PakAlumni Worldwide: The Global Social Network

The Global Social Network

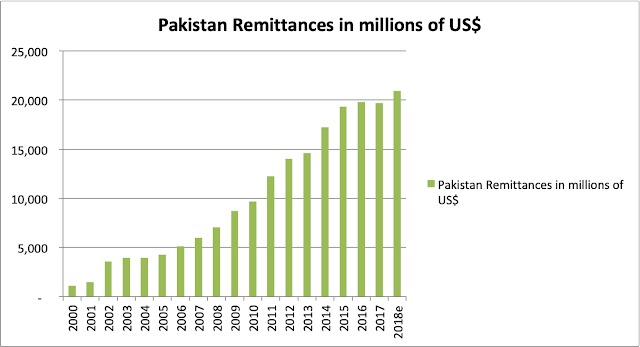

Diaspora Remittances to Pakistan Soar 21X Since Year 2000

Remittance inflows from Pakistani diaspora have jumped 21-fold from about $1 billion in year 2000 to $21 billion in 2018, according to the World Bank. In terms of GDP, these inflows have soared nearly 7X from about 1% in year 2000 to 6.9% of GDP in 2018.

Meanwhile, Pakistan's exports have declined from 13.5% of GDP in year 2000 to 8.24% of GDP in 2017. At the same time, the country's import bill has increased from 14.69% in year 2000 to 17.55% of GDP in 2017. This growing trade imbalance has forced Pakistan to seek IMF bailouts four times since the year 2000. It is further complicated by external debt service cost of over $6 billion (about 2% of GDP) in 2017. Foreign investment in the country has declined from a peak of $5.59 billion (about 4% of GDP) in 2007 to a mere $2.82 billion (less than 1% of GDP) in 2017. While the current account imbalance situation is bad, it would be far worse if Pakistani diaspora did not come to the rescue.

Diaspora Remittances:

Estimated inflows of $20.9 billion make Pakistan the world's 7th largest recipient of remittances for 2018, according data released by the World Bank in its latest "Migration and Remittances" report of December 2018. In South Asia region, Pakistan is the second largest recipient of remittances of $20.9 billion after top-ranked India's $79.5 billion.

Pakistan Remittances in Millions of US Dollars. Source: World Bank |

Remittances from Pakistani diaspora have grown nearly 21-fold since the year 2000. Pakistanis sent home remittances adding up to 6.9% of the country's GDP in 2018, up from 1% back in year 2000.

Pakistan's Trade:

In 2017, Pakistan exported goods and services worth $22 billion while it imports amounted to $57 billion, a trade deficit of $35 billion for the year. This is a dramatic deterioration from about $2 billion trade deficit (2% of GDP) in year 2000 to $35 billion trade deficit (about 12 % of GDP) in year 2017.

Pakistan Trade Deficit in Billions of US$. Source: World Bank |

Pakistan's exports have declined from 13.5% of GDP in year 2000 to 8.24% of GDP in 2017. At the same time, the country's import bill has increased from 14.69% in year 2000 to 17.55% of GDP in 2017.

Foreign Direct Investment:

Foreign direct investment (FDI) in Pakistan was a mere $2.82 billion (less than 1% of GDP) in 2017, down from a peak of $5.59 billion (4% of GDP) in 2007. The lack of foreign investment has contributed to the country's dwindling reserves and balance of payments difficulties requiring it to seek yet another IMF bailout.

Pakistan's External Debt. Source: State Bank of Pakistan via Dr. Is... |

Pakistan's Debt:

Significant growth in remittances from Pakistani diaspora has clearly helped but the external accounts gap is too big for it. This has forced Pakistan to borrow heavily in recent years. It has raised debt service costs and put pressure on Pakistan's reserves.

Summary:

Remittances from Pakistani diaspora have jumped 21-fold from about $1 billion in year 2000 to $21 billion in 2018, according to the World Bank. In terms of GDP, these inflows have soared nearly 7X from about 1% in year 2000 to 6.9% of GDP in 2018. Meanwhile, Pakistan's exports have declined from 13.5% of GDP in year 2000 to 8.24% of GDP in 2017. Foreign investment in the country has declined from a peak of $5.59 billion (about 4% of GDP) in 2007 to a mere $2.82 billion (less than 1% of GDP) in 2017. At the same time, the country's import bill has increased from 14.69% in year 2000 to 17.55% of GDP in 2017. This growing trade imbalance has forced Pakistan to seek IMF bailouts four times since the year 2000. It is further complicated by external debt service cost of over $6 billion (about 2% of GDP) in 2017. While the current account imbalance situation is bad, it would be far worse if Pakistani diaspora did not come to the rescue.

