PakAlumni Worldwide: The Global Social Network

Pakistan's fiscal year 2015-16 saw production of motorcycles soar to a new high of over 2 million units. This represents a 16.5% surge from last year. At the same time, passenger cars and light trucks sales rose to over 200,000 in fiscal 2016, a 20% jump over the same period last year.

Motorcycle Sales:

Rising motorcycle sales in Asia's developing nations like Pakistan are seen as a barometer of expanding middle class. It is, in part, attributed to rising incomes and availability of bank financing at historic low interest rates in the country.

As many as 2,071,123 motorcycles were manufactured during July-June (2015-16) compared to 1,777,251 units during July-June (2014-15), according to the latest data released by Pakistan Bureau of Statistics (PBS) and reported by Pakistani media.

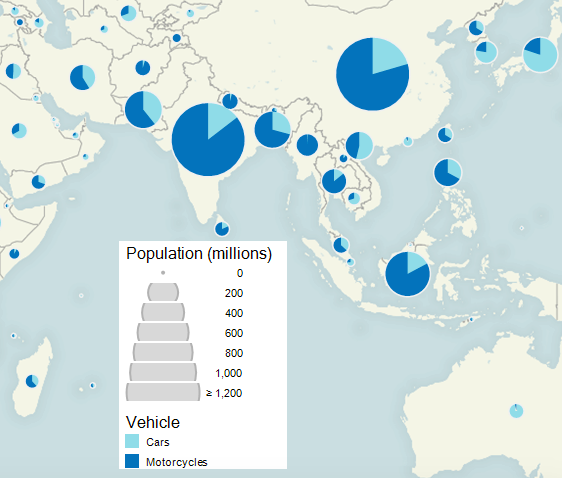

Pakistan is the World's Sixth Largest Motorcycle Market |

Car Sales:

In addition to the double digit increase in motorcycle sales, Pakistan also experienced 20% jump in sales of passengers cars, light commercial vehicles (LCVs), vans and jeeps. The total sales of local vehicles increased by 21% to 216,568 as compared to 179,953 units sold in FY15, according to industry data.

Auto Parts Industry:

Rising auto and motorcycle sales are helping boost Pakistan's auto parts industry as well. “We are getting orders and the pace is increasing,” said Sultan and Kamil International CEO Faisal Mahmood speaking to Pakistani media on the sidelines of the 12th Pakistan Auto Show 2016 held at the Lahore International Expo Centre. Mahmood’s company makes more than 350 automotive parts and exports to all major automobile markets in the world.

Other Growth Industries:

Among other industries seeing significant growth are pharmaceuticals (6.54%), cement (17.01%), chemicals (8.13%), non metallic mineral products (10.02%), fertilizers (13.81%), leather products (7.76%) and rubber products (7.16%), according to media reports.

Summary:

Pakistan's economic recovery is in full swing with double digit growth in multiple industries, including auto, pharma, chemicals, cement, fertilizers, minerals, etc. It is expected to pick up steam over the next several years with new investments on the back of China-Pakistan Economic Corridor related projects.

Related Links:

Growing Middle Class in Pakistan

China-Pakistan Economic Corridor

Riaz Haq

Pakistan wants to promote domestic production to create jobs for its growing labor force.

Excerpt of Wall Street Journal interview with President of Yamaha Motors in Japan:

WSJ: What about in South Asia?

Mr. Yanagi: We want to expand business in Pakistan and Bangladesh as soon as possible. We had a production venture in Pakistan but we dissolved it five years ago. We are now planning to begin local production again, on our own this time.

In Bangladesh, we import motorcycles from our plant in India on a small scale, but we are studying now the best way of running operations because of rising tariff barrier there.

http://www.wsj.com/articles/SB1000142405270230452070457912873316262...

Since this interview was conducted in Oct 2013, Yamaha has set up a motorcycle plant that began production last year in Pakistan.

“The new investment from Yamaha will create jobs and bring new technologies,” said Yamaha Motor Company President Hiroyuki Yanagi, adding that, “Pakistan is all set to become one of the top global markets of motorcycles.

http://tribune.com.pk/story/876873/investment-yamaha-resumes-assemb...

Sep 15, 2016

Riaz Haq

Honda Pakistan has announced plans to double its production capacity in three years, to cater to the estimated growth of the motorcycle market in the country.

Atlas Honda Ltd. (AHL), the joint venture company that takes care of production and sales of Honda motorcycles in Pakistan, has two manufacturing plants – one in Karachi (in Southern Pakistan) and the other in Sheikhupura (in Northeastern Pakistan). The former produces 1.5 lakh units and the latter rolls out 6 lakh units per annum.

The capacity expansion will be carried out in the Sheikhupura plant, to equip the facility to produce 12 lakh units per year. The plan will be executed phase-wise, with the first part of the operation involving the installation of a new production line which will commence functioning in October 2016. Further stages over a three year period is planned to achieve the target of producing 1.2 million motorcycles a year.

The investment AHL will be making for this plant expansion process is approximately USD 50 million (INR 327.32 crores). About 1,800 jobs are estimated to be created.

http://indianautosblog.com/2015/11/honda-pakistan-double-motorcycle...

Sep 15, 2016

Riaz Haq

#Pakistan flight in force at #Africa Aerospace & Defense Show 2016 | IHS Jane's 360 #AAD2016 http://www.janes.com/article/63857/pakistan-flight-in-force-aad16d3... …

Visitors to AAD are being treated to the aerial prowess of the Pakistan Aeronautical Complex Mushshak, a light, robust primary flight trainer and utility aircraft, whose display includes deliberate spinning.

PAC (Hangar 7, Stand CE12) entered the field of maintenance, repair and overhaul (MRO) of aircraft in the early 1970s, as well as components of Chinese origin for the Pakistan Air Force. PAC subsequently moved towards MRO of Mirage III and V aircraft.

In the field of aviation manufacturing, PAC progressed from the manufacture of the Mushshak and Super Mushshak aircraft for primary training to the Karakorum-8 (K-8) advanced jet trainer. The Super Mushshak is a powerful two-/three-seat trainer with a more advanced avionics package. The K-8 has a multi-role mission capability including air-to-air and air-to-ground weapon delivery.

Today, PAC has advanced technology to design and manufacture the multi-role JF-17 fighter aircraft and upgrade the avionics of fighter aircraft. The JF-17 Thunder is a new-generation single-seat multi-role light fighter with high manoeuvrability and beyond visual range capability. It has a long-range operational radius and advanced aerodynamic configurations.

The PAC contingent at AAD is headed by chairman Air Marshal Arshad Malik.

Sep 16, 2016

Riaz Haq

Byco oil refining capacity goes up to 155,000 barrels per day

http://www.brecorder.com/fuel-a-energy/193:pakistan/1181388:byco-oi...

Byco is now ahead of all refineries in Pakistan following the completion of its second unit, as its crude oil refining capacity has gone up to 155,000 barrels per day from 35,000 barrels per day.

Asad Siddiqui, Byco Chief Financial Officer (CFO) of the complex, talking to a select group of journalists here on Monday said the second unit of the refinery has completed, enhancing its refining capacity by 120,000 barrels per day, making it the country's largest refinery. He said that Byco has crossed Pak Arab Refining Company (PARCO) which has the refining capacity of 90,000 barrels per day, followed by 68,000 barrels of National Refinery, 48,000 barrels of Pakistan Refinery Limited and 45,000 barrels of Attock Refinery.

Replying to a question regarding expected removal of international sanctions against Iran, he said that if the sanctions are lifted Byco Refinery is all set to take the advantage of expected crude oil imports from Iran at discounted rates.

Byco CFO said that his company was well placed to benefit from removal of international sanctions against Tehran unlike the country's other refineries which had long term crude supply contracts.

"It is comparatively difficult for other refineries to switch over because of their long term agreements" but Byco has the potential to quickly take advantage of the emerging opportunity.

He said perhaps Iran would also offer discount on crude oil to open up its market and it would be a good omen for Pakistan.

He said Byco had completed one of the two new projects for isomerization and desulphurization and it had relatively short term crude supply agreements that provide flexibility for Iranian crude.

He said the Byco also had past experience of refining Iranian crude before its supply had suspended due to international sanctions.

He said because of consolidated business model, the company would be declaring profit for the first time for the quarter ending June 30, 2015 that would set the direction for its improved financial position in future.

He said the Byco management had decided to consolidate its refining business before going into expansion of retail outlets, adding that so far Byco was operating 250 petrol pumps across the country.

"The focus of our marketing has been on furnace oil sales and we have been able to secure furnace oil business from Nishat Chunia, K-Electric, Tapal, Liberty and Hub Power Company", he maintained.

