Low wages and trade preferential deals with Western nations have helped Bangladesh, currently designated "Least Developed Country" (LDC), build a $30 billion ready-made garments (RMG) industry that accounts for 80% of country's exports. Bangladesh is the world's second largest RMG exporter after China. With its designation as LDC (Least Developed Country), garments made in Bangladesh get preferential duty-free access to Europe and America. Rising monthly wages of Bangladesh garment worker in terms of US dollars are now catching up with the minimum wage in Pakistan, especially after recent Pakistani rupee devaluation. Minimum monthly wage in Pakistan has declined from $136 last year to $107 now while Bangladesh has seen it increase from $64 last year to $95 today. Western garment buyers, known for their relentless pursuit of the lowest labor costs, will likely diversify their sources by directing new investments to Pakistan and other nations. Competing on low cost alone may prove to be a poor long term exports strategy for both countries. Greater value addition with diverse products and services will be necessary to remain competitive as wages rise in both countries.

|

| Minimum Monthly Wages in US$ Market Exchange Rate |

Wage Hike in Bangladesh:

The government in Dhaka announced in September that the minimum wage for garment workers would increase by up to 51% this year to 8,000 taka ($95) a month, up from $64 a year ago, according to Renaissance Capital. But garment workers union leaders say that increase will benefit only a small percentage of workers in the sector, which employs 4 million in the country of 165 million people, according to Reuters. Bangladesh government promised this week it would consider demands for an increase in the minimum wage, after clashes between police and protesters killed one worker and wounded dozens.

|

| Monthly Minimum Wages in US$. Source: Renaissance Capital |

Pakistan Wage Decline:

Pakistani currency has seen about 25% decline in value against the US dollar since January 2018. As a result of this devaluation, the minimum monthly wage in Pakistan has dropped from $136 last year to $107 now while Bangladesh has seen it increase from $64 last year to $95 today. Renaissance Capital projects a further 10% depreciation in Pakistani rupee this year.

Race to the Bottom?

Competing on cost alone is like engaging in the race to the bottom. Neither Pakistan nor Bangladesh can count on being lowest cost producers in the long run. What must they do to grow their exports in the future? The only viable option for both is to diversify their products and services and add greater value to justify higher prices.

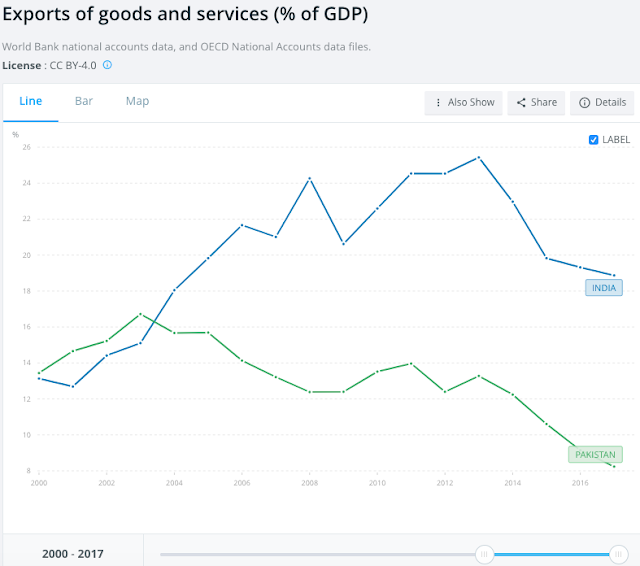

Pakistan's Export Performance:

The bulk of Pakistan's exports consist of low value commodities like chadar, chawal and chamra (textiles, rice and leather). These exports have declined from about 15% to about 8% of GDP since 2003. Pakistan's trade deficits are growing at an alarming rate as the imports continue to far outstrip exports. This situation is not sustainable. What must Pakistan do to improve it? What can Pakistan do to avoid recurring

balance of payments crises? How can Pakistan diversify and grow its exports to reduce the gaping trade gap? How can Pakistan's closest ally China help? Can China invest in export oriented industries and open up its huge market for exports from Pakistan? Let's explore answers to these question.

East Asia's Experience:

East Asian nations have greatly benefited from major investments made by the United States and Europe in export-oriented industries and increased access to western markets over the last several decades. Asian Tigers started with textiles and then switched to manufacturing higher value added consumer electronics and high tech products. Access to North American and European markets boosted their export earnings and helped them accumulate large foreign exchange reserves that freed them from dependence on the IMF and other international financial institutions. China, too, has been a major beneficiary of these western policies. All have significantly enhanced their living standards.

Chinese Investment and Trade:

Pakistan needs similar investments in export-oriented industries and greater access to major markets. Given the end of the Cold War and

changing US alliances, it seems unlikely that the United States would help Pakistan deal with the difficulties it faces today.

China sees Pakistan as a close strategic ally. It is investing heavily in the Belt and Road Initiative (BRI) which includes

China-Pakistan Economic Corridor (CPEC). A recent opinion piece by Yao Jing, the Chinese Ambassador in Pakistan, published in the state-owned

China Daily, appears to suggest that China is prepared to offer such help. Here are two key excerpts from the opinion piece titled "A community of shared future with Pakistan":

1. China will actively promote investment in Pakistan. The Chinese government will firmly promote industrial cooperation, expand China's direct investment in Pakistan, and encourage Chinese enterprises to actively participate in the construction of

special economic zones. Its focus of cooperation will be upgrading Pakistan's manufacturing capacity and expanding export-oriented industries.

2. China will also actively expand its imports from Pakistan. In November, China will hold the first China International Import Expo in Shanghai, where, as one of the "Chief Guest" countries, Pakistan has been invited to send a large delegation of exporters and set up exhibitions at both the national and export levels. It is hoped that Pakistan will make full use of this opportunity to promote its superior products to China. The Chinese side will also promote cooperation between the customs and quarantine authorities of both countries to facilitate the further opening-up of China's agricultural product market to Pakistan. China will, under the framework of free trade cooperation between the two countries, provide a larger market share for Pakistani goods, and strengthen cooperation and facilitate local trade between Gilgit-Baltistan and China's Xinjiang Uygur autonomous region. And China will take further visa facilitation measures to encourage more Pakistani businesspeople to visit China.

Pakistan's Role:Pakistan needs to take the Chinese Ambassador Yao Jing's offer to increase Chinese investments and open up China's market for imports from Pakistan. Pakistan's new government led by Prime Minister Imran Khan should take immediate steps to pursue the Chinese offer. Finance Minister Asad Umar needs to form a high-powered team of top bureaucrats and leading businessmen to develop a comprehensive plan to attract investments in export-oriented industries and diversify and grow exports to China and other countries. Pakistan must make full use of its vast network of overseas diplomatic missions to promote investment and trade.

Summary:

Pakistani currency has seen about 25% decline in value against the US dollar since January 2018. As a result of this devaluation, the minimum monthly wage in Pakistan has dropped from $136 last year to $107 now while in Bangladesh has seen it increased from $64 last year to $95 today. Renaissance Capital projects a further 10% depreciation this year. While this can help Pakistan's RMG exports in the short term, it is not good long term strategy. Competing on cost alone is a race to the bottom. Pakistan's manufactured exports per capita have declined in the last decade. Pakistan's exports have declined from about 15% of GDP to about 8% since 2003. The nation's trade deficits are growing at an alarming rate as the imports continue to far outstrip exports. This situation is not sustainable. Chinese Ambassador Yao Jing has offered a helping hand to increase Chinese investment and trade in Pakistan. Pakistan's new government led by

Prime Minister Imran Khan should take the Chinese Ambassador's plan seriously. Finance Minister Asad Umar needs to form a high-powered team of top bureaucrats and leading businessmen on a comprehensive plan to attract investments in export-oriented industries and diversify and grow high-value exports to China and other countries.

Riaz Haq

Bangladesh workers' wages rise in 6 grades

RMG workers' pay structure revised after PM's directive amid unrest for eight days

https://www.thedailystar.net/business/bangladesh-garment-workers-sa...

After eight days of labour unrest, the government yesterday announced a revised pay structure, with a slight increase in both basic and gross wages in six of the seven grades in the RMG sector.

In the new pay scale, which comes after years, the yearly increment has been fixed at 5 percent.

Workers had been demanding pay raise in three grades in particular -- grade 3, 4 and 5.

