PakAlumni Worldwide: The Global Social Network

The Global Social Network

Construction Boom Resumes in Pakistan

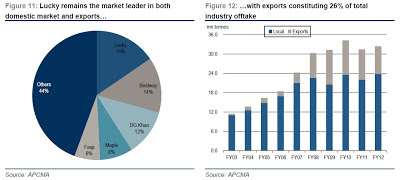

Renewed construction boom in Pakistan has helped the nation's cement producers significantly increase their sales and profits. Year-over-year, income at Lucky Cement, Pakistan's largest producer of building materials, is up 33% while DG Khan Cement, second largest cement company, has quadrupled its profits.

|

| Source: Credit Suisse Report on Pakistan Cement Sector |

Cement production, an important barometer of national economic activity, was up 8% in 2011-12, according to a research report compiled by a Credit Suisse analyst.

CS analyst Farhan Rizvi says in his report that "higher PSDP (Public Sector Development Program) spending has led to a resurgence in domestic cement demand in FY12 (+8%) and with increased PSDP allocation for FY13 (+19%) and General Elections due in Feb-Mar 2013, domestic demand is likely to remain robust over the next six-nine months".

|

| Nagan Chowrangi Interchange in Karachi |

Ongoing public sector projects include new large and small dams, irrigation canals, power plants, highways, flyovers, airports, seaports, etc. Most of these were already in the pipeline when the PPP government assumed control in 2008. Recent pre-election increases in PSDP funding allowed work to resume on these projects in 2011-12.

In addition to public sector infrastructure projects, there is a lot of privately funded real estate development activity visible in all major cities of the country. Big real estate developers like Bahria Town and Habib Construction are developing both commercial and housing projects in Islamabad, Karachi and Lahore. Other cities like Faisalabad, Hyderabad, Larkana, Multan, Mirpur, Peshawar and Quetta are also seeing new housing communities, golf courses, hotels, office complexes, restaurants, shopping malls, etc.

|

| Artist's Rendering of Sheraton Islamabad Golf City Resort |

Credit Suisse is bullish on Pakistan's cement sector in particular and Pakistani shares in general.

CS analyst Farhan Rizvi has initiated coverage with "an OVERWEIGHT stance, as we believe compelling valuations, improving domestic demand outlook, better pricing power and easing cost pressures make the sector an attractive investment proposition. Despite better growth prospects (3-year CAGR of 17% over FY12-15E) and improving margins, the sector trades at an attractive FY13E EV/EBITDA of 3.8x, 49% discount to the historical average multiple of 7.4x. Moreover, FY13E EV/tonne of US$74 is approximately 29% discount to historical average EV/tonne of US$104 and 50% discount to the region".

Another CS analyst Farrukh Khan, based in Credit Suisse’ Asia Pacific

headquarters in Singapore,says in his research report that “liquidity in 2012 has been concentrated in stocks offering positive

earnings surprises (e.g., United Bank, Lucky Cement, DG Khan Cement and

Bank Alfalah), enabling them to be strong outperformers. With further improvements in

liquidity, we expect a broad-based price discovery to take hold in

attractively valued oil and fertilizer stocks as well.”

A string of strong earnings announcements by Karachi Stock Exchange

listed companies and the Central Bank's 1.5% rate cut have already helped the KSE-100 index gain 32% in US dollar terms year to date.

Related Links:

Haq's Musings

Strong Earnings Propel KSE-100 to 4 Year High

Development in Pakistan-Defence.pk

Credit Suisse on Pakistan Cement Sector

Credit Suisse Research Report on Pakistan Equities

Tax Evasion Fosters Aid Dependence

Poll Finds Pakistanis Happier Than Neighbors

Pakistan's Rural Economy Booming

Pakistan Car Sales Up 61%

Resilient Pakistan Defies Doomsayers

Land For Landless Women in Pakistan

-

Comment by Riaz Haq on October 31, 2012 at 10:12pm

-

Here's an ET report on KSE-100 hitting a new high today:

KARACHI:

As investors shrugged off lethargy from the long Eidul Azha weekend, the stock market rebounded amid greater investor participation to close at a new historic high.

