PakAlumni Worldwide: The Global Social Network

The Global Social Network

Double Digit Rise in Energy Consumption Confirms Pakistan's Economic Recovery in 2021

Oil consumption in Pakistan jumped 19% to 20.8 million tons in 2021, a strong indication of the country's economic recovery from the COVID-impacted 2020. In addition to oil, Pakistanis also consumed nearly 4 billion cubic foot of natural gas every day. Energy is fundamental to the functioning of any economy.

|

| Pakistan Oil Consumption. Source: Arif Habib |

|

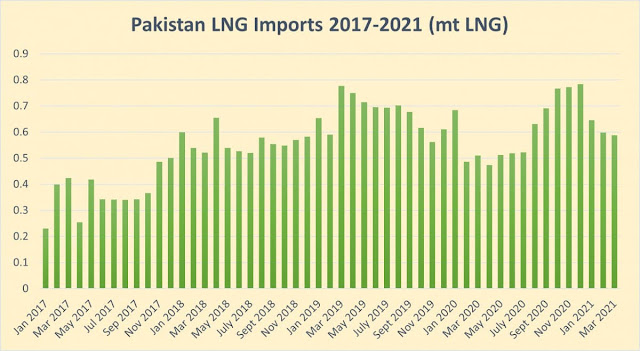

| Pakistan LNG Imports 2017-2021 in million tons |

|

| Pakistan Natural Gas Consumption in Billion Cubic Feet Per Day |

|

| Pakistan Auto Sales. Source: Arif Habib |

Motorcycle sales in the first 9 months of CY 2-21 were 1.4 million units, up 37.5% vs the 2020 and 13.0% vs the 2019. Atlas Honda dominated the motorcycle market with sales up 52.2%. Soaring cement consumption, rising auto sales and double digit increase in energy consumption in Pakistan in 2021 confirm that Pakistan's recovery from the COVID-induced slump is well underway.

-

Comment by Riaz Haq on February 19, 2022 at 7:24am

-

Pakistan is seeking to buy liquefied natural gas (LNG) cargoes from the spot market after two long-term suppliers failed to fulfil commitments to deliver shipments in March, Bloomberg reported on Friday while citing “people with knowledge of the matter”.

https://www.dawn.com/news/1675863/pakistan-to-tap-spot-cargoes-afte...

Pakistan LNG Ltd has issued a tender for two cargoes to be delivered next month, the international news agency said.

Two suppliers, Eni SpA and Gunvor Group Ltd, recently informed Islamabad about their inability to deliver cargoes scheduled for March, Pakistan LNG Ltd told Bloomberg.

A global energy crunch has resulted in LNG spot prices surging to levels that are too high for cash-strapped nations like Pakistan. The South Asian nation purchased its most expensive LNG cargo ever in November after a similar cancellation, and has avoided additional purchases since then.

Pakistan is “carefully” analysing its gas shortage, and will purchase cargoes depending on the prices they receive, Pakistan LNG Ltd told the news agency. It’s looking for the cargoes to be delivered between March 2 and March 3 and from March 10 to March 11, it said. The offers are due on Feb 22.

Eni’s LNG deliveries to Pakistan were disrupted after its supplier defaulted on obligations for an unspecified reason, the Italian company told Bloomberg in an emailed statement. “Eni is evaluating all contractual remedies, including legal actions,” the company said by email.

Gunvor declined to comment, the Bloomberg report said.

-

Comment by Riaz Haq on February 24, 2022 at 8:18am

-

#Pakistan PM #ImranKhan holds over 3-hour-long meeting with #Russian President #Putin in #Moscow. The two leaders discussed #Islamophobia, #Afghanistan, bilateral, regional, and #SouthAsian issues, #economic cooperation, other "important matters". #gas https://www.geo.tv/latest/401228-putin-to-meet-imran-khan-in-three-...

Prime Minister Imran Khan Thursday held a meeting with Russian President Vladimir Putin to discuss wide-ranging matters.

The president and the prime minister's meeting lasted for more than three hours, during which they discussed Islamophobia, Afghanistan, bilateral, regional, and South Asian issues, among other "important matters", the Russian Foreign Ministry said in a statement.

The joint statement of the meeting will be released shortly.

