PakAlumni Worldwide: The Global Social Network

The Global Social Network

Thirlwall Law: Why Hasn't Pakistan's GDP Grown Faster Than 5% Average Since 1960s?

Pakistan's economy has grown at a compounded annual growth rate (CAGR) of about 5% since the 1960s. While Pakistan's average 5% annual economic growth rate is faster than the global average, it falls significantly short of its peer group in Asia. The key reason is that, unlike Pakistan's, the East Asian nation's growth has been fueled by rapid rise in exports. History shows that Pakistan has run into balance of payments (BOP) crises whenever its growth has accelerated above 5%. These crises have forced Pakistan to seek IMF bailouts 13 times in its 73 year history. Pakistan's current account deficits would be a lot worse without 23X growth in remittances from overseas Pakistanis since year 2000. What Pakistan has experienced is BOP-constrained growth as explained in 1979 by Thirlwall Law, a law of economics named after British economist Anthony Philip Thirlwall. Another reason why Pakistan has lagged its Asian peers in terms of economic growth is its lower savings and investment rates. Every time Pakistan has faced a balance of payments crisis, the result has been massive currency devaluation, high inflation and slower growth for a period pf multiple years. This is is exactly what Pakistan's current government led by Prime Minister Imran Khan is dealing with right now. This pain is the result of years of flat exports, soaring imports and excessive debt taken on during former Prime Minister Nawaz Sharif's PMLN government from 2013 to 2018. The best way for Pakistan to accelerate its growth beyond 5% in a sustainable manner is to boost its exports by investing in export-oriented industries, and by incentivizing higher savings and investments.

History of Pakistan's IMF Bailouts

Economic Growth Since 1960:

The World Bank report released in June, 2018 shows that Pakistan's GDP has grown from $3.7 billion in 1960 to $305 billion in 2017, or 82.4 times. In the same period, India's GDP grew from $37 billion in 1960 to $2,597 billion in 2017 or 71.15 times. Both South Asian nations have outpaced the world GDP growth of 60 times from 1960 to 2017.

While Pakistan's GDP growth of 82X from 1960 to 2017 is faster than India's 71X and it appears impressive, it pales in comparison to Malaysia's 157X, China's 205X and South Korea's 382X during the same period.

Thrilwall's Model:

Thrilwall's BOP-constrained growth model says that no country can sustain long-term growth rates faster than the rate consistent with its current account balance, unless it can finance its growing deficits. Indeed, if imports grow faster than exports, the current account deficit has to be financed by borrowing from abroad, i.e., by the growth of capital inflows. But this cannot continue indefinitely. Here's how Jesus Felipe, J. S. L. McCombie, and Kaukab Naqvi describe it in their May 2009 paper titled "Is Pakistan’s Growth Rate Balance-of-Payments Constrained? Policies and Implications for Development and Growth" published by Asian Development Bank:

"The reason is straightforward. If the growth of financial flows is greater than the growth of GDP, then the net overseas debt to GDP ratio will rise inextricably. There is a limit to the size of this ratio before international financial markets become distinctly nervous about the risk of private and, especially in less developed countries, public default. If much of the borrowing is short-term, then there is danger of capital flight, precipitating the collapse of the exchange rate. Not only will this cause capital loses in terms of foreign currency (notably United States [US] dollars) of domestic assets owned by foreigners (the lenders), but it will also cause severe domestic liquidity problems. This is especially true of many developing countries as overseas borrowing by banks and firms is predominantly denominated in a foreign currency, normally US dollars. As the exchange rate plummets, so domestic firms have difficulty finding domestic funds to finance their debt and day-today operations, often with disastrous consequences."

Investment as Percentage of GDP Source: State Bank of Pakistan

Pakistan's Rising Current Account Deficit:

