PakAlumni Worldwide: The Global Social Network

India lost 6.8 million salaried jobs and 3.5 million entrepreneurs in November alone. Many among the unemployed can no longer afford to buy food, causing a significant spike in hunger. The country's economy is finding it hard to recover from COVID waves and lockdowns, according to data from multiple sources. At the same time, the Indian government has reported an 8.4% jump in economic growth in the July-to-September period compared with a contraction of 7.4% for the same period a year earlier. This raises the following questions: Has India had jobless growth? Or its GDP figures are fudged? If the Indian economy fails to deliver for the common man, will Prime Minister Narendra Modi step up his anti-Pakistan and anti-Muslim rhetoric to maintain his popularity among Hindus?

|

| Labor Participation Rate in India. Source: CMIE |

Unemployment Crisis:

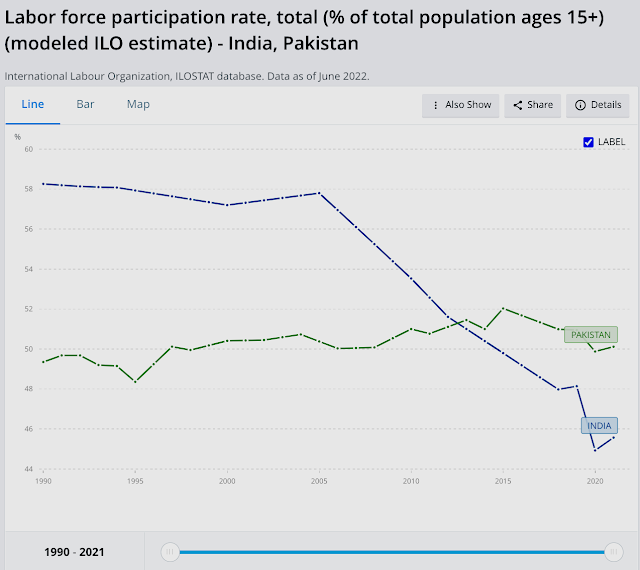

India lost 6.8 million salaried jobs and its labor participation rate (LPR) slipped from 40.41% to 40.15% in November, 2021, according to the Center for Monitoring Indian Economy (CMIE). In addition to the loss of salaried jobs, the number of entrepreneurs in India declined by 3.5 million. India's labor participation rate of 40.15% is lower than Pakistan's 48%. Here's an except of the latest CMIE report:

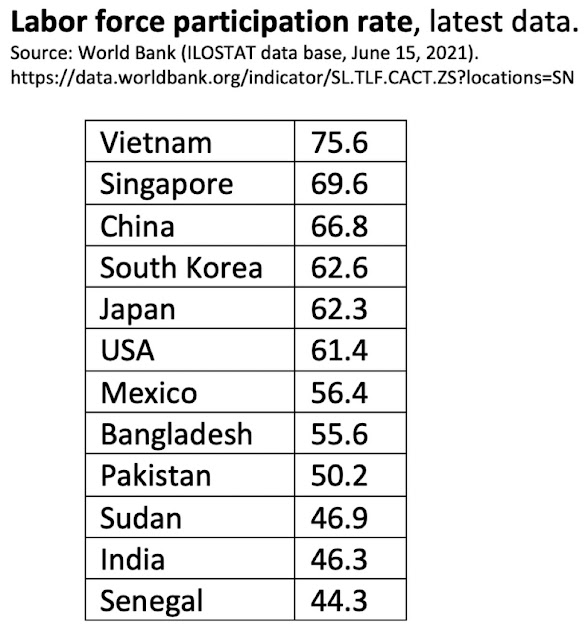

"India’s LPR is much lower than global levels. According to the World Bank, the modelled ILO estimate for the world in 2020 was 58.6 per cent (https://data.worldbank.org/indicator/SL.TLF.CACT.ZS). The same model places India’s LPR at 46 per cent. India is a large country and its low LPR drags down the world LPR as well. Implicitly, most other countries have a much higher LPR than the world average. According to the World Bank’s modelled ILO estimates, there are only 17 countries worse than India on LPR. Most of these are middle-eastern countries. These are countries such as Jordan, Yemen, Algeria, Iraq, Iran, Egypt, Syria, Senegal and Lebanon. Some of these countries are oil-rich and others are unfortunately mired in civil strife. India neither has the privileges of oil-rich countries nor the civil disturbances that could keep the LPR low. Yet, it suffers an LPR that is as low as seen in these countries".

|

| Labor Participation Rates in India and Pakistan. Source: World Bank/ILO |

|

| Labor Participation Rates for Selected Nations. Source: World Bank/ILO |

Youth unemployment for ages15-24 in India is 24.9%, the highest in South Asia region. It is 14.8% in Bangladesh 14.8% and 9.2% in Pakistan, according to the International Labor Organization and the World Bank.

|

| Youth Unemployment in Bangladesh, India and Pakistan. Source: ILO, WB |

In spite of the headline GDP growth figures highlighted by the Indian and world media, the fact is that it has been jobless growth. The labor participation rate (LPR) in India has been falling for more than a decade. The LPR in India has been below Pakistan's for several years, according to the International Labor Organization (ILO).

|

| Indian GDP Sectoral Contribution Trend. Source: Ashoka Mody |

|

| Indian Employment Trends By Sector. Source: CMIE Via Business Standard |

|

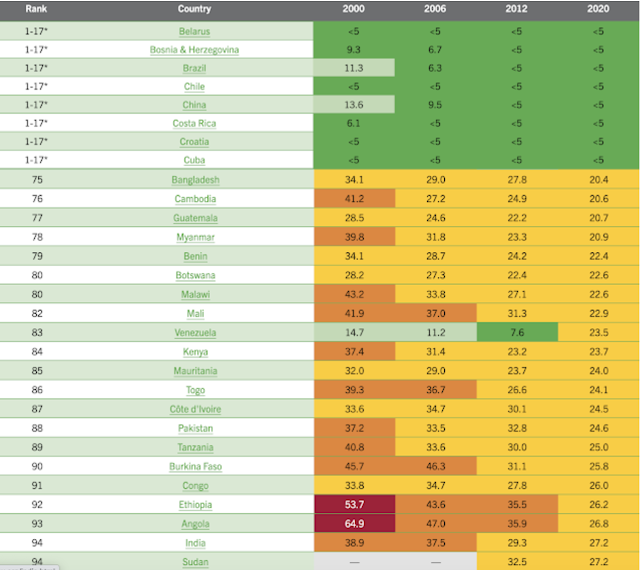

| World Hunger Rankings 2020. Source: World Hunger Index Report |

Hunger and malnutrition are worsening in parts of sub-Saharan Africa and South Asia because of the coronavirus pandemic, especially in low-income communities or those already stricken by continued conflict.

India has performed particularly poorly because of one of the world's strictest lockdowns imposed by Prime Minister Modi to contain the spread of the virus.

Hanke Annual Misery Index:

Pakistan's Real GDP:

Vehicles and home appliance ownership data analyzed by Dr. Jawaid Abdul Ghani of Karachi School of Business Leadership suggests that the officially reported GDP significantly understates Pakistan's actual GDP. Indeed, many economists believe that Pakistan’s economy is at least double the size that is officially reported in the government's Economic Surveys. The GDP has not been rebased in more than a decade. It was last rebased in 2005-6 while India’s was rebased in 2011 and Bangladesh’s in 2013. Just rebasing the Pakistani economy will result in at least 50% increase in official GDP. A research paper by economists Ali Kemal and Ahmad Waqar Qasim of PIDE (Pakistan Institute of Development Economics) estimated in 2012 that the Pakistani economy’s size then was around $400 billion. All they did was look at the consumption data to reach their conclusion. They used the data reported in regular PSLM (Pakistan Social and Living Standard Measurements) surveys on actual living standards. They found that a huge chunk of the country's economy is undocumented.

Pakistan's service sector which contributes more than 50% of the country's GDP is mostly cash-based and least documented. There is a lot of currency in circulation. According to the State Bank of Pakistan (SBP), the currency in circulation has increased to Rs. 7.4 trillion by the end of the financial year 2020-21, up from Rs 6.7 trillion in the last financial year, a double-digit growth of 10.4% year-on-year. Currency in circulation (CIC), as percent of M2 money supply and currency-to-deposit ratio, has been increasing over the last few years. The CIC/M2 ratio is now close to 30%. The average CIC/M2 ratio in FY18-21 was measured at 28%, up from 22% in FY10-15. This 1.2 trillion rupee increase could have generated undocumented GDP of Rs 3.1 trillion at the historic velocity of 2.6, according to a report in The Business Recorder. In comparison to Bangladesh (CIC/M2 at 13%), Pakistan’s cash economy is double the size. Even a casual observer can see that the living standards in Pakistan are higher than those in Bangladesh and India.

