PakAlumni Worldwide: The Global Social Network

The Global Social Network

Fintech to Expand Financial Inclusion in Pakistan

About 100 million Pakistani adults lacked access to formal and regulated financial services as of 2016, according to a World Bank report on financial inclusion. Only 2.9% of adults in Pakistan had a debit card, and only 1% of adults used them to make payments. Just 1.4% of adults used an account to receive wages and 1.8% of adults used it to receive government transfers in 2014. Since then, Pakistan has been leading the way in South Asia in digital finance and branchless banking.

According to the latest State Bank statistics on branchless banking (BB) sector, mobile wallets reached a high of 33 million as of September 2017, up 21% over the prior quarter. About 22 percent of these accounts – 7.4 million – are owned by women, up 29% in July-September 2017 over previous quarter. A McKinsey and Co analysis shows that adoption of financial technology (fintech) can help dramatically increase financial inclusion in Pakistan.

Karandaaz Pakistan , a non-profit organization, set up jointly by UK’s Department for International Development and Bill and Melinda Gates Foundation, is promoting financial technology in the country. Finja and Inov8 are among the better known fintech startups in the country. Chinese e-commerce giant Alibaba's Ant Financial's recent entry in Pakistan is creating a lot of excitement in Pakistan's fintech community.

Financial and Digital Inclusion in Pakistan. Source: Brookings Inst... |

Importance of Financial Inclusion:

Access to regulated financial services for all is essential in today's economy. It allows people and businesses to come out of the shadows and fully participate in the formal economy by saving, borrowing and investing.

Those who lack access to regulated banking services are often forced to resort to work with unscrupulous lenders who trap them in debt at unaffordable rates. Such loans in extreme cases lead to debt bondage in developing countries.

Financial inclusion is good for individuals and small and medium size businesses as well as the national economy. It spurs economic growth and helps document more of the economy to increase transparency.

Status of Financial Inclusion in Pakistan:

About 100 million Pakistani adults lacked access to formal and regulated financial services as of 2016, according to a World Bank report on financial inclusion. Only 2.9% of adults in Pakistan had a debit card, and only 1% of adults used them to make payments. Just 1.4% of adults used an account to receive wages and 1.8% of adults used it to receive government transfers in 2014. Since then, Pakistan has been leading the way in South Asia in digital finance and branchless banking.

M-wallets Growth in Pakistan in millions. Source: Business Recorder |

Mobile wallets, also called m-wallets, are smartphone applications linked to bank accounts that allow users to make payments for transactions such as retail purchases. According to recent State Bank statistics on branchless banking (BB) sector, mobile wallets reached a high of 33 million as of September 2017, up 21% over the prior quarter. About 22 percent of these accounts – 7.4 million – are owned by women, up 29% seen in Jul-Sep 2017 over previous quarter. Share of active m-wallets has also seen significant growth from a low of 35% in June 2015 to 45% in September 2017.

“The benefits of digital payments go well beyond the convenience many people in developed economies associate with the technology,” says Dr. Leora Klapper, Lead Economist at the World Bank Development Research Group. “Digital financial services lower the cost and increase the security of sending, paying and receiving money. The resulting increase in financial inclusion is also vital to women’s empowerment.”

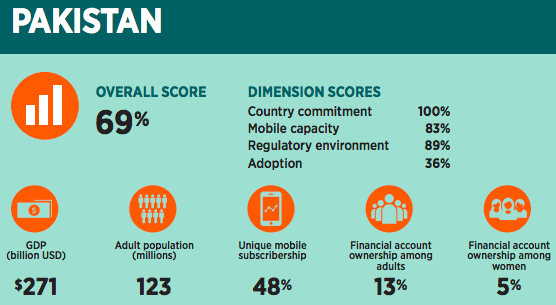

A McKinsey and Co analysis shows that adoption of financial technology (fintech) can help dramatically increase financial inclusion in Pakistan. Pakistan is ranked 16th among 26 nations ranked by Brookings Institution with an overall score of 69% in "The State of Financial and Digital Inclusion Project Report" for 2017. The Internet revolution is enabling rapid growth of financial technology (fintech) for increasing financial inclusion in Pakistan.

A McKinsey Global Institute report titled "Digital Finance For All: Powering Inclusive Growth In Emerging Economies" projects that adoption of financial technology (fintech) in Pakistan will add 93 million bank accounts and $36 billion a year to the country's GDP by 2025. It will also create 4 million new jobs and add $7 billion to the government coffers in this period.

