PakAlumni Worldwide: The Global Social Network

The Global Social Network

Thirlwall Law: Why Hasn't Pakistan's GDP Grown Faster Than 5% Average Since 1960s?

Pakistan's economy has grown at a compounded annual growth rate (CAGR) of about 5% since the 1960s. While Pakistan's average 5% annual economic growth rate is faster than the global average, it falls significantly short of its peer group in Asia. The key reason is that, unlike Pakistan's, the East Asian nation's growth has been fueled by rapid rise in exports. History shows that Pakistan has run into balance of payments (BOP) crises whenever its growth has accelerated above 5%. These crises have forced Pakistan to seek IMF bailouts 13 times in its 73 year history. Pakistan's current account deficits would be a lot worse without 23X growth in remittances from overseas Pakistanis since year 2000. What Pakistan has experienced is BOP-constrained growth as explained in 1979 by Thirlwall Law, a law of economics named after British economist Anthony Philip Thirlwall. Another reason why Pakistan has lagged its Asian peers in terms of economic growth is its lower savings and investment rates. Every time Pakistan has faced a balance of payments crisis, the result has been massive currency devaluation, high inflation and slower growth for a period pf multiple years. This is is exactly what Pakistan's current government led by Prime Minister Imran Khan is dealing with right now. This pain is the result of years of flat exports, soaring imports and excessive debt taken on during former Prime Minister Nawaz Sharif's PMLN government from 2013 to 2018. The best way for Pakistan to accelerate its growth beyond 5% in a sustainable manner is to boost its exports by investing in export-oriented industries, and by incentivizing higher savings and investments.

History of Pakistan's IMF Bailouts

Economic Growth Since 1960:

The World Bank report released in June, 2018 shows that Pakistan's GDP has grown from $3.7 billion in 1960 to $305 billion in 2017, or 82.4 times. In the same period, India's GDP grew from $37 billion in 1960 to $2,597 billion in 2017 or 71.15 times. Both South Asian nations have outpaced the world GDP growth of 60 times from 1960 to 2017.

While Pakistan's GDP growth of 82X from 1960 to 2017 is faster than India's 71X and it appears impressive, it pales in comparison to Malaysia's 157X, China's 205X and South Korea's 382X during the same period.

Thrilwall's Model:

Thrilwall's BOP-constrained growth model says that no country can sustain long-term growth rates faster than the rate consistent with its current account balance, unless it can finance its growing deficits. Indeed, if imports grow faster than exports, the current account deficit has to be financed by borrowing from abroad, i.e., by the growth of capital inflows. But this cannot continue indefinitely. Here's how Jesus Felipe, J. S. L. McCombie, and Kaukab Naqvi describe it in their May 2009 paper titled "Is Pakistan’s Growth Rate Balance-of-Payments Constrained? Policies and Implications for Development and Growth" published by Asian Development Bank:

"The reason is straightforward. If the growth of financial flows is greater than the growth of GDP, then the net overseas debt to GDP ratio will rise inextricably. There is a limit to the size of this ratio before international financial markets become distinctly nervous about the risk of private and, especially in less developed countries, public default. If much of the borrowing is short-term, then there is danger of capital flight, precipitating the collapse of the exchange rate. Not only will this cause capital loses in terms of foreign currency (notably United States [US] dollars) of domestic assets owned by foreigners (the lenders), but it will also cause severe domestic liquidity problems. This is especially true of many developing countries as overseas borrowing by banks and firms is predominantly denominated in a foreign currency, normally US dollars. As the exchange rate plummets, so domestic firms have difficulty finding domestic funds to finance their debt and day-today operations, often with disastrous consequences."