PM Imran Khan arrived in Moscow on a two-day official visit yesterday, where he was received at the airport by Russia's deputy foreign minister and presented with a guard of honour at the airport.

PM Imran Khan also had to discuss economic cooperation between the two countries, hours after a number of Western nations hit Russia with new sanctions for its military deployment into parts of eastern Ukraine.

The premier was set to push for the construction of a long-delayed, multi-billion-dollar gas pipeline to be built in collaboration with Russian companies, an official told Reuters.

The 1,100 km (683 miles)-long pipeline, also known as the North-South gas pipeline, was initially agreed to in 2015 and was to be financed by both Moscow and Islamabad, using a Russian company to construct it.

After the meeting with President Putin, PM Imran Khan met Russia's Deputy Prime Minister Alexander Novak.

In an interview ahead of his trip, PM Imran Khan had expressed concern about the situation in Ukraine and the possibility of new sanctions and their effect on Islamabad's budding cooperation with Moscow.

It is unclear how the latest sanctions will affect the project, which would deliver imported Liquified Natural Gas (LNG) from Karachi on the Arabian Sea coast to power plants in Punjab.

FM Qureshi meets Russian counterpart

Separately, Foreign Minister Shah Mahmood Qureshi and his Russian counterpart Sergey Lavrov discussed important regional and global issues amid the Moscow-Kyiv crisis.

During the meeting, Pakistan and Russia reaffirmed their commitment to further strengthen bilateral relations, with FM Qureshi assuring his counterpart that Islamabad gives importance to its relationship with Moscow.

"Pakistan attaches special importance to bilateral relations with Russia [...] relations between Pakistan and Russia have gradually strengthened," FM Qureshi said while speaking on the occasion.

The foreign minister said Pakistan is pursuing the agenda of promoting economic priorities and regional ties under the vision of PM Imran Khan.

The two leaders discussed important regional and global issues, including bilateral relations, enhancing cooperation in areas of mutual interest.

Later, Lavrov congratulated FM Qureshi and Pakistani leadership for successfully conducting the extraordinary Organisation of Islamic Cooperation's (OIC) Council of Foreign Ministers session on Afghanistan.

The Russian foreign minister also expressed best wishes regarding the upcoming meeting of the OIC Council of Foreign Ministers in Islamabad next month.

-

Comment by Riaz Haq on March 17, 2022 at 6:34pm

-

The nation’s (Pakistan's) energy costs had already been increasing. They more than doubled to $12 billion in July through January from the previous seven-month period, according to government data.

https://www.bloomberg.com/news/articles/2022-03-15/pakistan-struggl...

Pakistan is struggling to buy diesel due to a supply shortage with more traders targeting Europe as the loss of Russian fuel flows sets in.

Pakistan State Oil Co. hasn’t been able to secure additional shipments from its main supplier Kuwait Petroleum Corp., people familiar with the matter said.

PSO has requested more diesel from KPC and bought cargoes from the spot market, a spokesman for the retailer said in an emailed response to questions. “Product is moving toward the west” and there is a need to diversify international supplies due to the challenges, the company said, without saying if it had received additional diesel.

Pakistan’s difficulties come amid a global shortage of the industrial and transport fuel that’s been exacerbated by Russia’s invasion of Ukraine. It’s putting more pressure on government finances after Prime Minister Imran Khan cut domestic fuel and electricity prices at the start of March, despite agreeing the opposite with the International Monetary Fund.

See also: An Oil Price Rally Is Bad. A Diesel Crisis Is Worse: Javier Blas

The nation’s energy costs had already been increasing. They more than doubled to $12 billion in July through January from the previous seven-month period, according to government data.

Pakistan’s Oil and Gas Regulatory Authority has proposed that PSO buy fuel for the nation’s private retailers for the next three months as the surging prices make it tough to break even, according to a document seen by Bloomberg.

-

Comment by Riaz Haq on July 4, 2022 at 2:00pm

-

Arif Habib Limited

@ArifHabibLtd

FY22: Petroleum Sales grow by 16% YoY to 22.6mn tons.

