PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan Among Top 3 Likely Beneficiaries of US-China Trade War

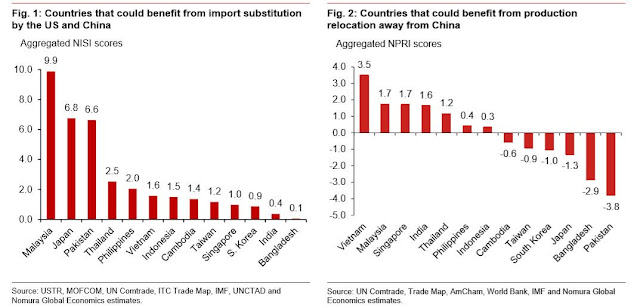

Nomura Securities strategists believe Malaysia, Japan and Pakistan are expected to be the top 3 beneficiaries of import substitution triggered by US-China trade war escalation. Nomura's analysis is based on detailed study of 7,705 items which will be subject to tariffs and counter tariffs by US and China if the stand-off continues. Nomura developed two indices as part of its research on the subject: NISI (Nomura Import Substitution Index) and NPRI (Nomura Production Relocation Index).

Source: Nomura Securities |

The two economic rivals have announced a series of tit-for-tat tariffs on imports in recent months with US set to increase tariffs to 25% on a range of Chinese products in January, unless the two sides reach a trade deal.

Nomura research shows the US list affects 3,477 products imported by US from China valued at $270 billion. Product categories affected are in electrical equipment, appliances and components (29%), machinery and mechanical appliances (22.7%) and furniture and related products (11.9%). China’s tariff list covers 4,228 US products with a combined value of $110 billion, and consists of food, beverage and tobacco, and vehicles.

Malaysia will benefit most, in particular from its exports of “electronic integrated circuits, liquefied natural gas and communication apparatus”. “Vehicles with only spark-ignition internal combustion reciprocating piston engines” will help Japan, according to the analysis, while Pakistan’s cotton yarn exports could rise.

If the trade war between the world's top two economies continues for years, there will also be production relocation of industrial units from China to other countries in the region. The biggest likely beneficiaries of it will be Vietnam, Malaysia, Singapore and India. Pakistan is least likely to benefit from it.

New opportunities are likely to open up for several Asian nations, including Pakistan, to increase industrial production and grow exports if the US-China trade war escalates.

Will the US-China trade conflict escalate? Is Pakistan capable of seizing the opportunity to expand its exports? Will Pakistan's recurring balance of payments crises end? Will Pakistan manage to avoid repeated IMF bailouts? Only time will tell.

Related Links:

Pakistan's Technology Exports Surge Past One Billion US Dollars

China to Invest in Pakistan's Export-Oriented Industries

Can Pakistan Avoid IMF Bailouts?

Can Imran Khan Lead Pakistan to the Next Level?

-

Comment by Riaz Haq on November 22, 2018 at 7:34am

-

Pakistan's tech exports jumped from $75 million in Sept 2018 to $104 million in Oct 2018, according to data from the State Bank of Pakistan

http://www.sbp.org.pk/ecodata/ExportsImports-Goods.pdf

The export receipts from Pakistan stood at $355 million, during the first four months of the current financial year which started July. These receipts show a year-on-year increase in the IT-related exports standing at 5%. The exports value from the same period last year stood at $337 million. During the last year, the Pakistani IT exports had shown a growth of 13% during the whole financial year.

On a rather good note, the IT-related imports showed a decline as more reliance went towards indigenous produce of ICT-related services and products. The imports have decreased from $163m to $147 showing a decrease of 9.8%. It must be mentioned here that the facts presented in this report account for the trades with receipts and apart from this a lot of informal trade also happens between Pakistan and the rest of the world.

-

Comment by Riaz Haq on November 22, 2018 at 1:35pm

-

Pakistan's tech exports jumped from $75 million in Sept 2018 to $104 million in Oct 2018, according to data from the State Bank of Pakistan

http://www.sbp.org.pk/ecodata/ExportsImports-Goods.pdf

Pakistan's information technology exports have bucked the nation's declining exports trend with double digit growth to reach $1,065 million in fiscal year 2018, according to the State Bank of Pakistan. It is generally believed that Pakistan's central bank underestimates technology exports. Some have argued that the actual IT exports were closer to $5 billion in fiscal 2018. Some of the differences can be attributed to the fact that the State Bank IT exports data does not include various non-IT sectors such as financial services, automobiles, and health care.

https://www.riazhaq.com/2018/08/state-bank-pakistan-it-exports-surg...