“With renewed buying interest from institutional clients and foreign fund managers, the market closed at yet another historic high,” said Topline Securities equity dealer Samar Iqbal. “Investors anticipate lower inflation figures for the month of October, due [to be announced] tomorrow. Bullish sentiments were further augmented after better-than-expected result announcements from Pakistan Petroleum and the Hub Power Company.”

The Karachi Stock Exchange’s (KSE) benchmark 100-share index gained 0.72% or 114.18 points to end at the 15,910.11 points level. Trade volumes surged to 136 million shares compared with Tuesday’s tally of 85 million shares. The value of shares traded during the day was Rs4.96 billion.

“Pakistan stocks closed at their highest-ever, led by oil and cement stocks, as global commodities and stocks rally in the aftermath of Hurricane Sandy,” commented Arif Habib Corp analyst Ahsan Mehanti. He also attributed the market’s optimism to the positive current account balance for the first quarter of the fiscal year, and speculation that the State Bank might announce yet another cut in its policy rate next month.

“Major activity was again seen in the cement sector with DG Khan Cement and Lucky Cement gaining 2.0% and 3.1% respectively,” reported JS Global analyst Shakir Padela. “This is likely on the back of October cement dispatch numbers due to be announced in the coming days.”

DG Khan Cement was the volume leader with 14.98 million shares gaining Rs1.04 to finish at Rs52.91. It was followed by Azgard Nine with 9.00 million shares gaining Rs0.46 to close at Rs6.97 and Askari Bank with 7.73 million shares losing Rs0.07 to close at Rs16.57.

“The Oil and Gas Development Company also managed to close the day up by 2.2% on the back of foreign buying in the script,” added Padela.

Foreign institutional investors were net buyers of Rs264.33 million, according to data maintained by the National Clearing Company of Pakistan Limited.

http://tribune.com.pk/story/459038/market-watch-cement-oil-stocks-t...

-

Comment by Riaz Haq on November 3, 2012 at 10:36am

-

Those who keep raising BOP crisis alarm should read the following from Business Recorder:

ABU DHABI: Pakistan expects that strong double-digit growth in remittances from Gulf region will help achieve its overall target of $15 billion in the current fiscal year 2012-13.

Remittances from Gulf Cooperation Council GCC states to Pakistan may hit $10 billion in current fiscal year as the government is confident of having positive results from fresh measures it announced to boost inflows from UAE and Saudi Arabia. Overseas Pakistanis residing in GCC countries sent home a record $8 billion in remittances in financial year 2011-12, reflecting 60.77% share in total remittances of $13.18 billion. About four million overseas Pakistanis residing in Gulf States remitted $6.573 billion in fiscal year 2010-11.

The remittances inflow from Gulf states rose about 21.71% in last fiscal year. Remittances from GCC may reach between $9.5 billion and $10 billion in current fiscal year amid hopes that same growth trend will continue. Remittances from GCC states rose to $730.56 million in July 2012 compared to $677.60 million in same month last year. Total remittances also climbed 9.89% to $1.20 billion last month, indicating a strong growth for rest of the year.

"Pakistan has been witnessing a growing surge in remittances since present democratic government took over in 2008. From mere $6.4 billion remittances in 2008, fiscal year 2011-12 saw record remittances of $13.18 billion. Hopefully, we expect to achieve $15 billion remittances target for the year 2012-13," Pakistan Ambassador to the UAE Jamil Ahmed Khan told Khaleej Times.

Saudi Arabia remained a leading source of remittances for Pakistan in Gulf region with a leading share of $349.66 million in July. The remittances inflow from UAE stood at $240.54 million and other GCC states contributed $140.36 million last month.

---

Remittances witnessed 17.67% annual growth in last fiscal year inviting attention of economic managers to exploit opportunity for enhancing remittances to the maximum.