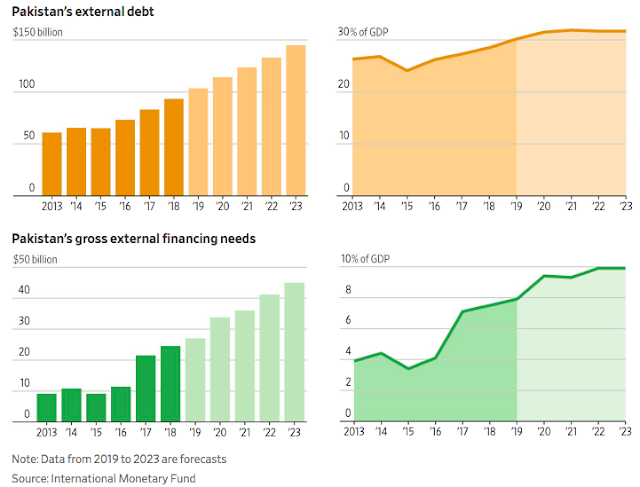

Pakistan's external debt has been rising rapidly in recent years to fund its ballooning twin deficits of domestic budget and external accounts. It pushed the external debt service cost to $12 billion in fiscal 2019-20, and added to the trade deficit of nearly $24 billion. Remittances of $21 billion from Pakistani diaspora reduced the current account deficit to $11 billion, but still forced the new PTI government to seek yet another IMF bailout with its stringent conditions to control both fiscal and current account deficits. These conditions resulted in dramatic slow-down in the country's GDP growth.

|

| Pakistan's External Debt. Source: Wall Street Journal |

Pakistan's Exports:

Pakistan’s exports have continued to lag behind that of its South Asian competitors since the early 1990s. Bangladesh’s exports have increased by 6.2 times compared to Pakistan’s, measured in terms of exports per capita, and that of India by 6.8 times, according to Princeton's Pakistani-American economist Atif Mian.

|

| Exports Per Capita in South Asia. Source: Dawn |

Balance of Payments Crises:

Every time Pakistan has faced a balance of payments crisis, the result has been massive currency devaluation, high inflation and slower growth for a period of multiple years. This is is exactly what Pakistan's current government led by Prime Minister Imran Khan is dealing with right now. This pain is the result of years of flat exports, soaring imports and excessive debt taken on during former Prime Minister Nawaz Sharif's PMLN government from 2013 to 2018.

|

| Export Growth in South Asia. Source: WSJ |

Savings and Investment:

The second reason why Pakistan lagged its Asian peers in terms of economic growth is its lower savings and investment rates. There's a strong relationship between investment levels and gross domestic product. The more a country saves and invests, the higher its economic growth. A State Bank of Pakistan report explains it as below:

"National savings (in Pakistan) as percent of GDP were around 10 percent during 1960s, which increased to above 15 percent in 2000s, but declined afterward. Pakistan’s saving rate also compares unfavorably with that in neighboring countries: last five years average saving rate in India was 31.9 percent, Bangladesh 29.7 percent, and Sri Lanka 24.5 percent..... Similarly, domestic savings (measured as national savings less net factor income from abroad) also declined from about 15 percent of GDP in 2000s, to less than 9 percent in recent years. Domestic savings are imperative for sustainable growth, because inflow of income from abroad (remittances and other factor income) is uncertain due to cyclical movements in world economies, exchange rates, and external shocks".

Net Foreign Direct Investment Source: State Bank of Pakistan

21X Remittance Growth Since Year 2000:

Remittance inflows from Pakistani diaspora have jumped 21-fold from about $1 billion in year 2000 to $24 billion in 2020, according to the World Bank. In terms of GDP, these inflows have soared nearly 7X from about 1% in year 2000 to 6.9% of GDP in 2018.

Meanwhile, Pakistan's exports have declined from 13.5% of GDP in year 2000 to 8.24% of GDP in 2017. At the same time, the country's import bill has increased from 14.69% in year 2000 to 17.55% of GDP in 2017. This growing trade imbalance has forced Pakistan to seek IMF bailouts four times since the year 2000. It is further complicated by external debt service cost of over $6 billion (about 2% of GDP) in 2017. Foreign investment in the country has declined from a peak of $5.59 billion (about 4% of GDP) in 2007 to a mere $2.82 billion (less than 1% of GDP) in 2017. While the current account imbalance situation is bad, it would be far worse if Pakistani diaspora did not come to the rescue.

Summary:

Pakistan's average economic growth of 5% a year has been faster than the global average since the 1960s, it has been slower than that that of its peers in East Asia. It has essentially been constrained by Pakistan recurring balance of payment (BOP) crises as explained by Thirlwall's Law. Pakistan has been forced to seek IMF bailouts 13 times in the last 70 years to deal with its BOP crises. This has happened in spite of the fact that remittances from overseas Pakistanis have grown 24X since year 2000. Every time Pakistan has faced a balance of payments crisis, the result has been massive currency devaluation, high inflation and slower growth for a period pf multiple years. This is is exactly what Pakistan's current government led by Prime Minister Imran Khan is dealing with right now. This pain is the result of years of flat exports, soaring imports and excessive debt taken on during former Prime Minister Nawaz Sharif's PMLN government from 2013 to 2018. The best way for Pakistan to accelerate its growth beyond 5% is to boost its exports by investing in export-oriented industries, and by incentivizing higher savings and investments.