The decision came following directives of the prime minister after an event-packed day, on which workers continued their protests, factory owners threatened to shut down their units and a tripartite committee held almost a daylong meeting to reach a consensus on the hike.

The meeting of the 20-member committee, which has representation of the workers, owners and the government, approved wage increase in grade 1-6. The hike ranges from a token Tk 15 to a modest Tk 747.

The raise is effective from December last year and will be adjusted from February.

The gross pay in grade 7 remains unchanged at Tk 8,000, which was Tk 5,300 in the previous pay structure announced in 2013.

The government will publish a new gazette of the revised wage in the next three to four days, said Labour and Employment Secretary Afroza Khan, who heads the tripartite committee.

The committee was considering pay hikes in the three “most problematic” grades -- 3, 4 and 5.

But at a meeting at Gono Bhaban on Saturday night, Sheikh Hasina instructed officials to revise the latest pay structure, originally announced in September last year, for all grades, sources said.

The workers will receive the arrear with their pay for February, Commerce Minister Tipu Munshi told reporters after the meeting.

“We were mainly concerned about the pay in grade 3, 4 and 5. But we eventually revised the wages six grades so workers get a little more,” he said, announcing the decision at a press conference at the ministry.

Amirul Haque Amin, president of the National Garment Workers Federation, said, “We welcome the revision and the new wage structure.”

He was speaking on behalf of the trade union leaders who are on the tripartite committee.

Reaction among the workers were mixed.

Alamgir Kabir, who works at a Ha-Meem Group factory, said he was happy and that he would join work today.

Another worker, however, said he was not satisfied. But still he would go back to work, if his colleagues did so.

Incidents of labour unrest over the pay structure made headlines in early December, just two months after the pay package was announced.

That protest died down ahead of the general election.

However, when workers drew their salary for January, they spotted a huge disparity -- in some cases, their gross wages came down instead of going up, triggering the latest bout of protest.

After yesterday's announcement, trade union leaders hope the workers will join work.

“We, the trade union orgainsations, do not approve of the anarchy that we have seen over the last few days,” said Amirul of the National Garment Workers Federation.

He also said they would have no objection if the government took action against any wrongdoers.

“We are requesting the workers to go back to work from tomorrow [today]. We are also calling them to cooperate with the factory managements so they can make up for the loss incurred in the last few days,” he said.

Meanwhile, BGMEA President Siddiqur Rahman yesterday threatened to shut down all factories if the workers did not join work.

"No work, no pay," he told an emergency press conference at the BGMEA office.

UNREST CONTINUES

At least 10 garment workers were injured in clashes with police during protest in different areas of Ashulia on Dhaka-Tangail highway yesterday.

The protestors vandalised at least five vehicles, burned tyres and wooden objects on the road, halting traffic for around one and a half hours.

The protest for pay hike continued for the 8th day yesterday, even as a tripartite committee representing workers, owners and the government sat in a meeting to consider their demand.

Protestors at Jamgara and Narsinghpur said they would not leave the streets until the government announced the revised wage structure.

They began their demonstration in the area around 8:00am, blocking a number of roads.

Police quickly rushed to the spots and charged batons to clear the roads. Police also used water cannons and teargas shells on them.

Vehicular movement was halted until 9:30am, creating a huge tailback.

“We dispersed the workers by firing teargas and using water cannons as they blocked at least 10 points of the highway and its adjacent roads,” said Sana Shaminur Rahman, superintendent of Dhaka Industrial Police-1.

At least 50 factories in Ashulia area were closed as workers of these factories continued their protests.

In Gazipur, most factories were closed because of the unrest.

As a result, the sector is incurring a huge loss, said owners and officials of several factories.

[Our Savar and Gazipur correspondents contributed to the report.]

Jan 13, 2019

Riaz Haq

Rise of #Bangladesh. CLSA's Chris Wood believes Bangladesh's reliance on #garments sector is obstacle to future growth as it faces the risk of lower #wage alternatives in #Africa, #automation & loss of duty-free #market access when it loses #LDC status. https://asia.nikkei.com/Spotlight/Cover-Story/The-rise-and-rise-of-...

"Exiting LDC status gives us some kind of strength and confidence, which is very important, not only for political leaders but also for the people," she (Shaikh Hasina) told the Nikkei Asian Review in an exclusive interview in December. "When you are in a low category, naturally when you discuss terms of projects and programs, you must depend on others' mercy. But once you have graduated, you don't have to depend on anyone because you have your own rights."

Hasina says Bangladesh's strong economic growth will not just continue, but accelerate. "In the next five years, we expect annual growth to exceed 9% and, we hope, get us to 10% by 2021," she said.

"I always shoot for a higher rate," she laughs. "Why should I predict lower?"

On many fronts, Bangladesh's economic performance has indeed exceeded even government targets. With a national strategy focused on manufacturing -- dominated by the garment industry -- the country has seen exports soar by an average annual rate of 15-17% in recent years to reach a record $36.7 billion in the year through June. They are on track to meet the government's goal of $39 billion in 2019, and Hasina has urged industry to hit $50 billion worth by 2021 to mark the 50th anniversary of what Bangladeshis call their Liberation War.

A vast community of about 2.5 million Bangladeshi overseas workers further buoys the economy with remittances that jumped an annual 18% to top $15 billion in 2018. But Hasina also knows the country needs to move up the industrial value chain. Political and business leaders echo her ambitions to shift from the old model of operating as a low-cost manufacturing hub partly dependent on remittances and international aid.

To that end, Hasina launched a "Digital Bangladesh" strategy in 2009 backed by generous incentives. Now Dhaka, the nation's capital, is home to a small but growing technology sector led by CEOs who talk boldly about "leapfrogging" neighboring India in IT. Pharmaceutical manufacturing -- another Indian staple -- is also on the rise.

Behind the impressive numbers and bold ambitions, however, are daunting hurdles ranging from structural problems to deep political divisions, which have come to the fore ahead of national elections on Dec. 30.

Bangladeshi politics have been dominated for years by the bitter rivalry between Hasina and former Prime Minister Khaleda Zia, whose family histories go back to opposing sides of the liberation struggle, when Bangladesh was known as East Pakistan. Both women have been in and out of power -- and prison -- over the past three decades. Khaleda Zia, who chairs the opposition Bangladesh Nationalist Party, is in jail on corruption charges that she says are false.

Since 1981, Hasina has led the ruling Awami League, founded by her father, Sheikh Mujibur Rahman, the country's first president, who was killed by army personnel along with most of his family in 1975. The party enjoyed strong support in some past elections. But opposition activists and human rights groups have voiced concern about potential polling fraud and intimidation tactics. After two consecutive five-year terms for the ruling party, analysts point to a palpable "anti-incumbency" sentiment among some voters. Yet from an economic standpoint, many agree that a ruling party victory would support further development.

"If the polling passes without too much strife and the status quo is maintained, then [Bangladesh] would seem an attractive long-term story," said Christopher Wood, managing director and chief strategist at Hong Kong-based brokerage CLSA.

Jan 13, 2019

Riaz Haq

https://asia.nikkei.com/Spotlight/Cover-Story/The-rise-and-rise-of-...

DHAKA -- Bangladesh defies economic and political gravity. Since its 1971 war of independence with Pakistan, the country has been known for its tragedies: wrenching poverty, natural disasters and now one of the world's biggest refugee crises, after the influx of 750,000 Rohingya Muslims fleeing persecution in neighboring Myanmar.

Yet, with remarkably little international attention, Bangladesh has also become one of the world's economic success stories. Aided by a fast-growing manufacturing sector -- its garment industry is second only to China's -- Bangladesh's economy has averaged above 6% annual growth for nearly a decade, reaching 7.86% in the year through June.

From mass starvation in 1974, the country has achieved near self-sufficiency in food production for its 166 million-plus population. Per capita income has risen nearly threefold since 2009, reaching $1,750 this year. And the number of people living in extreme poverty -- classified as under $1.25 per day -- has shrunk from about 19% of the population to less than 9% over the same period, according to the World Bank.

Earlier this year, Bangladesh celebrated a pivotal moment when it met United Nations criteria for graduating from "least developed country" status by 2024. To Prime Minister Sheikh Hasina, the elevation to "developing economy" means a significant boost to the nation's self-image.

