PakAlumni Worldwide: The Global Social Network

Some of Prime Minister Narendra Modi's supporters claim that his "Make in India" campaign has brought India to the verge of becoming a manufacturing behemoth 69 years after the nation's independence. Others claim India is already a manufacturing powerhouse. Let's examine these claims based on data.

Manufacturing Ranking:

While India now ranks 6th in the world in terms of total manufacturing output, it still sits at a very low 142nd position terms of manufacturing value added per capita, according to the United Nations Industrial Development Organization's Industrial Development Report 2016. Pakistan's manufacturing value added is ranked 146th by the same report.

Manufacturing Output:

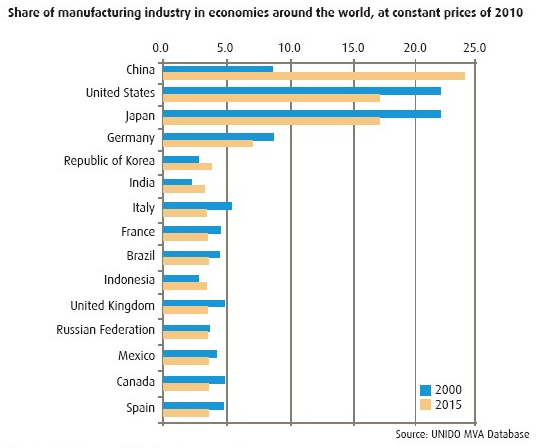

India's 3% share of the world's total manufacturing output puts it at a distant sixth position behind China's 24%, United States' 17%, Japan's 16%, Germany's 7% and South Korea's 4%.

The UNIDO data shows that India's manufacturing value added (MVA) per capita at constant 2005 prices increased from US$155.73 in 2005 to $168.42 in 2014. However, as percentage of GDP at constant 2005 prices in US$, India's MVA decreased from 15.10% in 2005 to 13.85% in 2014

UNIDO reports that Pakistan manufacturing value added (MVA) per capita at constant 2005 prices increased from US$135.03 in 2005 to $143.84 in 2014. Its MVA as percentage of GDP at constant 2005 prices in US$ decreased from 18.05% in 2005 to 17.41% in 2014.

India's manufacturing output declined 0.7% in April-June 2016-17 |

Make in India:

Prime Minister Narendra Modi has recognized how far behind India is in the manufacturing sector. His government's highly publicized "Make in India" is designed to Change that.

What does India, or for that matter any other developing country, need to boost its manufacturing output? Most experts agree on two essential pre-requisites for industrial development:

1. Energy and Infrastructure

2. Skilled Manpower

China's rapid industrialization over the last few decades has shown that the focus must be on the above two to achieve desired results. Has India learned from the Chinese experience? Let's examine this question.

Energy and Infrastructure Development:

"Infrastructure is the biggest hurdle to the ambitious Make in India program of the government," Standard and Poor Global Ratings Credit Analyst Abhishek Dangra told reporters on a conference call, according to India's Economic Times publication.

"The government is scaling up spending, but its heavy debt burden could derail its ambitions to improve public infrastructure," the Standard and Poor report said.

India suffers from huge energy deficit. Over 300 million of India’s 1.25 billion people live without electricity. Another 250 million get only spotty power from India’s aging grid, with availability limited to three or four hours a day, according to an MIT Energy Report. The lack of electricity affects rural and urban areas alike, limiting efforts to advance both living standards and the country’s manufacturing sector.

Skilled Manpower:

“India doesn’t have a labor shortage—it has a skilled labor shortage,” said Tom Captain, global aerospace and defense industry leader at Deloitte Touche Tohmatsu, according to a Wall Street Journal report.

The WSJ report said that over 80% of engineers in India are “unemployable,” according to Aspiring Minds, an Indian employability assessment firm that did a a study of 150,000 engineering students at 650 engineering colleges in the country.

NPR's Julie McCarthy reported recently that ten million Indians enter the workforce every year. But according to the Labour Bureau, eight labor-intensive sectors, including automobiles, created only 135,000 jobs last year, the lowest in seven years.

Impact on Agriculture:

Prime Minister Modi's focus on manufacturing is talking away resources and attention from India's farmers who are killing themselves at a rate of one every 30 minutes.

Majority of Indian farmers depend on rain to grow crops, making them highly vulnerable to changes in weather patterns. As a comparison, the percentage of irrigated agricultural land in Pakistan is twice that India.

More than half of India's labor force is engaged in agriculture. Value added per capita is among the lowest in the world. Pakistan's agriculture value added per capita is about twice India's. This is the main cause of high levels of poverty across India.

Chinese Experience:

China has shown that it is possible to make huge strides in manufacturing while at the same time achieve high productivity levels in agriculture.

On the manufacturing front, China has taken care of the basics like energy, infrastructure and skilled manpower development to achieve phenomenal growth.

As part of the China-Pakistan Economic Corridor (CPEC) development, Pakistanis are learning from the Chinese to replicate success in manufacturing.

The first phases of CPEC are focused on building power plants, gas pipelines, rail lines, roads and ports at a cost of $46 billion. At the same time, China and Pakistan are also focussing on skills training via vocational schools and Pakistan-China Education Corridor. These projects will lay the foundation necessary to ramp up manufacturing in Pakistan.

Summary:

Both India and Pakistan want to emulate the success of China in the manufacturing sector. The Chinese experience has shown that development of energy, infrastructure and skilled labor are essential to achieve their manufacturing ambitions. The South Asians must move beyond hype to do the hard work necessary for it. Pakistan is working with China via CPEC to make progress toward becoming a manufacturing powerhouse.

Related Links:

Auto Industry in India and Pakistan

UN Industrial Development Report 2016

China-Pakistan Economic Corridor

Riaz Haq

Is #Lockheed dumping obsolete #F16 on #India? - #MakeInIndia #Modi #BJP BBC News

http://www.bbc.com/news/world-asia-india-40344566

Lockheed Martin and India's Tata Group have formalised an agreement to relocate the manufacturing of the most advanced F-16 fighter jets to India.

The effort is aimed at securing a multi-billion dollar deal from Delhi.

The announcement comes days ahead of Indian PM Narendra Modi's visit to Washington for a meeting with President Trump.

But some defence experts are accusing Lockheed of offloading obsolete aircraft on India.

What's in the deal?

India will be able to "produce, operate and export the multi fighter F-16 Block 70 aircraft", a joint release said.

"Contingent upon (the) US and Indian government agreement and approval, F-16 Block 70 aircraft would be produced exclusively in India," said a Lockheed Martin statement to the BBC.

"The F-16 Block 70, the next production version of the aircraft, would be the only F-16 version in production. As such, India would become the future home of F-16 production worldwide."

Many see the arrangement as a boost to Mr Modi's "Make in India" push, although it may take years to bear fruit.

Lockheed and Tata would have to win a formal bidding process to begin co-manufacturing.

Why does India need it?

India needs to replace over 200 aged MiGs that are already pushing the expiry date, experts say.

The Russian-supplied MIGs have faced criticism over the years for alleged malfunctioning and frequent crashes that have killed scores of Indian pilots.

F16s have dominated the global market for years.Image copyrightLOCKHEED WEBSITE

Russians blame the crashes on poor Indian maintenance.

India has been trying to ease its traditional reliance on Russia by diversifying its buying options.

US to buy more F-35 fighter jets from Lockheed Martin

Lockheed Martin shares suffer after Trump F-35 tweet

Why are India's air force planes falling out of the sky?

India and France sign Rafale fighter jet deal

It bought French Rafales off the shelf in 2016 after lengthy and arduous negotiations.

Steeply escalating costs, poor after-sales service and a lack of sophisticated military equipment are the reasons cited by some analysts for the shift away from Russia.

The F-16s are said to be up against competition from Sweden's Saab group and its Gripen jets.

How cutting-edge are F-16s?

F-16s have dominated the global market for years. More than 3,000 of the multi-role aircraft are currently in use by 26 countries.

F-16 production in India will support thousands of jobs in the US, said a joint statement issued from Paris, apparently to counter expected criticism that the deal would fall foul of Mr Trump's "America First" policy.

They were originally conceived in the early 1970s as a "lightweight air-to-air day fighter".