He said Byco was facing problems because of the issue of turn over tax, but the authorities had not only understood the tax anomaly but was committed to issue an enabling clarification. He explained that refinery was set up under tax-holiday for seven years when there was no turn over tax which was imposed subsequently and the government had agreed to do away with it. He said about 95 per cent of the oil pricing was based on crude price which meant that turn over tax could simply eat away the entire profit.

He said that due to the completion of isomerization and desulphurization of within plants into a couple of months it would convert its entire Naphtha production into motor spirit that would almost double its production from 12,500 barrels per day to cut costs.

He said the government had appreciated the co-operation extended by the Byco in controlling petrol crisis early this year and now looked forward to take benefit of its location and infrastructure.

He said the company could directly provide furnace oil to Hubco next door while Pakistan State Oil was also taking full advantage of Byco's strength of its own port facility in the shape of single point mooring.

Siddiqui said all major oil marketing companies including PSO, Hescol, Caltex and Shell in that order and other smaller companies were lifting products from Byco refinery.

Sep 17, 2016

Riaz Haq

Morgan Stanley's Ruchir Sharma: Prospects of #Pakistan’s #economy "VERY GOOD" & #India's "GOOD" http://tns.thenews.com.pk/pakistans-economy-ready-takeoff/ … via @TheNewsonSunday

Closer to home, he has clubbed four nations of South Asia — Pakistan, Bangladesh, India and Sri Lanka. In general the future outlook for South Asia holds ‘Good’ and for Pakistan it looks ‘Very Good’. I started jumping on the couch after reading the outlook for Pakistan and for the rest of the time I was reading the book I was only interested as to what the future outlook holds for Pakistan in the eyes of most influential investor and thinker. But then the author has added a caution and it’s damn important that we read and comprehend this fine print in detail.

Pakistan’s economy is taking off and the future outlook till 2020 has been termed ‘Very Good’. The rationale used in building this argument is that our working age population is growing and that’s a very good sign for the economy. Inflation is under control which is increasing in the vicinity of 3 per cent but on the other hand GDP is growing at 4.5 per cent. Contrary to the populist demagogy, our debt level is pretty low in relation to comparative economies whereby debt to GDP is at 65 per cent. We have a decent manufacturing base with export economy and we are also investing in factories by opening industrial parks as elucidated in the China-Pakistan Economic Corridor (CPEC).

Our trade deficit is on the decline as our import bill is on the wane, thanks to lower oil prices in the international market. We are also not exporting commodities whose prices are plummeting in the international market. We would be getting a shot in the arm once the CPEC starts rolling out as China has committed to invest US$ 46 billion in infrastructure and power related projects in Pakistan over the next 20 years.

Sharma says that even if 50 per cent of this commitment materializes, it would be enough to provide us with the necessary infrastructure that will take us from a low-income to a middle-income country during the next five years.

Though hard to digest, the most influential writer and investor says that we don’t have stale leadership like Vladimir Putin of Russia and Recep Tayyip Erdogan of Turkey who have clung to power for more than a decade and are in their fourth terms. But then Nawaz Sharif is in his third term too.

A very important point the author highlights is that for a coup-prone country like ours, the military finally seems to have decided to concentrate on ensuring the internal as well as external security while staying clear of politics.

Sep 18, 2016

Riaz Haq

#India’s falling #exports killed 70,000 #jobs in just one quarter. #Modi #AchheDin http://qz.com/784625 via @qzindia

India’s dismal export growth is leading to massive job losses. And, after months of shrinking exports without any signs of improvement, the employment situation in Asia’s third-largest economy is set to worsen.

The jobs market is already in pain. In the July-September quarter of the 2015 fiscal year, India recorded the lowest job growth compared to the same period in 2009, 2011, and 2013.

Plummeting exports are adding to the problem. Some 70,000 jobs were lost in the second quarter of 2015 alone due to a fall in India’s exports, according to the Associated Chambers of Commerce & Industry in India (Assocham). Most of these were contractual in nature, the joint study by Assocham and Thought Arbitrage, a research institute, said.

“While contractual jobs were lost, not adequate regular jobs were added to compensate that loss. Textile has been most affected,” the industry body, which represents over 450,000 Indian business entities, said in a release on Sept. 18.

India’s export growth has been negative in the last couple of years. Lacklustre global demand is one reason. It also doesn’t help that India’s manufacturing sector is still weak. Private investment in manufacturing is yet to pick up, which means exporters are scrambling for funds. Their funding costs are high too. All this has had an impact on the jobs market because exports have been slacking in sectors that are labour-intensive, such as engineering goods, leather, textiles, and rubber, among others.

Eight of the 14 labour-intensive sectors saw exports shrink in the 2016 financial year. In the previous year, job growth in these sectors was the slowest in seven years.

Sep 19, 2016

Riaz Haq

Asian Development Bank increases #Pakistan's economic growth projection for 2017 from 4.8% to 5.2% #Economy #GDP

"As such-and assuming further improvement in energy supply and security, and likely recovery in cotton and other agriculture-the growth forecast for FY2017 is revised up to 5.2%", the report added.

--

The report added that a major impetus to growth in FY2017 and beyond would be the implementation of $46 billion program of infrastructure spending on roads, railways, pipelines and electric power in an economic corridor project linking Pakistan with the People's Republic of China (PRC), which was announced in April 2015.

Fast-tracking would enable several energy projects to come on stream in FY2018, the report added.

The government significantly strengthened macroeconomic fundamentals and advanced a comprehensive program of structural reform under a 3-year program with the IMF that ended in September 2016.

Inflation has been squashed to the low single digits, foreign reserves rebuilt, and the budget deficit markedly reduced.

---

The general government budget for FY2017 projects further reduction in the deficit to 3.8% of GDP achieved by adopting new revenue measures and streamlining current expenditure.

Tax revenues are projected to increase by half a percentage point, raising the ratio of tax to GDP to 12.8% by eliminating more tax concessions and exemptions, expanding the withholding system as part of administrative reform to widen the tax base, and raising some excise taxes and customs duties, the report added.

Inflation is now expected to average 4.7% in FY2017.

The upward revision takes into account expected oil price rises and stronger domestic demand in an increasingly supply constrained economy.

It is tempered by the prospect of a broad agricultural recovery and only modestly higher global food prices. The July 2016 Monetary Policy Statement covering the first 2 months of FY2017 kept policy rates unchanged as the central bank continues its cautious forward-looking approach, expecting to hold inflation within the range of 4.5%-5.5%.

The report observes that the current account deficit was expected to widen in FY2017 to about $5 billion, or 1.6 % of GDP, which is higher than forecast in March.

The revision reflects a somewhat greater increase in global oil prices than expected and continued expansion in other imports stemming from faster economic growth.

Exports are expected to perform better during the year, increasing by nearly 5% as a recovery in cotton production underpins an upturn in textile sales, and as global prices for non-oil commodities reverse from a sharp decline to a modest increase.

The report added that the mobilization of larger inflows into the capital and financial accounts had been central to the 3-year economic program with the IMF, and these flows are projected to increase to $6.5 billion in FY2017, mainly with more foreign direct investment and continuing sizeable official flows.

Thus, even with the projected widening of the current account deficit, the overall balance should remain in surplus, augmenting official reserves.

The corridor project with the China is expected to attract more foreign direct investment, and already in 2015 investors announced 40 greenfield projects worth a remarkable $19 billion, or 4 times the norm in recent years.

Moreover, the decision by Morgan Stanley Capital International to put Pakistan in its MSCI emerging market index, effective from May 2017, will likely spur equity portfolio inflows.

http://www.brecorder.com/top-news/pakistan/320097-adb-revises-up-pa...

https://www.adb.org/sites/default/files/publication/197141/ado2016-...

Sep 28, 2016

Riaz Haq

#Honda’s new plant inaugurated in #Pakistan to produce 1.35 million motorcycles a year in world's 6th largest market

http://www.dawn.com/news/1291204/atlas-hondas-new-facility-inaugurated

LAHORE: Takahiro Hachigo, President, CEO and Representative Director of Honda Motor Co Ltd Japan, on Thursday inaugurated new facility of Atlas Honda Ltd (AHL) in Sheikhupura to expand its motorbike production.

Speaking on the occasion, Mr Hachigo announced that Pakistan has now become the sixth largest motorcycle market in the world.

Saquib H. Shirazi, speaking on the occasion, said with the enhancement of the production capacity, Atlas Honda is now well poised to serve the expanding market.

AHL, Honda’s motorcycle production and sales joint venture in Pakistan, discussed its plans to carry out production enhancement in machining and other fields at the Sheikhupura plant during the next three years.

