PakAlumni Worldwide: The Global Social Network

About 100 million Pakistani adults lacked access to formal and regulated financial services as of 2016, according to a World Bank report on financial inclusion. Only 2.9% of adults in Pakistan had a debit card, and only 1% of adults used them to make payments. Just 1.4% of adults used an account to receive wages and 1.8% of adults used it to receive government transfers in 2014. Since then, Pakistan has been leading the way in South Asia in digital finance and branchless banking.

According to the latest State Bank statistics on branchless banking (BB) sector, mobile wallets reached a high of 33 million as of September 2017, up 21% over the prior quarter. About 22 percent of these accounts – 7.4 million – are owned by women, up 29% in July-September 2017 over previous quarter. A McKinsey and Co analysis shows that adoption of financial technology (fintech) can help dramatically increase financial inclusion in Pakistan.

Karandaaz Pakistan , a non-profit organization, set up jointly by UK’s Department for International Development and Bill and Melinda Gates Foundation, is promoting financial technology in the country. Finja and Inov8 are among the better known fintech startups in the country. Chinese e-commerce giant Alibaba's Ant Financial's recent entry in Pakistan is creating a lot of excitement in Pakistan's fintech community.

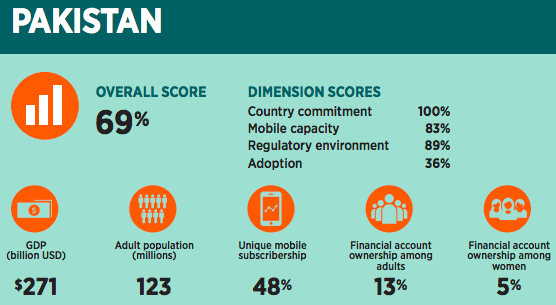

Financial and Digital Inclusion in Pakistan. Source: Brookings Institution |

Importance of Financial Inclusion:

Access to regulated financial services for all is essential in today's economy. It allows people and businesses to come out of the shadows and fully participate in the formal economy by saving, borrowing and investing.

Those who lack access to regulated banking services are often forced to resort to work with unscrupulous lenders who trap them in debt at unaffordable rates. Such loans in extreme cases lead to debt bondage in developing countries.

Financial inclusion is good for individuals and small and medium size businesses as well as the national economy. It spurs economic growth and helps document more of the economy to increase transparency.

Status of Financial Inclusion in Pakistan:

About 100 million Pakistani adults lacked access to formal and regulated financial services as of 2016, according to a World Bank report on financial inclusion. Only 2.9% of adults in Pakistan had a debit card, and only 1% of adults used them to make payments. Just 1.4% of adults used an account to receive wages and 1.8% of adults used it to receive government transfers in 2014. Since then, Pakistan has been leading the way in South Asia in digital finance and branchless banking.

M-wallets Growth in Pakistan in millions. Source: Business Recorder |

Mobile wallets, also called m-wallets, are smartphone applications linked to bank accounts that allow users to make payments for transactions such as retail purchases. According to recent State Bank statistics on branchless banking (BB) sector, mobile wallets reached a high of 33 million as of September 2017, up 21% over the prior quarter. About 22 percent of these accounts – 7.4 million – are owned by women, up 29% seen in Jul-Sep 2017 over previous quarter. Share of active m-wallets has also seen significant growth from a low of 35% in June 2015 to 45% in September 2017.

“The benefits of digital payments go well beyond the convenience many people in developed economies associate with the technology,” says Dr. Leora Klapper, Lead Economist at the World Bank Development Research Group. “Digital financial services lower the cost and increase the security of sending, paying and receiving money. The resulting increase in financial inclusion is also vital to women’s empowerment.”

A McKinsey and Co analysis shows that adoption of financial technology (fintech) can help dramatically increase financial inclusion in Pakistan. Pakistan is ranked 16th among 26 nations ranked by Brookings Institution with an overall score of 69% in "The State of Financial and Digital Inclusion Project Report" for 2017. The Internet revolution is enabling rapid growth of financial technology (fintech) for increasing financial inclusion in Pakistan.

A McKinsey Global Institute report titled "Digital Finance For All: Powering Inclusive Growth In Emerging Economies" projects that adoption of financial technology (fintech) in Pakistan will add 93 million bank accounts and $36 billion a year to the country's GDP by 2025. It will also create 4 million new jobs and add $7 billion to the government coffers in this period.

McKinsey report says that "Pakistan has solid digital infrastructure and financial regulation in place and has even had some success in digital domestic-remittance payments".

Fintech Players in Pakistan:

There are a number of companies, including some startups, offering fintech applications for smartphones that are linked to bank accounts. EasyPaisa operated by Telenor Microfinance is already well established. Among some of the better known startups working to disrupt the financial services sector in Pakistan are Finja and Inov8.

China's e-commerce giant Alibaba runs a major global e-payments platform Alipay. It also owns Ant Financial which has recently announced the purchase of 45% stake in Pakistan-based Telenor Microfinance Bank.

Telenor Pakistan runs its own e-payments platform EasyPay which will likely link up with Alipay global payments platform after the close of the Ant Financial deal. Bloomberg is also reporting that Alibaba is in serious talks to buy Daraz.pk, an online retailer in Pakistan. These developments are creating a lot of excitement in Pakistan's fintech and e-commerce communities.

Alibaba and Alipay and other similar platforms are expected to stimulate both domestic and international trade by empowering small and medium size Pakistani entrepreneurial businesses and large established enterprises.

Karandaaz Fintech Promotion:

A key player promoting financial inclusion is Karandaaz Pakistan , a non-profit organization, set up jointly by UK’s Department for International Development and Bill and Melinda Gates Foundation. It is providing grants for a number of local initiatives to develop and promote financial technology solutions in Pakistan.

Karandaaz Pakistan is promoting Fintech startups in 5 areas of focus:

1) Access to Financial services

Credit Scoring Models, Formalize savings through need based products, Digital lending services, and Insurance

2) Payments

Retail payments solutions through QR code, Supply / Value Chain Digitization, Ideas around digitization of online payments and merchant payments

3) E-Commerce

Smoothening of on-boarding process, Enabling Escrow Accounts for a retail merchant, Alternate payment modes other than COD

4) Interoperability

Innovative ideas to address the lack of interoperability among m-wallets

5) Early stage ideas related to:

M-Wallet Use cases, Education of Financial Services through technology, Customer Engagement / Experience, Micro Credit, Digital Savings

Summary:

About 100 million Pakistani adults lacked access to formal and regulated financial services as of 2016, according to a World Bank report on financial inclusion. Only 2.9% of adults in Pakistan have a debit card, and only 1% of adults use them to make payments. Just 1.4% of adults use an account to receive wages and 1.8% of adults use it to receive government transfers in 2014. At the same time, Pakistan is leading the way in South Asia in digital finance and branchless banking.

According to the latest State Bank statistics on branchless banking (BB) sector, m-wallets reached a high of 33 million as of September 2017, up 21% over the prior quarter. About 22 percent of these accounts – 7.4 million – are owned by women, up 29% seen in Jul-Sep 2017 over previous quarter. A McKinsey and Co analysis shows that adoption of financial technology (fintech) can help dramatically increase financial inclusion in Pakistan.

Karandaaz Pakistan , a non-profit organization, set up by UK’s Department for International Development and Bill and Melinda Gates Foundation, is promoting financial technology in the country. Chinese e-commerce giant Alibaba's Ant Financial's recent entry in Pakistan is creating a lot of excitement in the country's fintech community.

Related Links:

Fintech Revolution in Pakistan

The Other 99% of the Pakistan Story

Pakistan's Financial Services Sector

Riaz Haq

Pakistan Adopting Advance Technologies Rapidly: Anusha Rehman

Daniyal Sohail

https://www.urdupoint.com/en/technology/pakistan-adopting-advance-t...

Minister for Information Technology and Telecommunication Anusha Rehman Friday said, Pakistan was one of those countries that had been adopting the advance technology most rapidly to counter challenges of modern, digital era.

