PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan's Fintech Revolution to Promote Financial Inclusion

|

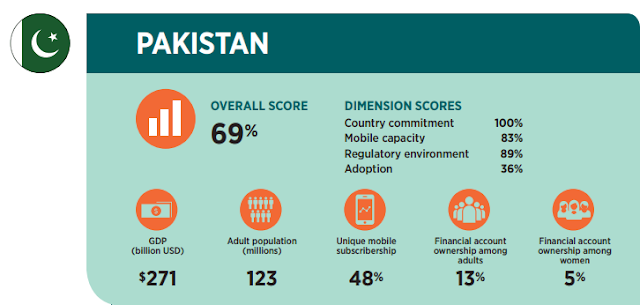

| Source: Brookings' Digital and Financial Inclusion Report 2017 |

Importance of Financial Inclusion:

Access to regulated financial services for all is essential in today's economy. It allows people to save, borrow and invest. Those who lack access to regulated banking services are often forced to resort to work with unscrupulous lenders who trap them in debt at unaffordable rates. Such loans in extreme cases leads to debt bondage in developing countries. Financial inclusion is good for the individuals as well as the national economies. It spurs economic growth and helps document more of the economy.

Easypaisa:

Fintech (financial technology) is bringing financial services to the unbanked population through non-bank institutions licensed by the State Bank of Pakistan, the top bank regulator in the country. One example of a non-bank is Telenor Pakistan, a leading mobile phone service operator, offering financial services via a large network of agents, currently over 70,000, far exceeding the total number of branches of all the banks in the country.

Easypaisa, a service operated by Telenor Pakistan, offers basic financial services like open a bank account, deposit or withdraw money, transfer funds, make mobile payments and pay utility bills.

Karandaaz:

Another important player promoting financial inclusion is Karandaaz Pakistan , a non-profit organization, set up by UK’s Department for International Development and Bill and Melinda Gates Foundation. It is providing grants to a number of local initiatives to develop and promote financial technology solutions in Pakistan.

Karandaaz Pakistan is promoting Fintech startups in 5 areas of focus:

1) Access to Financial services

Credit Scoring Models, Formalize savings through need based products, Digital lending services, and Insurance

2) Payments

Retail payments solutions through QR code, Supply / Value Chain Digitization, Ideas around digitization of online payments and merchant payments

3) E-Commerce

Smoothening of on-boarding process, Enabling Escrow Accounts

for a retail merchant, Alternate payment modes other than COD

4) Interoperability

Innovative ideas to address the lack of interoperability among m-wallets

5) Early stage ideas related to:

M-Wallet Use cases, Education of Financial Services through technology, Customer Engagement / Experience, Micro Credit, Digital Savings

Finja's SimSim Mobile Payment:

Finja is a Pakistani fintech startup that recently introduced SimSim app for mobile payments. It's the first such application that has received approval of the State Bank of Pakistan. Finja has raised $1.5 million in venture funds so far. SimSim uses NADRA, a biometric citizen identity card that the Pakistan government has issued to almost its entire adult population, comprising around 60 percent of the total population of 207 million.

Private Credit Bureaus:

Credit data and scoring are essential to facilitate risk assessment and lending by financial institutions.

Under the Credit Bureaus Act, 2015, privately-run credit bureaus can collect and disseminate the credit data from both financial and non-financial institutions including retailers, insurance companies, utility providers and landlords, as notified by the federal government, according to Muhammad Akmal, Director of Banking Conduct and Consumer Protection Department at the State Bank of Pakistan. The bureaus can do credit scoring, consolidate credit data for analysis and research purposes.

Progress To Date:

According to the latest State Bank statistics on branchless banking (BB) sector, m-wallets grew by 87% , reaching 27.3 million by the end of June 2017. It has a lot of room for growth in a county where about 100 million adults lack access to regulated financial services.

Pakistan is ranked 16th among 26 nations ranked by Brookings Institution with an overall score of 69% in "The State of Financial and Digital Inclusion Project Report" for 2017.