Related Links:

Haq's Musings

South Asia Investor Review

Pakistan Among World's Largest Food Producers

Food in Pakistan 2nd Cheapest in the World

Indian Economy Grew Just 0.2% Annually in Last Two Years

Pakistan to Become World's 6th Largest Cement Producer by 2030

Pakistan's 2012 GDP Estimated at $401 Billion

Pakistan's Computer Services Exports Jump 26% Amid COVID19 Lockdown

Coronavirus, Lives and Livelihoods in Pakistan

Vast Majority of Pakistanis Support Imran Khan's Handling of Covid19 Crisis

Pakistani-American Woman Featured in Netflix Documentary "Pandemic"

Incomes of Poorest Pakistanis Growing Faster Than Their Richest Counterparts

Can Pakistan Effectively Respond to Coronavirus Outbreak?

How Grim is Pakistan's Social Sector Progress?

Pakistan Fares Marginally Better Than India On Disease Burdens

Trump Picks Muslim-American to Lead Vaccine Effort

COVID Lockdown Decimates India's Middle Class

Pakistan Child Health Indicators

Pakistan's Balance of Payments Crisis

How Has India Built Large Forex Reserves Despite Perennial Trade Deficits

Conspiracy Theories About Pakistan Elections"

PTI Triumphs Over Corrupt Dynastic Political Parties

Strikingly Similar Narratives of Donald Trump and Nawaz Sharif

Nawaz Sharif's Report Card

Riaz Haq's Youtube Channel

Riaz Haq

#India's emerging twin #deficit problem: Rising fiscal deficit & growing trade deficit. If unchecked, both deficits could cause a serious #economic crisis, including Balance of Payments crisis. #poverty #unemployment #hunger #Modi #BJP https://indianexpress.com/article/explained/everyday-explainers/ind... via @IndianExpress

In its latest ‘Monthly Economic Review’, the Ministry of Finance has painted an overall optimistic picture of the state of the domestic economy. “The World is looking at a distinct possibility of widespread stagflation. India, however, is at low risk of stagflation, owing to its prudent stabilization policies,” it states.

The economic growth outlook is likely to be affected by several factors owing to the trade disruptions, export bans and the resulting surge in global commodity prices —all of which will continue to stoke inflation — as long as the Russia-Ukraine conflict persists and global supply chains remain unrepaired. “However, the momentum of economic activities sustained in the first two months of the current financial year augurs well for India continuing to be the quickest growing economy among major countries in 2022-23,” states the Finance Ministry report.

But, given the uncertainties, the report highlights two key areas of concern for the Indian economy: the fiscal deficit and the current account deficit (or CAD).

The report states that “as government revenues take a hit following cuts in excise duties on diesel and petrol, an upside risk to the budgeted level of gross fiscal deficit has emerged”.

The fiscal deficit is essentially the amount of money that the government has to borrow in any year to fill the gap between its expenditures and revenues. Higher levels of fiscal deficit typically imply the government eats into the pool of investible funds in the market which could have been used by the private sector for its own investment needs. At a time when the government is trying its best to kick-start and sustain a private sector investment cycle, borrowing more than what it budgeted will be counter-productive.

The report underscores the need to trim revenue expenditure (or the money government spends just to meet its daily needs). “Rationalizing non-capex expenditure has thus become critical, not only for protecting growth supportive capex but also for avoiding fiscal slippages,” it states. “Capex” or capital expenditure essentially refers to money spent towards creating productive assets such as roads, buildings, ports etc. Capex has a much bigger multiplier effect on the overall GDP growth than revenue expenditure.

Current account deficit

The current account essentially refers to two specific sub-parts:

* Import and Export of goods — this is the “trade account”.

* Import and export of services — this is called the “invisibles account”.

If a country imports more goods (everything from cars to phones to machinery to food grains etc) than it exports, it is said to have a trade account deficit. A deficit implies that more money is going out of the country than coming in via the trade of physical goods. Similarly, the same country could be earning a surplus on the invisibles account — that is, it could be exporting more services than importing.

If, however, the net effect of a trade account and the invisibles account is a deficit, then it is called a current account deficit or CAD. A widening CAD tends to weaken the domestic currency because a CAD implies more dollars (or foreign currencies) are being demanded than rupees.

The Ministry’s worry is that costlier imports such as crude oil and other commodities will not only widen the CAD but also put downward pressure on the rupee. A weaker rupee will, in turn, make future imports costlier. There is one more reason why the rupee may weaken. If, in response to higher interest rates in the western economies especially the US, foreign portfolio investors (FPI) continue to pull out money from the Indian markets, that too will hurt the rupee and further increase CAD.

Jun 22, 2022

Riaz Haq

#Indian Stock market in bear territory. Its value is already down nearly 20% from its January peak of about $3.7 trillion. Foreign investors have been selling Indian stocks at a record pace, withdrawing about $32 billion since September 2021. #Modi #BJP https://www.business-standard.com/article/markets/three-charts-show...

As surging inflation and the end of global easy-money policies send Indian stocks spiraling down from all-time highs, three charts show the pain is unlikely to end anytime soon.

The S&P BSE Sensex Index has fallen more than 15% from its October high, nearing the 20% loss that denotes a bear market. The selloff comes as climbing costs and a record plunge in the rupee have forced the nation’s central bank to join global peers in raising interest rates.

The Indian stock market’s value is already down nearly 20% from its January peak of about $3.7 trillion dollars. The unsupportive economic backdrop combined with an unprecedented exodus of foreign investors and earnings estimates that appear poised to tumble cloud the outlook for a rebound.

“We expect the markets to further correct from here,” said Benaifer Malandkar, chief investment officer at Raay Global Investments Pvt. “Expectation is that by the second quarter, most negative news, the outcome of the Fed’s actions will get priced in.”

Foreigner Flight

Overseas investors have been selling Indian stocks at a record pace, withdrawing about $32 billion from the market since September. The retreat of foreigners is part of a wave hitting nations including South Korea and Taiwan as well.

“India is not in isolation since it’s part of the emerging market basket, and clearly the EMs are out of favor,” said Raay Global’s Malandkar. “Until the US Fed rate is at its peak, we will see redemptions happening across EMs.”

Rosy Estimates

The drop in Indian equities has mainly been caused by valuation contraction so far. Earnings estimates for the NSE Nifty 50 Index are yet to clock a meaningful decline like that seen in MSCI Inc.’s broadest measure for Asian equities.

Over the past few weeks, strategists at Sanford C. Bernstein Ltd., Bank of America Corp. and JPMorgan Chase & Co. have expressed concerns about the earnings optimism that has surrounded India. Pending any rebound in valuations, estimate cuts are likely to pull stocks down further.

Suffering Small-Caps

Smaller stocks have been hit harder by investor risk aversion, with gauges of small and mid-cap Indian shares having already entered bear markets. Market breadth has weakened, with just 16% of S&P BSE 500 Index stocks trading above their 200-day average level, the lowest level in two years.

Jun 23, 2022

Riaz Haq

Explained: What FPIs’ market exit means

Foreign portfolio investors have pulled out Rs 42,000 crore this month amid rising inflation and monetary policy tightening in the US. How does this impact the market and the rupee, and what should you do?

https://indianexpress.com/article/explained/fpi-exit-stock-market-g...

Sustained capital outflows from the capital market have unnerved the stock markets and led to a weakening of the rupee amid rising inflation across the globe. With the US Federal Reserve set to hike rates further, outflows are likely to continue, putting pressure on the Indian currency.

---------------

Aggressive rate hike by the US Federal Reserve, coupled with elevated inflation and high valuation of equities continued to keep foreign investors at bay from the Indian stock market as they pulled out Rs 31,430 crore in this month so far. With this, net outflow by Foreign Portfolio Investors (FPIs) from equities reached Rs 1.98 lakh crore so far in 2022, data with depositories showed. Going forward, FPI flows to remain volatile in the emerging markets on account of rising geopolitical risk, rising inflation, tightening of monetary policy by central banks, among others, Shrikant Chouhan, Head - Equity Research (Retail), Kotak Securities, said. According to the data, foreign investors withdrew a net amount of Rs 31,430 crore from equities in the month of June (till 17th).

http://www.millenniumpost.in/business/fpis-withdraw-rs-31430-crore-...