Related Links:

Can Pakistan Avoid Recurring Balance of Payment Crisis?

Pakistan Economy Hobbled By Underinvestment

Can Indian Economy Survive Without Western Capital Inflows?

Pakistan-China-Russia Vs India-Japan-US

Chinese Yuan to Replace US $ as Reserve Currency?

Remittances From Overseas Pakistanis

-

Comment by Riaz Haq on December 10, 2018 at 5:31pm

-

#Pakistan to focus on #engineering sector #exports.#ImranKhanPM advisor Razzak Dawood invited #Japanese companies to look into the information and #technology, small and medium enterprises and #agriculture value-chain sectors for #investments. https://www.thenews.com.pk/print/404268-pakistan-focuses-on-enginee...

Adviser to the Prime Minister on Commerce Abdul Razak Dawood on Monday said Pakistan graduated from its traditional textile and leather sectors to export of engineering goods, while inviting Japanese companies to benefit from the country’s geographical connectivity to Asian markets.

Dawood, while addressing a seminar on Pakistan’s Economic Policy, invited representatives of Japanese companies to look into the information and technology, small and medium enterprises and agriculture value-chain sectors for investment.

“Advisor underlined that Pakistan had graduated from its traditional sectors of textile and leather to the export of engineering goods,” an official statement quoted him as saying.

“He (the advisor) called for taking advantage of Pakistan’s strategic location for exports to the Middle East, Africa and Central Asia.”

Japan External Trade Organization (Jetro) and Ministry of Economy, Trade and Industry of Japan, Ministry of Commerce and Textiles and the Embassy of Pakistan in Japan jointly organised the seminar. Around 200 participants primarily from the Japanese business community attended the event.

Adviser to the Prime Minister on Commerce underscored the importance of furthering trade and investment relations between Japan and Pakistan, while highlighting growing potential of the local market, vibrant demography, low productivity costs, availability of rich natural resources and a liberal investment regime.

“Out of all the G-7 countries, Pakistan has a longstanding trade and investment relationship with Japan and there is a need to build upon the reserve of historical linkages, goodwill, understanding and respect for brand Japan in Pakistan,” Dawood said.

The advisor said the balance sheets of multinational corporations in the country reflect that they are making profits. He invited Japanese businesses to explore huge opportunities in trade and investment in the country. He also highlighted massive investment in infrastructure projects with the potential to make the country a regional hub for trade and investment.

There are 86 Japanese companies operating in the country with some enhancing their investments while new ones entering the local market. A recent annual survey of the Jetro ranked Pakistan as the first in terms of business growth expectation, profitability and local employment.

-

Comment by Riaz Haq on December 21, 2018 at 7:55am

-

#UAE plans to deposit $3 billion in #Pakistan's central bank "in the next few days", the UAE state news agency WAM reported on Friday, while a Pakistani official said #Islamabad also hopes it will allow deferred payments for #oil supplies. #IMF #economy

http://www.arabnews.com/node/1423831#.XB0L2ByGdkA.twitter

Pakistan is battling to bring under control a gaping current account deficit that's wobbled its economy and lowered growth.

Islamabad is engaged in bailout talks with the International Monetary Fund (IMF) but has also sought financial help from allies China and Saudi Arabia.

The UAE deposit is aimed at supporting Pakistan's monetary policy, WAM said, citing the state-run Abu Dhabi Fund for Development.

Hours after the WAM announcement, Pakistani Information Minister Fawad Chaudhry told Reuters that Islamabad was "also hoping to get deferment for oil payments" from UAE.

Chaudhry declined to disclose the sum of assistance sought through deferred payments, but said this was part of the discussions that led to the UAE announcing it would deposit $3 billion with Pakistan's central bank.

The minister added that the UAE planned to make investments in Pakistan, including a refinery and desalination plants.

In October, Saudi Arabia said it would loan Pakistan $6 billion, including a $3 billion deposit for its foreign currency reserves and another $3 billion in deferred oil payments.

China, Pakistan's staunchest ally and financial benefactor, has also pledged to help but has not announced the size of any assistance package.

-

Comment by Riaz Haq on December 21, 2018 at 4:29pm

-

The United Arab Emirates has announced its intention to deposit US$3 billion (equivalent to AED11 billion) in the State Bank of Pakistan "to support the financial and monetary policy of the country", reported WAM, the official news agency of the Emirates.

https://www.dawn.com/news/1452799

The Abu Dhabi Fund for Development said, in a statement today, that it will deposit the said amount in the coming days to enhance liquidity and monetary reserves of foreign currency at the bank.

The country's support for Pakistan's fiscal policy is based on the historical ties between the two people, said WAM, and the two friendly countries and the desire to further develop the bilateral cooperation in all fields.

