PakAlumni Worldwide: The Global Social Network

The Global Social Network

Is Modi's "Make in India" All Hype?

Some of Prime Minister Narendra Modi's supporters claim that his "Make in India" campaign has brought India to the verge of becoming a manufacturing behemoth 69 years after the nation's independence. Others claim India is already a manufacturing powerhouse. Let's examine these claims based on data.

Manufacturing Ranking:

While India now ranks 6th in the world in terms of total manufacturing output, it still sits at a very low 142nd position terms of manufacturing value added per capita, according to the United Nations Industrial Development Organization's Industrial Development Report 2016. Pakistan's manufacturing value added is ranked 146th by the same report.

Manufacturing Output:

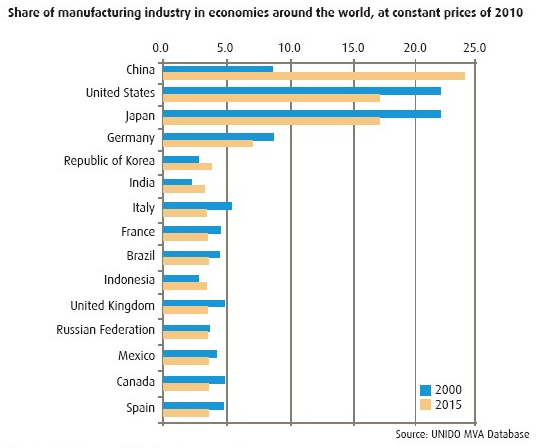

India's 3% share of the world's total manufacturing output puts it at a distant sixth position behind China's 24%, United States' 17%, Japan's 16%, Germany's 7% and South Korea's 4%.

The UNIDO data shows that India's manufacturing value added (MVA) per capita at constant 2005 prices increased from US$155.73 in 2005 to $168.42 in 2014. However, as percentage of GDP at constant 2005 prices in US$, India's MVA decreased from 15.10% in 2005 to 13.85% in 2014

UNIDO reports that Pakistan manufacturing value added (MVA) per capita at constant 2005 prices increased from US$135.03 in 2005 to $143.84 in 2014. Its MVA as percentage of GDP at constant 2005 prices in US$ decreased from 18.05% in 2005 to 17.41% in 2014.

India's manufacturing output declined 0.7% in April-June 2016-17 |

Make in India:

Prime Minister Narendra Modi has recognized how far behind India is in the manufacturing sector. His government's highly publicized "Make in India" is designed to Change that.

What does India, or for that matter any other developing country, need to boost its manufacturing output? Most experts agree on two essential pre-requisites for industrial development:

1. Energy and Infrastructure

2. Skilled Manpower

China's rapid industrialization over the last few decades has shown that the focus must be on the above two to achieve desired results. Has India learned from the Chinese experience? Let's examine this question.

Energy and Infrastructure Development:

"Infrastructure is the biggest hurdle to the ambitious Make in India program of the government," Standard and Poor Global Ratings Credit Analyst Abhishek Dangra told reporters on a conference call, according to India's Economic Times publication.

"The government is scaling up spending, but its heavy debt burden could derail its ambitions to improve public infrastructure," the Standard and Poor report said.

India suffers from huge energy deficit. Over 300 million of India’s 1.25 billion people live without electricity. Another 250 million get only spotty power from India’s aging grid, with availability limited to three or four hours a day, according to an MIT Energy Report. The lack of electricity affects rural and urban areas alike, limiting efforts to advance both living standards and the country’s manufacturing sector.

Skilled Manpower:

“India doesn’t have a labor shortage—it has a skilled labor shortage,” said Tom Captain, global aerospace and defense industry leader at Deloitte Touche Tohmatsu, according to a Wall Street Journal report.

The WSJ report said that over 80% of engineers in India are “unemployable,” according to Aspiring Minds, an Indian employability assessment firm that did a a study of 150,000 engineering students at 650 engineering colleges in the country.