While addressing the concluding ceremony of five-day "Huawei mobile Pakistan Congress 2018" the minister said, the technology advancements were coming in Pakistan adding "we also hope that we can have huawei made in Pakistan as soon as possible." Anusha said, Ministry of IT had started projects for Baluchistan worth Rs 26 billion to provide 3g service to the people there.

In the history of IT of Pakistan, this was the biggest investment for Balochistan, which aimed to target hundreds of villages to connect these remote areas with 3G service, she added. She said,a population of about 196,177, covering 269 mauzas and an area of 39,434 sq kms would get modern broadband facilities through this project.

The project would cover Awaran, Jhal Jao and Mashkai tehsils/sub-tehsils of Awaran district and Bela, Lakhra, Liari, Uthal, Dureji, Hub, Sonmiani and Kanraj of Lasbel district, she added. The Minister said, after launching 3G services in Baluchistan, other services like careem would be start in in the province which would be a great achievement of Ministry of Information Technology.

She emphasized the importance of technological advancement and virtual assistance for the generations to come to bring this nation on path of Technology evolution and prosperity. "Government is making all out efforts to introduce 5G technology in Pakistan by 2020 to bring it at par with Developed economies in term of technology advancements." She emphasized that women's economic empowerment was at the heart of the sustainable development and essential to achieve gender equality, poverty eradication and inclusive economic growth.

She shared initiatives steered by IT ministry in this regard, particularly ICT for Girls program. She said, achievements of Pakistan in the arena of ICT and future plans for continued growth in this sector would enable transformation into "Digital Pakistan".

Anusha described the DigiSkills program as an important part of Information Technology initiative of the government that would create online employment opportunities to enable youth to earn 200 to 300 dollars per month and with the help of this program, youth from across the country would provide services across the globe.

She appreciated the Huawei Technology role in setting such precedent to promote emerging technologies in Pakistan by involving Industry players and engaging the Government to make it reality. The Minister hoped that people of Pakistan were going to use the opportunities that were created by Huawei, the technology giant.

Apr 27, 2018

Riaz Haq

Ant Financial is about to upend the entire Pakistani retail banking sector

‘There is ZERO realization of what is coming and how big this sea change will be

http://www.atimes.com/article/ant-financial-is-about-to-upend-the-e...

anking in Pakistan has not, to put it diplomatically, reached its full potential. It is so inefficient, according to one industry insider, that more than 35 banks provide services to only about 12% of the population. But Omer Salimullah, a fintech specialist with Karachi-based JS Bank, wrote in a post last week that the days are numbered for this sorry state of affairs, and China’s Ant Financial will be the catalyst.

The Alibaba subsidiary took the plunge into the Pakistani financial services market with an acquisition earlier this month, looking to tap into the potential of around 100 million un-banked individuals. Ant Financial’s acquisition of Telenor Microfinance Bank for the sum of US$185 million is “a VERY big deal,” Salimulla emphasized. “As a comparison, 100% of RBS Pakistan was sold to Faysal Bank for US$ 50 million. Please note that Ant has not valued a Pakistani micro finance bank at US$ 410 million. What they have valued is the almost complete takeover of the retail financial services market from incumbent banks,” he said.

Ant’s partnership with Telenor’s mobile banking brand, Easypaisa, is going to transform banking services in the country, and synergy with a possible acquisition of Pakistan’s largest e-commerce player Daraz, will expand the ecosystem even further. The Chinese fintech giant stands to swallow up a huge chunk of the youth an un-banked market, according to Salimulla, and many small to mid-sized banks will not survive the next several years.

“There is too much old-world thinking in corridors of powers in banks. There is ZERO realization of what is coming and how big this sea change will be,” he warned.

May 22, 2018

Riaz Haq

How Ant Financial Will Completely Change the Pakistani Retail Banking Landscape

https://www.linkedin.com/pulse/how-ant-financial-completely-change-...

Banking in Pakistan is an extremely in-efficient industry where 35+ banks have only been able to bank 25 million Pakistanis in the last 70 odd years. This means that as an industry, banks are providing their services to only 12% of the population. The branchless banking industry has not fared much better either with only 35 million wallets out of which 50% are inactive (no activity in the past 3 months). This is a sorry state of affairs by any yardstick. In the new world, wherever there has been inefficiency in an industry, it has been disrupted – big time! Uber, Didichuxing, Careem, Grab have decimated the taxi industry worldwide. AirBnB has dented the hotel industry significantly to the extent that Airbnb is now bigger than the world's top five hotel brands put together. PayTM in India (Ant owns more than 50% of Paytm and has injected close to US$ 1 billion into this company) has now become the biggest financial firm in India, in less than five years. and plans to become the world's largest digital bank with 500 million account holders. With all the inefficiencies found in it's midst, the retail banking industry in Pakistan is a prime candidate for this type of massive disruption.

In this backdrop comes the Ant Financial Services Group (“Ant Financial”), established by Alibaba Group and its founder Jack Ma acquisition of 45% of Telenor Microfinance Bank (TMB) for US$ 185 million at a total post money valuation of US$ 410 million. Make no bones about it - this is a VERY big deal. As a comparison, 100% of RBS Pakistan was sold to Faysal Bank for US$ 50 million. Please note that Ant has not valued a Pakistani micro finance bank at US$ 410 million. What they have valued is the almost complete takeover of the retail financial services market from incumbent banks. They realize that Pakistan is one of the most in-efficient banking markets in the world and it will be simple to take every last morsel of the retail banking pie from banks. The market potential of some 100 million un-banked individuals is a mouth-watering prospect for Ant.

How Will “Ant Paisa Bank” Take Over Retail Banking in Pakistan?

Go big on QR: Ant will introduce Alipay (or a local variant) here in Pakistan. This will be their big play to capture a huge chunk of retails payments which are currently happening in cash. QR uptake has been slow in Pakistan where only small players like FonePay are pushing it. With the financial & marketing muscle that Ant brings, they will make QR payments common with incentives on both the merchant and customer side.

- Digital Lending: This will be the secret sauce which finally tips the scale for digitization payments in Pakistan. Consumer lending via Ant has reached $95 billion in China and Paytm in India launched Paytm Score in February which they will use to lend to users of their platform. Our biggest hurdle in digitizing cash payments has been the reluctance of users (especially merchants) to document their cash flow fearing tax implications. In a country where less than 1% of the population pays tax, this has always been the biggest impediment in digitizing payments. However, once the conversation switches to these merchants receiving funding/loans from Ant based on their throughput via Ant channels (i.e. giving loans to small businesses for purchasing goods from Ali Baba), they will be more than happy to roll the transaction through digital channels.

-

May 22, 2018

Riaz Haq

How Ant Financial Will Completely Change the Pakistani Retail Banking Landscape

https://www.linkedin.com/pulse/how-ant-financial-completely-change-...

Technology Stack: In a recent interview post the Ant investment, Shahid Mustafa, CEO of Telenor Bank said “….there’s a sunset date for the current technology and that’s when we will look to upgrade the back-end technology”. With all the financial clout that Ant will bring, the thing that will break the proverbial camel’s back (the camel being the Pakistani financial industry) will be the tech prowess that Ant will introduce in Pakistan. MIT Tech Review published an article with the headline “Meet the Chinese Finance Giant That’s Secretly an AI Company” referring to Ant’s AI, computer vision and natural language processing capabilities. This is how important AI is to Ant. Last year the company acquired EyeVerify, a U.S. company that makes eye recognition software. Ant will bring AI powered payments, lending, insurance, and anti-fraud capabilities to Pakistan and completely transform the way financial services are delivered. Think Instant and Frictionless.

- Amazing User Experiences: The news of Ant buying Daraz, the largest e-commerce player in Pakistan, has been doing the round for quite some time. If this deal goes through, Ant will bring it’s world class e-commerce expertise via Ali Baba to Pakistan. Digital payments has always been a challenge for e-commerce in Pakistan. Having both the payment and e-comm side under its control, Ant can make a huge dent into both these fledgling areas. Imagine being offered an AI-powered personalized & instant loan on shopping done on Daraz. Imagine being able to file an insurance claim for a car accident where all you need to do is take a picture of the accident and Ant’s AI image processing engine will finalize the findings in seconds. Imagine bots talking to Pakistanis in any regional language to handle customer service or conduct transactions (voice will remove the last block in making digitization widespread in Pakistan where lack of education prevents reading and writing based solutions to gain traction)

Why Does This Matter to Existing Banks?

