PakAlumni Worldwide: The Global Social Network

Pakistan's fiscal year 2015-16 saw production of motorcycles soar to a new high of over 2 million units. This represents a 16.5% surge from last year. At the same time, passenger cars and light trucks sales rose to over 200,000 in fiscal 2016, a 20% jump over the same period last year.

Motorcycle Sales:

Rising motorcycle sales in Asia's developing nations like Pakistan are seen as a barometer of expanding middle class. It is, in part, attributed to rising incomes and availability of bank financing at historic low interest rates in the country.

As many as 2,071,123 motorcycles were manufactured during July-June (2015-16) compared to 1,777,251 units during July-June (2014-15), according to the latest data released by Pakistan Bureau of Statistics (PBS) and reported by Pakistani media.

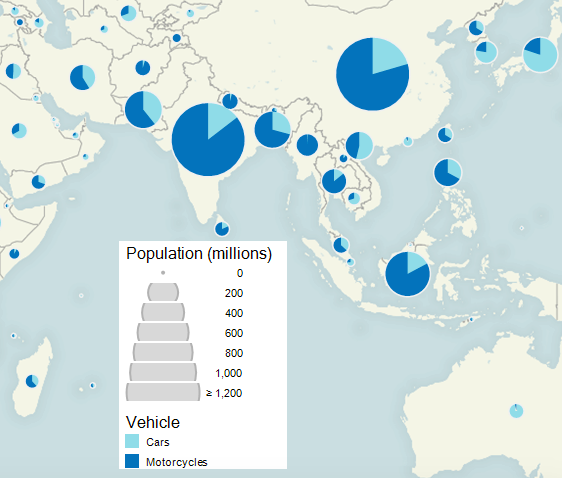

Pakistan is the World's Sixth Largest Motorcycle Market |

Car Sales:

In addition to the double digit increase in motorcycle sales, Pakistan also experienced 20% jump in sales of passengers cars, light commercial vehicles (LCVs), vans and jeeps. The total sales of local vehicles increased by 21% to 216,568 as compared to 179,953 units sold in FY15, according to industry data.

Auto Parts Industry:

Rising auto and motorcycle sales are helping boost Pakistan's auto parts industry as well. “We are getting orders and the pace is increasing,” said Sultan and Kamil International CEO Faisal Mahmood speaking to Pakistani media on the sidelines of the 12th Pakistan Auto Show 2016 held at the Lahore International Expo Centre. Mahmood’s company makes more than 350 automotive parts and exports to all major automobile markets in the world.

Other Growth Industries:

Among other industries seeing significant growth are pharmaceuticals (6.54%), cement (17.01%), chemicals (8.13%), non metallic mineral products (10.02%), fertilizers (13.81%), leather products (7.76%) and rubber products (7.16%), according to media reports.

Summary:

Pakistan's economic recovery is in full swing with double digit growth in multiple industries, including auto, pharma, chemicals, cement, fertilizers, minerals, etc. It is expected to pick up steam over the next several years with new investments on the back of China-Pakistan Economic Corridor related projects.

Related Links:

Growing Middle Class in Pakistan

China-Pakistan Economic Corridor

Riaz Haq

Ritesh Kumar Singh

@RiteshEconomist

While domestic #demand is hampered by high taxes on both vehicles, fuels, motor insurance and repair and maintenance as well as traffic congestion that jack up the cost of owning #vehicles relatively stronger rupee is hurting #Exports, for instance, of 2W.

https://twitter.com/RiteshEconomist/status/1611901898642321409?s=20...

Two-wheeler sales stuttering, how long before it gets better?

After signs of recovery, two-wheeler sales slipped in December showing weakness in domestic demand as well as exports. Expectations are that improving rural demand will drive sales, albeit after a couple of quarters

https://www.moneycontrol.com/news/opinion/two-wheeler-sales-stutter...

ighlights December saw leading two-wheeler firms report a sales drop both year-on-year and month-on-month Domestic demand is yet to grow beyond 2019 pre-pandemic levels Rural sentiment is turning positive but yet to translate into two-wheeler purchases Exports were hit due to devaluation in currencies of importing markets After a couple months of improvement, a weak December for two-wheeler (2W) sales is a setback for forecasts of recovery in 2023. This auto segment registered a marginal year-on-year (yoy) sales rise, while declining compared to the previous...