Full Report

https://arifhabib.com/r/PetroleumSalesJun-22.pdf

@Pakstockexgltd

@Official_PetDiv

#Pakistan #Economy #AHL

#OGRA #PSO #APL #HASCOL #SHEL #Pakistan #AHL

https://twitter.com/ArifHabibLtd/status/1543854255890698240?s=20&am...

-

Comment by Riaz Haq on July 19, 2022 at 10:59am

-

Arif Habib Limited

@ArifHabibLtd

Highest ever oil import bill during FY22 amid a 71% YoY jump in Arab Light prices along with 19% YoY volumetric growth.

https://twitter.com/ArifHabibLtd/status/1549436102188081153?s=20&am...

---------------

Arif Habib Limited

@ArifHabibLtd

Balance of Trade FY22

Historic high trade deficit during FY22, up by 56% YoY

Exports: $ 31.79bn; +26% YoY

Imports: $ 80.18bn; +42% YoY

Trade Deficit: $ 48.38bn; +56% YoY

https://twitter.com/ArifHabibLtd/status/1549433873347579904?s=20&am...

-----------------

Arif Habib Limited

@ArifHabibLtd

Historic high textile exports during FY22, increased by 26% YoY to USD 19.33bn

https://twitter.com/ArifHabibLtd/status/1549430609520508931?s=20&am...

-

Comment by Riaz Haq on July 25, 2022 at 11:21am

-

The ongoing global energy crisis has left countries scrambling for fuel. As wealthy buyers of liquefied natural gas (LNG) offer top dollar for every available cargo, Pakistan faces dire fuel and power shortages with little end in sight.

https://ieefa.org/resources/ieefa-finding-right-way-forward-pakista...

There will be no easy way forward. Reversing Pakistan’s dependence on imported fossil fuels by accelerating the shift to low-cost domestic renewable energy sources will be crucial for energy security and economic growth. In the meantime, Pakistan needs a coherent LNG procurement strategy that avoids locking in high prices for upcoming decades.

Ripple effects of low LNG supply

In the aftermath of Russia’s invasion of Ukraine, Europe is buying significantly more volumes of LNG to cut its dependence on Russian gas. But with almost no spare global LNG supply capacity, European buyers have pulled existing cargoes away from developing nations by offering higher prices.

Pakistan is suffering the consequences. In July, state-owned Pakistan LNG Limited (PLL) issued a tender to buy ten cargoes of LNG through September but did not receive a single bid.

This is the fourth straight tender that went unawarded. In a previous tender, PLL received only one bid from Qatar Energy at a price of US$39.80 per million British thermal unit (MMBtu). At this price, a single cargo would cost over US$131 million, but the government rejected the offer to conserve its dwindling foreign exchange reserves.

The effects have been disastrous. Power cuts are crippling household and commercial activities, while gas rationing to the textile sector has resulted in a loss of US$1 billion in export orders. Despite energy conservation efforts, many areas continue to experience load shedding of up to 14 hours, as the generation shortfall reached 8 gigawatts (GW).

LNG procurement: spot purchases vs. long-term contracts?

Some countries are shielded from extreme LNG price spikes by long-term purchase contracts. But Pakistan sources roughly half of its LNG from spot markets, increasing the country’s exposure to global price volatility.

To mitigate the situation , Pakistan has expressed openness to signing new long-term contracts, with one official claiming the country would go for an unusually long 30-year contract. The contracts will most likely be signed with Qatar and United Arab Emirates.

However, Pakistan’s experience with long-term contracts has been problematic. Term suppliers had defaulted at least 12 times over the past 11 months, most recently in July when Pakistan desperately needed fuel.

Long-term contracts—which are typically tied to a ‘slope’ or a percentage of the Brent crude oil price—are reportedly 75% more expensive than one year ago. If Pakistan signed a deal now with a 16-18% slope, and assuming current Brent crude prices of US$100, a single cargo would cost roughly US$55-61 million. At the 11-13% slope of Pakistan’s current contracts, meanwhile, a cargo would cost US$37.5-44.3 million. Although Brent crude prices will vary, it is clear that Pakistan would risk locking in higher prices by signing new long-term contracts in the current LNG environment.

Moreover, with limited global LNG supply, long-term contracts would likely not start until 2026, when significant new global supply capacity is expected online. Pakistan’s LNG needs are more immediate.