With the marketing and tech muscle that Ant will bring into Pakistan, the next 24 months are going to be critical for small to mid-sized banks. Easypaisa is a brand that resonates both with the un-banked and the youth. These markets are major growth areas for banks going forward and if these are taken away by Easypaisa due to providing delightful user experiences, the oxygen will be sucked out of this industry. Expect to see a LOT of mergers among the incumbent banks. The big-5 may survive due to their corporate and treasury business but the mid to small sized banks will go under water due to the coming tsunami. It may seem that I may be overstating the threat but this is not the case. There is a high level of digital illiteracy on the management boards of Pakistani banks and the average age of C-level suites in banks is 50+. There is too much old-world thinking in corridors of powers in banks. There is ZERO realization of what is coming and how big this sea change will be.

What Can Existing Banks Do?

Are we looking to help banks that charge customers an average of PKR 50 for an Interbank Fund Transfer (IBFT) transaction (some are charging more than PKR 150) while giving out free checkbooks? Most banks think they’ve become digital because they’ve rolled out a mobile app. All the other important areas like account opening, lending, payments continue the way they were implemented in the mid-90s. This is not digital. And no Head of Digital Transformation or a Head of Innovation can convert a dinosaur into an agile cheetah. Transforming an organisation is next to impossible due to legacy systems and legacy mindsets (Nokia and Kodak couldn't do it).

May 22, 2018

Riaz Haq

#Technology firms Avanza Group & Premier Systems announce investment of $5 million in the #payment #gateway to connect individuals with merchants and banks via joint venture as Avanza Premier Payment Services (APPS) in #Pakistan #mobilepayments #ecommerce https://www.techjuice.pk/two-technology-firms-to-establish-online-p...

Two technology groups in Pakistan have collaborated to develop a local online payment gateway system to take a share in the growing e-commerce market of Pakistan.

Avanza Group and Premier Systems announced to invest over $5 million in the gateway which is aimed to connect individuals with merchants and banks. According to sources, the two companies will set up the joint venture as Avanza Premier Payment Services (APPS).

Mahmood Kapurwala, CEO of Avanza Group said, “the size of Pakistan’s e-commerce market is estimated to be $1 billion, which should be $30-$40 billion in a country with a population of 207 million.’ He also partnered with NCR, Avaya, Microsoft, and IBM. He added, “We are looking at this gap as an opportunity.”

APPS claims to be the first Financial Technology (fintech) in the country to obtain payment system provider (PSP) and payment system operator (PSO) licenses from the State Bank of Pakistan (SBP). According to McKinsey and Company, a worldwide management consulting firm, Fintech will add about 4 million jobs, 93 million bank accounts and $36 billion annually to the gross national product (GNP), and $7 billion to the government’s net revenue by 2025.

The newly-founded company plans to incentivize brick and mortar businesses with free online services, like building websites and digital marketing. It will only take a certain share in the profit that comes through online businesses. Adnan Ali, CEO, APPS said: “It will move Pakistan towards digitizing major institutions, such as merchants, schools, billing industries, mutual funds and other corporate entities by providing a digital gateway.”

Avanza Group CEO said, Increase in e-commerce acceptance will also help grow the overall retail market when people will have the choice to buy products present in other cities, He said, “If everything remains on track, earning a revenue of Rs400 million will not be a big deal.”

Aug 12, 2018

Riaz Haq

#Pakistan #digital #banking growth accelerates. Fiscal 2017-18 saw 3.4 million #ecommerce transactions worth Rs18.7 billion, representing year over year growth of 183.3% and 98.9%. #fintech https://www.globalvillagespace.com/pakistan-banking-sector-witnesse... via @GVS_News

The State Bank of Pakistan (SBP) in its ‘Payment Systems Review’ for the financial year 2017-2018 has provided a statistical snapshot of the payment systems in the country, showing growth in various traditional and modern payment systems.

During the financial year 2018, the country’s core payment systems infrastructure remained operationally resilient. All the channels of payment systems showed significant growth compared to the previous year. The large-value payment system i.e. Pakistan Real Time Interbank Settlement Mechanism (PRISM) processed 1.7 million transactions amounting Rs361 trillion.

There were 1,094 locally registered e-Commerce Merchants having their merchant accounts in 8 banks as of the end of June 2018 showing limited boarding of e-Commerce merchants in the country

These transactions showed significant growth of 54.5 percent and 29.2 percent in both volume and value of transactions compared to the previous financial year. In these transactions, the transactions with regards to third-party customers’ transfers have the highest share of 1.3 million transactions (i.e. 79 percent of the overall recorded transactions) whereas Government securities settlement transactions have the highest share of Rs256 trillion in a value of transactions.

There were 1,094 locally registered e-Commerce Merchants having their merchant accounts in 8 banks as of the end of June 2018 showing limited boarding of e-Commerce merchants in the country. Consumers carried out 3.4 million online transactions of worth Rs18.7 billion on these locally registered e-Commerce Merchants during the year FY18.

These transactions showed a significant YoY growth of 183.3 percent and 98.9 percent compared to the previous year. In addition to the above, domestically issued Debit, Credit and Pre-paid cards processed 6.8 million transactions of Rs. 39.7 billion on local and International e-Commerce merchants. In these e-Commerce transactions, Credit Cards has the highest share both in volume and value of transactions.

While no specific information has been provided on the number of users of these cards, the number of transactions processed through these cards has increased by 37.3 percent with total transactions, as on June 2018, having been reported at 34.4 million, at a value of Rs201.5 billion during the fiscal year 2018.

Agriculture loans in 2017/18 were 38.1 percent higher than the previous year’s disbursements of Rs704.5 billion, the State Bank of Pakistan (SBP)

Having grown at a pace of 21.8 percent and 23.4 percent in the volume and value of transactions respectively, during the year under review, debit cards processed a total of 441.1 million transactions worth Rs5.1 trillion, far greater than the size and value of transactions conducted using credit cards.

However, the bulk of this usage has been on transactions concerning ATM withdrawals whereas the share of transactions with respect to Point of Sale usage has been merely 8.6 percent in volume and 2.9 percent in the value of transactions.

Credit cards, on the other hand, has been the predominant medium for Point of Sale usage, with the 87.2 percent of the total volume of credit card transactions being made on Point of Sale payments and 10.2 percent in e-Commerce transactions.

Meanwhile, Banks disbursed agriculture credit of Rs972.6 billion during the last fiscal year of 2017/18, falling short of Rs1 trillion target set by the Agriculture Credit Advisory Committee (ACAC), the central bank said on Thursday.

Aug 14, 2018

Riaz Haq

SBP to increase financial inclusion of SMEs to 17pc

https://pakobserver.net/sbp-to-increase-financial-inclusion-of-smes...

Assistant Chief Manager, SBP’s Banking Services Corporation, Ms. Rabia Yaqoob Khan gave a detailed presentation to the business community on financing schemes of SBP for SMEs.

Rabia Yaqoob Khan said that only six percent SMEs were currently availing loans from banks despite the fact that 40 percent of them have relationship with banks. She said that SBP has set target of increasing financial inclusion of SMEs from current 6 to 8 percent to 17 percent by 2020 so that these businesses could achieve better growth and development.

Assistant Chief Manager, SBP’s Banking Services Corporation said that SBP has launched 9 financing schemes for SMEs at 6 percent markup to facilitate them expansion and growth. She said that for this purpose, regulatory framework and taxation system would be simplified for SMEs.

She said that the incumbent government was taking keen interest in promoting SMEs and hoped that maximum SMEs should avail these schemes for fast growth and development.

In his welcome address, Senior Vice President ICCI, Muhammad Naveed Malik said that SMEs were the backbone of our economy as they constituted over 90 percent of total business enterprises in Pakistan. He said SMEs contributed 30 percent to GDP, 25 percent to exports and 78 percent to industrial employment that showed their important role in the economic development of the country.

