PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan Ranked 5th in the World For Financial Inclusion Policy

When people in need of money go to unscrupulous and unregulated moneylenders, they usually get trapped in mounting debts at exorbitant interest rates. In developing nations like India and Pakistan, many end up losing their basic freedom and human dignity when they are forced to work as bonded laborers. How can this situation be changed?

The first obvious answer is to enforce laws and rules against the use of bonded labor. The second, often ignored, answer is to enable people to legitimately borrow the money they need from regulated financial institutions like banks. In addition, they can also save and invest money as bank customers. This is called financial inclusion.

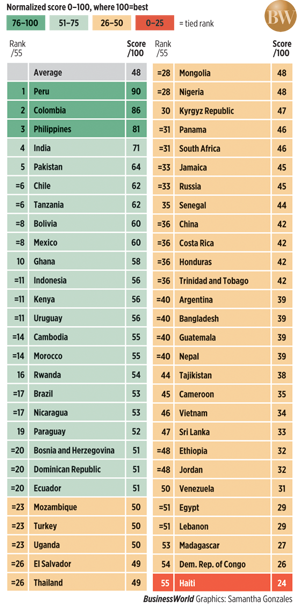

The Economist magazine publishes an annual Economic Intelligence Unit (EIU) assessment and ranking of countries for their policies to promote financial inclusion. In 2015, the EIU has ranked Pakistan 5th in the world among 55 countries surveyed for financial inclusion. Peru (90 points) and Colombia (86) remained the top two countries for financial inclusion. The Philippines was followed by India (71) and Pakistan (64), while Chile and Tanzania (62) tied at sixth and Bolivia and Mexico (60) tied at eighth. Ghana (58) rose in the ranks to clinch the 10th place. Finishing at the bottom of the rankings were Haiti, Congo, and Madagascar.

Pakistan had 41.7 million bank accounts last year for its adult population of about 100 million, according to the State Bank of Pakistan (SBP). More than 31.3 million accounts, or 75% of all bank accounts, belonged to the personal accounts category. The SBP has recently modified the regulatory framework to quicken the bank account-opening process with the help of the national database authority, according to Pakistan's Express Tribune newspaper. “NADRA is the real-time online depository of the biometric impressions of close to 100 million people,” Tameer Microfinance Bank CEO Nadeem Hussain said, adding that utilizing its database had so far resulted in eight million one-minute accounts.

According to a new CGAP (Consultative Group to Assist the Poor), accumulated research confirms that financial inclusion, defined as access to and use of formal financial services, benefits the poor people. Some 20 randomized control trials (RCTs) indicate that formal financial services, such as microcredit, savings, insurance and mobile payments, can have a positive impact on a variety of microeconomic indicators, including self-employment business activities, household consumption, and well-being. “But benefits are not limited to the microeconomic level,” notes co-author Robert Cull, Lead Economist, Finance and Private Sector Development Research Group at the World Bank. “In addition to benefits to individuals, non-experimental evidence indicates that broader financial inclusion also coincides with greater local economic activity and decreased economic inequality at the macroeconomic level.”

Inability to have a bank account in modern economy causes financial exclusion of such individuals who happen to be poor. Improving their financial inclusion is essential to make them participants in the nation's economy. The State Bank's efforts to promote financial inclusion are part of Pakistan's war on poverty that needs to continue until all citizens have full access to financial services in the country. The high and growing penetration rate of mobile phones offers the fastest way to do this by offering branchless mobile banking to everyone with a cell phone.

Related Links:

Pakistan Economy Near Trillion Dollar Mark

Pakistan 2.0: Technology Driving Productivity

Branchless Mobile Banking Takes Off in Pakistan

Financial Services Sector in Pakistan

Pakistan Ranks High in Microfinance

Pakistan Deploying Mobile Apps to Improve Governance

-

Comment by Riaz Haq on February 26, 2017 at 10:12am

-

#Pakistan banks embark on #financialinclusion-

http://www.khaleejtimes.com/business/banking-finance/pakistan-banks...