Investment as Percentage of GDP Source: State Bank of Pakistan

Pakistan's Rising Current Account Deficit:

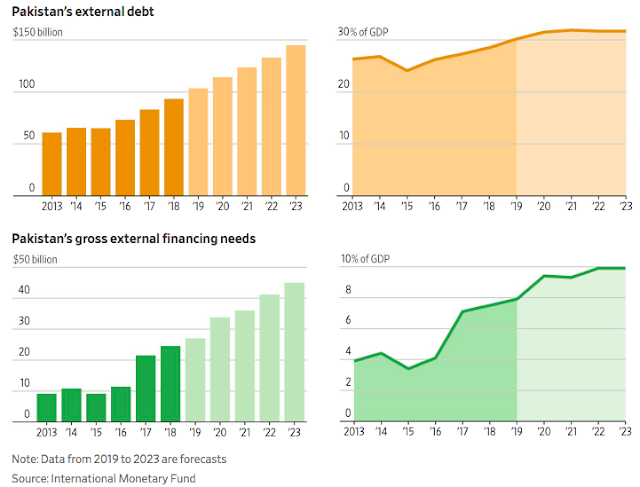

Pakistan's external debt has been rising rapidly in recent years to fund its ballooning twin deficits of domestic budget and external accounts. It pushed the external debt service cost to $12 billion in fiscal 2019-20, and added to the trade deficit of nearly $24 billion. Remittances of $21 billion from Pakistani diaspora reduced the current account deficit to $11 billion, but still forced the new PTI government to seek yet another IMF bailout with its stringent conditions to control both fiscal and current account deficits. These conditions resulted in dramatic slow-down in the country's GDP growth.

|

| Pakistan's External Debt. Source: Wall Street Journal |

Pakistan's Exports:

Pakistan’s exports have continued to lag behind that of its South Asian competitors since the early 1990s. Bangladesh’s exports have increased by 6.2 times compared to Pakistan’s, measured in terms of exports per capita, and that of India by 6.8 times, according to Princeton's Pakistani-American economist Atif Mian.

|

| Exports Per Capita in South Asia. Source: Dawn |

Balance of Payments Crises:

Every time Pakistan has faced a balance of payments crisis, the result has been massive currency devaluation, high inflation and slower growth for a period of multiple years. This is is exactly what Pakistan's current government led by Prime Minister Imran Khan is dealing with right now. This pain is the result of years of flat exports, soaring imports and excessive debt taken on during former Prime Minister Nawaz Sharif's PMLN government from 2013 to 2018.

|

| Export Growth in South Asia. Source: WSJ |

Savings and Investment:

The second reason why Pakistan lagged its Asian peers in terms of economic growth is its lower savings and investment rates. There's a strong relationship between investment levels and gross domestic product. The more a country saves and invests, the higher its economic growth. A State Bank of Pakistan report explains it as below:

"National savings (in Pakistan) as percent of GDP were around 10 percent during 1960s, which increased to above 15 percent in 2000s, but declined afterward. Pakistan’s saving rate also compares unfavorably with that in neighboring countries: last five years average saving rate in India was 31.9 percent, Bangladesh 29.7 percent, and Sri Lanka 24.5 percent..... Similarly, domestic savings (measured as national savings less net factor income from abroad) also declined from about 15 percent of GDP in 2000s, to less than 9 percent in recent years. Domestic savings are imperative for sustainable growth, because inflow of income from abroad (remittances and other factor income) is uncertain due to cyclical movements in world economies, exchange rates, and external shocks".

Net Foreign Direct Investment Source: State Bank of Pakistan

21X Remittance Growth Since Year 2000:

Remittance inflows from Pakistani diaspora have jumped 21-fold from about $1 billion in year 2000 to $24 billion in 2020, according to the World Bank. In terms of GDP, these inflows have soared nearly 7X from about 1% in year 2000 to 6.9% of GDP in 2018.

Meanwhile, Pakistan's exports have declined from 13.5% of GDP in year 2000 to 8.24% of GDP in 2017. At the same time, the country's import bill has increased from 14.69% in year 2000 to 17.55% of GDP in 2017. This growing trade imbalance has forced Pakistan to seek IMF bailouts four times since the year 2000. It is further complicated by external debt service cost of over $6 billion (about 2% of GDP) in 2017. Foreign investment in the country has declined from a peak of $5.59 billion (about 4% of GDP) in 2007 to a mere $2.82 billion (less than 1% of GDP) in 2017. While the current account imbalance situation is bad, it would be far worse if Pakistani diaspora did not come to the rescue.