-

Comment by Riaz Haq on November 22, 2018 at 4:17pm

-

#Pakistan’s #digital revolution is happening faster than you think. Growth is being accelerated by other major investments in #power and #connectivity #infrastructure, technology and digital infrastructure. #technology #CPEC https://www.weforum.org/agenda/2018/11/pakistan-s-digital-revolutio... via @wef

The digital power of China’s Belt & Road Initiative (BRI) is slowly unfolding and shaping into a whole new area of opportunity.

When the BRI took global centre stage in 2013, most conversations revolved around traditional infrastructure: building roads, railways, power sources and linking borders. However, the digital awakening that BRI brings, and the associated development of human capital and innovation, is much more powerful.

The global map is being altered at a much faster rate than anticipated due to the disruption created by digital infrastructure, artificial intelligence, the Internet of Things, and blockchain. Further digital and technological disruption is now set to mend fractures in society – leading to improved living conditions and enhanced economic empowerment.

This disruption has given new life to e-commerce and the start-up scene in BRI countries. In light of the Global Competitiveness Index 4.0, it is extremely important that economies grow in all areas, overcoming challenges and making investment in human capital and innovation. Resilience and agility are key.

Looking at the South Asian region, some of the traditional deterrents to growth have been inadequate transport facilities, patchy power supplies and lack of financial inclusion. As we have seen in the past, industrial revolutions take their time to reach developing countries but the Fourth Industrial Revolution has been quick to reach all corners of the world.

Billions of dollars of investment are bridging the infrastructure and power supply gap while improving technology – the goal is to look past the problems that have hindered the road to progress in countries along the BRI.

The flagship project of the BRI, the China-Pakistan Economic Corridor (CPEC), which is a major collaboration between China and Pakistan, has been rapidly progressing and the impact of the project can be seen in the lives of Pakistani people, as reflected in an improving human development index.

Pakistan, which is emerging from many years of the war on terror, is now on a decent path to progress, with economic growth of 5.8% and improved investor confidence. At the World Economic Forum in 2017, Ebay’s chief executive, Devin Wenig, highlighted Pakistan as one of the fastest growing e-commerce markets in the world. In 2018, Alibaba bought Pakistan’s largest e-commerce platform, Daraz.pk.

..... Ant Financial Services, China’s biggest online payment service provider, recently bought a 45% stake in Telenor Microfinance Bank, in a deal that valued the Pakistani bank at $410 million.

Irfan Wahab, chief executive of Telenor Pakistan, called the deal a “game changer”; while Eric Jing, chief executive of Ant Financial, said it would provide “inclusive financial services in a transparent, safe, low-cost and efficient way to a largely unbanked and underbanked population in Pakistan”.

This kind of investment will benefit from the significant demographic dividend in Pakistan, targeting the largely unbanked young population, and providing not only financial inclusion but also a base on which to build digital businesses.

What the country needs now is to improve its position on the innovation and financial inclusion indices, currently at 89 and 75 respectively, on the World Economic Forum’s Competitiveness Index 2018.

-----------

The rapid completion of CPEC projects and the use of digital technology in the process is disrupting the economy and the lives of people at the same time. The question is whether Pakistan’s leadership will choose to embrace these technologies and take advantage of the biggest project on the road to progress. The future is full of opportunities and promise.

-

Comment by Riaz Haq on February 7, 2019 at 7:24am

-

#UNCTAD estimates $1 billion in #export gains for #Pakistan, gains of 3.8% of its total exports because of #US-#China #tradewar. Last fiscal year Pak exported $23.212 billion worth of product, up 14% over the prior fiscal year. #PTI https://www.thenews.com.pk/print/428639-unctad-estimates-1bln-in-ex...

A new study by UNCTAD looks at the repercussions of existing tariff hikes by the United States and China, and the effects of the increase scheduled for 1 March.

“Substantial effects relative to the size of their exports are also expected for Australia, Brazil, India, Philippines, Pakistan and Viet Nam,” Geneva-based UNCTAD, the part of the United Nations secretariat, said in the latest study.

Around $250 billion in Chinese exports will be subject to US tariffs, while approximately $110 billion in US exports will be subject to China’s tariffs.

Pakistan will be among the countries that could benefit from Chinese tariffs on the US. The largest beneficiary of the trade war would be European Union in export gains, followed by Mexico, Japan, Canada, Korea, India, Australia, Brazil, Taiwan, Viet Nam, Singapore and others.

“Countries that are expected to benefit the most from US-China tensions are those which are more competitive and have the economic capacity to replace US and Chinese firms,” the intergovernmental body said.

