PakAlumni Worldwide: The Global Social Network

The Global Social Network

Diaspora Remittances to Pakistan Soar 21X Since Year 2000

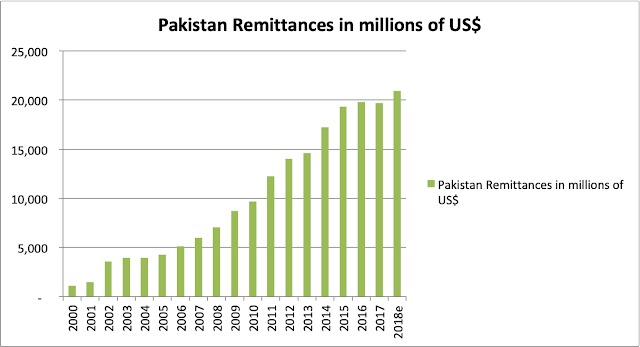

Remittance inflows from Pakistani diaspora have jumped 21-fold from about $1 billion in year 2000 to $21 billion in 2018, according to the World Bank. In terms of GDP, these inflows have soared nearly 7X from about 1% in year 2000 to 6.9% of GDP in 2018.

Meanwhile, Pakistan's exports have declined from 13.5% of GDP in year 2000 to 8.24% of GDP in 2017. At the same time, the country's import bill has increased from 14.69% in year 2000 to 17.55% of GDP in 2017. This growing trade imbalance has forced Pakistan to seek IMF bailouts four times since the year 2000. It is further complicated by external debt service cost of over $6 billion (about 2% of GDP) in 2017. Foreign investment in the country has declined from a peak of $5.59 billion (about 4% of GDP) in 2007 to a mere $2.82 billion (less than 1% of GDP) in 2017. While the current account imbalance situation is bad, it would be far worse if Pakistani diaspora did not come to the rescue.

Diaspora Remittances:

Estimated inflows of $20.9 billion make Pakistan the world's 7th largest recipient of remittances for 2018, according data released by the World Bank in its latest "Migration and Remittances" report of December 2018. In South Asia region, Pakistan is the second largest recipient of remittances of $20.9 billion after top-ranked India's $79.5 billion.

Pakistan Remittances in Millions of US Dollars. Source: World Bank |

Remittances from Pakistani diaspora have grown nearly 21-fold since the year 2000. Pakistanis sent home remittances adding up to 6.9% of the country's GDP in 2018, up from 1% back in year 2000.

Pakistan's Trade:

In 2017, Pakistan exported goods and services worth $22 billion while it imports amounted to $57 billion, a trade deficit of $35 billion for the year. This is a dramatic deterioration from about $2 billion trade deficit (2% of GDP) in year 2000 to $35 billion trade deficit (about 12 % of GDP) in year 2017.

Pakistan Trade Deficit in Billions of US$. Source: World Bank |

Pakistan's exports have declined from 13.5% of GDP in year 2000 to 8.24% of GDP in 2017. At the same time, the country's import bill has increased from 14.69% in year 2000 to 17.55% of GDP in 2017.

Foreign Direct Investment:

Foreign direct investment (FDI) in Pakistan was a mere $2.82 billion (less than 1% of GDP) in 2017, down from a peak of $5.59 billion (4% of GDP) in 2007. The lack of foreign investment has contributed to the country's dwindling reserves and balance of payments difficulties requiring it to seek yet another IMF bailout.

Pakistan's External Debt. Source: State Bank of Pakistan via Dr. Is... |

Pakistan's Debt:

Significant growth in remittances from Pakistani diaspora has clearly helped but the external accounts gap is too big for it. This has forced Pakistan to borrow heavily in recent years. It has raised debt service costs and put pressure on Pakistan's reserves.

Summary:

Remittances from Pakistani diaspora have jumped 21-fold from about $1 billion in year 2000 to $21 billion in 2018, according to the World Bank. In terms of GDP, these inflows have soared nearly 7X from about 1% in year 2000 to 6.9% of GDP in 2018. Meanwhile, Pakistan's exports have declined from 13.5% of GDP in year 2000 to 8.24% of GDP in 2017. Foreign investment in the country has declined from a peak of $5.59 billion (about 4% of GDP) in 2007 to a mere $2.82 billion (less than 1% of GDP) in 2017. At the same time, the country's import bill has increased from 14.69% in year 2000 to 17.55% of GDP in 2017. This growing trade imbalance has forced Pakistan to seek IMF bailouts four times since the year 2000. It is further complicated by external debt service cost of over $6 billion (about 2% of GDP) in 2017. While the current account imbalance situation is bad, it would be far worse if Pakistani diaspora did not come to the rescue.

