PakAlumni Worldwide: The Global Social Network

The Global Social Network

Construction and Manufacturing Driving Double-Digit Growth in Pakistan Cement and Steel Production

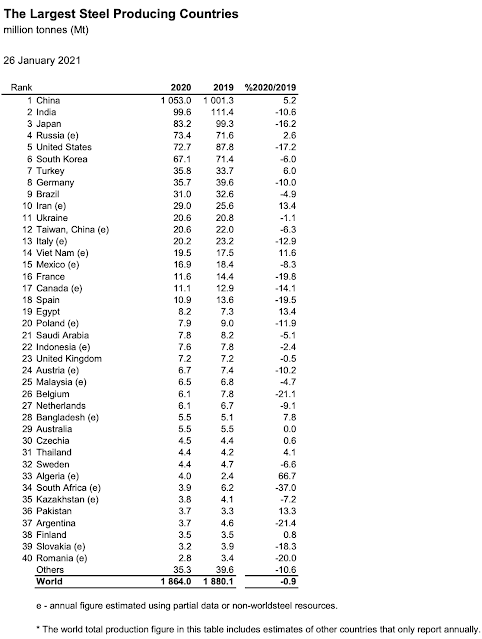

Pakistan steel production grew by 13.3% in 2020, the second fastest among the top 40 steel producing countries, according to data published by the World Steel Association. At the same time, Pakistan Bureau of Statistics revealed that the nation's steel imports rose by 18% year-over-year. The demand for steel was driven by construction and manufacturing sectors which are leading Pakistan's economic recovery.

|

| World Steel Production. Source: World Steel Association |

Pakistan steel-makers produced 3.7 million tons of steel in 2020, up 13.2% from 3.2 million tons in 2019. Neighboring India saw 10.6% decline in steel production in the same period. Global steel production declined 0.9% in 2020. Pakistan also imported $2.1 billion worth of iron, steel and scrap in the first 7 months (July 2020- January 2021) of the current fiscal year. It's a jump of 18% from the same period in prior fiscal year. Pakistan steel industry reached peak production of 5 million tons in 2017 before declining to 4.7 million tons in 2018 and 3.3 million tons in 2019.

Construction boom helped Pakistan grow its domestic cement consumption by 17% in the first 7 months (July 2020-January 2021) of the current fiscal year. Domestic cement sales rose to 27.65 million tons in this period, while exports grew by 10.23% to 5.71million tons from 5.186 million tons in the same period last year. The total cement sales (local and exports) were 33.36 million tons, up 15.77% over the corresponding period of the last fiscal year.

Related Links:

Pakistan to Become World's 6th Largest Cement Producer By 2030

Pakistan's Response to COVID19 Pandemic

Pakistan Digital Economy Surged 69% Amid Covid19 Pandemic

Soaring Food Prices Hurting Pakistanis

Najam Sethi on Desperation in PDM Ranks

India's Firehose of Falsehoods Against Pakistan

-

Comment by Riaz Haq on February 28, 2021 at 6:52pm

-

Economic indicators, social spending on upward trajectory

https://nation.com.pk/26-Jan-2021/economic-indicators-social-spendi...

The Pakistan Tehreek-i-Insaaf (PTI) government has started yielding results in the form of improved economic indicators which was providing necessary cushion to further strengthen the social safety nets.

The government managed to put the economy back on track by introducing financial discipline and taking politically tough and unpopular decisions. “Putting the economic indicators back on the positive trajectory was a herculean task for the present government as it inherited an economy with a major balance of payment crisis which led to high inflation and low growth,” said a press release issued on Monday.

The Large Scale Manufacturing (LSM) has shown significant growth so far in the current fiscal year. The LSM grew by 7.4 percent in October and 14.5 percent in November which was the highest monthly growth in twelve years. The manufacturing recovery was also becoming broader with 12 out of 15 sub sectors registering positive growth leading to employment generation, officials say.

The incentives given to the industries including the construction sector have triggered an economic activity in the country, it said. It further said that with the industries operating at its full capacity, there has been a significant increase in the exports and the exports reached to $2.3 billion in December 2020, highest in seven years.