NPR's Julie McCarthy reported recently that ten million Indians enter the workforce every year. But according to the Labour Bureau, eight labor-intensive sectors, including automobiles, created only 135,000 jobs last year, the lowest in seven years.

Impact on Agriculture:

Prime Minister Modi's focus on manufacturing is talking away resources and attention from India's farmers who are killing themselves at a rate of one every 30 minutes.

Majority of Indian farmers depend on rain to grow crops, making them highly vulnerable to changes in weather patterns. As a comparison, the percentage of irrigated agricultural land in Pakistan is twice that India.

More than half of India's labor force is engaged in agriculture. Value added per capita is among the lowest in the world. Pakistan's agriculture value added per capita is about twice India's. This is the main cause of high levels of poverty across India.

Chinese Experience:

China has shown that it is possible to make huge strides in manufacturing while at the same time achieve high productivity levels in agriculture.

On the manufacturing front, China has taken care of the basics like energy, infrastructure and skilled manpower development to achieve phenomenal growth.

As part of the China-Pakistan Economic Corridor (CPEC) development, Pakistanis are learning from the Chinese to replicate success in manufacturing.

The first phases of CPEC are focused on building power plants, gas pipelines, rail lines, roads and ports at a cost of $46 billion. At the same time, China and Pakistan are also focussing on skills training via vocational schools and Pakistan-China Education Corridor. These projects will lay the foundation necessary to ramp up manufacturing in Pakistan.

Summary:

Both India and Pakistan want to emulate the success of China in the manufacturing sector. The Chinese experience has shown that development of energy, infrastructure and skilled labor are essential to achieve their manufacturing ambitions. The South Asians must move beyond hype to do the hard work necessary for it. Pakistan is working with China via CPEC to make progress toward becoming a manufacturing powerhouse.

Related Links:

Auto Industry in India and Pakistan

UN Industrial Development Report 2016

China-Pakistan Economic Corridor

-

Comment by Riaz Haq on June 19, 2022 at 10:00am

-

Why Multinational companies are quitting #India? 8 years after #Modi first urged foreign companies to “Make in India”, #Indian #economy is seeing thousands of foreign firms leaving. #MakeinIndia #Islamophobia #Hindutva #BJP #bigotry #violence #hate

https://www.deccanherald.com/business/business-news/why-mncs-are-qu...

Eight years after Prime Minister Narendra Modi first urged multinational companies to “Make in India”, Asia’s third-largest economy is seeing many foreign firms give up on the country

A slew of big names including German retailer Metro AG, Swiss building-materials firm Holcim, US automaker Ford, UK banking major Royal Bank of Scotland, US bikemaker Harley-Davidson and US banking behemoth Citibank have chosen to

pull the plug on their operations in India or downsize their presence here in recent years. That is a worrying trend at a time when India is trying to position itself as an alternative to China, in a post-Covid world where many MNCs are looking to diversify their supply chain.

A total of 2,783 foreign companies with registered offices or subsidiaries in India closed their operations in the country between 2014 and November 2021, Commerce and Industry Minister Piyush Goyal told Parliament late last year. That is not a small figure, given that there are only 12,458 active foreign subsidiaries operating in India.

------

This might also explain why some of the world’s biggest chipmakers have not warmed up to India despite its government rolling out a red carpet for them by approving a $10 billion incentive plan last year to establish chip and display industries in the

in the country.

----------

When asked if he would consider setting up a factory in India, Tesla CEO Elon Musk tweeted last month that the automaker would not set up a manufacturing plant “in any location where we are not allowed first to sell & service cars”.

Musk will instead look for potential opportunities in Indonesia, known for its business-friendly policy and production of nickel, a critical ingredient in making EV batteries.

-

Comment by Riaz Haq on July 1, 2022 at 4:44pm

-

#India's #manufacturing activity hits 9-month low in June 2022. S&P Global India Manufacturing Purchasing Managers’ Index (PMI) fell to 53.9 in June from 54.6 in May, the weakest pace of growth since last September. #unemployment #jobs #Modi #BJP #economy https://www.business-standard.com/article/economy-policy/india-s-ma...