"Exiting LDC status gives us some kind of strength and confidence, which is very important, not only for political leaders but also for the people," she told the Nikkei Asian Review in an exclusive interview in December. "When you are in a low category, naturally when you discuss terms of projects and programs, you must depend on others' mercy. But once you have graduated, you don't have to depend on anyone because you have your own rights."

Hasina says Bangladesh's strong economic growth will not just continue, but accelerate. "In the next five years, we expect annual growth to exceed 9% and, we hope, get us to 10% by 2021," she said.

"I always shoot for a higher rate," she laughs. "Why should I predict lower?"

On many fronts, Bangladesh's economic performance has indeed exceeded even government targets. With a national strategy focused on manufacturing -- dominated by the garment industry -- the country has seen exports soar by an average annual rate of 15-17% in recent years to reach a record $36.7 billion in the year through June. They are on track to meet the government's goal of $39 billion in 2019, and Hasina has urged industry to hit $50 billion worth by 2021 to mark the 50th anniversary of what Bangladeshis call their Liberation War.

A vast community of about 2.5 million Bangladeshi overseas workers further buoys the economy with remittances that jumped an annual 18% to top $15 billion in 2018. But Hasina also knows the country needs to move up the industrial value chain. Political and business leaders echo her ambitions to shift from the old model of operating as a low-cost manufacturing hub partly dependent on remittances and international aid.

To that end, Hasina launched a "Digital Bangladesh" strategy in 2009 backed by generous incentives. Now Dhaka, the nation's capital, is home to a small but growing technology sector led by CEOs who talk boldly about "leapfrogging" neighboring India in IT. Pharmaceutical manufacturing -- another Indian staple -- is also on the rise.

The government is now implementing an ambitious scheme to build a network of 100 special economic zones around the country, 11 of which have been completed while 79 are under construction.

The concept neatly capitalizes on Bangladesh’s record population density, leveraging what Faisal Ahmed, chief economist at Bangladesh Bank, calls the “density dividend. “The proximity of our population also helped us design and spread social and economic ideas such as microfinance and low-cost health care. But we need to better manage our scarce land resources, and part of the answer is to develop well-functioning industrial parks and SEZs,” he said.

Behind the impressive numbers and bold ambitions, however, are daunting hurdles ranging from structural problems to deep political divisions, which have come to the fore ahead of national elections on Dec. 30.

Bangladeshi politics have been dominated for years by the bitter rivalry between Hasina and former Prime Minister Khaleda Zia, whose family histories go back to opposing sides of the liberation struggle, when Bangladesh was known as East Pakistan. Both women have been in and out of power -- and prison -- over the past three decades. Khaleda Zia, who chairs the opposition Bangladesh Nationalist Party, is in jail on corruption charges that she says are false.

Since 1981, Hasina has led the ruling Awami League, founded by her father, Sheikh Mujibur Rahman, the country's first president, who was killed by army personnel along with most of his family in 1975. The party enjoyed strong support in some past elections. But opposition activists and human rights groups have voiced concern about potential polling fraud and intimidation tactics. After two consecutive five-year terms for the ruling party, analysts point to a palpable "anti-incumbency" sentiment among some voters. Yet from an economic standpoint, many agree that a ruling party victory would support further development.

"If the polling passes without too much strife and the status quo is maintained, then [Bangladesh] would seem an attractive long-term story," said Christopher Wood, managing director and chief strategist at Hong Kong-based brokerage CLSA.

Speaking at her official residence in central Dhaka, the prime minister rejected local and international criticism of creeping authoritarianism. Her party, she insisted, is "committed to protecting democracy in Bangladesh."

Business seems largely on the ruling party's side -- if only for stability's sake. In recent interviews in Dhaka, executives and political analysts dismissed suggestions that political turbulence could derail the country's growth trajectory.

"We feel relieved that all political parties are participating in the elections," said Faruque Hassan, managing director of Giant Group, a leading garment manufacturer, and senior vice president of the Bangladesh Garment Manufacturers and Exporters Association. "We feel positive that despite political differences we can continue to keep economic issues separate -- although we know that without political stability you can't grow, and you could scare international customers."

Tailoring its industrial policy

The ready-made garment industry is a key factor in the country's phenomenal success story. The industry is the country's largest employer, providing about 4.5 million jobs, and accounted for nearly 80% of Bangladesh's total merchandise exports in 2018.

It has undergone seismic changes since the watershed Rana Plaza disaster in 2013, when a multi-story garment factory complex collapsed, killing more than 1,130 workers. In the aftermath, the industry was forced by international apparel brands to implement sweeping reforms, including factory upgrades, inspections and improved worker conditions.

A visit to one of Giant Group's gleaming factories brings home the industry's rapidly changing dynamics. In a vast room a handful of workers oversees a fully automated operation that feeds fabric and thread into a huge machine that cuts, stitches and turns out finished garments. In another space nearby, about 300 workers, mostly women, operate machines that embroider and add applique to garments.

"Our entire industry changed in just 90 seconds in April 2013, generally for the better," said Hassan of Giant. "We don't actually want 100% automation -- hopefully we can offset the impact by shifting more workers into value-added fields, applique, embroidery and so on."

Further investment is needed if Bangladesh's garment industry is to remain competitive.

"Bangladesh is still dominated by more basic products and cotton, whereas growth worldwide has been in man-made fibers. We need more investment in these areas, not to produce more cotton shirts," he said.

Bangladesh's textile industry could gain if China's garment exports are hit by a prolonged U.S.-China trade war. But other garment centers are also taking aim at a vulnerable China, including Vietnam, Turkey, Myanmar and Ethiopia.

Intensifying international competition has already sparked consolidation in Bangladesh's garment industry, reducing the number of factories by 22% in the last five years to 4,560, according to the BGMEA.

CLSA's Wood believes that Bangladesh's reliance on the garment sector is a potential obstacle to future growth. "This sector on a 10-year view faces the risk of cheap wage alternatives such as Africa, automation and the loss of duty-free market access if Bangladesh transitions from LDC status [as scheduled for 2024]," he said.

"For now the challenge is to develop other sectors, with pharmaceuticals and business process outsourcing being two areas of promise. But this will require much more foreign investment," he said.

FDI is not Bangladesh's strong point. While it nearly tripled during Hasina's nine years in office, from $961 million in fiscal 2008 to nearly $3 billion in the year to June 30, this compares poorly with other Asian countries, including Vietnam and Myanmar.

Government officials partly blame the country's consistently low rankings in the World Bank's annual "Ease of Doing Business" survey, which they fear deters foreign investors. The latest survey, issued in December, put Bangladesh at 176th of 190 countries, citing excessive red tape, poor infrastructure and transport.

The government has moved to streamline the investment process with the creation of a "one-stop" investor service intended to replicate similar services in Singapore and Vietnam. But this has yet to gain momentum.

More successful is Hasina's digital push. With her son, a U.S.-educated tech expert, as a key adviser, the program has introduced generous tax breaks for the information and communications technology sector and a sweeping scheme to build 12 high-tech parks across the country.

In Dhaka, a new generation of IT entrepreneurs talks about beating India -- which leapt onto the global map with its basic outsourcing industry -- by focusing on AI, robotics and disruptive technologies.

Bangladesh's exports of software and IT services reached nearly $800 million in the year to June 30 and are on track to exceed $1 billion this fiscal year. The government's target of reaching $5 billion in ICT-related exports by 2021 is "very, very challenging but achievable," said Habibullah Karim, CEO of software company Technohaven and a co-founder of the Bangladesh Association of Software & Information Services, an industry body.

"From $800 million to $5 billion is a sixfold increase in three years. That's tough in itself. The second challenge is that the global outsourcing market is actually shrinking," Karim said. "Many tasks, such as airline and hotel reservations and insurance claims ... are now fully automated."

There have been outstanding homegrown tech successes, such as ride-sharing service Pathao, which received a $2 million investment from Indonesian unicorn Go-Jek, and mobile financial services group bKash, in which Alipay, an arm of China's Alibaba Group Holding, took a 20% stake in April.

But go-ahead industries badly need more financing, said Khalid Quadir, CEO and co-founder of Brummer & Partners (Bangladesh), which manages Frontier Fund, the country's only private equity fund. He argues that innovation thrives on a strong private equity industry that can channel funds to promising companies and help them list.

