PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan Tech Summit 2020 at Draper University in San Francisco Bay Area

Hundreds of Pakistanis and Pakistani-Americans attended Pakistan Tech Summit 2020 at Draper University in San Mateo, California on February 15, 2020. It was organized by Arzish Azam of Ejad Labs with sponsorships from JS Bank, Netsol, VisionX, Pakistan IT ministry, Pakistan National IT Board and Pakistan Software Exports Board. This event came after a recent report in Germany's Deutsche Welle (DW) by Miriam Partington who wrote in a story titled "Pakistan: The next big Asian market for tech startups?" that "Pakistan's young and tech-savvy population, market of over 220 million people and increasing levels of local capital are creating opportunities for tech entrepreneurs".

Pakistan Tech Summit:

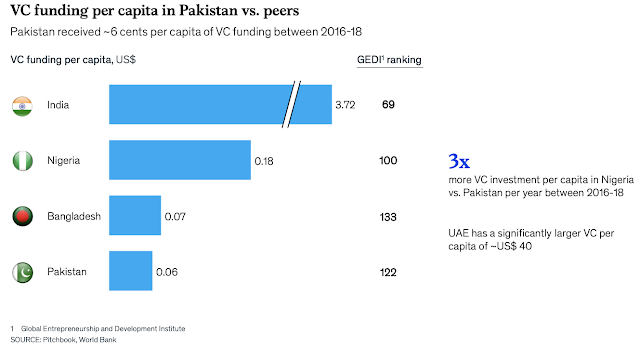

At this conference, I was really encouraged by the presence of many young Pakistan entrepreneurs eager to realize the vision of Digital Pakistan. Enthusiasm is necessary but not sufficient. What is missing is serious attention to attract more risk capital to support these young enthusiastic entrepreneurs. Unfortunately, I did not see any known Silicon Valley venture capitalists (VC) at the event. Recent McKinsey report on Pakistani startup ecosystem noted that per capita venture capital is just 6 cents, lower than 7 cents in Bangladesh and only a third of 18 cents in Nigeria. What Pakistan needs is a venture capital initiative along with digitization initiative.

Founders or cofounders of several Pakistani startups pitched their companies hoping to attract venture investors. Among the attendees were many young enthusiastic techies.

Najeeb Ghauri, Chairman of Netsol Technologies, made a pitch that focused on the opportunities presented to investors by Pakistan's growing young enthusiastic talent pool and large aspirational middle class population. JS Bank's Noman Azhar talked about his bank's fund that invests in Pakistani startups taking advantage of the government's Digital Pakistan Initiative. An example of their investment is e-challan systems in Islamabad and Peshawar.

Morning keynote speaker was Farrukh Mahboob of VisionX which offers custom-built digital products and mobile applications for businesses. Their digital solutions are tailored to clients’ needs and are powered by emerging technologies including artificial intelligence (AI), augmented and virtual reality (AR, VR). VisionX clients includes Fortune 500 companies.

A number of startup pitches followed. Founders or co-founders of DontPort, Integry, Kumlaudi, SafePay, JoyCo and Social Pie pitched their ideas.

Examples of VC Funded Startups:

McKinsey report "Starting up: Unlocking entrepreneurship in Pakistan" has cited Daraz, Zameen, PakWheels, Tez Financial, Patari, AugmentCare and Sastaticket. Monis Rahman, CEO of Rozee.pk, says this is an incomplete list. He personally knows about funds raised by the following companies that are missing from the McKinsey list:

Rozee.pk -- $9 Million across 3 rounds

Finja -- $4.5 Million seed + bridge (working on $15 Million round)

Airlift -- $12 Million Series A (working on $20 Million round)

Lack of Venture Capital:

It was great to see many young Pakistan entrepreneurs eager to realize the vision of Digital Pakistan. Enthusiasm is necessary but not sufficient. What is missing is an enabling environment for startups to attract more risk capital to support these young enthusiastic entrepreneurs. Unfortunately, I did not see any known Silicon Valley venture capitalists (VC) at the event. Recent McKinsey report on Pakistani startup ecosystem noted that per capita venture capital is just 6 cents, lower than 7 cents in Bangladesh and only a third of 18 cents in Nigeria. India's level of per capita is at $3.72 and UAE's $40 per capita VC investment is more than 10X India's.