The annual assembly production capacity of AHL has now become 1.35 million units, with 150,000 units from the Karachi plant and 1.2 million units from the Sheikhupura plant.

Oct 22, 2016

Riaz Haq

#Pakistan #auto parts maker Loads Limited CEO more than bullish on nation's auto sector. #economy #manufacturing

http://tribune.com.pk/story/1310741/optimistic-loads-limited-ceo-ju...

Munir Bana advised many of his employees to buy the company’s shares as date of the book-building portion of the IPO neared. Many of them hesitated, but some of them opted to buy a personal stake in the auto part maker’s expansion plan.

Weeks later, many regretted their decision and those who bought the shares wished they had invested more.

After all, the share price of Loads Limited – the last listing on the Pakistan Stock Exchange in 2016 – jumped over 100% within a few weeks of trading. It is currently priced at Rs56.76 after starting on Rs34 and has also handed out 10% bonus shares and Rs1 as dividend to its shareholders.

“Our employees were hesitant to enter the stock market, but when I insisted many of them bought the company’s shares,” said Bana, the CEO of Loads Limited, one of the leading auto part makers in the country.

“Those who did not buy or purchase just a few shares now regret (their decision).”

Before offering 50 million shares through the IPO, the company first offered 2.5 million shares to its employees to engage them in the company’s future aggressive investment plans. The company eventually managed to raise Rs1.7 billion, an amount the company is now using for expansion of its production capacity.

Loads makes radiators, exhaust systems, mufflers, sheet metal components among other parts, and its clients include more than a dozen national and multinational companies engaged in the production of motorcycles, cars and heavy vehicles manufacturers.

Bullish on future growth

Bana, a Chartered Accountant, believes two developments have been positive triggers for the local auto industry — the China-Pakistan Economic Corridor (CPEC), a $55-billion investment and loan package that envisages changing the way China conducts trade, and the Automotive Development Policy (ADP) 2016-21 announced in March 2016.

Industry experts believe the auto sector would be a major beneficiary of CPEC, given the corridor’s vision of upgrading Pakistan’s road and highways network.

Officials say the country would need heavy vehicles not only during the construction phase, but also after the infrastructure projects are completed.

“New entrants and new models, as well as the increase in heavy vehicles, all speak for themselves,” he said.

Jan 29, 2017

Riaz Haq

#Pakistan’s Middle Class Soars as Stability Returns - WSJ. #economy #middleclass

https://www.wsj.com/articles/pakistans-middle-class-soars-as-stabil...

Pakistan, often in the headlines for terrorism, coups and poverty, has developed something else in recent years: a burgeoning middle class that is fueling economic growth and bolstering a fragile democracy.

The transformation is evident in Jamil Abbas, a tailor of women’s clothing whose 15 years of work has paid off with two children in private school and small luxuries like a refrigerator and a washing machine.

For companies like the Swiss food maker Nestlé SA, such hungry consumers signal a sea-change.

“Pakistan is entering the hot zone,” said Bruno Olierhoek, Nestlé’s CEO for Pakistan, saying the country appears to be at a tipping point of exploding demand. Nestlé’s sales in Pakistan have doubled in the past five years to $1 billion.

Although often overshadowed by giant neighbors India and China, Pakistan is the sixth most-populated country, with 200 million people. And now, major progress in the country’s security, economic and political environments have helped create the stability for a thriving middle class.

An unpublished study last year that measured living standards, from Pakistani market research firm Aftab Associates, found that 38% of the country is middle class, while a further 4% is upper class. That’s a combined 84 million people—roughly equivalent to the entire populations of Germany or Turkey.

Such households are likely to have a motorcycle, color TV, refrigerator, washing machine and at least one member who has completed school up to the age of 16, the study found. Official figures show that the proportion of households that own a motorcycle soared to 34% in 2014 from 4% in 1991, and a washing machine to 47% from 13% over that same period. These trends are also attracting international business.

In December, Royal FrieslandCampina NV, a Dutch dairy company, paid $461 million to buy control of Engro Foods, a Pakistani packaged milk producer in a country where most milk is sold unpasteurized from open milk containers.

“What we see is consumer spending is rising and a middle class coming up,” said Hans Laarakker, Engro’s new chief executive.

Late last year, China’s Shanghai Electric Power agreed to pay $1.8 billion for a majority of Karachi’s electric supply company; Turkish electrical appliance maker Arçelik paid $258 million for a Pakistani appliance maker, Dawlance, saying Pakistan has an “increasingly prosperous working and middle class”; and French car maker Renault SA said it was seeking to set up a plant in Pakistan.

Meanwhile, during the past three years, deaths from terrorist attacks have fallen by two-thirds, as the army battles jihadists. Economic growth reached an eight-year high of nearly 5% in the past financial year, and China has begun a multibillion-dollar infrastructure investment program. The Karachi stock market rose 46% last year and continues to soar.

------

In the developing world, the ability to purchase durable goods such as motorcycles—which itself can lead to new opportunities in employment, education and leisure—is generally viewed as an indicator of a middle class lifestyle. Motorcycle purchases soared in Pakistan to 2 million a year now from 95,000 in 2000, leading Honda Motor Co. to double its production capacity there. Buyers of Honda’s cheapest motorcycle typically earn between just $200 and $300 a month, which would put them well below the poverty line in the West, but here that gives them disposable income.

“All these big companies globally, if they’re not looking at Pakistan, need to look at Pakistan, because it’s a huge consumption economy emerging,” said Saquib Shirazi, chief executive of Honda’s Pakistan joint venture.

Feb 1, 2017

Riaz Haq

#Automobile companies eye production in #Pakistan as local market accelerates. #manufacturing #economy https://www.ft.com/content/328ca8ae-f34a-11e6-8758-6876151821a6

When Naeem Khan went into his local automobile dealer in Karachi to replace his five-year-old taxi with a rickshaw, he was not expecting to leave with a brand new air-conditioned car instead.

But after getting a financing package that was cheaper than he expected, Mr Khan became one of an increasing number of Pakistanis who have recently bought vehicles they previously only dreamt of owning.

The national surge in sales has prompted three global carmakers to commit in the past few months to starting production in Pakistan, potentially doubling the number of foreign carmakers in the country.

“The dealer told me it was the right time to get a loan to buy a car,” says Mr Khan. “Five years ago he said he would have told me to buy a second-hand car or a rickshaw, but today I could afford to buy a new car.”

Pakistan’s car market is still small, and dominated by the three Japanese brands that have local manufacturing plants: Toyota, Honda and Suzuki. The trio made all but seven of the country’s domestically manufactured cars in 2015-16, according to the Pakistan Automotive Manufacturers’ Association, though the figures are just a fraction of their total global car sales.

In the past, analysts say, manufacturers have been put off by the country’s relative poverty, as well as political instability and concerns about security.

But in the past few months, France’s Renault and both Hyundai of South Korea and its affiliate Kia have announced they will soon start assemblies in Pakistan, in partnership with local companies. It marks a return for Kia and Hyundai, which left in the previous decade when their local partner suffered financial problems.

The new and returning entrants are being drawn in by several factors.

The first is both the scale of the potential market in a country of 200m people, as well as the rate at which it is already growing. In 2012-13, carmakers sold 118,830 cars in Pakistan. By 2015-16, that had risen 52 per cent to 181,145.

Analysts say the surge has left Toyota, Honda and Suzuki struggling to meet demand with their customers sometimes forced to wait as long as five months before their cars are delivered.

Yong Sohn, general manager at the Hyundai group, says: “Population and growth-wise, Pakistan is very promising.”

Renault declined to talk about its plans while it is in negotiation with local partners.

Part of the reason for the rise in car sales is that Pakistanis are getting richer. Between 2010 and 2015, the amount each person earned per year rose from $4,370 to $5,320 as measured in gross national income per capita at purchasing power parity.

------

That trend is expected to continue, partly helped by China’s plans to invest more than $52bn in Pakistan’s infrastructure under the “One Belt, One Road” project. Hyundai forecasts that, consequently, car sales in Pakistan will hit 300,000 a year by 2020.

Just as importantly, say analysts, has been the corresponding fall in interest rates. Since September 2000, the rate at which banks can borrow from the Pakistan central bank has fallen from 13 per cent to 6.25 per cent.

Saleem Memon, who sells finance packages for carsin central Karachi, says: “A few years ago, customers sometimes paid 16 or 17 per cent in annual interest rates. Now, if they are lucky, they can get a good deal for around 11 per cent.”