Following the announcement, Prime Minister Imran Khan took to Twitter to thank the UAE government for "supporting Pakistan so generously in our testing times".

"This reflects our commitment and friendship that has remained steadfast over the years," said the prime minister.

The Abu Dhabi Fund for Development has financed eight development projects in Pakistan with a total value of AED1.5 billion, including AED931 million in grants, added WAM. The funds covered projects in sectors such as energy, health, education and roads.

Pak-UAE ties

The PTI-led government, which completed its 100 days in power on November 26, counted "resetting relations with key partners including Saudi Arabia and the UAE" among its accomplishments in its performance report.

Since assuming office in August, the premier has visited the UAE twice.

The first visit took place in September when Khan visited Saudi Arabia and then the UAE. He was received by Crown Prince of Abu Dhabi Sheikh Mohammed bin Zayed bin Sultan Al Nahyan and the two countries had agreed to strengthen economic, trade and investment relations.

The next month, a UAE delegation — comprising CEOs/senior officials of major companies including Mubadala Petroleum, ADIA (Sovereign Wealth Funds), Etisalat, DP World, Dubai Investment Authority, Emaar Properties, Aldahra Agriculture and Abu Dhabi Fund for Development — arrived in Pakistan.

According to Foreign Minister Shah Mahmood Qureshi, the one-day visit of the delegation — headed by Dr Sultan Aljaber, minister of state and CEO of Abu Dhabi National Oil Company — was a follow-up to the prime minister’s maiden visit to Abu Dhabi.

In November, the premier embarked on his second trip to the UAE amid reports that the gulf state was ready to extend financial assistance to Pakistan. Khan was received by the Abu Dhabi crown prince in the UAE capital and was accorded a reception at the presidential palace, which was followed by delegation-level talks.

He was accompanied by a high-level delegation comprising Foreign Minister Qureshi, Finance Minister Asad Umar, Petroleum Minister Ghulam Sarwar Khan, Power Minister Omar Ayub Khan, PM’s Adviser on Commerce Abdul Razak Dawood, PM’s Adviser on Accountability Shahzad Akbar and Chief of the Army Staff Gen Qamar Javed Bajwa, among others.

During his day-long trip, the prime minister had also met Sheikh Muhammad bin Rashid Al Maktoum, the vice president and prime minister of the UAE and ruler of Dubai.

-

Comment by Riaz Haq on December 22, 2018 at 4:54pm

-

With #UAE aid, #Pakistan bridges half gap with reduction in the current account deficit from $19 billion to around $13 billion for FY 18-19. #Debt servicing is now estimated at $8.8 billion. @pid_gov expects $4.5 billion in commercial loans. #economy #IMF https://tribune.com.pk/story/1872107/2-uae-aid-pakistan-bridges-hal...

With an announcement by the United Arab Emirates (UAE) that it is giving $3 billion in loans, Pakistan government has bridged half of the financing gap after including Saudi Arabian assistance, but it still waits for another $6 billion that will mainly come from commercial banks.

The Ministry of Finance’s financing lineup shows deposits of $6 billion by the monetary authorities, after the assistance from the UAE and Saudi Arabia. On top of that, receipt of $4.3 billion has been estimated on account of oil financing facilities from the Islamic Development Bank and Saudi Arabia during the current fiscal year.

Still, $4.5 billion would be required in commercial loans from foreign banks to meet the revised external financing requirement of $22 billion, said sources in the Ministry of Finance.

IMF projects inflation rate to hit 14% by June

They said Pakistan had already received $450 million worth of foreign commercial loans in first five months of the current fiscal year and it needed another $4 billion in the remaining seven months.

The UAE announced on Friday that it would deposit $3 billion in the State Bank of Pakistan (SBP) to bolster the country’s dwindling foreign currency reserves. With the announcement, the UAE will match the assistance from Saudi Arabia, which had agreed to park $3 billion in Pakistan’s foreign exchange reserves.

--

Saudi Arabia has already announced a $6-billion assistance package, equally divided between cash and oil supply on deferred payments. Of that, $2 billion has already been deposited with the central bank.

In the outgoing week, Finance Minister Asad Umar told a parliamentary panel that Pakistan would pay 3.18% interest on the Saudi loan.

“It is expected that loan terms for the UAE financial assistance will be similar to the Saudi loan,” said a senior government official.

----

For the current fiscal year 2018-19, the finance ministry has projected that gross external financing requirement of Pakistan will be $22 billion, down from initial estimates of $28 billion. This is primarily due to reduction in the current account deficit projection from $19 billion to around $13 billion, according to the ministry’s estimates.

