PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan to Become World's 6th Largest Cement Producer By 2030

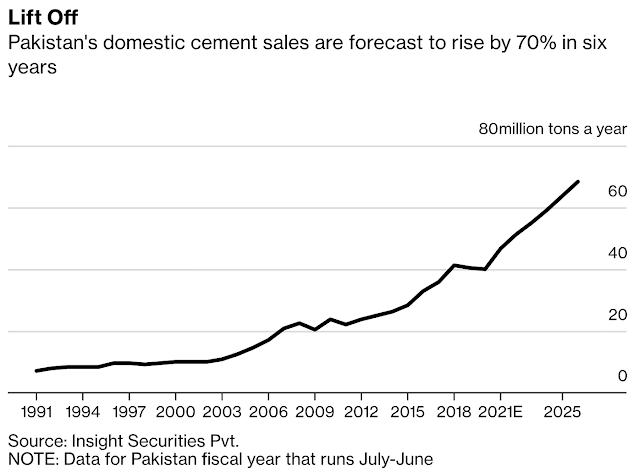

Pakistan's rank as world's leading cement producer will rise from 16th in 2018 to 6th by 2030. It will replace Japan among the world's top 10 cement producing nations in 2030, according to World Cement Association forecast. Cement consumption is an important indicator of development activity and economic growth. Pakistan's domestic cement sales are continuing to grow, up 9.2% in October, 2019 from the same month last year. Total sales (local and export) in 4-month period between July and October 2019 stood at 16.117 million tons, 4.5 per cent higher than 15.419 million tons during the same period last year.

| Source: World Cement Association |

Last year, Pakistan produced 41.14 million tons of cement, according to International Cement Review. The country's cement industry has already built capacity to produce 59.5 million tons in anticipation of future demand for housing and infrastructure. World Cement Association expects Pakistan to produce 85 million tons, 2% of the world's cement production in 2030.

|

| Cement Sales in Pakistan. Source: Bloomberg |

Currently, China produces more than half of all the cement used in the world. India produces 8% and and European Union 3%. The three will continue to be at the top in 2030. However, China's share will drop to 35% while India's share will double to 16%.

|

| Top Cement Producing Countries in 2019 |

Pakistan's domestic cement sales grew 9.2% in October, 2019 from the same month last year. Total sales (local and export) in 4 months period between July and October 2019 stood at 16.117 million tons, 4.5 per cent higher than 15.419 million tons during the same period last year. Cement consumption is an important indicator of the state of economy. It is the most important construction material. It drives construction industry that is among the biggest employers in the world. Cement is used to build homes, factories, schools, hospitals, roads, bridges, ports and all kinds of other infrastructure.

|

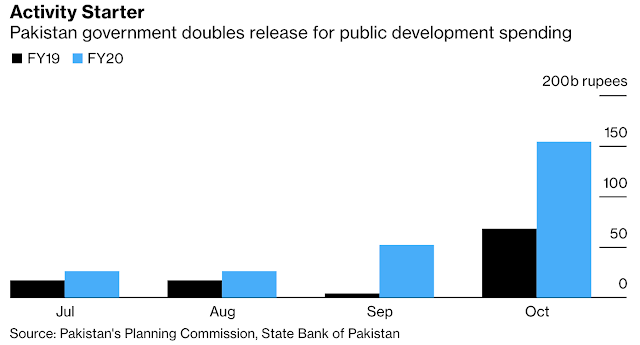

| Recent Spike in Public Sector Development Spending (PSDP) |

Development of infrastructure under China Pakistan Economic Corridor projects is continuing to drive cement demand in the country. In addition, construction of major new housing communities is underway. One example of such a community is Karachi's Bahria Town. It is being built on the outskirts of Pakistan's financial capital is among the world's largest privately developed and managed cities. It is spread over an area of a little over 70 square miles, larger than the 49 square miles area of San Francisco. When completed, Bahria Town will house over a million people, more than the entire population of San Francisco.

-

Comment by Riaz Haq on October 3, 2021 at 8:52pm

-

#Pakistan #cement industry's total capacity is currently at 69 million tons, and a further 18 million tons of capacity is in the pipeline. This will take total production capacity to 87 million tons by FY24. #construction #infrastructure #housing #economy https://www.cemnet.com/News/story/171425/pakistan-is-entering-a-new...