The massive selling by FPIs continued in June too as they have been incessantly withdrawing money from Indian equities since October 2021. Shrikant attributed latest selling to rising inflation, tight monetary policy by global central banks and elevated crude oil prices. Global investors are reacting to increased risks of a global recession as the US Federal Reserve was forced to raise interest rates by 75 basis points due to persistently elevated inflation. Moreover, it also indicated to continue its aggressive stance to contain stubbornly high inflation. "Strengthening of the dollar and rising bond yields in US are the major triggers for FPI selling. Since the Fed and other central banks like Bank of England and Swiss central bank have raised rates, there is synchronised rate hikes globally, with rising yields. Money is moving from equity to bonds," V K Vijayakumar, Cheif Investment Strategist at Geojit Financial Services, said.

On the domestic side as well, inflation has been a cause for concern, and to tame that, RBI has also been increasing rates

Jun 24, 2022

Riaz Haq

#Indian startups laid off over 10,000 #employees in the first 6 months of 2022. At least 27 startups fired workers across #India. As investors put pressure on #startups in India to cut costs, employees are collateral damage. #Ola #Blinkit #Modi #BJP https://qz.com/india/2181236/ola-blinkit-and-others-laid-off-10000-...

In a widely-circulated 2020 memo, marquee investor Sequoia had warned portfolio companies to keep their staffing levels sustainable. US-based startup accelerator, Y Combinator, also asked founders of its portfolio companies to “plan for the worst.”

The startups, though, seem to have botched it up. They have mostly cited cost-cutting and extended cash runways as reasons for slashing headcount. Macroeconomic uncertainties surely didn’t help.

“War in Europe, impending recession fears, and Fed rate hikes have led to inflationary pressures with massive correction in stocks globally and in India as well,” Vamsi Krishna, CEO of e-learning platform Vedantu, wrote in a May 18 blogpost. “Given this environment, capital will be scarce for upcoming quarters.”

There are myriad other ways to curb spending—a hiring freeze, curtailed marketing, saving on real estate—but laying off is evidently quick and easy. This is particularly so at tech startups which typically tend to over-hire while business is brisk.

Worryingly, the correction is far from over. Experts estimate that the layoff count will rise to 60,000 in the next six-to-nine months.

Jun 24, 2022

Riaz Haq

India’s Fintech Reckoning Arrives

Regulators are cracking down on financial technology firms—many backed by foreign capital—that were flourishing in the gray areas

https://www.wsj.com/articles/indias-fintech-reckoning-arrives-11655...

After a period of unbridled growth, India’s fintech industry faces a regulatory reckoning.

Things may not get as bad as they did in India’s rival China—but investors should still proceed with extreme caution until the dust settles.

On Monday, India’s central bank banned the loading of so-called prepaid payment instruments (PPIs)—essentially prepaid purchasing cards—using credit lines, jeopardizing several fintech buy-now-pay-later business models. Players such as Slice and Uni Cards—which are funded by Tiger Global, Accel, General Catalyst and Insight Partners—are likely to be affected.

Fintech players have issued hundreds of thousands of such cards with the aid of PPI licenses, and then loaded them using credit lines from banks and nonbanking financial institutions, according to brokerage Macquarie. These new-age credit cards—essentially a way to make an end run around strict credit card regulations—were targeted toward younger Indians, many of whom don’t have a long credit history.

Monday’s move indicates that the Reserve Bank of India is solidly against such a rent-a-license model where fintech startups tie up with banks and nonbanking financial institutions to sell products—a common practice in India.

In the past 18 months, the country’s financial technology sector—which has become systemically important to India—has absorbed about $14 billion of investment capital, according to data shared by Tracxn. The top global venture-capital firms have exposure—including Sequoia Capital, Y Combinator, AngelList, Accel and LetsVenture.

The RBI has in fact been advocating for tighter regulations for months: Earlier in 2022 it said it had formed a new fintech department. Monday’s circular is probably the beginning of a wider crackdown on fintech. And protecting vulnerable borrowers at a time of high inflation, tight liquidity and slowing growth is high on the RBI’s agenda. Companies in good standing with the regulator will likely emerge in better shape.

In the coming months, the Bank will likely introduce formal rules for India’s loosely regulated digital-lending ecosystem, including collection practices, data privacy, disclosures and capital-adequacy requirements. Fintech lending companies doubled disbursements in the financial year ending in March 2022 to a total of $2.3 billion, according to a report by the Fintech Association for Consumer Empowerment (FACE). Needless to say, all this will probably weigh on profitability.

Amid India’s tech IPO boom, shares of India’s top fintech company Paytm continue to languish. This is due not only to the lack of a sustainable and profitable business model but also to the RBI’s scrutiny. Several of Paytm’s peers will now appear likely to face much more scrutiny, too.

As investors in Chinese fintech recently discovered, once your industry gets on the bad side of regulators—even if a given company isn’t an initial target—things can go downhill fast. Investors would be wise to steer clear of any Indian fintech firms which have been bending the rules until there is more clarity on how far this crackdown will run.

Jun 25, 2022

Riaz Haq

India Can’t Be a Superpower If It Can’t Create Jobs

The country’s military can serve as a tool to project power or a scheme to generate employment, but it’s going to be very difficult to do both.

https://www.bloomberg.com/opinion/articles/2022-06-30/modi-s-attemp...

India’s attempt to reform military recruitment — which has set off political convulsions that show no signs of abating — once again shows that its aspirations to superpower status are no match for a below-par economy.

India’s military — particularly its army — is antiquated in organization and manpower-heavy. After some ill-advised, populist and expensive tinkering with pensions early in its tenure, the government found it was spending all its military budget on personnel, leaving very little for modernization or for hardware.

Meanwhile, for more than two decades, its own strategists have been calling for a leaner and younger army. The average Indian soldier is 32 or 33, making its army one of the oldest in the world.

And so, after two years in which the army suspended its typical annual enlistment of 60,000 young men on 20-year contracts, the government announced it was shifting to a tour-of-duty type system in which new recruits will be taken on for four years and then sent off with a handsome and tax-free discharge bonus of $15,000.

This has set off a firestorm of protest. Literally, in some cases, as angry would-be army recruits set trains — a very visible symbol of the central government even the most remote parts of India — alight.

The problem is that, for many young men in the most economically disadvantaged parts of India, the army is their only hope of a career ‑ or, for that matter, of getting married, given that years of sex-selective abortions have caused the gender ratio in those parts of India to skew heavily male. These men — or boys, since they’re mostly teenagers — have spent years running and practicing drills in hopes of getting selected.

Before the new recruitment system was announced, a typical applicant told a reporter for the Print: “If I don’t get a job in the army, my chances of living with dignity in my society are very low. My chances of marrying go down. People will mock me at every function.” Those who do return to their villages after their 20 years of service, on the other hand, tend to be respected and wind up in positions of local leadership.

It’s telling that the protests, and the anger, have largely been limited to the poorest parts of India, where other employment opportunities are scarce. The government has tried to emphasize the $15,000 payout the four-year men will receive and claimed that army training will make them more attractive on the job market. That argument holds less sway in areas where there’s little prospect of finding a good job today or four years from now.

The government has done itself no favors by obscuring its real motivations. Everyone knows this is about reducing the amount the military spends on salaries and creating an army that is younger and more agile technologically. At the same time, the government won’t reveal its plans for military transformation. Forget about detailing how much money the program would save; we don’t even know for certain how many people are currently employed by India’s military. For some reason, that’s treated as a state secret. (It’s estimated to be around 1.4 million, about half as many again as in China.)

Indian Prime Minister Narendra Modi is generally credited with having an instinctive understanding of what voters want. Yet it’s astounding how often his government designs policies in secret that then elicit a furious public reaction. While military reform was inevitable and overdue, surely it could have been discussed in public so that at least the current generation of aspirants would have known better than to run kilometers a day to get themselves in shape.

Jul 1, 2022

Riaz Haq

India Can’t Be a Superpower If It Can’t Create Jobs

The country’s military can serve as a tool to project power or a scheme to generate employment, but it’s going to be very difficult to do both.

https://www.bloomberg.com/opinion/articles/2022-06-30/modi-s-attemp...

As with farmer-led protests last year, there’s a chance the government will be forced to retreat in the face of this unwavering hostility in areas that remain politically powerful, if economically weak.