McKinsey report says that "Pakistan has solid digital infrastructure and financial regulation in place and has even had some success in digital domestic-remittance payments".

Fintech Players in Pakistan:

There are a number of companies, including some startups, offering fintech applications for smartphones that are linked to bank accounts. EasyPaisa operated by Telenor Microfinance is already well established. Among some of the better known startups working to disrupt the financial services sector in Pakistan are Finja and Inov8.

China's e-commerce giant Alibaba runs a major global e-payments platform Alipay. It also owns Ant Financial which has recently announced the purchase of 45% stake in Pakistan-based Telenor Microfinance Bank.

Telenor Pakistan runs its own e-payments platform EasyPay which will likely link up with Alipay global payments platform after the close of the Ant Financial deal. Bloomberg is also reporting that Alibaba is in serious talks to buy Daraz.pk, an online retailer in Pakistan. These developments are creating a lot of excitement in Pakistan's fintech and e-commerce communities.

Alibaba and Alipay and other similar platforms are expected to stimulate both domestic and international trade by empowering small and medium size Pakistani entrepreneurial businesses and large established enterprises.

Karandaaz Fintech Promotion:

A key player promoting financial inclusion is Karandaaz Pakistan , a non-profit organization, set up jointly by UK’s Department for International Development and Bill and Melinda Gates Foundation. It is providing grants for a number of local initiatives to develop and promote financial technology solutions in Pakistan.

Karandaaz Pakistan is promoting Fintech startups in 5 areas of focus:

1) Access to Financial services

Credit Scoring Models, Formalize savings through need based products, Digital lending services, and Insurance

2) Payments

Retail payments solutions through QR code, Supply / Value Chain Digitization, Ideas around digitization of online payments and merchant payments

3) E-Commerce

Smoothening of on-boarding process, Enabling Escrow Accounts for a retail merchant, Alternate payment modes other than COD

4) Interoperability

Innovative ideas to address the lack of interoperability among m-wallets

5) Early stage ideas related to:

M-Wallet Use cases, Education of Financial Services through technology, Customer Engagement / Experience, Micro Credit, Digital Savings

Summary:

About 100 million Pakistani adults lacked access to formal and regulated financial services as of 2016, according to a World Bank report on financial inclusion. Only 2.9% of adults in Pakistan have a debit card, and only 1% of adults use them to make payments. Just 1.4% of adults use an account to receive wages and 1.8% of adults use it to receive government transfers in 2014. At the same time, Pakistan is leading the way in South Asia in digital finance and branchless banking.

According to the latest State Bank statistics on branchless banking (BB) sector, m-wallets reached a high of 33 million as of September 2017, up 21% over the prior quarter. About 22 percent of these accounts – 7.4 million – are owned by women, up 29% seen in Jul-Sep 2017 over previous quarter. A McKinsey and Co analysis shows that adoption of financial technology (fintech) can help dramatically increase financial inclusion in Pakistan.

Karandaaz Pakistan , a non-profit organization, set up by UK’s Department for International Development and Bill and Melinda Gates Foundation, is promoting financial technology in the country. Chinese e-commerce giant Alibaba's Ant Financial's recent entry in Pakistan is creating a lot of excitement in the country's fintech community.

Related Links:

Fintech Revolution in Pakistan

The Other 99% of the Pakistan Story

Pakistan's Financial Services Sector

-

Comment by Riaz Haq on May 14, 2022 at 7:14pm

-

The Indian economy is being rewired. The opportunity is immense

And so are the stakes

https://www.economist.com/leaders/2022/05/13/the-indian-economy-is-...

As the country emerges from the pandemic, however, a new pattern of growth is visible. It is unlike anything you have seen before. An indigenous tech effort is key. As the cost of technology has dropped, India has rolled out a national “tech stack”: a set of state-sponsored digital services that link ordinary Indians with an electronic identity, payments and tax systems, and bank accounts. The rapid adoption of these platforms is forcing a vast, inefficient, informal cash economy into the 21st century. It has turbocharged the world’s third-largest startup scene after America’s and China’s.

Alongside that, global trends are creating bigger business clusters. The it-services industry has doubled in size in a decade, helped by the cloud and a worldwide shortage of software workers. Where else can Western firms find half a million new engineers a year? There is a renewable-energy investment spree: India ranks third for solar installations and is pioneering green hydrogen. As firms everywhere reconfigure supply chains to lessen their reliance on China, India’s attractions as a manufacturing location have risen, helped by a $26bn subsidy scheme. Western governments are keen to forge defence and technology links. India has also found a workaround to redistribute more to ordinary folk who vote but rarely see immediate gains from economic reforms: a direct, real-time, digital welfare system that in 36 months has paid $200bn to about 950m people.