The SVP ICCI said the tough collateral conditions of banks were the major hurdle for SMEs growth and urged that SBP should ask banks to offer soft term credit facility to SMEs that would help them to grow fast and play effective role in strengthening the economy.

Vice President ICCI Nisar Mirza said that strengthening SMEs would yield multiple benefits for the economy as it would promote trade and industrial activities, enhance exports, encourage investment, create more jobs and increase tax revenue of the government. He emphasized that government should pay special attention to promoting SMEs that would pave way for sustainable development of the economy.

Sardar Tahir, President, Islamabad Estate Agents Association, Zahid Rafiq General Secretary, Ch. Nadeem, Khalid Chaudhry, Dildar Abbasi, Muhammad Faheem Khan and others were present at the occasion.—INP

Sep 4, 2018

Riaz Haq

Fintech Factory, Pakistan’s first and only financial technology focused accelerator program in collaboration with TPS, Sybrid, Rapidcompute, JS Bank & Takaful Pakistan, is progressing towards Karandaaz’s 3rd Fintech Disrupt Challenge finale. Karandaaz, Pakistan’s leading promoter of financial inclusion and associated technology, partnered with Fintech Factory to induct selected applicants for FDC III (2018) into the accelerator program and help them reach a market-tested scalable MVP for the challenge.

Fintech Factory’s unique financial technology accelerator program takes startups with market validation and offers them access to state-of-the-art workspace, industry-leading mentors, skillset development through personalized training, and networking opportunities. The program aims to develop the ecosystem in a self-sustaining manner to catalyze innovation in the fintech space to reduce the digital divide and improve the lives of Pakistanis.

https://www.techjuice.pk/7-trainees-from-pakistans-first-fintech-ac...

Nov 22, 2018

Riaz Haq

#Legacy #banks #payment platform fights back. #Swift takes on #fintechs with new faster, more efficient system. SWIFT platform is now owned by 2,500 banks and is used to move more than $200 billion around the world daily. #blockchain https://www.ft.com/content/05d41660-f7c8-11e8-af46-2022a0b02a6c via @financialtimes

Legacy payments platform Swift is piloting a new system to speed up banks’ cross-border transfers and reduce errors, firing a shot across the bow of a blockchain-based project that claims to do the same thing and payments fintechs that offer cheaper, faster services.

Founded in 1973, Swift was banks’ original answer to the question of how to move money around the world more quickly and easily. The platform is now owned by 2,500 banks and is used to shift more than $200bn around the world daily.

Inefficiencies, however, have left the platform ripe for competition from payments start-ups such as Revolut and TransferWise, as well as the Interbank Information Network (IIN). More than 130 banks, led by JPMorgan Chase, have signed on to the blockchain-based IIN project, which shares information between banks on a mutual distributed ledger. That allows them to quickly resolve errors and compliance issues that can delay payments by weeks.

In a testament to how banks are hedging their bets on the future of payments, several of those banks are now part of a pilot for Swift’s own fix for lengthy payment delays — — a new “prevalidation” system in which banks use an application programming interface (API) to access each other’s data to check things such as the validity of bank account numbers when a payment is initiated.

Under the blockchain-based system information is shared on a mutually distributed ledger hosted on the cloud that can be accessed and edited by all participants in real time. The API system, by contrast, allows banks to access each other’s data on a bilateral basis, ensuring the recipient’s account information is correct before it is sent in an effort to reduce delays.

“We know that there are still some payments which are badly formatted and missing some information,” said Luc Meurant, chief marketing officer of Swift. “Instead of correcting that later in the chain and delaying payment, we are trying to anticipate as many of those issues as possible (with prevalidation) so payments can be processed faster.”

Swift estimated that around 10 per cent of all payments on its platform were held up because of errors. Manish Kohli, global head of payments and receivables at Citi, said the new system would “considerably reduce” the costs banks incur to resolve problematic payments and would improve customer experiences. That would “absolutely” allow banks to cut pricing and compete more effectively with fintechs, he added.

Mr Meurant said that while the solution was going after “exactly the same kind of issues” as IIN, Swift’s fix was superior because its angle is “one of scale and industrialisation” and the solution could be rolled out to Swift’s 10,000-plus members relatively quickly.

JPMorgan Chase has been the leading voice on the IIN, but is also one of the 15 banks taking part in the Swift pilot. A spokesman declined to comment on the relative merits of the two projects and JPMorgan’s decision to back both.

Mr Kohli said his bank, which has not joined the IIN, believed the Swift solution was more viable because APIs were already widely used within banks in applications such as sharing customer data to give people an aggregate view of their accounts in one place.

“We felt this would be faster to scale,” said Mr Kohli, adding that payments solutions only really work if they are ubiquitous.

He pointed to Swift’s success in introducing its global payments innovation (GPI) as evidence that it can achieve quick adoption. GPI, which allowed payments to be tracked end to end and introduced transparency on fees, was introduced more than a year ago and is being used in more than 50 per cent of Swift’s payments. It will be used exclusively by 2020 by users of the Swift network.

Dec 4, 2018

Riaz Haq

#Alibaba's #Alipay's entry to tap great potential of #Pakistan #ecommerce market. US$184 million investment to expedite mass adoption of digital #payments in Pakistan. #Internet penetration rising with estimated 60 million subscribers of 3G and 4G. https://on.china.cn/2EO9fAc

Alipay, a subsidiary of Hangzhou-based Ant Financial, has been cleared by the Competition Commission of Pakistan (CCP) to acquire a 45 percent stake in Pakistan's Telenor Microfinance Bank.

The investment of over US$184 million will expedite widespread adoption of digital payments in Pakistan. With internet penetration continuously on the rise, there are an estimated 60 million subscribers of 3G and 4G in the country that can become potential users of the service.

Several mobile payment services are presently operating in Pakistan. Primarily, these have been offered by telecom operators with a large number of cellular subscribers. However, limited international application has kept the penetration rate of the payment portals relatively low. Entry of Alipay, the world's largest mobile payment platform, will intensify competition higher, improve the quality of service and reinvigorate the entire landscape of the industry.

Pakistan's growing young population makes it suitable for embracing cashless payments on a large scale. People under the age of 30 form 64 percent of the population who are always the most likely to take up any new technology. On top of that, high cellular phone use will be a facilitative factor, since the mobile-first strategy for internet-based businesses is very valid in Pakistan.

Commencement of Alipay's operations in Pakistan will also provide a major push to e-commerce. eBay CEO Devin Wenig recently identified emerging economies like Pakistan as the fastest growing e-commerce hubs of the world. The trend is spreading like wildfire across the country with new online shops emerging constantly. A reliable e-payment gateway with worldwide collaborators is all that Pakistanis need to streamline their online transactions.

Alibaba had already acquired Pakistan's leading e-commerce platform Daraz. Utilizing the reach of Alibaba, Pakistani sellers will now be able to connect with global buyer.

The digital payment boom will be most beneficial for small and medium-sized enterprises that form the backbone of the national economy. Many of these businesses face difficulties in financial transactions due to being located in rural areas. Alipay might prefer to focus on them as the Pakistani government wants to reduce their business costs and difficulties.

Across the border in China, a new policy is on the cards to increase e-commerce purchases from overseas. Around 63 additional categories are being added to a product list of what can be imported duty-free through online platforms. Moreover, 22 cities, such as Beijing, Nanjing and Shenyang, are also being included in e-commerce pilot zones.

With several food items in the revised e-commerce import list, there is much potential for Pakistani farm produce. Fruits like mango and the mandarin hybrid kinnow can gain extended reach in the Chinese food market and the recent push to increase meat and poultry production could further boost Pakistan's exports.

The targeted online shoppers in China are increasingly focusing on foreign brands. Large businesses and premium brands from Pakistan can reach out to these buyers through Tmall Global – another Alibaba operated e-commerce platform allowing Chinese consumers to purchase products from abroad. Pakistan's small to medium businesses might not have the logistic prerequisites for this platform, but international-standard large companies certainly can.

Ant Financial is coming to Pakistan at a time when trade between Pakistan and China is touching new heights through the flagship project of Belt and Road Initiative (BRI) known as China Pakistan Economic Corridor (CPEC).

