PakAlumni Worldwide: The Global Social Network

The Global Social Network

Indian Economy Shrank in USD Terms in 2012-13 as Global Economy Slowed

Sharp fall in Indian currency against the US dollar and slower economic growth have caused India's GDP for Fiscal Year 2012-13 to shrink in US $ terms to $1.84 trillion from $1.87 trillion a year earlier. The Indian rupee has plummeted from 47.80 in 2012 to 54.30 to a US dollar in 2013, according to Business Standard. Since this report was published in Business Standard newspaper, Indian rupee has declined further against the US dollar to Rs. 59.52 today. At this exchange rate, India's GDP is down to $1.68 trillion, about $200 billion less than it was in Fiscal 2011-12.

|

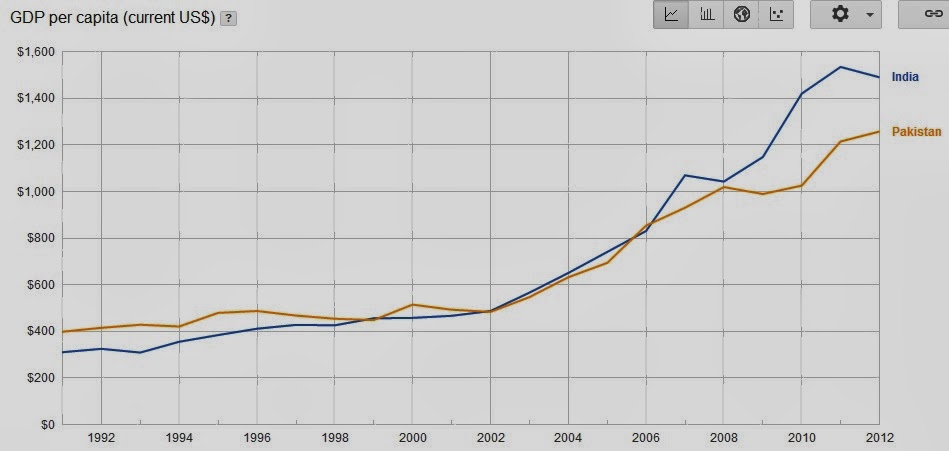

| Pakistan GDP Per Capita 1990-2012 Source: World Bank |

|

| Indian GDP Growth Rates 2004-2013 |

India's economy grew by 5.0% in 2012-13, its slowest annual rate in a decade, down from 6.2% last fiscal year. In the fourth quarter ending in March, gross domestic product grew by 4.8% year-over-year, slightly higher than the previous quarter when it expanded by 4.5%, according to Indian government data.

In the January-March quarter, the manufacturing sector increased output by just 2.6%, while production in the country's mines shrank by 3.1%.

Global ratings agency Standard and Poor's warned in May that India faces at least "a one-in-three" chance of losing its prized sovereign grade rating amid new threats to economic growth and reforms.

India's BBB-minus investment rating is already the lowest among BRICS and cutting it to "junk status" would raise the country's hefty borrowing costs.

The Organisation for Economic Cooperation and Development (OECD) this week lowered its projection of India's GDP growth this year to 5.3%, from 5.9% earlier.

Meanwhile, Pakistan's economy continues to struggle with its annual GDP rising just 3.6% to $252 billion ($242 billion at Rs. 100 to a USD exchange rate) in fiscal 2012-13, according to Economic Survey of Pakistan 2012-13 estimates based on 9 months data. The country is facing militancy and energy shortages impacting its economy.

Other world economies have also slowed down. US is slowly recovering but Europe is still struggling. BRIC growth rates are also slowing. China is slowing with its workforce aging and shrinking. In India, the slow pace of reform is hurting its growth, and Brazil and Russia are struggling with slowing demand for their export commodities.

Africa has replaced Asia as the continent with most of the world's fastest growing economies, according to The Economist magazine. The top 10 fastest growing economies in the world are: Macau, Mongolia, Libya, Gambia, Angola, Bhutan, China, Timor-Leste, Iraq and Mozambique.

China and the US , the two largest economies, still continue to be the bright spots and the main locomotives of the world economy, offering hope of global economic recovery.

Related Links:

Haq's Musings

India's Hyphenation: India-Pakistan or India-China?