Another factor drawing carmakers to Pakistan is that security has begun to improve thanks to a two-year campaign by the army. Mr Khan remembers days when he and other taxi driverswere routinely stopped at gunpoint by armed extortionists. “The streets are now safe and people feel comfortable driving till late at night,” he says.

Third, the government has drawn up policies aimed at attracting carmakers, such as cutting the duties applicable to parts shipped from abroad and making it easier to find a site to build a plant.

Feb 28, 2017

Riaz Haq

#Pakistan #Auto Show 2017: Auto part manufacturers gear up for biggest ever exhibition in #Karachi

https://tribune.com.pk/story/1343197/pakistan-auto-show-2017-auto-p...

Pakistan’s auto part manufacturers are bullish on future growth of the industry due to growing sales of locally-assembled vehicles and planned investments of new companies.

“A record number of foreign exhibitors are going to participate in the Pakistan Auto Show (PAPS) 2017,” Pakistan Association of Automotive Parts and Accessories Manufacturers (Paapam) Chairman Mashood Ali Khan told reporters at a local hotel on Wednesday.

Pakistan, Thailand: PAAPAM expresses concern over inclusion of auto sector in FTA

Paapam officials expect over 65 international exhibitors in PAPS 2017, being held from March 3-5 at the Expo Centre, Karachi. Relative improvement in security, macroeconomic stability and the announcement of the new auto policy in 2016 has created an ideal condition for global car manufacturers to invest in Pakistan.

Current conditions are particularly beneficial for the local auto part making industry, which is expected to provide auto parts to new automobile entrants that need their partnership to produce economical cars in Pakistan.

“New auto players like Kia and Hyundai are setting up their plants in Pakistan and this is a huge opportunity for us,” former Paapam Chairman Aamir Allawala commented.

“Last year, only six international exhibitors participated in the event, but this time the response is overwhelming. We are pleased to entertain a large complement of dignitaries from across the globe,” added Khan.

This time a total of 85 local exhibitors, 17 sponsors, six universities and 17 support organisations are going to take part in the show. This comes to a total of 192 exhibitors this year, as against 104 last year. In PAPS 2013, a total 15,000 visitors and 100 exhibitors were part of the show while in 2014 the number of visitors was 25,000 and there were 150 exhibitors. In 2015, the visitors increased to 30,000 and exhibitors were 200.

Government officials, local and international buyers and manufacturers, machinery manufacturers, raw material providers and service providers are expected to visit the show.

International visitors from Afghanistan, Bangladesh, China, Japan, the Netherlands, Sri Lanka, the UAE, the UK and African countries have attended the past events, but this year visitors from other countries as well are expected in this show, Paapam Senior Vice Chairman Saeed Iqbal Ahmed Khan said.

“We would like to strengthen our international relationships, which have been developed after years of hard work. Export orientation will be the key to introducing new and upgraded technology,” he said.

Paapam Vice Chairman Syed Mansoor Abbas commented that an additional important objective is to strengthen relationships with OEMs and strive to increase localisation content.

Mar 2, 2017

Riaz Haq

#Pakistan Indus Motor Company unveils Rs4bln (US$400m) investment plan to expand production. #Automobiles #Toyota

https://www.thenews.com.pk/print/195925-Indus-Motor-Company-unveils...

Indus Motor Company Limited (IMC), a country’s leading automaker, on Saturday unveiled four billion rupees investment plan to expand its annual production capacity by 200,000 units in a bid to capitalise on the growing consumer demand.

Currently, IMC holds an annual production capacity of 54,800 units, which are sold under the brand name of Toyota. The planned capacity enhancement would bring the production to 75,000 vehicles a year.

“Pakistan’s auto industry future looks very promising,” IMC Chief Executive Officer Ali Asghar Jamali told media at its third auto workshop.

“I am hopeful that Pakistan will be producing 500,000 cars per year by 2022,” Jamali said.

The demand for local as well as used cars has exponentially been growing for the last three years due to overall improvement in the macroeconomic activities.

Despite being a world’s biggest densely-populated country, Pakistan has, however, not seen rapid motorisation. The country has only 16 cars per 1,000 people. By 2020 the ratio is likely to reach 20 cars per 1,000.

Industry experts are expecting a fast growth in car sales due to growing and young middle-class in the country.

The experts said the country is the third largest growing economy in emerging market and it could benefit from the ongoing $57 billion worth of China-Pak Economic Corridor (CPEC) projects.

IMC recorded five percent drop in sales during the July-February period of 2016/17, but in light commercial vehicle -- vans and jeeps – sales of Toyota Fortuner increased to 568 during the period from 368 units in the corresponding period.

Analyst Sohaib Subzwari at Taurus Securities Limited attributed the fall in sales to “strong demand for Honda Civic and operational issues restricting production.”

Subzwari, however, said the growing construction and road network development activities on account of CPEC would contribute to growth in volumes of heavy and light commercial vehicles.

In July-February, IMC emerged as the second leading player by number of sold vehicles. Pak Suzuki was the first, while Honda was the third.

The government recently announced auto policy 2016-21 containing a number of incentives for Greenfield and Brownfield projects in the country’s Japanese-dominated auto market.

IMC started its operation as a joint venture of House of Habib of Pakistan, Toyota Motor Corporation and Toyota Tsusho Corporation of Japan in 1989.

Analysts said auto industry generally feels comfortable about the new auto policy, which they say has provided a solid road map to the investors to plan investment for a long period.

On premium (own money) and black marketing, Jamali said the government should impose Rs100,000 as a levy per car if the first owner sells it within six months of the purchase. “This will eliminate the middleman and investors who create artificial shortage of cars in the market,” he added.

Car manufacturers said import of used cars poses the biggest threat to the local industry’s survival.

“We purchase local parts of Rs150 million on every working day, which becomes Rs40 billion per year,” said IMC executive.

Pakistan imports more than 46,500 used cars in a year, around 15 percent of the total car sales of 283,000 units in 2016.

Aamir Allawalla, ex-chairman of Pakistan Association of Automotive Parts and Accessories Manufacturers (Paapam) said import of five-year old used vehicles dented the industry as it led to shutdown of several plants.

“New variants to be introduced by local players in the next years would, however, give a tough competition to the imported cars,” Allawalla said.

He said local industry wants long-term auto policies to get return on their investment and in order to avert ‘sudden shocks’. A huge investment in the sector has been planned, he added.

Apr 1, 2017

Riaz Haq

#Pakistan #automobile #motorcycle parts Industry looks for joint ventures with #Thailand

https://tribune.com.pk/story/1369096/auto-parts-industry-looks-join...

Pakistan auto part makers have met with their Thai counterparts in Bangkok to discuss the planned free trade agreement (FTA) and the possibility of joint ventures between the two countries.

The delegation from Pakistan was led by Pakistan Association of Automotive Parts and Accessories Manufacturers (Paapam) Chairman Mashood Ali Khan.

Khan said he was optimistic that a Thai delegation would visit Pakistan soon to push forward bilateral talks. Paapam had earlier expressed reservations about the proposed FTA with Thailand, fearing it may hurt interests of the local industry in coming years.

The delegation informed Thai auto part manufacturers about the rapidly growing automotive market in Pakistan, according to a press release. Paapam asked them to provide a complete list of their components with HS code and other details and also discussed the possibility of joint ventures.

Apr 2, 2017

Riaz Haq

#Yamaha launches new 125cc #motorcycle in #Pakistan. CEO says Pakistan is the world's 5th largest motorcycle market

https://www.dawn.com/news/1324844

Yamaha Motor Pakistan announced the launch of their new 125cc bike vowing to cater the need of common motorcycle users in Pakistan, read a statement issued by the company.

The latest model YB125Z is equipped with features like longer and wider size seat, engine balancer to reduce vibration, powerful headlight halogen lamp, self-starter and gear indication on speedometer, it said.

Yamaha earlier introduced two sporty versions in the 125cc category as it introduced YBR125 & YBR125G models around two years back.

YB125Z is priced at Rs115,900 and this model will be available in the market from the middle of April 2017.

Speaking at the launch, Executive General Manager of Yamaha Motor Co., Ltd. (Japan) Hiroyuki Seto said that Pakistan was now the fifth largest motorcycle market in the world, and Yamaha was looking at Pakistan as a huge potential market.

“We want to establish our presence in the 125cc standard segment in Pakistan,” he said.

Also speaking on the occasion, Yamaha Motor Pakistan’s Managing Director Shigeru Ishikawa highlighted YB125Z as new weapon to cut into mass segment.

“We have big confidence in our new product and it’s a time for us entering the next stage so our valued customers can now experience the real,” he was quoted as saying.