--------

Analysts say rising foreign remittances has not only brought stability to value of Pakistani rupee, but also played key role in narrowing down gap between foreign payments and receipts. The rising remittances, second major source of foreign exchange earnings after exports, practically helped the country with record foreign exchange reserves despite high oil prices and costly imports.

According to World Bank data, Pakistan has become fifth largest remittances recipient developing country in 2011 after India ($58 billion), China ($57 billion), Mexico ($24 billion), and the Philippines ($23 billion). World Bank estimated that remittance flows are expected to continue growing, with global remittances expected to exceed $593 billion by 2014, of which $441 billion will flow to developing countries.http://www.brecorder.com/top-news/1-front-top-news/75569-pakistan-e...

-

Comment by Riaz Haq on November 3, 2012 at 5:58pm

-

Here's an LA Times story on plans for Zulfikarabad:

SHAH BANDAR, Pakistan — In his dreams, Pakistani President Asif Ali Zardari sees a spectacular metropolis rising up from the vast stretches of mangrove swamp and sea-salted wasteland along the mighty Indus River Delta.

High-speed rail zips people from place to place. Vacationers soak up the South Asian sun at seaside resorts. Universities, factories and a new seaport pump vitality into the region. Miles of bike lanes crisscross the city, whose population would eventually reach 10 million.

Zardari wants to call his jewel Zulfikarabad, after Zulfikar Ali Bhutto, the founder of the country's ruling party, a prime minister and president, and the father of Zardari's slain wife, former premier Benazir Bhutto.

That's a lot of dreaming for a country struggling with a dizzying array of afflictions: Millions of Pakistanis are dirt poor, struggling to find clean water, contending with unreliable electricity and living in fear of violent extremists. In addition, the president has continued jousting with Pakistan's Supreme Court over long-standing graft allegations lodged years ago by Swiss authorities.

Such realities have put Zardari's popularity in a tailspin.

Many observers suspect that the president's enthusiasm for Zulfikarabad may be rooted in a burning desire to leave a legacy for this country of 180 million people. He's seeking an enduring achievement, they say, by an administration widely viewed as rife with failure.

Government officials won't place a price tag on the president's lofty vision, which is bound to cost tens of millions of dollars. They say only that the government's share would be limited to the construction of roads, bridges and other infrastructure, with the rest shouldered by investors.

Officials also say they consider the proposed city a desperately needed engine for jobs and economic growth.

Karachi, the country's largest city with a population of 18 million, is bloated with overcrowding and traffic jams, and needs a nearby city that can serve as a relief valve, they say.

"Karachi is getting choked," said Iftikhar Hussain Shah, managing director of the Zulfikarabad Development Authority. "It's going to suffer paralysis because there's no more room. So the people who are trying to look for setting up industries, they are looking for space.

----------

On a recent afternoon in Shah Bandar, a fishing village not far from where ground was broken this summer for a $39-million Zulfikarabad bridge, a group of sweat-soaked fishermen thumbed through a brochure promoting the city. They weren't too ruffled because they remembered a similar idea laid out by Bhutto's administration years ago to turn a nearby fishing hamlet, Keti Bandar, into a major sea port.

"Bhutto said it would happen," said Wali Mohammed, a 30-year-old Shah Bandar fisherman, "but years passed and nothing was built."

http://www.latimes.com/news/nationworld/world/la-fg-pakistan-new-ci...

-

Comment by Riaz Haq on November 3, 2012 at 10:52pm

-

Here's a News report on Pak current account surplus in Q1 of FY 2012-13:

KARACHI: Pakistan’s current account posted a surplus of $432 million during the first quarter of the current fiscal year, giving some respite to government confronting fast pace of foreign exchange reserves and weak foreign investment inflows, according to the State Bank of Pakistan (SBP) on Thursday.

The country experienced a current account deficit of $1.339 billion during the same period last year, it said.

A modest surplus in the current account balance is in line with the expectations of the economic analysts and experts, which have already indicated that the current account would remain in the green zone for the first quarter of FY13 in the wake of $1.2 billion Coalition Support Fund (CSF) reimbursements transferred by the United States to the services account of the country earlier in August this year.

