PakAlumni Worldwide: The Global Social Network

Pakistan Federal Board of Revenue has recently announced that “Sales Tax and Income Tax at import stage has been drastically reduced in case of smartphones of Rs15,000 or below". This action was apparently taken after Digital Pakistan Initiative led by Tania Aidrus asked for it. It has come under fire from the country's nascent mobile phone and smartphone manufacturing industry which is producing low-cost mobile phones. Pakistan's mobile handset market is the 8th largest in the world. Current annual demand is for about 40 million units of which 13 million are assembled in Pakistan while the rest are imported, according to a report by Dunya News. The import bill for Fiscal Year 2020 is expected to be about $1.2 billion. Boosting it will save billions of dollars of precious foreign exchange. It will create tens of thousands of jobs and spawn new auxiliary manufacturing industries for chargers, headphones, USB cables, cases, etc. In future, Pakistan could become a significant exporter of mobile handsets.

Mobile Phone Demand:

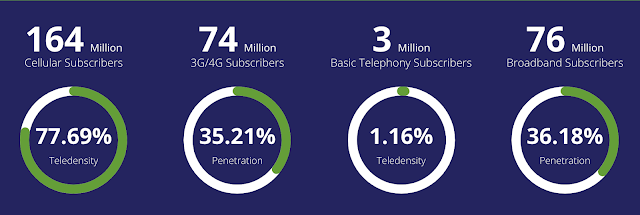

There are currently 164 million mobile phone users in Pakistan, the 8th largest in the world. The current annual demand for mobile phones in the country is estimated at about 40 million units, according to Pakistan Telecommunication Authority (PTA). The fastest growing demand is for 4G smartphones.

According to Pakistan Bureau of Statistics, mobile-phone imports (HS Code: 8517.1219) reached $498 million in 5 months period from July to November 2019, 64% jump over the prior year. Fiscal 2019-20 imports are expected to reach $1.2 billion.

Earlier, the growth rate for 4G handsets jumped from 16% in 2018 to 29% in 2019. Imports of mobile handsets soared 69% from $ 364 million in 2018 to $ 615.7 million in 2019. Pakistan is world's seventh largest handset importer and the 8th largest mobile phone market.

Domestic Manufacturing:

Pakistan Telecommunication Authority (PTA) has granted permission to 26 local companies for manufacturing out of which 15 are currently in production. Among those currently producing mobile handsets in Pakistan are: E-Tachi, GFive, Haier, Infinix and Tecno. They are producing 13 million mobile phones.

Domestic manufacturers claim that they can meet 80% of demand for mobile handsets over the next 2 to 3 years if they are sufficiently protected by higher tariffs on imports.

Domestic mobile phone manufacturing industry will save billions of dollars of precious foreign exchange. It will create tens of thousands of jobs and spawn new auxiliary manufacturing industries for parts, chargers, headphones, USB cables, cases, etc. In future, Pakistan could become a significant exporter of mobile handsets.

Summary:

Pakistan's mobile handset market is the 8th largest in the world. Current annual demand is for 40 million units. Domestic plants produce 13 million units while the rest are imported. The import bill for Fiscal Year 2020 is expected to be about $1.2 billion. The country's nascent mobile handset manufacturing industry fears a serious early setback if the FBR decision to lower duties on imports of foreign made mobile phones is not reversed. It is being blamed on Tania Aidrus, Prime Minister Imran Khan's advisor on Digital Pakistan Initiative, who would like to increase availability of mobile handsets. Domestic mobile phone manufacturing industry will save billions of dollars of precious foreign exchange. It will create tens of thousands of jobs and spawn new auxiliary manufacturing industries for chargers, headphones, USB cables, cases, etc. In future, Pakistan could become a significant exporter of mobile handsets.

Related Links:

Public Sector IT Projects in Pakistan

Pakistan's Gig Economy 4th Largest in the World

Afiniti and Careem: Tech Unicorns Made in Pakistan

Pakistani American Heads Silicon Valley's Top Incubator

Silicon Valley Pakistani-Americans

Digital BRI and 5G in Pakistan

Pakistan's Demographic Dividend

Pakistan EdTech and FinTech Startups

State Bank Targets Fully Digital Economy in Pakistan

Fintech Revolution in Pakistan

The Other 99% of the Pakistan Story

Riaz Haq

#Pakistan Business Council warns accession to the World Trade Organization’s (#WTO) treaty of free #trade of #IT products to break #cellphone & other #electric products #manufacturing dream. #technology #Smartphones #Electronics #informationtechnology https://www.thenews.com.pk/print/729918-pbc-warns-wto-treaty-to-bre...

PBC, in a report on Thursday, expected the information technology agreement (ITA) to cause jobs and revenue losses and suppress potential for exports.

“The ITA will result in a net loss to the economy by replacing locally manufactured products with imported ready-to-sell products in the ITA listed categories,” said the council. “This will not only undermine the efforts to encourage investment by electronics manufacturers in Pakistan, but it will also cost Pakistan its independence to apply policy interventions to gradually increase its product space for exporting electronic products.”

The agreement aims to eliminate custom duties and reduce non-tariff measures which restrict trade in IT and electronic products. The goal is to increase global trade and competition in IT goods and services, increase adoption of technology and spur innovation in the sector. ITA accounts for 97 percent of world trade in IT and electronic products with trade volume of $3.7 trillion in 2019.

“There is an inconclusive evidence to suggest ITA is an appropriate avenue to expand a country’s capability in manufacturing and exporting electronics and IT products,” said the PBC. “Whilst counties that a signatory to the ITA have increased their IT and electronic product exports, non-signatories have also increased exports manifold.”

India and Bangladesh use cascading tariff structure to increase localisation and manufacturing of electronics in their countries. India, being signatory to the agreement, is facing international disputes in the WTO for adopting policies for localising manufacturing of electronics, claiming them to be against the ITA protocols.

The information technology agreement is not bound on any member country of the WTO. It has so far been signed by advanced economies that already have strong exports base of IT products.

Pakistan’s imports of ITA related products rose six-fold between 2003 and 2019, significantly higher than the global average. The imports recorded a compound annual growth rate of 13.2 percent during the period. The growth rate was much higher than the global average of 8.4 percent, according to the PBC

The business council said the country has experienced de-industrialisation due to policies that discourage manufacturing and make it easier to import finished products.

PBC said allowing across the board zero duty on components and finished, ready-to-sell electronics, will result in closure of existing manufacturing units, and also discourage additional investments in production facilities for electronics.

“By disallowing cascading of tariffs under ITA, and removing the advantage for local manufacturing, for example as envisaged in the mobile phones manufacturing policy, companies such as Samsung may lose interest to invest in smartphone assembly in Pakistan,” it said. “Not only will this have an adverse impact on the external account, Pakistan will also miss opportunities to acquire technologies in manufacturing electronics by reducing the chances of foreign companies to enter Pakistan.”

The council said the Federal Board of Revenue estimated revenue loss of Rs3.5 billion from 105 tariff lines following Pakistan’s accession into the ITA.

Though imports of ITA-based products are a good proxy measure of technological adoption and accession to ITA will lead to zero-rated imports of electronics, it will further delay development of IT manufacturing sector.

Oct 21, 2020

Riaz Haq

Local mobile phone manufacturers have urged the Ministry of Industries and Production to implement Cabinet decision of exempting four percent withholding tax on the sale of Pakistan made handsets.

https://www.brecorder.com/news/40022762/4pc-wht-exemption-on-local-...

In a written letter to the Engineering Development Board (EDB) the Pakistan Mobile Phone Manufacturers Association (PMPMA) while urging the Ministry to exempt the sales of local manufactured cell phones from 4 percent withholding tax has requested for the implementation of June 2, 2020 Cabinet decision.

The letter was sent to Chief Executive Officer (CEO) EDB by PMPMA, copies of which have also been sent to Industries Minister and other Ministries, the Association revealed.

According to official sources the PMPMA since the approval of the mobile device manufacturing policy in June 2020, has repeatedly requested the relevant officials for the implementation of the policy in letter and spirit, so that they can optimise their operations but so far the ministry does not appear to be serious in implementing the policy.

This was the industry’s perception after the meeting held in the office of Minister of Industries on 3rd September, 2020 and subsequent follow up meeting with the Chairman and CEO (EDB) held in Lahore on 18 September, 2020.