In a cement conference, conducted by AKD Securities Ltd CEO, Muhammad Farid Alam, on 15 September 2021, Pakistan's cement industry producers confirmed that the country has entered another expansion phase. The total installed capacity of the cement industry in Pakistan is currently at 69Mta, and a further 18Mta of capacity is in the pipeline. This will take total production capacity to 87Mta by FY24.

Atif Kaludi, CFO of Lucky Cement Ltd, Muhammad Rehan, CFO at Attock Cement Pakistan Ltd, Shamail Javed, CFO at Gharibwal Cement Ltd, and Inayatullah Niazi, CFO at DG Khan Cement Ltd verified that the next expansion phase was imminent.

In FY21 Pakistan's cement sales grew by 20 per cent YoY to 57.4Mt. For FY22 experts expect demand to grow by 10 per cent YoY. They estimated that if demand continues to increase by 10 per cent each year, the industry will reach 100 per cent capacity utilisation by FY26.

Lucky Cement

Lucky will incur capex of PKR23bn (US$136.99m) for its upcoming cement expansion, of which approximately 50 per cent is funded through Temporary Economic Relief Financing (TERF) and Long Term Financing Facility (LTFF) facilities. The development is expected to commence operations by December 2022, Atif Kaludi added.

Attock Cement

Cement expansion of 4250tpd is expected to come online by January 2024. Similarly, a solar plant of 20MW is expected to go online by October 2021, said Muhammad Rehan.

Garibwal Cement

According to Shamail Javed, GWLC's announced expansion is subject to board approval. If the board approves, it will take two years to start commercial production.

DG Khan Cement

The company is expected to start construction of a project from next year. The 10,000-14,000tpd is expected to come online by FY25. The total cost of the project is expected to be US$250m and will be financed through a combination of debt and equity, said Inayatullah Niazi.

-

Comment by Riaz Haq on November 18, 2021 at 10:31am

-

Cement sector pledges to decarbonise Pakistan

https://www.thenews.com.pk/print/906340-cement-sector-pledges-to-de...

KARACHI: Pakistan Business Council (PBC) hosted a virtual session with British High Commission and Embassy of Italy to discuss the pathways for the decarbonisation of the country's cement sector.

This webinar comes at a time when the world leaders have huddled in Glasgow to discuss sustainability and growth without compromising everyone’s collective future. Speaking at the moot, Mike Nithavrianakis, British Deputy High Commissioner and Director of Trade, said, “Next to water, concrete is the second-most consumed substance on earth; on average, each person uses nearly three tonnes a year”.

According to Nithavrianakis, the concrete industry uses about 1.6 billion tons of Portland cement to produce 12 billion tons of concrete a year and accounts for 7-8 percent of greenhouse emissions. Ehsan Malik, CEO PBC, said, “The investment in infrastructure and the construction packages of the government will entail substantial increase in the use of cement in Pakistan, so we need to think about climate-resilient ways of production”.

Muhammad Ali Tabba, CEO Lucky Cement Limited and President of All Pakistan Cement Manufacturers Association said, “In a bid to achieve green growth going forward, the industry globally will have to adapt to climate change challenges and rework business models to ensure environmental stewardship and robust growth and the cement industry in Pakistan is committed to playing its role”. Faustine Delasalle, Co-Executive Director, Mission Possible Partnership and Director, Energy Transitions Commission explained, “There are essentially three routes, which need to be taken to meet the increasing demand whilst reducing emissions in the cement sector”. “The first being a need to relook at using materials efficiently, the second being improving energy efficiency and the third being employing new technologies to cut emissions,” Delasalle added.

According to the statement, Pakistan’s leading companies are also committing to reduce carbon emissions by disclosing their pledge openly. More than 28 companies from various sectors have signed the pledge letter to the ‘Business Ambition to 1.5 Degrees’ – and are ready to embark on the journey to reduce Carbon emissions to 50 percent by 2030.

-

Comment by Riaz Haq on December 12, 2021 at 9:57am

-

Household Appliances - Pakistan | Statista Market Forecast

https://www.statista.com/outlook/dmo/ecommerce/electronics/househol...

Revenue in the Household Appliances segment is projected to reach US$1,663m in 2021.

Revenue is expected to show an annual growth rate (CAGR 2021-2025) of 9.08%, resulting in a projected market volume of US$2,354m by 2025.

With a projected market volume of US$97,974m in 2021, most revenue is generated in China.