Analyst Brahma Chellaney charges Lockheed Martin with dumping obsolete F16s in India.Image copyrightTWITTER

But some commentators in India are asking if the agreement with the Tatas is an effort by Lockheed to offload old technology in India.

"India a dumping ground for obsolete weapons system?" asked defence expert Brahma Chellaney on Twitter.

"Lockheed Martin signs F-16 deal with Tata. Why Tata? Because they make the noisiest car?"

Defence writer Rahul Bedi agrees with Mr Chellaney.

"F-16s developed in the '70s have already reached the optimum level of modernisation. The US Air Force has phased them out in favour of the much more advanced F-35s," he told the BBC.

Disaster response personnel walk next to the wreckage of an Indian Air Force MiG-21 Bison aircraft that crashed in Soibugh on the outskirts of Srinagar on August 24, 2015.Image copyrightAFP

Image caption

Jun 20, 2017

Riaz Haq

#Indian Army Vice Chief says #Pakistan's #defense #industrial base better than #India's. #military

http://indianexpress.com/article/india/pakistan-defence-industrial-...

Lt. Gen. Sarath Chand, Vice Chief of Army Staff (VCOAS), said the ordnance factories have not been able to keep pace with changing technology while "there is no competition whatsoever" and it is "an unsuccessful method of supporting our defence requirements".

A top Army general on Tuesday said Pakistan has a better military industrial base and exports more defence equipment than India, as he came down heavily on ordnance factories which manufacture weapons for the forces. Lt. Gen. Sarath Chand, Vice Chief of Army Staff (VCOAS), said the ordnance factories have not been able to keep pace with changing technology while “there is no competition whatsoever” and it is “an unsuccessful method of supporting our defence requirements”.

“I would even go to the extent of saying that Pakistan probably has a better industrial base, as far as defence production is concerned, than our country. In fact they export defence equipment abroad, definitely more than what we are doing,” he said.

He wondered whether the functioning of ordnance factories is because of the assured orders they have or the lack of accountability. “There is little or no research and development. They do not even have the capability of absorbing the industry through transfer of technology, and in some cases they have even failed to assemble products that have been imported from abroad,” Lt. Gen. Chand said.

“It is very hard to see ordnance factories changing in the present state. Overall it has become an unsuccessful method of supporting our defence requirements,” he said. He was speaking at the inaugural session of AMICON 2017, a two-day conference organised by the Army and the CII.

He noted that having indigenous industrial capability is very crucial for the country. He further cautioned that in an event of a war, one has to look abroad for its sustenance. “And very often, friends have let us down whenever the chips have been down,” Lt. Gen. Chand observed.

He said the ‘Make in India’ programme, the Defence Procurement Policy 2016, the strategic partnership model, and the creation of the Army Design Bureau (ADB), are major steps taken by the government for fast-tracking indigenisation in the sector.

Jul 26, 2017

Riaz Haq

PM #Modi Calls The World To '#MakeInIndia,' But The Initiative Fails To Take Off. #India #BJP #Manufacturing

https://www.forbes.com/sites/suparnadutt/2017/07/24/missing-the-mar...

Just months after taking office in 2014, Indian Prime Minster Narendra Modi, standing below an immense logo of a lion, unveiled an economic vision for India to be a global manufacturing power. Investors should rush to “make in India,” he said. He claimed that his strong leadership would usher in economic revival by increasing the share of manufacturing in the country’s gross domestic product (GDP) to 25% by 2025, and creating 100 million new jobs by 2022. He vowed India would train apprentices by the hundreds of millions to service that manufacturing boom, reduce bureaucracy and improve infrastructure, paving the way for foreign investors.

Three years into his five-year term, although parts of India’s $2.3 trillion-strong economy are in better shape today than they were earlier — deficits are lower; businesses face somewhat less red tape — the contribution of the manufacturing sector to GDP is barely 16%, progress in improving the country’s inadequate roads, rail lines and ports has been slow and the job creation rate has fallen. Between, 2014 and December 2016, only 641,000 jobs were created. That is far too few, considering roughly one million people join the labor force every month.

Demonetization effect

Official GDP statistics show first-quarter growth in the economy, at an annual rate, was just 6.1% — unimpressive for a big, poor country with much catching up to do. Last November, demonetization severely set back the manufacturing sector. In the automobile industry, sales dipped 19% in December, the biggest monthly fall in 16 years. Sales of FMCG products fell 40-50%. The informal sector, which comprises over 80% of the economy, was the worst hit. Hundreds of small units downed their shutters, leaving thousands jobless.

Meanwhile, sectarian strife and instability, a worry in itself, also matters for the economy. Popular columnist Swaminathan S. Anklesaria Aiyar wrote in Times Of India that although Modi wants to sell India to the world as a global manufacturing hub, it will not be possible “if India’s fastest growing industry is lynch mobs.”

Also, the recent start of Goods and Service Tax (GST), supposed to create a single market, replacing lots of local taxes with national ones, was good to see, but the system, with six tax rates for different goods, is overly complicated and some in business complain it has been implemented poorly.

Almost nothing has gone as planned to attract investors to make in India.

Defense manufacturing

“Initially, the Make In India program was mainly focused on defense production, but little has happened there. The local production of big ticket items eludes us. Even as he was announcing this, PM Modi ordered ready to fly Rafale jets in France,” says Mohan Guruswamy, chairman of Centre for Policy Alternatives Society.

According to a new data released by Stockholm International Peace Research Institute (SIPRI), India is the world’s largest importer of major arms, accounting for 13% of the global total sales between 2012 and 2016. Lockheed Martin Corp and Saab AB have promised to build products in India, but not much has progressed due to red tape, reliance on state-owned companies and constant delays. While a manufacturing unit for assault rifles, a joint venture between India and Israel, was launched this month in Madhya Pradesh, the Army rejected the indigenous guns built by the Rifle Factory Ishapore after they failed the firing tests last month. This leaves India overwhelmingly reliant on foreign imports, mainly from Russia, the U.S. and Israel.

Jul 26, 2017

Riaz Haq

After Spending #Indian Rs. 36 billion, Made-In-#India Akash #Missile Fails Tests, Says Auditor. http://www.ndtv.com/india-news/3-600-crores-later-made-in-india-aka... … via @ndtv

3,600 Crores Later, Made-In-India Akash Missile Fails Tests, Says Auditor

The Akash and its newer variant, the Akash Mk-2, are a medium-range surface-to-air missile system designed to intercept enemy aircraft and missiles at a distance of 18-30 km.

As many as a third of the home-made Akash surface-to-air missiles have failed basic tests, says the country's national auditor, claiming the deficiencies of the missiles "posed an operational risk during hostilities."

The report of the Comptroller and Auditor General (CAG) is a big setback for the Make-In-India initiative which seeks to reduce India's dependence on imported arms. The report, given to parliament, says, "the missiles fell short of the target, had lower than the required velocity, and there was malfunctioning of critical units."

The Air Force has refused to comment on the report.

The Akash was produced by the state-run Bharat Electronics. The auditor says that though 3,600 crores have been paid to the manufacturer, none of the missile systems are installed at the six designated sites even though it has been seven years since the contract was signed.

The Akash and its newer variant, the Akash Mk-2, are a medium-range surface-to-air missile system designed to intercept enemy aircraft and missiles at a distance of 18-30 km. Tested extensively by the Indian Air Force, the Akash, which was first handed over in December 2008, was seen as a breakthrough indigenous system and in 2010, an additional six squadrons were ordered.

http://www.ndtv.com/india-news/3-600-crores-later-made-in-india-aka...

Jul 28, 2017

Riaz Haq

Nikkei #India #Manufacturing PMI dips sharply in July 2017. #MakeInIndia #GST #Modi

http://www.business-standard.com/article/news-cm/nikkei-india-manuf...

Output slides following implementation of goods and services tax

PMI survey data indicated that the introduction of the goods & services tax (GST) weighed heavily on the Indian manufacturing industry in July. New orders and output decreased for the first time since the demonetisation-related downturn recorded in December last year, with rates of contraction the steepest since February 2009 in both cases. Consequently, companies purchased fewer quantities of inputs for use in the production process, leading to an overall decline in holdings of raw materials and semi-finished items. Cost burdens increased further, but factory gate charges were lowered as firms attempted to win new business.