Haq's Musings

South Asia Investor Review

Pakistan's Debt Crisis

Declining Investment Hurting Pakistan's Economic Growth

Brief History of Pakistan Economy

Can Pakistan Avoid Recurring IMF Bailouts?

Pakistan is the 3rd Fastest Growing Trillion Dollar Economy

CPEC Financing: Is China Ripping Off Pakistan?

Information Tech Jobs Moving From India to Pakistan

Pakistan is 5th Largest Motorcycle Market

"Failed State" Pakistan Saw 22% Growth in Per Capita Income in Last...

CPEC Transforming Pakistan

Pakistan's $20 Billion Tourism Industry Boom

Home Appliance Ownership in Pakistani Households

Riaz Haq's YouTube Channel

PakAlumni Social Network

-

Comment by Riaz Haq on March 3, 2021 at 11:48am

-

Bangladesh achieved an economic landmark last week, when the United Nations’ Committee for Development Policy recommended that the country graduate from the least-developed-country categorization that it has held for most of the 50 years since it became independent.

https://www.wsj.com/articles/bangladesh-is-becoming-south-asias-eco...

Bangladesh is notable in South Asia for being the closest proxy for the successful development models seen at various stages in South Korea, China and Vietnam. Export-led development has the best modern track record of moving countries from very low income levels into middle-income status.

Bangladesh’s exports have risen by around 80% in dollar terms in the past decade, driven by the booming garment industry, while India and Pakistan’s exports have actually declined marginally.

There are other factors in the country’s favor as far as its development model goes: a very young demographic structure, a continued competitive edge in terms of wage levels, strong and rising female labor-force participation especially relative to the rest of South Asia.

There are some meaningful potential hindrances, however. For one, Bangladeshi export growth is well below that of Vietnamor Cambodia, where exports have more than tripled and more than doubled respectively over the past 10 years. India’s exports boomed in the early 2000s and then stagnated, so a continued upward trend isn’t guaranteed.

The next step for Bangladesh would be to transition toward higher-value forms of manufacturing and exporting, as Vietnam has done. Its export industry is still overwhelmingly focused on garment manufacturing. The country’s economic complexity, ranked by Harvard University’s Growth Lab, is 108 out of the 133 countries measured. That is actually lower than it was in 1995.

Bangladesh also finds itself, like India, outside of major Asian trade blocs. It isn’t a member of the Association of Southeast Asian Nations, or the Regional Comprehensive Economic Partnership or the Comprehensive and Progressive Trans-Pacific Partnership. Diversifying its manufacturing exports would require greater participation in intra-Asian supply chains—and probably a closer economic relationship with its neighbors to the east.

Caveats aside, Bangladesh’s exit from LDC status is probably a sign of further progress ahead—and a shot across the bow of other South Asian neighbors taking a very different approach to development.

-

Comment by Riaz Haq on June 11, 2021 at 8:22pm

-

#Pakistan earmarks PKR 3.06 tr ($20 billion) for #debt servicing (including interest payments) in the next fiscal year 2021-22, up from Rs 2.94 tr ($18.9 billion) this year. Fed govt allocated Rs 1.6 tr ($10.26 billion) for #foreign debt payments in FY22. https://www.dawn.com/news/1628877

The government has allocated Rs3.060 trillion for debt servicing (including interest payments) in the next fiscal year 2021-22.

During the current fiscal year, Rs2.94tr had been earmarked for the same.

The federal government allocated a sum of Rs1.6tr for foreign loans repayment, short-term loans and other advances in FY22. Rs1.49tr has been allocated for debt servicing in the current fiscal year, however, revised estimates placed it at Rs1.06tr.

Foreign Loans repayment for FY22 will be Rs1.42tr against Rs841 million for the current fiscal year. For short-term foreign credits, Rs74.4bn has been allocated for the next fiscal year. This year, revised estimates for short-term foreign credits are at Rs121.9bn.

According to the Pakistan Economic Survey of 2020-21, total public debt was recorded at Rs38,006bn at end March 2021, registering an increase of Rs1,607bn during first nine months of current fiscal year (9MFY21) which was much less when compared with the increase of Rs2,499bn witnessed during the same period last year.

The increase in total public debt during 9MFY21 was even lower than the federal government borrowing of Rs2,065bn for financing the fiscal deficit. The differential is primarily attributable to appreciation of the Pak rupee against the US dollar by around nine per cent which led to a decrease in the value of external public debt when converted into the local currency.