The exports of textile industry, it added went up by US $1.4 billion in December 2020, thus achieving the highest ever growth for any month and cement sale witnessed highest ever sale in October 2020.

Regardless of debt servicing of about US $10 billion annually, the foreign exchange reserves have reached about US $ 20 billion, highest since January 2018.

It further said that commercial bank deposits have witnessed highest growth in eighteen years. The current account has shown a surplus of US $1.6 billion during first five months of current financial year against a deficit of $1.7 billion in the corresponding period last year.

There has also been the lowest rise in the external debt in the financial year 2020 and that the loans taken by the present government were used to retire the ones taken by the previous governments.

“Pakistan’s improved ranking in the Ease of Doing Business index and the steps taken to facilitate the investors will also attract both foreign and domestic investments,” it said adding that apart from bringing improvement in economy, the government was also focusing to provide relief to the disadvantaged segments of the society.”

The budget of Ehsaas program has been doubled if compared with that of the year 2018. The cash assistance provided to millions of deserving families in most transparent manner in the wake of Covid-19 outbreak helped to protect and mitigate the sufferings of vulnerable segments of society.

Similarly, the Sehat Sahulat Cards scheme was being implemented on fast track basis both in Punjab and Khyber Pakhtunkhwa provinces which will bring a visible change in the lives of the people.

-

Comment by Riaz Haq on March 5, 2021 at 6:21am

-

#Asian Dev Bank says #Pakistan holds potential for rapid #economic growth. ADB will support #infrastructure, #agribusiness, and #finance sector #investments to boost competitiveness and private sector development, create jobs and drive #market innovation. https://www.thenews.com.pk/print/799135-adb-says-pakistan-holds-pot...

“Under vision 2025, the country aims to achieve upper middle-income status and provide quality jobs to its growing labor force. But Pakistan has struggled with boom-and-bust cycles in previous years due to low export capacity, weak domestic revenue, and other systemic challenges,” ADB Country Director for Pakistan Xiaohong Yang said. “This has been exacerbated by the coronavirus disease (COVID-19) pandemic, which caused a sharp downturn in 2020 and is likely to push more people into poverty,” she said in an interview. “Pakistan has the potential to become a regional hub for trade and economic activity, but greater cooperation is impeded by weak connectivity and trade links.”

In response to the pandemic, ADB is taking major steps in providing critical finance for the government to implement its pro-poor fiscal and monetary policy, introducing best practice, building capacity, and sharing knowledge through close partnerships with all stakeholders. Manila-based lender financed and co-financed $2 billion loans to help Pakistan overcome the pandemic challenges. The ADB already endorsed a new country partnership strategy for 2021–2025, designed to help restore economic stability and growth.

Yang said ADB will deploy its sovereign and nonsovereign operations to support infrastructure, agribusiness, and finance sector investments. It will target reforms that boost competitiveness and private sector development, create jobs and drive market innovation. Recently issued local currency linked bonds will allow ADB non-sovereign operations to engage sectors like education, health and manufacturing. Yang said flagship projects such as the Turkmenistan–Afghanistan–Pakistan–India pipeline project and the Turkmenistan–Uzbekistan–Tajikistan–Afghanistan–Pakistan electricity project will contribute to Pakistan’s energy security. Sanitary and phytosanitary measures to promote agricultural trade will be improved and aligned with international standards. The country will also benefit from the development of regional and national tourism, as well as regional approaches to fighting pandemics.

ADB will seek to enhance productivity and well-being by improving education, nurtrition, health systems, clean water and sanitation, affordable housing, and social protection. ADB will promote system-wide reforms on skills development, and investments in secondary education with a special emphasis on increasing girls’ enrollment. The challenge of out-of-school children will also be addressed through support for Ehsaas Kafalat conditional cash transfers for primary education, targeting children, particularly girls, from poor and vulnerable households. ADB will also continue to support disaster risk reduction and management, including investments in irrigation infrastructure which will make Pakistan more resilient to water shortages, future flooding, and food security, said its country’s representative.