Summary:

Pakistan is ranked 16th among 26 nations ranked by Brookings Institution with an overall score of 69% in "The State of Financial and Digital Inclusion Project Report" for 2017. Access to regulated financial services for all is essential in today's economy. It allows people to save, borrow and invest. Those who lack access to regulated banking services are often forced to resort to work with unscrupulous lenders who trap them in debt at unaffordable rates. Such debt in extreme cases leads to bondage in developing countries. Financial inclusion is good for the individuals as well as the national economies. It spurs economic growth and helps document more of the economy. The rapid growth of mobile phones and Internet access in Pakistan offers a unique opportunity to increase financial inclusion in the country. A number of players are working on financial technology to make its application a reality in Pakistan. Among these players are non-bank banks like Telenor and non-profits like Karandaaz.

Related Links:

Haq's Musings

Financial Services Sector in Pakistan

Pakistan Ranked Among Top 5 For Financial Inclusion Efforts

Pakistani Banks Post Strong Growth

Branchless Banking in Pakistan

Pakistan Ranks High in Microfinance

World's Largest Democracy Tops Slavery Charts

NADRA's Biometric Database

-

Comment by Riaz Haq on January 29, 2018 at 8:34am

-

Bahrain’s Ithmaar Bank plans aggressive expansion in Pakistan

Bahrain-based lender to add more than 100 branches in Pakistan this year through its subsidiary Faysal Bank

http://gulfnews.com/business/sectors/banking/bahrain-s-ithmaar-bank...

Dubai: Bahrain-based Ithmaar Bank plans to add more than 100 branches in Pakistan this year through its subsidiary Faysal Bank, to capitalise on the country’s low penetration rate of banking services, a senior executive said.

Ithmaar Bank owns 66 per cent of Faysal Bank, whose contribution to the Islamic retail bank’s overall balance sheet would likely grow to more than half as a result of the expansion, Ithmaar Deputy Chief Executive Abdul Hakeem Al Mutawa said on Monday.

“We are planning to be over 500 branches this coming year and are aggressive in this,” Al Mutawa said in an interview.

“Banking penetration is around less than 20 per cent in Pakistan, so there are good opportunities to grow.” Faysal Bank, which is listed on the Pakistan Stock Exchange, focuses on corporate, commercial, retail and consumer banking activities.

Al Mutawa was speaking after Ithmaar Bank’s parent company, Ithmaar Holding, listed on the Dubai Financial Market on Monday.

The company is already listed in Bahrain and Kuwait.

“The listing is good news for the company for growth capital and we are well established now to approach the capital markets,” Al Mutawa said, adding that the bank had no imminent plans to raise funds through a bond or loan.

In Bahrain, Al Mutawa said there were opportunities to grow the business from working with the government on providing financing for social housing. The bank currently has 16 branches in the kingdom.

Bahrain’s Ithmaar Holding is exploring the sale of its 25.4 per cent stake in Bahrain’s BBK BSC, which has operations in Bahrain and Kuwait, India and Dubai, sources familiar with the matter told Reuters in August.

Al Mutawa declined to comment on the time frame for the disposal of the BBK stake or identify the name of the company advising IB Capital, Ithmaar Holding’s investment subsidiary managing the asset.

“The performance of BBK is very good and still part of the portfolio of IB Capital, and if there are opportunities to maximise shareholder value I’m sure the board will take those,” he said.

-

Comment by Riaz Haq on January 30, 2018 at 5:00pm

-

McKinsey & Co: #Fintech will add about 4 million #jobs, 93 million #bank accounts, $36 billion annually to #GDP, and $7 billion to #Pakistan government’s net revenue by 2025.

https://tribune.com.pk/story/1615482/2-three-players-enter-pakistan...

At least three fintechs are set to capitalise on the rapidly growing financial sector of Pakistan, targeting an entry in the country’s market, according to the central bank.