Dec 25, 2018

Riaz Haq

How Chinese companies are planning a global fintech coup

Jayadevan PK Shadma Shaikh December 11, 2018

https://factordaily.com/chinese-fintech-goes-global/

A company document that FactorDaily reviewed lists eight major mobile wallet players in South and Southeast Asia among Ant Financial’s investee companies. These are Easypaisa in Pakistan, BCash in Bangladesh, TouchnGo in Malaysia, Kakaopay in South Korea, GCash in the Philippines, Ascend in Thailand and Emtek in Indonesia. And, of course, Paytm in India.

----------------

“Many of these people are either geographically remote, live in rural areas that are not served by banks, or that are not covered by branches and ATMs. The traditional banking services are not adequate or too expensive for these people,” says Konstantin Peric, Deputy Director, Level One Digital Payment Systems, Financial Services for the Poor (FSP) at the Bill & Melinda Gates Foundation.

To that end, Peric and a few other partner companies have built MojaLoop, an open-source software that can be used to build national digital payments platforms. In Swahili, Moja means One. Projects that use Moja Loop are underway in Kenya, Uganda, Tanzania, and Nigeria in Africa, and in Indonesia, India, Bangladesh and Pakistan in Asia.

---------------------

urugan is the owner of a small cloud kitchen in Shanghai. He speaks fluent Tamil, passable Mandarin, and a bit of English. The 41-year-old small time entrepreneur supplies Indian food to universities and office establishments in the city.

“I do it all on WeChat,” says Murugan, explaining how he runs a WeChat group called Murugan’s Kitchen where he posts a daily menu, takes orders and receives payments. “Most of my expenses are managed through WeChat,” he says. He serves between 100 and 200 customers daily.

If you want to gallivant about the galaxy, the Hitchhiker’s Guide to the Galaxy recommends getting a towel. But if you ever go to Beijing, a smartphone will do just fine.

Besides the ability to help you with obvious things, what makes the smartphone truly powerful here is that you can pay for everything using the phone. Not just in China’s large cities like Shanghai or football field sized shopping destinations such as China Mall in capital Beijing, but also in small towns and villages and tiny establishments.

Millions of entrepreneurs like Murugan, do business on mega platforms run by Alibaba and WeChat. China’s fintech growth, on the back of these platforms, has been unprecedented. With a record $12.8 trillion in mobile payment transactions in the 10 months to October last year, China even surpassed the United States, at only $49.3 billion during that period.

Mainly two apps – WeChat and Alipay – make all this possible. These apps owned by Chinese internet giants Tencent and Alibaba, respectively, control 93% of the country’s mobile payments market. As China pursued an industrial policy that made it the factory of the world and millions of Chinese came out of poverty, these apps played a big role in making their lives easier in the mainland.

Both Tencent and Alibaba, have reaped economic benefits of this growth. Tencent, which became China’s first company to cross $500 billion in market cap, is now valued at $374 billion. Alibaba has a market cap of $377 billion. Founders of these companies have also become immensely wealthy. Pony Ma, the founder of Tencent, is the world’s 14th richest person with a net worth of over $50 billion. Jack Ma is worth over $34.7 billion. Both are also members of the Communist party in China.

Next, they, along with dozens of hyper-funded upstarts, have designs on the world. They are quietly taking over the global fintech market at a scale that’s unheard of before. “If you said in 2010 that software is eating the world, in 2018, you should say Chinese software is eating the world,” says Nikhil Kumar, a volunteer with Indian software products think-tank iSpirt who was recently in China to learn more about the fintech ecosystem there.

Dec 25, 2018

Riaz Haq

How technology is driving financial inclusion around the world

https://www.worldfinance.com/banking/how-financial-technology-is-dr...

-----------------

The vast majority of unbanked adults live in developing economies. Compared with developed nations, banks in these regions tend to have far fewer branches. For instance, in Pakistan there were fewer than 11 commercial bank branches per 100,000 adults in 2017, compared with 31 in the US, according to the World Bank.

----------

This financial flexibility helps families meet unexpected economic setbacks and allows entrepreneurs to invest in their businesses and create jobs, Wald added. “Most importantly, digital financial inclusion allows economies to grow stronger and more inclusive.” For this reason, countries like Pakistan have come up with financial inclusion strategies in recent years. Pakistan’s government adopted a National Financial Inclusion Strategy (NFIS) in 2015 that aims for 50 percent of adults to have bank accounts by 2020 – including 25 percent of women.

Out of Pakistan’s population of around 210 million, only 21 percent of adults had bank accounts in 2017, according to the World Bank. But with high mobile penetration rates, this could soon change: research by Financial Inclusion Insights (Fii) found that 84 percent of men and 71 percent of women in the country have access to a mobile phone.

--------------------

201m

Population of Pakistan

21%

of adults in Pakistan had a bank account in 2017

34%

of men in Pakistan had a bank account in 2017

7%

of women in Pakistan had a bank account in 2017

--------

Both Smith and Wald cited India as something of a success story for financial inclusion. Its cash-based economy quickly digitalised over recent years, and the rate of bank accounts opening has been “absolutely extraordinary”, Smith said.

In neighbouring Pakistan, however, many locals are still wary of financial institutions. In a 2015 survey by Gallup Pakistan, 65 percent of respondents said they would rather deal with someone they knew than a bank.

Rehan Akhtar is the chief digital officer of Karandaaz, a non-profit that promotes financial inclusion and access to finance for micro, small and medium-sized enterprises (SMEs) in Pakistan. He told World Finance that convincing Pakistanis to adopt digital financial services over cash would require new policies, including digitalising all government transactions and enabling an environment for e-commerce transactions.

NFIS has prompted a number of new initiatives, including mobile bank account schemes, biometric identity verification and the promotion of fintech services. These policies have already strengthened the country’s microfinance sector.

In Pakistan, Akhtar said SMEs account for over 90 percent of the country’s 3.2 million businesses and 30 percent of GDP. “As a consequence, growth of SMEs can have a direct impact on achieving the targets of poverty alleviation and sustainable growth for Pakistan’s economy.”------------------

Investors are increasingly realising the opportunity unbanked populations offer. For instance, Chinese payment provider Ant Financial bought a 45 percent stake in Pakistan’s Telenor Microfinance Bank (TMB) for $184.5m in 2018. Ant Financial aims to develop mobile payments and digital financial services at TMB, which owns Easypaisa.

Stephen Rasmussen, who leads CGAP’s work on sustainable digital financial-services ecosystems, argued in a blog post that Ant Financial’s interest in Pakistan could be a game-changer by “spurring other businesses to become more ambitious about increasing mobile wallet uptake and use” and “[establishing] an investment benchmark in the market that could encourage additional investment into other fintech businesses”.

May 18, 2019

Riaz Haq

#Pakistan's Woman-Led Startup Tez #FinTech Wins Visa Everywhere Initiative Women’s Global Edition After Worldwide Search. Tez is first fully #digital financial institution in Pakistan providing #financialservices to unbanked/underbanked via smartphone apps https://www.fltimes.com/business/national/tez-financial-services-an...

The FinTech competition measured how applicants leveraged their companies’ unique ability to solve or transform consumer and/or commercial payment experiences locally, regionally or globally. The FinTech winner Tez Financial Services from Pakistan, represented by Naureen Hyat, is the first fully digital financial institution in Pakistan providing frictionless financial services to the unbanked and under-banked via a smartphone application.

“The Visa Everywhere Initiative has been a remarkable opportunity for Tez, Pakistan and our cause to enhance financial inclusion,” said Naureen Hyat, Co-founder and Business Head of Tez Financial Services. “It has not only served as a driver for growth but has also allowed us to tap into the connectivity and numerous partners at Visa. I’m honored to be a part of such a thriving group of women entrepreneurs. All of these finalists have already achieved so much – I’m excited to continue to be a witness to our growth collectively beyond this competition.”

The Social Impact Challenge sought women-led businesses around the world who are supporting sustainable and inclusive livelihoods and strengthening their local or regional economies. The Social Impact winner Green Girls Organization from Cameroon, represented by Monique Ntumngia, is a non-governmental organization that trains women and girls to harvest and create renewable energy from the sun and bio-waste.