Rather than lock in high prices for the long-term, buyers in Pakistan can consider signing shorter five-year contracts with portfolio players. Industry representatives have suggested there is space in the market for shorter contracts. Although shorter terms typically come at a price premium, they may temporarily help alleviate Pakistan’s exposure to extreme spot market volatility.

-

Comment by Riaz Haq on July 25, 2022 at 11:22am

-

The ongoing global energy crisis has left countries scrambling for fuel. As wealthy buyers of liquefied natural gas (LNG) offer top dollar for every available cargo, Pakistan faces dire fuel and power shortages with little end in sight.

https://ieefa.org/resources/ieefa-finding-right-way-forward-pakista...

Short-term contracts have to carry higher penalties in instances of non-delivery to avoid repeated supplier defaults. Coupled with the existing long-term contracts and spot purchases, short-term contracts would diversify the country’s supply portfolio, potentially allowing better price management, supply security, and flexibility.

Permanent shift away from LNG

In the longer term, cutting Pakistan’s dependence on imported fossil fuels altogether is the most affordable solution. Low-cost, domestic renewables like wind and solar can prove to be a crucial hedging mechanism against high, US dollar-denominated fossil fuel prices.

The government is beginning to recognize the unreliability and unaffordability of LNG compared to domestic renewables. Policymakers recently indicated that they would announce a new solar policy geared towards reducing LNG dependence, reducing high energy costs, and improving energy security.

Under the policy, due out August 1, 7-10 GW of residential solar systems would be deployed by the summer of 2023. In addition, the policy would allow the installation of seven utility-scale solar plants at the sites of existing thermal power plants.

This is a major step in the right direction, one that will help reduce gas and LNG demand in the power sector. We also identified other measures in a recent IEEFA report to limit LNG demand, such as reforming gas distribution company revenue regulations to reduce gas leakage, along with energy efficiency incentives.

Ultimately, there will be no one-size-fits-all solution to the current energy crisis, but a portfolio of short to long-term plans is necessary to mitigate Pakistan’s unsustainable reliance on LNG imports.

-

Comment by Riaz Haq on July 29, 2022 at 4:25pm

-

PetroChina explores #SouthAsia market, supplies first gasoil cargo to #Pakistan. A vessel loaded 324,454 barrels of #gasoil from the Jubail Refinery in #SaudiArabia on June 8 and discharged at Fauji, #Karachi in Pakistan on June 14, data from Kpler showed.http://www.spglobal.com/commodityinsights/en/market-insights/latest...

China used to be a key gasoline supplier to Pakistan, led by PetroChina, but gasoil flows were thin as it supplied only one 40,000-mt (298,000 barrels) gasoil cargo to the South Asian country in November 2021, China's official data showed.

Pakistan was also the only destination that recorded steady growth among China's top five gasoline recipients, with flows jumping 93.8% year on year to 1.56 million mt (64,000 b/d) over the first half of 2022 despite drying up of outflows in June. According to China's official data, this made Pakistan the second-biggest destination for Chinese gasoline cargoes over the same period, behind the regional trading hub, Singapore.

----------

The company is the international trading arm of China's state-owned oil and gas giant PetroChina.

The breakthrough comes after China's suspension of oil product exports to Pakistan since late May, following the South Asian country's imposition of a 10% regulatory duty on flows effective July 1 to shut the tax-free access created by a bilateral agreement in 2019.

Earlier, gasoline imports from China were exempted from any duties under Phase-II of the China Pakistan Free Trade Agreement.

"It also suggests PetroChina's effort to develop the South Asia market by sourcing barrels outside of China when Beijing tightens oil product exports to ensure domestic supply and cut emissions," said Sun Sijia, an analyst with Platts Analytics.

Moreover, this highlights a shift in the focus of Chinese state-run oil product trading desks' business to international trades. However, they were initially built to fix outlets for Chinese oil products, trading sources said.

According to the information on the WeChat account, the cargo was shipped by the Denmark-flagged clean tanker Torm Philippines.

The vessel loaded 324,454 barrels of gasoil from the Jubail Refinery in Saudi Arabia on June 8 and was discharged at Fauji, Karachi in Pakistan on June 14, data from Kpler showed.