"We have invested nearly $200 million over the years in areas including communications infrastructure, garments and pharmaceuticals. It's a drop in the ocean compared to the growth opportunities on offer. But to attract more capital of this kind, regulation could be more investor-friendly," he said, citing three-year lockup provisions on investments in newly listed companies.

Shameem Ahsan, chairman of IT company eGeneration and a former head of BASIS, sees Bangladesh's tech niche at the cutting edge of IT. "Forty years ago, the garment industry started with a few companies. Now Bangladesh is exporting $30 billion-plus worth and is second only to China. We want to do the same thing in the IT industry," he said.

Bangladesh is hoping to challenge India in pharmaceuticals, too. With its "least developed country" status, the country has enjoyed a waiver on drug patents. This has fueled intensifying competition between India and Bangladesh in the field of generic and bulk drugs. Among local star performers is Incepta Pharmaceuticals, Bangladesh's second-largest generics maker, which exports to about 60 countries, and Popular Pharmaceuticals, which is eyeing an eventual listing.

"When you look at U.S. and Europe ... their manufacturing plants are closing and they are coming to Asia. Why? Because of quality, affordable drugs," said Syed Billah, senior general manager at Incepta. "We have the quality and recognition from international regulatory bodies, and are very good at finished products. But in [bulk drugs], we are far behind, and seeking technology for that from China."

One of Bangladesh's competitive disadvantages is its poor infrastructure, and the country has turned to China for help. Under its Belt and Road Initiative, China has financed various megaprojects in Bangladesh, including most of the nearly $4 billion Padma Bridge rail link, which will connect the country's southwest with the northern and eastern regions. In all, China has committed $38 billion in loans, aid and other assistance for Bangladesh.

China's heavy infrastructure investment has drawn criticism of its "debt diplomacy" in other countries, including Pakistan and Sri Lanka. But local economists dismiss such concerns.

"I don't think Bangladesh is being pulled too far into China's orbit like Pakistan or even Sri Lanka," said Faiz Sobhan, senior director of research at the Bangladesh Enterprise Institute, an independent think tank, noting that the country is also reliant on Japanese infrastructure investment.

Hasina said the government is taking a more proactive role in the financing alongside international partners such as China, Japan and international financial institutions. "We have undertaken to establish our own sovereign wealth fund, worth $10 billion, to bankroll long-term physical infrastructure development. This is possible because our foreign exchange reserves stand at more than $32 billion now, from $7.5 billion 10 years ago."

Chinese investors also bought 25% of the Dhaka Stock Exchange in 2018, and Bangladesh is now the second-largest importer of Chinese military hardware after Pakistan.

While some may question so much investment from Beijing, Hasina said it is simply a fact that China is set to play a bigger role in the region.

"Our foreign policy is very clear: friendly relations with everyone," she said. "What China and U.S. are doing, it is between them."

Additional reporting by Nikkei staff writers Mitsuru Obe and Yuji Kuronuma, and Dhaka contributor Abu Anas

Jan 13, 2019

Riaz Haq

World Bank's Poverty and Shared Poverty Report 2018 compares the annual income growth rate of the bottom 40% of the population with the average income growth of the entire population for 91 countries for years 2010-2015. Here's the data for a few selected countries:

Country Bottom 40% income growth vs Average Income Growth

Pakistan 2.7% vs 4.3%

Bangladesh 1.4% vs 1.5%

Iran 1.3% vs -1.3%

Indonesia 4.8% vs 4.8%

Sri Lanka 4.8% vs 5.3%

Vietnam 5.2% vs 3.8%

Thailand 5.0% vs 3.0%

Malaysia 8.3% vs 6.0%

China 9.1% vs 7.4%

http://www.worldbank.org/en/publication/poverty-and-shared-prosperity

People experience poverty differently even within the same household. Traditional measures haven’t been able to capture variations because the surveys stop at the household level. Measuring poverty as experienced by individuals requires considering how resources are shared among family members. While data are limited, there is evidence that women and children are disproportionately affected by poverty in many — but not all — countries. Sex differences in poverty are largest during the reproductive years, when, because of social norms, women face strong trade-offs between reproductive care and domestic responsibilities on the one hand and income-earning activities on the other hand. Worldwide, 104 women live in poor households for every 100 men. However, in South Asia, 109 women live in poor households for every 100 men. Children are twice as likely as adults to live in poor households. This primarily reflects the fact that the poor tend to live in large households with more children.

There is evidence from studies in several countries that resources are not shared equally within poor households, especially when it comes to more prized consumption items. There is also evidence of complex dynamics at work within households that go beyond gender and age divides. More surveys are needed to capture consumption patterns of individuals so that governments can implement policies to bridge the inequalities within households.

Jan 14, 2019

Riaz Haq

1000s of #Bangladesh #garment workers clash with police. Min #wages rose by a little over 50% this month to 8,000 taka ($95) a month. But mid-level tailors said their rise was paltry and failed to reflect the rising costs of living, especially in housing. https://www.theguardian.com/world/2019/jan/14/bangladesh-strikes-th...

Thousands of garment workers in Bangladesh who make clothes for top global brands have clashed with police as strike action over low wages entered a second week.

Police said water cannon and tear gas were fired on Sunday to disperse huge crowds of striking factory workers in Savar, a garment hub just outside the capital, Dhaka.

“The workers barricaded the highway. We had to drive them away to ease traffic conditions,” said police director Sana Shaminur Rahman. “So far 52 factories, including some big ones, have shut down operations due to the protests.”

On Tuesday, one worker was killed when police fired rubber bullets and tear gas at 5,000 protesting workers.

Bangladesh is dependent on garments stitched by millions of low-paid tailors on factory floors across the emerging south Asia economy of 165 million people.

Roughly 80% of its export earnings come from clothing sales abroad, with global retailers H&M, Primark, Walmart, Tesco and Aldi among the main buyers.

Union leader Aminul Islam blamed factory owners for resorting to violence to control striking workers. “But they are more united than ever,” he told AFP. “It doesn’t seem like they will leave the streets, until their demands are met.”

The protests are the first major test for prime minister Sheikh Hasina since winning a fourth term in last month’s elections, which were marred by violence, thousands of arrests and allegations of vote rigging and intimidation.

Late on Sunday, the government announced a pay rise for mid-level factory workers after meeting manufacturers and unions. Not all unions have signalled they will uphold the agreement.

Babul Akhter, a union leader present at the meeting, said the deal should appease striking workers. “They should not reject it, and peacefully return to work,” he said.

Minimum wages for the lowest-paid garment workers rose by a little over 50% this month to 8,000 taka ($95) a month. But mid-level tailors said their rise was paltry and failed to reflect the rising costs of living, especially in housing.

Bangladesh’s 4,500 textile and clothing factories shipped more than $30bn worth of apparel last year.

The Bangladesh Garment Manufacturers and Exporters’ Association, which wields huge political influence, warned all factories might shut if tailors did not return to work immediately. “We may follow the ‘no work, no pay’ theory, according to the labour law,” association president Siddikur Rahman told reporters.

Last year Bangladesh was the second-largest global apparel exporter after China. It has plans to expand the sector into a $50bn-a-year industry by 2023.

But despite their role in transforming the impoverished nation into a major manufacturing hub, garment workers remain some of the lowest paid in the world.

Jan 15, 2019

Riaz Haq

Access to #electricity: #Pakistan 99%, #India 84%, #Bangladesh 76%. Source: World Bank 2016

https://twitter.com/theworldindex/status/1085029776556023808

Jan 15, 2019

Riaz Haq

#Foreign direct #investment (FDI) in #Pakistan hits six-month high. #FDI increased 17% to $319.2 million in Dec 2018 compared to $272.8 million in Dec, 2017. It's the second consecutive month that the FDI inflow rose in FY2018-19 https://tribune.com.pk/story/1889903/2-foreign-direct-investment-pa...

Pakistan achieved a six-month high foreign investment in different productive sectors of the economy in December 2018 after the country finished a year-long exercise of letting the rupee depreciate against the US dollar to create an equilibrium.

Foreign direct investment (FDI) increased 17% to $319.2 million in December 2018 compared to $272.8 million in the same month last year, the State Bank of Pakistan (SBP) reported on Wednesday.

This is also for the second consecutive month that the FDI has continued to surge on a month-on-month basis.