A reversal would carry its own costs, however. In an aspiring superpower the military should be an instrument designed to project power, ensure domestic security and respond to emerging threats. What India is learning is that, given its failure to create jobs, its army must also remain something of an employment generation scheme. If the country wants to play a bigger role in its region and in the world, it will first need to fix its economy.

Jul 1, 2022

Riaz Haq

#India's #manufacturing activity hits 9-month low in June 2022. S&P Global India Manufacturing Purchasing Managers’ Index (PMI) fell to 53.9 in June from 54.6 in May, the weakest pace of growth since last September. #unemployment #jobs #Modi #BJP #economy https://www.business-standard.com/article/economy-policy/india-s-ma...

India’s manufacturing sector activity eased to a nine-month low in June as growth of total sales and production moderated amid intense price pressures, a monthly survey said on Friday.

The seasonally adjusted S&P Global India Manufacturing Purchasing Managers’ Index (PMI) fell to 53.9 in June from 54.6 in May, the weakest pace of growth since last September.

The June PMI data pointed to an improvement in overall operating conditions for the twelfth straight month. In PMI parlance, a print above 50 means expansion while a score below 50 denotes contraction.

“The Indian manufacturing industry ended the first quarter of fiscal year 2022/23 on a solid footing, displaying encouraging resilience on the face of acute price pressures, rising interest rates, rupee depreciation and a challenging geopolitical landscape,” said Pollyanna De Lima, Economics Associate Director at S&P Global Market Intelligence.

Factory orders and production rose for the twelfth straight month in June, but in both cases the rates of expansion eased to nine-month lows. Increases were commonly attributed to stronger client demand, although some survey participants indicated that growth was restricted by acute inflationary pressures, the survey said.

According to the survey, monitored firms reported increase for a wide range of inputs — including chemicals, electronics, energy, metals and textiles — which they partly passed on to clients in the form of higher selling prices.

Lima further said there was a broad-based slowdown in growth across a number of measures such as factory orders, production, exports, input buying and employment as clients and businesses restricted spending amid elevated inflation.

According to the survey, inflation concerns continued to dampen business confidence, with sentiment slipping to a 27-month low. Elsewhere, input delivery times shortened for the first time since the onset of Covid-19.

“Fewer than 4 per cent of panellists forecast output growth in the year ahead, while the vast majority (95 per cent) expect no change from present levels. Inflation was the main concern among goods producers,” the survey said.

On the job front, employment rose for the fourth successive month, albeit at a slight pace that was broadly in line with those seen over this period.

Meanwhile, the Reserve Bank of India (RBI) in its financial stability report released on Thursday said persistently high inflation globally is to stay longer than anticipated as the ongoing war and sanctions take a toll on economies, threatening a further slowdown to global trade volumes.

The global economic outlook is clouded by the ongoing war in Europe and the pace of monetary policy tightening by central banks in response to mounting inflationary pressures, the RBI report said.

Jul 1, 2022

Riaz Haq

Foreign #investors flee #India, putting pressure on #Indian #currency. #Modi government raises #import taxes on #gold to preserve #forex reserves, support #INR, amid rising #inflation and twin current account and fiscal deficits. #BJP #Hindutva #economy

https://economictimes.indiatimes.com/news/economy/indicators/india-...

Investors reeling from the brutal emerging markets selloff over the past six months again fled the rupee as India’s currency hit new lows, prompting the government to curb gold imports and oil exports to arrest a widening deficit.

The government raised import taxes on gold, while increasing levies on exports of gasoline and diesel in an attempt to control a fast-widening current account gap. The moves sent Reliance Industries Ltd NSE -7.20 %. and other energy exporters tumbling, bringing down the benchmark index by as much as 1.7%. The rupee fell again.

The actions underscore how emerging economies, specially with twin current account and fiscal deficits, are increasingly facing pressures on their currencies as forceful rate hikes by the Federal Reserve accentuate outflows. Despite having the world’s fourth-biggest reserve pile, the rupee has hit a succession of record lows in recent weeks. The Indonesian rupiah, the other high-yielder in Asia, fell to its lowest in two years on Friday.

Policy makers in many emerging markets face stark choices as they battle soaring inflation and capital flight as the Fed tightens policy: raise rates and risk hurting growth, spend reserves that took years to build to defend currencies, or simply step away and let the market run its course.

New Delhi’s move also underscores the economic challenges faced by Prime Minister Narendra Modi’s government as inflation in the world’s sixth-largest economy accelerates and external finances worsen. The central bank has been battling to slow the currency’s decline, and runaway rupee depreciation will worsen price pressures, and may spur more rate hikes that weigh on growth.

The measures “aim to reduce the impending pressure on the current account deficit and thus the currency,” said Madhavi Arora, lead economist at Emkay Global Financial Services. “Complementary policy efforts from both fiscal and monetary side essentially reflects the looming pain on the balance of payments deficit this year.”

While the Reserve Bank of India has been seeking to smooth out the rupee’s 6% decline this year, banks have reported dollar shortages as investors and companies rushed to swap the rupee for other assets or to pay for imports. The latest measures were spurred by a sudden surge of gold imports in May and June, the Finance Ministry said Friday.

The government raised the import duty on gold to 12.5%, reversing a cut last year. The higher taxes on shipments of gasoline and diesel sent shares of Reliance Industries, a key exporter, down by as much as 8.9%.

India is the world’s second-biggest gold consumer and local futures rose as much as 3% in Mumbai, the biggest intraday jump in almost four months, due to the higher import costs.

Finance Minister Nirmala Sitharaman said on Friday that India is seeking to discourage gold imports as it helps preserve foreign exchange. She added “extraordinary times” require such measures including the imposition of a windfall tax on fuel exports.

“The challenges are emanating from the same source, which is higher commodity prices,” said Rahul Bajoria, senior economist, Barclays Bank Plc. “India can neither find supply onshore nor we will be able to cut back the consumption of oil. That makes the whole situation a lot more unpredictable both in terms of how this plays out and how long this continues for.”

For the broader fuel market, a drop in Indian exports could further tighten global markets that are grappling with reduced supply from Russia and rising post-pandemic demand.

Jul 2, 2022

Riaz Haq

Sonam Srivastava of Wright Research sees slowdown in IT, infra, but bets on auto, FMCG

https://www.moneycontrol.com/news/business/markets/daily-voice-sona...

The mood in the market has improved in the last couple of weeks, but this could be a short-term rebound. We did see a slight easing in European inflation. While the recession in the west is more of a reality, many expect the pain to be over sooner. Nevertheless, we cannot rule out another correction.

Sonam Srivastava, founder of Wright Research, expects some early signs of a slowdown in the quarterly earnings from next week with margin pressure intensifying in IT and infrastructure. She, however, is bullish on auto and FMCG companies.

The recent tax hike on oil exports is a harsh step by the government, but it is warranted by their commitment to controlling the excessive inflationary pressures the economy is facing. "It might impact ONGC and Oil India earnings for FY23 by 36 percent and 24 percent, so we could see more pain in these scrips in the medium term," she shares in an interview to Moneycontrol.

Q: Do you think the consistent consolidation and possibility of another round of major market correction can spoil the mood of domestic institutional investors and retail investors?

A: The mood in the market has improved in the last couple of weeks, but this could be a short-term rebound. We did see a slight easing in European inflation. While the recession in the west is more of a reality, many expect the pain to be over sooner. Nevertheless, we cannot rule out another correction.

I believe that while a minority of new investors will get discouraged and quit, the equity market has gained a large set of sticky long-term investors in the past few years who will continue to support the market.

Q: Any themes that you are buying aggressively?

A: We are excited about the rising consumer demand and reopening themes. We expect FMCG to keep reaping the benefit of good monsoons and easing crude prices. On the other hand, hotels, multiplexes and travel stocks also look attractive.

Auto has been a powerful theme in the last few months, but we are cautiously optimistic given that there has already been a strong rally. IT, which has corrected massively, has started to look exciting, and we are picking some stocks in this basket.

We are also excited about the new India stocks gaining from the government production linked incentive (PLI) schemes, which we expect to outperform as soon as the switch happens towards growth.

Q: Do you think the market has made the final bottom by hitting lows in June and waiting for a trigger to see a sharp move?

A: It is tough to say we have reached the bottom. Many in the market are calling for the worst time to be over, but you can never confidently say that, given the type of uncertainty we have seen in the last year. The Fed rate hikes are priced in, and we are now just waiting for positive triggers like the easing of inflation or the end of the conflict in Ukraine.

A triangular pattern formation on the charts and the price movement in the subsequent few trading sessions will be essential and confirm either a positive breakout or a negative trend.