Summary:

Pakistan's average economic growth of 5% a year has been faster than the global average since the 1960s, it has been slower than that that of its peers in East Asia. It has essentially been constrained by Pakistan recurring balance of payment (BOP) crises as explained by Thirlwall's Law. Pakistan has been forced to seek IMF bailouts 13 times in the last 70 years to deal with its BOP crises. This has happened in spite of the fact that remittances from overseas Pakistanis have grown 24X since year 2000. Every time Pakistan has faced a balance of payments crisis, the result has been massive currency devaluation, high inflation and slower growth for a period pf multiple years. This is is exactly what Pakistan's current government led by Prime Minister Imran Khan is dealing with right now. This pain is the result of years of flat exports, soaring imports and excessive debt taken on during former Prime Minister Nawaz Sharif's PMLN government from 2013 to 2018. The best way for Pakistan to accelerate its growth beyond 5% is to boost its exports by investing in export-oriented industries, and by incentivizing higher savings and investments.

Haq's Musings

South Asia Investor Review

Pakistan's Debt Crisis

Declining Investment Hurting Pakistan's Economic Growth

Brief History of Pakistan Economy

Can Pakistan Avoid Recurring IMF Bailouts?

Pakistan is the 3rd Fastest Growing Trillion Dollar Economy

CPEC Financing: Is China Ripping Off Pakistan?

Information Tech Jobs Moving From India to Pakistan

Pakistan is 5th Largest Motorcycle Market

"Failed State" Pakistan Saw 22% Growth in Per Capita Income in Last...

CPEC Transforming Pakistan

Pakistan's $20 Billion Tourism Industry Boom

Home Appliance Ownership in Pakistani Households

Riaz Haq's YouTube Channel

PakAlumni Social Network

-

Comment by Riaz Haq on September 14, 2020 at 10:17am

-

#Pakistan #economy gains strength as #coronavirus cases decline. It's seen from growing cement-to-fuel sales & demand for home appliances to cars. Economist Muzammil Aslam who expects economic expansion at 4%-5% in current FY with demand push https://www.bloomberg.com/news/articles/2020-09-13/pakistan-s-econo... via @markets

https://twitter.com/haqsmusings/status/1305555250925826053?s=20

Evidence of momentum returning can be seen from growing cement-to-fuel sales and demand for home appliances to cars. That’s happening even as Pakistan added fewer than 2,900 cases last week compared with almost 35,000 cases in a week in June, and 96% of the total 300,000 infected have fully recovered.

“It has surprised everybody,” said Muzzammil Aslam, chief executive officer at Tangent Capital Advisors Pvt., who expects economic expansion at 4%-5% in the year started July, higher than the government’s 2.1% target. “The growth is led by an aggregate demand push.”

Cement sales rose 38% from a year ago to 4.8 million tons in July, and near a record level seen in October. A government program to give amnesty to tax evaders, provided they fund construction projects, is expected to fuel activity -- and demand for cement -- as work resumes after the lockdown.

“We expect dispatches to continue their rising run moving forward because of tax measures,” said Saad Khan, research head at IGI Securities Ltd. “Substantial decline in interest rates and mandatory targets given for banks to increase housing and construction financing to at least 5% of private sector credit” will also help, he said.

Cement sales eased to 3.5 million tons in August, mainly because of torrential rains across the country.

Fuel Sales

Gasoline sales in June rose to a record high as people return to work after lockdown measures eased in May, according to A. A. H. Soomro, managing director at KASB Securities Pvt. Sales have stayed elevated in July and August.

Fuel for power generation has increased as well. Fuel oil sales rose in June to the highest in a year while LNG spot cargo purchase resumed in June after a six-month hiatus.

Car Sales

Local car deliveries have recovered to about 10,000 units after four months as the end of lockdown ushered in new demand.

Kia Motors Corp.’s local unit is planning to add a second shift at its factory in Karachi from January.

Manufacturing

Manufacturing output improved for a second consecutive month in June. The overall recovery in large-scale manufacturing will likely be stronger in the October-to-December quarter with worldwide demand picking up, said Khaqan Najeeb, a former adviser to Pakistan’s finance ministry. Home appliances are also seeing “robust demand,” said Haroon Ahmad Khan, chief executive officer at Waves Singer Pakistan Ltd.

