREC governments. Of these investments, transport got the major share with $8 billion or 78 per cent. Asian Development Bank Vice President Wencai Zhang said: "There are huge financing requirements in Carec for transport and trade facilitation, for which 108 projects have been identified at an investment cost of $38.8 billion for the period 2012-2020. Investment for the priority energy sector projects will be $45 billion in this period."

CPEC North-South Corridor:

China Pakistan Economic Corridor (CPEC) is a major part of the north-south corridor that will allow trade to flow among CAREC member countries, many of which are resource-rich but landlocked nations. The corridor will enable the group to access to the Pakistani seaports in Gwadar and Karachi as part of the new maritime silk route (MSR) as envisioned by China and Pakistan.

Pakistan's Finance Minister Dar says the CPEC would complement the regional connectivity initiatives of CAREC. "Once the six CAREC corridors and mega ports, now under construction, start operating, they will provide access to global markets. They will deliver services that will be important for national and regional competitiveness, productivity, employment, mobility and environmental sustainability. All of us should gear our national policies to achieve these targets."

CPEC consists of transport and communication infrastructure—roads, railways, cable, and oil and gas pipelines—that will stretch 2,700 kilometers from Gwadar on the Arabian Sea to the Khunjerab Pass at the China-Pakistan border in the Karakorams.

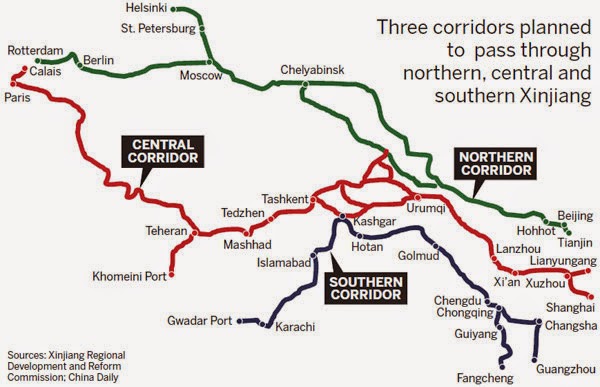

China and Pakistan are developing plans for an 1,800 kilometer international rail link from the city of Kashgar in the Xinjiang Uygur autonomous region in Western China to Pakistan's deep-sea Gwadar Port on the Arabian Sea, according to Zhang Chunlin, director of Xinjiang's regional development and reform commission.

"The 1,800-kilometer China-Pakistan railway is planned to also pass through Pakistan's capital of Islamabad and Karachi," Zhang Chunlin said at the two-day International Seminar on the Silk Road Economic Belt in Urumqi, Xinjiang's capital, according to China Daily.

"Although the cost of constructing the railway is expected to be high due to the hostile environment and complicated geographic conditions, the study of the project has already started," Zhang said. "China and Pakistan will co-fund the railway construction. Building oil and gas pipelines between Gwadar Port and China is also on the agenda," Zhang added.

Pakistan is making a serious effort to stabilize Afghanistan, a member of CAREC. A trilateral conference of China, Russia and Pakistan is scheduled this month in Moscow as part of this effort. Afghan instability has prevented Pakistan from connecting with other STANs for commerce and trade. Now the development of CPEC will enable Pakistan to bypass Afghanistan, if necessary, to connect with Central Asia region through Western China.

Summary:

History shows that growth of regional and global trade in East Asia, Europe and North America regions has been a major driver of economic opportunity and prosperity. Unfortunately, SAARC has been a huge disappointment for Pakistanis. With the development of CPEC and CAREC, Pakistan can now begin to participate in the growth of regional and global trade that will benefit the people of Pakistan. The path to Pakistan's participation in SAARC will open up if or when India-Pakistan relations improve.

Here's a National Geographic Documentary on CPEC:

https://youtu.be/q2lWYxbIBCs

Related Links:

Haq's Musings

1800 Km Pak-China Rail Link

China Pakistan Economic Corridor

CPEC to Create Over 2 Million Jobs

Modi's Covert War in Pakistan

ADB Raises Pakistan GDP Growth Forecast

Gwadar as Hong Kong West

China-Pakistan Industrial Corridor

Indian Spy Kulbhushan Yadav's Confession

Ex Indian Spy Documents RAW Successes Against Pakistan

Pakistan FDI Soaring with Chinese Money for CPEC

-

Comment by Riaz Haq on December 25, 2022 at 4:38pm

-

CAREC ENERGY OUTLOOK 2030

https://www.adb.org/sites/default/files/publication/850111/carec-en...