Q: Is there any possibility of another round of correction in the metal sector/stocks before any bottom formation?

A: Metal prices are increasingly governed by the Chinese economy, which has started showing signs of recovery after a long time. If the recovery in China persists, we could see some strength in the Metal prices at rock bottom right now.

A sustained long-term recovery in meal prices will only come after the current global environment calms down and focus shifts to infrastructure spending.

Jul 3, 2022

Riaz Haq

Sonam Srivastava of Wright Research sees slowdown in IT, infra, but bets on auto, FMCG

https://www.moneycontrol.com/news/business/markets/daily-voice-sona...

Q: Among commodities, do you think oil is the last to collapse?

A: In an inflationary environment, there is a supply-side constraint on commodities, and the bankers are trying to bring down demand to match that. So while the recent correction in commodity prices might end with oil, we can see commodity inflation revive again while inflation is roaring. So the short term might be negative for commodities, but we could see a resurgence in the prices in the medium term.

Q:Companies will start releasing their first-quarter earnings scorecard in the current month. What are your general expectations?

A:We expect early signs of a slowdown in the earnings from next week. The IT sector will show margin pressure, high attrition and low hiring patterns. Infrastructure, realty and other cyclical might show early signs of a slowdown.

On the other hand, the auto sector could show good numbers, and FMCG could also show encouraging numbers. We expect the commentary for most companies to become more cautious and sombre given the global situation.

Jul 3, 2022

Riaz Haq

#India Hit By Emerging Market #Investor #Exodus As #India #Rupee Tumbles. Investors reeling from the brutal emerging markets selloff over the past six months again fled the rupee as India's currency hit new lows. #Modi #BJP #Hindutva #economy https://www.ndtv.com/business/indian-economy-hit-by-selloff-in-emer...

Investors reeling from the brutal emerging markets selloff over the past six months again fled the rupee as India's currency hit new lows, prompting the government to curb gold imports and oil exports to arrest a widening deficit.

The government raised import taxes on gold, while increasing levies on exports of gasoline and diesel in an attempt to control a fast-widening current account gap. The moves sent Reliance Industries Ltd. and other energy exporters tumbling, bringing down the benchmark index by as much as 1.7%. The rupee fell again.

The actions underscore how emerging economies, specially with twin current account and fiscal deficits, are increasingly facing pressures on their currencies as forceful rate hikes by the Federal Reserve accentuate outflows. Despite having the world's fourth-biggest reserve pile, the rupee has hit a succession of record lows in recent weeks. The Indonesian rupiah, the other high-yielder in Asia, fell to its lowest in two years on Friday.

Policy makers in many emerging markets face stark choices as they battle soaring inflation and capital flight as the Fed tightens policy: raise rates and risk hurting growth, spend reserves that took years to build to defend currencies, or simply step away and let the market run its course.

New Delhi's move also underscores the economic challenges faced by Prime Minister Narendra Modi's government as inflation in the world's sixth-largest economy accelerates and external finances worsen. The central bank has been battling to slow the currency's decline, and runaway rupee depreciation will worsen price pressures, and may spur more rate hikes that weigh on growth.

The measures “aim to reduce the impending pressure on the current account deficit and thus the currency,” said Madhavi Arora, lead economist at Emkay Global Financial Services. “Complementary policy efforts from both fiscal and monetary side essentially reflects the looming pain on the balance of payments deficit this year.”

While the Reserve Bank of India has been seeking to smooth out the rupee's 6% decline this year, banks have reported dollar shortages as investors and companies rushed to swap the rupee for other assets or to pay for imports. The latest measures were spurred by a sudden surge of gold imports in May and June, the Finance Ministry said Friday.

Commodity Pressures

The government raised the import duty on gold to 12.5%, reversing a cut last year. The higher taxes on shipments of gasoline and diesel sent shares of Reliance Industries, a key exporter, down by as much as 8.9%.

India is the world's second-biggest gold consumer and local futures rose as much as 3% in Mumbai, the biggest intraday jump in almost four months, due to the higher import costs.

Finance Minister Nirmala Sitharaman said on Friday that India is seeking to discourage gold imports as it helps preserve foreign exchange. She added “extraordinary times” require such measures including the imposition of a windfall tax on fuel exports.

“The challenges are emanating from the same source, which is higher commodity prices,” said Rahul Bajoria, senior economist, Barclays Bank Plc. “India can neither find supply onshore nor we will be able to cut back the consumption of oil. That makes the whole situation a lot more unpredictable both in terms of how this plays out and how long this continues for.”

For the broader fuel market, a drop in Indian exports could further tighten global markets that are grappling with reduced supply from Russia and rising post-pandemic demand.

Jul 4, 2022

Riaz Haq

#India Hit By Emerging Market #Investor #Exodus As #India #Rupee Tumbles. Investors reeling from the brutal emerging markets selloff over the past six months again fled the rupee as India's currency hit new lows. #Modi #BJP #Hindutva #economy https://www.ndtv.com/business/indian-economy-hit-by-selloff-in-emer...

Big Reserves

Friday's measures highlight the central bank has a tough fight on the external front in coming months. RBI Governor Shaktikanta Das has said the central bank uses a multi-pronged intervention approach to minimize actual outflows of dollars and won't allow a runaway rupee depreciation.

And while investors have been put on watch over emerging-market stress by Sri Lanka's struggle with a dollar crunch leading to hyperinflation, the RBI has close to $600 billion of foreign-exchange reserves. But those reserves are depleting as the central bank steps up its fight to stop the slide in the rupee amid capital outflows and a current account gap that is expected to double this year.

“Investors should expect the currency to still depreciate,” said Arvind Chari, chief investment officer at Quantum Advisors Pvt. in Mumbai. “Will more taxes on exports impact corporate activity? Maybe not in the short term but it could in the medium to long term.”

Jul 4, 2022

Riaz Haq

#India’s World-Beating Growth Isn’t Creating #Jobs. #Unemployment rate is hovering around 7% or 8%, up from about 5% five years ago. The labor force participation rate has dropped to just 40% of the 900 million #Indians of legal age. #Modi #BJP #Hindutva

https://www.bloomberg.com/news/articles/2022-07-15/why-india-s-worl...

No other major economy has been expanding as fast as India lately, beating both China and the US. But beyond the headlines lies the grim reality of rising unemployment. The nation of 1.4 billion people isn’t creating enough jobs for its growing workforce, despite campaign promises by Prime Minister Narendra Modi to make it a priority. Output is increasing as a result of pandemic-related government spending while the private sector sits on the fence, deterred by dim conditions for new investment. Meanwhile, pandemic-related disruptions and rising inflation are making it harder for everyone to get by. Tensions boiled over in June when angry youth facing bleak job prospects blocked rail traffic and highways in many states for days, even setting some trains on fire.

The unemployment rate in India has been hovering around 7% or 8%, up from about 5% five years ago, according to the Centre for Monitoring Indian Economy, a private research firm. At the same time, the workforce shrank as millions of people dejected over weak job prospects pulled out, a situation that was exacerbated by Covid-19 lockdowns. The labor force participation rate -- meaning people who are working or looking for work -- has dropped to just 40% of the 900 million Indians of legal age, from 46% six years ago, according to the CMIE. By comparison, the participation rate in the US was 62.2% in June.

Jul 15, 2022

Riaz Haq

#India’s #Employment Rate in June Lowest in Last One Year, Says CMIE. Employment shrank by 13 mln, including 10 mln staying out

Shrinkage entirely in rural areas, should improve with monsoon - Bloomberg

https://www.bloomberg.com/news/articles/2022-07-05/june-employment-...

India’s labor market showed fresh signs of weakness in June, with the employment rate falling to its lowest in two years, as patchy monsoon rains may have delayed deployment of agricultural workers in rural areas, the head of a private research firm said.

Writing in the Business Standard newspaper on Tuesday, Mahesh Vyas, who is chief executive officer at the Centre for Monitoring Indian Economy Pvt, said the employment rate fell to 35.8% in June, from 37.07% in May. The jobless rate climbed to 7.8% of the total workforce in June, from 7.1% in May.

The rise in the jobless rate was entirely led by a rise in rural unemployment, data showed. The unemployment rate in rural India increased to 8.03% from 6.62% in May, while in urban areas, the jobless rate eased to 7.30% in June from 8.21% a month ago.

Overall, employment shrank by 13 million to 390 million in June, against a gain of 8 million jobs in April and May, Vyas said. While around 13 million jobs were lost during the month, the count of the unemployed increased by only 3 million as the rest exited the labor force, Vyas wrote.