-

Comment by Riaz Haq on March 6, 2021 at 6:36pm

-

#Construction Boom in #Pakistan: #Cement sales soar 14% to 37.95 million tons in first 8 months of current fiscal year, up from from 33.31m tons in the same period last fiscal year. #Exports also grew 6.62% to 6.33m tons from 5.94m tons in 8MFY20. #COVID19 https://www.dawn.com/news/1610422

Overall cement sales posted a growth of 14 per cent to 37.95 million tonnes in 8MFY21 from 33.31m tonnes in the same period last fiscal year.

Local dispatches increased by 15.51pc to 31.62m tonnes in 8MFY21 from 27.37m tonnes in the same period last year. Exports also grew 6.62pc to 6.33m tonnes from 5.94m tonnes in 8MFY20.

As per data of the All Pakistan Cement Manufacturers Association (APCMA) released on Tuesday, North-based mills dispatched 26.82m tonnes for domestic consumption during 8MFY21, a jump of 15.29pc compared to the same period last year which was 23.26m tonnes. Exports from North were 1.63m tonnes, down by 9.83pc from 1.81m tonnes during the same period of last year.

South-based mills dispatched 4.79m tonnes in the domestic market during 8MFY21 which was 16.73pc higher than 4.11m tonnes dispatched during the corresponding period of last year. Exports from South were 4.70m tonnes, depicting a rise of 14pc over exports of 4.13m tonnes during the same period last year.

Rising cost of electricity and coal have led to increase in the cost of cement production, which is becoming difficult for the cement industry to absorb, a spokesperson for the APCMA said.

In February, cement sector showed 2pc growth to 4.577m tonnes as compared to 4.489m tonnes during Feb 2020.

Local cement dispatches in February witnessed a 6pc hike to 3.961m tonnes as compared to 3.735m tonnes in the same month of 2020. Exports continued a declining trend as seen during the last three months. Total exports dropped by 18.24pc from 753,444 tonnes in Feb 2020 to 616,030 tonnes in February.

During February, the North-based factories sold 3.28m tonnes locally, up by three per cent from 3.17m tonnes in Feb 2020, while sale of South-based mills stood at 683,384 tonnes for local consumption which was 21.49pc higher than 562,501 tonnes in Feb 2020.

Exports from North-based mills decreased by 7.71pc to 186,595 tonnes in February from 202,181 tonnes in Feb 2020 whereas the exports from South decreased by 22pc to 429,435 tonnes in February from 551,263 tonnes during the same month last year.

According to Topline Securities, cement prices averaged at Rs601 per 50kg bag in the Northern region while prices remained unchanged at Rs610-615 in the Southern region.

-

Comment by Riaz Haq on March 7, 2021 at 11:29am

-

#Pakistani rupee enjoying smart recovery as #economy recovers. From a high of 168 against the #US dollar seen during the last year when pandemic started, the rupee has appreciated by 6.5% and is currently trading near 158 levels. #exports #remittances https://www.khaleejtimes.com/business/economy/pakistani-rupee-enjoy...

Pakistan's rupee has staged a smart recovery against the US dollar on positive economic indicators, and experts believe it will continue its upward trend despite some challenges ahead.

Analysts and market experts said the currency will be a major beneficiary of higher GDP growth, rising foreign exchange reserves and consistent remittances inflows of over $2 billion during the first eight months of the current 2020-21 financial year.

The rupee has so far appreciated 1.7 per cent against the dollar this year and closed at 157.12 on the interbank market on Friday. Against the UAE dirham, it ended slightly up at 42.77 against 43.6 on January 8, reflecting an appreciation of 1.9 per cent.

“The Pakistani rupee has returned to stability chiefly due to higher remittances, debt relief on account of Covid-19 payment relief plan and economic rebound in the country,” experts said.

Latest central bank data indicates that Pakistan’s economy is expected to post 2.5 per cent GDP growth in the current fiscal year ending June 2021 after contracting 0.4 per cent last year as the government’s policy measures start yielding positive results.

The country registered a 24 per cent year-on-year increase in workers’ remittances to $16.5 billion during the July 2020-January 2021 period, while foreign exchange reserves rose to $20.13 billion during the week ended February 26 from $20.04 billion a week ago, according to the State Bank of Pakistan (SBP).