During the first five months of FY19, the current account deficit stood at $6 billion, which was 11% less than the comparative period of previous year. But the pace was not enough to restrict the deficit to $13 billion in the remaining seven months of the year.

Debt servicing has now been estimated at $8.8 billion, suggesting repayment of some of the maturing deposits has been deferred.

Against the annual budgetary projection of $2 billion, the government has estimated receiving $4.5 billion on account of commercial loans. These include $1.7 billion in short-term commercial loans and $2.8 billion in medium-term commercial borrowings. Most of these loans are expected to come from Chinese commercial banks.

The government has dropped the plan of issuing $3 billion worth of Eurobond and Sukuk in the current fiscal year and proceeds of only $700 million have been projected, probably on account of Diaspora bonds.

Commercial borrowing has been replaced with sovereign bonds aimed at avoiding a high financing cost in the absence of an International Monetary Fund (IMF) programme. But this will increase refinancing risks due to the short tenor of commercial borrowings.

Another $2 billion is expected to come from some “unidentified sources”.

Nearly $2 billion in Chinese project financing has been estimated for the current fiscal year to meet the financing gap.

---

Project financing from these two organisations has now been estimated at slightly over $1 billion.

-

Comment by Riaz Haq on January 1, 2019 at 10:01am

-

#Beijing to lend $2 billion to #Pakistan to shore up rupee. This financial support signals deepening #economic ties between #China and Pakistan even as #Islamabad is negotiating with the #IMF for a potential $7 to $8 billion loan. #CPEC https://www.ft.com/content/bd083b78-0d70-11e9-acdc-4d9976f1533b via @financialtimes

China has pledged to lend at least $2bn to Pakistan to shore up its foreign exchange reserves and prevent further devaluations of the rupee against the dollar, two senior government officials have told the Financial Times.

The financial support, which is not being publicly announced by China, comes as the government of Prime Minister Imran Khan is struggling with a weakening fiscal position, high debt repayments and dwindling reserves.

“China’s promise to Pakistan is an indication of their commitment to help us avoid a crisis. If the rupee falls sharply and we need to prevent its slide, we can turn to China,” said a senior government official in Islamabad.

Chinese officials were not immediately available for comment.

The promised financial support signals deepening economic ties between China and Pakistan even as Islamabad is negotiating with the IMF for a potential $7bn to $8bn loan.

Pakistan’s finance ministry and the IMF are due to resume discussions later this month on details of the package, which is expected to come with tough conditions, such as slimming down the country’s bloated state-owned enterprises through job cuts.

The rupee has lost more than a fifth of its value against the dollar since late 2017 and Fitch has cut Pakistan’s debt rating deeper into junk territory last month. Pakistan’s foreign reserves, at $7.3bn, have dropped to about one and a half months of import cover, regarded as a critically low level, said economists.

After decades of close military co-operation, Beijing has been stepping up financial support for Pakistan, with Chinese state-backed banks lending $4bn to Islamabad in the year ending June 2017.

China has committed to invest more than $60bn in infrastructure, energy, railway and road projects in Pakistan under the China-Pakistan Economic Corridor, a centrepiece of Chinese president Xi Jinping’s Belt and Road Initiative. The corridor is intended to link China’s western region with Pakistan’s newest deep seaport financed by Beijing at Gwadar near the Gulf.

In December, Mr Khan’s cabinet approved a plan to issue renminbi denominated “panda bonds” in the Chinese market, which one officials said could raise $1bn to $1.2bn.

Analysts said that by not publicly announcing its offer to Pakistan, Beijing hoped to avoid further raising US concerns over its relationship with Islamabad.

In July 2018, Mike Pompeo, the US secretary of state, warned the IMF against a bailout to Pakistan that would help the country pay back its loans to China.

Zubair Khan, a former Pakistan commerce minister, said China’s discreet dealings with Pakistan were not meant to “undercut” the IMF. “China is a very important member of the IMF. They [China] also want Pakistan to fix our economy,” he said.

Pakistan’s allies in the Middle East are also stepping up to help Islamabad. Saudi Arabia has pledged to lend $6bn to Pakistan in the financial year to June 2019 while the United Arab Emirates has promised to lend another $3bn during the same period.

The south Asian country’s recurring challenges include a persistent failure to reform one of the world’s worst performing tax collections. Less than 1 per cent of Pakistan’s population pays income tax.