This shrinkage brought down labor force participation rate to 38.8%, against 40% in the preceding two months. While this drop in employment and an equally sharp deterioration in other labor market ratios were alarming, the jobs picture was not completely dire across the country, Vyas wrote.

He said that since monsoon rains were 32% below normal last month, it could have “slowed the deployment of labor into the fields.” Labor participation may improve as rainfall picks up in coming weeks, he added.

The agriculture sector shed nearly 8 million jobs in June, mostly connected to plantations, while crop cultivation added 4 million jobs, according to Vyas.

The data also pointed toward growing vulnerabilities for salaried workers with 2.5 million losing their jobs in June. The government shrunk the demand for armed forces while opportunities in private equity-funded new-world jobs have also started to shrink, Vyas wrote.

Jul 29, 2022

Riaz Haq

Ex #RBI Gov R. Rajan: Turning #Muslims Into "2nd Class Citizens" Will Divide #India. Warning against majoritarianism, he cited #SriLanka as an example of what happens when politicians try to deflect a job crisis by targeting minorities. #Modi #Islamophobia https://www.ndtv.com/india-news/turning-minority-into-2nd-class-cit...

Former Reserve Bank of India Governor Raghuram Rajan on Saturday said India's future lies in strengthening liberal democracy and its institutions as it is essential for achieving economic growth.

Warning against majoritarianism, he said Sri Lanka was an example of what happens when a country's politicians try to deflect a job crisis by targeting minorities.

Speaking at the 5th conclave of All India Professionals Congress, a wing of the Congress party, in Raipur, he said any attempt to turn a large minority into "second class citizens" will divide the country.

Mr Rajan was speaking on the topic 'Why liberal democracy is needed for India's economic development'.

".What is happening to liberal democracy in this country and is it really that necessary for Indian development? ... We absolutely must strengthen it. There is a feeling among some quarters in India today that democracy holds back India ... India needs strong, even authoritarian, leadership with few checks and balances on it to grow and we seem to be drifting in this direction," Mr Rajan said.

"I believe this argument is totally wrong. It's based on an outdated model of development that emphasizes goods and capital, not people and ideas," said the former chief economist of the International Monetary Fund.

The under-performance of the country in terms of economic growth "seems to indicate the path we are going on needs rethinking," he said.

The former RBI governor further said that "our future lies in strengthening our liberal democracy and its institutions, not weakening them, and this is in fact essential for our growth."

Elaborating on why majoritarian authoritarianism must be defeated, he said any attempt to "make second class citizens of a large minority will divide the country and create internal resentment." It will also make the country vulnerable to foreign meddling, Me Rajan added.

Referring to the ongoing crisis in Sri Lanka, he said the island nation was seeing the "consequences when a country's politicians try to deflect from the inability to create jobs by attacking a minority." This does not lead to any good, he said.

Liberalism was not an entire religion and the essence of every major religion was to seek out that which is good in everyone, which, in many ways, was also the essence of liberal democracy, Mr Rajan said.

Claiming that India's slow growth was not just due to the COVID-19 pandemic, Mr Rajan said the country's underperformance predated it.

"Indeed for about a decade, probably since the onset of the global financial crisis, we haven't been doing as well as we could. The key measure of this underperformance is our inability to create the good jobs that our youth need," the former RBI governor said.

Jul 30, 2022

Riaz Haq

Ex #RBI Gov R. Rajan: Turning #Muslims Into "2nd Class Citizens" Will Divide #India. Warning against majoritarianism, he cited #SriLanka as an example of what happens when politicians try to deflect a job crisis by targeting minorities. #Modi #Islamophobia https://www.ndtv.com/india-news/turning-minority-into-2nd-class-cit...

Citing the strident protests against the Centre's 'Agniveer' military recruitment scheme, Mr Rajan said it suggested how hungry the youths were for jobs.

"Just a while ago you saw 12.5 million applicants for 35,000 railway jobs. It is particularly worrisome when India has a scarcity of jobs even when so many women are not working outside their homes. India's female labour force participation is among the lowest in G-20 at 20.3 percent as in 2019," he pointed out.

Talking about the "vision of growth" of the current government led by Prime Minister Narendra Modi, he said it centres around the term 'atmanirbhar' or self-reliance.

"Now, to the extent it emphasizes better connectivity, better logistics, better roads and devotes more resources to it, in some way this (atmanirbhar vision) seems the continuation of the past reformed decades. And that's good," he said.

But, the former RBI governor said, in many ways a look at what 'atmanirbhar' is trying to achieve takes one back to an early and failed past where the focus was on physical capital and not human capital, on protection and subsidies and not on liberalization, on choosing favourites to win rather than letting the most capable succeed.

Asserting that there was a misplaced sense of priorities, Mr Rajan said the nation was not spending enough on education, with tragic consequences.

"Many (children) not having been to school for two years are dropping out. Their human capital, which is their and our most important asset in the coming years, is something we are neglecting. We are failing them by not devoting enough resources to remedial education," Mr Rajan said.

Jul 30, 2022

Riaz Haq

Kaushik Basu

@kaushikcbasu

IMF's just-released World Economic Outlook shows, over 3 years, 2020-2, India's annual growth is 2.9%, behind China (4.5%) & low-income country average (3.1%). This is not where India was; its economy has enough strength. This is the price of divisive politics & erosion of trust.

https://twitter.com/kaushikcbasu/status/1552926615662985216?s=20&am...

Jul 30, 2022

Riaz Haq

India is experiencing a job market crisis. Applicants for preferred jobs outnumber vacancies by numbers that make the process a lottery. The qualifications of applicants for many jobs far exceed the skills or knowledge required. Attempts to influence or rig the appointments process to monetise scarcity are common. And the response to perceived malpractice or suspect policy shifts can be violent, as recently seen in the case of appointments to the railways and the military.

https://frontline.thehindu.com/columns/economic-perspectives-the-jo...

The argument that the same crisis afflicts most market economies, including many developed ones, mitigates for some people the disquiet the crisis should evoke. What is missed is that the nature and intensity of the jobs crisis is not similar across the board. India seems especially hard hit. What is more, a rather expansive definition of what constitutes employment and the varying definitions adopted by different sources make the picture fuzzy and lead to an underestimation of the problem.

Disturbing ‘facts’

The stylised “facts” the available data yield are, however, disturbing enough. Despite questions regarding method and coverage, the National Statistical Organisation’s annual Periodic Labour Force Survey (PLFS) is the best source of information on employment and unemployment trends. According to the latest report, 7.5 per cent of the labour force was unemployed in 2020-21 (July to June), even when a person is defined as employed if he/she worked for at least one hour on at least one day during the seven days preceding the date of survey (current weekly status).

Aug 1, 2022

Riaz Haq

India Jobs Crisis

https://frontline.thehindu.com/columns/economic-perspectives-the-jo...

With about 40 per cent of India’s 1.41 billion population in the labour force, this implies that about 42 million people who were available for work were not employed. If computed on a usual status basis (or based on the activity of a person for a relatively long time in the 365 days preceding the date of survey), the unemployment rate fell to 4.2 per cent. That amounts to around 25 million unemployed on a usual status basis. Around 21 million of these unemployed people were in the 15-29 years age group. The crisis is not of absent jobs in general but of employment among the youth in particular. A youthful population swells the number in the age group where people are capable of and wanting to work. But they find it difficult to get into the workforce.

The PLFS is the more recent version of the government’s effort to track the employment and unemployment situation in the country. Before 2017-18, the official statistical system undertook detailed surveys of the employment situation once in five years. On the grounds that an annual assessment was needed for effective policymaking, which has been a complete failure when it comes to employment generation, the government has carried out the PLF surveys since 2017-18. They yield quarterly and annual estimates. Annual estimates are as of now available for the four years ending 2020-21. Since results from these surveys can be compared, the government has taken credit for the apparent rise in employment over these four years when the labour force participation rate rose from 35.9 to 39.2 per cent and the unemployment rate declined from 8.9 to 7.5 per cent on a current weekly status basis. The corresponding figures for usual status employment were labour force participation rates of 36.9 per cent to 41.6 per cent and unemployment rates of 6.1 and 4.2 per cent. The aggregate figures do seem to point to an improvement, however marginal, on the employment front.

This improvement may seem surprising because of the well-recognised adverse employment generation consequences of India’s development path and the policy moves that have made a bad situation worse. Among the many features of the development path that determined employment outcomes, three in particular are worth noting. The first is that the non-agricultural sector has proved incapable of absorbing, at least in decent jobs, the multitudes that have had to move out of agriculture because it could no longer serve as the sink for a growing volume of the unemployed.