At 47.9 in July, down from 50.9 in June, the Nikkei India Manufacturing Purchasing Managers Index (PMI) was at its lowest mark since February 2009 and highlighted the first deterioration in business conditions in 2017 so far. The downturn was widespread across the three broad areas of manufacturing, with intermediate goods producers the worst affected.

Incoming new work dropped for the first time in the year-to-date and at the steepest pace since early- 2009. Anecdotal evidence indicated that the GST launch hampered demand. Different to the trend for total order books, new export orders continued to rise in July. That said, the rate of expansion softened from June's eight-month high.

Lower sales triggered an overall accumulation in stocks of finished goods. The rise in holdings of manufactured products was marginal, but interrupted a two-year period of ongoing depletion.

Discouraged by the downturn in factory orders, companies lowered production in July. The fall ended a six-month sequence of growth, and the rate of reduction was the most pronounced since the global financial crisis.

Fewer output requirements caused a reduction in purchasing activity. Although moderate, the contraction in buying levels was the quickest in eight-and-a-half years. Subsequently, inventories of inputs decreased.

According to Indian manufacturers, higher tax rates sparked greater cost burdens in July. However, the pace at which input costs rose was moderate and much weaker than its long-run average. Reflecting attempts to win new business in the face of a competitive environment, some companies lowered their selling prices. Overall, the rate of discounting was marginal. Prior to July, charges had increased for 16 months in succession.

After having increased in June, payroll numbers fell in the current reporting month. But, with the vast majority of panellists signalling unchanged headcounts, the rate of job shedding was marginal overall.

The 12-month outlook for output remained positive in July, with companies expecting more clarity regarding the GST to support growth. New projects in the pipeline and improved product quality were also mentioned as reasons underpinning positive sentiment. The level of confidence was at an 11-month high.

Commenting on the Indian Manufacturing PMI survey data, Pollyanna De Lima, Principal Economist at IHS Markit and author of the report, said: "Manufacturing growth in India came to a halt in July, with the PMI down to its lowest mark in almost eight-and-a-half years amid widespread reports that the sector has been adversely affected by the implementation of the goods and services tax. The reductions in output, new orders and purchasing activity were all the steepest since early-2009.

"The downturn was broad-based across all sub-sectors covered by the survey, with output scaled back among firms in the consumer, intermediate and investment goods categories amid falling order books.

Aug 5, 2017

Riaz Haq

India simply cannot afford to boycott “Made in China”

Devangshu Datta, Scroll.in

https://qz.com/1079903/india-simply-cannot-afford-to-boycott-made-i...

A few days after the Doklam standoff erupted in June, a series of bizarre online advertisements interspersed my surfing experience. A televangelist yoga teacher-cum-entrepreneur started exhorting Indians to start boycotting Chinese goods. Presumably the Indian conglomerate that the yoga teacher fronts sensed an opportunity to expand its product lines.

The yoga teacher wasn’t the only person advocating the boycott of Chinese goods. The Swadeshi Jagran Manch, the Rashtriya Swayamsevak Sangh (RSS), and other front organisations for the ruling dispensation all made similar high-decibel noises. The arguments they proffered in favour of Swadeshi are stupid.

Swadeshi is a stupid idea under most circumstances and especially so when it is applied to the India-China trade relationship. This is the argument its proponents offer:

China is an enemy.

India buys lots of Chinese goods.

If India stops buying Chinese goods, China would hurt more because it has a trade surplus with us.

Indians could start producing such goods domestically and, thus, stimulate the domestic industry.

If India stopped importing goods from abroad in general and produced everything domestically, it would have a strong economy.

On the face of it, this might seem a plausible set of premises connected by a glib chain of logic. So let’s address them one by one.

1. ‘China is an enemy’

Perhaps true. It is certainly very friendly with one of India’s neighbours, which New Delhi does not get on with. It also has live border disputes with India (and Bhutan) in multiple places. China has excellent relationships and huge economic ties with several other neighbours. In Facebook-speak, India’s relationship with some of these neighbours is complicated.

For instance, India’s relationship with Nepal has deteriorated because of objections over its new constitution, adopted in 2015. That year, it imposed an unofficial blockade of goods into the Himalayan nation to protest against it.

India’s relationship with Myanmar is more or less okay except that Naypyidaw was quite unhappy about Delhi tom-tomming surgical strikes against Naga insurgents in its territory in 2015.

Our relationship with Sri Lanka is so-so and likely to remain that way because of the ill-conceived military operation led by the Indian Peace Keeping Force in the island nation in the late 1980s.

With regard to Bangladesh, the enclave business has been largely sorted out with the historic land swap in 2015 but there are still disputes about river-water sharing. There is a knee-jerk tendency among Indians to scream about illegal Bangladeshi immigrants. There is also a knee-jerk tendency for Bangladesh to scream about being bullied by its bigger neighbour. There are also accusations that Indian separatists have havens in Bangladesh and that Bangladeshis are part of Islamic terror networks.

2. ‘India buys lots of Chinese goods’

Yes indeed, India buys all sorts of stuff ranging from solar power equipment and high-end electronics to plastic buckets, Hindu idols, and winter coats. China’s exports to India were an estimated $61 billion in 2016-17 while India’s exports to China were $10 billion in that period. So China has an enormous surplus with regard to India.

3. ‘If India stops buying Chinese goods, the Chinese would hurt more because China has a trade surplus’

Looking at India’s trade deficit with China in the context of gross domestic product or GDP, however, China has less exposure. Its exports to India amount to about 2.7% of India’s GDP (about $2.26 trillion in 2016, according to World Bank data) and about 0.5% of Chinese GDP (about $11.2 trillion in 2016, according to the World Bank). India’s exports to China amount to about 0.08% of Chinese GDP and about 0.45% of Indian GDP.

Sep 18, 2017

Riaz Haq

India simply cannot afford to boycott “Made in China” Part 2

Devangshu Datta, Scroll.in

https://qz.com/1079903/india-simply-cannot-afford-to-boycott-made-i...

If there was a trade war, India would have to source the same goods from elsewhere and ditto for China. India is internationally competitive in the things it offers to China. Similarly, China offers good value in its exports to India. But both India and China would also need to find other markets and that would not be easy since both nations are large markets themselves.

As a thought experiment, assume that both countries have to pay a 10% premium to source from elsewhere, China then pays the equivalent of 0.09% of its GDP and an absolute amount of about $11 billion while India pays the equivalent of 2.9% of GDP and an absolute amount of about $66 billion.

Which nation loses more?

4) ‘Indians could start producing those goods domestically and thus stimulate domestic industry’

Indians do not buy Chinese goods out of a desire to do charity. They buy them because imported alternatives are more expensive and India cannot produce the same things as cheaply at the same quality. If India tried to produce the same goods locally, or imported them from other nations, it would have to pay a premium either way. That premium would mean that Indians will have less money to spend elsewhere. More than that, it would mean the unproductive use of human resources and of capital.

5) ‘If India stopped importing goods from abroad in general and produced everything domestically, it would have a strong economy’

No it would not. India tried this idiocy for decades. It banned all imports (except the ones that were absolutely necessary) and produced shoddy overpriced Ambassador cars, fridges that did not cool, telephones that did not work, bottles with defective caps, paper cups with holes. Indians were fleeced by their compatriots for years in the name of swadeshi. What is more, producing goods domestically will not necessarily generate net employment. Chinese companies operating in India employ huge numbers. Those people would be laid off in a trade war.

There are also a few things India simply cannot produce domestically.

One is energy—India is woefully deficient in crude, high-grade coal and gas. It has to import these energy commodities and will always have to do so.

India is also deficient in rare-earth metals. These are required to produce solar power equipment, wind turbines, cellphones, laptops, and most other electronic gear. Guess which nation has a 90% global monopoly in rare earths? Here is a hint—its initials read “PRC.” As India moves further in the direction of clean, green energy, it becomes ever more dependent on Chinese rare earths.

At the beginning I had said that swadeshi is a stupid idea under most conditions, not just in the India-China context. Let me explain why in a series of Q&As.

As mentioned earlier, India will always have to import some commodities, so:

How does one pay for imports?