Debt from multilateral and bilateral sources cumulatively constituted over 80pc of external public debt portfolio at end March 2021. A set of reforms initiated by the government to improve the economy has brought strong support from multilateral development partners during the last two years. This is expected to strengthen confidence and catalyse additional support from development partners’ public debt in the coming years which will also help in reducing the pressure on domestic sources.

Pakistan is availing the G-20 Debt Service Suspension Initiative (DSSI) for a period of 20-months (May 2020-December 2021) which will help defer the debt servicing impact to the tune of around US$3.7bn during this period.

The government remained within the benchmarks and thresholds defined in the Medium-Term Debt Management Strategy (MTDS) at the end of December 2020.

The Economic Survey claims that Pakistan has witnessed one of the smallest increases in its public debt during the Covid-19 pandemic. Global public debt to GDP ratio increased by 13 percentage points – from 84pc in 2019 to 97pc in 2020 – whereas Pakistan’s Debt-to-GDP ratio witnessed a minimal increase of 1.7 percentage points and stood at 87.6pc at end June 2020 compared with 85.9pc at end June 2019.

Interest servicing was recorded at Rs2,104bn during 9MFY21 against the annual budgeted estimate of Rs2,946bn. Domestic interest payments were recorded at Rs1,934bn and constituted around 92pc of total interest servicing during 9MFY21 which is mainly attributable to higher volume of domestic debt in total public debt portfolio.

On a full year basis (2020-21), interest servicing is expected to remain below the budgeted estimates primarily due to extension of DSSI from January to June 2021, appreciation of Pak rupee against the US dollar and lower interest servicing on account of National Savings Schemes due to withdrawals against discontinued prize bonds.

-

Comment by Riaz Haq on June 12, 2021 at 6:08pm

-

#Pakistan pins hopes on #export-oriented industries, #agriculture and #housing sector for sustainable growth. Keen to promote exports and take their volume from 8% at present to 20% of Gross Domestic Product (#GDP) in coming years. #economy #Budget2021 https://www.khaleejtimes.com/business/pakistan-pins-hopes-on-agricu...

Addressing a joint post-budget press conference in Islamabad on Saturday, federal minister for finance Shaukat Tarin said the government has presented a growth-oriented budget that also includes relief measures to businessmen, investors, exporters, farmers and common man.

Federal Minister for Industries Khusro Bukhtiar, advisor to the Prime Minister on commerce Razak Dawood, special assistant to the Prime Minister on poverty alleviation and social protection Dr Sania and Federal Board of Revenue chairman Asim Ahmed were also present at the press conference and clarified various aspects of the budget.

Exports share in GDP

Tarin said the government is keen to promote exports and take their volume from eight per cent at present to 20 per cent of the Gross Domestic Product (GDP) in coming years. ”We have suggested various steps to promote exports that would help reduce pressure on the foreign exchange reserves, besides developing the local industrial sector,” he said.

The minister said the special economic zones being set up under the China-Pakistan Economic Corridor would also help in local industrial development and create job opportunities for the skilled and semi-skilled work force.

Agri sector development

Tarin said the government has proposed special initiatives for the development of agriculture sector and prosperity of farming community in the country.

“We accords special attention to small land holders up to 12.5 acres and will extend up to Rs450,000 interest-free loans to enhance agriculture production and alleviate poverty. We have also mobilised banking sector to extend credit facilities to growers at affordable rates,” he said.

“Every farming household would be provided Rs250,000 interest free loan for purchasing agriculture inputs. Another Rs200,000 will be provided to purchase tractor and other machinery to bring innovation and technological advancement in local agriculture sector,” he added.

The finance minister said development of marketing services, cold storage facilities and building strategic reserves of food commodities would also help curb the menace of hoardings, artificial shortage of food commodities and practice of extra profiteering.

Growth-oriented budget

Tarin, who presented PTI’s fourth budget on Friday, said the main focus of the growth-oriented budget is to empower the country’s poor segment so that they would not have to wait for trickle-down effect of economic progress.

“The government is directly targeting the poorest of the poor and facilitating them with different initiatives to upgrade their living standards. It would utilise the ‘bottom-up-approach’ for improving the living conditions of around six million low-income households,” the minister said.

Under the initiative, Tarin said every urban household would be provided Rs500,000 interest-free business loan. Likewise, every farming household would be given interest free loan of Rs150,000 for every crop, interest fee farming loan of Rs250,000 and interest free loan of Rs200,000 for buying tractor and agricultural implements.