Need For Venture Investment Initiative:

Pakistan needs to have a venture capital initiative to ensure that Pakistani startups fully participate in Digital Pakistan Initiative. Part of the venture capital initiative should create legal and policy framework to protect investors and facilitate their exit strategies. Pakistan government should invite venture capitalists and offer to participate as a significant investor in professionally VC funds that invest in Pakistani startups. Experienced Pakistani VCs and entrepreneurs like Asad Jamal and Monis Rahman can be used as a resource to establish this venture investment initiative.

Summary:

Recent "Pakistan Tech Summit 2020" at Draper University in San Francisco Bay Area attracted dozens of enthusiastic tech savvy young men and women ready with their startup pitches. It confirmed what Deutsche Welle's Miriam Partington recently reported in a story titled "Pakistan: The next big Asian market for tech startups?" in which she wrote: "Pakistan's young and tech-savvy population, market of over 220 million people and increasing levels of local capital are creating opportunities for tech entrepreneurs". Unfortunately, I did not see any known Silicon Valley venture capitalists (VC) at the event. Recent McKinsey report on Pakistani startup ecosystem noted that per capita venture capital is just 6 cents, lower than 7 cents in Bangladesh and only a third of 18 cents in Nigeria. India's level of per capita is at $3.72 and UAE's $40 per capita VC investment is more than 10X India's. Pakistan needs to have a venture capital initiative to ensure that Pakistani startups fully participate in Digital Pakistan Initiative. Part of the venture capital initiative should create legal and policy framework to protect investors and facilitate their exit strategies. Pakistan government should invite venture capitalists and offer to participate as a significant investor in professionally managed VC funds that invest in Pakistani startups. Experienced Pakistani VCs and entrepreneurs like Asad Jamal and Monis Rahman can be used as a resource to establish this venture investment initiative.

Related Links:

Pakistani-American VC Asad Jamal Invested Early in Baidu

Pakistani Students Win First Place in Stanford Design Contest

Pakistanis Win AI Family Challenge in Silicon Valley

Pakistani Gamer Wins ESPN E-sports Player of the Year Award

Pakistan's Expected Demographic Dividend

Pakistan's Research Output Growing Fastest in the World

AI Research at NED University Funded By Silicon Valley NEDians

Pakistan Hi-Tech Exports Exceed A Billion US Dollars in 2018

Rising College Enrollment in Pakistan

Pakistani Universities Listed Among Asia's Top 500 Jump From 16 to ...

Pakistani Students Win Genetic Engineering Competition

Human Capital Growth in Pakistan

-

Comment by Riaz Haq on July 7, 2021 at 4:58pm

-

#Pakistan's #tech ecosystem is finally taking off. In 2021, Pakistani #startups are on track to raise more money than the previous 5 years combined. This capital is coming from investors from #Asia, #MiddleEast & top #SiliconValley VCs.

https://tcrn.ch/2TEwRR0 via @techcrunch

https://twitter.com/haqsmusings/status/1412922307438268416?s=20

Pakistan, the world’s fifth most populous country, has been slow to adapt to the internet economy. Unlike other emerging economies such as China, India and Indonesia, which have embraced digitization and technology, Pakistan has trailed the region in the adoption of technology and startup formation.

Despite this, investors have dreamed for years of the huge opportunities in unlocking Pakistan’s potential as a digital economy. As a country of 220 million people, almost two-thirds of whom are under the age of 30, Pakistan draws natural comparisons to Indonesia — which has rapidly emerged as one of the most vibrant technology ecosystems outside the U.S. and China.

After years of lagging behind, over the course of the past 18 months, Pakistan’s technology ecosystem has come to life in unprecedented fashion. In 2021, Pakistani startups are on track to raise more money than the previous five years combined. Even more excitingly, a large portion of this capital is coming from international investors from across Asia, the Middle East and even famed investors from Silicon Valley.

The rapid emergence of Pakistan’s technology ecosystem on the international stage has been no accident — it’s the result of a confluence of changing facts on the ground and shifting dynamics in the startup and investing world as a result of the pandemic.

The sudden emergence of Pakistan’s tech ecosystem on the international stage has been driven by three major factors: an improving security situation, quickly growing mobile connectivity, and critical legal changes and deregulation.

As a frontline state and coalition partner in the United States’ invasion of Afghanistan, Pakistan saw fatalities from terrorist violence soar from 295 in 2001 to a peak of over 11,000 in 2009. This climate of instability and violence scared away international business and investors from Pakistan for much of the first two decades of the 21st century.