“This opportunity will allow Green Girls to reach more women and girls and expand our footprint to provide renewable energy,” said Monique Ntumngia, Founder of Green Girls Organization. “Visa’s network and support will not only help my organization scale but will provide a number of rural African communities sustainable energy sources from the sun and bio-waste – creating a ripple effect of impact.”

In addition to Green Girls and Tez, the following entrepreneurs competed for the two top prizes:

FinTech Finalists:

WeCashUp of France, represented by Annicelle Kungne, is the largest Pan African payment gateway that enables eCommerce companies to accept mobile money, cash and cards online in 36 African countries.

Papaya Global of Europe, represented by Eynat Guez, is a SaaS platform that supports total workforce management (payroll, PEO, and contractor management) along with benefits and a full cross-border payments solution in over 100 countries.

DinDin of Latin America, represented by Stéphanie Fleury, provides basic financial services to the unbanked and underbanked individuals and businesses in Brazil, through their app, web-based internet banking and API platforms. Their goal is to promote financial inclusion to more than 115 million people through their B2B2C financial ecosystem.

PoshVine of Asia Pacific, represented by Garima Satija, helps financial services organizations increase customer loyalty and share of spends through contextual, personalized perks and rewards administration. They are building a coalition customer loyalty program through their network of more than 15,000 merchant partners whereby users can earn and easily redeem points using linked debit or credit cards.

Alloy of North America, represented by Laura Spiekerman, provides real-time identity and risk decisioning for financial services, including KYC/AML and fraud checks.

Jul 1, 2019

Riaz Haq

Tez Financial Services Becomes the First #Pakistani #Startup to Raise $1.1 Million in Seed Round Led by #Ebay founder's Omidyar Network. #fintech #Pakistan #technology https://prn.to/2XiruCC

KARACHI, Pakistan, Oct. 19, 2018 /PRNewswire/ -- Tez Financial Services, the first fully digital Non-Bank Microfinance Company (NBMFC) in Pakistan, today announced that it has raised USD$1.1 million in a seed round led by Omidyar Network, the impact investment firm established by Pierre Omidyar, the founder of eBay. Other investors on this round include Accion Venture Lab, the seed-stage investment initiative of global nonprofit Accion, and Planet N. Funds will help the company build its credit portfolio, enhance its mobile technology platform, and secure the company's NBMFC license.

You can learn more about the challenge, opportunity, and impact in this video.

"Our aim is to become the primary financial service provider for the unbanked and underbanked in Pakistan," said Nadeem Hussain, co-founder and CEO of Tez, who has more than 30 years of experience in the global financial services industry. "Tez delivers a seamless experience for our customers, providing loans in under 15 minutes as opposed to the usual month timeline from local commercial banks. Soon, we will be able to process life and health insurance claims in a similar timeframe."

In Pakistan, more than 50 percent of the population is unbanked, with only 23 percent of the population served by formal channels, and another 24 percent by informal channels, according to the World Bank. Despite the fact that the country has 43 banks, low penetration of formal financial services including credit (14%), savings (12%), and insurance (2%) is persistent.

Most unbanked and underbanked consumers use a variety of informal financial tools to manage their finances, but those can be unreliable, expensive, and inefficient. With more than one-third of the population living below the poverty line, minor fluctuations in income can raise significant short-term financing needs. That can mean the difference between paying a bill at the end of the month, such as tuition, or buying groceries.

Mobile phones are changing all of that. The GSMA estimates that in two years, more than 80 percent of Pakistan will have 3G/4G coverage. The country already boasts 28 million mobile accounts—an indicator of consumers' readiness to adopt digital financial services, especially in remote areas not served by traditional banking.

"New technologies, higher smartphone penetration, and falling data costs are fueling a great momentum for financial inclusion in frontier markets such as Pakistan. Tez is leveraging this to push the boundaries of banking in the country with an all-digital offering," said Kabir Kumar, head of Policy and Ecosystem Building at Omidyar Network. "Tez's diverse team is also well-positioned to bring about the products and services that really speak to the next generation of consumers in that country."

"Tez marks our first investment in Pakistan, a country with a significant need for innovative products that can bring its population into the formal financial system," said Michael Schlein, President and CEO of Accion. "By supporting Tez's all-digital model, we can help make an important difference for millions of underserved Pakistani families and businesses."

Tez uses some of the latest technologies, such as artificial intelligence, to analyze consumers' digital footprint trends, social behavior, and consumption patterns in order to customize its offerings to meet each individual's needs through an all-encompassing, easy to use app, as follows:

Tez has integrated with EasyPaisa, UBL Omni, and SimSim as its branchless banking partners, resulting in the largest combined agent network for its customers. Tez has also partnered with two of the largest insurance companies in Pakistan—EFU Life and Jubilee General—to provide life and health coverage. VentureDive is the technology partner, fostering technological innovation at a global scale, with offices in Pakistan, UAE, and Germany. Tez will soon launch additional products that will help further advance financial inclusion in Pakistan.

How it works

Jul 1, 2019

Riaz Haq

Pakistani startup Tez Financial Services wins at Inclusive Fintech50

https://www.samaa.tv/technology/2019/06/pakistani-startup-tez-finan...

Pakistani fintech startup Tez Financial Services has been selected as one of the winners of 2019’s Inclusive Fintech 50. Tez was the only Pakistani startup to have qualified for the competition, reported Clarity.pk.

The winners of Inclusive Fintech 50 were announced on June 17 by the MetLife Foundation and Visa Inc, with global nonprofit Accion and World Bank Group member IFC. The competition was launched in February.

Inclusive Fintech 50 is a competition to help early-stage fintech companies attract capital and resources to benefit the world’s three billion financially underprivileged people.

Tez Financial Services is the first fully digital Non-Bank Microfinance Company focused on serving the unbanked and underbanked in Pakistan.

The founders of Tez were leading forces in the creation of Tameer Bank, Easypaisa, and CheckIn Solutions.

Jul 3, 2019

Riaz Haq

The share of cash payments worldwide is falling rapidly, from 89% in 2013 to 77% today

High internet use and state support help countries ditch cash

Even within the rich world, the most digitised societies use cash least often

https://www.economist.com/graphic-detail/2019/08/01/high-internet-u...

On july 27th, outside Brooklyn’s hipper-than-thou Smorgasburg street-food market, a dozen hungry visitors stand idle amid the barbecue fumes. Rather than queuing for food, they are waiting at a cash machine. Yet inside the market, vendors are trying to wean their customers off cash. Gourmets who use Apple Pay, a mobile-payment service, receive hefty discounts on their purchases. “Apple pays us the difference,” one trader explains.

Most transactions around the world are still conducted in cash. However, its share is falling rapidly, from 89% in 2013 to 77% today. Despite the attention paid to mobile banking in emerging markets, it is rich countries, with high financial inclusion and small informal economies, that have led the trend. Within the rich world, more-digitised societies tend to make fewer cash payments. In Nordic countries like Norway and Denmark, where 97% of people use the internet, around four out of five transactions were already cashless by 2016, according to a recent review chaired by Huw van Steenis of the Bank of England. In contrast, internet penetration in Italy is just 61%, and 85% of transactions there were still handled in cash in 2016.

Aug 2, 2019

Riaz Haq

Accion Venture Lab closes $33 million to invest in inclusive #fintech #startups. Tahira Dosani, MD of Accion Venture Lab, said that their investments are global with a focus on emerging markets investing in #UAE, #Pakistan, #MENA.

https://www.menabytes.com/accion-venture-lab-33-million/ via @MENAbytes

Accion Venture Lab has emerged as a leader in fintech impact investing by investing in tens of fintech startups around the world including Now Money from the United Arab Emirates and Tez from Pakistan. According to its statement, for every dollar Accion Venture Lab has invested, its portfolio companies have raised an additional $13 in equity capital from later-stage investors.

Tahira Dosani, the Managing Director of Accion Venture Lab, in a conversation with MENAbytes, said that their investments are global with a focus on emerging markets, adding that they have plans to continue investing in UAE, Pakistan, and other markets in the Middle East & North Africa.