FonePay, Monet and TPL Rupya are entering Pakistan’s financial market, said a quarterly report of the State Bank of Pakistan (SBP), hinting at a rise in the business-to-consumer e-Commerce (e-B2C). Growing incomes, coupled with advancement in communication technology and expansion of internet access and branchless banking, has been propelling the sector forward, said the SBP report.

The new financial technology will enable people to make online transactions to anyone available on any mobile wallet account, which is not yet possible.

Fintech will add about 4 million jobs, 93 million bank accounts, $36 billion annually to the gross national product (GNP), and $7 billion to Pakistan government’s net revenue by 2025, according to McKinsey & Company, a worldwide management consulting firm.

“Bank accounts seem to be on track as there are 7 million today. This includes 1.8 million traditional accounts, accumulated over 50 years, and 5.2 million mobile/branchless accounts accumulated in around one-tenth of that time,” said National Technology Fund Ignite CEO Yusuf Hussain.

This is because globally, traditional bank accounts rise proportionately to GNP, but mobile accounts can rise exponentially. The central bank’s target of 50 million accounts by 2020 should be on track, as the McKinsey forecast, he remarked. Transactions worth Rs20.7 billion were carried out by consumers on international e-commerce websites, said the SBP.

-

Comment by Riaz Haq on January 30, 2018 at 5:01pm

-

DIGITAL FINANCE FOR ALL:

POWERING INCLUSIVE GROWTH

IN EMERGING ECONOMIES

McKinsey & Co 2016

For our GDP calculations, we used McKinsey’s proprietary general equilibrium

macroeconomic model, and we tested the robustness of these results with a partial

equilibrium Solow growth model. We also used our Solow model to understand specific

individual effects of different components of the model. Field research in seven large

countries covering a range of income levels and geographies—Brazil, China, Ethiopia, India,

Mexico, Nigeria, and Pakistan—informed our quantitative analysis and provided rich insights

into the conditions that must be in place to capture the value from digital finance. In addition,

we conducted more than 150 interviews around the world with a variety of experts and

stakeholders to obtain a more detailed view of the different elements we fed into our model.

----------------

The growth potential for Pakistan sits in the middle of the range at 7 percent, somewhat

below its lower-income peers, reflecting its unique circumstances. Financial inclusion in

Pakistan is extremely low—only 13 percent of adult population has a financial or mobilemoney

account today. Pakistan’s total loans outstanding to all borrowers—household,

corporate, and government—amount to only 17 percent of GDP, compared with the average

of 112 percent of GDP in emerging economies.70 This extremely underdeveloped starting

position provides significant upside potential to expand its pool of formal savings and credit,

however also incurs costs above that of lower-income peers.

https://www.mckinsey.com/~/media/McKinsey/Global%20Themes/Employmen...

-

Comment by Riaz Haq on January 31, 2018 at 10:19pm

-

Fintech’s silent revolution

Sarwat AhsonDecember 18, 2017

https://www.dawn.com/news/1377207

Enticed by disruptive and yet innovative technology, the financial system is reorganising itself to regain its robust health, reduce costs and make its services more efficient and affordable after the 2008 crisis. Fintech is ushering in a silent revolution.

Its outreach is expanding and it now embraces activities that can be broadly categorised into: Lending tech, Payments tech (billing/remittance), Crypto currencies (bitcoin), Wealth Management (Robo advisors), Crowd funding, Insurance and Regtech (regulations).

Pakistan’s financial sector has responded to the challenges of applying these new technologies by strengthening its human resource and developing customer interface platforms. Most banks now have Chief Innovation Officers or Digital Initiative departments.

Various online Payment Systems and Mobile Apps have been developed to encourage footfall in branches.

The demand for a swift payment mechanism is evident from the quick adaption of digitisation efforts and rising e-commerce platforms. The latest State Bank’s Annual Performance Review states that “e-Commerce is picking up with 571 merchants offering their products online. During FY2017, 1.2 million transactions valued at Rs9.4 billion were processed through e-commerce”.