“The forex reserves held by the central bank increased $70 million to $12.978 billion due to the government’s official inflows. The foreign exchange reserves of commercial banks also increased to $7.155 billion from $7.132 billion,” the SBP said.

The central bank data also showed that Pakistan’s current account deficit shrank by 55 per cent on a year-on-year basis to $229 million in January from $512 million in the same month last year due to rising exports and higher remittances.

Devesh Mamtani, chief market strategist at Century Financial, said the rupee sustained an upward trend on account of positive economic indicators, but some challenges will keep the currency under pressure in 2021.

“From a high of 168 against the US dollar seen during the last year when pandemic started, the rupee has appreciated by 6.5 per cent and is currently trading near 158 levels. A wave of positive factors have helped the rupee to gain strength over the past year. This includes factors like resumption of the IMF’s [International Monetary Fund’s] $6 billion lending facility, narrowing of current account deficit and G20 lenders’ agreement for a second debt relief for Pakistani economy. The resumption of the IMF bailout programme is especially a huge win for the economy as had it been stalled last year owing to the pandemic,” Mamtani said.

-

Comment by Riaz Haq on March 19, 2021 at 5:10pm

-

Houses, flats for 1,500 Pakistani labourers under Naya Pakistan Housing project

https://www.thenews.com.pk/latest/806196-1500-pakistani-labourers-t...

It is very difficult for the salaried class, workers and laborers to construct or purchase a house in the cities due to soaring prices of land, Prime Minister Imran Khan said Thursday.He was addressing a ceremony in Islamabad in connection with allotment of 1,500 houses and flats to the working class under the Naya Pakistan Housing programme.

The premier said the government has started the Naya Pakistan Housing project with a new mindset to provide support to these segments of society to own a house.

The ceremony started with a short speech by the PM's aide on Overseas Pakistanis Zulfi Bukhari, who said that in the first phase of this project completed by Workers Welfare Fund, 1008 flats and 500 houses have been constructed.

For the first time, workers and labourers are being provided with their own roof on mortgage basis, Minister for Communications and Postal Services Murad Saeed had said.

Under this scheme, houses will be distributed among widows and disabled, besides labourers on ownership rights to those who are earning less than Rs 0.5 million.

The premier said the government has introduced a legislation under which banks will provide loans on 5% interest rate for the construction of houses.

He said banks have promised to set aside Rs380 billion for this purpose.

Imran Khan said there is a boom in the construction industry due to the incentives given by the present government. He said this will not only lead to wealth creation but also provide job opportunities to the youth.

-

Comment by Riaz Haq on March 22, 2021 at 8:23pm

-

#Pakistan's current account #deficit falls 76% to $50m in Feb, from a deficit of $197m in Feb 2020, the 3rd consecutive month the current account has seen a deficit, after a surplus for 5 months in a row. #Exports rise 8% & #remittances jump 24%. #economy https://www.dawn.com/news/1613970

The current account showed a surplus of $881 million during the first eight months of FY2021.

Pakistan’s current account deficit (CAD) for February declined 75 per cent year-on-year (YoY) and 76pc month-on-month (MoM) to $50 million, compared to a deficit of $197m in Feb 2020 and $210m last month.

This marks the third consecutive month the current account has recorded a deficit, after registering a surplus for five months in a row.

Overall, during the first eight months of FY21, the current account shows a surplus of $881m compared to a deficit of $2.74 billion in the corresponding period last year.

The narrowing of the deficit in February is largely attributable to continued strong growth in workers’ remittances and a sustained recovery in exports since November 2020, which more than offset the increase in imports due to domestic food shortages and recovering economic activity.

In February, the MoM improvement was due to a 45pc decline in primary income deficit, whereas the YoY improvement was attributable to 8pc and 24pc rise in total exports and remittances, respectively.

Total exports (goods and services) during the month jumped 3pc to $2.65bn compared to the $2.58bn logged in the previous month. Similarly, on a yearly basis, total exports witnessed an increase of 8pc in Feb 2021 against $2.46bn in Feb 2020.