India’s manufacturing sector activity eased to a nine-month low in June as growth of total sales and production moderated amid intense price pressures, a monthly survey said on Friday.

The seasonally adjusted S&P Global India Manufacturing Purchasing Managers’ Index (PMI) fell to 53.9 in June from 54.6 in May, the weakest pace of growth since last September.

The June PMI data pointed to an improvement in overall operating conditions for the twelfth straight month. In PMI parlance, a print above 50 means expansion while a score below 50 denotes contraction.

“The Indian manufacturing industry ended the first quarter of fiscal year 2022/23 on a solid footing, displaying encouraging resilience on the face of acute price pressures, rising interest rates, rupee depreciation and a challenging geopolitical landscape,” said Pollyanna De Lima, Economics Associate Director at S&P Global Market Intelligence.

Factory orders and production rose for the twelfth straight month in June, but in both cases the rates of expansion eased to nine-month lows. Increases were commonly attributed to stronger client demand, although some survey participants indicated that growth was restricted by acute inflationary pressures, the survey said.

According to the survey, monitored firms reported increase for a wide range of inputs — including chemicals, electronics, energy, metals and textiles — which they partly passed on to clients in the form of higher selling prices.

Lima further said there was a broad-based slowdown in growth across a number of measures such as factory orders, production, exports, input buying and employment as clients and businesses restricted spending amid elevated inflation.

According to the survey, inflation concerns continued to dampen business confidence, with sentiment slipping to a 27-month low. Elsewhere, input delivery times shortened for the first time since the onset of Covid-19.

“Fewer than 4 per cent of panellists forecast output growth in the year ahead, while the vast majority (95 per cent) expect no change from present levels. Inflation was the main concern among goods producers,” the survey said.

On the job front, employment rose for the fourth successive month, albeit at a slight pace that was broadly in line with those seen over this period.

Meanwhile, the Reserve Bank of India (RBI) in its financial stability report released on Thursday said persistently high inflation globally is to stay longer than anticipated as the ongoing war and sanctions take a toll on economies, threatening a further slowdown to global trade volumes.

The global economic outlook is clouded by the ongoing war in Europe and the pace of monetary policy tightening by central banks in response to mounting inflationary pressures, the RBI report said.

-

Comment by Riaz Haq on September 12, 2022 at 11:12am

-

China's dominance of manufacturing is growing, not shrinking

Country gaining market share in both low- and high-tech sectors

https://asia.nikkei.com/Opinion/China-s-dominance-of-manufacturing-...

William Bratton is author of "China's Rise, Asia's Decline." He was previously head of Asia-Pacific equity research at HSBC.

When it comes to discussions about China's manufacturing capabilities, there is an all-too-frequent disconnect between rhetoric and reality.

On the one hand, it is widely understood that Chinese producers are losing relative competitiveness. Higher labor costs, bitter trade frictions, rising geopolitical tensions and the domestic pursuit of zero-COVID are all encouraging exporters to leave the country.

China, it is thus argued, has passed "peak manufacturing" and its status as the world's manufacturer stands to be superseded by other countries in the region. By extension, this will materially impact China's economic trajectory and the region's evolving geopolitical balances.

On the other hand, there has been a lack of substantive evidence offered to support the above argument. Although anecdotes abound about certain companies relocating production out of China, the data suggests that such moves are not at the scale necessary to reverse the upward momentum of the country's manufacturing base, nor its international competitiveness.

The most obvious evidence of this is in trade flows.

It is not just that Chinese exports have remained remarkably robust despite COVID-related lockdowns. More than that, the latest numbers from the U.N. Conference on Trade and Development imply that Chinese producers have become more competitive in recent years, not less.

China's manufactured exports, for example, have been growing significantly faster than those of Germany, the U.S., Japan or South Korea. As a result, its share of global manufactured exports by value surged to a new high of 21% last year, compared to just 17% in 2017. The country is now a more important international supplier than Germany, the U.S. and Japan combined.