Pakistan Mobile Phone Manufacturers Association deliberated the issue and raised the following five point opinion in the letter: (i) the exemption of 4 percent withholding tax on local sales of locally manufactured mobile phones is an integral part of the mobile device manufacturing policy approved by the federal cabinet on 2nd June, 2020.

(ii) The exemption is absolutely critical to provide a level playing field to the local industry which consists of more than 15 manufacturers and provides employment to over 7 to 10 thousand. Moreover the local cell phone manufacturers are planning to expand their plants to produce more handsets to meet the local demand for mobile phones.

(iii) If the exemption, already approved under the MDMP, is not notified, it shall disturb the differential envisaged under the MDMP between the duty and taxes on CKD/SKD kits of locally manufactured mobile phones as compared to CBU imports into the country.

(v mobile phone industry is strategic a sector which, if properly incentivised, can provide employment opportunities to over 200,000 Pakistanis, and within a short period of time, create export opportunity worth billions of rupees.

Oct 21, 2020

Riaz Haq

Infinix #mobile phone factory in #Karachi is producing around 3 million mobile devices per year. It is reshaping the #smartphone experience in #Pakistan with its latest offerings. Here's how - Sponsored - DAWN.COM. https://www.dawn.com/news/1586440

Infinix, a leading smartphone brand in the Pakistani market has caused a stir in the world of tech in a short period of time.

Leading the future in the smartphone world in Pakistan, the brand has set new benchmarks in innovation-led manufacturing through cutting-edge technology, exquisitely designed dynamic smartphones, and conquered global life experiences with a winning combination of technology tossed with fashion.

Infinix is well known for being bold and forward-leaning.

Instead of playing it safe, it has taken the risk and moved fast. Instead of waiting for others, it has set the direction for competitors.

The tech innovator has completed five strong and successful years in the market, growing from strength to strength, becoming the most loved, and trusted choice in Pakistan; a legendary brand that challenges the norms with devices explicitly designed for the country's youth to learn about the opportunities and challenges of global expansion, focusing on fast-moving high-tech space.

Here's a rundown of Infinix’s journey of becoming a success story in Pakistan.

How it all began

The journey started in 2013 with a strategy of complete line of mobile devices.

With the SURF series 39's initial release, the brand introduced ‘ALPHA’ and unveiled the high-end ‘Marvel series’ which received fantastic response. The same year, Infinix broke through the market with the launch of the ‘Zero series’. Its popularity with the masses instantly made it a premium smartphone brand in the emerging markets.

The company's success depended not only upon the quality product but also the reliability & benchmark it had set. During its trailblazing tenure in 2015, the brand witnessed top sales record for any single product with the launch of ‘HOT’. Simultaneously, the ‘NOTE series’ was introduced to cater to the business and daily functionality for consumers.

Aware of the nature of its millennial audience and financial restraints, Infinix took a giant leap in 2016 by introducing a winning combination of tech and fashion, i.e. the ‘S series.’

Infinix has currently been marked as the largest mobile phone production and assembly company in Pakistan. The existing factory produces 3 million units per year.

Exquisite design

Infinix innovations have a clear purpose: represent infinite possibilities and distinctive characteristics.

Influenced by French designs and investments, they make life better and easier. The designs are more personal, intelligent, and deliver an experience that flows seamlessly and continuously wherever you go. It combines power and functionality, whether you are at work or play at home or away.

Tech innovation

A brand that envisions phones as an expression of self-discovery and has struck a chord with users who prioritise fashion and technology through daily interactions, Infinix's range of intuitive products has become a lifestyle by default, representing intelligent and trend-setting experiences around the world.

In a developing country like Pakistan, smartphones, in general, are unable to reach the masses due to their high price points. Infinix designs smartphones for techies who are on the lookout for stylish and aesthetic designs at the best value for money.

Presence around the globe

The company has its footprints across the world; however, its contemporary design, the need for digital technology, and effective functionality have made it incredibly popular across more than 70 countries in South East Asia, South Asia, Africa, Latin America, and the Middle East.

Oct 23, 2020

Riaz Haq

Interest in cellphone assembly grows as smuggling falls

PTA has so far permitted 24 companies to assemble handsets in Pakistan

https://tribune.com.pk/story/2186936/interest-cellphone-assembly-gr...

Last month, Pakistan began local manufacturing of mobile phones, which is expected to open further avenues of investment in the country and create employment opportunities.

Chinese company Transsion Holdings and Pakistan’s Tecno Group have formed a joint venture called Transsion Tecno Electronics Ltd (TTE) with the Chinese company having 40% shareholding while the remaining 60% stake is held by the Pakistani firm.

The joint-venture company – the first 3G/4G smartphone manufacturing facility in Pakistan – has initial capacity to produce 1.8 million units annually on a single-shift basis with over 800 skilled workers below 30 years of age.

“The value of Pakistan’s mobile phone market stands at Rs366 billion, which is even higher than the value of the auto sector which is around Rs360 billion,” remarked TTE CEO Asif Allawala. “Interestingly, the government drafts policies conducive for the auto sector but ignores the mobile phone industry.”

He added that the industry would not be able to sustain much longer if the import of smartphones remained cheaper than local manufacturing.

Mobile industry worldwide

The mobile phone sector ranks among the five biggest industries in the world with sales revenue of $522 billion and over 6 billion devices sold annually.

China has been enjoying the label of being the global hub of handset manufacturing since 2010. The country exports mobile phones worth over $150 billion a year.

However, the handset production is now moving out of China due to rising labour cost and a prolonged trade war with the US.

“On average, Chinese labour costs $600 per month while Pakistan’s labour is much cheaper at only $120 per month,” said the TTE CEO.

However, Pakistan still remains far behind in the race of providing cheap labour force as many other Asian nations are increasingly luring mobile phone assembly companies by offering low-cost workers.

Most of the demand for mobile phones stems from Asia and Africa while markets in Europe and North America are on a saturation point, hence, their trend remains more or less flat each year. This provides a further incentive to the mobile phone manufacturers to relocate their units to Asian nations.

According to Statista, 1.5 billion units of smartphones were sold in 2019 worldwide. The number had been 122 million in 2007.

Pakistan’s market

Pakistan has 164 million cellular subscribers out of a population of 207 million. The country ranks seventh among world’s largest handset importers.

Alone in 2015, the country saw 114 million mobile subscriber identity modules (SIMs) sold with 46 million supporting 3G/4G while 68 million were 2G subscribers.

“Due to its mammoth size, no global brand can ignore Pakistan’s market,” said TTE Director Aamir Allawala. “The country’s annual market size, including 2G, 3G and 4G, is estimated at 34 million units.”

That meant the country’s demand for mobile phones remained in millions every year as a cellphone, especially smartphone, was changed by many consumers after two to three years, he said.

Pakistan Telecommunication Authority (PTA) has successfully tackled the handset smuggling. Government’s endeavours to curb grey channels have yielded results as the country recorded 110% increase in legally imported mobile phones in 2019 compared to 2018.

“According to analysis, an increase of 110% has been seen in legal import of devices from the formal channel,” confirmed a PTA spokesperson to The Express Tribune.

Over more than a year ago, the government started blocking the mobile sets (smuggled phones) that were not approved by PTA with the help of Device Identification, Registration and Blocking System (DIRBS).

Nov 2, 2020

Riaz Haq

#Pakistan on brink of inking #industrial accord with #China for industrial cooperation to develop B2B joint ventures, build Special Economic Zones (SEZs) and industrialization under the second phase of #CPEC. #economy #industry #business #manufacturing https://www.thenews.com.pk/print/759243-pakistan-on-brink-of-inking...

“Prime Minister Imran Khan has already given approval to it. After consultation, both the countries will formally sign this framework agreement,” a senior official said.

On Tuesday, representatives from both the countries held the fifth meeting of Joint Working Group (JWG) on industrial cooperation under CPEC through video conference.

The Chinese side appreciated the efforts undertaken by Pakistan to elevate the MoU (Memorandum of Understanding) on industrial cooperation into a Framework for an increased cooperation under CPEC and agreed to continue consultation for its signing at the earliest. They also hailed the idea of joint industrial diagnostic studies followed by an action plan.

Khashih-ur-Rehman, Additional Secretary/Executive Director General, Board of Investment (BOI) and Ying Xiong, Director General, National Development & Reform Commission (NDRC), China co-chaired the meeting. Representatives from line ministries, provincial governments, and embassies attended the meeting.