The SBP report further states that “25 financial Institutions provide internet banking and 18 have mobile apps. During FY17, 25.2m internet banking transactions were processed valuing at Rs969bn. Mobile banking accounted for 7.4m transactions valuing Rs141bn, representing an annual volume growth of 32 per cent and 12pc respectively”.

Pakistan’s financial sector has responded to challenges by strengthening its human resource and developing customer interface platforms

-

Comment by Riaz Haq on January 31, 2018 at 10:20pm

-

THE EXPRESS TRIBUNE > BUSINESS

By mid-2018: With Fintech, Pakistan set to dismantle barriers to branchless banking

https://tribune.com.pk/story/1602502/2-mid-2018-fintech-pakistan-se...

Fintech is all set to revolutionise Pakistan’s financial sector in upcoming months as the telecom regulator is taking steps to facilitate online transactions across all mobile phone networks just like making a phone call from one network to another.

Fintech (financial technology) is an electronic platform that will enable users to make financial transactions from one platform to any account-holders on other mobile phone networks all over the country.

So far, such online transactions were not possible because of the absence of inter-operability across the telecom network.

At present, Telenor’s Easypaisa, Jazz’s Mobicash and United Bank Limited’s Omni are providing mobile-based branchless banking services. However, their customers cannot transfer money from one service to another.

In an effort to promote fintech, the Pakistan Telecommunication Authority (PTA) – the telecom regulator – has decided to award Third Party Service Providers’ licences by June or July 2018, which will pave way for inter-operability between cellular mobile operators and ramp up financial inclusion all over the country.

“We have received two applications and the Third Party Service Providers’ system is expected to be launched in mid-2018,” said the PTA spokesperson in an email response to The Express Tribune.

This innovative system will also provide access to banking services for people having simple feature phones who will be able to make online financial transactions.

The new platform will help dismantle existing barriers that prevent digital wallets (branchless bank account-holders) from sending money to different bank accounts. Users will be able to make transactions from wallet to wallet or wallet to the bank account.

This will significantly reduce hard cash transactions and stave off the threat of cash theft. The State Bank’s vision of financial inclusion will also get a boost as it aims to provide 50% of the adult population access to the legal financial system by 2020.

Adnan Khan, a retailer in Sultanabad, a low-income locality of Karachi, told The Express Tribune that he expected his business to jump 100% after the launch of fintech platform. At present, he sends back many of his clients just because all mobile banking services are not available at his outlet.

PTA insists that it is an open licensing regime and it can issue more licences as per market needs and absorption.

Licence fee for the Third Party Service Provider is Rs1 million and Rs10-million performance bond is mandatory which is associated with roll-out obligations. Other regulatory obligations like annual licence fee, which is 0.5% of gross revenue of the licensee, are applicable as per licensing conditions.

The number of mobile phone banking transactions, which stood at 1.2 million in the first quarter of 2017, increased 12% to 1.3 million in the second quarter. In terms of value, the transactions surged 24% from Rs21 billion in the first quarter to Rs26 billion in the second quarter.

With the Third Party Service Providers’ platform, more digital financial services will be available in the Pakistani market.

“The third-party framework will also be critical for the launch of Asaan Mobile Account under the National Financial Inclusion Strategy,” said the PTA spokesperson.

-

Comment by Riaz Haq on January 31, 2018 at 10:21pm

-

THE EXPRESS TRIBUNE > PAKISTAN > PUNJAB

ITU, BMGF ink financial inclusion research projects

https://tribune.com.pk/story/1623181/1-itu-bmgf-ink-financial-inclu...

The Information Technology University (ITU) and Bill & Melinda Gates Foundation (BMGF), represented by Karandaaz Pakistan, signed an agreement for three research projects on financial inclusion. In this regard, an agreement signing ceremony was held in Lahore on Wednesday.

While speaking on the occasion, ITU Vice-Chancellor Dr Umar Saif said Pakistan’s first FinTech Centre, established at ITU, will ensure financial inclusion and make a large portion of the population a part of the economy through technology. The project will be in collaboration with BMGF.

“Pakistan is a growing economy and the gender-based financial inclusion will become part of the documented economy.”