In the Household Appliances segment, the number of users is expected to amount to 20.8m users by 2025.

User penetration will be 5.6% in 2021 and is expected to hit 8.6% by 2025.

The average revenue per user (ARPU) is expected to amount to US$132.78.

----------------

Household Appliances - Bangladesh | Statista Market Forecast

https://www.statista.com/outlook/dmo/ecommerce/electronics/househol...

Revenue in the Household Appliances segment is projected to reach US$988m in 2021.

Revenue is expected to show an annual growth rate (CAGR 2021-2025) of 27.87%, resulting in a projected market volume of US$2,642m by 2025.

With a projected market volume of US$97,974m in 2021, most revenue is generated in China.

In the Household Appliances segment, the number of users is expected to amount to 56.4m users by 2025.

User penetration will be 16.2% in 2021 and is expected to hit 32.7% by 2025.

The average revenue per user (ARPU) is expected to amount to US$36.69.

-

Comment by Riaz Haq on December 12, 2021 at 9:57am

-

Pakistani Motorcycles Market burnt out. In the third quarter sales have been flat from the previous year. Consequently, Year to Date September sales were 1.4 million, up 37.5% vs the 2020 and 13.0% vs the 2019, running towards the second all-time level, just below the 2018 record.

https://www.motorcyclesdata.com/2021/10/25/pakistan-motorcycles/

Motorcycles Market 2021 Trend

Pakistani two wheeler market is accelerating and recovering fast, following the lost reported in the 2020, when prolonged shutdown and lockdowns blocked the production and the commercial activities for a while.

This year the demand is back very fast and we can expect the market to be back on the pre covid track, when it was one of the fastest growing worldwide.

Sales speed up in the first half of this calendar year, when two and three wheeler sales have been 951.093, up a huge 66.8% vs the 2020 and +9.0% vs the 2019, hitting the new record as highest semester ever.

In the third quarter sales have been flat from the previous year. Consequently, Year to Date September sales were 1.4 million, up 37.5% vs the 2020 and 13.0% vs the 2019, running towards the second all-time level, just below the 2018 record.

The competitive arena is dominated by Honda with sales up 52.2%. It is followed by United Auto (+10.7%) and Road Prince (+6.0%), the best local brands.

----------

A decade ago, Bangladesh two-wheeler sales were below 10.000 units per year. Then the industry evolved rapidly, thanks to the investments of new local brands – like Runner and Walton, Indians companies – Bajaj Auto, Hero Motor and TVS -, and Japanese – Suzuki, Yamaha and Honda.

https://www.motorcyclesdata.com/2021/03/12/bangladesh-motorcycles/

In the 2012 the market was already up 10 times compared with 5 years before, while kept steady growing until the 2016, when sales were not far from the quarter of a million.

However, the new policy established by the government in the 2017 changed the industry perspective immediately booming the demand, thanks to the cut of motorcycles price in a range of 20% (both for imported and local made models) and a new life started.

In the following years the market boomed up doubling volume to hit the 487,000 units in the 2018 and finally at over 549,000 units in the 2019.

While Japanese brands are growing, the market is literally dominated by Indian brands, with Baja Auto leader with near 33% of share, followed by Hero Motor and TVS. Honda is fast growing and hold a market share near 11%.

-

Comment by Riaz Haq on December 12, 2021 at 9:57am

-

Cement Production in Pakistan increased to 4042 Thousands (4 million tons) of Tonnes in September from 3765 Thousands of Tonnes in August of 2021. source: State Bank of Pakistan

https://tradingeconomics.com/pakistan/cement-production

-------------------

In the last seven years, the production capacity of the local cement companies increased by 131 percent, while demand rose by 106 percent.

At the end of 2018, the production capacity stood at 5.80 crore tonnes, while the demand rose to as much as 3.10 crore tonnes.

Of the locally produced cement, the government uses 35 percent, commercial developers use 35 percent and individual-level small buyers use the rest.

From 2011 to 2018, the per capita use of cement increased by 97 percent to stand at 187kg. However, the country yet lags behind the world average of per capita use of 563kg.

Bangladesh is the 40th country in the world cement market now.

https://www.tbsnews.net/economy/bangladeshs-cement-industry-booming

-

Comment by Riaz Haq on March 16, 2022 at 12:33pm

-

#Pakistan #cement production has grown from 35 million metric tons in 2015 to 55 million metric tons in 2021. #CPEC #NayaPakistan #housing #infrastructure #construction #exports https://www.globalcement.com/news/item/13839-update-on-pakistan-mar...

https://twitter.com/haqsmusings/status/1504176499032616960?s=20&...