Regulatory Framework

Upon obtaining independence in 1947, Pakistan introduced several authorities to regulate the energy

market (Government of Pakistan 1958). The Water and Power Development Authority (WAPDA), which

served as a key player in the power sector, was unbundled in the 1990s to ensure the establishment

of a liberalized energy market and fair competition. As a consequence, both private operators and

state-owned enterprises became eligible to participate in the generation sector via a single-buyer

scheme. The Generation, Transmission and Distribution of Electric Power Act has introduced a newly

established independent authority: the National Electricity and Power Regulatory Authority (NEPRA),

which regulates power sector companies and sets tariffs and operational standards. One of the key laws

on energy efficiency, the National Energy Efficiency and Conservation Act, established a National Energy

Efficiency and Conservation Authority, with a mandate to set the strategic direction and national standards

for energy efficiency measures (The Gazette of Pakistan 2016).

Two authorities, the Private Power and Infrastructure Board (PPIB) and the Alternative Energy

Development Board (AEDB), were established as the main institutions, providing support to private

energy project developers as well as investors (Government of Pakistan, AEDB 2006; The Gazette o

Pakistan 2012). Each board has been established for specific projects: the PPIB was created and tasked to

approve conventional generation projects, while the AEDB was responsible for the approval of renewable

energy projects.

Fossil fuel production in Pakistan is regulated by a set of rules for oil, natural gas, and coal, which govern

the process of obtaining permission for the exploration and production of fossil fuels. The Oil and Gas

Regulatory Authority (OGRA) is a primary regulator of the market and licensing authority. The Authority

issues licenses for coal, oil, and natural gas through a competitive bidding process. Coal and petroleum

development and production licenses are given for 25 years, with the possibility of renewal for 5 years.

With increasing market transparency and private sector participation in energy projects leading to

growing investments, the country has introduced a general concept for a competitive electricity market.

These new rules, already published by NEPRA and coming into force in 2022, are regulating the transfer

from a single-buyer model to a competitive model in the wholesale segment (Khan 2020).

The natural gas market, in contrast, is still operating under the single-buyer scheme, and a competitive

market for natural gas supply is yet to be introduced, as state-owned utilities act as single monopolies.

-

Comment by Riaz Haq on December 25, 2022 at 4:38pm

-

CAREC ENERGY OUTLOOK 2030

https://www.adb.org/sites/default/files/publication/850111/carec-en...

Regulatory Framework

Upon obtaining independence in 1947, Pakistan introduced several authorities to regulate the energy

market (Government of Pakistan 1958). The Water and Power Development Authority (WAPDA), which

served as a key player in the power sector, was unbundled in the 1990s to ensure the establishment

of a liberalized energy market and fair competition. As a consequence, both private operators and

state-owned enterprises became eligible to participate in the generation sector via a single-buyer

scheme. The Generation, Transmission and Distribution of Electric Power Act has introduced a newly

established independent authority: the National Electricity and Power Regulatory Authority (NEPRA),

which regulates power sector companies and sets tariffs and operational standards. One of the key laws

on energy efficiency, the National Energy Efficiency and Conservation Act, established a National Energy

Efficiency and Conservation Authority, with a mandate to set the strategic direction and national standards

for energy efficiency measures (The Gazette of Pakistan 2016).

Two authorities, the Private Power and Infrastructure Board (PPIB) and the Alternative Energy

Development Board (AEDB), were established as the main institutions, providing support to private

energy project developers as well as investors (Government of Pakistan, AEDB 2006; The Gazette o

Pakistan 2012). Each board has been established for specific projects: the PPIB was created and tasked to

approve conventional generation projects, while the AEDB was responsible for the approval of renewable

energy projects.

Fossil fuel production in Pakistan is regulated by a set of rules for oil, natural gas, and coal, which govern

the process of obtaining permission for the exploration and production of fossil fuels. The Oil and Gas

Regulatory Authority (OGRA) is a primary regulator of the market and licensing authority. The Authority

issues licenses for coal, oil, and natural gas through a competitive bidding process. Coal and petroleum

development and production licenses are given for 25 years, with the possibility of renewal for 5 years.

With increasing market transparency and private sector participation in energy projects leading to

growing investments, the country has introduced a general concept for a competitive electricity market.

These new rules, already published by NEPRA and coming into force in 2022, are regulating the transfer

from a single-buyer model to a competitive model in the wholesale segment (Khan 2020).

The natural gas market, in contrast, is still operating under the single-buyer scheme, and a competitive

market for natural gas supply is yet to be introduced, as state-owned utilities act as single monopolies.

