PakAlumni Worldwide: The Global Social Network

Pakistan's travel and tourism industry is booming with significant improvement in security situation. In 2015, it contributed 7% of Pakistan's GDP. It includes foreign and domestic travel and tourism spending or employment in the equivalent economy-wide concept in the published national income accounts or labour market statistics.

There are are multiple indicators showing this industry will contribute more this year. Growth in air travel and hotel occupancy are among the top indicators of travel and travel and tourism industry growth.

Hotel Occupancy:

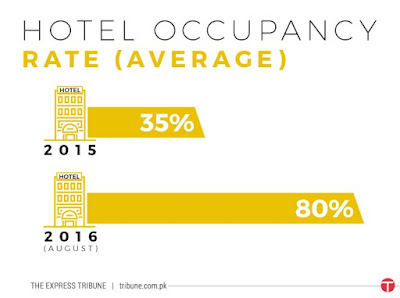

“The rate of hotel occupancy has surged to 80% across the country compared to 35% before the current calendar year started,” said Beach Luxury Hotel Director Business Development Rehan Wahid, according to report in the Express Tribune newspaper. “Hotels in Islamabad and Lahore are fully booked most of the days. However, this is yet to happen in Karachi,” he said.

Thanks to the ramp-up of China-Pakistan Economic Corridor (CPEC) related projects, Gwadar is leading the way for new hotel construction with permits issued for least 5 new 5-star hotels so far in the new port city. These include a 250-room hotel apartment project of the management of Pearl Continental Hotels and another one of the Bahria Group. Gwadar Airport growth of 73% was the fastest of all airports in Pakistan.

Air Travel:

Pakistan air travel market is among the fastest growing in the world. IATA (International Air Transport Association) forecasts Pakistan domestic air travel will grow at least 9.5% per year, more than 2X faster than the world average annual growth rate of 4.1% over the next 20 years. The Indian and Brazilian domestic markets will grow at 6.9% and 5.4% respectively.

Pakistan saw 23% growth in airline passengers in 2015, according to Anna Aero publication. Several new airports began operations or expanded and each saw double digit growth in passengers. However, Gwadar Airport growth of 73% was the fastest of all airports in Pakistan.

The top 12 airports all saw large double digit increases. Multan grew 64%, Quetta 62% and Faisalabad +61% all climbing one place as a result of all of them seeing a growth of over 60%. Turbat Airport in Balochistan is the newest airport to reach the top 12 in terms of traffic.

Security Situation:

The key reason for travel and tourism boom is significant improvement in the security situation since the launch of Pakistan Army anti-terror campaign called Zarb-e-Azb. Civilian deaths have been cut from 2,378 in 2011 to 412 this year until August 14, 2016. Total number of deaths, including civilians and security personnel, have been reduced from 11,704 in 2009 to 1232 so far in 2016, according to South Asia Terrorism Portal (SATP.org)

Terrorism-Related Deaths in Pakistan Source: South Asia Terrorism Portal |

Summary:

Hotel occupancy rates have risen from just 35% in 2015 to 80% this year. Air travel is growing rapidly with IATA forecasting Pakistan to be among the world's fastest growing air travel markets. All airports in the country, including several new ones, are seeing double digit increases in the number of passengers flying in and out of them. Improved security since the start of Operation Zarb e Azb and political stability are underpinning growing confidence in Pakistan.

Related Links:

Pakistan Sees Robust Growth in Consumption of Energy, Cement and Steel

Politcal Stability Returns to Pakistan

Auto and Cement Demand Growth in Pakistan

Pakistan's Red Hot Air Travel Market

China-Pakistan Economic Corridor FDI

Riaz Haq

Airline seeks flights to smaller cities

https://tribune.com.pk/story/2501376/airline-seeks-flights-to-small...

KARACHI:

A domestic airline already operating in Pakistan has sought approval from the CAA to launch flights to smaller airports using low-capacity aircraft.

The move aims to provide air travel options for passengers currently relying on buses, trains, and cars for long journeys from the North to the South of the country.

During a press conference on Monday, Director General of the CAA Nadir Shafi Dar addressed several matters concerning Pakistan's aviation sector. It was his first formal media briefing since the CAA's recent restructuring into two divisions.

Dar announced that airports in smaller cities, including Sukkur, Multan, Faisalabad, and Sialkot, and more remote regions like Gwadar, Gilgit, and Skardu, would soon offer regular air services.