Rehman remarked that elevation of the MoU on IC (Industrial Cooperation) between Pakistan and China into a comprehensive framework would create new avenues for strengthening industrial cooperation under CPEC which is also open to third party participation.

Cooperation would likely enhance B2B and project to project (P2P) ties, balance and modernise existing industry, expedite SEZs development and promotion, seek technical and financial assistance from China, increase production capacity, and facilitate businesses with support of financial institutions from both sides, etc, he added.

Asim Ayub, Project Director of Project Management Unit (PMUC-CPEC-ICDP) on Industrial Cooperation of BoI, appreciated the Chinese side for accepting the Draft Framework Agreement shared by the Pakistani side in early November 2020.

Early signing of the Framework Agreement on IC would help both sides achieve maximum objectives of CPEC in line with its long-term Plan, Ayub said, adding that immense efforts had been ensured by Pakistani to devise the Draft Framework, taking all the provinces and other stakeholders on board and final approval of the Honorable Prime Minister was also obtained accordingly.

He stressed a Framework Agreement was the need of the hour for a measurable impact with regards to Industrial Cooperation, SEZs, Business to Business (B2B) and People to People (P2P) collaboration.

Ayub said Pakistan highly regarded the idea of Industrial Diagnosis by the Chinese side and extended its highest support to the group of experts from CIECC for the Textile Industrial Diagnosis last year. However, he was of the view that the Industrial Diagnosis needed to be carried out in a joint manner involving experts from both sides who might submit the Diagnosis Report to the JWG along with an Action Plan that would be imperative for the respective industrial sector.

The meeting also discussed progress made on Rashakai, Dhabeji, Alama Iqbal Industrial City, and Bostan SEZs under the CPEC, the revival project of Pakistan Steel Mill, China Pakistan Young Workers Exchange and Cooperation, and Karachi Coastal Comprehensive Development Zone.

Dec 15, 2020

Riaz Haq

Smartphones Policy to Create 50,000 Jobs in the Next Few Years

https://www.phoneworld.com.pk/smartphones-policy-to-create-50000-mo...

There are about 16-18 cell phone manufacturers operating in Pakistan and a few others are coming. These plants are providing jobs to about 25,000 people – mostly young boys and girls. The industry experts are of the opinion that 50,000 more jobs will be created in the segment in the next few years. Some say that 70 per cent of jobs would be for women.

One auto parts manufacturer in Karachi delved into the smartphone assembling in the early days and is producing around 500,000 units a month for the local market. He is confident that the capacity would double in a year and the production will reach a million units a month.

Another player in Lahore is making a state-of-the-art mobile assembly facility which is going to be operational in January 2021. The aim is to reach 500,000 units a month by March-April; and by June-July, the facility will start expanding. The aim is to reach a million units a month by the end of 2021. The assembler is the biggest importer of smartphones in Pakistan and is doing backward integration.

The mobile phone formal industry is growing fast. In yesteryears, around 800,000-900,000 units used to be imported a month in Pakistan through formal channels. After the induction of Device Identification, Registration and Blocking System (DIRBS), illegal imports of the phone is no longer possible. Due to this and lockdown, smartphone imports went up to 2-2.2 million in June 20. Overall, the monthly average import in Pakistan is standing around 1.3-1.5 million units a month in 2020.

Majority of the phones are in the category of $200 or low, and all these would probably be assembled in Pakistan within a couple of years. Any company that would not decide to assemble in Pakistan could be wiped out in the cheap smartphone segment. That could be a worry for Samsung. The company operates in all segments. Its premium phones would keep on coming as imported units – but the segment is small. If the company doesn’t start assembling here, it risks losing market share. it is still mulling on the assembly idea.

Apart from Samsung, big Chinese brands such as VIVO and OPPO are also weighing options of starting assembly in Pakistan, and VIVO could be one big player in a few years in the local market assembling. Once big companies come in and set up units in Pakistan, parts manufacturing may start taking place at home. There will be a huge spillover for the local assemblers.

The smartphone policy is envisaging in stage 1 (2020-21) to start assembling units here – that is happening and credit goes to EDB and Ministry of Industries. In stage 2, the plan is to have a charger, Bluetooth, handsfree, and motherboard (PCB) assembly by 2022. Housing and other plastic parts manufacturing to start in 2023, and stage 4 is to make display and battery by 2025.

For all these steps, big Chinese and Korean players should come and assemble here. PM Imran Khan should take this initiative and talk at the government-to-government level. The ground is being laid. The industry players are charged, the gaps in cellphone and data penetration still exist and the government needs to work on rolling the right infrastructure. The smartphone assembly could well be the first step of Pakistan venturing into the tech hardware.

Dec 21, 2020

Riaz Haq

Pakistan: 1.2 million #smartphones manufactured in first two months of 2021. These phones were manufactured at the 33 local #mobile devices assembly plants in #Pakistan. #manufacturing – Gulf News

https://gulfnews.com/world/asia/pakistan/pakistan-12-million-smartp...

The number of smartphones assembled and produced in January and February 2021 indicate a significant increase as compared to the last two years. The country produced 2.1 million smartphone devices in 2020 and 119,639 in 2019, according to Pakistan Telecommunication Authority (PTA).

The country has produced over 25 million mobile devices including 4G smartphones following the successful implementation of PTA’s Device Identification, Registration and Blocking System (DIRBS).

“With the successful execution of DIRBS, the local assembly industry has evolved from infancy to well-growing stage, with significant growth seen in the local assembly of smartphones,” PTA said. The system implemented in 2019 also led to a significant increase in legal imports of mobile devices.

In 2020, Pakistan approved its first mobile device manufacturing policy to attract investment and encourage manufacturers of major cell phone brands to set up plants in Pakistan.

Job opportunities

The policy also aims to create more job opportunities in Pakistan, create smartphone research and development centers and boost the production of electronic equipment in Pakistan.

The government’s offered several tax incentives and abolished withholding tax on locally assembled phones which encouraged the investors to set up companies in Pakistan, says Minister for Information Technology and Telecommunication Syed Amin ul Haque.

Leading smartphone brand Infinix currently has the largest mobile phone production and assembly plant in Pakistan where 3 million units are produced each year.

Vivo, Airlink and Advance Telecom are the three new companies that will soon establish their manufacturing units in Faisalabad, Lahore and Karachi.

PTA also received several mobile device manufacturing applications after finalizing its mobile device manufacturing regulations which “will help create more jobs in this technical sector, as well as enable consumers to buy locally manufactured mobile devices.”

5G connectivity

Pakistan’s telecom sector offers attractive investment opportunities as it boasts of 178 million mobile phone subscribers with 93 million 3G-4G users, according to the January 2021 data.

Pakistan is also set to launch 5G mobile phone connectivity by December 2022 following a successful trial by PTA in February 2021.

The demonstrations included remote surgery, cloud gaming and overview of anticipated 5G technology applications for social and economic development of Pakistan.

“With the successful 5G trial in a limited environment, we believe that this technology will unlock new realities for eHealth, smart homes and cities, agriculture, autonomous vehicles, cloud computing, Internet of Things and Artificial Intelligence” Nadeem Khan, acting CEO of PTCL Group said.

Mar 6, 2021

Riaz Haq

#Pakistan Engineering Development Board on #mobile #phone #manufacturing : TranssionTecno’s Itel, Infinix & Tecno are producing 650,000 units per month in #Karachi. Airlink’s plant in #Lahore has production capacity of 500,000 to 800,000 units per month.”

https://www.techjuice.pk/engineering-development-board-begins-works...

In recent news, the Engineering Development Board (EDB), which is a technical arm of the Ministry of Industries and Production (MoIP), has begun working on a framework for the local assembly of tablets, smartphones, and other related mobile accessories in the near future.

The MoIP further stated that the smartphone industry could be larger than the existing automotive industry in the upcoming years due to the high demand for devices across the country. Hence, this report has been formulated in line with the Mobile Device Manufacturing Policy of the Pakistan Telecom Authority, whereas the manufacturing plants fall under the ambit of the EDB.

EDB further added:

“TranssionTecno, Karachi-based company assembles three brands including Itel, Infinix, and Tecno, has increased local assembly from 150,000 units to 650,000 units per month. Airlink Communication Ltd has commenced its test trials at its plant in Lahore, and has the production capacity of 500,000 to 800,000 units per month.”

Moreover, the EDB General Manager Policy Asim Ayaz stated that this policy provides sufficient advantage to the local manufacturing of smartphones especially below the price range of $200 in comparison with imported sets which normally are too costly for consumers to purchase.