By generating foreign exchange from exports.

How does one generate foreign exchange from exports?

By producing globally competitive goods and services.

How does one produce goods and services that are globally competitive?

By focussing capital and human resources in areas where there is a competitive edge. Economic theory says that if Nation A has a competitive advantage over Nation B in producing two separate items, Nation A should nevertheless focus on producing the one item where it has the larger margin.

How does one produce goods and services that are uncompetitive?

By squandering capital and resources in uncompetitive sectors swadeshi ensures the production of uncompetitive goods and services.

Sep 18, 2017

Riaz Haq

#MakeinIndia is looking more and more like a bad joke.

#India #Modi #Manufacturing https://blogs.timesofindia.indiatimes.com/folk-theorem/make-in-indi... … via @TOIOpinion

Flashback to September 2014, when PM Narendra Modi unveiled a scheme called, ‘Make in India’ (MII), with a gear-and-cogs lion logo. Three years later MII has, literally, gone off the rails. By October next year, work was supposed to start on the largest MII project: a $2.5 billion venture by America’s GE to make diesel-electric locomotives in Marhaura, in Chhapra, Bihar.

But two weeks ago, New Delhi switched off the Bihar project, saying electric trains were the future. Chief minister Nitish Kumar, who gambled his political future by breaking with a Congress-Lalu Yadav coalition to ally with BJP recently, isn’t amused. He says it’ll take ages to electrify India’s 1,10,000 km of tracks. As a two-time rail mantri and Bihari, Nitish should know.

Against government claims that 96% of Bihar villages are electrified, a 2015 survey found only 8% of households get electricity for 20 hours a day. A staggering 80% of homes don’t use electricity for lighting, but get by with kerosene lamps. An incensed GE wants India to pay it Rs 1,300 crore in compensation. Such irony: our loss-making, cash-poor railways will now pay to cancel MII investments. What is New Delhi smoking?

By the mid-2000s, most railways worldwide scrapped all-electric locomotives to pull the heaviest loads; without an internal combustion mechanism, electric engines take very long to accelerate or brake. Now the world’s most powerful locomotives, like 2015’s 4,400 horsepower (HP) EMD machines in the US or Iran’s Alstom 4,300 HP engines or China’s 6,250 and 6,300 HP HNX series, are diesel-electric combinations; Russia’s giant 11,300 HP Sinara locomotive is powered by a GT gas-electric engine.

New Delhi thinks electric trains will save India the cost of diesel. Is electricity made out of thin air? A study in the mid-2000s argued that it makes no sense to run heavy freight trains, moving under 100km per hour, with electricity. By shifting all freight trains to diesel, railways could save 20% of its power bills. The bijli could be diverted to industry and commerce, which now use diesel to generate power. Shunting the locomotive project could be the last nail in MII’s coffin, but there are other stupendous failures.

Someone fancifully called India the ‘pharmacy of the world’. This hype is busted by numbers. India contributes 0.9% of its GDP to research, compared to China’s 2.1%. Medicine is no exception. Last year, a team led by Samiran Nundy, one of India’s most respected medical doctors, found 60% of medical institutions produced no research. Those that did were mostly taxpayer-funded, with Delhi’s AIIMS at the lead. But even AIIMS produced less than a third of the nearly 5,000 research papers published by the Massachusetts General Hospital every year.

Another study found that of the top 316 medical R&D spenders worldwide, India had only eight (mostly state-owned), while China was host to 21. India does the grunt work of digitising global research or supplying human guinea-pigs to test therapies developed overseas. We pretend our medicine-makers are world beaters. Rubbish. Mostly, they import medical raw material (called Active Pharmaceutical Ingredients, or APIs) from China, package and sell them as desi brands. This adds some value to Indian exports, especially to the US, wary of importing bulk drugs direct from China. In 2000, India imported only 23% of APIs from China. Through 2014-16, when MII was supposedly in full throttle, we imported 52% of APIs from China, each year.

Sep 30, 2017

Riaz Haq

#Smartphones made in #India? #Manufacturing ambition hits hurdles. #MakeInIndia #Modi #Apple #Foxconn

http://www.reuters.com/article/us-india-manufacturing-smartphones/s...

India’s ambitions to become a smartphone-making powerhouse are foundering over a lack of skilled labor and part suppliers along with a complex tax regime, industry executives say.

Prime Minister Narendra Modi has championed a manufacturing drive, under the slogan ‘Make in India’, to boost the sluggish economy and create millions of jobs. Among the headline-grabbing details was a plan to eventually make Apple APPL.O iPhones in India.

Three years on, as executives and bureaucrats crowded into a Delhi convention center for an inaugural mobile congress last week, India has managed only to assemble phones from imported components.

While contract manufacturers such as iPhone-maker Foxconn Technology Co (2354.TW) and Flextronics Corp have set up base in India, one of the world’s fastest-growing smartphone markets, almost none of the higher value chip sets, cameras and other high-end components are made domestically.

Plans for Taiwan-based Foxconn to build an electronics plant in the state of Maharashtra, which local officials said in 2015 could employ some 50,000 people, have gone quiet.

According to tech research firm Counterpoint, while phones are assembled domestically because of taxes on imported phones, locally made content in those phones is usually restricted to headphones and chargers - about 5 percent of a device’s cost.

“Rather than feeling that India is a place where I should be making mobile phones, it’s more like this is the place I need to(assemble) phones because there is lower duty if I import components and assemble here,” a senior executive with a Chinese smartphone maker said.

He declined to be named for fear of harming business.

Oct 2, 2017

Riaz Haq

India plans to lessen its drug reliance on China

http://economictimes.indiatimes.com/articleshow/60990092.cms

Currently, India gets 70-80% of its medicines and medical devices supplies, including raw material for pharmaceuticals (Active Pharmaceutical Ingredient) from China. This poses a major risk of severe drug shortage if India's diplomatic relations with China worsen.

In fact, in 2014, National Security Adviser Ajit Doval had also warned the government about India's over-dependence on China for API and how the tension between the two countries can cause a crisis in the public health ..

Oct 8, 2017

Riaz Haq

Why Is Manufacturing More Expensive In India Than In China?

https://www.forbes.com/sites/quora/2017/12/13/why-is-manufacturing-...

Why are manufacturing costs higher in India, compared to China? originally appeared on Quora: the place to gain and share knowledge, empowering people to learn from others and better understand the world.

Answer by Balaji Viswanathan, CEO of Invento Robotics, on Quora:

A number of my relatives run manufacturing plants in Tamil Nadu, a relatively developed state. My in-laws have also recently started importing from China (replacing their Indian suppliers) and I will tell you why costs are higher than in China.

Power availability: You start a plant and realize that power availability is not 24/7. In Coimbatore and other industrial places you get power for like eight hours a day. That means the machinery lies idle for sixteen hours and that wasted capacity adds to the cost.

Cost of power: In India, we subsidize the power to farmers so much (farmers are a huge political base to regional parties) that the electricity companies either have to go bankrupt or charge huge amounts for industries. Electricity cost is often higher than some developed countries.

Cost of labor: Getting good factory labor in places like Tamil Nadu has become extremely hard. Skilled people are already in high-paying industries. The unskilled ones are hard to deal with. When we get labor from the north, they often move out without much notice (go to Diwali on vacation and never return). Skill building is lacking. If you pay $250, the quality of labor you get in China is likely higher than what you get in India.

Cost of transportation: Given the poor roads, a shipment from India's north can take a week or more to reach India's south. Sometimes it is quicker and cheaper to actually get a shipment from Shenzhen than Kolkata. Time is money and all those delays add to your cost. If I could get something in two days, I could sell it immediately rather than wait two months to sell it (add up the interest costs).

Bureaucracy: Starting a new plant or to adding anything to an existing one is very costly in time and money. You need to fill out a huge number of forms and grease a lot of palms just to do something legal and useful. Shipping across states is also very delayed (this is why the industry is pushing for GST). Unless most of the Indian laws - especially the one dealing with factories and labor - are thrown out, corruption, delays, and inefficiencies will remain.