-

Comment by Riaz Haq on January 1, 2019 at 4:29pm

-

The economy in 2019 by Hammad Azhar

The economy has slowed down, the Rupee has been devalued, interest rates have gone up and there has been some increase in the rate of inflation in the country. Why has this happened? And what prospects does the economy hold in 2019? This article answers the above questions in an honest and as simple a manner as is possible.

https://www.thenews.com.pk/print/413356-the-economy-in-2019

Pakistan’s economy is recovering from what can be best described as a ‘consumption led’ growth period that was financed by short term debt instruments and a stifling of investment climate. Consumption as percentage of GDP went up from the already worrying figure of 91.8% in FY14 to 94.5% in 2018. Correspondingly, total gross investment (that includes government investment also) in Pakistan was reported at just 16.4% of GDP in FY18 whereas India’s figure stands at close to 30% and Bangladesh is at 31% of GDP. Additionally, our spur of consumption spree was associated with policies in the past that instead of channeling the countries resources into savings, investments and industrialization further aggravated the problem of private investment. And here’s how:

To begin with, we saw a very visible deterioration in the economy’s fundamentals as the country exited the last IMF program in 2016 and all forms of fiscal and monetary discipline were abandoned. What this means is that we were fuelling growth in the economy by spending from resources that we did not have. For example, in the last financial year alone, RS 1300 billion of government spending was financed by printing money and monetization of public debt. The previous government was also happy to ask FBR to withhold genuine refunds to the tune of hundreds of billions of Rupees of businessmen and entrepreneurs that further squeezed their working capital and halted all their expansions. This whole model broadly represented the previous government’s fiscal policy and it’s no surprise that it fuelled only consumption growth. And it also led to whopping RS 2300 billion or 6.6 % of fiscal deficit in the system i.e. the excess of government spending over government’s income.

Now let’s take a look at the monetary side. In the first 4 years of the previous government, the Real Exchange Rate (the buying power of the currency in comparison to other currencies) appreciated by 28% without any improvement in the trade deficit to justify this increase. This means that our exports became that much uncompetitive in the international markets and we began subsidizing our imports. This led to the closure of hundreds of export houses and fuelled a largely consumption led increase in our imports. From a point where we had a Current Account deficit of just USD 2.5 BN in 2013, the figure soared to USD 19 Billion in 2018.

The second aspect of monetary policy is Interest Rates. The interest rates were kept low in the past but that also did not translate into any notable increase in private sector borrowing, the loans that our entrepreneurs use for investments and setting up businesses and industry. The reason that private sector was not advanced these loans by the banks is that the government was doing what the economists call ‘crowding out’ the private sector. The banks were more than happy to lend to the government in the form of Treasury Bills. So in effect, the lower interest rates actually did not lead to any investment and the whole monetary scheme of things further fuelled the consumption spree.

The result of the above mentioned fiscal and monetary policies was not surprising for any economist. The country came on the verge of bankruptcy at the close of the last financial year (FY2018). Once both the IMF program ended and oil prices began to rise, the superficial nature of the whole economic model unfolded and the State was left with nothing to finance its fiscal expenditures and its huge import bill.

So what has the new government done about this? And what does it plan to do in order to make sure that the repeat of the above does not take place?The first and foremost plank of the new government’s economic priority in 2018 has been that the country must meet its financing obligations in terms of debt repayment due this financial year (USD 9 billion) and that the current account deficit is reduced to the range from USD 11-13 Billion from the current USD 19 Billion. The fiscal side also has to show improvement as the last reported fiscal deficit of 6.6% is not sustainable. The above priorities are necessary and overarching in order to keep the economy functioning and not defaulting on its both external and internal obligations.

The good news is that as a result of adjustments by SBP in the exchange rate and the imposition of Regulatory Duties by the government on non-essential items, we have seen a sharp reduction in the growth of imports that has gone down from the figure of 26% growth to a negative figure. Some commentators have criticized the steep adjustment in the exchange rate. However, one has to take into account the fact that the exchange rate was allowed to appreciate in real terms and the need for corrections had been piling up for at least 4 of the last 5 years. Therefore the country had deviated significantly from its Actual Exchange Rate value and a one-time steep adjustment had become inevitable.

The foreign remittances, another foreign exchange source, have also shown a very encouraging rise of 12.5% in the first quarter and the export sector is also showing a positive growth. In 2019, the government shall announce a comprehensive incentives package for overseas workers to send their remittances through the formal channels. Improving the speed, security and reducing the red tape that is currently surrounding the formal channel procedures is a central aspect of the upcoming incentives package for foreign remittances.

The new government’s successful foreign policy has led to friendly countries offering us sizeable support for our Balance of Payments. Bilateral assistance in the form of funds and deferred oil payment facilities from KSA, UAE and other countries has begun to pour in. As a result of the above, the country has successfully averted the balance of payments crises and all economic trends indicate that our deficits are coming down rapidly to within manageable ranges.