Furthermore, contrary to the view that supply chains are reducing their exposure to China, Chinese manufacturers have consolidated their primacy across the vast majority of sectors over recent years. In fact, what is particularly remarkable about China's evolving trade structure is that it has been able to simultaneously gain export share in both low- and high-technology industries, including those as eclectic as leather products, truck trailers and optical instruments.

Such gains are hardly indicative of an industrial base under stress. They instead highlight the hyper-competitiveness of China's producers, who increasingly dominate the East and Southeast Asian manufacturing landscape.

For all the chatter about companies leaving China and the changing geographies of supply chains, the reality is that it generated nearly half of the region's manufactured exports in 2021, compared to less than a third 15 years ago.

This competitiveness is derived from the complex and self-reinforcing interaction of multiple factors, many of which are a function of China's size. This allows the country to support far higher levels of domestic competition, innovation and specialization than its neighbors, and results in greater efficiencies and lower production costs, which regional rivals will always struggle to replicate. These scale benefits are subsequently magnified through aggressive industrial development policies that have no obvious precedent in terms of scope or ambition.

So China's manufacturing advantages must be viewed holistically, especially as it can be highly misleading, however tempting, to draw conclusions based on the trends of any specific factor.

-

Comment by Riaz Haq on September 12, 2022 at 11:13am

-

China's dominance of manufacturing is growing, not shrinking

Country gaining market share in both low- and high-tech sectors

https://asia.nikkei.com/Opinion/China-s-dominance-of-manufacturing-...

William Bratton is author of "China's Rise, Asia's Decline." He was previously head of Asia-Pacific equity research at HSBC.

The country's rapidly rising wages, for example, attract much attention. But it would be a mistake to assume that this signals the loss of competitiveness in more labor-intensive industries.

Rather, it reflects dramatic improvements in productivity and a broader structural shift into higher technology sectors. Furthermore, the use of national averages masks the diversity of China's labor force, with a substantial pool still on relatively low wages.

This is seen in the irrefutable fact that the country's manufacturers are still gaining export share across low-technology and labor-intensive industries, including textiles. In other words, their innate advantages are so substantial and so overwhelming that higher labor costs by themselves have no material impact on their competitiveness.

As such, despite all the frequently cited anecdotes, there is no real evidence that the factors underpinning China's competitiveness are being reversed. Rather, Asia's manufacturing industries will continue to concentrate in China, further entrenching its status as the core of the region's economic system.

This is the challenge for the rest of the region. No matter how hard they try, few countries, if any, will be able to replicate or match China's natural advantages. And this will have profound longer-term economic and geopolitical consequences.

Against the onslaught of highly competitive Chinese products, emerging economies will struggle to develop the manufacturing sectors they need to achieve and sustain productivity-led growth over the long-term.

But even more advanced nations are not immune from the pressures created by China, with the hollowing-out of their industrial structures a very real danger. The displacement of Japanese and South Korean manufacturers from the global telecommunications equipment and shipbuilding markets demonstrates just how quickly China can engage with its neighbors at their own games -- and win.

So for all the suggestions that China's grip on manufacturing is weakening, the reality could not be more different. It is not the Chinese producers that are losing influence, but their rivals across the region.

In fact, the natural forces driving the country's competitive advantages are now both so substantial and entrenched that the rest of Asia is seemingly engaged in an unfair trade fight -- and one it is unlikely to win. The region's slide toward a clearly defined economic core-periphery structure -- with China dominating and the rest being disadvantaged -- now looks inevitable.

In turn, this is creating dependencies which will prove evermore difficult to disentangle, no matter how strong the apparent political commitment in some countries to do so.

This is seen in how recent attempts to diversify imports away from Chinese producers have been constrained by the lack of credible alternative suppliers. It is noticeable that Australia and India, countries positioning themselves as regional rivals to China, have increased -- not reduced -- their reliance on Chinese manufactured imports over the last three years.