In contrast, the combined imports of goods and services during the month under review grew 2pc to $5.184bn as opposed to $5.07bn recorded in January. On a yearly basis, overall imports of goods and services soared 17pc from $4.437bn in February last year.

This resulted in a trade deficit of $2.535bn in Feb 2021, up 1pc MoM and 28pc YoY.

Cumulatively, during 8MFY21, total exports stood at $19.87bn, shrinking 2pc YoY, whereas total imports grew 4pc YoY to $37.296bn, resulting in a trade deficit of $17.42bn, up 13pc YoY.

Workers' remittances by overseas Pakistanis registered a growth of 24pc YoY to $2.26bn during Feb 2021, while on a monthly basis they remained flat.

During the first eight months of FY 21, the continued healthy growth in inflows took the cumulative figure to a record level of $18.74bn, up 24pc YoY.

-

Comment by Riaz Haq on March 26, 2021 at 9:29pm

-

Pact signed to assemble European brand vehicle

https://www.dawn.com/news/1614622

The Lucky Motor Corporation (LMC), manufacturer and distributor of Kia vehicles, entered into a Licence and Technical Assistance Agreement this week with the Stellantis Group to assemble and distribute one of their European brands in Pakistan.

The Stellantis Group is the world’s fourth largest car group which was recently formed and it contains a portfolio of 14 international brands.

The LMC in mid-2019 had signed an MoU and expression of interest (EoI) with Groupe PSA which is now part of the Stellantis Group. Last year before achieving the manufacturing licence under the government’s new entrant policy, the LMC (then known as Kia Lucky Motors) had informed the government of its intentions to partner with Peugeot, a brand of the Stellantis Group.

-

Comment by Riaz Haq on March 30, 2021 at 12:44pm

-

#Pakistan selling US$ #bonds on global market for the first time since $2.5 billion were raised in 2017. New Pricing: $1 billion 5-year note at 6%. $1 billion 10-year note at 7.375%. $500 million 30-year bond at 8.875%. It follows #IMF deal resumption https://www.bloomberg.com/news/articles/2021-03-30/pakistan-starts-...

Pakistan is selling a $2.5 billion dollar bond that will be a key test of investor sentiment after the resumption of a $6 billion bailout program with the International Monetary Fund.

The South Asian nation is offering the notes in three parts, people familiar with the matter said, asking not to be identified because they’re not authorized to speak about it.

The debt deal comes amid a flurry of developments in recent days, as Pakistan’s economy grapples with continued fallout from the pandemic. Prime Minister Imran Khan named a new finance minister on Monday, its third finance chief in less than three years. The IMF was set to release about $500 million to the country as the lender’s board completed certain reviews of a $6 billion bailout program, according to a statement last week.

Pricing for the offering is as follows, according to the people familiar:

The $1 billion five-year note will yield 6% after initial discussions of 6.25% area

The $1 billion 10-year note will yield 7.375% after initial discussions of 7.5% area

The $500 million 30-year bond will yield 8.875% after initial discussions of 8.875%-9%

Fair value is at high-5% for the five-year securities, low-7% for the 10-year portion and high-8% for the 30-year bond, according to Nicholas Yap, credit analyst at Nomura International (HK) Ltd.

The “bonds should see decent investor demand following a number of positive developments in the country of late” including the IMF loan resumption, Yap wrote in a report Tuesday.

The government plans an “international Sukuk transaction sometime after the Eurobond issuance,” the finance ministry said in a reply to questions last week. The country expected to raise more than $1.5 billion in global bonds if market conditions remained conducive, Muhammad Umar Zahid, director of debt at the ministry, said last month.

Credit markets have been busy this quarter, despite a run-up in rates in recent weeks. The Maldives, another non-investment grade sovereign borrower, sold a $200 million dollar five-year Sukuk security this week at 10.5%.

Pakistan is raising funds through the global market for the first time after pricing $2.5 billion of securities in 2017.

It’s doing so as the foreign exchange market sends more bullish signals.

Pakistan’s rupee has advanced to around its highest level against the dollar in nearly two years. It has gained about 4% so far in 2021, the only currency to strengthen against the dollar in Asia, according to a basket of currencies compiled by Bloomberg.