-

Comment by Riaz Haq on December 25, 2022 at 4:39pm

-

CAREC ENERGY OUTLOOK 2030

https://www.adb.org/sites/default/files/publication/850111/carec-en...

Policy Framework

Several governmental decrees have set the policy framework for the energy sector. The main government

priorities in power generation were outlined in the Power Generation Policy and Transmission Line Policy

in 2015 (Government of Pakistan, PPIB 2015). The priorities for renewable energy were set in 2019 in

the Alternative and Renewable Energy Policy (Government of Pakistan 2019). The government has also

published a National Energy Conservation Policy to promote the use of domestically available resources.

The following priorities were outlined in the abovementioned policy documents:

(i) Development of renewable energy. With the established target for renewable energy

generation in the electricity mix (up to 30% of nonhydropower renewables and 30% of

hydropower by 2030), Pakistan aims to attract more investment into its renewables sector

(Qasim 2020). The government has already started facilitating investments in sustainable

energy sources, mainly by encouraging lower tariffs via introducing competitive bidding and

offering tax benefits as well as incentives for local production of renewable energy equipment,

such as solar panels and wind turbines.

(ii) Improvement in energy efficiency. Pakistan aims to increase the energy sector’s profitability

and sustainability by reducing energy losses as well as increasing energy efficiency. Specifically,

to realize the country’s considerable energy-saving potential of, on average, 25% in key sectors

(industry, residential, transport, and agriculture), the NEECA will be implementing a number of

policies: developing necessary regulations, introducing the national scheme for certified energy

auditors, establishing national Energy Efficiency awards, etc.

(iii) Introduction of a competitive energy market. As stated in the country’s Power Generation

Policy, Pakistan aims to provide sufficient power generation capacity and high-quality energy

services at the least cost. The country plans to achieve that by enhancing fair competition and

market liberalization. In 2020, NEPRA approved a detailed framework and implementation plan

for a competitive trading bilateral contract market, the main goal of which is to establish the

competitive wholesale electricity market with multiple sellers and buyers by 2022.

(iv) Promotion of domestic exploration and production of oil and natural gas resources. Through

optimized pricing and licensing mechanisms, Pakistan wants to further develop its domestic

production of fossil fuels to become more self-reliant and reduce its dependence on imports

(the share of imports constituted around 40% of the total primary supply in 2018).

Forecast Methodology

One of the objectives of this country study is to present a detailed overview and analysis of future energy

market trends in Pakistan. For this purpose, three scenarios were developed, considering the country’s

regulatory framework, technological development, and consumer preferences, among other factors

(Box 17). Supply and demand, technology, carbon emissions, and investment outlooks were derived

based on these scenarios.

-

Comment by Riaz Haq on December 25, 2022 at 4:39pm

-

CAREC ENERGY OUTLOOK 2030

https://www.adb.org/sites/default/files/publication/850111/carec-en...

Policy Framework

Several governmental decrees have set the policy framework for the energy sector. The main government

priorities in power generation were outlined in the Power Generation Policy and Transmission Line Policy

in 2015 (Government of Pakistan, PPIB 2015). The priorities for renewable energy were set in 2019 in

the Alternative and Renewable Energy Policy (Government of Pakistan 2019). The government has also

published a National Energy Conservation Policy to promote the use of domestically available resources.

The following priorities were outlined in the abovementioned policy documents:

(i) Development of renewable energy. With the established target for renewable energy

generation in the electricity mix (up to 30% of nonhydropower renewables and 30% of

hydropower by 2030), Pakistan aims to attract more investment into its renewables sector

(Qasim 2020). The government has already started facilitating investments in sustainable

energy sources, mainly by encouraging lower tariffs via introducing competitive bidding and

offering tax benefits as well as incentives for local production of renewable energy equipment,

such as solar panels and wind turbines.

(ii) Improvement in energy efficiency. Pakistan aims to increase the energy sector’s profitability

and sustainability by reducing energy losses as well as increasing energy efficiency. Specifically,

to realize the country’s considerable energy-saving potential of, on average, 25% in key sectors

(industry, residential, transport, and agriculture), the NEECA will be implementing a number of

policies: developing necessary regulations, introducing the national scheme for certified energy

auditors, establishing national Energy Efficiency awards, etc.

(iii) Introduction of a competitive energy market. As stated in the country’s Power Generation

Policy, Pakistan aims to provide sufficient power generation capacity and high-quality energy

services at the least cost. The country plans to achieve that by enhancing fair competition and

market liberalization. In 2020, NEPRA approved a detailed framework and implementation plan

for a competitive trading bilateral contract market, the main goal of which is to establish the

competitive wholesale electricity market with multiple sellers and buyers by 2022.