Despite slowdown in the financial inflows and moderate pace of exports, the analysts attributed the current account surplus to two major developments, external account witnessed a decent growth in workers’ remittances and military aid from the United States under the CFS.

This is the second consecutive surplus in the current account balance as it recorded a surplus of $919 million in July-August FY13.

Analysts said the CSF put positive impact on both, current and fiscal deficits of the country.

“The position of the balance of payments will be highly dependent on the pace of dollar inflows and international oil prices in the second quarter of this fiscal year,” said Sayem Ali, an economist at a foreign bank.

“Oil prices and large debt repayments are likely to pose significant risk to the balance of payments position in FY13,” said Ali.

The country is expected to record small level of current account deficit in anticipation of another $600 million payment by the United States administration under the head of CSF by November, he said. This will help contain the current account deficit and cushion forex reserves to some extent, he added.

“The full-year FY13 current account deficit is likely to be $3.5 billion, or 1.5 percent of GDP as compared to the deficit of $4.6 billion (two percent) reported in the last fiscal year,” he said. The current account witnessed a deficit of $331 million during September 2012 as against the surplus of $1.084 billion for August this year.

The current account during July-September stood at 0.7 percent of GDP as compared to a deficit of 2.3 percent of GDP in the same period last year, it said.

According to the data, the trade balance remained negative as it amounted to $3.634 billion during the first three months of the current fiscal year as compared to $4.158 billion in July-September FY13.

During the period July-September 2012, services account saw a surplus of $2.120 billion as compared to $1.190 billion in the same period last year.

Total exports stood at $5.994 billion against $6.142 billion, while imports reached $9.628 billion against $10.30 billion during the corresponding period a year ago.

http://www.thenews.com.pk/Todays-News-3-138178-Current-account-posts-$432m-surplus-in-first-quarter

-

Comment by Riaz Haq on November 3, 2012 at 11:08pm

-

Here's an ET report on the performance of a Swedish fund investing in Pakistan:

The company is currently in the process of trying to find a distributor for the British market, where a large Pakistani expatriate population would form a natural investor base. DESIGN: ESSA MALIK

KARACHI:One of the best performing mutual funds that invests in Pakistani stocks is based in Sweden.

The Tundra Pakistanfond, run by Stockholm-based asset management company Tundra Fonder, was launched in October 2011, within one month of the firm’s founding, and currently has the equivalent of over $40 million in assets under management, belonging to nearly 20,000 Swedish individual investors. Uniquely for European asset managers, Tundra’s Pakistan fund constitutes roughly 80% of the company’s total assets under management, tying its fortunes very closely to the Pakistani economy, or at least European investor interest in it.

But perhaps what is interesting is the fact that the fund is one of the best-performing funds that invests in Pakistan, returning approximately 21.3% in Swedish krone over the past year (about 20.2% in US dollars). That performance handily beats the MSCI Pakistan index, which rose by about 13.1% in US dollar terms during that period. The KSE-100 Index has yielded a 20.7% return in US dollars during that period.

Yet that is not Tundra’s only impressive feat. According to data provided by the Mutual Funds Association of Pakistan, Tundra’s performance, when taking into account the impact of the rupee’s depreciation, would beat all but five of the equity funds managed by firms based in Karachi, placing the Tundra Pakistanfond comfortably in the top one-third of all funds that invest in the Pakistani equity markets.

So how does Tundra do it? Its founder and CEO, Mattias Martinsson, appears to have had substantial experience in investing in emerging and frontier markets. Martinsson, 39, began his career in 1996 at a company called Hagströmer & Qviberg which specialised in offering Russian stocks to Swedish investors. That interest in Russia continues to this day, with Tundra’s only other country-specific fund being a Russia-focused fund.....

This remarkable understanding of the Pakistani market appears to come from a long-abiding interest in the country on the part of Martinsson.