The second economic priority of the PTI government is that growth shall now have to be led by exports, investment and productivity instead of consumption and imported finance capital. I mention exports first because a country earns its foreign exchange primarily by virtue of this sector. And foreign exchange earnings are required to fill our huge financing gap and escape from the debt dependency trap. The readjustment of the exchange rate by bringing it at par with its actual market value has helped in restoring competitiveness of our exports. Furthermore, the government has also reached an agreement with the export sectors with regards to freeing up their entire stock of working capital stuck up with FBR in the shape of pending refund claims. This government will no longer use the entrepreneur’s capital to cover up and finance its own shortcomings in raising revenues or funding showcase projects. On this same note, the government has also taken the unprecedented step of bringing at par the energy costs that our exporters face. LNG and Natural Gas mix is now being supplied to them at the regional average rate of USD 6.5 per MMBTU. A similar approach is being worked out when it comes to the electricity tariffs that shall be notified at 7.5 cents/KWH for the export sector. With these measures in place, the export sector in 2019 will be able to unleash its real comparative advantage and earn the much needed foreign exchange for Pakistan.

Another much debated subject these days is interest rates. One would be justified to ask the question that how the government on one hand claims to be promoting ‘investment led growth’ whilst on the other hand is raising interest rates, the act that in theory discourages investment? Firstly, the need for raising interest rates arose when the rupee was devalued. Devaluation causes inflationary pressures to rise in the economy and in order to prevent the rise in prices from forming a spiral and going out of control, the interest rate had to rise simultaneously. However Pakistan’s interest rate in Real Terms (adjusted for inflation) is approximately 4% now. That’s the same rate in real terms that is prevalent in all countries in our region. Furthermore, fresh data with regards to interest rates and investment is painting a very different figure from what many would predict. The ‘private sector credit off take’ in the economy in the first quarter has risen by more than 400%. This means that current interest rates are not stifling investment at all. The explanation for this seems to be that once the ‘crowding out’ phenomenon that was mentioned above was eliminated, the suppressed appetite of the private sector for loans came into play. This phenomenal growth in private sector loans is a much needed development and this trend shall continue into 2019.

Studies point out that apart from restrictive economic policies that were hindering savings and investment in Pakistan, there are two additional features in play. Security and Taxes. The security situation has significantly improved over the years following the successful ‘Zarb-e-Azb’ operation conducted and led by the military. However, little attention has been paid to the most complicated and business unfriendly tax policies and laws in place. Whilst Pakistan is 136th in the rank of the ‘ease of doing business’ index, we are 173rd when it comes to ‘complicated tax systems’ as per a World Bank report. This means that taxes are right now the single biggest hindrance in the way of investment in the economy and the current government is formulating bold initiatives in this regard that shall be rolled out in 2019. For example, ‘With-Holding’ taxes on filers is nothing but a ‘red tape’ as most of the sums under this head are adjusted in the annual return anyway. Similarly, for the non-filers, this tax has only acted to reduce the ‘Cash to Deposits’ ratio in the economy. As per some calculations that take into account the ‘multiplier effect’ of deposits and subsequent lending in the banking system, it is estimated that up to Rs 6 trillion can potentially be made available for private sector lending if the disincentives from transacting in the banking system are removed and the government in 2019 fully intends upon beginning to phase out these distortionary taxes.

I now turn towards the question that affects each one of us; overall economic activity. As mentioned above, the general policy paradigm was in need of a shift, from ‘consumption’ towards ‘investment’. This shift in economic priority entailed a readjustment in the fiscal and monetary policies of the country. ‘Change’ is always accompanied by a certain degree apprehension and uncertainty. We indeed see that in our economy now and it is understandable. We are witnessing a correction or a ‘hang over’ from the over consumption of the past as we sail away from that approach towards a more sustainable and structurally sound economic model. However, as the contours of this new economic approach become clear and an investment focused and pro-business set of policies and framework is put in place, we expect this uncertainty to be swiftly replaced by investor confidence and growth.

2019 shall be a year in which Pakistan shall take significant steps towards improving its ‘ease of doing business climate’. A new tariff policy aimed at rationalizing duties on imports of raw materials, machinery plus simplification in taxes and filing procedures for Individuals, Corporations and Businesses shall be announced. Taxes shall no longer be used purely to raise revenues. The aim of the separation of Tax Policy Division from FBR’s administration is precisely to phase out all taxes that have added to the cost of doing business in Pakistan and replace them with measures that create incentives for SME’s and businesses.

Reforming Pakistan’s tax laws is an extensive subject and a Tax Reform Implementation Committee that I head has already been notified. It is composed of the original authors of the famous and well written Tax Reform Commission Report that was never followed up with policy. My next article will be devoted purely towards the issues of upcoming ‘Tax Reforms’ so I leave this subject with the comment for now that the government will not shy away from undertaking bold measures at simplification and ease of filing taxes and reforming FBR into a business friendly entity in 2019.