He maintained that joining hands with international development partners like BMGF for innovation and research in financial technology was a welcome step. “We welcome partnerships with local and international entities for financial inclusion through innovative applications of technology to help Pakistan reform digital financial services, especially with the inclusion of women,” he pointed out.

Similarly, Karandaaz CEO Ali Sarfraz Hussain said, “Together with BMGF and UK’s Department of Development, we are working with various departments for financial inclusion, including National Savings, State Bank of Pakistan and Agriculture Department of Punjab with a special grant from FinTech Centre.”

BMGF Deputy Director Financial Services Jason Lamb said that the Gates Foundation focused on Pakistan among the five largest countries, including Indonesia and Algeria, India etc. “Digital technology is playing a key role in fundamental changes in services with credit availability,” he added.

Jason said that more knowledge and research would trigger greater financial inclusion of women through technology in Pakistan. “It is heartening to see academicians stepping up to work closely with the industry in solving issues. Karandaaz and ITU have partnered to make this possible,” he said.

He said that ITU’s FinTech would devise many innovations and some research projects, while three specific academic researches would improve existing knowledge on women’s use of digital financial services and the barriers they face.

He maintained the researches will help in understanding and proposing solutions to mitigate these barriers. “One of the researches will focus on viability of a mobile app to form a rotating savings and credit association of women that will help them save and borrow collectively,” Lamb said.

He said another research will help in designing a digital financial system for business and personal use of micro entrepreneur women, while the third research will focus on digital solutions to safeguard women against SMS fraud in Pakistan.

-

Comment by Riaz Haq on February 3, 2018 at 9:55am

-

Pakistan on road towards digital economy

To further utilise this FinTech phenomenon, it is mandatory for the relevant authorities to promote the products among the masses

https://nation.com.pk/24-Jan-2018/pakistan-on-road-towards-digital-...

It was not that long ago, Pakistani bank account holders had to wait in the long ques for their basic banking transactions. Gladly, with the introduction of ATMs about two decades ago, many banking procedures can now be done without even visiting the bank branches. Despite of this, still there is an issue of “mobility” as account holders have to personally visit ATM’s for their banking transactions.

This issue of mobility opened up new avenue and now there is rapid increase in information sharing between financial institutions and technological firms. This merger of Finance and Technology is popularly known as “FinTech”.

Today, FinTech has become a global phenomenon that has made the banking and day to day financial services more accessible to a common man particularly through smartphones. According to the forecasts of International Data Corporation (IDC), 70% of smartphones were destined to be shipped to emerging markets while only 30% to the developed world. This 70% of smartphones are now widely being used as mobile bank accounts and mobile wallets.

Talking specifically about Pakistan, according to World Bank, about 100 million adults in Pakistan don’t have access to formal and regulated financial services. This number is approximately 5% of the world’s entire “unbanked” population, which currently stands at 2 billion. Despite of this, there is one huge positive aspect that Pakistan leads in digital finance and branchless banking in South Asia as 6% of adults have mobile accounts compared to South Asia’s average of 2.6%. This shows that Pakistani consumers are ready to accept the new technology.

The acceptance of new technological platforms is evident from the fact that Pakistani banking industry that started back in 1947 touched figure of 40 million bank accounts in the year 2016 whereas it took branchless banking only five years to reach 17 million accounts. There is also a forecast that in few more years this figure would reach 20 to 30 million. This growth was possible due to the increase in the mobile phone subscribers in Pakistan.

With the introduction of National Financial Inclusion Strategy (NFIS) launched in 2015, now almost all banks have introduced their official banking apps. These apps allow users to perform basic banking operations like checking balance, transfer of funds, payment of utility bills etc. All these transactions are done over a safe and secure network and secondly the issue of mobility (mentioned earlier) has also been solved as all transactions can be done with a touch of few buttons right from home.