It is true that this manufacturing mastery may not have been developed as a deliberate geopolitical tool. But in the same way the U.S. was able to use its post-World War II industrial leadership to advance its own interests, the reliance on Chinese products will naturally give Beijing unrivaled power and influence within Asia. As such, China's future economic and political dominance of the Asian regional economy is set to be underpinned by its vibrant, dynamic and hypercompetitive manufacturing industries, whatever the country's doomsayers may claim.

-

Comment by Riaz Haq on September 15, 2022 at 7:17pm

-

Wisconsin Is Coming to India and Not in a Good Way

Analysis by Tim Culpan | Bloomberg

https://www.washingtonpost.com/business/wisconsin-is-coming-to-indi...

The project is fantastical: A $19 billion investment into semiconductor and display-panel sectors, with the creation of 100,000 jobs in a state with little experience in technology manufacturing.

If voters and taxpayers in India’s northwestern Gujarat state are excited about this “ landmark investment” they ought to read up on recent Wisconsin history. The US state bought into a similar pipe dream in 2017 when then-President Donald Trump teamed up with then-Governor Scott Walker to lure Foxconn Technology Group, whose Taipei-listed flagship is Hon Hai Precision Industry Co. The Taiwanese company said it’d invest $10 billion and hire 13,000 workers.

Wisconsin never hit its targets. And neither will Gujarat.

What’s playing out today in India is eerily similar to what happened in the US Midwest five years ago, but this time the people and government of Gujarat have no excuse for not being aware of what’s likely to unravel. Americans were told clearly that the project in Mount Pleasant didn’t make sense. But still, they went ahead.

It’s inconceivable that Foxconn truly thought it would spend as much as $10 billion to build a high-tech manufacturing plant in the middle of US farm country. But, as founder and Chairman Terry Gou said early on in the planning phase: “There is such a plan, but it is not a promise. It is a wish.”

So when Vedanta Ltd. chairman Anil Agarwal says his company will invest 1.54 trillion rupees ($19.4 billion), we ought to take it as wishful thinking, rather than a promise. And we can also pause to bathe in the sweet irony of his chosen venture partner: Foxconn, the same name behind the Wisconsin project. Though, to be fair, the Taiwanese are less a driving force behind this India project and more a consulting partner. The numbers, choice of location, and project scope are mostly decided by Vedanta, which is bearing most of the financial burden.

Foxconn made various pledges in Wisconsin that never came to fruition, with a promise for a state-of-the-art 10G liquid-crystal-display panel factory being the most egregious. At least it never committed to assembling iPhones, the product for which Foxconn is most famous.

The Taiwanese company’s perfidiousness was in some respects spurred by local and national governments intent on selling to their voters (and taxpayers) the assurance that a $3 billion incentives package — the largest in US history — would be worth the expense. It will be the “Eighth Wonder of the The World,” Trump proclaimed at the groundbreaking ceremony in 2018.

Governments from Washington to New Delhi don’t want to offer corporate welfare to lure hum-drum projects like chip-testing and assembly. They want to send press releases and tweets that hail their territory’s move into the upper echelons of industrial society. To meet that PR goal, they often tie incentives not to reasonable evolutionary steps in economic development, but to extravagant plans that people never dreamed of.

And the recipients of such sweeteners are more than happy to oblige, safe in the knowledge that there’s almost no downside in overpromising and under-delivering. And those who doled them out — either long gone from office, or safely entrenched — won’t be required to foot the bill either. Scott Walker lost his re-election bid, in large part because of the failure of the Foxconn deal; however, he didn’t lose his home like dozens of Wisconsinites who were displaced to make way for the “wonder” that never was.

-

Comment by Riaz Haq on September 15, 2022 at 7:17pm

-

Wisconsin Is Coming to India and Not in a Good Way

Analysis by Tim Culpan | Bloomberg

https://www.washingtonpost.com/business/wisconsin-is-coming-to-indi...

Now it’s India’s turn to dream, until such time comes that it must face reality.