Mar 13, 2021

Riaz Haq

Smartphone brands in Pakistan:

https://www.phoneworld.com.pk/smartphone-brand-share-in-pakistani-m...

Infinix:

The smartphones of Infinix have become popular for rendering quality products with excellent specs and features at an affordable cost, Because of this, it has witnessed growth in terms of value in the Pakistani market for the whole year. Its value rose from 11.6% in Q1 of 2020 to 27.6% in Q2 of 2020. Afterward, it witnessed a slight decline of 6.5 % in Q3 of 2020 then again increased a bit to 23.4% in Q4 of 2020. Even if you see the last four quarters, its value has remained constant without large fluctuations. Similarly, in terms of units, its share has also witnessed a similar trend, it increased in Q2 and witnessed a bit of decline in Q3 of 2020 and again jumped to 27.5% in Q4 of 2020.

Vivo:

The smartphones of Vivo are also popular in the Pakistani market. Due to this, they are also witnessing growth in terms of value in the recent era. Their market value of Vivo witnessed a positive trend except for Q2 in which it saw a decline. In the last two quarters, its share increased from 17.1 % in Q3 of 2020 to 22.2 % in Q4 of 2020. Similarly, in terms of units sold, a similar trend has been followed. The decline was only witnessed in Q2 of 2020 while in the last two quarters its share has increased from 15.3% in Q3 of 2020 to 20.2% in Q4 of 2020.

Tecno:

As Tecno and Infinix are subsidiaries of the same parent company, So the notion is the same, providing quality products at an affordable price. Therefore, its value has also not much fluctuated and seen a bit of decline in Q3 of 2020 after increasing in Q2 of 2020 as you can see in the above-mentioned graph. But again its value rose from 9.5 % in Q3 of 2020 to 14.3 % in Q4 of 2020. Simultaneously, in terms of units sold, its share has increased and seen a constant trend from 16.5 % in Q3 of 2020 to 19.0 % in Q4 of 2020.

iTel:

iTel is making gradually evolving in the Pakistani market because of its budget price. In terms of units sold, its share has not much fluctuated. It has seen a bit of decline in the Q2 of 2020 but its share increased from 5.5% in Q3 of 2020 to 8.8% in Q4 of 2020.

Oppo:

Oppo is renowned for providing the best camera phones. It has been witnessing a rising trend in 2019 but this time around its share has been falling in all Q1, Q2, and Q3 quarters as you can see in the graph, and its share in terms of value has fallen to 10.4 % in Q4 of 2020.

Samsung:

Unfortunately, the tech giant Samsung has not been able to grasp a major portion of the market share. However, its share hasn’t witnessed many fluctuations both in terms of units and value. In terms of units, its share increased in Q1 of 2020 and decreased in Q2 of 2020 then increased to 8.6% in Q3 of 2020 and fallen again 8.0 % in Q4 of 2020. However, on the other side, in terms of value, it has witnessed a growth of 0.1 % in the last quarter and only seen a decline in Q2 of 2020.

Others:

The other smartphone brand share include Huawei, Xiaomi, Realme, Apple etc. These brands are also seeing a decline in the local smartphone market. In terms of units sold, their share has decreased significantly from Q1 of 2020 to Q4 of 2020. Similarly, in terms of value, their share has decreased from 25.6 % in Q1 of 2020 to 17.5 % in Q4 of 2020. The tech-giant Huawei due to the non-availability of Google service has literally vanished from the local market.

Conclusion:

The afore-mentioned data is updated and taken from a very reliable source. If you have any queries regarding it, you can tell share them in the comment section!

Mar 13, 2021

Riaz Haq

The majority of the people in Pakistan tend towards cheaper and simpler smartphones. As we know that most of the top quality products like apple devices are expensive and a bit sophisticated if we compare them with the Android devices. As Android phones are being produced by a number of companies due to which they are much cheaper and most indigenous people know how to use them. Therefore, it is evident that most Pakistani people’s preference would be an Android phone in less price than Apple devices as they are expensive. In this article, we would let you know the smartphone brand share in the Pakistani Market.

https://www.phoneworld.com.pk/smartphone-brand-share-in-pakistani-m...

Smartphone Brand Share in Pakistan (2020)

Smartphone Market Share (Units & Value):

I will start with Infinix.

Infinix:

The smartphones of Infinix have become popular for rendering quality products with excellent specs and features at an affordable cost, Because of this, it has witnessed growth in terms of value in the Pakistani market for the whole year. Its value rose from 11.6% in Q1 of 2020 to 27.6% in Q2 of 2020. Afterward, it witnessed a slight decline of 6.5 % in Q3 of 2020 then again increased a bit to 23.4% in Q4 of 2020. Even if you see the last four quarters, its value has remained constant without large fluctuations. Similarly, in terms of units, its share has also witnessed a similar trend, it increased in Q2 and witnessed a bit of decline in Q3 of 2020 and again jumped to 27.5% in Q4 of 2020.

Vivo:

The smartphones of Vivo are also popular in the Pakistani market. Due to this, they are also witnessing growth in terms of value in the recent era. Their market value of Vivo witnessed a positive trend except for Q2 in which it saw a decline. In the last two quarters, its share increased from 17.1 % in Q3 of 2020 to 22.2 % in Q4 of 2020. Similarly, in terms of units sold, a similar trend has been followed. The decline was only witnessed in Q2 of 2020 while in the last two quarters its share has increased from 15.3% in Q3 of 2020 to 20.2% in Q4 of 2020.

Tecno:

As Tecno and Infinix are subsidiaries of the same parent company, So the notion is the same, providing quality products at an affordable price. Therefore, its value has also not much fluctuated and seen a bit of decline in Q3 of 2020 after increasing in Q2 of 2020 as you can see in the above-mentioned graph. But again its value rose from 9.5 % in Q3 of 2020 to 14.3 % in Q4 of 2020. Simultaneously, in terms of units sold, its share has increased and seen a constant trend from 16.5 % in Q3 of 2020 to 19.0 % in Q4 of 2020.

iTel:

iTel is making gradually evolving in the Pakistani market because of its budget price. In terms of units sold, its share has not much fluctuated. It has seen a bit of decline in the Q2 of 2020 but its share increased from 5.5% in Q3 of 2020 to 8.8% in Q4 of 2020.

Oppo:

Oppo is renowned for providing the best camera phones. It has been witnessing a rising trend in 2019 but this time around its share has been falling in all Q1, Q2, and Q3 quarters as you can see in the graph, and its share in terms of value has fallen to 10.4 % in Q4 of 2020.

Samsung:

Unfortunately, the tech giant Samsung has not been able to grasp a major portion of the market share. However, its share hasn’t witnessed many fluctuations both in terms of units and value. In terms of units, its share increased in Q1 of 2020 and decreased in Q2 of 2020 then increased to 8.6% in Q3 of 2020 and fallen again 8.0 % in Q4 of 2020. However, on the other side, in terms of value, it has witnessed a growth of 0.1 % in the last quarter and only seen a decline in Q2 of 2020.

Others:

The other smartphone brand share include Huawei, Xiaomi, Realme, Apple etc. These brands are also seeing a decline in the local smartphone market. In terms of units sold, their share has decreased significantly from Q1 of 2020 to Q4 of 2020. Similarly, in terms of value, their share has decreased from 25.6 % in Q1 of 2020 to 17.5 % in Q4 of 2020. The tech-giant Huawei due to the non-availability of Google service has literally vanished from the local market.

Conclusion:

The afore-mentioned data is updated and taken from a very reliable source. If you have any queries regarding it, you can tell share them in the comment section!

Mar 13, 2021

Riaz Haq

Hammad hopes smartphones sector to be bigger from automobile industry

https://www.app.com.pk/business/hammad-hopes-smartphones-sector-to-...

:Federal Minister for Industries and Production Hammad Azhar expressed the hope that smart phones manufacturing sector would prove to be even bigger from automobile industry in Pakistan and in next 10 years, its export revenues might be equal to country’s textile sector.

He was addressing as chief guest at the inaugural ceremony of Airlink Smartphone Assembly Line here at Quaid-i-Azam Industrial Estate Kot Lakhpat on Saturday.

Airlink Chairman Aslam Hayat Piracha, CEO Muzaffar Hayat Piracha and Engineering Development Board (EDB) Chairman Almas Hyder also spoke on the occasion, while Lahore Chamber of Commerce and Industry (LCCI) President Mian Tariq Misbah and a large number of businessmen and industrialists were also present.