“The pending rupee devaluation was one of the biggest concerns of foreign direct investors. Now when Pakistan has addressed the concern, it has regained foreign investors’ trust on the country,” Overseas Investors Chamber of Commerce and Industry (OICCI) Secretary General M Abdul Aleem told The Express Tribune.

Despite heavy inflow from China, FDI fails to pick up in FY18

The SBP has devalued the rupee by a whopping 32% in the last 13 months to Rs138.90 to the US dollar on Wednesday.

Besides, the political uncertainty linked to the July 2018 general elections has come to an end and investors have gradually built trust on the recently installed government in the country as well, he added.

In the recent months, the foreigners squeezed investment in wait for clarity on economic policies of the new government. “The government has taken tough decisions over rupee devaluation and (key) interest rate hike. The initiatives have apparently won the investors’ confidence,” he said.

Unlink the previous five months when China remained the only healthy foreign investor in Pakistan, Netherlands and Norway also appeared as significant foreign direct investors in December 2018, according to SBP.

China alone has invested net FDI worth $120.6 million in December, while Norway and Netherlands have appeared as the second and third largest investor with $65.2 million and $47.6 million, respectively.

Sector-wise, it was financial business which attracted the single highest investment worth $137.3 million in the month. This was followed by chemicals with $50.9 million and construction $45.1 million.

Cumulatively in the first six months (July-December) of the current fiscal year, FDIs have dropped 19% to $1.31 billion compared to $1.63 billion in the same period last year.

“The investment attracted in the six months is not bad keeping in view the then political uncertainty and investors waited for clarity on the government economic policies,” Aleem said.

“However, the much-awaited jump in FDIs is yet to come,” he said.

Clarity and confidence on the new government are gradually increasing. “The full-year FDIs should be much higher than $2.8 billion achieved in the previous fiscal year (ended June 30, 2018),” he said.

“The country may attract more foreign investment in oil and gas exploration, telecom, consumer goods, and CPEC-related new investment,” said the official, adding that CPEC-related investments had slowed down over the last seven-eight months.

The total foreign investment, including portfolio investment and public and private external debt, has dropped by a whopping 77% to $899.5 million in the six months compared to $3.95 billion in the same period last year.

The massive drop is seen due to adjustment of the debt Pakistan raised through sale of Sukuk and Eurobond worth $2.5 billion November 2017. The government has not raised debt during July-December 2018 period.

Jan 17, 2019

Riaz Haq

#Pakistan wriggles out of #IMF clutches. As a result, in geopolitical terms, #Washington’s capacity to leverage Pakistani policies is significantly diminishing. #Saudi-Pak ties are moving on to new level of dynamism. https://indianpunchline.com/pakistan-wriggles-out-of-imf-clutches/

Without doubt, this is a major development in the region. The Saudi-Pakistan relationship, which has been traditionally close and fraternal, is moving on to a new level of dynamism. The Saudi investment decision can be taken as signifying a vote of confidence in the Pakistani economy as well as in Prime Minister Imran Khan’s leadership. It comes on top of the $6 billion package that Saudi Arabia had pledged last year (which included help to finance crude imports) to help Pakistan tide over the current economic difficulties.

The visiting Saudi minister Khalid al-Falih told reporters in Gwadar, “Saudi Arabia wants to make Pakistan’s economic development stable through establishing an oil refinery and partnership with Pakistan in the China Pakistan Economic Corridor.” This remark highlights that Saudi Arabia is openly linking up with the China-Pakistan Economic Corridor (CPEC). China has welcomed this development, but countries that oppose the CPEC such as the US and India will feel disappointed.

From the Indian perspective, the Saudi investment in Gwadar becomes a game changer for the port city, which was struggling to gain habitation and a name. Inevitably, comparisons will be drawn with Chabahar. India has an added reason to feel worried that its Ratnagiri Refinery project, which has been described as the “world’s largest refinery-cum-petrochemical project” is spluttering due to the agitation by farmers against land acquisition. The Saudi Aramco was considering an investment in the project on the same scale as in Gwadar. Will Gwadar get precedence over Ratnagiri in the Saudi priorities? That should be the question worrying India.

The Saudi energy minister disclosed that Crown Prince Mohammed bin Salman will be visiting Pakistan in February and the agreement on the Gwadar project is expected to be signed at that time. Of course, it signifies that Saudi Arabia is prioritizing the relations with Pakistan. The fact remains that Saudi Arabia has come under immense pressure of isolation following the killing of Jamal Khashoggi.

There is much uncertainty about the dependability of the US as an ally and security provider. Riyadh is diversifying its external relations and a pivot to Asia is under way. Suffice to say, under the circumstances, a China-Pakistan-Saudi axis should not look too far-fetched. There is also some history behind it.

To be sure, Iran will be watching the surge in Saudi-Pakistani alliance with growing trepidation. The Saudi presence in Pakistan’s border region with Iran (such as Gwadar) has security implications for Tehran. Iran has been facing cross-border terrorism.

Jan 17, 2019

Riaz Haq

#American #agribusiness giant Cargill to grow #Pakistan business with US$200 million investment for expansion across its #agriculture trading and supply chain, edible #oils, #dairy, #meat and animal feed businesses while ensuring safety, food traceability. https://www.thenews.com.pk/latest/420270-cargill-to-grow-pakistan-b...

Cargill renewed its long standing commitment to Pakistan by announcing plans to invest more than US$200 million in the next three-to-five years.

The announcement was made soon after Cargill’s global executive team, led by Marcel Smits, head of Global Strategy and Chairman, Cargill Asia Pacific region, and Gert-Jan van den Akker, president, Cargill Agricultural Supply Chain, met with the Prime Minister Imran Khan and other senior government officials to discuss the company’s future investment plans.

Being a global food and agriculture producer with a strong focus on Asia, Cargill aims to partner on Pakistan’s growth by bringing its global expertise and investment into the country.

The company’s strategy includes expansion across its agricultural trading and supply chain, edible oils, dairy, meat and animal feed businesses while ensuring safety and food traceability.

Cargill will bring world class innovations to support the flourishing dairy industry in Pakistan, which is already moving toward modernization, as well as the rising demand for edible oils backed by evolving consumption patterns and a growing market for animal feed driven by sustained progress made by the poultry industry in Pakistan.

Cargill’s proposed investments will support Pakistan’s overall economic development and contribute to local employment.

The visiting delegation informed the Prime Minister that M/s Cargill intended to invest in Pakistan as back as 2012 but were discouraged by mismanagement, corruption and non-availability of level playing field during the previous governments. However, investor’s confidence has restored after the incumbent Government and the policies being pursued by it.

The prime minister welcomed investment plans of M/s Cargill in the area of agriculture development, import substitution and enhancement of agricultural products.

He highlighted the efforts of the government towards ensuring transparency, providing the business community with level playing field and improving ease of doing business in the country.

The PM assured the delegation full support from the government.

Jan 17, 2019

Riaz Haq

#Egyptian billionaire Naguib Sawiris offers to build 100,000 housing units in #Pakistan as part of #PMImranKhan’s Naya Pakistan #housing initiative. http://www.arabnews.pk/node/1437706/pakistan

Egyptian billionaire Naguib Sawiris has offered to build 100,000 housing units in Pakistan to help realize Prime Minister Imran Khan’s dream of an ‘ambitious’ housing project, officials said on Friday.

“Naguib Sawiris has expressed his will to invest in 100,000 units of affordable housing to help prime minister (Imran Khan) in his vision toward Pakistan,” Tarek Hamdy, Chief Executive officer of Elite Estates — a partnership between Ora Developer and Saif Holding — told Arab News in an exclusive interview.

Owned by Sawiris, Ora Developers is already engaged in the construction of a multibillion-dollar housing scheme named ‘Eighteen’ which was launched in 2017 in Islamabad with local partners, Saif Group and Kohistan Builders.

Sawiris’ first investment in Pakistan was in Mobilink, a cellular operator.

PM Khan in October 2018 had launched ‘Naya’ (New) Pakistan Housing Project in line with his party’s election manifesto, which promised fivr million houses for the poor.

Hamdy says they have “set rules or guidelines of the way of doing things” that apply to every real estate projects — whether they are affordable or high value units.

“We will use our experience and knowhow to deliver this properly to the people of Pakistan,” he added.

Since the announcement of the low-cost housing project for the poor, the scheme has been at the heart of all political and economic discourses with several calling it too ambitious.