-

Comment by Riaz Haq on July 26, 2021 at 7:59am

-

#Pakistani #fintech Dastgyr raises $3.5 million in seed round. #Karachi-based B2B marketplace aims to connect over 2 million underserved #retailers directly to manufacturers, distributors, and wholesalers to fix what is currently a fragmented supply chain https://www.dawn.com/news/1637048

On top of further building the tech stack and expanding the already 280-odd team, “the funds will be deployed towards officially launching new fintech solutions that Dastgyr’s team has already been experimenting with, including ‘Buy Now Pay Later’.

Its fintech products will strive for financial inclusion of the retailers that Dastgyr aims to serve, the majority of whom remain unbanked. "Access to financing options will ultimately enable them to have more purchasing power and expand their businesses to include more categories, improve store capacity, or purchase new equipment like refrigerators and shelves,” the press release states.

Founded in 2020 during the height of Covid-19, Dastgyr is a B2B marketplace app that enables retailers to order wholesale inventory of over 2,000 stock-keeping units (SKUs) with guaranteed next-day delivery and telephonic helpline support. Product categories on the app include fast-moving consumer goods, stationery, mobile accessories, and more. The startup claims to have grown the gross merchandise value 7x between September 2020 and July 2021, while boasting 5,240 daily active users on the app.

SME retailers are the backbone of Pakistan’s economy, representing a combined market of roughly $125 billion dollars, about 30-40 per cent of the country’s GDP. Dastgyr aims to empower and uplift this segment with a near-perfect supply chain and financial inclusion to increase that contribution even further, the press release states.

In addition to SOSV, the round also included ADB Ventures, the Asian Development Bank’s venture capital arm, Seedstars, and Edgebrook Partners, marking their first investments into the Pakistan market. Strategic institutional and angel investors from the MENA region also participated, including Zayani Venture Capital and Tricap investments.

“Pakistan is seeing the same patterns as India five years ago and China 10 years ago: with 75pc of the population owning a smartphone, the first-movers in mobile-first services will be the winners. We are particularly impressed with Dastgyr’s culture of growth: the company’s fintech offering is truly a game-changer for the unbanked and underbanked while ensuring the success of their businesses. We are particularly impressed with the company’s culture of growth and are proud to have the company as part of our portfolio,” said William Bao Bean, General Manager at SOSV and Managing Director of MOX.

Dastgyr’s asset-light model functions on a cross-docking approach: goods are delivered to sorting centres, sorted into individual orders and routes, and are then dispatched to retailers. Currently operational in both Karachi and Lahore after its official launch in September 2020, it has fulfilled hundreds of thousands of orders worth millions of dollars to roughly 30,000 customers.

Dastgyr hasn’t raised an incredibly large dollar amount in this seed round, but its management has been conscientious about ensuring that their deployment of capital remains exceedingly efficient. Its current investment to gross merchandise value (GMV) ratio is $1 into $58.

Dastgyr’s team includes former members of some of the region’s fastest growing startups, including Daraz (Rocket Internet venture acquired by AliBaba), Careem (acquired by Uber), and Airlift (raised Pakistan’s largest Series A at the time led by First Round Capital).

-

Comment by Riaz Haq on July 27, 2021 at 8:13am

-

@FaseehMangi: Pakistan’s startups fund raising is going through the roof. Record $101 million in the first half of this year compared with $65.6 million in the whole of 2020 https://twitter.com/FaseehMangi/status/1420013252981964805?s=20 Pakistan’s Keenu Eyes IFC backing as startups raises record funds – Bloomberg (Bloomberg) -- Wemsol Pvt., known as Keenu, is looking to raise as much as $5 million from the International Finance Corporation that would extend a record fundraising spree by Pakistan’s startups. The Karachi-based company, which makes point-of-sale debit and credit card machines, will use the money to expand its network, Chief...

-

Comment by Riaz Haq on July 27, 2021 at 10:30am

-

IFC board to consider the investment proposal by end of August

Keenu is only non-bank in Pakistan POS payments space

Wemsol Pvt., known as Keenu, is looking to raise as much as $5 million from the International Finance Corporation that would extend a record fundraising spree by Pakistan’s startups.

https://www.bloomberg.com/news/articles/2021-07-27/pakistan-s-keenu...