Hammad Azhar said that effective and well-conceived industrial policies of the PTI government were now resulting into industrial revolution and robust economic growth.

He mentioned that when PTI came into government in 2018, around 70 to 80 per cent of smart phones sold in the local markets were smuggled lot. Curbing mobile phones’ smuggling was a herculean task, he continued, the government studied anti-smuggling strategies of other countries, and introduced DIRBS (Mobile Devices Identification, Registration and Blocking System) under which no mobile phone could be activated in Pakistan without clearing/paying all relevant duties and taxes.

“We have also removed all the reservations and apprehensions of the traders and all other stakeholders in this regard and due to effective policies of the government, there is no smuggled phone in the local markets and the government is collecting 60 to 70 billion rupees duty/tax from mobile phones. These measures also created ample space in the local market for the local manufacturers of smart phones,” he maintained.

Federal Minister added that government had also introduced Mobile Phones Manufacturing Policy-2020 and now five major players of this sector were setting up their manufacturing units in Pakistan.

“This is our landmark journey and now we are moving from local market towards export of smart phones,” he said and cited that Vietnam’s annual export revenues from mobile phones export stood at US $ 45 billion, which forms 25 per cent of its GDP.

Mar 20, 2021

Riaz Haq

Non-textile exports rise in 8MFY21

The exports of engineering goods went up 19.74pc and surgical instruments 4.92pc. In the engineering sector, the export of electric fans posted over 15pc growth followed by transport equipment 0.95pc and other electrical machinery 17.16pc respectively.

https://www.dawn.com/news/1613334

Mar 20, 2021

Riaz Haq

GST removal on locally-assembled units: Samsung, OPPO may start manufacturing cellphones

https://www.brecorder.com/news/40072439/gst-removal-on-locally-asse...

M/s Samsung and M/s OPPO are likely to start local assembly in Pakistan soon after removal of sales tax on locally assembled mobiles from above $ 200 category.

Mobile Device Manufacturing Policy 2020 was approved by the ECC in May 2020. The decision was subsequently ratified by the Cabinet on June 2, 2020.

The mobile device manufacturing policy provides sufficient advantage to the local manufacturing of mobile phones especially below $ 200 category in comparison with imports in completely built condition. M/s VIVO, M/s Airlink Communications, M/s Inovi Telecom are amongst the new investors in local assembly of mobile phones that have already started their trial production in February 2021.

The combined capacity of these three companies is more than 1 million mobile handsets per month whereas M/s Transsion Tecno, a Karachi based company assembling three famous brands including Itel, Infinix and Tecno , has increased local assembly from 150,000 units to 650,000 units per month owing to increase in demand soon after the policy was launched. In addition to the new entrants in mobile assembly, few experienced companies like G-Five and Q Mobile was already operating in the market, while M/s Samsung and OPPO are poised to enter local assembly in Pakistan market and are probably waiting for the implementation of approved recommendation of policy to remove sales tax on locally assembled mobiles from above $ 200 category. By introduction of new players and capacity enhancement by existing companies, Pakistan will soon be able to meet major portion of local demand, which was around 3.6 million per month in CY 2020.

The local manufacturing companies are moving rapidly from 2-G non android market to the 4-G smart phones as the local manufacturing has ensured availability of mobile handsets at competitive prices to customers.

Engineering Development Board (EDB), a technical arm of Ministry of Industries and Production (MoIP) was made the secretariat of Mobile Policy.

The policy has provisioned a 3 % export rebate for the local companies to enter into export market. From the initial success of the policy and increased demand in local and international market, the local assemblers are optimistic about export of locally assembled mobile phones.

The mobile phone manufacturing industry is expected to become larger than the automotive industry of Pakistan in terms of turnover in a few years and employment is expected to grow manifold. To further boost the electronics sector, work has already started on preparing appropriate framework for local assembly of tablets, allied equipment and mobile accessories in near future in line with its vision to improve the entire eco system, and make this the fastest growing sector in terms of employment and exports in the near future.

Mar 24, 2021

Riaz Haq

#Samsung plans #smartphone assembly in #Pakistan. Smartphone imports in Pakistan have swelled by 63% to $1.860 billion in 11MFY21 from $1.138bn in the same period last year. There are over 100 million #mobile #broadband subscribers. DAWN.COM

https://www.dawn.com/news/1633812

South Korean tech giant Samsung has been in talks with three investors for setting up a mobile manufacturing unit in Pakistan.

Sources said out of three parties, one has a franchise from Korea which has already set up vehicle assembling plants in Pakistan under Auto Development Policy (ADP) 2016-21, while other two are different parties.

They said so far no agreement has been signed as Samsung, after short listing various companies, is in the process of finalising its plan to award the licence to one of the companies for cellphone manufacturing.

The world’s biggest smartphone maker said in an earnings estimate on Wednesday that it expected operating profit of around 12.5 trillion won ($11 billion) for April to June, up from 8.15 trillion won a year earlier.

Companies being shortlisted for award of licence

“The Korean company aims to start local assembly of cellphones in the last quarter of this year,” a source, who is looking after the development in the mobile phone sector, told Dawn on Wednesday.

Market sources said Samsung may prefer the option to ink the agreement with one of the Korean companies operating in Pakistan owing to comfort level which it may not find with non-Korean firms.

The Engineering Development Board (EDB), an arm of the Ministry of Industries and Production (MoIP), approved Mobile Device Manufacturing Policy (MDMP) in 2020 and so far 21 companies have been given the green signal for mobile device manufacturing authorisation from March to June 2021.

As per EDB list, factories’ locations include Rawalpindi, Karachi, Lahore, Faisalabad and Islamabad. Some prominent brand names include Nokia, Oppo, Infinix, Tecno, Itel, Vivo, Alpha, Realme, VGOTEL, DCODE, Calme, Xcell, Spice, TCL, Alcatel, etc.

Sources said that the government has framed MDMP to encourage foreign players to take a plunge in Pakistan for setting up cellphone manufacturing unit. The aim is to produce the product under the banner of “Make in Pakistan” and to discourage imports.

Cellphone imports, as per figures of Pakistan Bureau of Statistics (PBS), have swelled by 63pc to $1.860 billion in 11MFY21 from $1.138bn in the same period last fiscal year.

According to the Economic Survey 2020-21, during July 2012 to February 2021, telecom sector has attracted over $3.9 billion of Foreign Direct Investment (FDI). The FDI in telecom during July-February FY21 was $101.1 million. Telecom operators have invested an amount of $363.9m during July-December FY21.

The main driver behind this investment is the cellular mobile sector which has invested $253.5m during the period. The overall investment in the telecom sector during the first eight months of FY21 crossed $465m. Pakistan’s cellphone subscribers have reached 183.48m till May 2021.

Jul 8, 2021

Riaz Haq

#China #tech-giant Xiaomi to Set up Local #smartphone assembly unit in #Pakistan. Xiaomi is following the footsteps of other major brands like Tecno, Infinix & Realme which have recently opened their local #manufacturing units in Pakistan. #mobilephones https://www.phoneworld.com.pk/tech-giant-xiaomi-to-set-up-local-ass...

In a landmark development, the Chinese tech giant Xiaomi has announced that it will set up a local assembly unit in the country in three to four months, according to sources. The latest development will not only generate employment opportunities for the indigenous people but will also boost the local smartphone manufacturing space in the country. Furthermore, the local manufacturing of smartphones will also attract foreign direct investment (FDI) and ramp up a foreign exchange through exports.

Tech-giant Xiaomi to Set up Local Assembly Unit in Pakistan: Source

Basically, Xiaomi is following the footsteps of other major brands like Tecno, Infinix, Realme, etc. who have recently announced to open their local manufacturing unit in Pakistan. It will greatly benefit the company as Xiaomi is currently one of the most loved brands in Pakistan. It can be evident if we look at the sale of its recently launched devices like Mi 11, Note 10, etc. The primary reason behind its huge demand is that it renders quality, consumer-centric (gaming phones, camera phones, etc.), and affordable products.

Furthermore, as we know that Xiaomi deals in a range of accessories and IoT products. So if the company’s smartphone local assembly becomes a success story then the company will surely install other product manufacturing assemblies as well.

Currently, Pakistan is the 7th largest importer of mobile phones with a humungous market size of over 40 million users. Thus, consequently, local manufacturing will also save foreign exchange on mobile phone imports.