Financial Inclusion Plan's target is to raise number of customers with access to bank accounts

The Pakistani banking sector, which has already been highly profitable, is on track to expand further with millions of new customers set to enter its fold owing to financial inclusion initiatives.

The priority target of the Financial Inclusion Plan (FIP) is to raise the number of customers with access to bank accounts and services to 50 per cent of the adult population. The number was 23 per cent in 2015 and 12 per cent in 2008.

These are some of the key objectives of the State Bank of Pakistan (SBP), the central bank, and its two associates - Pakistan Microfinance Investment Company (PMIC) and the Central Directorate of National Savings (CDNS) - in launching the Pakistan Financial Inclusion & Infrastructure Project. It has the potential to expand the banking sector, the overall economy and fund new infrastructure projects. The World Bank has come up with a $130 million assistance programme for the FIP.

This decision has been welcomed by the government, bankers and the millions of villagers who have never visited a bank, written a cheque or dealt in any other banking instrument.

What will be the profitability and benefits for service providers and the common man? "The sky is the limit," Finance Minister Ishaq Dar told Khaleej Times.

"The programme will impact the people and the whole economy in a scale never imagined in the entire developing world," said Mohammad Ashraf Wuthra, governor of the SBP.

A spokesman of the SBP's Development Finance Group (DFG) said the project aims at providing banking services to persons, households and businessmen, better access to financial services and banking via modern digital payments. "This will be assisted by fast-growing IT services," the spokesman said.

The SBP will channel the required funds through the PMIC. It is the PMIC's responsibility to provide funds to institutions such as micro finance banks and CDNS branches to develop new financial products to attract people with small savings. The initiative will also help people with savings to fund national infrastructure projects and provide funds to small and medium industries and commercial units at reasonable costs.

Owners of small businesses and households are still seeking greater access to credit, banks, the financial market and other sources of finance. After the policy was implemented to expand financial inclusion from 2008 to 2015, the number of people and households with access to various types of financial services had risen from 12 per cent in 2008 to 23 per cent in 2015.

Apart from the Financial Inclusion Plan, the banks are moving ahead in other areas too. For instance, the growth in FDI inflows is enhancing banks' profitability and financial transactions. The SBP reported that FDI inflows rose 9.9 per cent during the first seven months of the financial year 2016-17 as compared to 2015-16. The fund inflow was mainly from the Netherlands, China and Turkey.

In another development, the SBP has asked banks, forex firms and money changers to accept old US dollar bills from the public. People, including overseas Pakistanis visiting home, have raised complaints that money changers and banks are not accepting old US dollar bills and bills of smaller denominations. In cases where they accepted old bills and bills of $5, $10 and $20, the customers had to suffer losses in terms of lower rates. This move by the SBP should be a big help to all Pakistanis at home and abroad.

-

Comment by Riaz Haq on March 18, 2017 at 9:16am

-

#Visa QR #mobile payments coming to #Indonesia, #Pakistan, #Vietnam

http://www.telecomasia.net/content/visa-qr-payments-coming-indonesi...

Visa will soon be expanding its QR-based mobile payment service to ten more markets, including Indonesia, Pakistan and Vietnam.

The service, named mVisa, is now live in India, Kenya and Rwanda, and will soon be available to merchants and consumers in the three new APAC markets, as well as Egypt, Ghana, Kazakhstan, and Nigeria.

mVisa, a mobile solution, aims to provide easy and secure digital commerce to financial institutions, merchants and consumers in emerging markets.

The service is designed to help merchants overcome infrastructure issues by allowing consumers to use their mobile phones to make cashless purchases at merchant outlets, pay bills remotely and send money to friends and family members by securely linking their Visa debit, credit or prepaid account to the mVisa application.

mVisa digitizes the underlying account and allows consumers to transfer funds from their account to the retailer’s account reliably and securely by scanning a QR code.

Use cases of mVisa include the allowing subscribers of Tata Sky, a direct-to-home service provider in India, to recharge their account by using their mobile phones to scan the WR code directly from the TV screen or online. This function allows Tata Sky customers to order and pay for monthly or one-time services from home without having to visit a physical retail outlet.