“European Union exports are those likely to increase the most, capturing about $70 billion of US-China bilateral trade ($50 billion of Chinese exports to the US, and $20 billion of US exports to China). Japan, Mexico and Canada will each capture more than $20 billion.”

China’s tariffs on US exports will give benefits mostly to non-Chinese firms and the same will be case vis-à-vis US tariffs on China’s exports.

“The reason is simple: bilateral tariffs alter global competitiveness to the advantage of firms operating in countries not directly affected by them,” the UNCTAD said. “This will be reflected in import and export patterns around the globe.”

China is the third biggest export destination for Pakistan after the US and UK, accounting for seven percent share in the country’s total exports to the world. But, China is the biggest import source for Pakistan with nearly 24 percent share in the country’s total imports of $60 billion.

China-Pakistan’s bilateral free trade agreement largely remains in benefit of the former with the latter facing trade deficit of almost $10 billion.

-

Comment by Riaz Haq on August 1, 2019 at 7:18am

-

#China’s #Denim #Exports to US Slide, as Other Major Suppliers Gain Ground. Among the top 5 is #Pakistan, with its denim exports to US up 10.58% to $95.37 million. Pakistan’s market share is up 11.87% in the 12 months to 6.48%. https://sourcingjournal.com/denim/denim-business/china-denim-import... via @SourcingJournal

It’s likely that no matter what happens with the Trump administration’s threat to impose stiff punitive tariffs on Chinese apparel imports, damage has already been done.

Many importers have clearly taken the risk of 25 percent duties on Chinese goods and decided to sew them into their sourcing strategies, limiting their exposure to the once-dominant Chinese market, even with the imposition of those tariffs now on hold. Supply chain diversification is in full effect and the latest data from the Commerce Department’s Office of Textiles & Apparel (OTEXA) reflects it.

“People are diversifying their denim sourcing locations. Some people are getting out of China and some people are staying in China,” Robert Antoshak, managing director at Olah Inc., said. “There is definitely confusion in the marketplace.”

The swing in production is most evident among the top suppliers of blue denim apparel, 97 percent of which are jeans. Denim apparel imports from China dropped 5.16 percent in value to $287.49 million in the year through May, compared to the same period in 2018. This brought China’s market share for jeans imports down 1.77 percent to 23.35 percent for the year.

The next four top suppliers all gained ground on China in the 12-month period, according to OTEXA.

In the second place spot, Mexico, which has had its own round of tariff threats from the White House, though they seem to have subsided for now, saw its jeans imports increase 17.61 percent in the first five months of the year to reach $332.43 million in value. Mexico’s market share rose 11.55 percent to 21.98 percent for the year.

Denim apparel imports from third-place supplier, Bangladesh, were up 6.26 percent year to date to $183.42 million, as the country’s market share advanced 7.61 percent to 14.62 percent. Vietnam’s jeans shipments to the U.S. jumped 35 percent to $105.07 million in the first five months of the year, compared to the year-ago period. This lifted Vietnam’s market share 40.49 percent to 8.2 percent.

Rounding out the top five was Pakistan, with its shipments to the U.S. increasing 10.58 percent to $95.37 million. Pakistan’s market share was up 11.87 percent in the 12 months to 6.48 percent.

“There’s no doubt that the trade war between the U.S. and China has resulted in production being spread out across Asia and being a Pakistan manufacturer, we have benefited,” Ebru Ozaydin, senior vice president of sales and marketing at Artistic Milliners, said at last month’s Kingpins New York show.

The Western Hemisphere, led by Mexico, Nicaragua and Guatemala, continued to increase its denim production, too.

Imports from the region rose 14.83 percent year to date through May to $414.07 million. This gave the Western Hemisphere a 27.64 percent market share, with a 10.4 percent gain for the year.

-

Comment by Riaz Haq on August 12, 2019 at 5:27pm

-

TOKYO -- Having prepared for the prospect of additional U.S. tariffs on Chinese goods, Japanese corporations with factories in China are expected to move faster in shifting production out of the country now that Washington has decided to escalate the trade war.

The U.S. announced Thursday that a 10% duty on roughly $300 billion in Chinese goods will take effect on Sept. 1. President Donald Trump said the duty can be increased in stages and that tariffs "can be lifted to well beyond 25%."

This fourth round of tariffs would cover a broad range of products, including smartphones, game systems and clothing.

Nintendo, which currently assembles most of its Switch game systems in China, has begun moving production to Vietnam and intends to boost its output further in the Southeast Asian nation.

Sony's production of its PlayStation 4 game console, cameras and other products could be affected by the tariffs. The company has already been studying steps such as relocating production and hiking prices, so it will likely make decisions depending on the situation. At its earnings briefing at the end of last month, Senior Vice President Naomi Matsuoka said that she hopes to keep the operating profit impact of the fourth round of tariffs at less than 10 billion yen ($94 million) this fiscal year.