India's Share of World's Poor Jumps as World Poverty Declines

Forget Chindia--Chimerica Will Rescue the World

World Bank on Poverty Across India

Superpoor India's Superpower Delusions

Are India and Pakistan Failed States?

India Home to World's Largest Number of Poor, Hungry and Illiterate

India Leads the World in Open Defecation

India Tops in Illiteracy and Defense Spending

Indians Poorer than sub-Saharan Africans

-

Comment by Riaz Haq on June 29, 2013 at 4:56pm

-

Here are a couple of excerpt from Pakistan Economic Survey 2012-13 Highlights:

The per capita income in Rupee term has increased from Rs. 118,085/- to Rs. 131,543/- in outgoing fiscal year as compared to last year. In dollar terms it increased from $ 1,323 to $ 1,368 in 2012-13 as compared to last year. Per Capita Income in dollar terms grew at a rate of 3.4 percent in 2012-13 as compared to 3.8 percent growth last year.

-----------

Total population is estimated 184.35 million during the year 2012-13 however, in 2011-12 the

population was 180.71 million.This puts total Pak GDP in US dollar terms at $242 billion at Rs 100 to a US dollar exchange rate.

http://www.finance.gov.pk/survey/chapters_13/HGHLIGHTS%202013.pdf

-

Comment by Riaz Haq on June 29, 2013 at 11:22pm

-

Here's an excerpt from The Economist Magazine on India's Economy:

The prospects of a revival have only been complicated by the possible winding down of quantitative easing (QE) in America. India has been a voracious consumer of the hot money that has sloshed around the world in recent years, using it to plug its balance-of-payments gap. On June 26th the rupee hit a record low of 61 per dollar. It has been the weakest emerging-market currency in the past month. Credit-default swaps on State Bank of India, a proxy for the riskiness of India’s government debt, have risen towards the levels of a year ago. India is the riskiest big emerging economy on this measure. Indian officials have been wheeled out to utter the dreaded words: “Don’t panic.”

Rupeeasy does it

Are the officials right? An apocalyptic scenario is that equity investors and multinational firms head for the exit. They form the vast bulk of the stock of foreign capital in India. This is unlikely. India is still growing faster than most countries and plenty of outsiders remain beguiled. In April Unilever offered $5 billion to buy out minority shareholders in its Indian unit. Net outflows of equity investments have been small so far.Foreign bondholders are far less loyal. They have withdrawn $6.5 billion since mid-May. But the stock of external debt is a lowish 21% of GDP. Providing existing equity investors and multinationals stay put, India can probably handle a debt-buyers’ strike. Foreign reserves are 1.6 times likely financing requirements in the next year (defined as the current-account deficit plus short-term debt).

And although the world has got less forgiving as the end of QE looms, India’s stability has improved in some ways since last year. The government’s one unambiguous success is the public finances. Borrowing is still high but under Palaniappan Chidambaram, the finance minister since last August, it is no longer reckless. Control of spending and cuts in subsidies of fuel should mean the overall deficit in the year to March 2014 is 7% of GDP, according to Chetan Ahya of Morgan Stanley. For a while a deficit of 10% seemed possible. At this lower level India’s ratio of debt to GDP should be stable.

-------------

If deep reform is off the agenda, the government can still try the old approach of cranking the bureaucratic machine harder. Mr Chidambaram, once viewed as insufferable, is now praised by Mumbai’s tycoons for taking notes as they grumble about stalled projects. Since December a new committee headed by the prime minister, Manmohan Singh, has tried to push forward projects tangled in red tape: Mr Singh now personally reviews the rules for digging mud near road projects, for instance. But the committee has not made a meaningful difference. On The Economist’s count, the fresh capital investment it has sanctioned (rather than discussed or delegated to other bodies) amounts to 0.4% of GDP, spread over several years....http://www.economist.com/news/finance-and-economics/21580167-despit...

-

Comment by Riaz Haq on July 4, 2013 at 10:00pm

-

Here's a Reuters' report on GS analyst calling investments in emerging markets a "costly mistake":

LONDON, July 4 (Reuters) - Investors who wrongly called time on U.S. economic supremacy during the financial crisis are set to pay a hefty price for betting too much on the developing world, according to a top Goldman Sachs strategist.