Apr 5, 2017

Riaz Haq

The Pakistan motorcycle market is growing at the rate of 15 per cent annually. This is an appreciable static growth which anticipates the importance of presence of the local assemblers.

Atlas Honda is the market leader in the Pakistani motorcycle industry with over 65 per cent market share. Atlas Honda motorcycle industry showed a phenomenal jump from 1 million motorcycles a year in 2000-01 to currently 2 million a year .This is an evidence of dramatic change in consumer behavior in Pakistan.

In the past year over 1.5 million motorcycles were produced in the country out of which most were of 70cc engine capacity. A phenomenal growth has been observed in 100cc, 125cc and above segments with a growth trend of around 34 per cent and 20 per cent respectively. A decline in production of around 10 per cent is seen in the most popular 70cc motorcycles.

Due to Honda's 100 per cent motorcycle localisation and the prices of it being reasonable in the domestic market, the new international markets like South Africa and Iran are being explored. Already it has gained foreign markets like Bangladesh and Sri Lanka.

Local assembly of motorcycles started in 1964 when Atlas Group put up assembly facilities in Karachi to assemble Honda motorcycles before that the market was haunted by Japanese brands Honda, Yamaha and Suzuki.

The market experienced a major breakthrough in the late 1990's with the advent of assemblers. At present, there are around 100 assemblers in the country. Out of these around 81 are active assemblers. The popular 70cc brand still carries more than 80 per cent of the market share. The Honda Japan recently declared Pakistan as a hub for 70cc technology in the region.

From the years 2007 till 2011, the Honda motorcycle's price has gone up from Rs 58000 to Rs 68500. According to the Senior Managing Director of Honda Motor Company Japan, T Oyama, Pakistan will be amongst the top five countries in the world which will produce and export high quality motorcycles in the coming next few years.

Atlas Honda has achieved a lot of success in Pakistan and with its high sales and production; it will bring a boom to Pakistan's economy in an impressive way. Atlas Honda has invested $35 million this year alone in Pakistan and increased its motorcycle production capacity to 750,000 per year. Pakistan has one of the largest motorcycle consumer markets and it exports to regional buyers too.

The production capacity will be increased to one million units in the next few years with an estimated cost of an additional $50 million. This collaboration between Atlas Group Pakistan and Honda Japan is amongst the oldest in joint venture history of Honda Motor Company anywhere in the world, and together Atlas Honda Ltd. has brought about the drive for motorcycle industry in Pakistan.

Observing from recent growth in motorcycle sales in the 100cc and other categories, Pak Suzuki Motors Company has launched a new model of 110cc motorcycle. The company says it is keen to cater to the growing market of higher engine specification motorcycles. The launch price of the GD-110 has been set at Rs99, 999. The bike employs a 4-Stroke CDI engine which complies with Euro II emission standards.

Pak Suzuki remains the dominant player in Pakistan's four-wheelers market with over 60 per cent of the market. However, its share in the motorcycles market is just less than 2 percent.

http://www.thefinancialdaily.com/NewsDetail/172818.aspx

Apr 5, 2017

Riaz Haq

#Pakistan #auto sales stay buoyant as volumes rise 14% in 10 months July 2016-April 2017

https://tribune.com.pk/story/1407581/local-auto-sales-stay-buoyant-...

Local automobile sales, including light commercial vehicles (LCVs) and jeeps, in the first 10 months (Jul-Apr) of the current fiscal year totalled 176,937 units, up 14% compared to 154,949 units (excluding Punjab taxi scheme sales of 29,150 units) in the same period of previous year, according to data released by the Pakistan Automotive Manufacturers Association (Pama).

Auto industry seeks tax relief at retail stage

“Car sales remained robust and are expected to touch 270,000 units (including 60,000 imported cars) by the end of fiscal year in June 2017,” Topline Securities commented on Thursday.

Aug 2, 2017

Riaz Haq

#Philippines (sales up 30%), #Pakistan (sales up 18.9%) help #motorcycle makers avoid the skids- Nikkei Asian Review https://asia.nikkei.com/Business/Trends/Philippines-Pakistan-help-m...

Philippines, Pakistan help motorcycle makers avoid the skids

Demand in two countries surges just as sales slow elsewhere in Asia

SADACHIKA WATANABE and JUN ENDO, Nikkei staff writers

https://asia.nikkei.com/Business/Trends/Philippines-Pakistan-help-m...

The Philippines and Pakistan have become bright spots in Asia's motorcycle market, helping to offset slowdowns in other key countries.

Like the Philippines, Pakistan is providing some much-needed vroom. Sales are rising by double digits in the South Asian country, which has a population of nearly 200 million but gross domestic product per capita of $1,500 -- half the Philippines' figure.

Improved security is giving consumers more confidence to buy motorbikes. Sales surged 18.9% last year, to 1.43 million units, according to industry figures. Auto researcher Fourin estimates the market was actually 1.8 million to 2 million, factoring in imports by Chinese manufacturers.

Honda plans to double its motorcycle production capacity in Pakistan in the 2015 to 2018 period. It is already capable of turning out 1 million motorbikes.

Yamaha Motor, which dissolved its local joint venture in 2008, built a new plant to re-enter Pakistan in 2015. Motorcycles with 70cc engines are selling well, and Yamaha aims to buff its brand with a 125cc model.

Despite a population of 100 million, the Philippines' motorbike market is less than half that of Vietnam, which is home to 90 million people. The wealthy tend to own cars, while low-income earners typically get around on Jeepneys and other public transportation in urban areas.

But a couple of Japanese bike manufacturers -- Honda Motor and Yamaha Motor -- have sought to change that with scooters featuring automatic transmissions. Their marketing drives, coupled with rising income levels, are giving sales more zip.

Aug 4, 2017

Riaz Haq

#Pakistan car sales in July 2017 jump 41% to 19,577 units in July 2017, from July 2016 #Tractor sales spike 125% YoY

https://tribune.com.pk/story/1478567/locally-assembled-car-sales-ac...

Sales of locally assembled vehicles, including jeeps and light commercial vehicles, jumped to 19,577 units in July 2017, up 41% compared to 13,932 units in the same month of 2016, according to latest data released by the Pakistan Automotive Manufacturers Association (PAMA).

A Topline Securities’ report said the numbers were in line with its estimates. The apparently large difference in monthly sales may be attributed to reduced working days in July 2016 because of Eid holidays, the report said.

Pakistan could soon see these electric cars on its roads

Sales of Pak Suzuki Motor Company increased 37% year-on-year (YoY) in July 2017 due to strong demand for Wagon-R, up 77%.

With the introduction of a new model, sales of Cultus rose 66% YoY while Ravi sales were up 41%, which also supported the company’s growth.

Honda outperformed its peers in vehicle sales, posting 113% growth due to successful introduction of a new Civic model and new sports utility vehicle (SUV) BR-V.

Indus Motor sold 4,618 units in July 2017, up 11% YoY. The company’s focus remained on production of higher-margin Fortuner, which recorded a stellar growth of 543%.

Moreover, buyers were postponing their purchase of Toyota Corolla, waiting for the face-lift model, which has arrived now.

Truck and bus sales of PAMA member companies in July 2017 remained strong, growing 13% YoY. The trend is expected to continue, fuelled by the China-Pakistan Economic Corridor (CPEC) led growth, higher road connectivity, lower financing rates and enforcement of the axle load limit per truck on highways by the National Highway Authority.

Two and three-wheel vehicle sales for July 2017 grew strongly by 42% YoY due to rising disposable income of the lower middle class, the report added.

Why Pakistan should switch to hybrid cars

Tractor sales continued to exhibit an upward trajectory with sales growing by 125% YoY in July 2017.

Lower general sales tax, improved crop yield due to Punjab government’s Kisan Package and continuation of fertiliser subsidy to improve farmers’ purchasing power contributed to the strong tractor sales.

Moreover, in the provincial budget for fiscal year 2018, the Sindh government has set aside Rs2 billion in subsidy on tractor purchases by farmers.

Aug 12, 2017

Riaz Haq

Pakistan Government asks auto investors to conclude committed investments

https://www.thenews.com.pk/print/216089-Government-asks-auto-invest...

The government on Wednesday asked four investors, which was given approval to invest around $3 billion in setting up auto assembling plants in the country, to furnish all the necessary documents in order to finalise the agreements by next week.

In June, ministry of industries and production allowed United Motors Private Limited, Kia-Lucky Motors Pakistan Limited, Regal Automobiles Industries Ltd, and Nishat Group to set up units for assembly and manufacturing of vehicles under the Greenfield investment category.