Mahanagar Gas Limited, a utility provider in Mumbai, also issues customer bills printed with the mVisa QR code. Customers scan the QR code on the bill, as they would at a merchant outlet, and complete their transaction at their leisure.

-

Comment by Riaz Haq on March 29, 2017 at 7:53am

-

State #Bank to launch a #mobile app for financial transactions across #Pakistan. #mobilemoney #financialinclusion http://bit.ly/2ofA2Kp

The State Bank of Pakistan (SBP) has developed a mobile application – Asaan Mobile Account (AMA) – to allow financial transactions across the country.

The announcement was made by SBP Executive Director Syed Samar Hasnain while speaking at the event of rebranding of Tameer Microfinance Bank as Telenor Microfinance Bank. He said that AMA app will provide a single platform to all bank account holders on different mobile phone networks to conduct financial transactions, which will be like creating “universal interoperability”.

The application will be simple to use and will not necessarily require the use of smartphones. People with feature phones will also be able to benefit from the app. It will take about two minutes to create the account, with a cost of Rs. 10 for the verification of users’ information. Director said,

“People could pay their utility bills, while firms could disburse salaries and pensions via that application. The application would also help people make payments to their dry cleaner, milk vendor, barber and etc… Transactions would definitely have financial limitation and caps…”

National Database and Registration Authority (NADRA) is also on board with SBP for verifying clients’ information. Director added that the objective of the app is to reduce transactions in hard cash and avoid money thefts.

He further said that the number of branchless bank accounts has increased 3.7 times over the last year and the app will help SBP achieve its vision of providing access of banks to 50% adult population by 2020.

Telenor Microfinance Bank Chief Executive Officer Ali Riaz Chaudhry said that 100 million people in Pakistan are involved in economic activities in the country and 80 million of them don’t even have access to money and bank accounts. He said,

“We have set a target of providing access to money and banks to some 50 million people in the next three-four years. 20 million people transferred money worth Rs. 200 billion via Easypaisa in the last one year,”

SBP Director said that the AMA app was in the implementation stage and would be launched in June 2017.

-

Comment by Riaz Haq on May 27, 2017 at 7:16am

-

#Pakistan to launch state-of-the-art E-payment gateway. #PayPal #AliPay #ecommerce

https://tribune.com.pk/story/1420372/pakistan-launch-state-art-e-pa...

Finance Minister Ishaq Dar announced on Friday that Pakistan would open international electronic payment gateways ahead of the likely arrival of PayPal and Alipay in the country.

While presenting the budget for 2017-18 in the National Assembly, the finance minister said the State Bank of Pakistan (SBP) was developing a state-of-the-art e-gateway at a cost of Rs200 million.

“The system will facilitate transactions through mobile banking,” he said. “The Rs200-million investment is being undertaken by the SBP.”

Even though PayPal is a world-renowned international e-payment system, Alipay is not as common across the globe. However, recently, Prime Minister Nawaz Sharif developed an understanding with Alibaba Group Founder and Executive Chairman Jack Ma, who also owns Alipay, to open its office in Pakistan. Alipay will enable Chinese and Pakistani traders to make easy e-payments between the two countries.

Meanwhile, information and communications technology expert Parvez Iftikhar said the establishment of the e-gateway system at the highest regulatory level – the SBP – was an effort towards replacing the existing manual trade payment system by opening Letters of Credit.

Digital Pakistan

The finance minister said the telecommunication sector was one of the important pillars of the country’s economic development. Hence, in order to further incentivise the sector, customs duties at the rates of 11% and 16% were being withdrawn and a uniform rate of 9% regulatory duty was being levied on telecom equipment in the coming fiscal year.

Additionally, Dar said start-up software houses would be exempted from income tax for the first three years. Similarly, exports of information technology (IT) services from Islamabad and other federal territories will be exempted from sales tax.

Mobile phone industry – another important element in the IT sector – received a further relief as withholding income tax on mobile calls was reduced from 14% to 12.5% and federal excise duty was reduced from 18.5% to 17%.