The Karachi-based company, which provides point-of-sale debit and credit card machines, will use the money to expand its network, Chief Executive Officer Syed Ejaz Hassan said in an emailed reply. The company is also planning to create consumer and merchant wallets and will seek a license from the central bank, according to Numero Advisors, arrangers to the transaction.

Pakistan’s startups have raised a record $101 million in the first half of this year compared with $65.6 million in the whole of 2020, with most going to e-commerce and financial technology firms, according to a tracker from venture capitalist fund Invest2Innovate. The South Asian nation has the third-largest unbanked adult population globally, with about 100 million adults without a bank account, according to World Bank data.

IFC’s board will consider the investment proposal by end-August, the World Bank’s finance arm said by email. It added that the project would help Keenu expand its network toward small businesses.

Keenu is the only non-bank in the point-of-sale-space, with about 10,000 machines or 30% of total market share, according to Numero Advisors.

-

Comment by Riaz Haq on July 30, 2021 at 7:48am

-

Riaz Haq has left a new comment on your post "Pakistani-American VC At Top Silicon Valley Firm L...":

Digital technologies are set to transform the way people live and work in Pakistan. As we saw in the GSMA 2020 Digital Societies Report, which tracks the progress of 11 focus countries in Asia Pacific, Pakistan is advancing its societal, economic and digital ambition, as outlined in Digital Pakistan Vision. Indeed, our report’s digital society index tracked Pakistan in achieving one of the highest increases in its overall score.

https://dailytimes.com.pk/798868/pakistans-digital-transformation-2/

By 2023, the economic contribution of the mobile industry in Pakistan is expected to reach $24 billion, accounting for 6.6% of GDP .In an effort to stimulate this growth, Pakistan has recently moved forward with significant mobile services tax reforms.

Digital platforms, such as mobile services, have become the primary channel for a growing number of citizens to access public and private services, especially during the pandemic. Behind this development are the vital roles played by National and provincial policymakers, the Pakistan Telecommunication Authority (PTA) and Ministry of Information Technology and Telecommunication (MoITT), who have helped increase access for citizens high-quality connectivity and digital services. This has cultivated digital inclusion, e-commerce and a general entrepreneurial spirit for the people of Pakistan.

With a population of approximately 220 million, and more than 100 million people under the age of 25, Pakistan is well positioned to play a growing role in the global economy over the next decade.Pakistan’s mobile market has experienced rapid development over the last decade, playing a significant role in Pakistan’s growth. In 2018, the total economic contribution of the mobile ecosystem was worth $16.7 billion, equivalent to 5.4% of GDP.

In a post pandemic world, Industry 4.0 – otherwise known as the fourth industrial revolution – will help economies recover and become more resilient to future shocks. And technology, supported by mobile networks, will be at the core of Pakistan’s industrial development as it works to launch the fourth industrial revolution.

Pakistan’s recent policy actions offers a glimpse of this potential. But authorities must act together, creating the business environment necessary to realise these goals. A whole-of-government (WGA) approach will ensure better coordination of digital transformation initiatives across the public sector, complemented by private sector investment and innovation. We believe this holistic approach is a way for emerging and transition digital societies to leapfrog bureaucratic pain points.

-

Comment by Riaz Haq on July 30, 2021 at 7:49am

-

Digital technologies are set to transform the way people live and work in Pakistan. As we saw in the GSMA 2020 Digital Societies Report, which tracks the progress of 11 focus countries in Asia Pacific, Pakistan is advancing its societal, economic and digital ambition, as outlined in Digital Pakistan Vision. Indeed, our report’s digital society index tracked Pakistan in achieving one of the highest increases in its overall score.

https://dailytimes.com.pk/798868/pakistans-digital-transformation-2/

A whole of government approach in Pakistan creates the start of a predictable investment and flexible regulatory environment. These measures, needed to achieve the goals of Digital Pakistan, include tax reforms as well as efforts to implement Right-of-Way (RoW) infrastructure policies. The success of these efforts will be measured by their implementation, along with the growth they support in the future.

Implementing tax reforms for industry growth and infrastructure policy Pakistan recently approved tax reforms that will stimulate mobile industry growth. These include gradually reducing Advance Income Tax from 12.5% to 10% in the next financial bill (FY2021-22); further reducing to 8% in the 2022-23 Finance Bill; approval of harmonization /uniform rate of taxes on telecom service; withdrawal of SIM issue tax; simplification of and exemptions for withholding tax to ease doing business; reduction of minimum tax for telecom services from 8 to 3%.