Beijing is keen to cut the outflow of oil products by issuing fewer export quotas to ensure domestic supplies and tackle global inflation while reducing emissions to meet the country's net-zero targets.

So far this year, China's three rounds of allocation have taken the total quota volume to 22.5 million mt for 2022, 40% lower than the 37.61 million mt awarded in the three batches of 2021, data from S&P Global Commodity Insights showed.

-

Comment by Riaz Haq on January 4, 2023 at 3:31pm

-

Pakistan's oil consumption downtrend likely to spill over to early 2023

https://www.spglobal.com/commodityinsights/en/market-insights/lates...

Pakistan's oil demand likely to remain soft in Q1 2023: S&P Global

Gasoline sales over July-Dec down 15% on year, diesel falls 23%

Sluggish industrial activity to keep a lid on oil products consumption

Amid oil consumption falling by 19% on the year over July-June followed by a drop in transportation fuels demand in July-September stemming from devastating floods, Pakistan saw a slower economic recovery in October-December. This exacerbated by higher oil prices owing to economic woes likely led to a contraction in oil demand in 2022 from 2021 levels, according to Shreyans Baid, a Senior South Asia oil analyst at S&P Global.

"Pakistan's oil demand is likely to remain soft at least until the first quarter of 2023 and is likely to recover in the latter part of the year. Overall, we expect the 2023 Pakistan oil demand to grow on the year, although downside risks remain," Baid said, referring to a continued slowdown in industrial activity, economic challenges, and shortage of foreign exchange reserves.

Oil sales during the first six months of the country's fiscal year were at 9.03 million mt, compared with 11.10 million mt in the same period of the previous year, data from oil marketing companies and the Oil Companies Advisory Council showed.

Yousuf Saeed, head of research at Darson Securities, said that during these months industrial activity slowed substantially, resulting in relatively lower movement of heavy transportation commercial vehicles.

Additionally, many factories were either partially or fully closed as the shortage of foreign exchange reserves was prompting the country's central bank, the State Bank of Pakistan, to be cautious in making overseas payments, restricting the ability of industries to import raw materials in time to run their operations.

The country's foreign exchange reserves held by SBP for the week ended Dec. 23, 2022, reached $5.8 billion, the lowest in almost eight and a half years, and just enough to cover five weeks of imports.

Product sales head south

Motor gasoline sales during the six-month period that ended Dec. 31, 2022, dropped 15% on the year to 3.83 million mt. At the same time, diesel and fuel oil consumption dropped 23% on the year to 3.36 million mt and 24% on the year to 1.45 million mt, respectively, according to OCAC data.

"Gasoline sales declined on account of high prices while fuel oil sales declined due to lower demand from the power sector, as authorities relied on relatively cheaper sources for electricity production during the winter season," Saeed said.

Anand Kumar, an equity research analyst at Optimus Capital Management, also held similar views, saying monthly oil consumption declined on the back of lower fuel consumption in the winter season. Diesel demand also dropped significantly as sales to the agriculture sector dropped with the ending of the crop sowing season, resulting in reduced irrigation activity.

"Oil demand is expected to remain at low levels due to the economic slowdown and an expected rise in petroleum prices, which may happen due to an anticipated rise in general sales tax or higher levies on petroleum products," he said.

"We foresee the country's oil demand for the remaining months of the fiscal year to be about 9.9 million mt, taking the overall consumption in 2022-23 to 18.9 million mt, a decline of 16.1% on a year-on-year basis," Kumar added.

On a monthly basis, motor gasoline sales in December 2022 were around 620,000 mt, down 11% from 700,000 mt of the same month in 2021, while diesel consumption fell by 15% to 520,000 mt and fuel oil by 3% to 120,000 mt over the same period, OCAC data showed.

Comment

- ‹ Previous

- 1

- 2

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

Agriculture, Caste, Religion and Happiness in South Asia

Pakistan's agriculture sector GDP grew at a rate of 5.2% in the October-December 2023 quarter, according to the government figures. This is a rare bright spot in the overall national economy that showed just 1% growth during the quarter. Strong performance of the farm sector gives the much needed boost for about …

ContinuePosted by Riaz Haq on March 29, 2024 at 8:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network