-

Comment by Riaz Haq on April 3, 2021 at 7:31am

-

#Pakistan #Cement sales jump 44.4% in March to 5.773 million tons from 3.722 million tons in the same period last year with huge increase in domestic consumption and exports. Total cement sales in July20-March21 were 43.325m tons, up 17% from last year. https://profit.pakistantoday.com.pk/2021/04/03/cement-sales-grow-re...

The cement sector posted the highest-ever monthly growth of 44.39 per cent in March at 5.773 million tonnes from 3.722m tonnes in the corresponding period last year due to a massive increase in domestic consumption and exports.

According to a local media report that compiled data released by the All Pakistan Cement Manufacturers Association (APCMA), local cement dispatches in March 2021 stood at 4.563m tonnes, up by 42pc compared to 3.214m tonnes in the same period last year whereas, exports surged by 60pc from 507,480 tonnes in March 2020 to 810,962 tonnes in March 2021.

During the month under review, cement mills in the North dispatched 3.809m tonnes to local markets against 2.749m tonnes in March 2020, up by 38.52pc. In March 2021, south-based mills dispatched 753,704 tonnes in domestic markets, which was 62.28pc higher than 464,440 tonnes in the same period last year.

Exports from North-based mills registered an enormous increase of 162.58pc as the volumes increased from 106,759 tonnes in March 2020 to 280,330 tonnes in March 2021.

Exports from the South rose by 32.42pc to 530,632 tonnes in March 2021 from 400,721 tonnes during the same month last year.

During the first nine months of the current fiscal year (9MFY21), total cement dispatches (domestic and exports) were 43.325m tonnes that was 17pc higher than 37.035m tonnes during the corresponding period of last fiscal year.

-

Comment by Riaz Haq on April 5, 2021 at 8:24pm

-

Federal Minister for Planning and Development Asad Umar said on Sunday afternoon said that Century Steel, a Chinese firm with an investment of US $240 million, would set up a steel mill in Rashakai Special Economic Zone (SEZ) which would produce about 1.5 million tons of steel.

https://gwadarpro.pk/1378965463858860033/chinese-company-to-produce...

Addressing the reception ceremony of the first consignment, carrying equipment and machinery for Century Steel at Karachi Port to set up a steel mill in the Rashakai SEZ, Umar said this occasion was another manifestation of exceptional relation between Pakistan and China.

He said the Chinese firm would also employ over 600 Pakistanis during the construction phase while in the second phase over 1000 people would be provided jobs.

According to an official statement, Umar said projects under China Pakistan Economic Corridor (CPEC) were progressing at a fast pace during the tenure of the incumbent government.

He informed that China Road and Bridge Corporation, (CRBC), a Chinese firm had entered into an agreement with Pakistan under CPEC to promote foreign investments for development and marketing in Rashakai SEZ.

He said the work for the provision of necessities including electricity and others at Rashakai SEZ was underway at a fast pace.

Asad Umar said CPEC was now entering into the most important second phase. The projects were now not limited to infrastructure only.

He said the bilateral relation between Pakistan and China was not new and whenever Pakistan needed a friend China was there.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

American Prof John Mearsheimer on International Geopolitics in South Asia

Professor John Mearsheimer, a renowned international relations expert known for his theory of "offensive realism", has recently spoken to India's CNN-News18 about the impact of US-China competition on geopolitics in South Asia. Sharing his thoughts in interviews on India-Pakistan conflict after the Pahalgam attack, he said: "There is really no military solution to this (Kashmir)…

ContinueHas Pakistan Destroyed India's S-400 Air Defense System at Adampur?

Pakistan claims its air force (PAF) has destroyed India's high-value Russian-made S-400 air defense system (ADS) located at the Indian Air Force (IAF) Adampur air base. India has rejected this claim and posted pictures of Prime Minister Narendra Modi posing in front of its S-400 rocket launchers in Adampur. Meanwhile, there are reports that an Indian S-400 operator, named Rambabu Kumar Singh, was killed at about the time Pakistan claims to have hit it. Pakistan is believed to have targeted…

ContinuePosted by Riaz Haq on May 21, 2025 at 4:00pm — 3 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network