A senior official at BoI told The News that the four companies would likely to bring in investment of around three billion dollars, “which will help in breaking the existing cartel of three Japanese car assemblers and bringing down prices and create job opportunities.”

A statement said Khizar Hayat Gondal, secretary ministry of industries and production and Azhar Ali Chaudhry, secretary Board of Investment held a meeting on Wednesday with the four awardees of Greenfield status under the Auto Development Policy (ADP) 2016-21 as a follow-up of the meeting held on June 6.

The investors were urged to meet the necessary codal requirements under the policy as early as possible. They were asked to prepare their agreements to be effected pursuant to the award of ‘Greenfield status’ without any loss of time.

All concerned assured that these agreements would be finalised over the next week. Most of them expressed the resolve to present all necessary documentation by the 20th of this month, according to the statement.

Secretary ministry said companies awarded with Greenfield investment would be required to separately enter into agreements with the ministry of industries and production to ensure compliance with ADP 2016-21, relevant statutory regulatory orders and various timelines for completion of the projects for availing incentives under this policy.

The meeting asked the Engineering Development Board (EDB) to examine and put up these cases for approval as and when complete documentation is received.

Next monthly meeting with investors will be convened in the ministry of industries and production in the 2nd week of August 2017.

EDB will issue manufacturing certificate and list of importable components to new investors after verifying that their manufacturing facilities are adequate to produce roadworthy vehicles. The investors appreciated efforts of the ministry and the board for being pro-active in finalising investment proposals in record time.

Applicants for award of Greenfield status also participated during the meeting and showed their level of preparedness. The applicants are Habib Rafiq (Pvt.) Ltd., Khalid Mushtaq Motors (Pvt) Ltd., Pak-China Motors (Pvt) Limited, Foton JW Auto Park (Pvt) Ltd, Cavalier Automotive Corporation (Pvt) Ltd.

Sep 20, 2017

Riaz Haq

Two bike makers of Pakistan, Atlas Honda Limited and United Auto Motorcycle broke all previous production and sales records in August. 187,249 bikes were sold in July-Aug 2017-18 in comparison to 136,476 units in 2016-17 by Atlas Honda Limited.

Similarly, production and sales in May 2017 were 90,800 and 93,060 units while in August 2017 it was 95,200 and 91,599 units.

United Auto Motorcycle also made new records as its production and sales surged to 35,555 and 36,084 in August 2017 in comparison to its previous record in November 2016 of 32,773 units.

In July-Aug 2016-17 the sales by UAM were 49,464 while this year during same period UAM sales increased to 67,023 units.

Moreover, statistics by Pakistan Automotive Manufacturers Association confirmed that Road Prince Bike Assembler also made record production of 23,650 units in Aug 2017 compared to its last record of 19,508 units in October 2016.

Other than this sale of Honda Civic/City, Suzuki Swift and Toyota surged from 5,295, 689 and 8,250 units during July-August 2016 to 7,766, 722 and 8,657 units this August 2017. Sales of Suzuki Cultus and Suzuki WagonR climbed up from 2,190 and 2,352 units to 3,670 and 4,137 units. Similarly, Suzuki Mehran and Suzuki Bolan sales increased from 5,676 and 2,865 units to 6,826 and 3,224 this August 2017. Trucks, Jeeps, Vans, Tractors sales also showed a considerable rise from the previous year.

CPEC played a significant role in high sales of trucks and other vehicles.

https://www.researchsnipers.com/bike-makers-break-previous-producti...

Sep 20, 2017

Riaz Haq

#Pakistan large scale manufacturing posts 4 year high growth of 12.98% in July 2017 | http://thenews.com.pk

https://www.thenews.com.pk/print/231581-LSM-posts-four-year-high-gr...

Karachi: Large scale manufacturing sector posted a four-year high growth of 12.98 percent year-on-year in the first month of the current fiscal year on infrastructure-driven boom and growing auto demand.

Pakistan Bureau of Statistics (PBS) data on Thursday showed that iron and steel production climbed 46.36 percent in July over the same month a year ago, followed by automobiles (42.56pc) and non-metallic mineral products (37.95pc).

LSM output increased 12.78 percent in September 2017 over the same month of 2016. PBS statistics revealed that production of billets soared more than 74 percent YoY to 476,000 tonnes in July.

Production of tractors more than doubled to 5,087 units in July 2017 from 2,067 units in July 2016, while output of trucks, jeeps and cars, light commercial vehicles and motorcycles increased 24.4 percent, 55.75 percent, 16.03 percent and 26.46 percent, respectively.

Other sectors that recorded growth in July included engineering products (21.95pc), food, beverages and tobacco (19.02pc), pharmaceuticals (11.14pc), paper and board (11.23pc), wood products (10.95pc), chemicals (5.13pc), coke and petroleum products (4.87pc), rubber products (4.51pc), leather products (2.52pc) and textile (0.43pc).

Fertiliser and electronics sectors, however, recorded a flat production in July over the corresponding month a year ago. Large scale manufacturing grew 4.36 percent in July over June, according to PBS.

Industrial production grew 5.02 percent in the last fiscal year of 2016/17. LSM, accounting for 80 percent of the industrial sector’s 10 percent share in GDP, posted a four-year high growth of 5.6 percent in the fiscal 2016/17. Government set LSM sector’s target at 5.7 percent for FY2018.

Infrastructure development boosted demand of iron and steel products as well as cement, which are the key industries in the country. Auto sales have also been growing in the recent past as demand of heavy vehicles in China-funded development projects, uptake of passenger vehicles and rising sales of tractors for recovering agriculture sector speeded up production in the industry.

The bureau logs trend of industrial sector on the basis of statistics from Oil Companies Advisory Committee (OCAC), ministry of industries and provincial bureaus of statistics. Ministry of industries track production trend of 36 products, Oil Companies Advisory Committee monitors 11 oil, lubricant and petroleum products and provincial authorities measure output of 65 items nationwide.

OCAC registered a 4.87 percent YoY growth in July and edged up 2.51 percent month-on-month. Production of liquefied petroleum gas surged 75.5 percent YoY to 56.29 million litres. Kerosene oil output soared 66.5 percent to 14.78 million litres in July.

Diesel production soared 41.33 percent to 2.15 million litres, while motor spirits output increased 14.6 percent to 237 million litres in July. Ministry of industries recorded a growth of 16.66 percent YoY and 8.09 percent month-on-month, said Pakistan Bureau of Statistics.

Sep 22, 2017

Riaz Haq

7,500 new #motorcycles hit roads daily in #Pakistan. Production reached 2.3 million motorcycles in 10 months. Up 22.34% in 4 months

https://dailytimes.com.pk/179824/7500-new-motorcycles-hit-roads-dai...

KARACHI: Motorcycles production in Pakistan is reaching to its highest level with 2.3 million quantity of produced during the ten months of 2017 while average 7,408 new motorcycles hit roads daily in the country.

The production of motorcycles increased by 22.34 percent during the first four months of fiscal year 2017-18 (FY18), as compared to the corresponding period of last year, latest data of Pakistan Bureau of Statistics (PBS) revealed.

PBS’s latest data reveals that the motorcycle production including locally assembled Japanese brand and Chinese made imported motorcycles’ brand stood at 2251917 units in the first ten months (January-October) of 2017. It is to be noted that at least 2.5 million motorcycles were manufactured during past year while the number of motorcycles’ production in Pakistan has already crossed the 2 million mark in just ten months of this year.

It has been observed that in the absence of any public transport system in Pakistan, lower middle-income class of the country has been compelled to compromise their safety by choosing the two-wheelers as their conveyance.

Muhammad Zahid Iqbal Malik of Pakistan Bikers Club (PBC) said motorcycle assemblers in Pakistan produce low quality products just to maintain price stability. He said steady prices besides easy installment plans are the main reasons behind rapid growth of two wheelers in Pakistan.

He said rapid motorcycle production in Pakistan apparently portrays brighter picture but it is a harsh reality that among 2 millions motorcycles produced in 2017 we didn’t manufacture even a single bike here with 100% Pakistani parts.

“It is true that motorcycle industry is booming and providing opportunities for locals and supporting the economy. But Pakistan is still far behind from its neighbouring country as Indian company Hero started manufacturing with Honda Japan and now it has become a separate entity bigger than Honda”, he added.

Association of Pakistan Motorcycle Assemblers (APMA) Chairman Mohammad Sabir Shaikh said globally, there is an average life of a motorcycle, but in Pakistan with the nonexistence of any such law, the tax departments are allowed to collect lifetime tax at the time of registration of a new bike.

He further added that the situation is really alarming as the authorities don’t follow any standards for motorcycles’ registration which is making the motorcycle as the leading cause of fatalities.