Jul 14, 2021

Riaz Haq

Lucky Motor to produce of Samsung-branded mobile #smartphone in #Pakistan beginning in December 2021. Plant will be located at LMC’s existing plant facility producing vehicles at Bin Qasim Industrial Park, Special Economic Zone, Port Qasim, #Karachi. https://www.brecorder.com/news/40107634

https://twitter.com/haqsmusings/status/1416039226492129281?s=20

Lucky Motor Corporation (LMC), a subsidiary of Lucky Cement Limited, has entered into an agreement with Samsung Gulf Electronics Co., FZE (Samsung) for the production of Samsung-branded mobile devices in Pakistan, stated a notice sent to the country’s stock exchange on Friday.

“In pursuance of this transaction, LMC has also initiated the process of seeking necessary regulatory approvals to carry on the said business and, in this endeavor, has filed an application with the Pakistan Telecommunication Authority (PTA) for securing the license,” added the notice.

The notice added the production facility for producing Samsung mobile devices will be located at LMC’s existing plant facility producing vehicles at Bin Qasim Industrial Park, Special Economic Zone, Port Qasim, Karachi.

Secretary informs parliamentary panel: 'Samsung poised to enter local market; two firms short-listed'

“The production facility is anticipated to be completed by end of December 2021. That further information on the amount contemplated to be invested in the production facility and the capacity thereof shall be discussed between the Parties (Samsung and LMC) in due course of time.”

LMC is currently engaged in the business of manufacturing, assembly, marketing, distribution and sales of Kia and Peugeot branded vehicles, parts and accessories thereof, in Pakistan.

The development comes as a major landmark for Pakistan that has been pushing to join the league of smartphone manufacturing countries.

In a bid to boost Pakistan's telecom and manufacturing sector, some 21 new companies have been authorised to start local manufacturing/assembly of mobile phones.

Jul 16, 2021

Riaz Haq

#China's Oppo to set up a dedicated assembly line in #Pakistan for Realme to produce #5G-enabled #smartphones and another for artificial intelligence (#AI) products at affordable rates. #Mobile #technology #Telecommunications #Internet #Broadband

https://tribune.com.pk/story/2311681/chinese-firm-to-launch-5g-phon...

Many smartphone companies have expressed their intention to begin production of mobile phones in Pakistan after cellular giant Samsung collaborated with the Lucky Group to produce high-quality phones in the country.

Now, the companies are making efforts to introduce 5G phones in the local market.

Chinese smartphone manufacturer Realme has shared plans to launch 5G-enabled phones in Pakistan at affordable prices after its parent announced the establishment of a local assembly line in the country.

Speaking to The Express Tribune, Realme Regional Marketing Director Sherry Dong said that the brand received an excellent reception in Pakistan, hence the company was now prioritising the country to introduce 5G mobile phones.

She added that the company was the first smartphone brand in Pakistan to sell over a million devices in less than a year, which was a significant milestone and paved the way for new investments and introduction of diverse products.

She announced that the company was planning to set up a local assembly line for its products after which top-notch technology would be available in Pakistan at affordable prices.

Read More: Why 5G is still out of Pakistan’s grasp

A few years ago, Realme’s parent company, Oppo Mobile Telecommunications Ltd, had expressed its interest in setting up a mobile assembly plant in Pakistan.

Giving further details, she said that the facility would have two separate assembly lines - one for each brand.

With a dedicated assembly line for Realme, the company will introduce 5G-enabled mobiles as well as other artificial intelligence (AI) products at affordable rates.

“5G is the future, therefore, we have to provide up-to-date technological products to Pakistani consumers at affordable prices,” she added.

The company utilises online marketplaces to promote its products because e-commerce has grown significantly in Pakistan due to the Covid-19 pandemic.

Keeping this in view, the management of the smartphone company has decided to introduce its own digital store in Pakistan’s online marketplace.

“We entered into partnerships with a couple of local companies to sell our products, but now we have decided to establish our own digital outlet in Pakistan,” she said.

Sherry added that digital platforms in Pakistan had matured over the past couple of years, but they still lagged behind regional countries.

She pointed out that the company faced some issues with Pakistan Customs as delay in release of shipments had caused shortage of its products.

Jul 22, 2021

Riaz Haq

Mobile Distributor Plans Pakistan’s Biggest Private Sector IPO

https://www.bloomberg.com/news/articles/2021-08-06/mobile-distribut...

Air Link Communication Ltd. plans to raise at least 5.85 billion rupees ($36 million) through an initial public offering this month, which would be the largest from a non-state firm in Pakistan.

The Lahore-based company plans to sell new and existing shares at a price between 65-91 rupees each, Chief Executive Officer Muzzaffar Hayat Piracha said in a reply to queries Friday. It will take investor orders on Aug. 30 and 31 and then price the offering.

Pakistan has seen a record streak of IPOs this year. Air Link, which started operations about a decade ago and has since become one of the largest distributors of phones in the country, saw sales rise 50% to 3.6 million units in year ended June.

The company plans to issue 60 million new shares and Piracha will sell 30 million from his holdings, said Kamran Nasir, CEO at JS Global Capital Ltd., consultant and bookrunner to the transaction. The IPO will be the largest since Interloop Ltd. raised about 5 billion rupees in 2019.

Air Link, which has also recently expanded into mobile assembling, plans to use the funds to expand its distribution network. It aims to have 150 outlets by 2026 from 14 currently, which will boost margins together with the assembly business, said Nasir.

The company expects its revenue to triple to 129 billion rupees and net income surging 500% to 9.2 billion rupees by fiscal 2025 from 2020, according to Nasir.

Aug 6, 2021

Riaz Haq

In what seems like an odd move for all involved, Pakistan's telecommunication regulator – the Pakistan Telecommunication Authority (PTA) – has announced approval for Lucky Motor Corporation (LMC) to manufacture Samsung mobile devices.

https://www.theregister.com/2021/08/11/in_pakistan_a_car_company/

The local automobile manufacturer is a joint venture between Lucky Group and South Korea's Kia Motors, and manufactures and distributes Kia cars built in a purpose-built plant in Karachi's Bin Qasim Industrial Park.

"The authorization to manufacture Samsung Mobile devices in Pakistan is a landmark achievement and will further revolutionize the vibrant mobile manufacturing ecosystem in the country by ensuring presence of major local and foreign players in the market," declared the regulator.

The PTA has issued similar Mobile Device Manufacturing (MDM) authorizations to 25 foreign and local companies to produce the tech in Pakistan. The devices will be both sold in the country as well as exported.

Samsung and Lucky inked the deal back in July. The production facility will be located at LMC's existing Karachi auto plant and is scheduled for completion by the end of 2021.

PTA tweeted, celebrating the job opportunity potential stemming from the new plant:

Samsung's decision to partner with an automobile manufacturer may seem unusual but, according to Pakistani brokerage and research firm Topline Securities, Samsung has form setting up factories in the region to serve domestic and export markets. In Bangladesh, for example, Samsung uses a local factory established in 2018 to produce 95 per cent of the 2.5 million mobile devices sold in-country.

Pakistani English-language daily The Express Tribune offers another reason the Lucky Group could be interested: the paper reported this week that an increase in prices for steel and other raw materials, plus shipping cost hikes, have caused a rise in vehicle prices even as COVID-repressed demand for cars was gradually rebounding.

The deal means Lucky Group has diversified into more affordable products, while Samsung has boosted local capacity, given local buyers a good reason to consider its wares, and diversified its manufacturing base.

Aug 11, 2021

Riaz Haq

Tweet from Almas Hyder, Chairman of Engineering Development Board (EDB):

Today 5500 units smart phones have been exporter from INOVI telecom to Middle East market. A good start for Pakistan.

https://twitter.com/AlmasHyder/status/1425828347238510593?s=20

Aug 12, 2021

Riaz Haq

#Pakistan begins #export of #smartphones . After authorisation from Pakistan #Telecom Authority (PTA), Inovi Telecom has exported 5,500 units of 4G smartphones carrying "manufactured in Pakistan" tag to the United Arab Emirates (#UAE). #electronics

https://tribune.com.pk/story/2315622/pakistan-begins-export-of-smar...

"PTA congratulates the company for this landmark achievement. This is the result of concerted efforts for the development of the mobile device manufacturing ecosystem in the country," the authority said in a statement issued on Saturday.