-

Comment by Riaz Haq on May 16, 2022 at 1:59pm

-

SBP

@StateBank_Pak

Another milestone achieved by #SBP in the journey of digitization, as number of #Raast IDs registration crosses 10 million mark since its launch in Feb22. Aggregated value of Person to Person (P2P) Transactions using #Raast system by customers crosses Rs36bn.https://twitter.com/StateBank_Pak/status/1526174517910986755?s=20&a...

-

Comment by Riaz Haq on August 10, 2022 at 7:42am

-

Non-bank finance firms disbursed over Rs6.14bn loans digitally

https://www.dawn.com/news/1673391/non-bank-finance-firms-disbursed-...

Licensed digital lending Non-Bank Finance Companies (NBFCs) have made rapid progress and started to show disruption in Pakistan’s lending landscape and are proving to be significant in furthering the journey of financial inclusion, data shared by the Securities and Exchange Commission of Pakistan (SECP) showed on Friday.

The SECP has licensed six fintech-enabled NBFCs, which have collectively reached out to 365,239 borrowers with disbursement of over Rs6,139 million through 858,998 loans, which signifies that many borrowers have obtained more than one loan from these lenders.

The data released by the SECP shows that the average loans size of these digitally-enabled NBFCs ranges from Rs1,000 to Rs80,000 depending upon the nature of business and target market of these entities.

“These are small loans available easily for the borrowers, but since these are digital-based, the borrowers cannot default and ignore the repayment,” said a senior official of the SECP adding that the data of defaulters is shared with the State Bank of Pakistan as a result the defaulter cannot avail any other financial service.

The official added under this lending mode, the small amount request by the borrower is credited into the digital wallet of the borrower within few hours as digital processing of the loan is fast and does not require any guarantee.

Newly licensed digital lending NBFCs include Finja Lending Services Limited, SeedCred Financial Services Limited, Qisstpay BNPL Limited, Tez Financial Services Limited, Cashew Financial Services Limited and CreditFix Financial Services Limited. These NBFCs are providing financial solutions to otherwise unserved and underserved through digital means and include Nano lending, Peer-to-Peer (P2P) Lending and Buy-Now-Pay-Later models etc.

All of these licences have been issued during the last three years to NBFCs that are engaged in digital lending using innovative fintech solutions.

The first fintech-enabled NBFC licence was issued in 2019 and only 55,528 requests were honoured, disbursing Rs495 million, while by the end of 2021, the six licence holders disbursed a total of Rs6.13 billion to 365,239 borrowers.

“This is a solution to the traditional complaint that the banks were not interested in small loans, and the majority of borrowers were those who either did not possessed credit cards or wanted to spend the amount in any sector which does not deal in credit cards,” the official added.

The SECP has said that fresh applications have been received for NBFC licence from investors who intend to engage in fintech based lending.

-

Comment by Riaz Haq on November 14, 2022 at 4:37pm

-

Investors, including HBL, participate in Finja’s Series A2 Funding Round

Finja, Pakistan’s largest dual-licensed SME digital lending platform, announced fresh capital injection as part of its $10 Million Series A2 financing round, with participation from notable investors including Sturgeon Capital and HBL.

https://www.globalvillagespace.com/investors-including-hbl-particip...

Finja, Pakistan’s largest dual-licensed SME digital lending platform, announced fresh capital injection as part of its $10 Million Series A2 financing round, with participation from notable investors including Sturgeon Capital and HBL. This investment round is multi-dimensional and includes equity, debt, and off-balance sheet capital. This is HBL’s second investment in Finja after its initial participation in the company’s Series A1 round.

With this injection, Finja has the capacity to finance more than $50 million over the next 12 months to catalyze the potential of Pakistan’s SME sector. This has set the stage to further scale Finja’s existing digital co-lending program to support its overall vision of empowering Micro, Small and Medium Enterprises (MSMEs) and their supply chains with digital credit.

This financing is a significant step towards more fully utilizing Finja’s credit engine, which continues to prove its scalability and accuracy, cementing Finja as the sustainable choice for SMEs throughout Pakistan.