Now banks and financial corporations should further try to promote and educate their account holders so that they can get maximum benefit from the facilities available through branchless and mobile banking. Moreover, products like Telenor Easypaisa, SimSim Mobile Wallet, and Jazz Cash are disrupting the normal day to day financial processes in the country serving almost every part of the society particularly the unbanked population.

Economy is the backbone of all kinds of development process thus the amalgamation of technology with finance is the step in the right direction. Now to further utilise this FinTech phenomenon, it is mandatory for the relevant authorities to promote the products among the masses.

-

Comment by Riaz Haq on March 13, 2018 at 10:49am

-

#China’s #Alibaba's subsidiary Ant Financial makes foray into #Pakistan through Telenor deal. #payments #fintech #CPEC

https://www.ft.com/content/e0ead4c2-26c8-11e8-b27e-cc62a39d57a0

Telenor Group, the Norwegian telecom giant and Ant Financial Services, an affiliate of Chinese e-commerce giant Alibaba, on Tuesday announced a ‘strategic partnership’ that will see Ant invest $184.5m in Pakistan’s Telenor Microfinance Bank (TMB), a subsidiary of Telenor.

The investment, which is the first by Ant in the south Asian country, will oversee investments in further developing TMB’s mobile payment and digital financial services.

“There are 100m Pakistanis (roughly half the population) who don’t have a bank account,” Sigve Brekke, CEO of Telenor Group, told the Financial Times, highlighting the scope for expansion of banking services. “The services they will receive will range from payments of bills, drawing salaries, drawing pensions and access to micro finance”.

Mr Brekke said progress by Pakistan in creating a national ID cards system run by the government’s national database registration authority has helped to improve documentation for financial transactions.

“This [customers’ details] have to match with their IDs [national ID cards],” he said. “Its a way [of documentation of money transfers] to deal with issues like money laundering.”

A central bank official in Karachi, the southern port city said products like the ones offered by TMB have helped to improve security of transactions, especially in congested urban neighbourhoods where thefts at gun point were common in the past.

“Rather than carry currency notes all around, its safer to go to a franchise and just send or receive money,” said the official. “This is the kind of service also helps people avoid going out in the rush hour.”

The announcement comes as Telenor Pakistan gets ready to celebrate its 13 years of existence in the country next week. During this time, the company has invested approximately U$3.5bn in Pakistan’s telecom sector where the demand for voice communication has quickly added to a rapidly growing number of data customers.

Mr Brekke said the company expects a strong growth in demand from customers who seek to use mobile services for financial transactions.

-

Comment by Riaz Haq on March 13, 2018 at 5:17pm

-

#Pakistani-#American founder Amir Wain of #SiliconValley #fintech #payments firm i2c expands operations to #Omaha #Nebraska

http://www.omaha.com/money/payments-company-to-bring-jobs-to-omaha-...

A California payments company plans to open its second North American operations center in Omaha by this summer and employ about 300 people within a year, with hiring to start next week.

The company, i2c Inc. of Redwood City, California, helps financial institutions, corporations and government agencies with credit, debit, prepaid and other payments through a cloud-based computer system called Agile Processing.

The company said Tuesday its Omaha investment would total $30 million over four years.

Much of the work will be “client facing,” servicing i2c’s clients, said Peg Johnson, a former First Data Resources executive who joined i2c a year ago and will head up the Omaha operation as executive vice president.

Johnson, a native Omahan, worked 20 years at First Data, most recently as a senior vice president running client services for one of its business lines.

“We absolutely knew that we wanted to bring these types of jobs to somewhere in the Midwest,” she said. “It’s all about the work ethic, the people’s loyalty to their employer.”

Omaha was chosen because of the city’s talent pool in the financial technology, or fintech, industry, she said.

“Omaha could not have been a better choice,” she said. “We have highly qualified, fintech-savvy personnel here.”

Omaha’s payment-related businesses include Omaha-born First Data, PayPal, Convergys and CSG Systems, all competing for many of the same people.

“I’m not worried at all,” Johnson said. “We’re going to be an employer of choice, obviously pay well. We’ll have a premier location and a premier facility.”