Update on Pakistan, March 2022 - Cement industry news from Global Cement

https://www.globalcement.com/news/item/13839-update-on-pakistan-mar...

(Graph in the article shows Pakistan cement production growth from 35 million tons in 2015 to 55 million tons in 2021)

Data from the All Pakistan Cement Manufacturers Association (APCMA) shows that cement despatches have been steadily growing since the mid-2010s with a blip in 2020 caused by the start of the Covid-19 pandemic. The upward trend has been driven by local sales. Exports have generally grown at the same time, with more variance, but they are yet to regain the high of nearly 11Mt reported in 2009. On a rolling annual basis, local sales have remained steady since mid-2021 but exports have been slowly falling. In April 2021 they were 9.17Mt but by February 2022 they were 7.33Mt. For the February 2022 figures APCMA blamed this on the growing cost of production, rising international freight rates, mounting coal prices and a trade ban with India. On that last point for example, Pakistan-based producers exported 1.21Mt of cement to India in the 2017 – 2018 financial year before exports stopped after February 2019. Despite a brief respite in the spring of 2021 talks are still ongoing to resume trade with India.

On the corporate side the country’s largest cement producer by capacity, Lucky Cement, drew the same conclusion as the APCMA with its half-year results to 31 December 2021. Its local sales volumes were down a little but its exports were down a lot. It noted that the reason its local sales were falling but national industry local sales were up slightly was due to some competitor plants being non-operational in the previous year. However, the company managed to keep sales revenue and earnings increasing year-on-year by successfully combating growing input costs with price rises. Bestway Cement, the country’s other large producer, reported a tougher situation in the second half of 2021, with both local sales and export volumes down. This was attributed to a boom in construction activity in the second half of 2020 as Covid-19 lockdowns were eased. Demand for cement since then was said to be ‘sluggish’ due to inflation and high commodity prices. It also pinned its marked fall in exports on political and economic instability in Afghanistan. However, turnover and operating profit were both up due to higher selling prices.

Elsewhere in the sector news since the start of 2021, Pakistan’s exports to South Africa remained stymied in early 2020 due to a review of ongoing tariffs and the government decision to restrict infrastructure projects to only using locally produced cement. On the sustainability front the APCMA started to set out its decarbonisation strategy in November 2021. It may have a long way to go given that a think tank reported earlier in the year that the cement sector was the largest emitter of coal-related CO2 emissions in the country, even more than power generation. Alongside this plenty of capacity additions have been announced. Lucky Cement started commercial cement production at its 1.2Mt/yr integrated Samawah cement plant in March 2021. Various new cement plants and upgrades to existing plants have been proposed by Bestway Cement, Cherat Cement, Fauji Cement, Kohat Cement Company, Lucky Cement and Maple Leaf Cement. Finally of note to a sector troubled by energy prices, in September 2021 the Pakistan International Bulk Terminal said it was going to upgrade its coal handling capacity to around 17Mt/yr by 2024.

-

Comment by Riaz Haq on March 27, 2022 at 7:39pm

-

Since the 1990s, the federal and provincial governments in Pakistan have sought to encourage private sector participation in development projects and in the provision of public infrastructure and related services in Pakistan. Beginning in the 2000s, several legal and regulatory changes have been made to expand the use of public–private partnerships.

https://www.lexology.com/library/detail.aspx?g=3df8a24e-6658-405c-a...

As of 2020, the federal government and all four provincial governments have passed PPP-specific legislation, formalising and enabling the regime, including by creating independent statutory bodies to facilitate, support and promote PPPs. At the federal level, the Public Private Partnership Authority (the PPP Authority) was set up in 2017 under the Public Private Partnership Authority Act, No. VIII of 2017 (the 2017 PPP Act). The PPP Authority replaced the Infrastructure Project Development Facility (IPDF), formed by the federal government in 2006 to facilitate PPPs. The 2017 PPP Act was subsequently amended through the Public Private Partnership Authority (Amendment) Act, 2021 (the 2021 Amendment Act), to create a more facilitative PPP regulatory framework and make it more amenable to private investment in development projects.