“Low-interest loans of up to Rs2 million would be provided to help the people buy houses, besides Sehat Card to every household to facilitate them in time of need,” Tarin said.

-

Comment by Riaz Haq on June 24, 2021 at 5:02pm

-

#Pakistan's public #debt stands at 78% of #GDP. Annual interest payments to use up one-third of the Rs. 8.5 trillion ($54 billion) 2021 federal budget....90% of debt payments are for domestic debt & 10% for foreign debt servicing. #economy #Budget2021 https://asia.nikkei.com/Economy/Interest-payments-consume-one-third...

https://twitter.com/haqsmusings/status/1408212855741030400?s=20

Interest payments consume one-third of Pakistan's budget

Over-reliance on loans bodes ill for fiscal sustainability and domestic needs

https://asia.nikkei.com/Economy/Interest-payments-consume-one-third...

Fiscal sustainability has become a major issue among political and economic analysts after Pakistan revealed early this month that servicing debt accounts for more than one-third of its federal budget.

Finance Minister Shaukat Tareen in the National Assembly on June 12 announced the fiscal 2021 federal budget of 8.48 trillion rupees ($54 billion). Interest payments on debt, which are expected to grow by 3.9% from the ongoing fiscal year, account for 3.06 trillion rupees, or 36% of budget expenditures. In contrast, the government is only spending 600 billion rupees on subsidies and 100 billion rupees for COVID-19 vaccinations and emergencies.

The budget also reveals a deficit of 3.99 trillion rupees. The federal government plans to borrow 3.74 trillion rupees to finance this deficit, which makes up 94% of the deficit.

Pakistan's reliance on debt is a violation of the country's Fiscal Responsibility and Debt Limitation Act 2005, which states that the government must limit debt to 60% of gross domestic product. Currently, the ratio stands at 78% of Pakistan's $303 billion GDP.

Hasaan Khawar, a public policy analyst based in Islamabad, says Pakistan borrows heavily not only to finance current expenditures but also to service existing debt. "Pakistan is a having a primary fiscal deficit. That's why the [International Monetary Fund] has been demanding a primary budget surplus so that it starts reducing debt."

"Resources that could have been spent on essential sectors like health, education or public investment are now being dedicated to interest payments," said Naafey Sardar, a senior research associate at Texas A&M University in the U.S., emphasizing that increased debt financing presents a trade-off for Pakistan. "Since increased public investment and expenditures on education and health are associated with improvements in economic growth, higher debt financing expenditures reflect a missed opportunity," he said.

Of the 3.06 trillion rupees earmarked for interest payments on debt, 2.76 trillion rupees, or 90%, will go toward servicing domestic debt.

A senior official involved with the government's development planning told Nikkei on condition of anonymity that domestic borrowing is unsustainable. "Domestic borrowing is always at high commercial rates and external borrowing is mostly at concessional rates. That's why domestic borrowing costs the economy more," the official said.

---

Experts believe that a combination of reduced government spending and a tax increase is the solution.

Sardar believes that the way out is to increase tax revenue. "Higher tax receipts can be earned by increasing the corporate tax rate from 29% to 35%," he said. Sardar added that at a time when corporate profits are surging, increasing corporate taxes could be a viable option.

Khawar believes that Pakistan can accrue surpluses by controlling fiscal waste. He says there is a multipronged strategy to deal with the problem. "Government needs to widen the tax base using technology for tax enforcement while reducing expenditures in loss-making state-owned enterprises," he said. "There is no quick fix to this. That's the bottom line."

-

Comment by Riaz Haq on June 25, 2021 at 5:29pm

-

Speaking at a Karachi Chamber of Commerce and Industry webinar in December, Adviser to the Prime Minister on Institutional Reforms Dr Ishrat Husain stressed the importance of looking beyond the textile sector and diversifying Pakistan’s exports. Otherwise, he warned, we will remain “stuck” at 25 to 30 billion dollars in exports per year.

https://www.dawn.com/news/1611075

“If we can capture just one percent of the Chinese market by providing components, raw materials [and] intermediate goods to the Chinese supply chain,” he had said, “we can get 23 billion dollars in exports to China, which is very favourably inclined towards Pakistan...”

From the looks of it, others were on the same page as Husain. Last month, it was reported by China Economic Net (CEN) that China will import dairy products from Pakistan. The Commercial Counsellor at the Pakistan Embassy in Beijing, Badar uz Zaman, told CEN that Pakistan got this opportunity due to its high quality dairy products, available at a low price.