Aug 1, 2022

Riaz Haq

India Jobs Crisis

https://frontline.thehindu.com/columns/economic-perspectives-the-jo...

The second is that manufacturing growth has been so disappointing that the structural transition away from agriculture to manufacturing in terms of shares in total GDP and employment, expected in the early stages of development, has remained incomplete in India. The slow growth of manufacturing meant that the much-needed shift in employment and worker distribution away from low-productivity agriculture to high-productivity manufacturing, which could ensure decent non-agricultural employment, did not occur.

And finally, although construction and services proved to be the much-needed outlets for India’s excess labour force, they proved inadequate to the task of making up for the shortfall in manufacturing. This is especially so because the more dynamic, modern services (including software and information technology–enabled services) have been characterised by a revenue growth that is much faster than employment growth, resulting in lagging employment generation even in India’s high-growth years led by a services boom. Workers must settle wherever jobs are available, irrespective of pay and the conditions of work.

One consequence of these trends is that “regular” and “formal” employment—or employment that is based on a formal contract, offers a degree of security of tenure, includes paid leave, and is associated with some form of social protection—is more the exception than the rule. In 2020-21, only 21 per cent of those employed were in regular employment. Another 23 per cent were engaged as casual labourers. The remaining 56 per cent were “self-employed”. For most of these workers, being at work does not mean being employed for most of the days or hours a person is available for work. A range of indicators captures the poor quality of even the employment afforded to most workers. Around 64 per cent of regular workers had no written job contract, 48 per cent were not eligible for paid leave, and 54 per cent were not eligible for any social protection. Regular male workers in all occupational categories, who are paid much more than female workers, earned on average between Rs.18,238 and Rs.19,103 over 30 days in 2020-21, or around Rs.608-637 a day.

Aug 1, 2022

Riaz Haq

India Jobs Crisis

https://frontline.thehindu.com/columns/economic-perspectives-the-jo...

Despite the extreme inequality that characterises the country, that average for the population as a whole is just around two and a half times the income that supports a family at the official poverty line. The corresponding figures for the self-employed were Rs.11,184–11,976, or Rs.373–399 a day. The average daily earnings of a casual worker, when employed, varied between Rs.311 and Rs.327. What is more, in real terms, or after having adjusted for inflation, these earnings declined between 2017-18 and 2020-21.

The difficulty of finding even a half decent job has discouraged many from seeking work and kept them out of the labour force. The labour force participation rates in India of 58 per cent for men and 25 per cent for women in 2020-21 are striking for two reasons: first, they are extremely low by global and even South Asian standards (excluding Afghanistan and Pakistan), and second, the participation rates for women, who are forced by patriarchal norms to focus on unpaid household work, are appallingly low. Given the absolute levels of female participation rates, the evidence that it rose from 17.5 per cent in 2017-18 to 25.1 per cent in 2020-21 is no cause to celebrate. In fact, as argued below, this is likely the result of household distress.

During the years when the annual labour force surveys were conducted and published (2017-18; 2020-21), the Indian economy moved out of its high-growth trajectory, which meant that the poor job-generation record resulting from the weak relationship between output growth and employment growth was made worse by the slowdown in GDP growth. This was aggravated by three “external” factors that devastated the economy during these years.

The first is the damage wrought by demonetisation, which shrank economic activity and led to closures of firms and loss of livelihoods. The second is the badly designed and poorly implemented goods and services tax, which both imposed compliance costs and set operational constraints on economic agents with attendant adverse impacts on both production and incomes. The third is the COVID-19 pandemic and the government’s handling of it, characterised by brutal lockdowns and measly stimulus measures, which too severely damaged economic activity and livelihoods. All these shocks affected more severely the “informal” sector, which is where the majority of working Indians are employed.

Question of survival

Given these long- and short-term trends, it may appear surprising that the PLFS figures for the four years ending 2020-21 point to an increase in the number of workers and a fall in the unemployment rate. However, those trends may be in keeping with what one should expect in a period when growth has been slowing and economic shocks have devastated large sections of the working poor. In a context in which social security or social protection is more the exception than the rule, an unemployed person must, for survival, rely as a dependent on an already underpaid earning member of the family. That option being absent, she or he can only starve. When economic conditions worsen, as they clearly have over the last four years, the ability of earning members to support dependents is considerably eroded. The only option then is for every able person to seek out whatever work is available for however many days even if the terms are poor.

Aug 1, 2022

Riaz Haq

India Jobs Crisis

https://frontline.thehindu.com/columns/economic-perspectives-the-jo...

This implies that in difficult times “distress employment” will rise, inflating the figures on those reported as being in the workforce and of those employed, when identified using the rather weak definitions adopted in the employment surveys. This is corroborated by the fact that much of the increase in employment over these four years is of female employment and employment in agriculture. A corollary of this distress-driven turn to any available job is a rise in labour force participation and in the number of workers and a fall in the unemployment rate. This is what seems to be happening in recent years. A similar tendency was observed over 1999-2000 to 2004-05—which was a period of extreme distress—when total employment as measured by the National Sample Surveys registered an increase of around 60 million.

What this implies is that using aggregate employment and unemployment numbers to assess intertemporal changes in the employment situation in the country is not warranted. “Improvements” in the number of people employed and the extent of unemployment could be as much a reflection of distress as they could be of advance; it all depends on the economic circumstances. What is clear as far as the Indian labour market is concerned is that the years of high growth have done little to improve a dismal employment picture, and the conditions of work only deteriorated after those heady growth days came to end. The jobs crisis is real.

Aug 1, 2022

Riaz Haq

https://theprint.in/opinion/not-just-global-hunger-index-indias-own...

Not just Global Hunger Index, India’s own govt data shows how worried we should be

The Modi government has questioned the methodology of the Global Hunger Index. But undernutrition is one of the leading factors of child mortality in India. https://theprint.in/opinion/not-just-global-hunger-index-indias-own...

Aug 28, 2022

Riaz Haq

GHI scores are calculated using a three-step process that draws on available data from various sources to capture the multidimensional nature of hunger (Figure A.1).

First, for each country, values are determined for four indicators:

UNDERNOURISHMENT: the share of the population that is undernourished (that is, whose caloric intake is insufficient);

CHILD WASTING: the share of children under the age of five who are wasted (that is, who have low weight for their height, reflecting acute undernutrition);

CHILD STUNTING: the share of children under the age of five who are stunted (that is, who have low height for their age, reflecting chronic undernutrition); and

CHILD MORTALITY: the mortality rate of children under the age of five (in part, a reflection of the fatal mix of inadequate nutrition and unhealthy environments).

Second, each of the four component indicators is given a standardized score on a 100-point scale based on the highest observed level for the indicator on a global scale in recent decades.

Third, standardized scores are aggregated to calculate the GHI score for each country, with each of the three dimensions (inadequate food supply; child mortality; and child undernutrition, which is composed equally of child stunting and child wasting) given equal weight (the formula for calculating GHI scores is provided in Appendix B).

This three-step process results in GHI scores on a 100-point GHI Severity Scale, where 0 is the best score (no hunger) and 100 is the worst. In practice, neither of these extremes is reached. A value of 0 would mean that a country had no undernourished people in the population, no children younger than five who were wasted or stunted, and no children who died before their fifth birthday. A value of 100 would signify that a country’s undernourishment, child wasting, child stunting, and child mortality levels were each at approximately the highest levels observed worldwide in recent decades. The GHI Severity Scale shows the severity of hunger—from low to extremely alarming—associated with the range of possible GHI scores.

BOX 1.1

WHAT IS MEANT BY “HUNGER”?

The problem of hunger is complex, and different terms are used to describe its various forms.

Hunger is usually understood to refer to the distress associated with a lack of sufficient calories. The Food and Agriculture Organization of the United Nations (FAO) defines food deprivation, or undernourishment, as the consumption of too few calories to provide the minimum amount of dietary energy that each individual requires to live a healthy and productive life, given that person’s sex, age, stature, and physical activity level.

Undernutrition goes beyond calories and signifies deficiencies in any or all of the following: energy, protein, and/ or essential vitamins and minerals. Undernutrition is the result of inadequate intake of food in terms of either quantity or quality, poor utilization of nutrients due to infections or other illnesses, or a combination of these factors. These, in turn, are caused by a range of factors, including household food insecurity; inadequate maternal health or childcare practices; or inadequate access to health services, safe water, and sanitation.