Traditionally, PPPs in Pakistan have been particularly common in the energy, power generation and transportation sectors. In fiscal year 2019–2020, 17 infrastructure projects involving private investment reached financial closure.2 The power sector made up the largest investment share with a total investment amount of US$5 billion.3 In recent years, though, the government has expressed a commitment to using PPPs in many more sectors including aviation, technology, healthcare, tourism and others. In late 2019, the Prime Minister approved a development plan, expected to run from fiscal years 2020 to 2023, termed the Public Sector Development Programme Plus (PSDP+) initiative, firmly orienting the government towards PPPs across sectors.4

In addition to the federal initiative, each of the four provinces – Sindh, Punjab, Balochistan and Khyber Pakhtunkhwa – has its own specific roster of projects and policies to promote PPPs. In accordance with the Constitution, PPPs in the areas enumerated in the Federal Legislative List fall within the domain of the federal government, while other areas generally fall under the domain of the provinces. This chapter focuses on the federal regime as exemplary of other models, but where relevant, also references the provincial regimes.

The year in review

According to information available on the PPP Authority's official website, at the federal level, 47 PPP projects are in the pipeline across sectors out of the 105 PSDP+ portfolio federal projects.5 Additionally, the PPP Authority lists a number of 'early harvest' projects that it is assisting with, including:

the construction of the Sukkur Hyderabad Motorway (expected cost around US$1.2 billion);

the construction of the Sialkot Kharian Motorway (expected cost around US$225 million);

the construction of a teaching and research hospital;

the construction of an innovations ecosystem (science and technology park);

the conversion of a guesthouse located in Lahore (the provincial capital of Punjab province) into a hotel;

the creation of a mass transit facility in a major city, the Karachi Circular Railway; and

the modernisation of the current Karachi–Pipri Rail Track.6

Previous projects finalised by the IPDF include:

the overlay and modernisation of the Lahore Islamabad Motorway (investment of US$460 million), which has been in operation since 2016;

the construction of the Lahore Sialkot Motorway (investment of US$438 million), which is in operation now;

the conversion of an existing four-lane super highway into a six-lane Karachi Hyderabad highway (investment of US$430 million), which has been in operation since 2017; and

the construction of the Habibabad Flyover (investment of US$8 million), which has been in operation since 2014.7

-

Comment by Riaz Haq on March 27, 2022 at 7:40pm

-

Pakistan - Operational Design for the Project Development Fund and for the Viability Gap Fund

https://openknowledge.worldbank.org/handle/10986/12391

This final report is the fifth deliverable for the World Bank funded project 'operational design for the project development fund and for the viability gap fund'. Taking into account feedback and further consideration of issues rose in the previous Reports, it aims to: provide high level recommendations on the overall Public Private Partnership (PPP) framework in Pakistan, recognizing international best practice but also taking into account the specific Pakistan context and the challenges faced their-in; provide the analysis of the project pipeline for PPP projects in Pakistan, on the basis of consultations undertaken in Islamabad in May 2009; and design possible structures for the Project Development Fund (PDF) and for the Viability Gap Fund (VGF), that is informed by the current local enabling environment for PPPs, including the institutional capabilities and the existing pipeline of PPP projects. This final report incorporates feedback from the World Bank and the Government of Pakistan on each of the above-listed issues, which were set out and discussed in details in previous reports.

-

Comment by Riaz Haq on June 13, 2022 at 7:42am

-

Pakistan allocates Rs800 billion for FY23 PSDP

June 11, 2022

https://pkrevenue.com/pakistan-allocates-rs800-billion-for-fy23-psdp/

The country presented the federal budget 2022/2023, which envisages PSDP worth 800 billion rupees for the next fiscal year.

It has been centered on improvement in sectors such as water resources, transport and communication, energy, higher education, health, science and technology, and balanced regional development.

The emphasis of PSDP is also on revival of CPEC and related projects for inter-provincial and regional connectivity with equal importance to Special Economic Zones to promote trade, industrialization and create job opportunities.

The major thrust in the Information and Communication Technology sector including establishment and operations of Special Technology Zones.

Under the PSDP, the government has allocated 44.179 billion rupees including foreign aid of 1.3 billion rupees to the Higher Education Commission for implementation of 151 development projects.

The allocation indicates an increase of one hundred percent over the last year.

An allocation of over 197 billion rupees has been made for 117 power related projects.