“This scheme is very ambitious yet very promising for the people of Pakistan. I think all the developers should help in this scheme. You cannot solely rely on the government to build five million houses,” Hamdy said.

Recently, the governor of Pakistan’s central bank had said that the massive housing project would require financing of upto Rs 17 trillion.

Hamdy believes that the promise of building five million affordable housing units cannot be realized in a short span of time. “I think the plan is right but it has to be in stages, has to be in steps. It could be achievable obviously that is not the project (to be achieved) in one or two years... may take few good years, may be couple of decades to be achieved,” he said.

In the Islamabad project the Ora Developers own a 60 percent stake in the project comprising a five-star hotel, 1,068 housing units, 921 residential apartments, business parks, hospitals, schools and other educational facilities and 13 office buildings, and a golf course. The networth of the project is $2 billion.

The next cities on the radar for real estate projects are Lahore, Karachi, and Faisalabad. “We intend to do more, we intend to invest more. I think that our portfolio of real estate could come to $10 billion worth of investments in the next five to 10 years including all the projects that we intent to do,” Hamdy said.

Pakistan’s housing sector is marred by frauds, scams and unfinished schemes which has been discouraging many potential investors from venturing into the sector. However, Hamdy says he is confident of delivering the promise by 2021.

Analysts say that Pakistan’s housing sector offers great opportunities for investment due to increasing demand. “According to estimates, the current real estate market value is around Rs900 billion which is three times that of the GDP,” Saad Hashmey, an analyst at Topline Securities, told Arab News, adding that the PM’s housing project is the need of the hour.

Pakistan faces a shortage of nearly 12 million housing units that may require a massive investment of around $180 billion, according to the former Chairman of the Association of Builders and Developers, Arif Yousuf Jeewa.

Pakistan expects to attract more than $40 billion foreign direct investment in the next five years in oil refining, petrochemical, mining, renewable energy, and real estate sectors. “We estimate that roughly around $40 billion investment will be made by three countries (Saudi Arabia, the UAE, and China) during the next three to five years,” Pakistan Board of Investment BoI chief, Haroon Sharif had told Arab News earlier, adding that “the investment would start materializing within the next two years”.

Jan 19, 2019

Riaz Haq

#CPEC to play larger role in driving #Pakistan's #economy.Some #MiddleEast countries have showed an interest in investing in projects under the CPEC framework. #China #SaudiArabia #UAE #Qatar - Global Times http://www.globaltimes.cn/content/1136891.shtml#.XEs_8QZWl3U.twitter

China and Pakistan have decided to widen the scope of the China Pakistan Economic Corridor (CPEC), the Economic Times reported, adding that the two countries have signed new agreements to launch industrial, agricultural and socio-economic projects under this initiative.

Why take this step at this very sensitive moment? In recent months, the project has been blamed for causing a debt trap and economic woes for Pakistan.

There is speculation that Pakistan's attitude toward the CPEC has caused dissatisfaction in China and that Beijing may be hesitant about continuing to offer loans for the project.

New projects will help reduce public misunderstanding of the CPEC. It's a flagship project of the China-proposed Belt and Road initiative. Although the project does face some difficulties, it is unlikely that China will change its supportive attitude on the CPEC.

China's efforts to push forward the CPEC won't be given up halfway. The CPEC has created an opportunity to support economic growth in the South Asian country, instead of an unbearable debt burden. Debt from China makes up only a small part of Pakistan's total burden.

The latest developments involving the CPEC add to evidence that the two countries believe the project will bring tangible benefits amid the current economic woes.

Several years after its launch, the CPEC has laid a foundation for sustainable economic development through infrastructure improvement. Perhaps now is the time to launch the second stage of the project to turn its focus to areas including industry, agriculture and socioeconomic projects, and further develop the Gwadar Port.

Some Middle East countries have showed an interest in investing in projects under the CPEC framework.

It is normal and natural for China and Pakistan to call for the accelerated development of the economic corridor and widen the scope of the project to attract more investment.

The CPEC's development may appear to slow down in the past few months, sparking concern that Beijing is hesitant about further investment. But it always takes time to discuss issues and details before drawing up detailed plans to launch a new stage of a project. At its second stage, the CPEC will play a bigger role in Pakistan's economy as the project focuses more on manufacturing and agriculture.

Jan 25, 2019

Riaz Haq

#Pakistan Central Bank expects slowdown in #economic growth to 4-4.5%. Corrective measures by #PTI government taken so far to fix the fundamentals have taken a toll mainly on two leading sectors – large-scale #manufacturing (LSM) and #agriculture. https://tribune.com.pk/story/1899685/2-sbp-expects-slowdown-economi...

“The 6.2% target for real GDP (gross domestic product) growth seems unachievable (in FY19),” the central bank said in its first-quarter report on the state of Pakistan’s economy for fiscal year 2018-19 issued on Tuesday.

The country hit a 13-year high economic growth of 5.8% in the previous fiscal year, but “at the cost of widening macroeconomic imbalances as manifested in the five-year high fiscal deficit and a record high current account deficit,” the central bank said earlier.

The LSM sector dropped 1.7% in the first quarter (July-September 2018) of the current fiscal year compared to 9.9% growth in the same quarter last year due to interest rate hikes, massive rupee depreciation against the US dollar and reduction in the government’s development budget.

Such measures were taken to fix the macroeconomic imbalances like the twin deficit. Simultaneously, they negatively impacted LSM and the agronomy.

“In fact, the large-scale manufacturing contracted for the first time in over seven years during Q1-FY19,” the SBP said in its first-quarter report. Furthermore, important budgetary measures such as the imposition of ban on high-value property and new car purchases by non-filers of tax returns restricted activity in these sectors. The government in the recent second mini-budget has, however, allowed the non-filers purchase of new cars up to 1,300cc.

Within the agriculture sector, preliminary estimates indicate that production of all major Kharif crops has remained lower compared to the last season.

“This decline can be attributed primarily to an alarming water availability situation, particularly in Sindh, which led to a 7.7% decline in the total area under production. Furthermore, crop yields also suffered due to subdued fertiliser offtake amidst rising prices of both urea and DAP,” the central bank said. The uptrend in international oil prices during the first quarter remained a big challenge for the economy as that resulted in an unwanted growth in the oil import bill. Pakistan meets around 70-80% of energy needs through imports.

Immediate challenges

Although the economy is responding to the stabilisation measures taken over the past few months, boosting foreign currency reserves and controlling inflation would remain the two near-term challenges to the economy, it said.

“Average inflation during Q1-FY19 increased to 5.6% – the highest quarterly growth since Q1-FY15,” it said. The SBP projected the inflation (Consumer Price Index) at 6.5-7.5% for the full fiscal year against the target of 6%.

Besides, narrowing down the continuously widening fiscal account deficit would remain a tough challenge for the economic managers. The fiscal deficit widened to Rs541.7 billion in the first quarter compared to Rs440.8 billion in the corresponding period of last year. “This was mainly because revenue collection could not keep pace with growing current expenditures.

“This increase came on the back of a steep rise in current spending (mainly debt servicing and defence), which more than offset marginal gains in the revenue collection,” the SBP said. The central bank projected the fiscal deficit at 5.5-6.5% in FY19 compared to the target of 4.9%.

Silver lining

The downturn in international oil prices has emerged as a blessing for the domestic economy. This is expected to help narrow down the current account deficit.

“The most important development has been the bearish spell in the global crude market that began in early October and ran through the rest of Q2-FY19. Oil prices have fallen by a quarter during this period and reached a year’s low level of $54 per barrel. This will lift some pressure from Pakistan’s oil import bill in at least the second quarter of the year,” the SBP said.

Jan 30, 2019

Riaz Haq

Faisalabad based Interloop, world’s biggest socks maker and supplier to Adidas and Nike, raised Rs 5 billion in an IPO at Karachi stock exchange today

https://www.thenews.com.pk/print/443994-interloop-ipo-raises-rs5-02...

Interloop Limited has successfully raised Rs5.025 billion through the largest private sector Initial Public Offering (IPO), placing itself among the top 50 companies listed on the Pakistan Stock Exchange (PSX) by market capitalisation, the company said on Thursday.

The company that supplies foot-hosiery to global sportswear giants like Nike and Adidas said, the two-day book building process was oversubscribed by 1.37 times with the price closing at Rs46.10/share.