Perhaps it’s a coincidence that the project went to the home state of Prime Minister Narendra Modi. Neighboring Maharashtra state thought it was a shoe-in for the deal, going so far as to issue a statement two months ago announcing that the Vedanta-Foxconn venture would invest there.

Accusations and rancor were flying thick and fast in Maharashtra after Agarwal and Modi took to the stage to celebrate the winner. But in reality, the people of India’s second most-populous state may end up celebrating not that they lost the project, but that they dodged a bullet.

Indians — in Gujarat and Maharashtra in particular — can take this as a warning: You don’t want to be another Wisconsin.

-

Comment by Riaz Haq on October 22, 2022 at 7:22pm

-

India is now ever more dependent on Chinese #imports despite seeking self-reliance. #Indian imports from #China include iron & #steel, copper, #nuclear reactors, shoes, animal & vegetable fats, mineral fuels, inorganic chemicals. #MakeinIndia #Modi #trade

https://finance.yahoo.com/news/india-now-ever-more-dependent-061000...

For the past few years, prime minister Narendra Modi’s government has been pushing businesses to “make in India” and lessen his country’s reliance on China-made goods.

The idea is to reduce India’s trade deficit with its neighbour. A trade deficit happens when a country’s imports exceed its exports.

Yet, after spending billions of rupees to build such self-reliance, China’s trade surplus with India has only exceeded $1 trillion, The Hindu reported yesterday (Oct. 20).

Bilateral trade between India and China

Trade ties between India and China began to grow in the early 2000s, driven by imports to India from China.

A large portion of these imports, according to the Indian government, include footwear, iron and steel, copper, nuclear reactors, animal and vegetable fats, mineral fuels, and inorganic chemicals among others.

In the past five years alone, imports from China have increased by nearly 30%, the Indian informed parliament in July (pdf).

“In 2021, annual two-way trade crossed $100 billion for the first time, reaching $125.6 billion, with India’s imports accounting for $97.5 billion, pegging the imbalance at close to $70 billion,” according to The Hindu.

Calls for Boycott of Chinese products

The increase in Chinese imports has come amid growing calls in India to boycott Chinese products.

Indian customers’ attitude towards Chinese products turned so hostile by the end of 2020 that some Chinese firms switched the “Made in China” label on their products to “Made in PRC” where PRC stands for the People’s Republic of China. This made the products’ country of origin a little less clear.

Tensions between the two nations increased when India banned a host of Chinese apps and the Modi government reportedly advised all states to avoid signing any deals with China.

None of these moves has apparently helped India. The country is now dependent on China more than it ever was.

-

Comment by Riaz Haq on October 31, 2022 at 7:02pm

-

The mystery of missing $12bn in India-China trade figures

5 min read . Updated: 01 Nov 2022, 12:56 AM IST

Dilasha Seth, Ravi Dutta Mishra

https://www.livemint.com/economy/mismatch-in-china-trade-figures-ra...

Vastly varying trade data from India and China have left experts searching for clues to explain the mismatch. While China has claimed that trade with India touched $103 billion in the first nine months of 2022, India’s data show that bilateral trade stood at just $91 billion.

$12 bn hole likely because of under-invoicing by importers, experts say · China claimed India's trade deficit widened to $75.67 bn, while India's...

-

Comment by Riaz Haq on November 26, 2022 at 12:55pm

-

Aakar Patel

@Aakar__Patel

manufacturing share of gdp has fallen after launch of make in indiaa report by ashoka ceda’s ankur bhardwaj showed jobs in manufacturing in india had halved after 2017

the beauty of new india is that popularity is dissociated from performance/governance

https://twitter.com/Aakar__Patel/status/1596395004733202432?s=20&am...

---------------

CEDA-CMIE Bulletin No 4: May 2021

With the second wave of the coronavirus pandemic battering India at present, the Indian economic outlook looks bleak for the second year in a row. In 2020-21, India’s real GDP growth is estimated to be minus 8%. This would also put pressure on India’s employment numbers. In previous bulletins, we have analyzed the impact of Covid-19 pandemic on employment, individual and household incomesand expenditures in 2020.