Qasif Shahid, Co-Founder Finja remarked, “The future of the financial services industry lies in collaboration between fintechs and banks. Moving away from vertical silos to open banking systems and embedded finance. This puts Finja in a winning position as it ramps up our capability to offer small and micro businesses digital products.” He further added, “With this new injection and our laser focus on optimizing our organization, we will now be turbo charging digital lending to SMEs through our association with HBL”

Finja today has emerged as one of the leading digital lending platforms in the country clocking a total lending throughput of PKR 7 Billion at the back of extending approximately 150,000 loans to 35,000 Karyana stores in 30+ cities. Finja also works closely with FMCG distributors and helps them to buy supplies upstream on credit and also provides purpose built working capital lending lines to SMEs scored through Finja’s proprietary AI/ML algorithms.

Kamran Zuberi, CEO Finja Lending Services, remarked that Finja is the first financial services entity to package capital in small amounts of PKR 50,000 and for periods of 7, 14 and 30 days to Karyana stores for availing credit to buy supplies and improve their sales. “We score these retailers from data that we get from our partnerships with multiple FMCG principles, hundreds of distributors and new-age market aggregators that operate mobile apps for small retailers to order supplies from.”

-

Comment by Riaz Haq on November 22, 2022 at 10:28am

-

Waada Buys Rival to Become Pakistan’s Top Insurance-Tech Startup

Pakistan’s insurance penetration is 0.7%, trailing neighbors

Nation to see further consolidation as funding slows: investor

---------------

Waada becomes largest technology led insurance start-up in Pakistan - 24/7 News

https://www.insurancejournal.com/news/international/2022/11/07/6938...

Pakistani online insurance startup Waada acquired a local rival to create the South Asian nation’s largest player in the field, seeking to benefit from growth in the burgeoning market.

The Karachi-based company took over MicroEnsure Pakistan, a unit of MIC Global operating in South Asia and Africa, in an all-stock deal, according to a statement Friday. The brands combined have 1.5 million active customers, Waada said, without disclosing the deal value. Waada also said it’s closed a seed round of $1.3 million from local angel investors and foreign venture capital firms.

Pakistani online insurance startup Waada acquired a local rival to create the South Asian nation’s largest player in the field, seeking to benefit from growth in the burgeoning market.

The Karachi-based company took over MicroEnsure Pakistan, a unit of MIC Global operating in South Asia and Africa, in an all-stock deal, according to a statement Friday. The brands combined have 1.5 million active customers, Waada said, without disclosing the deal value. Waada also said it’s closed a seed round of $1.3 million from local angel investors and foreign venture capital firms.

----------

https://247news.com.pk/waada-becomes-largest-technology-led-insuran...

Waada, The Insurance start-up has announce that the company has become the largest player among all technology-led start-ups in the country’s insurance segment after acquiring its rival company MicroEnsure Pakistan.

The Announcement was made on the startup’s Social media handle LinkedIn, In the announcement, it has been confirmed that deal has been locked however, company has not disclosed the details of the deal yet.

Separately, the company also announced a $1.3 million seed funding round. According to international news agency, the all-stock deal will bring the number of active customers of Wada to 1.5 million. “Waada aims to add customers using online sign-ups and has a goal to distribute 10m policies in three to five years,” it said.

-

Comment by Riaz Haq on November 22, 2022 at 10:36am

-

Pakistan:Insurance market grows by nearly 22% in 2021

https://www.asiainsurancereview.com/News/View-NewsLetter-Article?id...

The insurance industry posted gross annual premium of PKR432bn ($1.9bn) in 2021, 21.7% higher than the PKR355bn chalked up in 2020, according to data compiled by the Securities and Exchange Commission of Pakistan (SECP).

---------

Other News

- Pakistan:Insurance market sees GWP jump by 24% in 2021

- Pakistan:Adamjee's improved underwriting results lead to more balanced split...

- Thailand:Insurance industry growth predicted to be flat in 2023

- Hong Kong Insurance Awards 2022 winners feted

- Taiwan:Cathay Financial Holdings to raise at least US$1.4bn

-

Comment by Riaz Haq on November 22, 2022 at 11:51am

-

Insurance grows 22pc but penetration remains minuscule

https://www.dawn.com/news/1712835

The insurance sector grew nearly 22 per cent last year even though its penetration — the ratio of premiums to GDP — stayed at a paltry 0.91pc, a new report showed on Friday.

‘The Insurance Industry Statistics for 2021,’ the Securities and Exchange Commission of Pakistan’s (SECP) first report on the sector, said gross premiums jumped to Rs432 billion in 2021 from Rs355bn a year ago, a growth of 21.7pc.