-

Comment by Riaz Haq on September 14, 2020 at 12:36pm

-

How to fix Pakistan’s economy

Yousuf NazarUpdated 14 Sep 2020

https://www.dawn.com/news/1579562

Pakistan has gone through this boom and bust cycles many times before: an import-driven boom, balance of payments crisis, International Monetary Fund (IMF) bailout, stabilisation, a period of growth and then back to a crisis. This time is no different.

---------

These facts suggest that the reasons for Pakistan’s poor export performance are deep and structural. The 2019-20 improvement in the current account deficit has been largely the result of more than a $5bn fall in energy imports and (possibly one-off) record rise in the worker’s remittances as overseas Pakistanis return following the huge surge in unemployment across the globe including in the Middle East.

It is wrong to focus on just the so-called twin deficits: current account and fiscal. These are just symptoms of much wider and deeper issues including Pakistan’s chronically low savings and investments rate compared to its GDP. I would call them intellectual and capacity deficits. We need a growth model.

An exports-led growth model has lifted hundreds of millions out of poverty in countries like China, South Korea, Taiwan and Singapore. China invested heavily in education, particularly science and technology, as well as in heavy engineering and other capital-intensive industries. Foreign investors looking for trained and low-cost workers found no shortage of human talent as the ‘communist’ China had invested heavily in basic education and its Special Economic Zones (SEZs) jump-started the labour-intensive exports-led industrial revolution that has transformed China.

Tax concessions and government-guaranteed yields may have succeeded in attracting investments in the energy sector but this is an unsustainable model. Economic progress cannot be imported or borrowed. It has to come from long term pursuit of appropriate strategies through policies implemented consistently through competent governance. A successful national growth plan must have a 3D strategy: deregulate, devolve, and digitise.

Deregulation is essential to harness the energies of the private sector (especially medium-size businesses) severely constrained by bureaucratic hurdles and rent-seeking. Without devolution, it is impossible to provide basic services in a country with one of the fastest urbanisation rates, and without digitalisation, Pakistan cannot compete in a world defined by the digital divide as Bill Gates has put it. Imran Khan has three more years to change course. His success or failure would depend on how correctly he identifies the challenges and what resources and people he employs to meet those.

-

Comment by Riaz Haq on September 14, 2020 at 4:21pm

-

#UK increases #Export Finance country limit for #Pakistan to £1.5 billion. UK is Pakistan’s 3rd largest export partner, accounting for 7% of Pak's total exports to the UK. Increase in #credit #financing limit will help turbo-charge trade between the two. https://www.gov.uk/government/news/uk-increases-export-finance-coun...

This announcement will boost trade partnerships between the two countries and unleash Pakistan’s growth potential. UKEF helps secure large contracts by providing attractive financing terms to buyers and supporting working capital loans.

The British High Commissioner to Pakistan, Dr Christian Turner met with the Federal Minister of Commerce for Pakistan Razaq Dawood today to discuss trade ties and business potential between the two countries. The Commerce Minister welcomed the UKEF’s announcement of an increase of £500 million in the credit limit for business investment in Pakistan, especially at a time when Pakistan is looking to expand its trade potential to mitigate the impacts of COVID19.

The British High Commissioner, Dr Christian Turner said;

UK credit financing for Pakistan has tripled in the last two years, and is key to achieving my ambition to double the trade between the UK and Pakistan. It is a sign of our confidence in Pakistan and the strength of the unique relationship between the two countries. I encourage all Pakistan businesses to look for opportunities to partner with the UK on their journey towards economic prosperity.

The UK is Pakistan’s third largest export partner. Between July 2019 and March 2020 Pakistan exported 7% of its total exports to the UK, and the increase in the credit financing limit will help turbo-charge trade relations between the two countries.

Notes to the Editors:

UK Export Finance (UKEF) is the UK’s official Export Credit Agency (ECA) working closely with the Department for International Trade (DIT).

Its mission is to ensure that no viable UK export fails for lack of finance or insurance, while operating at no net cost to the taxpayer.