In order to fully realise the benefits of these tax recommendations, the Financial Bill (FY 2021-22) must be enacted into law. Similarly, we recommend policy makers implement Right of Way (RoW)and other policies that impact the infrastructure supporting digital and mobile access. Recently, a significant milestone was reached when policy makers in Pakistan approved, for the first time, RoW infrastructure policy. We commend this move and urge that these policies are implemented quickly. As technology evolves, unforeseen challenges can arise that may not have occurred to policy makers during their inception.

Spectrum roadmap and digital inclusion

Along with these crucial policies and regulatory modernisation initiatives, there are additional steps needed as Pakistan continues to build itself into a digital society. In particular, the development and implementation of a five-to-seven-year spectrum roadmap. Spectrum is the foundation for mobile services. Sufficient spectrum allows mobile networks to reach even more citizens in Pakistan and offer a better quality of service.

Digital Pakistan also includes digital inclusion as one of its policy objectives. Currently, it has a 54% mobile broadband usage gap , as defined by people who live within the footprint of a mobile broadband network but do not use mobile internet. A spectrum roadmap provides stability and certainty as it helps to create a more investment-friendly environment for mobile operators looking to build 5G and 4G mobile networks.

Industry and government stakeholders

A holistic, whole-of-Government approach speeds digitization and the adoption of new technologies in a more efficient manner. By removing barriers caused by siloed efforts from different ministries, Pakistan could more efficiently harness the capabilities of its existing 4G networks, while preparing for 5G. Another key piece in the digitization effort will be the solicitation of input from industry stakeholders. A transparent consultation process that offers parties the ability to submit thoughtful input has the potential to lead to an enabling regulatory framework primed for new technologies.

-

Comment by Riaz Haq on August 18, 2021 at 7:25am

-

Pakistan’s Airlift raises $85 million for its quick commerce startup, eyes international expansion

https://techcrunch.com/2021/08/17/pakistans-airlift-raises-85-milli...

A one-year-old startup that is attempting to build the railroads for e-commerce in Pakistan has just secured a mega round of funding in a major boost to the South Asia nation’s nascent startup ecosystem.

Airlift operates a quick commerce service in eight cities including Lahore, Karachi, and Islamabad in Pakistan. Users can order groceries, fresh produce, other essential items including medicines as well as sports goods from Airlift website or app and have it delivered to them in 30 minutes.

The startup said on Wednesday that it has raised $85 million in its Series B financing round at a valuation of $275 million. Harry Stebbings of 20VC and Josh Buckley of Buckley Ventures co-led the financing round, which is by far the largest for a Pakistani startup.

Sam Altman, former president of Y Combinator, Biz Stone, co-founder of Twitter and Medium, Steve Pagliuca, co-chairman of Bain Capital, Jeffrey Katzenberg, ex-chief executive of Disney and Quibi, and Taavet Hinrikus, founder and chief executive of TransferWise also participated in the new round, which brings the startup’s to-date raise to $110 million.

Stanley Tang, co-founder of DoorDash, Simon Borrero, founder and chief executive of Rappi, Baastian Lehman, founder and chief executive of Postmates, Quiet Capital and Indus Valley Capital also participated in the new round.

Airlift started as a transit business, building a service similar to Uber for air conditioned-buses in Pakistan. The startup quick amassed traction, clocking over 35,000 rides a day. And then the pandemic arrived, disrupting all mobility in the country.

That’s when Usman Gul, the founder and chief executive of Airlift, took the call to pivot to quick commerce, he told TechCrunch in an interview.

“This entire space of quick commerce is on the brink of global transformation. Airlift is in the forefront for leading that transformation in Asia and Africa,” he said. Gul said he plans to expand the service to many international markets in the next few months.

“Airlift’s early traction in Pakistan is a window into the future for how quick commerce will play out in the developing world,” said Altman in a statement.

Airlift today operates over 30 dark stores and processes hundreds of thousands of orders each month.

Gul said the startup has found that setting up these fulfillment centers is the most efficient way to serve the market. “The more middlemen you introduce in this chain between the items and the customers, you begin to compromise the experience,” he said.

Within the first twelve months of launch, Airlift has been able to reduce its cost of blended customer acquisition to $5 and unit costs to $2.50, it said.

Gul said the startup, which today employs over 100 people, plans to expand to more categories including electronics. “The idea is to expand to new categories and build the railroads to move consumer goods from manufacturers to consumers,” said Gul.