The U.S. investment bank helped inspire a twenty-fold surge in financial investment in China, India, Russia and Brazil over the past decade, its chief economist popularising the term BRICs in a 2001 research paper.

Sharmin Mossavar-Rahmani, in charge of shaping the portfolios of the bank's rich private clients, has been arguing against that trend for four years, however, trying to persuade investors and colleagues they were safer sticking with the developed world.

The past six months has substantially vindicated that view. China's boom is finally wobbling under the weight of economic imbalances including an undervalued currency, and emerging stock markets are down 13 percent compared to an 11 percent rise in the U.S. S&P 500 index over the same period.

"Many investors and market commentators have been too euphoric about China over the last decade and this euphoria is finally abating. Many just followed the herd into emerging markets and over-allocated to many of the key countries," she says.

"It is easier to be part of the herd even if one is wrong, than stay apart from the herd and be right in the long run."

The net gains for U.S. stock markets may just be a taste of the reassertion of western dominance that may emerge in the next few years, Mossavar-Rahmani argues.

Structural advantages like abundant mineral wealth, positive demographics and, most importantly, inclusive, well-run political and economic institutions make the United States the best bet going forward, she says.

"(Emerging market) investors are taking on so many risks compared with the U.S. where the risk is largely cyclical rather than structural," she says.

Many of the cyclical issues affecting the U.S. such as high levels of debt, are also on their way to being resolved.

"One thing that normally puts investors off from increasing their U.S. holdings is the long term debt profile, but we think the magnitude of the work done to address this has been underappreciated by investors," she says.

WEST IS BEST

The idea that authoritarian countries are less effective than open economies like the U.S. at incentivising entrepreneurship and innovation is long accepted in academia.

Daron Acemoglu and James Robinson laid out the case for doubting the emerging power of China and others in a book 'Why Nations Fail' last year, arguing poor institutions that entrench inequality will hamper a country's path to prosperity.

But this view was largely put aside by professional investors who allowed themselves to be swept up in a "mania" about the rewards up for grabs in emerging markets, especially China....

-

Comment by Riaz Haq on July 8, 2013 at 4:18pm

-

Here's a Hindu newspaper report on Indian corporate foreign debt:

July 8, 2013:

India’s international investment position (IIP) saw significant deterioration in the year-ended March 31, 2013. The country’s net liabilities to other countries rose by $57.8 billion to $307.8 billion over the course of the year. This caused the net IIP to worsen from a negative 14 per cent of GDP to a negative 16.7 per cent.The International Investment Position compares what India owes to entities located overseas (liabilities) relative to what it is owed by foreign entities (assets). In recent years, India’s liabilities have been expanding while assets have stagnated.

FDI DOWN

Liabilities have soared on the back of exporters taking more short term credit, and loans and deposits flowing in from overseas. A break-up of the country’s international liabilities indicates that overseas trade credit, loans and deposits extended to India, grew by 13.8 per cent in 2012-13 from 2011-12 levels. This amounted to 18.4 per cent of GDP in March 2013, up from 16.8 per cent in 2012-13.

This was a weak year for inbound foreign direct investments, which grew only by 5.1 per cent. Portfolio investment expanded by 10.4 per cent during the year. This was mainly in the form of equity inflows.

In contrast, Indian companies remained rather cautious about investing across the border. International assets — which capture investments in foreign currency — stagnated at 24.3 per cent of GDP compared to 24.5 per cent a year ago. This was driven by the 0.8 per cent decline in the foreign exchange reserves.

Portfolio investments by Indian companies fell by 6.6 per cent, but direct investments overseas rose by 6.3 per cent. This depicts the value of the country’s direct investment abroad, portfolio investments, equity and debt security investments, trade credits, loans and reserve assets, among others, as a proportion of its cumulative economic output in a given year.

The ratio of net foreign liabilities to GDP is regarded as an indicator of default risk. This indicates that the country’s liabilities to external parties have been rising as a proportion of its economic output.

http://www.thehindubusinessline.com/economy/india-owes-more-to-over...

-

Comment by Riaz Haq on July 11, 2013 at 8:40am

-

As of 2012, the World Bank data shows Pakistan's PPP GDP is $518 billion.