He was off the view that the government should set the effective life limit of a motor cycle for tax reasons since the tax offices use 100 years as their average life at present. He suggests that the tax authorities should register a motorbike only for five years and after that period the registration of the motorbikes should be subjected to fitness tests.

Jan 16, 2018

Riaz Haq

#Motorcycle production in #Pakistan up 15.44% in FY 2017-18. 2,650,233 motorcycles produced in July-May (2017-18) , up 15.44% from 2,295,846 during July-May (2016-17). #Manufacturing #economy

https://nation.com.pk/04-Aug-2018/motorcycle-production-up-15-44pc-...

The production of motorcycles during the first eleven months of fiscal year (2017-18) increased by 15.44 per cent as against the corresponding period of last year, Pakistan Bureau of Statistics (PBS) reported.

As many as 2,650,233 motorcycles were manufactured during July-May (2017-18) against the output of 2,295,846 during July-May (2016-17), showing growth of 15.44 per cent, the latest PBS production data revealed.

The production of cars and jeeps witnessed 20.10 per cent increase during the period under review as 214,904 jeeps and cars were manufactured during July-May (2017-18) against the production of 178,944 units during July-May (2016-17).

The production of light commercial vehicles (LCVs) witnessed an increase of 18.54 per cent in production during the period under review by growing from 22,927 units last year to 27,178 million during 2017-18.

The production of tractors also increased from 50,049 units last year to 67,371 units, showing growth of 34.61 per cent while the production of trucks increased by 20.27 per cent, from 7,104 units to 8,544 units.

However, the production of buses during the period under review witnessed the negative growth of 31.54 per cent by going down from the output of 1,043 units to 714 units.

Meanwhile, on the year-on-year basis, the production of motorcycles increased by 14.57 per cent by growing from the output of 231,295 units in May 2017 to 264,984 units in May 2018.

The production of tractors also witnessed an upward growth of 19.56 per cent by growing from 5,746 units in May 2017 to 6,870 units in May 2018.

The production of jeeps and cars increased by 0.74 per cent as the country manufactured 18,227 jeeps and cars during May 2018 against the production of 18,094 units in May 2017, the PBS data revealed.

The production of tractors also witnessed an upward growth of 19.56 per cent by growing from 5,746 units in May 2017 to 6,870 units in May 2018.

The production of LCVs witnessed decrease of 12.96 per cent in production by going down from the output of 2,368 units in May 2017 to 2,061 units in May 2018.

The output of trucks witnessed the negative growth of 7.02 per cent by going down from the output of 869 units in May 2017 to 808 units in May 2018 while the output of buses declined by 19.51 per cent by declining from 82 units to 66 units.

It is pertinent to mention here that the overall 'Large Scale Manufacturing Industries' (LSMI) of the country witnessed the growth of 6 per cent during the first eleven months of the current fiscal year compared to the corresponding period of last year.

The country’s LSMI Quantum Index Numbers (QIM) was recorded at 149.19 points during July-May (2017-18) against 140.75 points during July-May (2016-17), showing growth of 6 per cent.

The highest growth of 3.62 per cent was witnessed in the indices monitored by Ministry of Industries, followed by 1.58 per cent growth in the products monitored by Provincial Bureaus of Statistics (PBOS) and 0.80 growth in the indices of Oil Companies Advisory Committee (OCAC).

On yearly basis, the industrial growth increased by 2.76 per cent during May 2018 as compared to same month of last year, however, on month-to-month basis, the industrial growth decreased by 11.63 per cent in May 2018 when compared to growth of April 2018, the PBS data revealed.

Aug 5, 2018

Riaz Haq

50 Auto Factories' Production Improved With JICA Support

https://www.urdupoint.com/en/business/50-auto-factories-production-...

Small and Medium Enterprises Development Authority (SMEDA) has improved production systems of 50 Auto Factories with the support of Japan International Cooperation Agency (JICA).

Small and Medium Enterprises Development Authority (SMEDA) has improved production systems of 50 Auto Factories with the support of Japan International Cooperation Agency (JICA).

SMEDA Chief Executive Officer Sher Ayub disclosed this here Wednesday while commenting on second term of SMEDA-JICA joint project being run for technical support of auto parts manufacturing industry in Pakistan.

The project, he said, was being conducted in coordination with Pakistan Association of Automotive Parts and Accessories Manufacturers (PAAPAM).

He acknowledged services of the Provincial Chief SMEDA-Sindh Mukesh Kumar to make this project successful in close coordination with PAAPAM.

He said that Auto sector was one of the rapidly growing sectors in Pakistan. Its contribution towards the national economy in the form of technology transfer, employment and revenue generation is visible, he said and pointed out that the sector had a significant room to further improve quality, bring innovation and flexibility of manufacturing system which is being addressed with the support of JICA. He observed that Japan's technical support had helped the local auto parts manufacturers to get prepared for export market by improving quality and productivity of their products, as per world's requirements.

Earlier, at a ceremony held at PAAPAM Office, the SMEDA (Sindh) Provincial Chief Mukesh Kumar gave a briefing on the activities to be conducted under second term of SMEDA-JICA joint project for technical support of Auto sector in the country.

Yoshihisa Onoe - senior representative of JICA Pakistan Office, Hiroshi KANEKI - Chief of JICA Technical Team, Hiroshi SASAKI-Deputy Chief of JICA Team, Ikuta, Ishitaki, Sato (JICA Experts) and Muhammad Ashraf Sheikh, Senior Vice Chairman PAAPAM also spoke on this occasion.

Yoshihisa Onoe-the Senior Representative of JICA, in his address, assured to continue the technical support for Pakistan's industry to compete in the world market in terms of technical know-how and the modern manufacturing techniques.

He acknowledged that JICA's collaboration with SMEDA and PAAPAM had proved to be very useful for the local auto parts' manufacturing industry in Pakistan.

He was glad to note that productivity of the sector had increased to an optimal level, whereas, the rejection rates to be witnessed in the manufacturing processes had reduced to the lowest possible level. He said that the SMEs, engaged in auto parts manufacturing, had a great potential to compete the world market and assured to extend fullest technical support of JICA to impart the best practices being exercised in auto sector of the developed world.

Muhammad Ashraf Sheikh, Senior Vice Chairman (PAAPAM) appreciated SMEDA initiatives to get JICA's technical cooperation for auto parts industry.

He said that PAAPAM members had greatly availed of the assistance to increase their productivity and reduce rejection rates in their manufacturing processes. He urged SMEDA and JICA to continue the program even after completion of the set period.

Sep 6, 2018

Riaz Haq

Kumho to supply tech to new #Pakistani tire player. #SouthKorea company signed a 10-year #technology-transfer agreement with #Pakistan #battery maker Century Engineering for manufacturing 28 tire products for passenger, commercial vehicles." #automobile

http://disq.us/t/36u4mye

SEOUL, South Korea—Kumho Tire Co. Inc. has agreed to provide tire manufacturing technology to a Pakistani battery producer that is planning to branch into tire production.

At a Sept. 27 ceremony in Seoul, Kumho signed a 10-year technology-transfer agreement with Century Engineering Industries (Pvt.) Ltd. covering technologies "required to manufacture 28 tire products for passenger and commercial vehicles."

Based in Karachi, Pakistan, Century Engineering—d.b.a Phoenix Batteries—is a car-battery manufacturer that aims to build a tire plant with a capacity of 5 million units.

Under the deal, Kumho Tire will receive $5 million for the supplied technology as well as royalties equal to 2.5 percent of Century's annual sales for 10 years, the South Korean company said in a statement.

The scope of the agreement covers design, quality control, training as well as manufacturing process.

Century Engineering has as yet not disclosed other details about its plans for tire production, including the site and timetable.

Oct 2, 2018

Riaz Haq

#Tractors production in #Pakistan up 33.20%. During the period from July-June, 2017-18 about 71,894 tractors were manufactured as compared to the 53,975 tractors of same period of last year. #agriculture https://pakobserver.net/tractors-production-up-33-20pc/ via @pakobserver

The domestic production of tractors during fiscal year 2017-18 witnessed growth of 33.20 percent as compared the production of the corresponding period of last year.

During the period from July-June, 2017-18 about 71,894 tractors were manufactured as compared to the 53,975 tractors of same period of last year.

On month on month basis, the local production of tractors also grew by 15.21 percent as it was recorded at 3,926 units in June 2017 to 4,523 units in June 2018. according the Quantum Index Number of Large Scale Manufacturing.