“We hope that provincial governments will also reduce the rate of sales tax on mobile industry,” he said. “In order to encourage the use of smartphones, the customs duty will be reduced from Rs1,000 to Rs650.”

Iftikhar commended the incentives and tax relief for the IT sector, which were meant to enable industrial players to invest more in the sector. “Digitalising Pakistan is the way forward. This is how we will cope with the developed countries,” he said.

Nevertheless, he added more could have been done to achieve a faster growth in the sector. “Reduction of withholding tax on phone calls and duty on smartphones is an encouraging development. However, calls and phones should have been made tax-free in the larger interest of digitalising the economy.”

Branchless banking

Dar announced exemption from withholding tax on cash withdrawals by branchless banking agents.

The move has been undertaken to realise the government’s dream of providing 50% adult population of Pakistan access to banks under its Financial Inclusion Strategy 2020. At present, 25% adult population has access to formal banking channels.

E-commerce and IT need to watch out for the budget

Iftikhar said the exemption from withholding tax on cash withdrawals under branchless banking would enable the government to document the economy, which would be one of the great efforts towards minimising the size of undocumented economy.

“Progress in almost every sector of the economy – like banking, agriculture, education, health and governance – is now linked with adoption of telecommunication,” he said.

Meanwhile, Jazz Director Communications Anjum Rahman said the government was supporting the agenda of ‘Digital Pakistan’, which was in line with the company’s vision and aspirations.

-

Comment by Riaz Haq on July 19, 2017 at 7:22am

-

Karandaaz #Pakistan signs grant agreements with 4 ‘#FinTech Disrupt Challenge’ winners - https://pakwired.com/karandaaz-pakistan-agreements-fintech/ … via @pakwired

One of Pakistan’s top financial technology & inclusion players, Karandaaz Pakistan, has signed grant agreements with four winners of the ‘FinTech Disrupt Challenge’ 2017. Aimed at hunting for extraordinary startup ideas worthy of creating substantial social impact, the second chapter of FDC solicited innovative responses to bottlenecks in Pakistan’s financial services sector.

Held at a local hotel in Islamabad, the event saw Karandaaz Pakistan CEO Mr. Ali Sarfraz signing grant agreements with the FDC 2017 winners. CreditFix, the FDC ’17 winner founded by Owais Zaidi, was awarded a grant of USD $100,000. Three runners-up namely Agri-Gate by Saad Tamman, UniKrew Solution by Naveed Tejani, Syed Taha Ali, and Muhammad Naveed Shareef, and Invoice Wakalah by Muhammad Waseem Sheikh, received USD $20,000 each in funding.

Through FDC 2017, Karandaaz had invited startups in five thematic areas including access to financial services, payments, e-commerce, interoperability, and early stage ideas related to mWallet use cases, education of financial services through technology, customer engagement/experience, microcredit, and digital savings. Banks, government regulators, incubators, and complementary actors from the FinTech industry had assembled together at the event to hear the 23 shortlisted startups present their ideas in front of a panel of experts.

“We are confident that the grants we have released today will help these promising startups go to market and change Pakistan’s financial services landscape for the better,” said Mr. Ali Sarfraz, CEO, Karandaaz Pakistan. “The FinTech Disrupt Challenge is a remarkable platform through which we give emerging and aspiring fin-tech players of Pakistan an opportunity to materialize their passion of promoting financial inclusion in the country. I wish CreditFix, Invoice Wakalah, UniKrew, and ‘Agrigate’ the very best of luck for the future.”

The FinTech Disrupt Challenge is an extension of Karandaaz Pakistan’s overall ambition of promoting financial inclusion to marginalized segments of the society. The company extends financial and technical support to financial technology startups which showcase substantial potential to create value for the society.

-

Comment by Riaz Haq on July 19, 2017 at 4:25pm

-

#Fintech Startups in #India & #Pakistan Find A Champion In Emerging Market Accelerator Called DFS Lab via @forbes

https://www.forbes.com/sites/chynes/2017/07/18/south-asian-fintech-...