Anti-large enterprises: India grew up in the mindset that large industries are bad. While many laws have changed since 1991, some of our laws, especially in textiles, are structured around small enterprises. Small businesses do not have the scale to produce cheaply and take on massive factories in China or Bangladesh. Thus, in the huge lucrative market of ready-made garments, Bangladesh quickly took the number two spot - leading to huge improvements in women development, while Indians are clinging to outdated laws favoring small, cottage industries.

If India has to compete with China, we have to completely overhaul all of the economic laws - taxes, labor, factories - we have had in place since 1947. Otherwise we will continue to be costlier than Vietnam and Bangladesh.

This question originally appeared on Quora - the place to gain and share knowledge, empowering people to learn from others and better understand the world. You can follow Quora on Twitter, Facebook, and Google+. More questions:

Manufacturing: Why are 53% of India's factories in only five states?

India: Is there a difference between Indian conservatism and American conservatism?

China: As an Indian what is your experience with China and its people?

Dec 14, 2017

Riaz Haq

#Modi, in #Davos2018 , Praises #Globalization Without Noting #India’s #Trade Barriers. #ModiAtDavos #China #tariffs

https://www.nytimes.com/2018/01/23/business/modi-in-davos-praises-g...

“Forces of protectionism are raising their heads against globalization,” Mr. Modi said during a speech to the World Economic Forum here. “Their intention is not only to avoid globalization, but they also want to reverse its natural flow.”

Notably missing from the speech was any mention of recent moves by Mr. Modi’s own government to restrict imports into India as part of a broad industrial policy meant to force foreign companies to increase manufacturing operations in the country. In essence, he is pursuing a protectionist agenda, at odds with the mantra of globalization.

Mr. Modi’s speech reflects the tenor of the times. As President Trump pushes an “America First” strategy, global leaders are lining up to position themselves as a counterpoint, even if there is sometimes a disconnect between the rhetoric and the reality.

In Davos last year, President Xi Jinping of China positioned himself as a champion of economic globalization in a rebuke to Mr. Trump, who, as president-elect at the time, was threatening to impose steep tariffs. Yet China has long bent the rules of commerce to fit it own needs.

Mr. Modi is following a similar path in India, as he looks to nurture growth in his sprawling economy and to create jobs.

Last month, India’s government imposed stiff tariffs on imports of cellphones, video cameras and televisions. The move put heavy pressure on Apple, which ships most of the iPhones it sells in India from China, to do more manufacturing in India.

Mr. Modi’s government is also considering a recommendation by India’s Directorate General of Safeguards, Customs and Central Excise that the country impose 70 percent tariffs on imported solar panels. Such a move would appear to conflict with Mr. Modi’s call here for international action on climate change. Introducing such stiff tariffs could well encourage the production of more solar panels in India, but it could also make solar power far more expensive for Indian consumers and, in turn, hurt the fight against climate change.

At 70 percent, the tariffs that India is considering on imported solar panels would be more than double those that the Trump administration said on Monday it would impose on such panels. Mr. Modi did not indicate in his speech what his government might decide on the issue.

-------

A ranking of countries on pollution and ecosystem protection released here on Tuesday showed India falling to 177 out of 180, down from 156 two years ago. By comparison, China was No. 120 on the list, which was compiled by Yale’s Center for Environmental Law and Policy.

“They are driving economic growth, but not paying attention to what I would call the parallel challenge of sustainable development: avoiding environmental degradation,” Daniel Esty, the center’s director, said of India.

As in the United States, industrial policies in India meant to foster domestic manufacturing can collide with a push by environmentalists and clean-energy electric utilities for solar panels, even imported ones, to be deployed as widely and as cheaply as possible. Among the other people attending Mr. Modi’s speech was Sumant Sinha, chairman and chief executive of ReNew Power Ventures, a company based on the outskirts of New Delhi that builds clean energy projects.

-----------

Devendra Fadnavis, the chief minister of Maharashtra, the vast Indian state that includes Mumbai and big manufacturing cities like Pune, also attended Mr. Modi’s speech. He said that he saw growing interest among companies from outside India to manufacture in the country. Foxconn, the giant Taiwanese manufacturer that produces the bulk of Apple’s consumer electronics, is in negotiations with Maharashtra officials to set up a large factory there.

Jan 23, 2018

Riaz Haq

#India Is World’s Largest Importer Of#Weapons With Insatiable Hunger, While#Pakistan Slashes#Arms Imports.#Modi#BJPReport by Stockholm International Peace Research Institute spotlights India’s floundering attempts to make firearms in India and growing preference of US over Russia as arms supplier.

India continues to be world’s largest importer for major firearms, an indication that Modi government’s Make In India drive for defence sector has faltered.

A report from the Stockholm International Peace Research Institute has found that India was the “world’s largest importer of major arms in 2013–17 and accounted for 12 per cent of the global total”.

The report spotlights India’s floundering attempts to make firearms in India. India has managed to get just Rs 1.17 crore as FDI in the defecne sector under the “Make in India” framework.

“FDI of amount $0.18 million has been received in the defence industry sector from April 2014 to December 2017,” said junior defence minister Subhash Bhamre, in a written reply to Lok Sabha recently.

India’s imports increased by 24% between 2008–12 and 2013–17, according to the report and majority of the firearms were sourced from India’s long-time supplier Russia, which accounted for 62 per cent of India’s arms imports in 2013–17.

"Asian and Indian arms procurement in particular are a reflection of the growing security competition in Asia," Rajeswari Pillai Rajagopalan , a senior fellow at ORF, told Outlook.

--------Surprisingly, India’s long-time foe has slashed its imports despite its tensions with India and internal conflicts.

“Pakistan’s arms imports decreased by 36 per cent between 2008–12 and 2013–17. Pakistan accounted for 2.8 per cent of global arms imports in 2013–17. Its arms imports from the USA dropped by 76 per cent in 2013–17 compared with 2008–12.”

Mar 12, 2018

Riaz Haq

#NobelPrize-winner Paul Krugman warns #India could end up with huge mass #unemployment if it does not grow its #manufacturing sector. #Modi #MakeInIndia

https://economictimes.indiatimes.com/news/economy/indicators/nobel-...

"There is this concept called artificial intelligence that you should be wary of. In future, while diagnosis may be outsourced to a doctor in India, it could also go to a firm based on artificial intelligence. Things like this could be a cause for worry for Indian services sector," Krugman said while speaking at a News 18 event.

"Japan is no longer a superpower because its working-age population declined, and China is looking the same. In Asia, India could take the lead but only if it also develops its manufacturing sector, not only the services one,” he said.

“India’s lack in the manufacturing sector could work against it, as it doesn't have the jobs essential to sustain the projected growth in demography. You have to find jobs for people,” he said.

On the other hand, India can also ride the next wave of globalisation on its demographic dividend. "India's growth story is quite unique. Services propelling growth to an extent that hasn't been seen anywhere else in the world and the possibilities of service globalisation has only just begun. Globalisation of service trade has a huge potential. That's one reason to be especially hopeful of India’s progress. It has the first-mover's advantage here," he said.

Mar 17, 2018

Riaz Haq

According to Counterpoint Research, in Q4 of 2016, Micromax had a 16% share of the smartphone market, which dropped to 5% in Q4 of 2017. Now, none of the Indian players figure among the top five.

While we 'Make in India', customers favor #Korean or #Chinese #mobile #handsets http://ecoti.in/W4GjoY via @economictimes #MakeInIndia #Modi #Manufacturing

The fall of Indian handset makers has been as dramatic as their rise. Almost 300 million devices are sold in India — a market second only to China, having overtaken the US in 2017. Yet, in this $20-billion business, Indian companies find the customer hanging up on them in favour of Korean, Chinese or even Russian brands.

Micromax has shifted to selling aircoolers, air-cons, washing machines and television sets. Consumer appliances are seen as stable in terms of technology — no need for tweaks every few months — with relatively better margins compared to the low single digits for handsets.