Entrepreneurs and businesses in Pakistan have to deal with multiple government departments that require extensive time and workforce to deal with. The methods these departments employ in the name of compliance with outdated legal statutes and their wide ambits mean that businesses and especially SMEs are put at a serious disadvantage and feel harassed. Therefore, the scope and powers of these departments is being revisited and shall be reviewed in conjunction with the provincial governments.

2019 is also expected to be the year for foreign investments in Pakistan. CPEC shall be entering its second phase that shall be more focused on trade and industry, moving on from infrastructure. This shall play a pivotal role in terms of technology and skills transfer to our economy. Multi-national companies from sectors ranging from automobiles, telecommunications, energy, electronics and others have also expressed their interest to invest in Pakistan. Our sizeable population and a young demographic holds great and yet untapped potential for any investor. In the coming year, we are confident to see these interests transforming into tangible foreign investments.

To sum up, the economy has averted the immediate severe balance of payments crises and all macro-economic indicators are showing positive trends towards stabilization. The general paradigm of fiscal and monetary policies has been realigned towards exports, investment and productivity growth. In the days to come, bold steps will be put in place to facilitate both foreign and local investment and dramatically improve the ease of doing business climate in the country.

-

Comment by Riaz Haq on January 3, 2019 at 11:39am

-

#Saudi #investments at #Gwadar port will soon be announced in #mining, #energy, #oil, #electricity, #renewable #energy sectors in #Pakistan. #Saudi delegation of #businessmen, #investors, members of #trade and #industry chambers visiting #Gwadar. #CPEC https://aawsat.com/node/1530696

A delegation of Saudi businessmen, investors and members of trade and industry chambers visited Wednesday Pakistan’s Gwadar port, the main hub for the China Pakistan Economic Corridor linked to the Silk Road initiative.

During the visit, the delegation reviewed investment opportunities at the port as well as in the special economic zones created by the Economic Corridor.

Saudi ambassador to Pakistan Nawaf al-Maliki indicated that Gwadar has many commercial and investment benefits for Saudi investors.

He pointed out that the Pakistani government promised to provide them with incentives and services.

Maliki stressed that the Kingdom is keen to invest in the Economic Corridor, saying Saudi investments at Gwadar port will be announced soon, a move that contributes to boosting Pakistan’s economic stability.

Adviser to the Saudi Minister of Energy, Ahmed al-Ghamdi, told Asharq Al-Awsat that the Saudi-Pakistani Coordination Council for Economic Collaboration will inform businessmen and other government agencies in Saudi Arabia about investment opportunities in the Pakistani port.

“Saudi Arabia is seeking to find an investment opportunity in Pakistan in general and in the port (Gwadar) in particular given its strategic area,” he said.

The adviser revealed that several Saudi state projects in mining, energy, oil, electricity and renewable energy, are underway in Balochistan province.

For his part, a member of the Council of Saudi Chambers, Khalil Mansour al-Afraa, stressed that the Council’s efforts come in tandem with the search for investment opportunities in industry and infrastructure by Saudi businessmen.

Afra revealed to Asharq Al-Awsat that an exhibition for businessmen from Pakistan and China will be held at the port in March.

-

Comment by Riaz Haq on January 5, 2019 at 8:35am

-

#Pakistan, #UAE finalize $6.2 billion #support package expected to be announced by Crown Prince Sheikh Mohammed bin Zayed Al Nahyan during his visit to #Islamabad starting on Sunday (Jan 6). It includes $3.2 billion deferred oil payments, $3 billion cash. https://www.dawn.com/news/1455585

He said the UAE’s package was exactly of the same size and terms and conditions as given by Saudi Arabia. The UAE package was finalised on Thursday evening, he said.

With this, Pakistan would get a total saving of about $7.9bn on oil and gas imports from the two friendly countries — accounting for more than 60 per cent of annual oil import bill of about $12-13bn, he said. This includes about $3.2bn each of oil supplies on deferred payments from the UAE and Saudi Arabia and about $1.5bn trade finance from the International Islamic Trade Finance Corporation (ITFC).

The total financing support from the UAE and Saudi Arabia, including the ITFC’s trade finance, would be around $13.9-14bn when cash deposits of $3bn each from the two countries were also included, he said.

This is in addition to a deep-conversion oil refinery to be set up by Parco — a joint venture of Pakistan and Abdu Dhabi — worth $5-6bn at Khalifa Point and an expected petro-chemical complex by Saudi Arabia at Gwadar Oil City.