“I came across Pakistan in 2005. At that time I, as most other people today, I had a lot of prejudice. I thought that Pakistan was an underdeveloped equity market, ruled by a military dictator. What I found was something very much different: IFRS [accounting standards], good corporate governance (for emerging markets), good disclosure and a well functioning equity market. In 2007, I attended a frontier markets conference in Singapore and met with ten or so Pakistani companies. Comparing them to the other attendees, I concluded that they were so far ahead, not only compared to their peers in frontier markets but also many emerging markets. I then visited Karachi, Lahore, and Islamabad in early 2008 and came back excited looking for a fund to invest in. There was none. Since then it has been a dream to launch a Pakistan fund.”

While it is not the only European mutual investing exclusively in Pakistan, it appears to be the largest. And given its compliance with UCITS IV European regulations, it is eligible to be marketed throughout the European Union. The company is currently in the process of trying to find a distributor for the British market, where a large Pakistani expatriate population would form a natural investor base.

Given Tundra’s astute investment decisions so far, European investors would be wise to keep an eye on its Pakistan fund.

http://tribune.com.pk/story/459989/frontier-markets-betting-on-paki...

-

Comment by Riaz Haq on November 4, 2012 at 10:03am

-

Here's Daily Times on KSE-100 crossing 16000 level:

Hopes for cut in policy rate boost KSE by 289 points

KARACHI: The Karachi stock market witnessed a historic trading week by breaching the psychological level of 16,000 points on back of hopes for further decline in the State Bank of Pakistan’s policy rate after consumer price index (CPI) inflation figures for October 2012 clocked in at 7.66 percent.

The Karachi Stock Exchange (KSE) 100-share index gained 288.83 points or 1.82 percent to close at 16,101.55 points as compared to 15,812.72 points of the previous week.

Analysts said investor sentiment was upbeat at the market throughout the week on expectations that October 2012 CPI figure will slide further.

The market opened on Tuesday after prolonged Eidul Azha vacations on a negative note as Hurricane Sandy that lashed US East Coast triggered uncertainty in global markets and propelled local investors to offload their holdings. The 100-share index shed 16.79 points or 0.11 percent to close at 15,795.93 points as compared to 15,812.72 points.

On Wednesday the market made another historic high level of 15,910 points as hopes for lower inflation for the month of October and better-than-expected earnings of Pakistan Petroleum Ltd and Hubco triggered across-the-board buying. The 100-share index gained 114.18 points or 0.72 percent to close at 15,910.11 points.

The record-breaking spree continued at the market on Thursday as investors went for buying on hopes that lower inflation figure will force the State Bank of Pakistan to reduce the policy rate. The 100-share index gained 52.26 points or 0.33 percent to close at 15,962.37 points

The market continued its record-breaking streak on the last trading day of the week Friday by crossing the psychological level of 16,000 points. The 100-share index gained 139.18 points or 0.87 percent to close at 16,101.55 points. The weekly turnover went up by 40.79 percent and traded 191.49 million shares compared to previous weeks 136.01 million shares.

“Market expectations were realised on Friday with October 2012 CPI clocking in at 7.66 percent as against 8.79 percent in September 2012, thus raising hopes of another rate cut in the next monetary policy (due in December),” said JS Sec analyst Furqan Ayub. “Investors’ interest was concentrated in the cement and textile sectors with Lucky Cement and Nishat Mills outperforming the market by 1.1 percent and 3.6 percent, respectively.”

Net buying by foreigners this week amounted to $12.6 million, he added.

Analysts said the market is at a historic high level and any untoward development can drag the market into the red zone, analysts said and added that technical correction is, however, due next week as usually when the 100-share index breaches psychological levels consolidation is seen and with this historic high it is evident.

http://www.dailytimes.com.pk/default.asp?page=2012\11\04\story_4-11-2012_pg5_16

-

Comment by Riaz Haq on November 4, 2012 at 10:02pm

-

Here's a Business Recorder report o Pakistan's cement industry:

There are signs of recovery of cement industry, which had generally recorded stagnant sales for the past four years or so, resulting in huge financial losses. The industry suffered a net loss of Rs 337 million in the first half of 2010-11 but earned a net profit of Rs 4,300 million in the first half of 2011-12. According to latest reports, total sales during fiscal year 2011-12 increased to a record level of 32.515 million tons, showing an increase of 8.84% in domestic sales and overall 3.45% increase compared to previous year as exports declined by 9.12%.