The total demand received was Rs6,727 million against total issue size of Rs 4,905 million, oversubscribed by Rs1,822 million or 1.37 times.

Arif Habib Limited is the consultant to issue for the IPO, while Ismail Iqbal Securities has been the book runners.

The Interloop offer has surpassed the previous record for a private company, when Pakistan Stock Exchange Ltd raised Rs4.5 billion two years ago. There have been larger sales by state-controlled companies in Pakistan.

Interloop is one of the world’s largest hosiery manufacturers and has an annual turnover in excess of Rs30 billion.

The company in a statement said one of the main objectives for the IPO was to expand hosiery production by opening a new plant and simultaneously and entry into the apparel business by opening a denim plant in Lahore, for which land had already been acquired.

Interloop Ltd., which makes socks for Nike and Adidas, is planning Pakistan’s biggest ever initial public offering by a private firm.

The company plans to raise as much as 6.8 billion rupees ($51 million) to expand its sock manufacturing capacity by around 20 percent and enter the denim business, said Chairman and Co-Founder Musadaq Zulqarnain. It will offer 12.5 percent of the business in the sale, likely to take place in January, and is aiming to lift revenue by 77 percent over five years, he said.

“Our capacity is already full,” Zulqarnain said in an interview at the company’s head office in Faisalabad. Interloop can see more growth, so will “take that risk” to expand, he said.

The listing comes as Prime Minister Imran Khan tries to spark an export revival to make up ground that Pakistan has lost to low-cost manufacturing destinations like Vietnam and Bangladesh. The new government has announced plans to cut gas and electricity prices to support companies selling abroad, although the push has been criticized for relying too much on subsidies.

The Interloop offer will surpass the previous record for a private company, when Pakistan Stock Exchange Ltd. raised 4.5 billion rupees two years ago. There have been larger sales by state-controlled companies in Pakistan.

https://www.bloomberg.com/news/articles/2018-11-09/sock-supplier-fo...

Mar 14, 2019

Riaz Haq

#Pakistan All Set To Cross USD 15 billion Mark In #Textile #Exports. “The textile industry exports is likely to cross $15 billion mark in case it continues to grow by 10 percent on an average for the remaining period of current fiscal.

https://www.textileexcellence.com/news/pakistan-all-set-to-cross-us...

Gohar Ejaz, patron in chief of APTMA (All Pakistan Textile Manufacturers Association) stressed that the availability of energy at regionally competitive price has boosted textile exports by 8.5% in the month of January 2019 on a y-o-y comparison in the corresponding period.

“The textile industry exports is likely to cross $15 billion mark in case it continues to grow by 10 percent on an average for the remaining period of current fiscal. It would likely be a record achievement of textile exports in such a short span of time. The exports of USD 3.5 billion yarn and fabric annually may boost textile exports to USD 14 billion in case closed capacity worth USD 3 billion exports is revived through the enablers ensured by the government,” pointed out Ejaz.

Apr 16, 2019

Riaz Haq

#Bangladesh #garment makers ask government to extend export subsidy after wage hike in Dec to sustain $30 billion #RMG #exports. Prices of readymade garments in 2018 were 7.4% lower in the U.S. market and 3.64% less in the European market than in 2012. https://reut.rs/2IpHCiG

Bangladesh’s garment makers have asked the government to extend a 5 percent export subsidy for the industry, saying they are being squeezed between low international prices for clothing and rising production costs.

The country’s garment industry, the world’s second biggest producer, currently receives a 5 percent cash incentive for exports but that is due to end on June 30.

Siddiqur Rahman, the president of the Bangladesh Garment Manufacturers and Exporters Association, told reporters on Wednesday that without the subsidy, more garment makers would go out of business. The association says that 1,200 garment factories have closed down in Bangladesh in the past five years.

Siddiqur said another 5 percent cash incentive on exports would cost the government $1.67 billion.

Commerce Minister Tipu Munshi told Reuters that he would talk to the finance minister about including the proposal in the budget for the fiscal year beginning July 1.

“After the enhancement of wages since December last year there is a pressure to the owners and if they get some cash incentive that would be a relief,” said Tipu.

Siddiqur said that the prices of readymade garments in 2018 were 7.4 percent lower in the U.S. market and 3.64 percent less in the European market than they had been in 2012.

At the same time the manufacturers’ costs have been climbing, mainly driven by labour costs.

Last year, there was a big increase in the minimum wage for Bangladesh garment makers and that drove the costs of production higher.

Bangladesh earns about $30 billion annually by exporting readymade garments.

Apr 17, 2019

Riaz Haq

As U.S. President Donald Trump’s trade war against Beijing intensifies, American buyers are diversifying their supplier base away from China, the No. 1 exporter of these goods to the U.S. Already, Bangladesh is close to snatching the trousers-to-towel crown. Pakistan, at No. 6 last year, has grown its own shipments to the U.S. by almost 12% this year. It may overtake India, which has seen virtually no improvement.

The good news is that the Pakistani rupee has fallen by almost 20% since 2017. That’s virtually wiped out the currency’s overvaluation adjusted for inflation differences with trading partners, as estimated by the IMF. If the currency slides further and inflation doesn’t accelerate, Pakistani exports should receive a boost, provided global growth and cotton availability for the textile industry hold up.

https://www.bloomberg.com/opinion/articles/2019-06-12/pakistan-flir...

Jun 12, 2019

Riaz Haq

Pakistan’s textile exports stagnant; RMG marks 3.2% growth

by Apparel Resources News-Desk

21-May-2019

https://apparelresources.com/business-news/trade/pakistans-textile-...

Mainstay of Pakistan’s economy, the textile industry of the country is in a sticky situation lately.

As per reports, in the first 10 months of the current fiscal year of 2018/19, textile exports from Pakistan remained flat at US $ 11.1 billion, as compared to the corresponding period of the previous year. And this despite Government’s various measures to boost exports.

However, on the positive side, export of readymade garments, bedwear and knitwear registered growth in the period under review.

As per data from Pakistan Bureau of Statistics (PBS), export of RMG improved 3.2 per cent to US $ 2.1 billion, while export of knitwear exports increased by 7 per cent year-on-year to US $ 2.3 billion and, export of bedwear marked an increase of 2.4 per cent to US $ 1.9 billion.

Further, in this period, export of raw cotton declined drastically by 67.2 per cent to US $ 18.5 million while export of cotton yarn fell 15.7 per cent to US $ 941.3 million.

Exports of cotton cloth also reportedly fell 2.7 per cent to US $ 1.7 billion (in the July-April period of the current fiscal year).

It may be mentioned here that due to continuous devaluation of rupee (fell by around 20 per cent in last year alone), exporters are able to improve on their margins on exports but on the flipside cost of doing business has gone up significantly.

Jun 14, 2019

Riaz Haq

Asia labor costs and China manufacturing relocation impact considerations

https://www.ventureoutsource.com/contract-manufacturing/asia-labor-...

Below, the annual cost (average) per manufacturer worker in China, Thailand, Malaysia, Indonesia, Pakistan, Philippines, India, Vietnam per Japan external trade organization (JETRO).

Average annual cost of a manufacturing worker (US$, 2017)

China: $10,131

Thailand: $6,997

Malaysia: $5,900

Indonesia: $5,421

Pakistan: $4,379

Philippines: $4,102

India: $3,982

Vietnam: $3,673

Jun 24, 2019

Riaz Haq

#Asia #Pacific trade pact can go on without #India 'for the time being' as China grows impatient with the slow progress on the #RCEP talks. #Malaysian PM Mahathir proposes going ahead with just 13 countries — without #India, #Australia and #NewZealand. https://cnb.cx/2L91HdL

Malaysian Prime Minister Mahathir Mohamad said on Saturday that he’s willing to conclude a mega Asia-Pacific trade agreement without India “for the time being.”

Mahathir was referring to the Regional Comprehensive Economic Partnership, or RCEP, which involves 16 countries in Asia Pacific. Negotiations have been going on since 2013, with one of the major sticking points being India’s reluctance to open up its markets.

A recent report by Nikkei Asian Review said China, growing impatient with the slow progress on RCEP talks, proposed going ahead with just 13 countries — removing India, Australia and New Zealand from the deal.

The 16 countries involved in RCEP are the 10 Southeast Asian nations and six of their large trading partners: China, Japan, South Korea, India, Australia and New Zealand. If the agreement is finalized, the 16 countries will form a major trading bloc that covers around one-third of the world’s gross domestic product.