(iv) Promotion of domestic exploration and production of oil and natural gas resources. Through

optimized pricing and licensing mechanisms, Pakistan wants to further develop its domestic

production of fossil fuels to become more self-reliant and reduce its dependence on imports

(the share of imports constituted around 40% of the total primary supply in 2018).

Forecast Methodology

One of the objectives of this country study is to present a detailed overview and analysis of future energy

market trends in Pakistan. For this purpose, three scenarios were developed, considering the country’s

regulatory framework, technological development, and consumer preferences, among other factors

(Box 17). Supply and demand, technology, carbon emissions, and investment outlooks were derived

based on these scenarios.

-

Comment by Riaz Haq on December 25, 2022 at 4:41pm

-

CAREC ENERGY OUTLOOK 2030

https://www.adb.org/sites/default/files/publication/850111/carec-en...

Supply and Demand Outlook

Rapid economic development and population growth in Pakistan are the main drivers for growth in

primary demand, which is projected to increase from 111 million toe in 2018 to 125–154 million toe in

2030, depending on the scenario. Demand has fallen during the COVID-19 pandemic, with nearly

a 4% decrease from 2019 to 2020, although rapid recovery and growth in demand is expected. In the

Business-as-usual (BAU) scenario, primary energy demand grows significantly at an annual rate of

3.1%, as this scenario assumes low to moderate efficiency gains and limited reductions of T&D losses.

As for the Government Commitments scenario, annual growth is lower, at 1.4%, due to higher efficiency

gains and lower grid losses. The Green Growth scenario shows the lowest compound annual growth rate

among the three scenarios, with only 1.2% growth until 2030, assuming the greatest reduction of energy

intensity (Figure 68).

In terms of energy sources, natural gas remains the most important energy resource in all three scenarios,

driven by the country’s large fleet of gas vehicles, and by direct consumption in the residential and

industrial sectors.

Box 17: Scenarios for Pakistan’s Energy Sector

Business-as-usual scenario: Projected energy supply and demand, with current energy system and policies;

Government Commitments scenario: Projected energy supply and demand, considering individual priorities of

the Government of Pakistan; and

Green Growth scenario: Projected energy supply and demand, considering enhanced energy transition and

environmental policies.

Electricity generation in Pakistan is mainly dominated by fossil fuel sources, specifically natural gas and oil.

Alternative energy sources in Pakistan consist mainly of hydropower and nuclear, while the share of wind

and solar PV is much lower. The Government Commitments scenario assumes a large share of renewables

in the mix, followed by a decrease in fossil fuel-generated power. The BAU scenario assumes a slower

expansion of renewable resource generation, leading to prolonged reliance on fossil fuels in 2030. In both

Government Commitments and Green Growth scenarios, many natural gas- and oil-fired power plants

are decommissioned, and their capacities are replaced by renewable energy.

Nonetheless, a shift toward renewables is evident in all scenarios via the expansion of hydropower

capacities and the further expansion of wind- and solar-powered plants. The Green Growth scenario

assumes the most ambitious development of nonhydropower renewables, leading to a 20% share of

wind and a 10% share of solar PV in 2030. Under the Government Commitments scenario, the share of

wind reaches 16% and solar PV is 9%, compared to much slower developments under the BAU scenario,

where wind energy reaches 7% and solar PV only 2%. Furthermore, reflecting a broad push toward the

development of hydropower, the expansion of hydropower capacity is assumed in all scenarios, with the

highest being in the Green Growth scenario (43% of the total generation mix) (Figure 69).

-

Comment by Riaz Haq on December 25, 2022 at 4:41pm

-

CAREC ENERGY OUTLOOK 2030

https://www.adb.org/sites/default/files/publication/850111/carec-en...

Supply and Demand Outlook

Rapid economic development and population growth in Pakistan are the main drivers for growth in

primary demand, which is projected to increase from 111 million toe in 2018 to 125–154 million toe in

2030, depending on the scenario. Demand has fallen during the COVID-19 pandemic, with nearly

a 4% decrease from 2019 to 2020, although rapid recovery and growth in demand is expected. In the

Business-as-usual (BAU) scenario, primary energy demand grows significantly at an annual rate of

3.1%, as this scenario assumes low to moderate efficiency gains and limited reductions of T&D losses.

As for the Government Commitments scenario, annual growth is lower, at 1.4%, due to higher efficiency

gains and lower grid losses. The Green Growth scenario shows the lowest compound annual growth rate

among the three scenarios, with only 1.2% growth until 2030, assuming the greatest reduction of energy

intensity (Figure 68).