Sharp subsidiary Dynabook builds all of its notebook computers in China, but Sharp said it will consider moving production to its own facilities in Vietnam or to plants of Taiwanese parent Hon Hai Precision Industry -- commonly known as Foxconn -- if the fourth round of tariffs is implemented.

Kyocera assembles copiers and multifunction printers for the U.S. market in China, and Europe-bound products in Vietnam.

"We will switch production between Chinese and Vietnamese facilities," Kyocera President Hideo Tanimoto told reporters on Friday, after the U.S. announced the fourth round of tariffs, which cover copiers and multifunction printers. The move is expected to cost up to several billion yen.

Ricoh moved production of U.S.-bound multifunction printers to Thailand from China at the end of last month, and is looking at building those products for the Japanese and European markets in China instead of Thailand.

Asics' shoes will be subject to the latest tariffs. "The impact of the tariffs will be negligible," said President Yasuhito Hirota. "But I am concerned about slowdowns in the U.S. and Chinese economies."

The U.S.-China trade frictions have crimped corporations' appetite to invest. Panasonic's sales of motors, sensors and other devices used in production equipment have declined as clients hold off on capital investment. The company believes that investment may cool further due to the fourth round of tariffs.

https://asia.nikkei.com/Economy/Tra...eed-up-China-exit-in-response...

-

Comment by Riaz Haq on March 12, 2020 at 8:01am

-

Some #Manufacturing may relocate to #Pakistan from #China after recovery from #coronavirus to reduce concentration of supply chain, says Deputy Gov of Pak State Bank. https://tribune.com.pk/story/2174277/2-industries-may-relocate-paki...

After recovery from coronavirus, the world is likely to reconsider the global supply chains to avoid concentration of industries in one country, China, which will create opportunities of relocation of some industries to Pakistan, said State Bank of Pakistan (SBP) Deputy Governor Dr Murtaza Syed.

Speaking at a meeting to discuss the impact of coronavirus on Pakistan’s trade, organised by the Federation of Pakistan Chambers of Commerce and Industry (FPCCI), Syed pointed out that though coronavirus cases were decreasing in China, the infections were increasing in other countries. “By the end of May, the situation may improve,” he added.

The central bank official stated that 50-60% of the factories were closed in China due to COVID-19, therefore, next quarter results would show a decline in economic growth. Last year, the global GDP grew around 3%, which was going to fall this year due to the epidemic, he said.

“Risk appetite is decreasing among investors around the world and money is moving towards risk-free markets like bonds,” he said.

Syed pointed out that England and other developed economies were reducing interest rate to help their markets cope with the impact of the coronavirus.

He told businessmen that in 2018, Pakistan imported electrical and electronic equipment worth $3.09 billion while machinery, nuclear reactors and boilers valuing at $3.09 billion were imported. Both the categories were among major imports from the country. The deputy governor said, “Pakistan also imports around 20% raw material, hence, there is disruption in the supply chain, which our businessmen are overcoming by heading towards other countries to substitute their imports.

“Machinery import is decreasing as Pakistan has completed imports under the China-Pakistan Economic Corridor (CPEC), therefore, currently we have some room. However, due to the decline in machinery imports, progress on the Special Economic Zones (SEZs) is going to be delayed.”

He pointed out that the exporters were also looking towards Africa and European countries to divert their exports. “Recently, oil prices decreased, which is going to have a positive impact on Pakistan, as oil is one of the major commodities imported every year.” In the near future, the situation due to the coronavirus could turn worse, but there was hope in the long term, he remarked.

Speaking during the meeting, The Indus Hospital Infectious Diseases Consultant Dr Samreen Sarfaraz said, “COVID-19 is a storm in a teacup, which is exaggerated and shown as a tsunami.”

“COVID-19 is moderately transmissible and a new viral illness of low mortality rate,” she said. “Roughly, 80% of patients recover without being admitted in a hospital, other 17% recover after admission for supportive care and only 3.4% die,” she said.

“Its pandemic potential is nothing when compared to the influenza pandemics in the past.”

Comment

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

Agriculture, Caste, Religion and Happiness in South Asia

Pakistan's agriculture sector GDP grew at a rate of 5.2% in the October-December 2023 quarter, according to the government figures. This is a rare bright spot in the overall national economy that showed just 1% growth during the quarter. Strong performance of the farm sector gives the much needed boost for about …

ContinuePosted by Riaz Haq on March 29, 2024 at 8:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network