GP 190621 Containers at Lianyungang Port

Aerial view of shipping containers sitting stacked at Lianyungang Port on June 3, 2019 in Lianyungang, Jiangsu Province of China.

Wang Jianmin | Visual China Group | Getty Images

In an interview with CNBC’s Tanvir Gill, Mahathir acknowledged the hurdles in reaching a deal among the 16 countries.

“I think we will work towards it. It’s quite difficult because we are competing economies ... we’re competing with each other and from there, to go on to work together requires some radical change in our mindset. That will take time,” he said in Bangkok, Thailand, where he’s attending a summit for the Association of Southeast Asian Nations.

In the end, we have to stop this trade war and certainly not to escalate (it).

Mahathir Mohamad

MALAYSIAN PRIME MINISTER

The Malaysian leader added that RCEP participants will have to consider which framework works best: China’s proposed 13-nation deal or the original one involving all 16 countries.

“But I think I would prefer 13 ... for the time being,” he said, suggesting he’s open to having India, Australia and New Zealand joining the pact in the future.

Trade war escalation

Several participating countries of RCEP have expressed hopes of coming to an agreement by the end of this year, as they say the U.S.-China tariff fight has brought fresh urgency to wrap up talks in Asia Pacific.

U.S. President Donald Trump and Chinese President Xi Jinping are expected to meet later this month at the G-20 summit in Japan. But Mahathir — like many who follow the developments closely — said he doesn’t expect much to come out of that meeting.

Taking sides in the trade war will be a ‘disaster for the world:’ Mahathir

Malaysia has often been cited as one of the beneficiaries of the trade war as companies move production out of China to circumvent elevated U.S. tariffs. Muhammed Abdul Khalid, an economic advisor to Mahathir, told CNBC in May that the Southeast Asian nation’s growth is set to gain an additional 0.1 percentage points due to the trade diversions to his country.

While that’s good for Malaysia, Mahathir on Saturday cautioned that such benefits may only be temporary. He explained that if there’s a change in government in the U.S., the new administration may have a new set of policies that could once again prompt companies to rethink where they want to locate their production and supply chains.

“In the short term, I think it is good news. But in the end, we have to stop this trade war and certainly not to escalate (it),” he said.

Jun 24, 2019

Riaz Haq

#Pakistan #exports to #Europe up 54% Since Grant of GSP+ Trade Preference For Pakistani Products https://www.gulftoday.ae/business/2019/07/14/pakistan-exports-to-eu...

European Union Ambassador to Pakistan Jean-François Cautain has stated that Pakistan’s export to Europe has increased fifty four per cent after grant of GSP Plus status to the country.

Talking to representatives of Council of Pakistan Newspaper Editors at National Press Club in Islamabad, he said GSP plus is a great opportunity for Pakistan to enhance its export especially in the areas of textile, surgical equipment, leather and sports goods.

He said the EU is focusing on improvement of education, vocational training, women development and governance in Pakistan. The Ambassador said EU’s new engagement plan for Pakistan is moving ahead to the strategic and security level. He said this plan will further improve military to military relations between EU and Pakistan.

He said the EU will review implementation of twenty seven conventions of International Covenant on Civil and Political Rights which is a requirement for GSP plus status. Later, he also planted a sapling in the lawn of National Press Club.

Meanwhile, Chairman Board of Investment, (BOI) Zubair Gilani said that Pakistan is deeply fascinated by China’s example of industrialisation and economic wisdom.

The China Pakistan Economic Corridor (CPEC) initiative and industrial cooperation between the two nations is the first step in transforming the lives of people of the two countries, he expressed these remarks while briefing a 50-member Chinese Investment Delegation here at BoI on Thursday.

Jul 20, 2019

Riaz Haq

President Donald #Trump has indicated that #UnitedStates wants to increase its #trade with #Pakistan by at least four-fold following a meeting with #ImranKhan. Trump’s Pakistan Trade Aims May Need Levi, JC Penney Sourcing Strategy Help. #Garments #Textiles https://www.spglobal.com/marketintelligence/en/news-insights/resear...

President Donald Trump has indicated that the U.S. wants to increase its trade with Pakistan by at least four-fold following a meeting with Prime Minister Imran Khan, Inside Trade reports. No firm policies or trade deal process has been put in place yet, though the ongoing need to secure Pakistan as a regional trade partner may give some incentive to do so ahead of the 2020 elections.

While the Trump administration will doubtless focus on increasing U.S. exports, Pakistan needs a significant boost to its export economy before it is in a position to increase its purchases significantly. Panjiva analysis of S&P Global Market Intelligence data shows that its exports contracted by 0.2% year over year in the 12 months to May 31, following a 0.9% annual decline in the prior three years to reach $23.1 billion.

The U.S. accounted for 16.6% of the total, and managed to increase by 5.8% year over year in the past 12 months, Panjiva data shows. The need for a trade deal, and closer relations, with the U.S. has also become more important since India’s decision to increase tariffs on Pakistani exports as outlined in Panjiva’s research of February 18.

The major challenge in boosting imports from Pakistan will lie in either diversifying its exports to the U.S., or significantly eating into the market share of other countries supplying the U.S. In aggregate the apparel and textile industries accounted for 37.8% and 35.1% respectively of all U.S. imports from Pakistan in the 12 months to May 31.

Given Pakistan accounted for just 1.7% of U.S. apparel imports and 8.4% of textiles there may well be room for increased market share.

From a developmental perspective it’s worth noting that shipments aside from textiles and apparel have actually fallen as a proportion of the total to 27.1% in the past 12 months compared to 38.9% in 1998. Other major import lines include cotton at 3.3%, optical equipment at 2.8% and plastics which accounted for 2.6%.

The largest importer of apparel and textiles from Pakistan in the past 12 months, aside from trade finance houses, has been Levi Strauss with 1,682 TEUs shipped. That followed a 101.5% year over year surge in shipments in 2Q. Other importers have also already been expanding their shipments. That was followed by JC Penney with 991 TEUs shipped after a 13.3% rise in 2Q while Adidas shipped 641 TEUs and grew by 9.9%.

Jul 31, 2019

Riaz Haq

#Pakistan #garment makers chase rivals in #India and #Bangladesh. Pakistan has been hailed as an "attractive sourcing base" by industry executives including Spencer Fung, CEO of Hong Kong-based supply chain giant Li & Fung https://asia.nikkei.com/Business/Business-trends/Pakistan-garment-m...

The global shift to online retailing is further intensifying cost competition, a trend that could benefit Pakistan.

Leading the shift is Amazon, which offers cheaper apparel that can be customized to individual shoppers' tastes and delivered quickly.

-----------

Pakistan garment companies are fighting hard to break into the supply chains of some of the world's biggest fashion brands as the country races to catch up with Bangladesh and other Asian apparel heavyweights.

The battle is fierce, however, as customers like Zara and H&M demand high quality and low costs from their suppliers, all on increasingly tight time tables.

Kay & Emms, a garment maker based in Faisalabad, says it is benefiting from clients' desire to diversify.

"We are getting more benefit because the customers are thinking that they are not 100% safe while putting all of their eggs in one basket that is either China or Bangladesh," Faisal Waheed, sales and marketing general manager at Kay & Emms.

Compared to the traditional leaders in garment production -- China, Vietnam and Bangladesh -- Pakistan is still a minor player, and the pressure on companies to reduce costs is intense.

"There is always a war-footing situation," Waheed said. "Every customer is cost-conscious, because they know they have the buying power around the globe. They have a lot of suppliers in their basket -- Cambodia, India, Bangladesh, China and Pakistan. If you don't act on war footing, you will be losing business."

---------------------

Pakistan has been hailed as an "attractive sourcing base" by industry executives including Spencer Fung, CEO of Hong Kong-based supply chain giant Li & Fung, as garment production for Western brands continue to shift to lower cost countries.

Kay & Emms is still small by global standards, with an annual turnover of just $50 million and 2,300 employees, but it is growing at an annual rate of 60%. About a fifth of its sales comes from Zara, a brand belonging to Spain's Inditex. Kay & Emms has been supplying jogging pants, hoodies, crew neck shirts, pullovers and zipper jackets for Zara since 2014, but it was a hard-earned success, according to Waheed.