The company hasn’t signed a lease yet but has chosen an existing building close to bus lines and with easy access, Johnson said. She declined to reveal its location before signing a lease.

The Omaha center will expand i2c’s account management, operations and client services divisions and have a computer network operations center, similar to a center i2c opened in Montreal in 2016.

In a press release, Amir Wain, i2c’s founder and chief executive, said the Omaha center will support the privately owned company’s growth.

“Our customers’ success is our No. 1 priority, and this expansion underscores our commitment as we continue on our path to $1 billion in revenue,” he said.

-

Comment by Riaz Haq on March 14, 2018 at 8:51am

-

#Cubix bags the first prize in the #Fintech Hackathon 2018 in #Karachi #Pakistan #Momentum

http://chicagoeveningpost.com/2018/03/08/cubix-bags-the-first-prize...

Thursday 8th March 2018 – Cubix ‘Kifayat’ – a solution to manage ballot committees digitally and way more conveniently – sounded spectacular to the jury.

After a long and intense period of 2 days of Hackathon, the jury – comprised of top management from Bank Alfalah, TPS and Covalent including banking executives and Fintech experts – selected CubixKifayat as the winner of Fintech Hackathon in Karachi, Pakistan. The theme of this hi-tech event was revolving around “Building interesting financial products atop the APIs provided by the Partners of the program” which may help in creating new customer experiences and revenue models by leveraging Pakistan’s digital payment ecosystem.

The Hackathon started right after the 10th Anniversary Celebrations at Cubix where the stage was set for the employees, partners and affiliates with their entire family. Many of the employees even from technical division were wrapping up the projects on tough deadline to share their milestone achievements in the event. Technical team hardly got time to breath in, entering the competition, yet Cubix with its legacy chose not to miss the opportunity and went ahead to showcase the talent. And it was an immense pleasure for the CTO of the company, Mr. Ali Sohani, to see that hard work did pay off beautifully when they not just managed to secure the position but, coming out as winners amongst all the city-wide competitors.

The Hackathon took place in Karachi at the Momentum 2018 and it was a treat to watch startups thriving to their maximum potential for funding and investments.

The participating teams were given access to multiple API’s of reputed organizations such as Bank Alfalah, TPS Worldwide and Access Group. They were tasked to innovate an idea that can solve a financial problem faced by majority of people and at the same time, proves to be beneficial for the banking industry.

Cubix Commerce responded with the CubixKifayat App, which simplifies the whole tedious procedure of managing a Ballot Committee. The app aims to manage ballot committee online while taking care of details like funds transfer and trust process involved in secure and distributed manner respectively. The app operates with connecting all of its users with a bank accounts or virtual online wallets that can be charged with EasyPaisa and JazzCash. Transfer of funds can be done via various digital payment mediums and all of the transactions will be transparent and secured. CubixKifayat aims to leverage banks and its users on a broader scale and with majority of Pakistanis using the old conventional method of managing ballot committee, this app can revolutionize the method of managing ballot committees forever.

“Earlier this year I came across an article that showcased, in Pakistan, Ballot Committees are 3rd most used channel to save money and for p2p-funding. This is where the idea of Cubix Kifayat emerged from. CubixKifayat is a solution for nearly every household in the country that yet doesn’t believe in big banks or centralized systems for the saving and lending of money.”Said CTO, Mr.Ali Sohani.

As a winner of the first ever Fintech Hackathon, Cubix Commerce has a long way to go and here is a proof of it. Bank Alfalah gave their APIs to team Cubixfor their future projects and self-learning.

Comment

- ‹ Previous

- 1

- 2

- 3

- 4

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

Agriculture, Caste, Religion and Happiness in South Asia

Pakistan's agriculture sector GDP grew at a rate of 5.2% in the October-December 2023 quarter, according to the government figures. This is a rare bright spot in the overall national economy that showed just 1% growth during the quarter. Strong performance of the farm sector gives the much needed boost for about …

ContinuePosted by Riaz Haq on March 29, 2024 at 8:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network