In this CEDA-CMIE Bulletin, we try to take a longer-term view of sector-wise employment in India. We base this on CMIE’s monthly time-series of employment by industry going back to the year 2016. For this bulletin, we have focused on seven sectors, viz. agriculture, mines, manufacturing, real estate and construction, financial services, non-financial services, and public administrative services. These sectors make up for 99% of total employment in the country.

https://ceda.ashoka.edu.in/ceda-cmie-bulletin-manufacturing-employm...

-

Comment by Riaz Haq on December 11, 2022 at 8:22am

-

India Can’t Dethrone China as the World’s Manufacturing Power

https://nationalinterest.org/blog/buzz/india-can%E2%80%99t-dethrone...

Due to its insufficient labor quality and infrastructure investment, fractured society, market restrictions, and trade protectionism, the South Asian nation is unlikely to replace China.

With everything seemingly going right for India, can it really replace China on the global supply chain? Unfortunately for India, due to its insufficient labor quality and infrastructure investment, fractured society, market restrictions, and trade protectionism, the South Asian nation is unlikely to replace China in the global manufacturing supply chain anytime soon.

To begin with, India’s labor quality and infrastructure availability fall far behind China’s. Many people consider India’s low labor costs a key advantage vis-à-vis China. Indeed, India’s daily median income in urban areas in 2017 was $4.21, roughly sixteen years behind China’s, which was $12.64. However, what good are low labor costs if the benefits are also relatively low? Despite India’s laudable development achievements in the past few decades, its capability enhancements have lagged far behind China’s. India’s share of stunted children today is roughly the same as China’s over two decades ago, its life-expectancy growth is twenty-five years behind China’s, and its adult literacy rate is roughly three decades behind.

Not to mention, India’s state capacity is less extensive than China’s, and many Indians who grow up in slums live their entire lives without government files. Therefore, India’s lag in labor capability enhancement behind China is likely worse than what official data suggest. These factors affect workers’ efficiency on factory floors and their ability to advance their careers in manufacturing over the long term. Low labor costs might not make up for these low labor qualities. In fact, if India cannot deal with these capability deficits effectively, its surging population might undermine India’s social stability, although the Modi administration has done well so far in this respect.

Besides labor, manufacturing also requires capital, especially infrastructure. Few developing countries can compete with China in this regard, and India is no exception. To be clear, when foreign investors chose China to be their manufacturing hub, it was, to a certain extent, a coincidence. In 1994, China reformed its tax system to enhance the central government’s control over the country’s fiscal revenues. The reform forced local governments to look for new sources of tax income and ultimately resort to local government financing vehicles (LGFVs). Because the land appreciation tax went to local governments, they began to encourage construction, sell rights to land use, and use tracts of land as collateral to fund infrastructure in the form of LGFVs. The LGFVs led to an abundance of investments and many empty industrial parks. When Western investors started to look overseas for places to build factories around the same period, China seemed especially appealing due to its availability of capital.

-------

Despite its many advantages and Western countries’ support, it is unlikely that India can replace China in the global manufacturing supply chain for the foreseeable future. Economically, despite its low labor costs, the low quality of India’s labor pool that stems from its deficits in capability development offset its labor advantages, and inadequate infrastructure investments put India at a disadvantage regarding capital costs. Socially, India’s fractured multi-dimensional society creates different economic demands for various groups, undermining the advantages of India’s large population. Politically, India’s market restrictions make its business environment less favorable and decrease its industrial labor supply. Meanwhile, protectionist traditions hinder India’s ability to adopt an export-oriented growth model and integrate itself into the global supply chain.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

Agriculture, Caste, Religion and Happiness in South Asia

Pakistan's agriculture sector GDP grew at a rate of 5.2% in the October-December 2023 quarter, according to the government figures. This is a rare bright spot in the overall national economy that showed just 1% growth during the quarter. Strong performance of the farm sector gives the much needed boost for about …

ContinuePosted by Riaz Haq on March 29, 2024 at 8:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network