It said that the successful implementation of the Device Identification Registration and Blocking System (DIRBS) and enabling government policies including the mobile manufacturing policy have created a favourable environment for mobile device manufacturing in Pakistan.

"As a part of this policy, Inovi Telecom Pvt. Ltd was issued mobile manufacturing authorisation by PTA on 9th April 2021," it added.

Within four months, according to PTA, the company has managed to export "manufactured in Pakistan" phones.

In recent times, the telecom sector has emerged as a prominent contributor to Pakistan’s economy as its share in the national exchequer soared 129% in 2020 compared to 2019, despite economic pressure arising from Covid-19.

In July, Lucky Motor Corporation entered into an agreement with Samsung Gulf Electronics to produce Samsung mobile phones in Pakistan at its automobile plant at Port Qasim.

In comments to The Express Tribune, Tecno Pack Telecom CEO Aamir Allawala termed the joint venture excellent development for the country

Samsung was a mobile phone giant and its decision to assemble phones in Pakistan was an indication of the success of the Mobile Device Manufacturing Policy (MDMP) launched by the government in June 2020, said Allawala.

The vision of the policy was clear i.e. by 2022, 80% of all mobile phones sold in Pakistan should be locally manufactured, he said.

The brands already being manufactured in Pakistan included Tecno, Infinix, Itel, Vivo, Oppo and Realme while Nokia was in the process of setting up a plant and kick-starting operations in September 2021, Allahwala further said.

Aug 14, 2021

Riaz Haq

Samsung's building a TV assembly plant in #Pakistan to churn out 50,000 units yearly. Samsung Electronics is also establishing a new #smartphone #manufacturing line in the country.- SamMobile

https://www.sammobile.com/news/samsung-building-tv-plant-pakistan-c...

Samsung Electronics is building a new TV manufacturing plant in Pakistan. The project will be finalized in collaboration with R&R Industries, and the factory is scheduled to become functional in the final quarter of the year. The news was confirmed via Twitter by the Advisor to the Prime Minister of Pakistan, Abdul Razak Dawood.

According to the news, the building of Samsung’s new TV manufacturing plant was made possible in part by the Made-in-Pakistan policy, which provides incentives to bolster the domestic manufacturing industry.

Through its new TV factory in Pakistan, Samsung will be able to produce roughly 50,000 units every year, though it’s not clear what TV models will be made there, exactly.

Samsung will also build phones in Pakistan

Aside from the new TV manufacturing plant built in collaboration with R&R Industries, Samsung Electronics is also establishing a new mobile phone manufacturing line in the country.

This was announced by Lucky Motor Corporation a couple of months ago, the latter of which will repurpose its automotive plant at Port Qasim to assemble Samsung mobile devices. By 2022, 80% of all mobile phones sold in Pakistan could be manufactured locally, though not exclusively at the Port Qasim assembly plant.

Sep 28, 2021

Riaz Haq

OPPO #Pakistan targets 5mln #mobilephone exports. The #Chinese company has plans to upgrade its assembly plant to a #manufacturing plant in Pakistan with a target to make 5 million mobile phones per annum. #smartphone

https://www.thenews.com.pk/print/896336-oppo-pakistan-targets-5mln-...

OPPO Pakistan has plans to upgrade its assembly plant to a manufacturing plant in Pakistan with a target to make 5 million mobile phones per annum.

OPPO Pakistan CEO George Long made the announcement during his meeting with Federal Minister for Industries and Production Makhdum Khusro Bakhtyar at his office on Wednesday.

Highlighting that the company also aimed to establish a research and development centre for transfer of technology and skill development of IT professionals in Pakistan, Long said OPPO was optimistic about exporting locally manufactured sets from the country.

Welcoming the announcement, the minister said that the government of Pakistan’s investment-friendly policies have improved the business ecosystem in Pakistan.

He said that local manufacturing of mobile would not only keep prices under control for local customers, but would also enable expansion of the mobile phone industry to become a bigger player in the economy. Bakhtyar said that this growth would result in the creation of numerous employment opportunities within the industry as well as associated industries in the country.

Earlier this month, the Pakistan Telecommunication Authority (PTA) had floated the draft ‘Mobile Device Manufacturing Regulations and Authorisation’ for the promotion of domestic manufacturing of mobile phones.

Oct 17, 2021

Riaz Haq

Chinese smartphone giant Xiaomi to set up local manufacturing plant in Pakistan

Dawood says initial production of Xiaomi will be around 3 million handsets per annum

https://tribune.com.pk/story/2327553/smartphone-giant-to-set-up-loc...

KARACHI:

One of the world’s largest mobile manufacturers will set up a handset manufacturing plant in Pakistan, announced Adviser to Prime Minister on Commerce and Investment Abdul Razak Dawood.

On his official Twitter handle on Tuesday, he cherished that the Make in Pakistan was bearing fruits as Xiaomi had partnered up with Airlink Communications to manufacture smartphones in Pakistan.

The production facility would be established at Quaid-e-Azam Industrial Estate, Lahore, he said adding that 2.5 to 3 million handsets will be produced per year.

“The production facility will become functional in January 2022 and it will create 3,000 direct and indirect jobs,” he remarked.

In comments to The Express Tribune, Tecno Pack Electronics Chief Executive Officer (CEO) Aamir Allawala said that Pakistan was among the top 10 handset markets in the world.

He cherished that Mobile Device Manufacturing Policy 2020 had begun bearing fruits.

Allawala highlighted that investment of global mobile brands in local manufacturing was nearly nil until June 2020 despite a huge domestic market.

Until that period, the duties and taxes on completely built units (CBU) mobile phones were kept low – at the same level as their parts and components, he added.

In July 2020, the government created a reasonable differential in duties and taxes between CBU and completely knocked down (CKD)/ semi-knocked down (SKD) mobile phones under the mobile device manufacturing policy, he said.

This encouraged almost all foreign brands to start local assembly of mobile phones with a plan of indigenisation of its parts, he added.

“Currently, Tecno, Infinix, Itel, Oppo, Vivo, Realme and Nokia are producing smartphones in Pakistan,” Allawala said, adding that Samsung would begin production from December 2021 and Xiaomi from early 2022.

“By January 2022, 90% of all mobile phones sold in Pakistan will be made in the country,” he said.

The next step will be localisation of parts and boost in smartphone exports and all companies are making efforts in this regard, he added.

Talking to The Express Tribune, information and communications technology (ICT) expert Parvez Iftikhar termed Dawood’s announcement great development provided that manufacturer sticks to smartphones only.

It would not only provide jobs and other benefits to the economy but also help in increasing 4G penetration in the country, which is a pre-requisite for 5G, he added.

“It is time to not just celebrate but also to build upon it and increase our bandwidth in terms of exports, local infrastructure, policy making as well as setting a vision,” according to SI Global CEO Noman Ahmed Said.

He emphasised the need to work towards meeting and matching international standards and inculcate that skill at the collegiate level for youth engagement.

The net smartphone sales were around 1.3 million this year, which indicated the booming market share that we were currently heading towards, granting more employment opportunities as well, he added.

Nov 6, 2021

Riaz Haq

#Samsung starts producing mobile phones in Pakistan. #Pakistan imported #smartphones worth $644.673m in first 4 months (July-October) of 2021, up from $557.961m during the same period of last year, registering a growth of 15.54%. - DAWN.COM

https://www.dawn.com/news/1661220

KARACHI: One of the world’s largest manufacturers of mobile phones, Samsung, has finally started production in Pakistan, lifting hopes of the authorities and the industry that this would cut down the import bill of the country in the months to come.

The development came to light on Tuesday at a meeting of the company’s top managers with the Senators who visited the production site in line with the plan to receive a briefing on the growing new sector and challenges ahead for the cellphones manufacturing industry in Pakistan.

“We were informed that Samsung has formally started its production,” Faisal Subzwari, chairman of the Senate’s Standing Committee on Industries and Production, told Dawn.

He headed a delegation of members of the Senate panel which visited Samsung’s production unit and an auto manufacturing plant, and held a meeting with the management of Export Processing Zone.

The company aims to manufacture around 3m handsets every year

“It’s really good to know that the company has started production within a short span of four months,” Mr Subzwari said. “We visited the production facility which was designed on modern lines and obviously the local manpower, support of local industry and conducive environment provided by the government led to such achievement. But still I believe that we need to move forward from just growing in the assembling area to localisation of the industry.”