On top of that, the government has also started backchannel discussions with Qatar for some relief in terms of reduction in LNG prices or a relaxed payment schedule, but that is now at an early stage.

In reply to a question, the cabinet member said Pakistan was deepening relationships with all three friendly Islamic nations without compromising bilateral ties for geo-political reasons.

He said the UAE crown prince would be paying a two-day visit, adding that all arrangements had been finalised in this regard.

He said Saudi Crown Prince Mohammad bin Salman was expected to arrive in the country in the first week of February and an MoU for establishing a petro-chemical complex was still being worked out on the request of Riyadh.

Pakistan has already received $2bn in cash deposit from Saudi Arabia at an interest rate of 3.18pc while the third tranche of $1bn is due in the first week of February. The Saudi oil facility would also start rolling out this month with an average $274 million per month.

Pakistan is currently importing about eight cargoes of LNG every month, costing $4.2 to $4.5bn a year and more than one-third of this could be financed through ITCF support. With support from Qatar, Pakistan is expecting about $9bn cushion in total oil and gas import bill.

-

Comment by Riaz Haq on January 12, 2019 at 7:41am

-

#Pakistan’s First #Blockchain-Based #Remittance Service Launched Using #Alipay’s #Technology. Pak #Telenor and #Malaysia's #fintech firm Valyou offer the service. Service is expected to enhance the #efficiency and #speed of remittances

https://www.ccn.com/pakistans-first-blockchain-based-remittance-ser...

A Pakistani financial institution has rolled out a cross-border remittance service based on blockchain technology developed by Alibaba affiliate, Alipay.

Telenor Microfinance Bank and Malaysian fintech firm Valyou have partnered to offer the service to that will operate between Malaysia and Pakistan. The service is expected to enhance the efficiency and speed of remittances from the former to the latter.

Additionally, Pakistan’s first blockchain-based remittance service will eliminate intermediary costs making it cheaper to send money. Users will also be able to track the remittances at ‘every step of the way’, according to a statement.

Lucrative Remittance Market

At the moment, it is estimated that Pakistanis living and working in Malaysia send around $1 billion annually. This is about 5% of the estimated $20 billion in remittances that is sent by the combined Pakistani diaspora spread across the globe. The State Bank of Pakistan’s governor, Tariq Bajwa, noted during the launch of the service that remittances contribute significantly to the country’s economy.

At around USD 20 billion per year, international remittances are important from the perspective of overall macroeconomic stability and their positive spillover in improving lives of millions of families. Home remittances contributed to over 6% in GDP, equivalent to over 50% of our trade deficit, 85% of exports and over one-third of imports during FY 2017-18.

This is not the first time that Alipay is involved in a blockchain-based remittance solution in Asia. Mid last year, Hong Kong-based AlipayHK announced a blockchain-based money transfer service between Hong Kong and the Philippines.

https://twitter.com/CryptoCoinsNews/status/101157117132065177

During the launch of the service the founder of Alibaba, Jack Ma, indicated that he had long wanted to reduce remittance costs between China and Pakistan:

This comes from a promise I made a long time ago when Alipay was just launched. I have friends who are Filipino and they asked me when they could use Alipay to send money home because it was too expensive through banks, which charge too much.

Filipino Remittance Market

Currently, the Philippines is the world’s third-largest remittance market. In 2017, inflows into the Southeast Asian country amounted to approximately $3 billion. A significant proportion of the expatriate community in Hong Kong hails from the Philippines. In 2016, Filipinos in the city-state are estimated to have remitted $561 million to their home country.

Another Chinese firm that recently announced plans to launch a remittance service in the Philippines is Huaren Capital. Unlike Alipay, Huaren Capital will launch a stablecoin pegged to the Filipino Peso and partner with local banks.

-

Comment by Riaz Haq on April 5, 2019 at 7:58am

-

UAE Population by Nationality (Expat population of UAE in 2018 )

https://www.globalmediainsight.com/blog/uae-population-statistics/

Nationality Population

India 2.62 million

Pakistan 1.21 million

Bangladesh 0.71 million

Philippines 0.53 million

Iran 0.45 million

Egypt 0.40 million

Nepal 0.30 million

Sri Lanka 0.30 million

China 0.20 million

All other countries 1.71 million

Total Expat Population 8.45 million

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

Agriculture, Caste, Religion and Happiness in South Asia

Pakistan's agriculture sector GDP grew at a rate of 5.2% in the October-December 2023 quarter, according to the government figures. This is a rare bright spot in the overall national economy that showed just 1% growth during the quarter. Strong performance of the farm sector gives the much needed boost for about …

ContinuePosted by Riaz Haq on March 29, 2024 at 8:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network