Owais Zaidi was sitting in traffic when a dilapidated-looking cab pulled up next to him. The cabbie asked to borrow 1,000 Pakistani rupees so he could get his tires changed, explaining that a market loan would cost him nearly 50 rupees a day in interest. Zaidi was moved by the man’s plight, and he gave the money as charity rather than a loan. But the encounter got him thinking about the millions of underbanked consumers in Pakistan who face predatory lending practices.

“The guy looked genuine so I gave him money, but it really bothered me how the poor are exploited,” Zaidi said. “Based on my experience consulting with banks, I know how straight-jacketed they are in their policies as well as thoughts.”

Zaidi decided to do more than help this one cabbie. In 2016, he founded CreditFix, a credit marketplace that draws on alternative data to assess creditworthiness among unbanked consumers. The company will launch a pilot program in Pakistan in August with 50,000 potential customers, Zaidi said. CreditFix’s platform will use borrowers’ work histories, mobile top-up records, and utility payments to generate credit scores that will then be visible to lenders who use the marketplace.

“The core goal of CreditFix is to facilitate the underserved and unserved segments of the population in getting access to fair credit, primarily for revenue generating assets,” Zaidi said.

CreditFix’s launch was aided in part by Digital Financial Services Innovation Lab (DFS Lab), a Bill & Melinda Gates Foundation-backed accelerator that supports fintech startups in the emerging markets of South Asia and sub-Saharan Africa. DFS Lab provides companies with grant money and is developing an investment model as well. However, the ultimate goal is to connect startups with investors who can provide advice and funding as these early-stage businesses evolve. The organization offers regular mentorship, along with access to resources such as Amazon Web Services and marketing and mobile app support through the Global Accelerator Network (GAN). DFS Lab aims to provide the types of support that are vital to startups and are often lacking in developing markets.

“In Silicon Valley, it’s still hard, but there’s a whole really rich ecosystem that happens -- networking, mentorship, an ethos and community around being an entrepreneur,” said DFS Lab Director Jake Kendall. “Those elements are really missing in developing countries. It’s very hard to connect with people who are at the global frontier.”

Access to qualified, experienced investors can prove particularly important, because predatory investors are prominent in emerging markets, according to Kendall. In some instances, the investors don’t understand the startup space because they’re coming from vastly different industries. In others, they’re focused solely on making money off the companies rather than helping them grow sustainably. The team at DFS Lab tries to prevent such failures by getting quality companies in front of investors who can genuinely assist them.

---------------

With two billion adults still without bank accounts throughout the world, the need for innovative financial services is real. DFS Lab and the startups with which it works have a real opportunity to help meet that need by emphasizing the unique circumstances of underserved consumers in emerging markets.

-

Comment by Riaz Haq on July 26, 2017 at 6:24pm

-

#financialliteracy in #Pakistan at 26% higher than #India's 24%, according to S&P Survey

http://gflec.org/wp-content/uploads/2016/02/Gallup-country-list-wit... …

-

Comment by Riaz Haq on August 6, 2017 at 10:25am

-

Pakistan Govt to launch $130m financial inclusion project

https://www.dawn.com/news/1313172

The government is embarking on the Pakistan Financial Inclusion and Infrastructure Project aimed at increasing access to financial services for households and businesses by improving usage of digital payments in the country.

Two World Bank institutions — International Bank for the Reconstruction and Development and the International Development Association — will jointly provide $130 million finance for the project. The project will be implemented by the recently-established Pakistan Microfinance Investment Company, the Central Directorate of National Savings and the State Bank’s development finance group.

Requesting assistance for the project, the government has informed the World Bank that the project will support a holistic national financial inclusion strategy (NFIS).

It will focus on the development of market infrastructure and the ecosystem that will facilitate access and usage of digital payments and financial services.

Access to credit for micro, small and medium enterprises will be supported by a line of credit that will catalyse private sector financing and focused interventions including technical assistance in line with the NFIS.