Related Links:

Can Pakistan Avoid Recurring Balance of Payment Crisis?

Pakistan Economy Hobbled By Underinvestment

Can Indian Economy Survive Without Western Capital Inflows?

Pakistan-China-Russia Vs India-Japan-US

Chinese Yuan to Replace US $ as Reserve Currency?

Remittances From Overseas Pakistanis

-

Comment by Riaz Haq on August 8, 2022 at 4:38pm

-

Remittances Are a Lifeline for Developing Countries With Economic Instability

https://thefintechtimes.com/remittances-are-a-lifeline-for-developi...

Remittances sent worldwide have increased 64.3 per cent in the past decade, rising from $420.1billion 10 years’ ago to $653.4billion in the last year, shows research by ACE Money Transfer, the online remittance provider.

---

Global economic growth is expected to slump from 6.1 per cent last year to 3.2 per cent this year — significantly lower than the 4.1 per cent anticipated in January. This is due to rising interest rates and spiralling inflation. This slowdown in growth is expected to hit low-income countries harder.

---

Remittances also play a key role in urban areas, helping drive investment into real estate and infrastructure in developing countries.

Rashid Ashraf, CEO of ACE Money Transfer, says, “Remittances have a massive impact on people’s lives across the world. When times are tough and economies are struggling, this is when remittances are particularly important.

“Around three-quarters of remittances sent globally are used to cover essential things, like putting food on the family’s table and covering medical expenses, school fees or housing expenses. In addition, in times of crises, migrant workers tend to send more money home to cover loss of crops or family emergencies.”

Countries facing significant economic stress at present include Sri Lanka, Pakistan, Nigeria and Nepal. Remittances play a key role in supporting the economies of all mentioned countries.

Remittances key to helping Sri Lanka and Nepal’s struggling economies

Sri Lanka in particular has struggled following the pandemic, with its economy having collapsed. The country has been short of cash to pay for vital food and fuel imports and has defaulted on its debt.

Remittances are a key pillar of Sri Lanka’s economy, reaching $7.1billion in the past year, up from $6.7billion the previous year. Remittances in Sri Lanka support economic growth, reduce the burden on social security payments and help alleviate poverty. Increases in remittances could significantly aid Sri Lanka’s economic recovery.

-----

How remittances can help moderate inflation in Pakistan and Nigeria

Pakistan and Nigeria are two other countries facing economic difficulties where remittances can play a key role in their recoveries. Both countries have been struggling with the effects of surging inflation this year.

Pakistan’s currency has devalued 28 per cent compared to the US dollar so far this year, fuelling surges in the prices of vital imported goods such as fuel, cooking oil and grains.

This has made remittances to Pakistan, which have risen 26 per cent to a record $33billion in the past year, even more important. Remittances are a key source of foreign currency for Pakistan and play a significant role in supporting its currency. This is in turn can help control inflation and the price of essential goods and services in the country.

---

The role of remittances in strengthening resilient economies like the Philippines

Remittances can also play an important role in countries where the economy has remained resilient. This includes the Philippines’ economy, which has continued to show rapid expansion this year despite global headwinds.

An important stabilising factor in its economy has been remittances, which have reached a record high of $34.9billion in the past year. Remittances in the Philippines are important in supporting domestic consumer spending, which has driven the country’s economic growth.

Remittances are a crucial source of foreign capital for many developing countries. Unlike other flows of private capital, remittances have remained resilient throughout the pandemic. As economics across the world continue to recover, remittances continue to play a vital role in helping countries build resilience and drive economic growth.

Comment

- ‹ Previous

- 1

- 2

- 3

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

Agriculture, Caste, Religion and Happiness in South Asia

Pakistan's agriculture sector GDP grew at a rate of 5.2% in the October-December 2023 quarter, according to the government figures. This is a rare bright spot in the overall national economy that showed just 1% growth during the quarter. Strong performance of the farm sector gives the much needed boost for about …

ContinuePosted by Riaz Haq on March 29, 2024 at 8:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network