The World Bank data also shows that Pakistan's economy is now the 23rd largest in the world in terms of PPP, up from 26th largest in 2008.

http://data.worldbank.org/indicator/NY.GDP.MKTP.PP.CD/countries/ord...

http://www.riazhaq.com/2009/11/is-pakistan-too-big-to-fail.html

-

Comment by Riaz Haq on August 2, 2013 at 11:00pm

-

Here's India Today on Goldman Sachs' downgrade of Indian economy:

US investment bank Goldman Sachs on Thursday downgraded its ratings on Indian stocks, calling them underweight as the rupee continued to tumbling against the dollar and economic growth remains sluggish.

The bank said the external funding environment has also become challenging causing the Reserve Bank of India (RBI) to tighten liquidity.

The bank also expected corporate earnings to grow at 5 per cent for the current fiscal year and 11 per cent for the next year, below consensus estimates.

"Recent activity data in the second quarter of 2013 has been sluggish with no signs of a pick-up in investment demand... Against a backdrop of lower growth, tighter liquidity and rising macro vulnerabilities, we downgrade India to underweight," the bank said.

"Our forecast for the dollar-rupee remains at 60 for the year but we expect continued weakness to 65 through 2016. The rupee remains inexpensive relative to our fair value estimate of dollar-rupee 65 which also suggests the currency can continue to weaken," it said.

"We even think that there is a greater probability of the RBI keeping liquidity tight even beyond 6 months, and hiking policy rates as well, rather than cutting them," it said.Read more at: http://indiatoday.intoday.in/story/goldman-sachs-says-indian-stocks...

-

Comment by Riaz Haq on August 2, 2013 at 11:26pm

-

With Indian rupee's free fall to 61.10 to a US dollar, Indian GDP in USD terms is down to about $1.64 trillion based on Rs. 100.2 trillion divided by 61.10

-

Comment by Riaz Haq on August 9, 2013 at 4:41pm

-

Here's Wall Street Fool on coming "collapse" of Indian economy:

I hate being a narcissist and an ego-maniac, but the truth is: I TOLD YOU SO.

If you haven’t already, I highly recommend READING THIS ARTICLE, that I had written last month (April 2013), and THIS ARTICLE (May 2013), outlining the exact process/method/path to India’s Inevitable Economic Collapse. Needless to say, India’s GDP just took a dump + The Reserve Bank of India (RBI) insisting that it wont cut rates as there is a significant UPSIDE RISK TO INFLATION, spooking investors and resulting in a highly coordinated (Panic) sell-off.

Here’s the piece from Times of India:

Pulled down by poor performance of farm, manufacturing and mining sectors, economic growth slowed to 4.8% in the January-March quarter and fell to a decade’s low of 5% for the entire 2012-13 fiscal.

Belying hopes of further rate cuts, the Reserve Bank governor D Subbarao’s comments that there are still upsides risks to inflation spooked stock markets. Additionally, RBI’s concern about widening country’s current account deficit amid rupee falling to over 10-month lows, also put pressure.

In this realm of reality, that we all inhabit, you simply cannot have both, Economic Growth and Low Inflation at the same time. Something has to give.

So here’s what I think is gonna happen:

The market players (American Hedge Funds) are going to rob the RBI at gun-point, just like Greece, and no-one will be able to stop them. The RBI will cave, and go BOJ on everyone’s ass.

http://wallstreetfool.com/2013/05/31/indias-inevitable-economic-col...

-

Comment by Riaz Haq on August 9, 2013 at 4:58pm

-

Here's Hindustan Times on Indian stocks collapse:

Stung by the rupee hitting historic low, stock markets on Tuesday collapsed on all-round selling with the S&P BSE Sensex nosediving by 449.22 points to end below the 19,000-mark, edging India out of the trillion dollar club.

Sentiment was extremely poor on Dalal Street as the rupee plunged to record low of 61.80 against the US dollar, stoking fears of a higher current account gap as import costs surge.

The Bombay Stock Exchange 30-share barometer resumed weak and continued its downslide to end at 18,733.04, a steep fall of 449.22 points or 2.34 %. In the last ten trading sessions, Sensex has fallen in nine days while yesterday has managed to settle in positive terrain.

After today's plunge and the rupee's decline, India's market capitalisation stood at Rs. 60.18 lakh crore, which translates to $989 billion at exchange rate of 60.8 versus the dollar. The rupee retreated from record lows to trade at 60.8 levels at 1710 hours.