In 2015, the government launched the National Financial Inclusion Strategy (NFIS) with a vision to allow individuals and firms access to a range of quality payments, savings, credit and insurance services which meet their needs with dignity and fairness.

In the last 25 years, Pakistan’s financial sector has gone from one dominated by underperforming state-owned banks to a modern and sound financial sector dominated by private banks. The banking sector accounts for 75 per cent of financial sector assets, with the balance in the National Savings Scheme (16.5pc); insurance companies (5pc); non-bank financial institutions (4.0pc); and microfinance institutions (0.5pc).

The microfinance sector is small in terms of assets, but is significant in terms of financial access. Financial soundness indicators indicate that the banking sector is generally sound, liquid and profitable. Islamic finance is growing rapidly, and currently accounts for 11pc of sector assets.

As a result, Pakistan has the highest penetration of mobile money accounts in South Asia at 5.8pc of the adult population, compared to the South Asian average of 1.9pc.

The gender gap on mobile accounts is much narrower than the overall gap for accounts. Despite these achievements, financial access remains low.

According to World Bank Global Financial Inclusion Database (FINDEX), only 13pc of adults in Pakistan had access to a formal account in 2014, far behind Sri Lanka at 83pc, India at 53pc and Bangladesh at 31pc.

-

Comment by Riaz Haq on August 8, 2017 at 8:00am

-

Gearing up #FinTech for wider #financialinclusion in #Pakistan

http://aurora.dawn.com/news/1142117

Financial technology start-ups (FinTechs) are transforming the financial services industry globally and more and more banks are embracing this platform in order to devise more innovative solutions. The trend is now catching on in Pakistan.

This year two organisations, Habib Bank Limited (HBL) and Karandaaz Pakistan held their FinTech challenges with two separate objectives. HBL launched their ‘Innovation Challenge’ in May to find potential start-ups to bring in new and efficient financial solutions and ideas to their financial system, and Karandaaz Pakistan (a not-for-profit organisation) ran its second round of Financial Disruptive Challenge (FDC), in partnership with the IBA AMAN Centre for Entrepreneurial Development to promote financial inclusion in Pakistan.

Giving details about the HBL Innovation Challenge, Abrar A. Mir, Innovation and Financial Inclusion Officer, HBL, says the bank realises the importance of engaging with the entrepreneurial ecosystem to develop new solutions, and in order to reach out to the start-up community and source new solutions, it ran the Innovation Challenge. “If the ideas are interesting, we will induct the teams and ask them to develop those ideas at HBL.” In this way, he adds, the bank will not only benefit from innovative solutions, but will also solve one of the biggest challenges for any start-up: finding their first customer.

The challenge was based on five themes for which the bank sought solutions. These included customer authentication, data protection, automation, artificial intelligence and regulatory reporting. It was open to anyone (teams or individuals) who could bring in ideas and help the bank achieve the aim of “becoming the bank of the future” – which, according to Mir, will have streamlined operations, improved service and customised product offerings for each customer’s unique needs.

“With the help of FinTechs and our existing data, we want to develop solutions to predict when customers need a car or a house loan, when their children are going to college or if they need financial help,” says Mir.

Applications were submitted via the HBL Innovation Challenge website. Mir says the response was encouraging as they received more than 60 proposals (including a few from entities outside Pakistan). After selection and grading by the panel of members from the HBL management, nine teams were shortlisted for the final held on May 23 this year. Three winners were announced. The first was LFD Default Prediction Algorithm; a team of young scientists who work on big data solutions. They developed algorithms for HBL to determine credit worthiness of existing and prospective customers. The solution will help HBL classify borrowers and gauge an individual’s willingness or ability to repay a credit or a loan. The second winner was Faceoff; a team of four software engineers with expertise in artificial intelligence. Faceoff brought solutions specialising in facial recognition to verify customers, reduce fraud and provide more secure services. The third was Wukla/Paksign; an online portal founded by three lawyers who provide digital legal services. The team developed solutions to sign legal documents digitally. These solutions help verify financial transactions made online.