Malnutrition refers more broadly to both undernutrition (problems caused by deficiencies) and overnutrition (problems caused by unbalanced diets, such as consuming too many calories in relation to requirements with or without low intake of micronutrient-rich foods).

In this report, “hunger” refers to the index based on four component indicators. Taken together, the component indicators reflect deficiencies in calories as well as in micronutrients.

https://www.globalhungerindex.org/about.html#:~:text=The%20average%....

Aug 28, 2022

Riaz Haq

Not just Global Hunger Index, India’s own govt data shows how worried we should be

The Modi government has questioned the methodology of the Global Hunger Index. But undernutrition is one of the leading factors of child mortality in India.

https://theprint.in/opinion/not-just-global-hunger-index-indias-own...

The Global Hunger Index 2021 is basically about undernutrition. It provides us an opportunity to introspect on why India’s performance is not as good as what our economic growth should have ensured. Rather than doing that, the Narendra Modi government has chosen to question the methodology of one particular indicator used in the report to assess the level of undernourishment. It is true that at its core, the Hunger Index is primarily an indicator of child undernutrition and mortality. While it does estimate the prevalence of undernourishment (PoU), its weightage in the index is only one third. The other three components of the index relate to the percentage of children under five years who show wasting, stunting, and child mortality (percentage of children who die before reaching five years of age). Dipa Sinha has explained the methodology of index in this article in The Hindu.

India collects its own data on health and nutrition that is widely considered to be credible and extremely useful. The fifth round of the National Family Health Survey was conducted in 2019-20 and its findings were released in December 2020. However, data for Uttar Pradesh, Punjab, Jharkhand, and Madhya Pradesh was not included in the first phase so the all-India performance is not yet known. The survey found that the progress is worse than expected, and stunting, reflective of chronic malnutrition, has increased in 11 out of the 17 states surveyed. Wasting, indicative of acute malnutrition, has also increased in 13 of these 17 states. Such malnourished children are more vulnerable to illness and disease. The percentage of underweight children has gone up in 11 of the 17 states. In Bihar and Gujarat, 40 per cent of children under the age of five, were underweight.

Undernutrition is one of the leading risk factors for child mortality in India, accounting for 68.2 per cent of total under-five deaths (10.4 lakh) in 2017. Children with severe undernutrition are at high risk of dying from diarrhoea, pneumonia, and malaria.

https://theprint.in/opinion/not-just-global-hunger-index-indias-own...

Aug 28, 2022

Riaz Haq

Releasing targets for curbing malnutrition in the country, specifically among children, Union Women and Child Development Minister Smriti Irani on Wednesday said in a written statement tabled in Rajya Sabha said that it aims at reducing stunting and under-nutrition (underweight prevalence) among children under 6 years by 2% per annum.

https://indianexpress.com/article/india/over-35-5-kids-stunted-govt...

The (Indian) ministry stated that it aims to reduce low birth weight by 2% per annum, and anaemia among children between six and 59 months, as well as women and adolescent girls from 15 to 49 years, by 3% per annum.

According to findings of the 2019-21 National Family Health Survey (NFHS-5), nutrition indicators for children under 5 have improved over NFHS-4 (2015-16).

Stunting (in India) has reduced from 38.4% to 35.5%, wasting from 21.0% to 19.3% and underweight prevalence is down from 35.8% to 32.1%, according to the data. Women (15-49 years) whose BMI is below normal has reduced from 22.9% in NFHS-4 to 18.7% in NFHS-5. Despite the decrease, nutrition experts have said that India has one of the highest burdens of malnutrition in the world.

According to data released on Wednesday, Meghalaya has the highest number of stunted children (46.5%), followed by Bihar (42.9%). Assam, Dadra and Nagar Haveli, Gujarat, Jharkhand, Madhya Pradesh and Uttar Pradesh have stunted children higher than the national average of 35.5%.

Puducherry and Sikkim have the lowest percentage of stunted children, data shows.

Explained |India’s role in UN Peacekeeping Missions over the years

Maharashtra has 25.6% wasted children (weight for height) — the highest — followed by Gujarat (25.1%).

Assam, Bihar, Dadra and Nagar Haveli, Karnataka and West Bengal have a higher percentage of wasted children than the national average of 19.3%.

Bihar has the highest number of underweight children (41%), followed by Gujarat (39.7%), and Jharkhand at (39.4%).

Assam, Dadra and Nagar Haveli, Karnataka, Madhya Pradesh, Maharashtra and Uttar Pradesh have a higher percentage of underweight children than the national average of 32.1%.

The NFHS-5 data shows that Jharkhand has the highest percentage of women, between 15 and 49 years, who have a below-normal Body Mass Index (BMI), a value derived from mass and height of a person, and an indicator of under-nutrition. More than 26% Jharkhand women have below-normal BMI, the national average being 18.5%.

Bihar, Chhattisgarh, Gujarat, Madhya Pradesh, Maharashtra and Odisha also have high percentages of undernourished women.

The Supplementary Nutrition Programme under Anganwadi Services and POSHAN Abhiyaan have been converged to form the ‘Saksham Anganwadi and POSHAN 2.0’ (Mission Poshan 2.0), which seeks to address the challenges of malnutrition in children, adolescent girls, pregnant women and lactating mothers.

Aug 28, 2022

Riaz Haq

A comparison of international and national references to measure the prevalence of stunting in Pakistani school-age girls

https://www.nature.com/articles/s41598-022-09511-3

Epidemiology of stunting in < 5 years old is well characterized; however, its prevalence in adolescence is inconsistent in different geographical locations. We estimated the prevalence of stunting in schoolgirls of Punjab, Pakistan, to standardize local references according to international and national references. In this population-wide cross-sectional study, 10,050 schoolgirls aged 8–16 years from 12 different districts of northern, central, and southern Punjab were analyzed. The prevalence of stunting was calculated by applying Centres for Disease Control and Prevention (CDC) and World Health Organisation (WHO) height-for-age references and the local reference for the study population. We used Cohen’s kappa statistics to analyze the agreement of our data with reference values, and chi-square test was used as the test of trend. Marked overestimation of the prevalence of stunting was observed (22.72% and 17.49% according to CDC and WHO, respectively) in comparison to local reference (4.94%). According to CDC and WHO references, there was an increasing trend of prevalence of stunting with higher age; however, data was comparable across all the age groups when local references were applied. We recommend that the prevalence of stunting in school-age girls should be determined by applying local height references rather than international ones to plan health strategies and treatments in the local population.

--------

The mean age of 10,050 schoolgirls included in this study was 12.7 ± 2.29 years (Mean ± SD). The overall prevalence of stunting in the study population using two international references is described in Fig. 1A. Overall, the percentage of girls with normal height in different age groups under study was quite similar (77.28% and 82.51%, respectively). The prevalence of stunted girls in our study cohort was 22.72% and 17.49%, according to CDC and WHO, respectively. The prevalence of stunting was similar for younger girls (8, 9 years) according to CDC and WHO, higher among girls of 10–12 years according to WHO compared to CDC and highest among girls of 13–16 years of age according to CDC compared to WHO reference (Table 1, Fig. 1A). When we applied the local height-for-age cut-offs obtained from our study population, a significantly higher percentage of the girls had standard height (95.06%, p ˂ 0.05, Table 1). The overall prevalence of stunting was markedly lower (4.94%, p ˂ 0.05, Fig. 1A) in all age groups when using the local reference, compared to CDC and WHO references. However, among 8-year-old girls, the prevalence of stunting was comparable to all the three references applied. A notable finding was the increasing trend of prevalence of stunting with increasing age when CDC and WHO references were applied. However, no such trend was observed when the local cut-offs were applied (Fig. 1A). We compared the height values obtained from our cumulative study cohort with CDC and WHO references and used kappa correlation to assess the degrees of agreement between these references and local references. There was poor agreement between the local reference in comparison with CDC and WHO (κ = 0.163, 0.325 respectively) references.

Aug 28, 2022

Riaz Haq

‘Diet of Average Indian Lacks Protein, Fruit, Vegetables’

On average, the Indian total calorie intake is approximately 2,200 kcals per person per day, 12 per cent lower than the EAT-Lancet reference diet's recommended level.

https://www.india.com/lifestyle/diet-of-average-indian-lacks-protei...

Compared to an influential diet for promoting human and planetary health, the diets of average Indians are considered unhealthy comprising excess consumption of cereals, but not enough consumption of proteins, fruits and vegetables, said a new study.Also Read - Autistic Pride Day 2020: Diet Rules For Kids With Autism