These include hydro power generation projects such as Diamer-Bhasha, Mohmand, Nai Gaj and the fifth extension of Tarbela. Initiatives like developing water storages, automatic telemetry system, rainwater harvesting, decreasing water losses, ground water regulation and management would be undertaken in consultation with the stakeholders.

Over nine billion rupees have been earmarked for Ten Billion Trees Tsunami Programme Phase-I to achieve the target of planting 500 million trees.

Similarly, over 563 million rupees and over 1.2 billion rupees have been allocated for installation of weather surveillance radars at Multan and Sukkur respectively.

The Federal PSDP has also proposed an amount of 1.5 billion rupees to complete the emergent nature of small flood schemes all over Pakistan.

An allocation of 227 billion rupees has been made for strengthening efficiency of transport and logistics for domestic commerce and regional connectivity.

The high impact infrastructure projects to be completed under Public Private Partnership mode include Sukkur-Hyderabad Motorway, Sialkot-Kharian Motorway, Kharian-Rawalpindi Motorway, and Karachi Circular Railway. Under the CPEC, D I Khan-Zhob section is under discussion with the Chinese side for financing and it is expected to be launched in the next financial year.

The concessional financing agreement for landmark ML-1 project is to be finalized in the second quarter of the next fiscal year and subsequently arrangements will be made for groundbreaking of the project.

A comprehensive National Action Plan for agriculture modernization has been prepared in terms of capacity building, agricultural product processing technology extension, fishery science and technology, aquaculture and aquatic products processing.

-

Comment by Riaz Haq on June 13, 2022 at 1:52pm

-

Cement production & sales in FY 2021-22

https://www.finance.gov.pk/survey/chapter_22/PES03-MANUFACTURING.pdf

Total local dispatches during July-March FY2022 slightly decreased by 0.03 percent to

36.17 mt from 36.18 mt last year. While, total exports clocked in at 4.64 mt (-35.04

percent) against 7.15 mt during the same period last year. Local dispatches from the

northern region decreased by 2.27 percent, while southern region dispatches surged by

12.3 percent. Exports from the north nosedived by 64.5 percent, while south witnessed

fall of 24.3 percent growth during the period.

Cumulative dispatches (local & exports) posted a decline of 5.8 percent and reached

40.82 mt during July-March FY2022 against 43.32 mt in the corresponding period.

---------------------

Table 3.9: Cement Production Capacity & Dispatches (Million Tonnes)

Years Production

Capacity

Capacity

Utilization (%)

Local

Dispatches

Exports Total

Dispatches

2006-07 30.50 79.23 21.03 3.23 24.26

2007-08 37.68 80.14 22.58 7.72 30.30

2008-09 42.28 74.05 20.33 10.98 31.31

2009-10 45.34 75.46 23.57 10.65 34.22

2010-11 42.37 74.17 22.00 9.43 31.43

2011-12 44.64 72.83 23.95 8.57 32.52

2012-13 44.64 74.89 25.06 8.37 33.43

2013-14 44.64 76.79 26.15 8.14 34.28

2014-15 45.62 77.60 28.20 7.20 35.40

2015-16 45.62 85.21 33.00 5.87 38.87

2016-17 46.39 86.90 35.65 4.66 40.32

2017-18 48.66 94.31 41.15 4.75 45.89

2018-19 59.74 78.48 40.34 6.54 46.88

2019-20 63.63 75.14 39.97 7.85 47.81

2020-21 69.26 82.93 48.12 9.31 57.43

July-March

2020-21 69.26 83.41 36.18 7.15 43.32

2021-22 51.94 78.58 36.17 4.64 40.82

Source: All Pakistan Cement Manufacturers Association (APCMA)

3.5 Small and Medium Enterprises

Small and Medium Enterprises (SMEs) are indispensable to the progress of the nation as

it contributes significantly to the economic and social development of the country in a

myriad way: create employment opportunities, foster human resource development and

stimulate value addition to the economy.

To support SMEs to play their due role in economic development, Small and Medium

Enterprises Development Authority (SMEDA) has taken various initiatives.

Comment

- ‹ Previous

- 1

- 2

- 3

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

Agriculture, Caste, Religion and Happiness in South Asia

Pakistan's agriculture sector GDP grew at a rate of 5.2% in the October-December 2023 quarter, according to the government figures. This is a rare bright spot in the overall national economy that showed just 1% growth during the quarter. Strong performance of the farm sector gives the much needed boost for about …

ContinuePosted by Riaz Haq on March 29, 2024 at 8:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network