In terms of energy sources, natural gas remains the most important energy resource in all three scenarios,

driven by the country’s large fleet of gas vehicles, and by direct consumption in the residential and

industrial sectors.

Box 17: Scenarios for Pakistan’s Energy Sector

Business-as-usual scenario: Projected energy supply and demand, with current energy system and policies;

Government Commitments scenario: Projected energy supply and demand, considering individual priorities of

the Government of Pakistan; and

Green Growth scenario: Projected energy supply and demand, considering enhanced energy transition and

environmental policies.

Electricity generation in Pakistan is mainly dominated by fossil fuel sources, specifically natural gas and oil.

Alternative energy sources in Pakistan consist mainly of hydropower and nuclear, while the share of wind

and solar PV is much lower. The Government Commitments scenario assumes a large share of renewables

in the mix, followed by a decrease in fossil fuel-generated power. The BAU scenario assumes a slower

expansion of renewable resource generation, leading to prolonged reliance on fossil fuels in 2030. In both

Government Commitments and Green Growth scenarios, many natural gas- and oil-fired power plants

are decommissioned, and their capacities are replaced by renewable energy.

Nonetheless, a shift toward renewables is evident in all scenarios via the expansion of hydropower

capacities and the further expansion of wind- and solar-powered plants. The Green Growth scenario

assumes the most ambitious development of nonhydropower renewables, leading to a 20% share of

wind and a 10% share of solar PV in 2030. Under the Government Commitments scenario, the share of

wind reaches 16% and solar PV is 9%, compared to much slower developments under the BAU scenario,

where wind energy reaches 7% and solar PV only 2%. Furthermore, reflecting a broad push toward the

development of hydropower, the expansion of hydropower capacity is assumed in all scenarios, with the

highest being in the Green Growth scenario (43% of the total generation mix) (Figure 69).

-

Comment by Riaz Haq on December 26, 2022 at 9:58am

-

Pakistan, Uzbekistan sign MoUs to increase bilateral trade to $1bn

https://www.dawn.com/news/1728370/pakistan-uzbekistan-sign-mous-to-...

Pakistan and Uzbekistan on Monday finalised agreements to expand investment and increase bilateral trade to $1 billion.

To this end, Commerce Minister Naveed Qamar and Uzbek Deputy Prime Minister Khodjave Jamshid Abdukhakimovich signed nine Memoranda of Understanding (MoUs).

Talking to the media on the occasion, Qamar said the two countries had decided to implement the Preferential Trade Agreement from February 1, 2023.

In a press release issued afterwards, the commerce ministry said the two countries also discussed the implementation of the Agreement between Uzbekistan and Pakistan on Transit Trade (AUPTT) and Uzbekistan would notify rules in this regard in February.

They also decided to undertake a joint visit to the Afghan capital in the last week of January to discuss problems faced by Pakistani and Uzbek transporters.

“Both sides agreed to formulate a joint strategy for transit trade through Afghanistan. Regional understanding on Transit and Trade Framework to be prepared including joint fund/mechanism for the upkeep of road infrastructure in Afghanistan.”

Uzbekistan requested an off-dock terminal at Karachi and Gwadar ports and was assured full facilitation, the statement added.

Besides this, the countries also decided to hold trade exhibitions and prepare a strategy to cooperate in e-commerce.

The Uzbek delegation is scheduled to meet a number of officials during its visit, including Prime Minister Shehbaz Sharif.

Uzbek President Shavkat Mirziyoyev had visited Pakistan earlier this year. During his visit, a number of agreements and MoUs were signed by the two sides. An MoU was signed between Uzbekistan’s Ministry of Tourism and Sport and Pakistan’s Ministry of Religious Affairs and Interfaith Harmony to promote religious tourism. Another MoU was inked between the two states in the field of environment and climate change.

Pakistan and Uzbekistan have been closely collaborating at regional and international fora especially at the United Nations, Organisation of Islamic Cooperation, Economic Cooperation Organisation, and Shanghai Cooperation Organisation.

Comment

- ‹ Previous

- 1

- …

- 3

- 4

- 5

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

Agriculture, Caste, Religion and Happiness in South Asia

Pakistan's agriculture sector GDP grew at a rate of 5.2% in the October-December 2023 quarter, according to the government figures. This is a rare bright spot in the overall national economy that showed just 1% growth during the quarter. Strong performance of the farm sector gives the much needed boost for about …

ContinuePosted by Riaz Haq on March 29, 2024 at 8:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network