In 2019/20, UKEF provided £4.4 billion of support for UK exports globally.

UKEF recently completed a comprehensive review of its Country Limits, resulting in increases in over 100 markets including Pakistan

The Export Financing offered is quite attractive if comparing to a commercial bank

There is a baseline requirement for 20% of the whole deal to come back to the UK, but that doesn’t necessarily mean –for example –the whole construction on the ground or the production of a specific product. It looks at the whole supply chain. The 20% can come from a UK company that looks after the procurement of services as part of a bigger deal. This makes UKEF very attractive for multinational consortiums.

-

Comment by Riaz Haq on September 14, 2020 at 4:44pm

-

#Remittances from overseas #Pakistanis exceed $2 billion for third month in a row. 'Over the last three months, remittances reached an unprecedented level of $7.3 billion, which is 37.2% higher than the same period of last year' #COVID19 https://profit.pakistantoday.com.pk/2020/09/14/remittances-exceed-2... via @Profitpk

Remittances rose to $2.095 billion in August, according to data released by the State Bank of Pakistan (SBP) on Monday, depicting a year-on-year growth of 24.4pc when compared with August 2019.

On a monthly basis, however, remittances were 24.3pc lower than the $2.768 billion remittances posted in July 2020. According to the SBP, this monthly decline reflected the usual seasonal decline in the post Eidul Adha period.

Most of the remittances in August were received from Saudi Arabia, at $593 million; followed by UAE at $410 million; and the UK at $302 million.

According to the SBP, workers’ remittances have now remained above $2 billion for the third month in a row.

In July, remittances were recorded at $2.77 billion, which was the highest ever level of remittances in a single month in Pakistan. And in June, remittances were recorded at $2.47 billion, which the SBP had dubbed as ‘historic’ at the time.

“Over the last three months, remittances reached an unprecedented level of $7.3 billion, 37.2pc higher than the same period last year,” the SBP noted.

According to the SBP, the rise in remittances is due to two reasons.

First, there has been increased efforts under the Pakistan Remittances Initiative (PRI). Under the PRI, the threshold for eligible transactions was changed from $200 to $100 under the Reimbursement of Telegraphic Transfer (TT) Charges Scheme, there has been an increase in adoption of digital channels, and a push for targeted marketing campaigns to promote formal channels for sending remittances.

Second, there has been a gradual re-opening of businesses in major host countries such as Middle East, Europe and United States.

It is a view echoed by analysts.

According to Tahir Abbas, head of research at Arif Habib Ltd., there has been an increase in remittances flows though formal channels.

Samiullah Tariq, head of research at Pakistan Kuwait Investment, also said that more overseas Pakistanis are using official banking channels to remit money to their homes, as there was a closure of flights and restriction of movement due to the Covid-19 pandemic.

Typically, money is sent to Pakistan by people physically carrying cash in their luggage, when they travel to visit Pakistan. However, due to the Covid-19 pandemic, and the subsequent cancellation in flights, people were forced to switch to formal channels, in an effort to make sure money reached their families.

In addition, the movement of cash transported on flights increases during Hajj and Umrah season. But this year, due to the Covid-19 pandemic there was a limited Hajj, and a bank on Umrah, which further curtailed people’s ability to send money through informal channels, and pushed them to use formal channels.

’31PC SURGE IN JULY-AUG’

Meanwhile, Prime Minister Imran Khan said on Monday remittances received by the country have increased by 31pc during the first two months of the fiscal year as compared to the same period last year.

Taking to Twitter, the premier said remittances of $2,095 million were received in August, which is an increase of 24.4pc.

-

Comment by Riaz Haq on September 18, 2020 at 9:25am

-

In the outgoing FY (2019-20), Pakistani expatriates remitted a record of $23.12 billion with more than 6% year-on-year (YoY) growth compared to $21.74 of FY 2018-19.

http://tribune.com.pk/article/97174/the-curious-case-of-pakistans-s...The momentum has not only persisted but amplified in on-going FY 21 with a whopping $2.77 billion remittance in July, followed by an inflow of $2.095 billion in August. This unprecedented surge is bemusing, and what has baffled many is the fact that this escalation has occurred during the pandemic. So, what could the potential triggers to this mammoth inflow be?

