PakAlumni Worldwide: The Global Social Network

Among 10 countries with the estimated net outflow of migrants exceeding 1 million over the period from 2010 through 2021, Pakistan saw 16.5 million migrants move overseas, the highest in the world, according to a report titled "World Population Prospects 2022" released by the United Nations Department of Economic and Social Affairs (UN DESA).

|

| Pakistani Workers' Overseas Migration Data (2010-2021). Source: Bureau of Emigration |

In many of these countries with more than one million people leaving, the outflows were due to temporary labor movements, such as for Pakistan (net outflow of 16.5 million), India (3.5 million), Bangladesh, (2.9 million), Nepal (1.6 million) and Sri Lanka (1.0 million). The report also said that India's population will surpass China's in 2023. Over half of the global population increase up to 2050 will be in just 8 countries: Democratic Republic of Congo, Egypt, Ethiopia, India, Nigeria, Pakistan, the Philippines & Tanzania.

|

| Population Sizes of China, India and Pakistan 1950-2099. Source: Our World in Data |

|

| Top Remittance Receiving Countries in 2021. Source: World Bank |

Pakistan has received nearly $31 billion in worker remittances in 2021, up a whopping 20% from the prior year, according to the World Bank. This is a new record representing nearly 10% of the country's gross domestic product (GDP). This money helps the nation cope with its perennial current account deficits. It also provides a lifeline for millions of Pakistani families who use the money to pay for food, education, healthcare and housing. This results in an increase in stimulus spending that has a multiplier effect in terms of employment in service industries ranging from retail sales to restaurants and entertainment.

Remittances from the European Union (EU) to Pakistan soared 49.7% in FY 21 and 28.3% in FY22, according to the State Bank of Pakistan. With $2.5 billion remittances in the first 9 months (July-March) of the current fiscal year, the EU ($2.5 billion) has now surpassed North America ($2.2 billion) to become the third largest source of inflows to Pakistan after the Middle East and the United Kingdom. Remittances from the US have grown 21%, second fastest after the EU (28.3%) in the first 9 months of the current fiscal year.

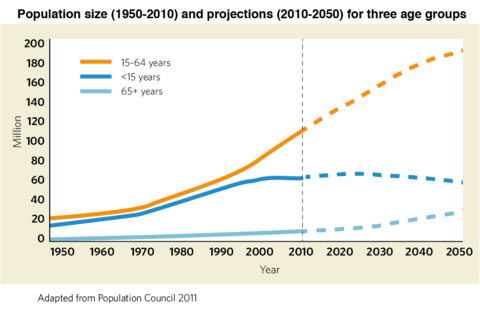

Pakistan's share of the working age population (15-64 years) is growing as the country's birth rate declines, a phenomenon called demographic dividend. This dividend is manifesting itself in high levels of worker exports and record remittances pouring into the country. Saudi Arabia and the United Arab Emirates(UAE) are the top two sources of remittances but the biggest increase (58%) in remittances is seen this year from Pakistanis in the next two sources: the United Kingdom and the United States.

|

| Projected Population Decline in Emerging Economies. Source: Nikkei Asia |

A common myth about emigration is that it is driven by poverty. But the fact is that the poorest and least developed people tend to stay put where they are; they do not migrate. It's only people who have a certain level of income and skills who are more likely to migrate to other countries for better opportunities. This fact has been well-established by multiple studies conducted in Africa.

Here's an except of African Development Bank report on migration:

"Results show that despite increase in the absolute number of migrants, Africa, particularly SubSaharan Africa has one of the lowest rate of emigration in the world .... Poorer countries generally have lower rate of emigration ......Bad socio-economic conditions generally seem to lead to higher rate of emigration by highly skilled individuals. Generally, migration is driven by motives to improve livelihoods with notable evidence on changes in labor market status. Often, self-employed or unemployed émigré ended up in wage employment. The paper outlines policy issues emerging from the migration trend in Africa."

|

| Migration vs Human Development Source: Hein de Haas |

Data shows that increased human and economic development is initially associated with increasing emigration. Any form of development in the poorest countries of the world is therefore likely to lead to accelerating emigration. Such findings contradict conventional thinking and force us to radically change our views on migration. Such rethinking can be achieved by learning to see migration as an intrinsic part of broader development processes rather than as a problem to be solved, or the temporary response to development “disequilibria”, according to The Conversation, a US publication.

Riaz Haq

Arif Habib Limited

@ArifHabibLtd

Highest ever remittances during FY22

Jun’22: $2.8bn, +2% YoY, +18% MoM

FY22: $ 31.2bn, +6% YoY

https://twitter.com/ArifHabibLtd/status/1548885472851726336?s=20&am...

Jul 18, 2022

Riaz Haq

US tops UAE in remittances to India: RBI paper

https://economictimes.indiatimes.com/news/economy/policy/us-tops-ua...

Remittances from the Indian diaspora in the US surged through the Covid months that saw a contraction in inflows from the traditional Gulf stronghold as jobs, contact-intensive and outdoor-oriented, were lost in West Asia through the initial shutdowns.

Research by central bank economists showed that the US surpassed the UAE as the top source country, accounting for 23% of total remittances in 2020-21. "This corroborates with the World Bank report (2021) citing an economic recovery.

"A lot of the remittance flow has got to do with the jobs and economic conditions in the host countries," said Madan Sabnavis, chief economist at Bank of Baroda NSE 3.80 %. "Remittances from the Gulf region were almost nil because of the slowdown and many had to face job losses. But in the US where most Indians are employed in IT and other white-collar jobs, the employment situation was more stable during the pandemic restrictions.

As the top recipient, India was expected to be one of the worst affected - with a projected decline of 23% - as the host country basket of the diaspora was vulnerable to the twin effects of economic slowdown and slump in oil prices. Defying the early projections, however, India remained the top recipient, accounting for 12% of total global remittances, recording a marginal decline of 0.2% in 2020 and a growth of 8% in 2021.

Jul 18, 2022