The size of paid claims rose from Rs170bn to Rs189bn, of which Rs136bn was paid by life insurance and Rs53bn by non-life insurance companies.

The number of policies stood at Rs10.1 million by the end of 2021, including 8m in the life insurance and family takaful segment and 2.1m in the non-life insurance and window takaful segment.

Insurance density — the ratio of gross premiums to the country’s population — stood at Rs2,084, the report said.

As of Dec 31, 2021, the insurance industry had 41 active operators, including 30 non-life insurers/general takaful operators, 10 life insurers/family takaful operators and one reinsurer.

The number of complaints also jumped, the report showed, as the sector received 10,297 complaints in 2021 compared to 8,254 a year ago. However, it also disposed of more complaints: 10,182 vs 8,086.

Of the total gross premiums of the non-life industry, 56pc came from Sindh, followed by 35pc from by Punjab, 7pc from Islamabad, whereas Balochistan, KP, GB and AJK each had a share of less than one per cent.

“As the data clearly demonstrates, Pakistan’s insurance market holds enormous untapped potential for growth,” SECP Commissioner Sadia Khan said in her remarks in the report.

-

Comment by Riaz Haq on December 23, 2022 at 5:01pm

-

Mobile banking doubles, internet banking grows by 51.7% in FY2021-22

As internet banking, POS, and eCommerce transactions post strong growth, the digital payments ecosystem is picking up steam

https://profit.pakistantoday.com.pk/2022/12/23/mobile-banking-doubl...

https://www.sbp.org.pk/PS/PDF/FiscalYear-2021-22.pdf

The overall number of payment cards, however, decreased during the year, from 45.9 million in 2020-21 to 42.4 million in 2021-22.

Bring in the fintech

According to the State Bank’s annual report, the four fully licensed EMIs (electronic money institution); Sadapay, Nayapay, Finja and CMPECC, combined had 262,558 total active accounts and 514,961 payment cards issued to their customers. Last year’s numbers on EMIs were not available for a comparison on how these numbers have grown.

The SBP has in the past has often emphasised on the potential fintech can play to boost digital payments and financial inclusion.

During his speech at the Institute of Banking Pakistan Annual Award Ceremony, Jameel Ahmad, Governor SBP stressed on the need for banks to revisit their traditional approach to service delivery and adapt quickly as digitalization shifts the balance of power from banks to tech savvy entities, hinting at the growing trend in fintech.

“Leveraging digital technology is essential not only to promote financial inclusion, but also to ensure that the industry keeps pace with emerging global trends,” opined Ahmed.

Speaking on the importance of technology, Ahmad quotes M-Pesa, a Kenyan fintech. “An often-cited success story is that of M-Pesa in Kenya, where it single-handedly drove mobile financial services availability and successfully raised financial services access in Kenya. “

Ahmad pointed out that a number of factors already exist in Pakistan that can help drive digital financial innovation and proliferation of a tech-based financial ecosystem. He pointed out that the nation has a fully functional digital ID system, ubiquity of mobile devices, penetration of mobile and broadband services, availability of faster payment rails, remote account opening process, and facilitative regulatory environment for enabling the entry of non-bank entities into the financial arena.

The Central Banker also points out that while fintech has brought competition, it also presents the sector with an opportunity to create synergies and mutually beneficial partnerships.

“Banks and Fintechs can partner with each other to provide innovative products for customers that are otherwise not viable on a standalone basis. For banks, such partnerships can help with penetration in untapped segments like retail businesses and Micro and Small Medium Enterprises, yielding beneficial outcomes for all stakeholders,” he said.

Encouraging the banks that are yet to make consistent and sustained moves toward technological transformation, Ahmad told them to make use of the digital bank frameworks and the instant payment system, RAAST, to position themselves for the future.

-

Comment by Riaz Haq on December 29, 2022 at 10:02am

-

Pakistan’s Agriculture-focused Fintech Digit++ Obtains Approval from State Bank

https://www.crowdfundinsider.com/2022/12/200398-pakistans-agricultu...

The State Bank of Pakistan (SBP), the nation’s central bank, has reportedly granted approval to the test launch of the country’s very first agriculture-focused Fintech platform, Digitt+ (providing an Electronic Money Institution or EMI permit).

Digitt+ is supported by Akhtar Fuiou Technologies (AFT), the firm revealed this past Friday.

According to the firm, the aim of this agri-Fintech app is to fully digitize the agricultural ecosystem, enable greater financial inclusion for local farmers and unbanked consumers via its tech, partnership, relationship with agri-businesses and FMCGs operating in Pakistan.