Jul 24, 2018

Riaz Haq

Pakistan MVA per capita 2010 $134 2015 $146

Sep 4, 2018

Riaz Haq

Investor Jayant Bhandari: #Indians in the West are India's best. Those left in #India are unskilled. People who think India can ever compete with #China or even continue to grow without West's help do not understand ground realities. #MakeInIndia #Modi http://jayantbhandari.com/jay-taylor-india-china-hk-ff/

If I need to get plumbing work done in India, I do the job myself, despite that the cost of a plumber is a mere couple of dollars. In Canada, where a similar work might cost fifty times more, I might get someone to do the job. Why? Because the plumber in India will do a horrible job and will create five new problems. I started and ran Indian subsidiaries of two European companies. The so-called cost advantages of India always stayed an illusion. Anyone who thinks that India can ever compete with China or even continue to grow without constant technological help from the West has no understanding of the ground realities in India. Here is a conversation I recently had with Jay Taylor:

Indian government exists for the sole purpose of collecting bribes. Indian bureaucrats are lazy, incompetent, and sadistic, a case study on which I wrote here a few days back. But what one must remember is that India’s most fundamental problem is its tribal and unskilled populace.

https://youtu.be/H2a21SWjR9E

Dec 23, 2019

Riaz Haq

China: leading trade partner; contribute to 18 percent of India’s imports

https://www.moneycontrol.com/news/business/moneycontrol-research/ho...

(India's) Import dependency on China for a range of raw materials (APIs, basic chemicals, agro-intermediates) and critical components (Auto, Durables, Capital goods) is skewed. To give a flavour, out of the respective imports, 20 percent of the auto components and 70 percent of electronic components come from China. Similarly, 45 percent of consumer durables, 70 percent of APIs and 40 percent of leather goods imported are from China.

-------------------

Trade figures suggest that India is the biggest importer of Chinese consumer goods. India imports almost seven times more from China than it exports to it. India has huge trade deficit with China – its largest with any country. In 2018-19, India’s exports to China were mere $16.7 billion, while imports were $70.3 billion, leaving a trade deficit of $53.6 billion.

It needs to be acknowledged that China’s exports to India account for only 2% of its total exports, so even if Indians boycott all the goods imported from China, it will not make as big an impact on China. Data also suggests that China is India’s largest trading partner, but the trade is heavily skewed in favour of China. Thus initiating a trade war when Indian manufacturing ability is limited is not going to favour India.

https://thewire.in/trade/china-goods-boycott-atmanirbhar-bharat

Jun 20, 2020

Riaz Haq

As #Chinese imports soar in #India, what happened to #Modi’s #MakeInIndia hype? #Indian govt data shows #China's share of the total imports in India has gone up from 13.7% last financial year to 18.3% in the 6 months to September. https://www.scmp.com/week-asia/economics/article/3110755/chinese-im... via @scmpnews

China not only remains India’s biggest source of imports, its share of the total actually increased in the six months to September, government data shows

Indian traders and manufacturers are struggling to end their reliance on Chinese goods partly thanks to a lack of high quality, locally made alternatives

-----------

Much of this has to do with the nature of India’s imports – more than half of which go towards producing finished goods – and the realisation that slogans popularised by Modi such as “vocal for local” might be easy to chant but are harder to put into practice.

-----------

Last week, the Reserve Bank of India announced the country had entered into a technical recession “for the first time in its history”, after recording a contraction – this time of 8.6 per cent – for the second quarter in a row. Between April and June, Asia’s third-largest economy shrank by 24 per cent, official figures show.

Despite this, Modi recently claimed India’s economy was on its way to recovery and would achieve his government’s target size of US$5 trillion by 2024 from the estimated US$2.8 trillion it is worth at present. Economic forecasters at Oxford Economics, however, said on Thursday that growth would continue to stall at around 4.5 per cent until 2025.

The government stills looks determined to walk the route of ‘self-reliance’ though. A day after 15 nations signed the Regional Comprehensive Economic Programme (RCEP) without India, Foreign Minister S Jaishankar said the country was determined to move away from trade arrangements towards a “self-reliant India” policy to “consolidate comprehensive national power”. Despite repeated attempts to reach them, officials in India’s commerce ministry did not comment.

The result is a deepening crisis for India’s traders and manufacturers, one of whom told This Week In Asia on condition of anonymity that the country’s smallest enterprises were the ones suffering the most. “The government asked us to not sack employees but offered us little relief or stimulus. Where we need substantial relief, we got a moratorium on our loans,” he said, referring to the government’s US$265 billion in economic aid announced in May.

Nov 22, 2020

Riaz Haq

"India has entered a technical recession in the first half of 2020-21 for the first time in its history," as per the article titled 'Economic Activity Index', authored by Pankaj Kumar of the Monetary Policy Department. ... The RBI has estimated that the economy will contract by 9.5 per cent for the full fiscal year.

https://www.theweek.in/news/biz-tech/2020/11/12/india-may-have-ente....

India's GDP growth is likely to have contracted 8.6 per cent in the second quarter this financial year, rendering the economy in a state of recession, the first ever published 'nowcast' report of the RBI said. This means that India will enter into a recession for the first time in history in the first half of this fiscal with two successive quarters of negative growth due to the COVID-19 pandemic. "India has entered a technical recession in the first half of 2020-21 for the first time in its history," as per the article titled 'Economic Activity Index', authored by Pankaj Kumar of the Monetary Policy Department.

A recession is a period of declining economic performance across an entire economy that lasts for several months. A recession is defined as two successive quarters of decline. India's economy had shrunk about 24 per cent in the first quarter ended June.

Researchers have used the 'nowcasting' method to arrive at the estimates ahead of the official release of data and their views in an article in RBI's monthly bulletin released on Wednesday do not constitute the central bank's views. ‘Nowcasting’ is the prediction of the present or the very near future of the state of the economy.

The government is due to publish official statistics on November 27.

The pandemic-induced lockdowns had led to a steep contraction of 23.9 per cent in the GDP for the April-June quarter as compared to the same period a year ago. The RBI has estimated that the economy will contract by 9.5 per cent for the full fiscal year.

It, however, added that the contraction is "ebbing with gradual normalisation in activities and expected to be short-lived." The economy will break out of contraction of the six months gone by and return to positive growth in the October-December quarter of 2020-21. Incoming data for the month of October 2020 have brightened prospects and stirred up consumer and business confidence, it said.

“With the momentum of September having been sustained, there is optimism that the revival of economic activity is stronger than the mere satiation of pent-up demand released by unlocks and the rebuilding of inventories. If this upturn is sustained in the ensuing two months, there is a strong likelihood that the Indian economy will break out of contraction of the six months gone by and return to positive growth in the third quarter (Q3) of 2020-21,” it said.

The index is constructed from 27 monthly indicators using a dynamic factor model and suggests that the economy rebounded sharply from May/June 2020 with the reopening of the economy, with industry normalising faster than contact-intensive service sectors, it said. The economic activity index can be used to gauge directional movements in GDP growth well ahead of official releases, it said.

The article said despite the raging pandemic, preliminary estimates are showing a jump in household financial savings to 21.4 per cent of GDP for the June quarter, as against 7.9 per cent in the June 2019 quarter and 10 per cent in the immediately preceding March 2020 quarter. "The sharp increase is counter-seasonal and may be attributed to the COVID-19-led reduction in discretionary expenditure or the associated forced saving and the surge in precautionary saving despite stagnant/reduced income," it said.

Nov 22, 2020

Riaz Haq

Wistron violence could sour #Apple's 'Make In India' plans. Thousands of workers angry over non-payment of wages, destroyed equipment and vehicles at a Wistron plant in southern #India, causing an estimated $60 million in damages. #Modi #MakeInIndia https://reut.rs/3npyHyy

Violence at a Wistron Corp factory in southern India is likely to stall the company’s and its client Apple Inc’s drive to expand local manufacturing, while forcing the government to redouble efforts to encourage foreign investors.

The Taiwanese company, one of Apple’s top suppliers, had been hiring in significant numbers at the plant that became operational earlier this year.

It assembled the second-generation iPhone SE there and was expected to start producing newer models, but the violence has led the company to shut the site and file a police complaint against more than 5,000 contract workers for destruction of property.

Wistron has not disclosed details, but one source familiar with the situation, speaking on condition of anonymity, said the area where smartphones are assembled and lines where delicate components, such as printed circuit boards, are mounted, have been damaged.

The company did not respond to a request for comment from Reuters. It said in a regulatory filing in Taiwan that it was doing its best to get the plant running again.

Apple also did not respond to a request for comment.