Washington-based Accion Venture Lab, according to the statement, is typically the first institutional investor in its portfolio companies, providing both capital and extensive strategic and operational support across a broad range of functional areas.

Tahira, speaking to MENAbytes said that they invest in early-stage startups (with average cheque size of USD 500,000) that are leveraging technology or innovation to improve the reach, quality, and affordability of financial services for low-income and underserved individuals and small businesses, “Our initial investment in a startup is always at the seed stage, but we will follow-on in A and B rounds in companies we have invested in.”

Speaking about their portfolio companies (Now Money and Tez) in MENA & Pakistan, Tahira added, “We see a lot of potential in both these businesses. Tez provides consumer credit in Pakistan to individuals who struggle to access credit through other formal means. The loans Tez provides are critical for income smoothing and day-to-day management for their customers. NOW Money serves migrant workers in the UAE, providing them with a digital bank account, debit card, and the ability to send remittances digitally and quickly back to their families. We expect both of them to see continued growth over the coming years.”

“We’re seeing substantial growth in the amount of investment capital available for fintech startups from what we saw when Accion Venture Lab launched in 2012, but money isn’t enough,” said Venture Lab Managing Director Tahira Dosani. “Capital must be paired with strategic and operational support that is informed by a deep knowledge of the sector, target customer, and a deliberate focus on how new technologies can help the underserved build better lives. We can accelerate the growth trajectories of companies through our capital plus approach to investing.”

Michael Schlein, President and CEO of Accion, commenting on the occasion, said, “Despite progress, three billion people still have no safe or simple way to save money, get a loan to build a business, pay a bill, or protect their health and property with insurance. Fintech startups are finding new ways to provide products and services that help these underserved people. Yet often startups lack the capital and strategic support they need to grow and scale their impact. Accion Venture Lab addresses this need.”

Accion Venture Lab’s portfolio companies, according to the statement, offer potential to reach underserved communities by building solutions around insurtech, agricultural finance, digital lending, and personal financial management, ultimately supporting entrepreneurship, resilience in farming, gig economy and migrant workers, healthcare, transportation, and education.

Sep 15, 2019

Riaz Haq

Leading #Pakistani Bank Partners With #Ripple to Launch #Digital #Payments Solution. Faysal Bank Limited (FBL) has launched a digital payments solution through a partnership with #US-based Ripple, a #blockchain-based money transfer platform. #fintech

https://www.crowdfundinsider.com/2019/09/151318-leading-pakistani-b...

FBL is one of Pakistan’s largest commercial banks with over 220 branches nationwide and assets totaling $1.5 billion.

Announced on September 6, 2019, FBL’s partnership with Ripple was commemorated by a meeting in Karachi, Pakistan’s leading industrial and financial center. The business meeting was attended by Faysal Bank’s president Yousaf Hussain.

FBL, an Islamic private bank, has joined more than 200 financial institutions and payment providers that are using RippleNet, a decentralized global payments network for conducting fast and cost-effective cross-border transactions.

The leading Pakistani bank has reportedly been working on various initiatives aimed at supporting the development of a digital economy. FBL notably became the first major private Pakistani bank to introduce a virtual payment card in Pakistan in 2017.

FBL recently sponsored a one-day summit focused on electronic payments in Karachi, in order to spread “mass awareness about digital money.”

Pakistan’s regulatory authorities have not drafted guidelines for transactions involving cryptocurrencies. In 2018, the country’s central bank, the State Bank of Pakistan (SBP), ordered all local financial institutions to suspend services being offered to individuals and firms dealing in Bitcoin and other digital assets.

Sep 21, 2019

Riaz Haq

#Pakistan lays out #digital #payments strategy. It has been praised by #WorldBank president David Malpass, who adds that the SBP must be joined by other stakeholders in the drive for digital #financialservices. #fintech #FinancialInclusion https://www.finextra.com/newsarticle/34761/pakistan-lays-out-digita... via @Finextra

The State Bank of Pakistan has set out a new, digital-focused, national payment systems strategy designed to boost financial inclusion, particularity for women.

Cash still dominates Pakistan's economy, with most wages paid in paper money and merchants largely unable to accept digital payments. Just 21% of adults have a transaction account and of these only seven per cent are women.

With such a low base, the central bank claims that migration to electronic payments will stimulate consumption and trade, boosting Pakistan's economy by as much as seven per cent and creating four million jobs by 2025.

Governor Reza Baqir says the bank will strengthen the country's legal and regulatory framework to bring it in line with international best practices, laying the groundwork for a "modern and robust digital payments network".

Rules are already in place for the digital onboarding of merchants to encourage acceptance of non-cash payments, while the central bank is also developing a faster payments system. The government will continue to move towards electronic payments, possibly creating a shared platform for all disbursements and collections.

The strategy has been praised by World Bank president David Malpass, who adds that the SBP must be joined by other stakeholders in the drive for digital financial services.

Nov 14, 2019

Riaz Haq

#Pakistan plans cashless society. State Bank to to install additional 1 million #digital access points over 3 years. A Micro #Payment Gateway is being implemented in collaboration with the Bill and Melinda Gates Foundation for faster #retail #payments. https://nation.com.pk/20-Jan-2020/pakistan-adopts-roadmap-towards-c...

A roadmap has been brought in practice in government's circles to take the country towards a cashless society, reports Gwadar Pro Mobile News Net. The State Bank of Pakistan (SBP) earlier launched the National Payment Strategy System (NPSS) in order to build a road map and action plan for Pakistan to have a modern and robust digital payments network.

According to the report, the key goal of the strategy is to make the access of the people easier to financial services while helping them to improve financial inclusion in the country, particularly for women, along with greater documentation of the economy.

Therefore the SBP aimed to develop a faster payment system that would simplify the requesting, receiving and sending of payments in the country.

The State Bank of Pakistan in collaboration with the private sector, would increase the number of digital access points for making easy payments and plans to install additional one million digital access points over the next three years. SBP also claimed that migration to electronic payments will stimulate consumption and trade, boosting Pakistan's economy by as much as seven per cent and creating four million jobs by 2025. The Micro Payment Gateway is being implemented in collaboration with the Bill and Melinda Gates Foundation to ensure faster retail payments.

Meanwhile the World Bank also extended its full support to the central bank in implementation of key economic reforms and action items as highlighted in the strategy. Cash still dominates Pakistan's economy, with most wages paid in paper money and merchants largely unable to accept digital payments. Only 21% of adults have a transaction account and of these only seven percent are women. In developing countries like Pakistan, transparent cashless digital transactions can instill greater confidence in international investors.

Pakistan can acquire much from other developed countries like China to further boost the digital payment system, which is still in its infancy, as the latter has an immense knowledge base, experience and advanced technology in this field.

China's estimated 890 million unique mobile payment users made transactions totaling around $17 trillion in 2017—more than double the 2016 figure. The number of people making mobile merchant payments raised to 577 million in 2019 and expected to touch almost 700 million in 2022.

Beside many advantages coming with it there are also few challenges and issues with digital payments in country like Pakistan. For example, cyber security remains a key focus area of the central bank as keeping the system protected from cyber-attacks is a major challenge. Issues related to internet connectivity, power infrastructure, digital payment set-ups and lack of necessary insight among wider society can constrain the outreach of digital transactions. Cash is not an option but a necessity for a major chunk of our population, as only 21% of Pakistanis have access to formal financial services.

Therefore, cashless economy cannot be imposed rather it has to be gradually adopted by general public for successful implementation. The application also needs to be very simple and easy to use so that everyone can understand.

Jan 20, 2020

Riaz Haq

NayaPay partners with #Visa to fast-track #digital #payments in #Pakistan. NayaPay will use Visa Direct to simplify cross-border money transfers for freelancers & other Pakistan based businesses working with international clients, and overseas #remittances https://www.dawn.com/news/1571618

NayaPay has joined the Visa Fintech Fast Track program, speeding up the payment company’s integration process with Visa and enabling NayaPay to leverage the reach, capabilities, and security of the Visa global payments network.

Through the Fast Track program, NayaPay has access to Visa’s growing partner network, technology and resources to accelerate innovation in digital payments in Pakistan.