As reported by local sources, Digitt+ has teamed up with FuiouPay, an international payment solutions provider, in order to offer a market-based alternative to the traditional banking system.

As explained in the announcement, FuiouPay provides holistic enabling solutions via their 75 intellectual property licenses and proprietary software solutions.

Qasim Akhtar Khan, Founder and Chief Strategy Officer at Digitt+, noted that the firm will offer financial technology solutions to farmers residing in the country, who will have the option to open bank accounts and also gain access to credit and digital financial services – including easy bill payments, digital commerce, investments as well as fund transfers.

As noted in the update, the approval from the State Bank of Pakistan is a key milestone.

This ongoing initiative has the potential to address persistent food security issues, significantly improve yields and enhance human welfare in Pakistan, directly affecting local farmers and merchants, he stated.

Notably, Pakistan has been a significant agriculture powerhouse for many years. Agriculture employs around 50% of the nation’s workforce and also contributes approximately 25% to the GDP.

While this is considerable, the industry doesn’t have adequate access to financial services from the banking sector.

Ahmed Saleemi, CEO of Digitt+ explained that using tech to create digital financial products focusing on micro services to build a platform that should support the delivery of these solutions for the retail Agri market and corporate sector can be achieved via the provision of business tools.

-

Comment by Riaz Haq on December 30, 2022 at 10:58am

-

Although Pakistani startups posted a 36% decline in third quarter (July-September) of calendar year 2022 compared to the previous quarter, the financial technology (fintech) showed rising graph during the same period.

https://www.nation.com.pk/10-Nov-2022/unbanked-population-helping-p...

According to the data of Invest2Innovate (i2i), a startups consultancy firm, six out of the 14 deals that took place in Q3 2022 were fintech startups, compared to two deals of e-commerce startups. Fintech startups raised $38 million which is 58% of total funding ($65 million) in Q3 2022, compared to e-commerce startups that raised 19% of total funding. The i2i data shows that in Q3 2022, fintech raised 37.1% higher than what it raised in Q2 2022 ($27.7 million). Similarly, in Q2 2022, the total investment of fintech was 63% higher compared to what it raised in Q1 2022 ($17 million).

Sumbal Qureshi, a fintech consultant, told WealthPK that political situation has an impact on the economic situation of the country due to which a lot of foreign fintech companies have held back their initiatives. This situation is also a challenge for local fintech firms. The unusual growth is just because the existing fintechs and more established companies are trying to survive at the moment. They are trying to overcome the situation by continuing to invest in the fintech sector.

Imran Jattala, a well-known IT expert, told WealthPK that 5% of the world’s unbanked population lives in Pakistan. About 18,000 people are crossing the age of 18 every day in Pakistan, and unbanked population and those under 18 use fintech for their financial affairs. So fintech and digital banking is going to thrive despite a decrease in startup funding.

According to data of Pakistan Telecommunication Authority (PTA), over the years, branchless/mobile banking has shown tremendous growth based on the telco-banks-fintech nexus, contributing significantly to financial inclusion. The m-banking network has expanded to over 534,460 m-banking agents and 74.6 million m-wallet accounts. This network enabled more than 2.2 billion annual transactions worth over Rs8 trillion in 2021. Despite these developments, cash still dominates economic activities and there is scant use of electronic payments, especially by micro and small retailers. Cash is the predominant payment method in Pakistan as it is considered ‘safe’ by the majority of retailers and suppliers. Many wages and salaries are also paid through cash.

The importance and usage of electronic banking and alternative delivery channels has increased during the post-Covid-19 period. Realising this, the State Bank of Pakistan further incentivised the use of digital financial channels by instructing banks to waive all inter-bank and intra-bank charges on digital transactions. This resulted in a substantial annual increase of 206% in inter-bank transfers and 122% in intra-bank transfers through internet banking. For mobile banking, the impact was even higher, with a three-fold increase in mobile banking inter-bank transfers from Rs765 billion in FY 2020 to Rs2.346 trillion in FY 2021.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

Agriculture, Caste, Religion and Happiness in South Asia

Pakistan's agriculture sector GDP grew at a rate of 5.2% in the October-December 2023 quarter, according to the government figures. This is a rare bright spot in the overall national economy that showed just 1% growth during the quarter. Strong performance of the farm sector gives the much needed boost for about …

ContinuePosted by Riaz Haq on March 29, 2024 at 8:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network