The country has witnessed robust growth in local production of cellular phones. During the first 10 months of this year, the Pakistan Telecommunication Authority (PTA) data says, the production of mobile phones by local manufacturing plants has almost doubled to 18.87 million against the import of mobile phones which stood at 45m.

However, despite the increase in local production of mobile phones, the import remained on a higher side. The PTA data says that mobile phones worth $644.673m were imported during the first four months (July-October) of 2021 compared to $557.961m during the same period of last year, registering a growth of 15.54 per cent.

The industry believes that it may take time to achieve the desired results but with the fresh start in an absolutely new industrial avenue, things have finally started moving in the right direction.

“With production of around 250,000 to 300,000, we aim to produce around 3m cellphones every year,” Mohammad Ali Tabba, chief of the Lucky Group which partners with Samsung to produce cellphones in Pakistan, told Dawn. “The whole production line is manual with no robotic assistance. So you can imagine how much workforce is required offering employment in this absolutely new area of engineering in Pakistan.”

He agreed that the country needed to move towards localisation from its current status of assembling industry and believed it was more the role of the industrial sector than the government to go for modification and compatibility.

“It’s not only the local production of cellphones but also a host of opportunities which it brings. From employment to investment and from export opportunities to local capacity building, it carries immense potential,” said Mr Tabba.

Dec 1, 2021

Riaz Haq

Samsung TV plant begins production in Karachi

https://www.dawn.com/news/1662359

ISLAMABAD: South Korean technology giant Samsung Electronics has operationalised its first TV line-up plant in collaboration with a local firm in Karachi, Commerce Adviser Razak Dawood announced on Monday.

Taking to Twitter, Mr Dawood shared photos of the facility and tweeted: “We congratulate Samsung Electronics on operationalising its first TV Line-up plant in Pakistan at Karachi in collaboration with R&R Industries. Initially, the unit will produce 50,000 TV sets and increase the capacity to 100,000 units within 2 years.”

South Korean technology giant Samsung Electronics has operationalised its first TV line-up plant in collaboration with a local firm in Karachi, Commerce Adviser Razak Dawood announced on Monday.

Taking to Twitter, Mr Dawood shared photos of the facility and tweeted: “We congratulate Samsung Electronics on operationalising its first TV Line-up plant in Pakistan at Karachi in collaboration with R&R Industries. Initially, the unit will produce 50,000 TV sets and increase the capacity to 100,000 units within 2 years.”

Mr Dawood said the collaboration was in line with Make-in-Pakistan policy of the Ministry of Commerce. “I urge all our firms to partner up with leading international companies to set up units in Pakistan,” the adviser further tweeted.

R&R Industries Pvt Ltd had signed an agreement with Samsung to set up a plant in Karachi’s Korangi Industrial Area. The construction and fabrication of the factory has already been completed.

The local partner company believes the collaboration will create more than 700 jobs in Pakistan due to the vast nature of this project.

It is expected that the business revenue of the project will be approximately touch Rs5 billion per annum and an annual target of producing 50,000 TV units.

Samsung Electronics, founded in 1969, quickly became a major manufacturer in the Korean market. This soon expanded to Samsung becoming a leading global brand and has been one of the world’s leading manufacturer of televisions for the last 15 years.

It is also worth mentioning that Lucky Motor Corporation (LMC), a subsidiary of Lucky Cement Ltd announced, in July that it has entered into an agreement with Samsung Gulf Electronics Co., FZE (Samsung) for the production of Samsung-branded mobile devices in Pakistan. The production facility will be located at LMC’s existing plant which is expected to be completed by end December.

Dec 7, 2021

Riaz Haq

#Pakistan plans to export #smartphones in 2022. Pak produced 22.12 million handsets during January-November 2021 and imported 9.95 million. The country's #Mobile Device #Manufacturing Policy 2020 set a 49% localization target by June 2023. #economy https://tribune.com.pk/story/2337404/pakistan-eyeing-to-boost-cell-...

Adviser to the Prime Minister on Commerce and Investment Abdul Razak Dawood on Wednesday said that after achieving “big success” in the manufacturing of mobile phones last year, Pakistan was now seeking expansion into exports.

Pakistan, a net importer of mobile phones prior to 2016, produced 22.12 million handsets during January-November 2021 and imported 9.95 million during the same period, data from the Pakistan Telecommunication Authority (PTA) shows.

In 2020, Pakistan’s import of mobile phones was 24.51 million compared to 13.05 million sets produced locally.

Various Chinese mobile phone manufacturers have played a key role in Pakistan’s production boom in 2021, according to the PTA.

Local manufacturing plants assembled 9.03 million smartphones while the number of 2G mobile phones was 13.09 million.

“I would say that our whole venture into manufacturing mobile phones has been a big success,” Dawood said in an interview with Arab News on Wednesday.

“It has been very successful because we now see that every month the number of mobile phones coming into the country is decreasing and the numbers that are being produced and sold locally is increasing.”

The PM’s aide said the record levels of local manufacturing were achieved under a new “conducive policy” introduced by the current government.

The Mobile Device Manufacturing Policy 2020 set a 49 per cent localization target by June 2023, including 10 per cent localization of parts of the motherboard and 10 per cent localization of batteries.

“We have developed a policy for local assembling of mobile phones … We are currently looking at becoming a world-class assembler of mobile phones,” Dawood said.

“We are right now concentrating on low-end mobile phone sets and we hope that soon we will be able to start getting into high-end phones with world-class companies.”

Jan 6, 2022

Riaz Haq

#Pakistan businessman hints at #iPhone plant in the country. Local #manufacturing could reduce import tariffs to make its best iPhones more affordable and accessible in the country. #Apple saves around 22% on import duties by making its phones in #India https://www.imore.com/pakistan-business-leader-hints-iphone-plant-c...

Pakistan business leader Javed Afridi says he is in talks with Apple to bring an iPhone assembly plant to the country.

Afridi made the revelation on Twitter in response to a question from journalist Shiffa Yousafzai:

Afridi is best known as the owner of Pakistan's MG JW Automobile, and the CEO of Haier & Ruba. He is also the chairman and owner of Pakistani T20 cricket franchise Peshawar Zalmi. Haier is a leading Pakistani supplier of home appliances and tech including laptops and LED TVs.

The murmurings could be reminiscent of a similar deal Apple did in India in order to onshore iPhone assembly in the country there. Like India, iPhones and other Apple products sold in Pakistan are subject to high import tariffs if they aren't made locally, driving up the price.

If Apple was able to set up some form of manufacturing it could reduce the impact of these tariffs to make its best iPhones more affordable and accessible in the country. Apple saves around 22% on import duties by making its phones in India instead of importing them. It would also help Apple reduce its reliance on its supply chain in China, a weakness highlighted by the pandemic which saw heavy disruption to supply in the early part of 2020. Like India, Apple could also consider using phones made in Pakistan for export as well as the local market.

Apple announced its new iPhone SE earlier this week, featuring 5G and the A15 chip from the iPhone 13, a great budget option at just $429.

Mar 12, 2022

Riaz Haq

It’s an era of mobile phone and telecom technologies. With its ever-increasing demand, the mobile phone has already become a basic need for almost every person. Especially, after the COVID-19 pandemic, when the lockdown was imposed and the most convenient way to connect with others or perform our daily tasks was through the mobile phones, the demand for this gadget and related applications reached its maximum level. During the pandemic, the overall data usage also increased which in return, helped the telecom companies to gather more revenue hence contributing to the positive growth of the IT and telecom sector.

https://www.phoneworld.com.pk/from-global-to-local-what-mobile-manu...

Pakistan itself has seen tremendous growth in the IT and telecom sectors over the past few years. No doubt, the inception of 3G/4G services in Pakistan has opened new avenues of growth and innovation in the country. With 191 million cellular subscribers, teledensity has reached 86.71% whereas, 3G/4G penetration stands at 49.94%. . According to the Pakistan Bureau of Statistics (PBS), Pakistan’s mobile imports witnessed an increase of 7.63 per cent in the first eight months from (July-February) the current fiscal year by reaching the value of $1311.493 million to $1,411.619 million.

So far, the establishment of local manufacturing plants has brought an investment of over $126 million to the country

To boost the telecom sector, the Government approved the local mobile phone manufacturing policy back in 2020. Pakistan Telecommunication Authority (PTA) in light of the policy issued Mobile Device Manufacturing (MDM) Regulations on January 28, 2021.