As an Electronic Money Institution (EMI), NayaPay will enable users to open E-Money accounts within a few minutes and make hassle-free digital payments to each other and to businesses.

NayaPay consumers and merchants can use their NayaPay Visa debit card to perform online and in-store transactions with millions of retailers worldwide as well as withdraw cash conveniently at any ATM location.

NayaPay customers can also scan Visa merchant QR codes to make payments directly through their app.

NayaPay will also be leveraging Visa Direct to simplify cross-border money transfers for freelancers and other Pakistan based businesses working with international clients, and households receiving remittances from their families abroad.

Users will be able to accept funds instantly and directly into their NayaPay wallets from over a billion Visa cards across the globe.

“We are committed to helping fintechs achieve their potential – enabling big ideas to flourish and supporting them through the reach, scale and security of the Visa network,” said Kamil Khan, Country Manager, Pakistan, Visa. “We have strategically evolved both our platforms and how we work with partners and customers to encourage a broadening of the fintech ecosystem globally and are excited by the opportunities and new use cases the NayaPay partnership will enable in Pakistan. Our work with NayaPay is a stepping stone in that evolution and we look forward to further supporting them on their journey.”

Danish Lakhani, CEO NayaPay, said: “We are delighted to have found a partner in Visa that shares our goals of making financial services simpler, more convenient and accessible to Pakistani users – the needs of whom have been overlooked for far too long. Over the past few months, we have been integrating Visa’s offerings to reinforce our issuing and acquiring capabilities and to deliver on our promise of becoming a part of citizens’ daily lives.”

“By joining Visa’s Fintech Fast Track program, exciting fintechs like NayaPay gain unprecedented access to Visa experts, technology, and resources,” said Otto Williams, Vice President, Strategic Partnerships, Fintech and Ventures, CEMEA at Visa. “The Visa Fintech Fast Track program lets us provide new resources that rapidly growing companies need to scale with efficiency. We’re delighted to welcome NayaPay into our program and look forward to working with them on their payment solutions that will transform financial inclusion in Pakistan.”

Jul 28, 2020

Riaz Haq

Digital payment and banking technology provider i2c has been tapped to fuel Pakistan’s first “digital-native financial super app” TAG, which is set to roll out in the first quarter of 2021, according to a Tuesday (Jan. 5) announcement emailed to PYMNTS.

https://www.pymnts.com/news/international/2021/i2c-chosen-fuel-paki...

"i2c’s tech stack provides us a sound foundation for enabling the kind of innovative, safe and secure payments experiences we’re bringing to market,” TAG CEO Talal Ahmad Gondal said in the announcement.

TAG provides instant payments capability to Pakistan’s unbanked adult population of roughly 100 million. The app includes features like mobile top-up, bill payment, automated teller machine (ATM) access, and the capacity to send and receive funds immediately without charges to anyone with a TAG account and tools to keep track of spending. The firm’s roadmap includes expansion to the Middle East and North Africa.

"We're thankful for TAG’s selection of our platform and for the opportunity to play a role in helping bring digital financial services to so many people," Aurangzaib Khan, i2c’s general manager for the MEA region, said in the announcement.

The news comes as Pakistan experienced a sizable rise in remittances from nationals working in other countries in July, showing a rare case of the pandemic helping a country’s economy.

"More good news for Pak economy,” Pakistan Prime Minister Imran Kahn tweeted in August. “Remittances from overseas Pakistanis reached $2,768 mn in July 2020, highest-ever amount in one month in the history of Pakistan. This is 12.2 percent increase over June 2020 and 36.5 percent increase over July 2019.”

As the worldwide pandemic and ensuing economic disruption have blurred the boundaries between traditional means of payment, i2c CEO Amir Wain told PYMNTS in November the largest business opportunity ahead will be in credit, with mobile becoming the largest game-changer.

“The stars of financial services in 2021 will have something to do with credit,” Wain said, adding the days of the simple checking or demand draft accounts (DDA) are over. “You can’t be a star with the DDA in 2021.”

-----------

i2c Inc. drives innovation to the global digital payments and open banking industry with a multi-function platform built for endless possibilities. Advanced “building block” processing technology at its core provides a vast suite of credit, debit and prepaid solutions—all from a single global SaaS platform. This enables clients to dynamically configure payment solutions with unparalleled flexibility, agility and performance while maintaining highly secure and reliable payments.

Founded in 2001, and headquartered in Silicon Valley, i2c’s next-generation technology helps organizations drive revenue growth, scale and adapt to change while supporting millions of users in more than 200 countries and territories and all time zones

https://www.linkedin.com/company/i2c-inc/

Jan 9, 2021

Riaz Haq

As founder and CEO of i2c, Amir is responsible for defining a clear vision and setting strategic direction for the company. Recognized as a pioneer in the prepaid/stored value industry, Amir founded software development firm Innovative Private Limited in 1987 and led the global launch of the transaction processing platform FastCash. Propelledby the success of Innovative, he founded i2c, Inc. in 2001 to bring next-generation processing solutions to the payments industry. Contributing to the company’s expansive growth curve, under Amir’s guidance, i2c has introduced a number of industry firsts, including card-linked offers, event-driven account holder communications and gift card voice personalization.

Today, as market opportunities for payments & emerging commerce continue to expand at a dramatic rate, Amir is leading i2c’s continued push to innovate the enabling infrastructure and solutions that transform commerce. Today’s consumers want choices, and Amir’s vision is to build the flexible solutions they seek in an increasingly mobile and global world.

----------------

I was born in Pakistan and before I could legally purchase beer, I came to the US to the University of Texas in Arlington to do my computer science and engineering. So it was an interesting journey coming across the globe to a new place, not knowing anyone. And, I thought besides the education in the class, just being in a new place at that age was a great learning for me. So really, really enjoyed my time and I learned a lot, and I really would call myself a serial entrepreneur because I never really worked for anyone right after college. And in fact, even during my last 18 months at college, a friend of mine and I were doing custom coding and doing projects for people. And as I graduated, I went back to Pakistan to be with my parents and saw a tremendous opportunity in terms of exposing the power of personal computing to the corporate world. And I'm talking 1986 so the IBM XT had come out, Lotus 123 was there, and it was a 10X change on the old way of doing things and just showing people some use cases and how all of this could be used was number one, extremely exciting and offered tremendous benefits to the other party. And, so that kind of got me thinking about starting a business and we started with a training program of computer appreciation for the senior executives. And I started doing this multi-day course for the senior management at large organizations and from one referral to another, that got the business going.

So, everyone kind of loved the spreadsheet aspect but then they would have problems that couldn't be solved by a spreadsheet, like inventory management, anything which has historical data and so on. So, we started getting business for custom software development and from there, it was more and more focused on the finance sector and we did a lot of work for banks in that space doing custom software development. And, currently I am based in the Bay area. I've been here since 2001, beginning of 2001, so just after the dotcom party ended. So, it was a good time and it's been a fantastic journey since then. And i2c was my third business that I started. So, between 1986 and 2001, and the other two businesses still operate successfully, with one of them traded on the stock exchange. The other is run by management. I’m on the board and spending most of my time at i2c that I'm very actively engaged with, and since then I've invested in a couple of other businesses and help them get started. So absolutely entrepreneurship I think is one thing that I have kind of seen and had in me throughout this journey.

https://leadersinpayments.com/show-notes/f/amir-wain-ceo-of-i2c

Jan 9, 2021

Riaz Haq

To support issuers, i2c offers a highly configurable, global platform that provides the agile technology infrastructure and capabilities needed to respond to changing market conditions and stay competitive. Instead of pre-packaged products, i2c provides over 100,000 interlocking payment functions that we refer to as building blocks. These payment building blocks can be rapidly configured by issuers to create their own unique value propositions for credit, debit, prepaid or mobile banking products. Rapid product configuration enables issuers to get to market in days versus months.

Using the i2c platform, issuers can also enable cardholders to set up and manage their preferences for alerts, spending controls or restrictions in different types of merchants or by geography. For cardholders who travel cross border, they also have the opportunity to carry multiple currencies on just one card and lock in foreign exchange rates before they travel or transact, so they have better control of their spending.