An existing airline has already requested permission to operate small aircraft on these routes, with plans to introduce flights for up to 40 to 50 passengers by early 2025.

The airline will initially deploy at least three small aircraft, with services expected to begin in the second quarter of 2025.

The DG further expressed optimism that more airlines would follow suit, boosting air connectivity for primary and secondary airports across the country.

"Currently, about 30 million passengers travel from the North to the South annually by bus, train, or car. If the airline sets reasonable fares, this route could become commercially viable," said Dar.

He also provided an update on PIA, saying that an audit of all national airline aircraft had been initiated following several incidents of technical landings and other issues.

Oct 15, 2024

Riaz Haq

Sukkur Airport expected to launch international flights soon - Pakistan

https://www.dawn.com/news/1898964

International flights from Begum Nusrat Bhutto Sukkur Airport are expected to begin soon amid plans to expand the airport, it emerged on Wednesday following a Pakistan Aviation Authority (PAA) meeting.

PAA’s Planning and Development Director Abbas Sheikh and other officials visited the Sukkur Chamber of Commerce and Industry today for a meeting and to discuss the airport’s expansion. During the occasion, the chamber’s committee convener, Muhammad Mohsin Farooq, announced that approval was granted for two weekly flights from Sukkur to Jeddah beginning from July this year.

He credited the development to the efforts of Sukkur Chamber of Commerce President Khalid Kakezai and former president Bilal Waqar Khan.

The officials also discussed expansion plans for the Sukkur Airport, including building cargo terminals and runways to facilitate cargo flights.

The officials directed that estimates be provided for products exported from Sukkur and surrounding areas to develop a comprehensive development plan for passenger and cargo flights.

Former president of the Sukkur Chamber of Commerce, Abdul Fatah Sheikh, highlighted the various products exported from the city, including dates, cotton, rice, pickles, fruits, vegetables, fish, and handicrafts, which are currently exported through Karachi, Multan, and Faisalabad.

However, with the airport’s expansion, these products will be exported directly from Sukkur, he said.

In 2019, Pakistan International Airlines launched direct international passenger flights from Sialkot International Airport to Europe.

Apr 1

Riaz Haq

Saad @AirlinePilotMax

Why Pakistan’s next aviation boom won’t start in Karachi or Lahore… it will start with 70–90 seat regional jets.

Everyone talks about CPEC, tourism potential, and Gwadar — but ask any traveler from Gilgit, Skardu, Chitral, or even Multan how many flights they actually get per week. The bottleneck isn’t demand. It’s connectivity.

Here’s the quiet truth: Pakistan’s geography and demographics are textbook-perfect for modern regional jets like EmbraerE-Jets .

Why they can become the real backbone of feeder routes:

1. Runway reality

Most northern and secondary airports (Skardu 11,000 ft but high elevation, Chitral, Gilgit, Muzaffarabad, DG Khan, etc.) can’t reliably take 737s/A320s year-round, especially in summer. A 76-seat E175 performs where the big narrowbodies struggle.

2. Frequency > Capacity

Gilgit in peak season sells out 2–3 daily 50-seaters in minutes. One 180-seat A320 a day doesn’t solve the problem — four 78-seat flights do. Higher frequency unlocks tourism and same-day business travel.

3. Unit cost revolution

New-generation regional jets (E2, A220) now have seat costs within 5–10 % of an A320 on stages <500 nm, but with half the trip cost. Perfect for thin routes that can’t fill 180 seats yet.

4. Domestic feed = International yield

Every passenger from Skardu, Chitral or Sukkur who connects in Islamabad or Lahore is pure marginal revenue for PK, EK, QR, TK widebody flights. Feed the hubs, feed the bottom line.

5. Proven model next door

India went from 20 regional jets in 2015 to over 120 today (mostly under UDAN). Result? New stations, lower fares, and routes that eventually graduated to A320s when traffic matured. Pakistan can copy-paste the playbook.

The fleet Pakistan truly needs in the next 5–7 years isn’t 30 more A320s… it’s 30–40 modern regional jets, flown aggressively on 40–50 underserved routes.

When a family in Hunza can fly to Karachi same-day return for a medical appointment, or a textile buyer from Faisalabad can visit three cities in one day — that’s when aviation becomes an economic accelerator, not just transport.

https://x.com/airlinepilotmax/status/1996101019173093827?s=61&t...

on Saturday