All three winners, rather than receiving a cash reward, will take HBL on as a client and deploy their solutions. The remaining six finalists received cash awards worth Rs 200,000 each – “as a token of appreciation.” According to Mir, HBL plans to make this challenge an annual event and hopes to see more interesting solutions in future rounds.

Karandaaz Pakistan concluded their second Fintech Disruptive Challenge on May 20 this year.

-

Comment by Riaz Haq on September 22, 2017 at 11:05am

-

(Germany's) InsuResilience Investment Fund to acquire 25pc equity stake in (Pakistan's) Asia Insurance:

http://nation.com.pk/business/22-Sep-2017/insuresilience-investment...

LAHORE - The InsuResilience Investment Fund, set up by the German Development Bank KFW and managed by Swiss-based Impact Investment Manager Blue Orchard Finance, has entered into an agreement to acquire a significant minority stake in Lahore-based Asia Insurance Company Ltd, a general insurance company offering agriculture insurance to over 100,000 farmers in Pakistan.

The Blue Orchard managed InsuResilience Investment Fund and Asia Insurance Company Ltd, an innovative and fast growing general insurance company based in Pakistan, have signed an agreement according to which the Fund will subscribe to a rights issue in the insurance company for a 25 percent equity stake in the company post-equity injection, taking the company’s total equity to approximately Rs 1.04 billion. Asia Insurance Company is a leading player in agriculture, livestock and farm implements micro-insurance with approximately 44% of its gross written premium in 2016 coming from these areas. The proceeds of the investment will help Asia Insurance Company to grow by increasing the company’s risk capital and supporting its underwriting capacity in agriculture, hereby extending its outreach to low income farmers.

The InsuResilience Investment Fund, as part of the InsuResilience Initiative of the German G7/G20 presidencies, aims to contribute to the adaption to climate change by improving access to and the use of climate risk insurance in developing countries and emerging economies. The Fund has been set up as a public-private partnership and combines private equity and private debt investments. The investment is subject to regulatory approvals.

“Pakistan experiences various natural disasters and consequences of climate change, but has a low level of insurance coverage, leaving a significant part of its low-income population without protection. We are looking forward to partnering with Asia Insurance Company Ltd, a leading Pakistani insurance company, to extend the insurance coverage of poor and vulnerable households,” says Ernesto Costa, Co-Head of Private Equity at BlueOrchard.

“The agriculture sector directly and indirectly makes up a large portion of Pakistan’s economy. Now more than ever, with our country being impacted by recurring natural calamities, the need for extensive loss mitigation for this sector is paramount. Asia Insurance has been actively involved in providing coverage for farmers, crops, tractors and other various factors of this sector for 5 years, and with InsuResilience Investment Fund’s investment, will expand our outreach and our range of insurance products for this market with a view to innovative solutions tailored to Pakistan’s needs,” says Ihtsham ul-Haq Qureshi, CEO of Asia Insurance Company Ltd.

Luxembourg-based InsuResilience Investment Fund has been set up by KfW, the German Development Bank, on behalf of the German Federal Ministry for Economic Cooperation and Development (BMZ). The overall objective of the InsuResilience Investment Fund is to contribute to the adaptation to climate change by improving access to and the use of insurance in developing countries. The specific objective of the fund is to reduce the vulnerability of low-income households and micro, small and medium enterprises (MSME) to extreme weather events. The InsuResilience Investment Fund has been set up as a public-private-partnership and combines private debt and equity investments in two separately investible sub-funds as well as technical assistance and premium support.

Asia Insurance Company Ltd is a general insurance company based in Lahore, authorized and supervised by the Insurance Division of the Security Exchange Commission of Pakistan.

Comment

- ‹ Previous

- 1

- 2

- 3

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

Agriculture, Caste, Religion and Happiness in South Asia

Pakistan's agriculture sector GDP grew at a rate of 5.2% in the October-December 2023 quarter, according to the government figures. This is a rare bright spot in the overall national economy that showed just 1% growth during the quarter. Strong performance of the farm sector gives the much needed boost for about …

ContinuePosted by Riaz Haq on March 29, 2024 at 8:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network