The extraordinary leap can be primarily due to the tightening of informal money markets, which has augmented the inflow through formal banking channels. In the budget for FY 2020-21, the incumbents allocated Rs25 billion to formalise foreign remittances, which would aid in stockpiling foreign exchange reserves to service colossal national debt obligations.

Pakistanis typically used to carry cash in their luggage physically. But due to flight reduction and sparse international travels, they would have been compelled to access official banking channels for money transfers. Also, remittances might have incremented on account of significant job losses in the Gulf region due to the Covid-related recession. Hence the spiral may demonstrate high one-time repatriation of money back to Pakistan.

On the other hand, the State Bank of Pakistan (SBP) has emphasised an orderly ‘market-based’ exchange rate management and sound policymaking under the Pakistan Remittance Initiative. The SBP sheds the spotlight on the reduction of the threshold for eligible transactions from $200 to $100 under the Reimbursement of Telegraphic Transfer (TT) Charges Scheme. It also stressed on adoption of digital channels and targeted marketing campaigns to promote formal routes. Similarly, IT-related freelance services’ payment limits have increased from $5,000 to $25,000 per individual per month. The SBP believes that it has facilitated to enhance home remittances through formal banking channels in Pakistan.

The crux of the matter is remittances will upslope further in the future due to effectuated compliance of formal banking channels. Still, the recent abnormal increment will ease down in the coming months when the western economies recuperate from the ramifications of the Covid-related slump.

-

Comment by Riaz Haq on September 18, 2020 at 8:58pm

-

#Pakistan earns $1.44 billion in #IT #exports, up 20.72% from $1.19 billion from last year. #computer services exports grew 23.44% as it surged to $1,106 million from US $ 895.990 million last year. #technology #economy #trade https://dunyanews.tv/en/Business/561082-Pakistan-earns-US$1438-million-from-IT-services-export-during-FY2019-20

Pakistan earned US $ 1438.827 million by providing different information technology (IT) services in various countries during July-June (2019-20).

This shows growth of 20.72 percent when compared to US $ 1191.864 million earned through provision of services during the corresponding period of fiscal year 2018-19, Pakistan Bureau of Statistics (PBS) reported.

During the period under review, the computer services grew by 23.44 percent as it surged from US $ 895.990 million last year to US $ 1106.027 million during July-June (2019-20).

Among the computer services, the exports of software consultancy services witnessed increase of 14.98 percent, from US $ 354.397 million to US $ 407.492 million while the export and import of computer software related services also rose by 11.62 percent, from US $ 285.235 million to US $ 318.368 million.

The exports of hardware consultancy services decreased by 16.55 from, US$ 2.345 million to US$ 1.957 million whereas the exports of other computer services rose by 51.91 percent from US$ 247.976 million to US $ 376.699 million. In addition the export of repair and maintenance services however witness decline of 74.97 percent from $6.037 million to $1.511 million.

Meanwhile, the export of information services during the period under review increased by 61.39 percent by going up from US $ 1.580 million to US $ 2.550 million.

Among the information services, the exports of news agency services increased by 100.89 percent, from US $ 0.677 million to US $ 1.360 million whereas the exports of other information services also increased by 31.78 percent, from US $ 0.903 million to US $ 1.190 million.

The export of telecommunication services also witness increase of 12.22 percent as these went up from US $ 294.294 million to 330.250 million during the fiscal year under review, the data revealed.

Among the telecommunication services, the export of call centre services increased by 26.17 percent during the period as its exports increased from US $ 98.858 million to US $ 124.730 million whereas the export of other telecommunication services also increased by 5.16 percent, from US $ 195.436 million to US $205.520 million during the period under review, the PBS data revealed.

It is pertinent to mention here that the services trade deficit of the country during the fiscal year (2019-20) decreased by 42.96 percent as compared to the corresponding period of last year.

During the period from July-June, 2019-20, services exports decreased by 8.66 percent, whereas imports reduced by 24.25 percent, according the data released by Pakistan Bureau of Statistics.