Pakistan is the fourth largest milk producer globally, Zaman pointed out.

Indeed, the country’s dairy industry has great potential and can prove to be ‘white gold’ for Pakistan. Unfortunately, the sector is currently struggling due to various reasons but, if its export potential is realised, it can transform not only the sector itself but Pakistan’s economy as well.

According to the Food and Agriculture Organisation at the United Nations, in the last three decades, global milk production has increased by more than 59 percent, from 530 million tonnes in 1998 to 843 million tonnes in 2018.

This rise in global milk consumption is an opportunity for countries such as Pakistan to earn foreign exchange by exporting milk and dairy products to countries which have insufficient milk production. According to a Pakistan Dairy Association estimate, with support from the government, Pakistan can earn up to 30 billion dollars from exports of only dairy products and milk.

Unfortunately, this potential is being wasted. As per statistics provided by the Pakistan Dairy Association, livestock and dairy currently make up approximately only 3.1 percent of Pakistan’s total exports; which would mean about a mere 0.68 billion dollars in FY2020.

-

Comment by Riaz Haq on October 6, 2021 at 1:12pm

-

Atif Mian

@AtifRMian

I tried. My take on what it would take to change Pakistan's economic trajectory - which hasn't been good for a while now. https://youtu.be/9SYPP3UhD20

https://twitter.com/AtifRMian/status/1445772210078031884?s=20

-------------

Riaz Haq

@haqsmusings

Replying to

@AtifRMian

and

@ajlongshanks

I agree with you. #Pakistan needs to dramatically boost #exports to get out of the #IMF trap and achieve sustainable #gdp growth

http://www.riazhaq.com/2020/09/thirlwall-law-why-hasnt-pakistans-gd...

https://twitter.com/haqsmusings/status/1445831151008976901?s=20

-

Comment by Riaz Haq on November 11, 2021 at 12:41pm

-

#Pakistan #GDP growth rate of over 5.5% to hurt economy: Finance Minister Shaukat Tarin. "I’d not like to see 6% (growth) this year. That’s going to be damaging for our economy". High #economic growth makes twin (fiscal & current account) deficits grow. https://www.dawn.com/news/1656236

Folks may not realise it, but the economy is growing fast. It’s growing so fast that the country’s finance tsar is afraid he may have to cap it at 5.5 per cent this year. A higher economic growth rate will hurt the country, according to Shaukat Tarin, adviser to the prime minister on finance and revenue.

Speaking at the annual dinner of CFA Society Pakistan on Friday, Mr Tarin said he and the International Monetary Fund (IMF) want the GDP growth rate to stay in the range of 5pc and 5.5pc for 2021-22. “But I’d not like to see 6pc (growth) this year. That’s going to be damaging for our economy,” he told the annual meeting of finance professionals.

In response to a question, Mr Tarin said the IMF programme is not going to impede the targeted 5pc growth rate. “Our growth is not slowing down,” he said, adding that he’s held a “very healthy kind of discussion” with the Fund about which people will “find out pretty soon”.

He took pains to emphasise that the IMF programme won’t kill growth — a claim that’s in contrast to the typical IMF prescription involving reduced government spending and higher interest rates that slow down GDP growth.

“Let me tell you that we’re not very far away from what the IMF wants us to do,” he said while noting that IMF-prescribed policy actions include ending tax exemptions, higher revenue generation and reforming income and other taxes. “We told them we don’t believe in pyramiding. We believe in broadening... They also want us to grow but they don’t want us to grow in an unsustainable manner,” he said.

As evidence of the higher-than-targeted growth rate of 5pc for 2021-22, the finance adviser said motorbike sales are at a record-high level, large-scale manufacturing growth is in double digits and tax collection is Rs230 billion above its target. “At this speed, we’ll cross Rs6 trillion. It’s not because of imports. Income tax is also up 32pc. It’s all-around growth. The use of electricity is up 13pc.”

As for the rising current account deficit, Mr Tarin said its numbers are “balanced as of now”. He said the government will clamp down on imports if the current account deficit keeps growing because it doesn’t want unsustainable growth.

“The export coverage of imports has to go up. In three to four years, the export cover must go up to 70-80pc. We’re giving incentives to IT sector so that it can grow 100pc.”

He criticised the financial sector for not being responsive to the needs of the economy. About 85pc credit is disbursed in nine cities while three-quarters of it goes to the corporate sector, he said. “It’s dysfunctional. We’ve got to fix it.”