This trend of domestic sales is expected to remain in momentum in future, given the present conditions. The 2012-13 federal budget has provided more incentives and relief to cement industry such as excise duty has been slashed by Rs 200 per ton and the GST by one percent. These measures will encourage construction activities in the country.

Cement demand in any country is inextricably linked to the growth in GDP. Pakistan's 3.70 GDP in 2011-12 was lowest in the region but it is projected as 4.30 in the current financial year, following some strong prospects of economic revival. Major driver for cement consumption is infrastructure development and house-building projects. There has been an allocation of Rs 873 billion under the Public Sector Development Programme (PSDP). A number of mega water and power sector projects are in pipeline, including Diamer Bhasha multipurpose project and two additional Chashma Nuclear Power projects, while almost 12 other large projects are planned for initiation during this financial year. Construction of a project of the size of Diamer Bhasha is estimated to create an additional cement demand in the range of 8 to 9 million tons. PSDP allocation to Wapda is to the level of Rs 76.85 billion.

There are 56 housing and works projects covered under the PSDP, besides the ongoing reconstruction and rehabilitation activities nation-wide that would be accelerated, whereas National Highway Authority will get Rs 50.73 billion. Demand of cement is thus projected to grow by more than 20% this year and in subsequent years. Currently, per capita consumption of cement in Pakistan is 131-kg, one of the lowest even among developing countries, while world average is 273-kg. To ensure future economic growth, Pakistan will need to invest considerably in its infrastructure development, despite the economic challenges it faces.

Cement industry comprises 24 cement plants with an annual installed capacity of producing 44.22 million tons of cement. Key players of the industry are Lucky Cement with combined installed capacity of 7.712 million tons of cement annually, Bestway Cement having a combined capacity of 5.914 million tons, DG Khan Cement of 4.220 million tons, Fauji Cement of 3.433 million tons, Maple Leaf Cement of 3.370 million tons and Askari Cement of 2.675 million tons. These six groups of companies represent 62% of total installed capacity for cement production in the country. While these groups have been making substantial profits, small cement producers continue to struggle to recover their operating costs...

http://www.brecorder.com/articles-a-letters/187/1222558/

Here's an excerpt of Pakistan cement and minerals case study by ABB of Switzerland:

The consumption of cement increased from 70 kg in 2003 to 120 kg/capita in 2008, a 70% increase in 5 years.

Pakistan’s cement consumption per capita is comparable to that of India’s, which is at 132 kg.

Pakistan has 28 different cement producers, 22 of which are registered on the Karachi Stock

Exchange.Production of cement

North region, Punjab and NWPT:approximately.

30 million tpa.South region, Sindh and Baluchistan:

approximately 10 million tpa.

mineralshttp://www05.abb.com/global/scot/scot244.nsf/veritydisplay/e7af7737...$File/CH_EMR_2009.pdf

-

Comment by Riaz Haq on November 5, 2012 at 4:10pm

-

Here are a couple reports related to cement demand:

1. Business Recorder on PSDP funds release:

ISLAMABAD: The Planning Commission of Pakistan has so far released Rs87.3 billion under its Public Sector Development Programme (PSDP) against the total allocations of Rs233 billion for the fiscal year 2012-13.

Out of total Rs51.5 billion have been released for 344 infrastructure development projects while Rs33 billion for 673 social sector projects, according to the latest data of the Planning Commission.

Similarly,Rs08 billion have been released for 68 other projects and Rs2 billion for Earthquake Reconstruction and Rehabilitation Authority (ERRA).

According to data, these releases have been made against Rs233 PSDP allocations.