Two sources close to the situation, who asked not to be named because they were not authorised to speak to the press, said restarting could be difficult.

Dec 16, 2020

Riaz Haq

#China’s #Trade Boom Continues in May on Strong Global Demand. #Exports to #India jumped more than 100% for the second straight month. Overseas demand for Chinese goods remained strong as economies from the U.K. to the U.S. emerged from months of lockdown https://www.bloomberg.com/news/articles/2021-06-10/china-u-s-agree-...

China’s exports continued to surge in May, although at a slower pace than the previous month, fueled by strong global demand as more economies around the world opened up. Imports soared, boosted by rising commodity prices.

Exports grew almost 28% in dollar terms in May from a year earlier, the customs administration said Monday, weaker than forecast and below the pace in April, but still well above historical growth rates. Imports soared 51.1%, the fastest pace since March 2010, leaving a trade surplus of $45.5 billion for the month.

Overseas demand for Chinese goods remained strong as economies from the U.K. to the U.S. emerged from months of lockdown. Exports to emerging markets like India and in Southeast Asia, which have seen a resurgence in Covid-19 outbreaks, also climbed. South Korea’s exports, a bellwether for world trade, surged the most since 1988 in May, a sign that the global recovery is strengthening.

“It’s still a fairly healthy set of numbers,” Jonathan Cavenagh, senior market strategist at Informa Global Markets, said in an interview on Bloomberg TV. “We know that global demand is still recovering and that trend is likely to continue towards the end of the second quarter and into the third quarter as the major developed economies open up.”

Exports to the U.S. moderated, although still grew at a healthy pace of about 21% growth, while shipments to the European Union slowed to an almost 13% expansion. Purchases by Indian companies jumped more than 100% for the second straight month.

There was also a shift in categories driving export growth. Sales of household appliances and lighting grew, while there was a more than 41% drop of textile and fabric goods, which includes masks and protective clothing. These changes “seem to be consistent with our view that strengthening exports of non-Covid related products offset weakening exports of Covid-related products as global vaccination proceeds,” Goldman Sachs Group economists wrote in a note.

Jun 10, 2021

Riaz Haq

#Ford wakes up badly burnt from its #India dream. #US #carmakers believed they were buying into a boom - the next #China. Now they are pulling out after heavy losses. #Modi #MakeInIndia #manufacturing https://www.reuters.com/business/autos-transportation/ford-wakes-up...

Sep 17, 2021

Riaz Haq

“Make in India” has failed, replaced by a government that never admits defeat with a call for “self-reliance.” Now, exactly 30 years after India turned away from central planning and liberated the private sector, the government is again handing out subsidies and licenses while putting up tariff walls

https://www.business-standard.com/article/economy-policy/why-india-...

One of Narendra Modi’s first promises when elected India’s prime minister in 2014 was to revive the country’s manufacturing sector. India had been de-industrializing since the early part of the century and policy makers correctly argued that only mass manufacturing could create enough jobs for a workforce growing by a million young people a month.

In his first major speech as prime minister, Modi invited the world to help: “I want to appeal all the people world over [sic], ‘Come, make in India,’ ‘Come, manufacture in India.’ Sell in any country of the world but manufacture here.”

The “Make in India” slogan quickly developed into a full-fledged government program, complete with a snazzy symbol — a striding lion made out of meshed gears. Government officials spoke at length about increasing foreign direct investment and improving the business climate to attract multinational companies. Careful targeting of the World Bank’s Ease of Doing Business indicators raised the country 79 positions in the five years after Modi took office.

And, after all that, in 2019 the share of manufacturing in India’s GDP stood at a 20-year low. Most foreign investment has poured into service sectors such as retail, software and telecommunications. “Make in India” has failed, replaced by a government that never admits defeat with a call for “self-reliance.”

---------

The government’s defenders point out that its investor-friendly reforms weren’t answered; nobody came to “Make in India.” And, they ask, hasn’t China profited handsomely from subsidizing its own manufacturing sector?

Such arguments miss the point. Modi’s manufacturing push never went much further than gaming the World Bank’s indicators. No investor believes structural reforms, particularly to the legal system, have gone deep enough. India has a large workforce but too few skilled workers. To top it all off, the rupee is overvalued. Rather than work at solving these interconnected and complex problems, politicians in New Delhi have decided to paper over them with taxpayer money.

Perhaps picking winners has worked for China. What Indians know for certain is that it did not work here after decades of trying. Sure, public investment in sectors of vital strategic importance — electricity storage, perhaps, or cutting-edge pharma — is defensible. But when you start throwing money at every sector that you wish had developed on its own, then all you’re announcing to the world is that you’re out of ideas.

India’s haphazard foray into industrial policy is going to fail, just as “Make in India” did. And it’s likely to cost the country billions along the way.

May 6, 2022

Riaz Haq

Cause of concern! Bank credit to manufacturing declines

Bank credit to 10 out of the 15 sectors declined in the last decade, an analysis by MVIRDC World Trade Centre (WTC) Mumbai shows.

The share of manufacturing sector in the total non-food bank credit declined from 24% to 13.5% in the last decade (2011-12 to 2020-21) due to banks' shift towards lending to personal loans, infrastructure, weaker sections and services sectors, an analysis by MVIRDC World Trade Centre (WTC) Mumbai shows. The outstanding bank credit to the manufacturing sector as a share of manufacturing GDP also declined from 16% in 2011-12 to 13% by 2020-21, it points out.

The analysis, based on Reserve Bank of India (RBI) data, also shows that bank credit to 10 out of the 15 sectors declined as a share of total bank credit. This includes sectors such as base metals, textiles, chemicals, food processing, engineering, automobiles and gems & jewellery.

Noting that the decline in bank credit exposure to manufacturing sector is also reflected in the slow growth in manufacturing investment in the country, WTC analysis says that gross capital formation (a proxy for investment in the economy) has grown at a tepid pace of 2% CAGR in the manufacturing sector during the last 10 years from 2011-12 to 2020-21, compared to a growth of 6% in overall investment in the economy. "The share of manufacturing in India's gross capital formation also shrunk from 17.2% in 2011-12 to 14.36% in 2020-21. On the other hand, sectors such as transport, storage, communication, trade repair, hotels and other services witnessed growth in their share of total capital formation in the economy," it says.

"The stagnancy in bank credit exposure to these core manufacturing sectors does not bode well for our Make in India and Aatmanirbhar program. It is welcome that the share of personal loans, credit to weaker sections and credit to the services sectors have been growing in the overall bank credit. At the same time, we need to promote bank lending to manufacturing sectors, especially in labour intensive segments such as leather, textile, food processing to prevent a situation of jobless growth," Vijay Kalantri, chairman at MVIRDC WTC Mumbai, says.

The analysis notes that in the last 13 years since 2008, the share of personal loans in total bank credit grew from 23% to 27%, while the corresponding figure for credit to weaker sections has grown from 4.8% to 7.5%. Similarly, the infrastructure sector witnessed higher share in overall non food credit, up from 9.3% to 10.2%. The WTC report says that as the central government establishes a dedicated financing institution for the infrastructure sector and as asset monetisation pipeline is implemented effectively, the burden of infrastructure financing on banks will reduce, which in turn may enable banks to focus more on funding to the manufacturing sector.

May 6, 2022

Riaz Haq

Elon Musk won't manufacture Tesla cars in India because government prohibits selling and servicing of EVs

Indian leaders have made multiple failed appeals for Musk to bring Tesla to India

https://www.foxbusiness.com/economy/elon-musk-manufacture-tesla-car...

Tesla CEO Elon Musk said the company will not manufacture cars in India if the country does not allow it to sell and service its electric vehicles.

When asked by a Twitter user Friday if Tesla would be manufacturing a plant in India in the future, Musk said the move cannot happen under the country's current rules.

"Tesla will not put a manufacturing plant in any location where we are not allowed first to sell & service cars," Musk tweeted.

The team Musk hired in India last year has since been instructed to focus on the Middle East and the larger Asia-Pacific markets.

Musk's comments come as the Indian government has yet to accept his demand to reduce import duties on Tesla cars.

Indian leaders have made multiple failed appeals for Musk to bring Tesla to India.