He said it takes 10 to 20 years of consistent growth for trickle-down economics to work. “Trickle-down doesn’t follow four-year growth (spurts). That’s why we’re adopting a bottom-up approach,” he said, adding that the government will provide poor 4m households with interest-free loans for agriculture, business and housing purposes, besides ensuring healthcare and technical education for them at a cost of Rs1.4tr.

“We’ll have large banks wholesale finance to NBFIs (non-bank financial institutions) and microfinance NGOs... Now is the time to roll out loans,” he said.

-

Comment by Riaz Haq on November 14, 2021 at 5:20pm

-

Opinion by Khurram Husain:

The (Pakistan) government expects the GDP growth rate to rise to 6pc by the end of the fiscal year, while the Fund projects the same figure at 5.6pc. The difference is appreciable, but in both cases the trend is still upward, showing that the pace of activity in the economy is rising.

https://www.dawn.com/news/1395791

But the external sector, the traditional Achilles heel of Pakistan’s economy, is rapidly deteriorating. Foreign exchange reserves are falling fast, mainly on account of a growing trade deficit that the government is struggling to contain through ad hoc measures like regulatory duties and a slight depreciation in the exchange rate.

The Fund report estimates that net international reserves, the figure we get after deducting key short-term liabilities as well as money owed to the IMF from the gross foreign exchange reserves, is now negative $0.7bn. Back in 2016, when the last Fund programme ended, the same figure stood at $7.5bn.

This is a very large decline, even though the gross reserves are still sufficient to cover just over two months of imports, above critical levels but below the benchmark for sustainability, which is four months. The decline appears to be driven by a fall in the gross foreign exchange reserves since September 2016 as well as a doubling of the State Bank’s own short-term liabilities in the form of forwards and swaps.

An obvious question asserts itself regarding these two developments: rising GDP growth rate and falling foreign exchange reserves. The question is, which of these trumps the other? Will the GDP growth and the attendant investments that lie behind it become some sort of auto-correcting mechanism, in due course driving up exports, boosting competitiveness and thereby arresting and reversing the growing current account deficit?

Or will the continuously declining foreign exchange reserves eventually force an abrupt correction in the form of a large devaluation, hike in interest rates and collapse of domestic demand, as happened in 2008? Projected out into medium-term future, common sense says that eventually economic growth bows to economic fundamentals, and not the other way round.

The report shows that the Fund staff and the government did not see eye to eye when looking into the future in the medium term. The government’s projections of the state of inflows and outflows of foreign exchange were clearly more bullish that that of the Fund. According to the Fund’s projections, gross foreign exchange reserves will not hit the critical level of one month’s import cover for another three years.

There is still time for corrective action, but ad hoc measures, which include short-term borrowing and regulatory duties, do not seem to be doing the trick.

-

Comment by Riaz Haq on November 19, 2021 at 6:55pm

-

Pakistan needs to create export culture: Dawood

Emphasises all departments should facilitate exporters to boost exports

https://tribune.com.pk/story/2329944/pakistan-needs-to-create-expor...

KARACHI:

Although Pakistan’s exports are rising due to favourable government policies, the country needs to create an export culture to give it a further boost, said Adviser to Prime Minister on Commerce and Investment Abdul Razaq Dawood.

Speaking at a press conference on Wednesday, Dawood said that the creation of export culture was a major task for the Ministry of Commerce.

To achieve the desired objective, all departments like the Federal Board of Revenue (FBR), ports as well as the government should facilitate the exporters, he said.

“Again and again, we go to the IMF to get dollars as we are short of foreign exchange,” he lamented.

Last year, Pakistan’s exports increased 30% year-on-year while information technology exports registered a rise of 47%, Dawood said. This year, IT exports have surged 45% year-on-year so far.

Pakistan’s overall export target for FY22 is $38.7 billion including $20 billion in textile exports.

He voiced hope that the country would make $38 billion worth of exports, with $31 billion in goods shipments and $7 billion in services exports.

He underlined that under the diversification policy, Pakistan witnessed a 77% surge in exports of non-traditional products to the unconventional markets.

However, the increase was not phenomenal in the traditional markets, he said, adding that it would take up to five years to reap full benefits of the policy.

“We are exactly on target,” Dawood remarked and emphasised the need to instill export culture in every sector so “everybody should have export in their mind, right from the FBR to the people working in farms.”

Stressing the importance of export diversification, Dawood said that Pakistan was targeting new markets such as Central Asia, Kenya and Nigeria.

“We had been to Nairobi, but could not follow up due to Covid-19,” he said.