It is pertinent to mention here that the total size of the PSDP for the year 2012-13 is Rs360, including Rs100 billion foreign aid, which is managed by Economic Affairs Division and Rs27 billion special programmes, release of which are made by Cabinet Division or Finance Division.

According to break up details total cost of 344 infrastructure projects has been estimated at Rs2346.4 billion, out of which Rs210.9 billion have been earmarked in the 2012-13 budget that include Rs85.6 as foreign aid.

Likewise, the total cost of social sector projects is Rs547.1, of which Rs136.2 billion have been allocated in the current PSDP with foreign aid of Rs8.4 percent.

The cost of other projects has been estimated at Rs40.6 billion out of which Rs3 billion have been earmarked in the PSDP 2012-13 while Rs10 billion have been earmarked for ERRA in the current development programme.

http://www.brecorder.com/pakistan/general-news/89070-873bn-released...

2. Daily Times on decline i cement exports:

Cement exports declined by 20.59% in October

* Exports to India also decline by 37.5 percent

Staff Report

KARACHI: Overall despatches of cement for the month of October 2012 declined by 5.87 percent mainly due to a drastic decline of 20.59 percent in export of cement.

Revealing the data for the month of October 2012, a spokesman of the All Pakistan Cement Manufacturers Association said that the cement industry despatched 2.767 million tonnes of cement in October 2012 that was 5.87 percent less than 2.939 million tonnes despatched in the corresponding month of 2011.

He said in October 2012 the local cement despatches was 2.086 million tonnes, which were up by 0.19 percent as compared to 2.082 million tonnes despatched in October 2011.

He said in the first four months of this fiscal the total cement despatches stood at 10.474 million tonnes, which was slightly higher than the total despatches of 10.436 million tonnes achieved during corresponding period of last year. He said overall gain in despatches was only 0.37 percent. The capacity utilisation of the industry during July-October 2012 period stood at 70.19 percent.

He said cement exports continued their downward trend in October 2012 as well declining by a massive 20.59 percent from the exports achieved in October 2011. Pakistan exports cement to Afghanistan, India and other destinations through sea. During the period from July-October 2012, exports to Afghanistan declined by 9.46 percent to 1.634 million tonnes.

The exports to India he added declined by 37.51 percent to 0.158 million tonnes and exports to other destinations through sea increased by 2.34 percent to 1.161 million tonnes.

http://www.dailytimes.com.pk/default.asp?page=2012\11\06\story_6-11-2012_pg5_10

-

Comment by Riaz Haq on November 12, 2012 at 10:02pm

-

Here's PakistanToday on the latest PSDP funds release by Planning Commission:

ISLAMABAD - The Planning Commission of Pakistan released Rs 88.8 billion under its Public Sector Development Programme (PSDP) against the total allocations of Rs 233 billion for the fiscal year 2012-13.

Out of the total Rs 51.5 billion had been released for 344 infrastructure development projects while Rs 34.5 billion had been set aside for 673 social sector projects, according to the latest data of the Planning Commission.

Similarly, Rs 0.8 billion had been released for 68 other projects and Rs 2 billion for Earthquake Reconstruction and Rehabilitation Authority (ERRA).

According to the data, these releases had been made against Rs 233 PSDP allocations up to November 8.

The total size of the PSDP for the year 2012-13 was Rs 360, including Rs 100 billion foreign aid, which was managed by the Economic Affairs Division and Rs 27 billion special programmes, release of which were made by the Cabinet Division or Finance Division.

According to break up details the total cost of 344 infrastructure projects had been estimated at Rs 2346.4 billion, out of which Rs 210.9 billion had been earmarked in the 2012-13 budget that included Rs 85.6 as foreign aid.

The total cost of social sector projects was Rs 547.1 billion, of which Rs 136.2 billion had been allocated in the current PSDP with foreign aid of Rs 8.4 percent.

The cost of other projects had been estimated at Rs 40.6 billion, out of which Rs 3 billion had been earmarked in the PSDP 2012-13 while Rs 10 billion had been earmarked for ERRA in the current development programme.