Dipen Shah, Head of PCG Research, Kotak Securities said: "Markets ended sharply lower on the back of continuing concerns about the rupee and some disappointing results. The rupee traded at a new low and that caused concerns in market." ...

http://www.hindustantimes.com/business-news/WorldEconomy/Stocks-plu...

-

Comment by Riaz Haq on August 9, 2013 at 6:20pm

-

Here's an Economist piece on India losing business and industry to overseas hubs:

Some service industries do seem to be shifting from India. India’s balance of trade in business and financial services has slipped into modest deficit from a surplus five years ago. The number of big India-related corporate legal cases at Singapore’s arbitration centre has doubled since 2009, to 49 last year. It is setting up a Mumbai office to win more business. Trading of equity-index derivatives has shifted—a fifth of open positions are now in Singapore and DGCX, a Dubai exchange, is launching two rival products this year. A recent deal by Etihad, the airline of Abu Dhabi, to buy a stake in Jet, an Indian carrier, should see more long-haul traffic shift to the Gulf. (Jet’s boss, Naresh Goyal, lives in London.) More rupee trading seems to be taking place offshore.

The biggest worry is that heavy industry is getting itchy feet. Coal India, a state-owned mining monopoly sitting on some of the world’s biggest reserves, plans to spend billions of dollars buying mines abroad—red tape and political squabbles mean it is too difficult to expand production at home.

Some fear manufacturing is drifting offshore. In the five years to March 2012, for every dollar of direct foreign investment in Indian manufacturing, Indian firms invested 65 cents in manufacturing abroad. Some big firms such as Reliance Industries plan to invest heavily in India, but others such as Aditya Birla are wary. Its boss, Kumar Mangalam Birla, has said that he prefers to invest outside India—an echo of his father, who expanded in South-East Asia during India’s bleak years in the 1970s.

The Gulf has seen tentative signs of Indian manufacturers shifting base. Rohit Walia, of Alpen Capital, an investment bank, says that in the past year he has helped finance an $800m fertiliser plant and a $250m sugar plant. Both will be built in the United Arab Emirates, by Indian firms that will then re-export much of the output back home. The Gulf’s cheap power and easy planning regime make this more feasible than setting up a plant in India. “It’s a new trend,” says Mr Walia.

The temptation for India is to invent new rules to keep economic activity from moving abroad. In 2012 the government tried to override its treaty with Mauritius, only to scare investors so much that it had to back down. To try to plug its balance of payments, India is tightening rules on buying gold. The country’s ministry of finance is said to be examining the shift of currency-trading offshore. The government has intervened to insist that shareholder disputes arising from the Etihad-Jet deal be settled under Indian law—not English as originally proposed.

Yet in the long run, coercing Indians and foreigners to do their business in India would be self-defeating. Some may simply go on strike and it is far better that activity takes place abroad than not at all. Any rise in the share of offshore activity is best viewed as a warning system about what is most in need of reform at home.

The biggest warning sign would be if Indians themselves started to leave. Despite some mutterings among the professional classes, that does not seem to be happening. Still, if India does not kick-start its economy and reform, more than derivative trading and Bollywood singalongs will shift abroad.

http://www.economist.com/news/international/21583285-growth-slows-a...

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistan's Homegrown Link-17 Kill Chain Helped Shoot Down India's Rafale Fighter Jets

Using a homegrown datalink (Link-17) communication system, Pakistan has integrated its ground radars with a variety of fighter jets and airborne early warning aircraft (Swedish Erieye AWACS) to achieve high level of situational awareness in the battlefield, according to experts familiar with the technology developed and deployed by the Pakistan Air Force. This integration allows quick execution of a "…

ContinuePosted by Riaz Haq on May 31, 2025 at 9:00am

American Prof John Mearsheimer on International Geopolitics in South Asia

Professor John Mearsheimer, a renowned international relations expert known for his theory of "offensive realism", has recently spoken to India's CNN-News18 about the impact of US-China competition on geopolitics in South Asia. Sharing his thoughts in interviews on India-Pakistan conflict after the Pahalgam attack, he said: "There is really no military solution to this (Kashmir)…

ContinuePosted by Riaz Haq on May 24, 2025 at 5:30pm — 13 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network