It may be recalled that the overall Large Scale Manufacturing Industries (LSMI) of the country witnessed growth of 5.38 percent during the year 2017-18 compared to last year.The LSMI Quantum Index Numbers (QIM) was recorded at 147.07 points during July-June (2017-18) against 139.55 points during July-June (2016-17), showing growth of over 5.38 percent.

Meanwhile the production of trucks witnessed growth of 5.76 percent by going up from the output of 608 units in June 2017 to 643 units in June 2018.

The production of trucks also increased from 7,712 units last year to 9,187 units, showing growth of 19.13 percent while the production of tractors increased by 33.20 percent, from 53,975units to 71,894 units.

On year-on-year basis, the production of jeeps and cars increased by 40.90 percent during the month of June 2018 against the output of June 2017. During the period under review, Pakistan manufactured 16,234 jeeps and cars during June 2018 against the production of 11,522 units during June 2017.

During last financial year, the production of light commercial vehicles (LCVs) witnessed an increase of 19.74 percent in production during the period under review by growing from 24,265 units last year to 29,055 LCVs during 2017-18.

Oct 3, 2018

Riaz Haq

Iron, steel output swells to 4.7m tonnes

https://www.dawn.com/news/1646475

KARACHI: The production of iron and steel, with billets/ingots mainly used in the construction industry, in the last 10 years swelled by 196 per cent to 4.777 million tonnes in FY21 from 1.616m tonnes in FY12.

H/CR sheets/strips, coils/plates, also known as flat steel products for production of electronics, surged to 3.296m tonnes in FY21 from 1.850m tonnes in FY12, Pakistan Bureau of Statistics (PBS) data of Large-Scale Manufacturing (LSM) showed.

Rising production of steel related products has led to higher imports of raw materials. For making steel bars, the country’s iron and steel scrap imports in FY21 rose to 4.719m tonnes costing $1.86bn from 1.568m tonnes valuing $538m in 2011-12, the PBS figures showed.

Besides, iron and steel imports swelled to 2.992m tonnes amounting to $1.959bn in FY21 from 1.755m tonnes ($1.4bn) in 2011-12.

Commenting on rising demand for steel bars, Pakistan Association of Large Steel Producers Secretary General Syed Wajid Bukhari said steel bar production till 2011-12 was about three to 3.5m tonnes while the current demand now hovers between 6.5m tonnes to 7m tonnes.

He attributed increase in steel bar prices to soaring scrap prices in the world market to $550 per tonne from $300 per tonne while one dollar is now equal to 168 as compared to Rs85 in 2011-12.

He said gas price increased to Rs97 per unit from Rs15 per unit in the last 10 years followed by power tariff to Rs21 per unit from Rs6 per unit. Freight charges are 100 per high now.

Mr Bukhari was of the view that steel bar demand would soar to nine to 10 million tonnes by 2023-24 in view of rising construction activities.

Private sector consumes 80pc of total steel bar production as compared to 20pc by the public sector, he added.

Hassan Bakhshi, former chairman Association of Builders and Developers (ABAD), said a multi-storey high project to be built on 1,000 yards plot with three floors for car parking requires around 1,100 tonnes of steel bars.

He claimed that steel bar demand has been on the rise due to 80pc construction work on highrise projects in Punjab while the Sindh Building Control Authority (SBCA) has been creating problems in clearing new projects.

“Only 91 projects have been cleared by the SBCA in the last two years in Karachi as compared to 500-7,000 projects a year some 10 years back,” he said.

The projects being promoted on the social, print and electronic media belong to Punjab while in Karachi, advertisement campaigns have been running for old projects which had been approved very late.

Pakistan Association of Parts and Accessories Manufacturers Association chairman Abdul Rehman Aizaz was of the view that auto assemblers and their vendors consume 15,000-20,000 tonnes per month of iron and steel in different forms which are used in making different parts by the vendors and the assemblers.

Bike production swelled to 2.475m units from 1.645m units in FY12, while jeeps/cars production rose to 163,122 units from 154,706 units in FY12.

Trucks and buses production in FY21 jumped to 3,808 and 570 units from 2,597 and 568 units FY12.

Domestic appliances and electronic products have shown phenomenal growth in the last 10 years. For example, production of refrigerators, deep freezers and air conditioners has swelled to 1.337m units, 109,029 units and 505,493 units from 1.062m units, 56,313 units and 240,338 units in FY12. Electric fans production rose to 2.498m units from 1.908m units.

Nov 29, 2021

Riaz Haq

Pakistan becomes the fourth largest bike manufacturer country in the world

https://www.edgedandtaken.com/pakistan-becomes-the-fourth-largest-b...

Prime Minister Imran Khan met yesterday with prominent industrialists and businessmen in Islamabad. During the meeting, the Prime Minister Imran Khan stated that Pakistan has become the fourth largest producer of bike in the world. Discussing the automotive sector, Imran Khan said tractor exports increased by 10% while the country produced 90% of its parts.

This is not the first time the Prime Minister has cited the bike industry and its apparent success. Last year, the Prime Minister stated that in the fiscal year 2020-2021, Pakistan recorded the largest number of motorcycle sales in the history of the country. He said record motorcycle sales show that the country’s low-income class is making progress. Given that motorcycles are known as the journey of an ordinary person, “aam admi ki sawari”, the Prime Minister Imran Khan says that the increase in motorcycle sales means the strengthening of “aam admi”.

Meanwhile, prices as well as bikes sales speak differently. During 2021, motorcycle companies gradually increased prices. According to our research, Honda has increased the rates by 7 times, Yamaha 5 times, while Suzuki has revised its rates 4 times.

The figures show that the price of the most famous Honda CD70 has risen by Rs. 14,800 last year, while the Honda CG 125 saw a total increase of Rs. 21 000. Meanwhile, Yamaha’s well-known YBR bikes have noticed a price increase of Rs. 30,500 during 2021.

And Suzuki motorcycle prices have risen to Rs. 25,000 last year. It shows how much prices have risen. Surprisingly, despite this repeated increase in prices, sales figures in 2021 continued to show upward trajectories, leading the country into a massive motorcycle manufacturer in the world.

According to the data, sales of Honda, Yamaha and Suzuki motorcycles increased in the period July-November 2021, as well as from month to month. The PAMA report showed that Atlas Honda Limited broke its sales record. In November, the company sold its highest number of bikes at 128,503 units, beating its October sales record when 125,031 bikes were sold.

Honda sales, meanwhile, rose to 563,575 units in July-November from 512,010 in the same period last year. Other Japanese motorcycle companies, Suzuki and Yamaha, also recorded high sales during this 5-month period.

The data showed that Suzuki sold 14,915 bikes in those five months compared to 8,719 in the same period last year. This means that its sales increased by 71%. Meanwhile, Yamaha sales rose to 9,962 units from 8,733 last year, a jump of 14%.

Feb 4, 2022

Riaz Haq

Bilal I Gilani

@bilalgilani

From just 3 million motorcycles 15 year ago , we now have over 22 million motorcycles

Ppl had disposable income to afford this

Much of these motorcycle are used for rural to urban mobility

Motorcycles r environmentally less harmful than cars ( ideal is public transport)

https://twitter.com/bilalgilani/status/1496406817794056194?s=20&...

Feb 23, 2022

Riaz Haq

Bilal I Gilani

@bilalgilani

Poverty picture based on World Bank data

Don't believe the gloom spreaders

If you have one foot in US , every day you try to justify your exit by dissing Pakistan

Facts belie your gloom story

Long way to go but Pakistan is progressing

https://twitter.com/bilalgilani/status/1496405609096351746?s=20&...

(Graph shows poverty declining from 64% in 2001 to 40% in 2008 and 21.9% in 2018)

Feb 23, 2022

Riaz Haq

Vehicle Sales in Pakistan

https://minutemirror.com.pk/speedy-recovery-33561/

In the first eight months of the current financial year (July 2021-February 2022), the automobile industry sold cars at a record pace and car sales went up by a record 57 per cent. According to the data released by the Pakistan Automotive Manufacturers Association, 149,813 vehicles were sold in the first eight months of the current financial year as against 95,139 units in the same period of the previous financial year. The breakup of the sale data tells interesting tales: of the sold vehicles, car sales accounted for 57.5 per cent, truck sales for 82.2 per cent, jeep/pickup sales for 51.5 per cent and farm tractor sales for 6 per cent during the period. However, the sale of motorcycles and rickshaws declined by 3%. Car sales are likely to continue to rise till the end of the current financial year. The increased sale of trucks shows the revival of economic activities across the country. Farm tractors’ sale figures are also encouraging as the agriculture sector has seen an unprecedented boom, thanks to the farmer-friendly policies of the government. The figure strengthens the government’s claims of economic recovery.