The services worth US $ 5.449 billion exported during the period under review as compared the exports of US $ 5.966 billion in same period of last year, whereas imports of services into the country was recorded at US $ 8.284 billion as against the imports of US $ 10.936 billion, the data revealed.

-

Comment by Riaz Haq on September 19, 2020 at 6:11pm

-

Fitch has warned of decline in remittances amid the #Coronavirus shock. But #remittances have been robust in #Pakistan and Bangladesh. ADB says 14% of households in #Bangladesh, 8% in #Philippines, 4% in Pakistan and 2% in #India receive remittance income. https://www.fitchratings.com/research/sovereigns/apac-remittances-t...

Fitch Ratings-Hong Kong-08 September 2020: The coronavirus pandemic and subsequent impact on the oil market are having a considerable effect on migrant workers and are likely to supress remittance flows in the APAC region, Fitch Ratings says in a special report. We expect flows to weaken in the coming quarters, even though recent amounts have been surprisingly robust in some countries due to temporary factors. Declining remittances in economies that are dependent on them may affect sovereign ratings through pressures on external finances and economic growth.

Demand for migrant labour has provided an important and stable source of foreign-currency remittance flows for a number of APAC sovereigns, including Bangladesh (6.0% of GDP), Pakistan (7.9%), Sri Lanka (8.0%) and the Philippines (8.4%). India is the largest recipient of remittances globally but they account for a small share of GDP at 2.9%. Remittance flows have helped keep current account deficits contained by offsetting large trade deficits. Indeed, without remittances the Philippines, Pakistan, Sri Lanka, and Bangladesh would all have large current account deficits of between 7%-10% of GDP.

Remittances in APAC also provide economic benefits to recipient countries. First, they support domestic consumption by providing an additional income source to households. According to the Asian Development Bank, about 14% of households in Bangladesh receive remittance income, 8% in the Philippines, 4% in Pakistan and 2% in India. Second, job opportunities for migrant workers relieve slack in domestic job markets.

Remittance flows in APAC were surprisingly mixed in the second quarter of 2020. Monthly data show a considerable and broad decline in remittances during April and May, as Fitch expected, but a recovery in June and July. The rebound in flows was particularly robust in Pakistan and Bangladesh, where flows broke records in both June and July. Sri Lanka and the Philippines also saw an improvement in remittance flows in June, but much more modest.

Anecdotal evidence points to temporary factors for the increase in recorded remittances in the recent period. These include migrant workers transferring their savings in preparation to return home, the impact of lockdown restrictions on transferring funds and a shift to formal remittance channels, which are picked up in the official data.

Fitch forecasts a 12% decline across the region in the second half of the year as the temporary support factors fade.

The deterioration in remittance inflows is likely to widen current account deficits, contributing to higher external financing needs. For countries with fragile external finances, such as Pakistan and Sri Lanka, the shock to remittances could exacerbate existing challenges. Lower oil prices and subdued import demand, however, are likely to soften the aggregate impact on external balances.

Remittances typically provide a countercyclical buffer for economic activity and vulnerable households. In domestic economic shocks, family members working abroad can increase remittances to help mitigate the impact of sluggish domestic activity. The pandemic, however, represents a much more synchronised global economic shock than previous downturns. This limits the potential support of the remittance channel.

Lower remittance flows could affect public finances through two channels: lower revenue collection from weaker consumption and higher social spending to support remittance-dependent households as well as returning migrant workers. Many countries in the region already have limited fiscal space to address the current coronavirus shock and the decline in remittances could exacerbate current challenges.

-

Comment by Riaz Haq on October 29, 2020 at 1:08pm

-

‘Exports to increase up to $28 bn by end of current fiscal’, says Razzak Dawood. “Though we need to do a lot on various conventions, but the progress on many issues mentioned in the detailed report will help continue the GSP Plus facility for Pakistan.” https://www.thenews.com.pk/print/728019-exports-to-increase-up-to-2...