"Our request to him is to come to India and manufacture here. We have no problems. The vendors are available, we offer all kinds of technology and because of that, Musk can reduce the cost," Road Transport and Highways Minister Nitin Gadkari said during the Raisina Dialogue 2022 conference last month, according to TribuneIndia.com.

"India is a huge market and offers good export opportunities too. Musk can export Tesla cars from India," he added.

Gadkari said in February that Musk must first manufacture in India before Tesla cars can be driven on the roads.

Musk had tweeted in January that he could not release Tesla vehicles in India yet due to "challenges with the government." And last summer, the billionaire posted to Twitter that he would like to launch Teslas in India, but the country's import duties are "the highest in the world by far of any large country."

India currently levies a 100% tax on imported vehicles costing more than $40,000, inclusive of insurance and shipping expenses. Cars that cost less than $40,000 face a 60% import tax.

Musk also said on Twitter Friday that SpaceX is waiting on approval from the Indian government to provide the company's Starlink satellite internet to the south Asian country.

May 29, 2022

Riaz Haq

Why Multinational companies are quitting #India? 8 years after #Modi first urged foreign companies to “Make in India”, #Indian #economy is seeing thousands of foreign firms leaving. #MakeinIndia #Islamophobia #Hindutva #BJP #bigotry #violence #hate

https://www.deccanherald.com/business/business-news/why-mncs-are-qu...

Eight years after Prime Minister Narendra Modi first urged multinational companies to “Make in India”, Asia’s third-largest economy is seeing many foreign firms give up on the country

A slew of big names including German retailer Metro AG, Swiss building-materials firm Holcim, US automaker Ford, UK banking major Royal Bank of Scotland, US bikemaker Harley-Davidson and US banking behemoth Citibank have chosen to

pull the plug on their operations in India or downsize their presence here in recent years. That is a worrying trend at a time when India is trying to position itself as an alternative to China, in a post-Covid world where many MNCs are looking to diversify their supply chain.

A total of 2,783 foreign companies with registered offices or subsidiaries in India closed their operations in the country between 2014 and November 2021, Commerce and Industry Minister Piyush Goyal told Parliament late last year. That is not a small figure, given that there are only 12,458 active foreign subsidiaries operating in India.

------

This might also explain why some of the world’s biggest chipmakers have not warmed up to India despite its government rolling out a red carpet for them by approving a $10 billion incentive plan last year to establish chip and display industries in the

in the country.

----------

When asked if he would consider setting up a factory in India, Tesla CEO Elon Musk tweeted last month that the automaker would not set up a manufacturing plant “in any location where we are not allowed first to sell & service cars”.

Musk will instead look for potential opportunities in Indonesia, known for its business-friendly policy and production of nickel, a critical ingredient in making EV batteries.

Jun 19, 2022

Riaz Haq

#India's #manufacturing activity hits 9-month low in June 2022. S&P Global India Manufacturing Purchasing Managers’ Index (PMI) fell to 53.9 in June from 54.6 in May, the weakest pace of growth since last September. #unemployment #jobs #Modi #BJP #economy https://www.business-standard.com/article/economy-policy/india-s-ma...

India’s manufacturing sector activity eased to a nine-month low in June as growth of total sales and production moderated amid intense price pressures, a monthly survey said on Friday.

The seasonally adjusted S&P Global India Manufacturing Purchasing Managers’ Index (PMI) fell to 53.9 in June from 54.6 in May, the weakest pace of growth since last September.

The June PMI data pointed to an improvement in overall operating conditions for the twelfth straight month. In PMI parlance, a print above 50 means expansion while a score below 50 denotes contraction.

“The Indian manufacturing industry ended the first quarter of fiscal year 2022/23 on a solid footing, displaying encouraging resilience on the face of acute price pressures, rising interest rates, rupee depreciation and a challenging geopolitical landscape,” said Pollyanna De Lima, Economics Associate Director at S&P Global Market Intelligence.

Factory orders and production rose for the twelfth straight month in June, but in both cases the rates of expansion eased to nine-month lows. Increases were commonly attributed to stronger client demand, although some survey participants indicated that growth was restricted by acute inflationary pressures, the survey said.

According to the survey, monitored firms reported increase for a wide range of inputs — including chemicals, electronics, energy, metals and textiles — which they partly passed on to clients in the form of higher selling prices.

Lima further said there was a broad-based slowdown in growth across a number of measures such as factory orders, production, exports, input buying and employment as clients and businesses restricted spending amid elevated inflation.

According to the survey, inflation concerns continued to dampen business confidence, with sentiment slipping to a 27-month low. Elsewhere, input delivery times shortened for the first time since the onset of Covid-19.

“Fewer than 4 per cent of panellists forecast output growth in the year ahead, while the vast majority (95 per cent) expect no change from present levels. Inflation was the main concern among goods producers,” the survey said.

On the job front, employment rose for the fourth successive month, albeit at a slight pace that was broadly in line with those seen over this period.

Meanwhile, the Reserve Bank of India (RBI) in its financial stability report released on Thursday said persistently high inflation globally is to stay longer than anticipated as the ongoing war and sanctions take a toll on economies, threatening a further slowdown to global trade volumes.

The global economic outlook is clouded by the ongoing war in Europe and the pace of monetary policy tightening by central banks in response to mounting inflationary pressures, the RBI report said.

Jul 1, 2022

Riaz Haq

China's dominance of manufacturing is growing, not shrinking

Country gaining market share in both low- and high-tech sectors

https://asia.nikkei.com/Opinion/China-s-dominance-of-manufacturing-...

William Bratton is author of "China's Rise, Asia's Decline." He was previously head of Asia-Pacific equity research at HSBC.

When it comes to discussions about China's manufacturing capabilities, there is an all-too-frequent disconnect between rhetoric and reality.

On the one hand, it is widely understood that Chinese producers are losing relative competitiveness. Higher labor costs, bitter trade frictions, rising geopolitical tensions and the domestic pursuit of zero-COVID are all encouraging exporters to leave the country.

China, it is thus argued, has passed "peak manufacturing" and its status as the world's manufacturer stands to be superseded by other countries in the region. By extension, this will materially impact China's economic trajectory and the region's evolving geopolitical balances.

On the other hand, there has been a lack of substantive evidence offered to support the above argument. Although anecdotes abound about certain companies relocating production out of China, the data suggests that such moves are not at the scale necessary to reverse the upward momentum of the country's manufacturing base, nor its international competitiveness.

The most obvious evidence of this is in trade flows.

It is not just that Chinese exports have remained remarkably robust despite COVID-related lockdowns. More than that, the latest numbers from the U.N. Conference on Trade and Development imply that Chinese producers have become more competitive in recent years, not less.

China's manufactured exports, for example, have been growing significantly faster than those of Germany, the U.S., Japan or South Korea. As a result, its share of global manufactured exports by value surged to a new high of 21% last year, compared to just 17% in 2017. The country is now a more important international supplier than Germany, the U.S. and Japan combined.

Furthermore, contrary to the view that supply chains are reducing their exposure to China, Chinese manufacturers have consolidated their primacy across the vast majority of sectors over recent years. In fact, what is particularly remarkable about China's evolving trade structure is that it has been able to simultaneously gain export share in both low- and high-technology industries, including those as eclectic as leather products, truck trailers and optical instruments.

Such gains are hardly indicative of an industrial base under stress. They instead highlight the hyper-competitiveness of China's producers, who increasingly dominate the East and Southeast Asian manufacturing landscape.

For all the chatter about companies leaving China and the changing geographies of supply chains, the reality is that it generated nearly half of the region's manufactured exports in 2021, compared to less than a third 15 years ago.

This competitiveness is derived from the complex and self-reinforcing interaction of multiple factors, many of which are a function of China's size. This allows the country to support far higher levels of domestic competition, innovation and specialization than its neighbors, and results in greater efficiencies and lower production costs, which regional rivals will always struggle to replicate. These scale benefits are subsequently magnified through aggressive industrial development policies that have no obvious precedent in terms of scope or ambition.

So China's manufacturing advantages must be viewed holistically, especially as it can be highly misleading, however tempting, to draw conclusions based on the trends of any specific factor.

Sep 12, 2022

Riaz Haq

China's dominance of manufacturing is growing, not shrinking