The Planning Commission of Pakistan had been following a proper mechanism for the release of funds and accordingly funds are released as per given mechanism.http://www.pakistantoday.com.pk/2012/11/13/city/islamabad/planning-...

-

Comment by Riaz Haq on November 13, 2012 at 11:30am

-

Here's a speech by Pak Finance Minister Dr. Hafeez Shaikh on economy as reported in The Nation newspaper:

Finance Minister Dr Abdul Hafeez Sheikh has said that Pakistan’s economy continues to show signs of recovery with improvement in key macroeconomic indicators. Despite major external and internal shocks, the economy has shown resilience and is projected to grow by 4.3 percent in FY13 after a healthy growth of 3.7 percent in FY12. Exports continue to show a healthy growth, remittances remain strong keeping foreign exchange reserves stable and most importantly inflation has continued to show a declining trend.

The goal is to build on these positive trends and insulate the economy against any potential external shocks such as a rise in oil prices and global contagion, Sheikh said while addressing the inaugural sesson of PSDE on “ Economic Reforms for Productivity, Innovation and Growth” on Tuesday.

He said the Government has successfully doubled the tax collection from Rs.1 trillion to Rs.2 trillion in the last four years; remittances have more than doubled from US$ 6.4 billion in 2007-08 to US$ 13 billion by year end 2011-12. Inflation has moderated to 8.8% in the first four months of FY13. Exports are likely to cross the target of US$ 26bn in FY13. Hard budget constraints are being ensured to maintain fiscal discipline and expenditure has been curtailed to 35% of the budget in the first four months of FY13.

Sheikh said fiscal austerity measures of Rs15bn including freezing of non salary current expenditures and ban on new recruitments are currently under implementation. Austerity measures have been deepened under which current expenditures is being curtailed. Fiscal deficit is projected to be contained at 4.7% of GDP during FY13.

-----------

The finance minister said the government initiated important mega projects in energy and infrastructure sector which would provide the economy a base for sustainable economic growth in future. Some of the initiatives include: Neelum-Jhelum Hydropower Project, Diamer-Bhasha Dam, 4th Tarbela Extension Project; Chashma Nuclear Power Projects 3 and 4, Lyari Expressway, Mekran Coastal Road, M4 Motorway from Faisalabad to Khanewal, KKH Skardu Road and Realignment of KKH Road due to Attabad Lake. Mega projects completed during the period include Chashma Nuclear Power Project 2, Mangla Raising Project, Mirani Dam Project, Islamabad Peshawar Motorway and Islamabad Muzaffarabad Expressway. Overall, 650 projects worth Rs. 300 billion have been launched.

----------

He said major restructuring and reforms in Public Sector Enterprises (PSEs) and energy sector have been undertaken to reduce burden on budget and improve service delivery. Government has undertaken key structural reforms in the power sector under the Power Sector Reform Plan targeted at improving governance and legal framework and ensuring financial sustainability. In addition 3,334 MW has been added since 2008. Ongoing reforms have resulted in relative stability in the power sector and power shortages have been minimized along with reduction in line losses and improved recovery of arrears.

He said import of LNG and natural gas from neighbouring countries are being pursued to overcome the energy crisis. Extensive work is being done on turn-around plans of key PSEs. Restructuring plans of PIA, Pakistan Railways and Pakistan Steel Mills are under implementation and consequently haemorrhaging has been curtailed in these PSEs along with improvement in service delivery. Measures are being strengthened to restructure key PSEs with sound governance structures and professional management.

http://www.nation.com.pk/pakistan-news-newspaper-daily-english-onli...

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

Agriculture, Caste, Religion and Happiness in South Asia

Pakistan's agriculture sector GDP grew at a rate of 5.2% in the October-December 2023 quarter, according to the government figures. This is a rare bright spot in the overall national economy that showed just 1% growth during the quarter. Strong performance of the farm sector gives the much needed boost for about …

ContinuePosted by Riaz Haq on March 29, 2024 at 8:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network