He left his job at DoorDash and moved back to Pakistan to start Airlift. “The idea was to create impact at the base of the pyramid and solve problems that would enrich millions of lives — for whom change is desperately needed. That drove my transition frankly,” he said.

“Transparently, when I first met Usman, I knew this was an entrepreneur who was going to create an industry-defining company. Humble, ambitious and strategic, Usman will be one of the great founders of this generation,” said Stebbings in a statement.

-

Comment by Riaz Haq on August 24, 2021 at 7:36am

-

#Karachi-based #startup Bazaar completes series A round. #Pakistan's B2B marketplace and digital ledger platform Bazaar has raised $30 million led by #SiliconValley-based early stage VC Defy Partners & #Singapore-based Wavemaker Partners. https://tcrn.ch/3j9oAyj via @techcrunch

A one-year-old startup that is building a business-to-business marketplace for merchants in Pakistan and also helping them digitize their bookkeeping is the latest to secure a mega round in the South Asian market.

Bazaar said on Tuesday it has raised $30 million in a Series A round. The new financing round — the largest Series A in Pakistan — was led by Silicon Valley-based early stage VC Defy Partners and Singapore-based Wavemaker Partners.

Scores of other investors including current and former leaders of Antler, Careem, Endeavor, Gumroad, LinkedIn and Notion as well as new investors Acrew Capital, Japan’s Saison Capital, UAE’s Zayn Capital and B&Y Venture Partners and existing investors Indus Valley Capital, Global Founders Capital, Next Billion Ventures, and Alter Global also participated in the new round.

One way to think about Bazaar is — especially if you have been following the Indian startup ecosystem — that it’s sort of a blend between Udaan and KhataBook. “That’s a good way to describe us,” said Hamza Jawaid, co-founder of Bazaar in an interview. “We had this benefit of hindsight to not just look at India but other emerging markets,” he said.

“We saw lots of synergies between these two. If you look at commerce, you have to acquire every single merchant in every single category differently. Whereas with Khata, merchants in any city and category can download it. So effectively, it’s a great customer acquisition tool for you,” he said on a WhatsApp call, adding that this also provides greater insight into businesses.

Bazaar’s business-to-business marketplace, which provides merchants with the ability to procure inventories at a standard price and choose from a much larger catalog, is currently available in Karachi and Lahore, the nation’s largest cities, while Easy Khata is live across the country.

At stake is a booming $170 billion retail market in the world’s fifth-most populous nation that is yet to see much deployment of technology, said Saad Jangda, Bazaar’s other co-founder. Both of them have known each other since childhood and reconnected in Dubai a few years ago. At the time, Jawaid was at McKinsey & Company while Jangda was working with Careem as a product manager for ride-hailing and food delivery products.

There are about 5 million micro, small, and medium-sized businesses in Pakistan. Like India, even as a significant portion of the population has come online, most merchants remain unconnected, said the founders, who surveyed shops going door-to-door.

“We’ve been investing in FMCG B2B marketplaces across the region since 2017. After working with Hamza and Saad over the past year, we’ve been impressed by their customer-centric approach to product development and the speed of their learning and execution,” said Paul Santos, Managing Partner at Wavemaker Partners, in a statement.

“It’s no surprise that they’ve received glowing reviews from their customers and partners. We’re excited to support Bazaar as they solidify their market leadership and digitize Pakistan’s retail ecosystem,” he added.

The startup said it has amassed over 750,000 merchants since launch last year. And it appears to have solved a problem that many of its South Asian peers are still grappling with: Retention. Bazaar said it has a 90% retention rate.

I asked Jangda if he plans to expand to the ‘dukaan’ category. Several startups in Asia are currently building tools to help merchants set up online presence and accept digital orders. He said the market is currently not ready for a dukaan product just yet. “The B2C market is still developing, so there is not so much demand from the consumer side yet,” he added.

Comment

- ‹ Previous

- 1

- 2

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

Agriculture, Caste, Religion and Happiness in South Asia

Pakistan's agriculture sector GDP grew at a rate of 5.2% in the October-December 2023 quarter, according to the government figures. This is a rare bright spot in the overall national economy that showed just 1% growth during the quarter. Strong performance of the farm sector gives the much needed boost for about …

ContinuePosted by Riaz Haq on March 29, 2024 at 8:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network