The adviser revealed that around 115 businessmen from textile, engineering, IT and other sectors would be visiting Nigeria, where a series of business-to-business meetings had been arranged along with a conference and an exhibition.

Pakistan needed regional connectivity like the European Union, where member countries had 80-90% regional trade, he said, adding that Pakistan’s regional trade stood at only 5%.

Dawood highlighted that currently cargo trucks went through numerous loading and unloading phases at the borders.

Quoting an example, he said that cargo trucks from Uzbekistan arrived in Afghanistan and from there the goods were loaded on to Pakistani trucks.

He was of the view that cargo trucks should travel directly to their destinations in order to save time and the hassle of loading/unloading.

“In the next five to six months, we will streamline this,” he remarked.

Recently, two cargo trucks travelled from Karachi to Turkey and Azerbaijan, while one truck reached Moscow directly, he revealed.

Around 40% of the raw material was being imported at zero duty “but it is less than what we need”, he said.

Dawood highlighted that Pakistan collected 47% of duties at ports, while Bangladesh and India collected 27% of duties at ports. “The more you collect duties at the import stage, the more there is a bias against export.”

Answering a question about the prevailing gas crisis, he said “no doubt gas is a big issue.”

The supply of gas to any industrial unit that had a captive power plant would not be discontinued, he said. “Those working purely on electricity may face gas load-shedding.”

-

Comment by Riaz Haq on February 2, 2022 at 4:28pm

-

#Pakistan to end reliance on #IMF by boosting #exports, cutting #deficits & tapping #capital markets. #Textile exports are poised to surge 40% to a record $21 billion this year & further to $26 billion next year. Pak also incentivizing #tech exports boom.

https://www.bloomberg.com/news/articles/2022-02-02/pakistan-seeks-t...

Pakistan, which has sought almost 20 bailouts from the International Monetary Fund over half a century, wants to end its reliance on the multilateral lender by shrinking its deficits and tapping the capital markets.

Finance Minister Shaukat Tarin, who has negotiated the last leg of a current $6 billion IMF loan, plans to raise $1 billion via an ESG-compliant Eurobond in March after issuing a similar amount of Sukuk last week. He also targets to shrink the budget shortfall to 5%-5.25% of gross domestic product in the year starting July 1 from 6.1% the previous period and spur growth to 6% from 5%.

“I think this program should be enough,” Tarin, 68, said in an interview in Islamabad. “If we start generating 5%-6% balanced growth, which means sustainable growth, then I don’t think we need another IMF program.”

Prime Minister Imran Khan has been a vocal critic of IMF bailouts, saying “the begging bowl needed to be broken” if Pakistan must command respect in the world. He joins nations, including South Asian peer Sri Lanka, that prefer to maneuver with bilateral loans or commercial borrowings rather than adopt the austerity that accompanies an IMF agreement.

The first part of Tarin’s plan to halt Pakistan’s boom-bust cycle involves boosting exports. The central bank offered cheap loans to manufacturers and energy tariffs were brought in line with the region. Textile shipments -- more than half of total exports -- are poised to surge 40% to a record $21 billion in the year through June and further to $26 billion next year, according to Khan’s commerce adviser.

Pakistan also plans to extend similar incentives to the technology sector as it seeks to ride a wave of global venture-capital interest in startups. The policies could be unveiled in about a month, Tarin said.

Tarin was appointed in April 2021 and has since renegotiated some of the IMF’s financial conditions, including a smaller increase in utility prices and lower mop up in taxes than the lender had earlier insisted on.

He has adopted some of the structural conditions, which include increasing autonomy for the central bank and putting an end to deficit monetization. Like predecessors, he hasn’t been able to significantly broaden Pakistan’s tax base or sell loss-making state-run firms.

Previous governments accepted IMF conditions in the short term and, when the program ends, policy makers revert to profligate spending, Tarin said. Instead, he vowed to “control our expenses” in the upcoming budget.

“We are trying to now take those steps, which are going to put this economy on an inclusive and sustainable growth path,” said Tarin. “Once it gathers momentum and is sustainable, then I think we will probably see 20-30 years of growth.”

Comment

- ‹ Previous

- 1

- 2

- 3

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

Agriculture, Caste, Religion and Happiness in South Asia

Pakistan's agriculture sector GDP grew at a rate of 5.2% in the October-December 2023 quarter, according to the government figures. This is a rare bright spot in the overall national economy that showed just 1% growth during the quarter. Strong performance of the farm sector gives the much needed boost for about …

ContinuePosted by Riaz Haq on March 29, 2024 at 8:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network