Jan 7, 2023

Riaz Haq

Pakistani Motorcycles Market is gaining momentum. With the June +52.4% the industry ended the first half with a total of 832.902 sales (+39.5%), the best performance in the entire Asian region. Honda is market leader ahead of local OEMs.

Economic Outlook

Pakistan’s economy demonstrated a continued improvement in the last semester, building upon the stabilization achieved in FY2024, when GDP expanded by 2.5% after the previous year’s contraction. The positive momentum was fueled by sound macroeconomic management, effective inflation control measures, and enhanced fiscal and external accounts stability.

Inflation substantially declined to 7.2 percent in H1-FY2025 from 28.8% a year earlier, supported by easing global prices, a stable exchange rate, and targeted government policies. Policy reforms, monetary easing, and fiscal consolidation further strengthened the foundation for sustainable economic momentum.

Motorcycles Industry Trend and Perspectives

Following the prolonged collapse of 2 and 3 wheelers demand, started with devastating flood in July 2022, the Pakistani motorcycles market is secoveing, starting from the second half 2024.

Looking at the total industry data, after that the 2024 was the start of recovery after years of decline, this year the market is running up at full speed.

In 2024, although a bad start of the year, 2-wheeler sales have been 1.3 million (+18.4%) and the trend is continuing.

Indeed, with the June +52.4% the industry ended the first half with a total of 832.902 sales (+39.5%), the best performance in the entire Asian region.

Looking at the performance among the top manufacturers, the leader Honda reports sales up 33.1%, ahead of United Auto (+86.5%), Suzuki (+20.8%) and Road Prince (+19.9%).

Jul 25, 2025

Riaz Haq

Pakistan 2025. Motorcycles Market Rolls Up 35% After 9 Months, but Yamaha Stops Production

https://www.motorcyclesdata.com/2025/10/26/pakistan-motorcycles/

Pakistani Motorcycles Market is skyrocketing. In 2025 the domestic Pakistani 2-wheeler market is one of the fastest growing worldwide with Year to Date September sales at 1.24 million (+35.3%). However, Yamaha is closing the local plant.

Economic Outlook

Pakistan’s economy demonstrated a continued improvement in the last semester, building upon the stabilization achieved in FY2024, when GDP expanded by 2.5% after the previous year’s contraction. The positive momentum was fueled by sound macroeconomic management, effective inflation control measures, and enhanced fiscal and external accounts stability.

Inflation substantially declined to 7.2 percent in H1-FY2025 from 28.8% a year earlier, supported by easing global prices, a stable exchange rate, and targeted government policies. Policy reforms, monetary easing, and fiscal consolidation further strengthened the foundation for sustainable economic momentum.

Motorcycles Industry Trend and Perspectives

In a major development for Pakistan’s two-wheeler industry, Yamaha Motor Pakistan (Private) Limited has officially announced the end of its motorcycle production in the country. The decision, according to the company, comes as part of a change in business policy.

According to an official notification issued in mid September 2025, the company attributed this decision to a change in its business policy. Yamaha expressed gratitude to its customers for their long-standing loyalty and assured that after-sales support, spare parts supply, and warranty services will continue through its authorized dealers across Pakistan.

We see Yamaha decision as a key effect or radical changes in place in the country, with a policy totally oriented to EVs segment and the arrival of new strong players from China.

The whole market is fast growing and actually ranks as the 9th largest in the World with the best growing performance in 2025 among the top 50 markets.

Indeed, following the prolonged collapse of 2 and 3 wheelers demand, started with devastating flood in July 2022, the Pakistani motorcycles market is recovering, starting from the second half 2024.

Following an already very positive 2024, with sales up 18.4%, in 2025 the domestic Pakistani 2-wheeler market is one of the fastest growing worldwide with Year to Date September sales at 1.24 million (+35.3%).

The electric vehicles segment is boming, supported by government incentives and in the first 9 months 2025 reported a +64.6%.

Looking at the performance among the top manufacturers, the leader Honda reports sales up 31.3%, ahead of United Auto (+71.8%), Suzuki (+30.3%) and Road Prince (+25.6%).

22 hours ago