Razzak Dawood Tweet:I happy to share the good news that more and more brands are shifting to Pakistan. We just heard that Hanes, Guess, Hugo Boss & Target have shifted orders from China to Pakistan.https://twitter.com/razak_dawood/status/1321838253788532736?s=20

-

Comment by Riaz Haq on November 12, 2020 at 4:23pm

-

October #remittances to #Pakistan grow 14% to $2.3 billion, the 5th consecutive month above $2 billion. Remittances up 26.5% to $9.4 billion during the first 4 months of FY21, compared with July-Oct FY20. #economy #ImranKhan #PTI- Profit by Pakistan Today https://profit.pakistantoday.com.pk/2020/11/12/october-remittances-...

Workers’ remittances amounted to $2.3 billion during October 2020, showing an increase of 14.1 per cent when compared with October 2019.

This is for the fifth consecutive month that workers’ remittances remained above $2 billion, according to latest figures released by the State Bank of Pakistan (SBP) on Thursday.

A large part of the year-on-year (YoY) increase in October this year, 30pc, was sourced from Saudi Arabia, 16pc from the United States of America and 14.6pc from the United Kingdom (UK).

“Improvements in Pakistan’s FX market structure and its dynamics, efforts under the Pakistan Remittances Initiative (PRI) to formalise the flows and limited cross-border travelling contributed to the growth in remittances,” the SBP stated.

Meanwhile, on a cumulative basis, workers’ remittances rose 26.5pc to $9.4bn during the first four months of FY21, when compared with July-Oct FY20.

“These numbers were expected. The whole South Asia region is getting above-average inward remittances due to lockdown and reduction in flights and movement of unofficial funds,” said Muhammad Sohail of Topline Securities.

“In the short-run, this [the increase in remittances] will support local currency,” he added.

Earlier, a World Bank report had projected that remittances to Pakistan to grow at about 9pc in 2020, totalling about $24bn.

The World Bank attributed this increase to the diversion of remittances from informal to formal channels due to the difficulty of carrying money by hand under travel restrictions.

-

Comment by Riaz Haq on December 11, 2020 at 7:40am

-

#Remittances from Overseas #Pakistanis remain above $2 billion. In aggregate, remittances rose to an unprecedented $11.8 billion during the 5-month period Jul-Nov FY21, 26.9% higher than the same period last year.- Business & Finance - Business Recorder

https://www.brecorder.com/news/40040135/trend-continues-remittances...

Continuing with the trend, remittances sent home by overseas Pakistanis remain above $2 billion mark for the 6th consecutive month.

As per the State Bank of Pakistan (SBP), workers’ remittances maintained their strong momentum in November, remaining above $2 billion for a record sixth consecutive month. They rose to $2.34 billion, showing an increase of 2.4 percent over the previous month, while compared to the same period last year increased by 28pc.

As per the central bank data during the first five months of FY21, workers’ remittances have reached an unprecedented level of US$ 11.77 billion, 26.9 percent higher than the same period last year.

On average, workers’ remittances have been about half a billion (US$ 499 million) higher in each month of FY21 as compared to the same period last year.

Remittance inflows during the first five months of FY21 have mainly been sourced from Saudi Arabia ($ 3.3 billion), United Arab Emirates ($ 2.4 billion), United Kingdom ($ 1.6 billion) and United States ($ 1.0 billion).

SBP was of the view that this significant growth reflects continued government and SBP efforts to formalize remittances under Pakistan Remittances Initiative (PRI), growing use of digital channels amid limited international travel, orderly exchange market conditions and improved global economic activity.

Despite the COVID-19 pandemic, Pakistan's workers' remittances have managed to post strong growth, back in October home remittances sent by overseas Pakistan amounted to $ 2.3 billion, increasing by 14.1pc compared to October 2019.

Since June the country is receiving over $2 billion in home remittances monthly. In June, remittances amounted to $2.47 billion were arrived, while the country received highest-ever workers' remittances $2.76 billion in July.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

Agriculture, Caste, Religion and Happiness in South Asia

Pakistan's agriculture sector GDP grew at a rate of 5.2% in the October-December 2023 quarter, according to the government figures. This is a rare bright spot in the overall national economy that showed just 1% growth during the quarter. Strong performance of the farm sector gives the much needed boost for about …

ContinuePosted by Riaz Haq on March 29, 2024 at 8:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network