PakAlumni Worldwide: The Global Social Network

|

| GDP Ranking Changes Till 2075. Source: Goldman Sachs Investment Research |

|

| Economic Growth Rate Till 2075. Source: Goldman Sachs Investment Research |

Economic Impact of Slower Population Growth:

Daly and Gedminas argue that slowing population growth in the developed world is causing their economic growth to decelerate. At the same time, the economies of the developing countries are driven by their rising populations. Here are four key points made in the report:

1) Slower global potential growth, led by weaker population growth.

2) EM convergence remains intact, led by Asia’s powerhouses. Although real GDP growth has slowed in both developed and emerging economies, in relative terms EM growth continues to outstrip DM growth.

3) A decade of US exceptionalism that is unlikely to be repeated.

4) Less global inequality, more local inequality.

|

| Goldman Sachs' Revised GDP Projections. Source: The Path to 2075 |

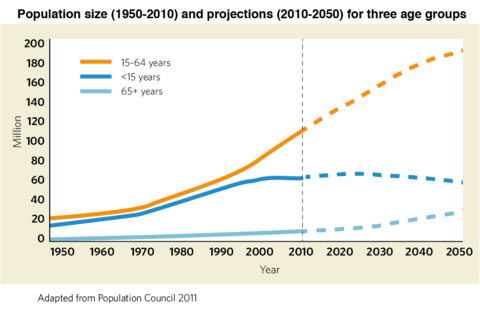

Demographic Dividend:

With rapidly aging populations and declining number of working age people in North America, Europe and East Asia, the demand for workers will increasingly be met by major labor exporting nations like Bangladesh, China, India, Mexico, Pakistan, Russia and Vietnam. Among these nations, Pakistan is the only major labor exporting country where the working age population is still rising faster than the birth rate.

|

| Pakistan Population Youngest Among Major Asian Nations. Source: Nikkei Asia |

|

| World Population 2022. Source: Visual Capitalist |

|

| World Population 2050. Source: Visual Capitalist |

Over 10 million Pakistanis are currently working/living overseas, according to the Bureau of Emigration. Before the COVID19 pandemic hit in 2020, more than 600,000 Pakistanis left the country to work overseas in 2019. Nearly 700,000 Pakistanis have already migrated in this calendar year as of October, 2022. The average yearly outflow of Pakistani workers to OECD countries (mainly UK and US) and the Middle East was over half a million in the last decade.

|

| Consumer Markets in 2030. Source: WEF |

World's 7th Largest Consumer Market:

Pakistan's share of the working age population (15-64 years) is growing as the country's birth rate declines, a phenomenon called demographic dividend. With its rising population of this working age group, Pakistan is projected by the World Economic Forum to become the world's 7th largest consumer market by 2030. Nearly 60 million Pakistanis will join the consumer class (consumers spending more than $11 per day) to raise the country's consumer market rank from 15 to 7 by 2030. WEF forecasts the world's top 10 consumer markets of 2030 to be as follows: China, India, the United States, Indonesia, Russia, Brazil, Pakistan, Japan, Egypt and Mexico. Global investors chasing bigger returns will almost certainly shift more of their attention and money to the biggest movers among the top 10 consumer markets, including Pakistan. Already, the year 2021 has been a banner year for investments in Pakistani technology startups.

Riaz Haq

In last 65 years (1952-2018), #Pakistan's #GDP growth rate has averaged 4.92%, reaching an all time high of 10.22% in 1954 & a record low of -1.80% in 1952. If Pakistan continues to average 4.92% over the next 53 years until 2075, it will be $4.9 trillion GDP in today's dollars

https://twitter.com/haqsmusings/status/1600882957543043072?s=20&...

Dec 8, 2022

Riaz Haq

In last 65 years (1952-2018), #Pakistan's #GDP growth rate has averaged 4.92%, reaching an all time high of 10.22% in 1954 & a record low of -1.80% in 1952. If Pakistan continues to average 4.92% over the next 53 years until 2075, it will be $4.9 trillion GDP in today's dollars

https://twitter.com/haqsmusings/status/1600882957543043072?s=20&...

$1 in 2021 is equivalent in purchasing power to about $5.27 in 2075, an increase of $4.27 over 54 years. The dollar had an average inflation rate of 3.13% per year between 2021 and 2075, producing a cumulative price increase of 426.85%. The buying power of $1 in 2021 is predicted to be equivalent to $5.27 in 2075.

https://www.in2013dollars.com/us/inflation/2021?endYear=2075&am...

----------------------

Multiplying $4.9 trillion in today's dollars by 5.27 gives us $25.8 trillion in 2075 dollars.

Dec 8, 2022

Riaz Haq

Saudis to aid Pakistan, deals eyed in Egypt, Turkey

https://www.taipeitimes.com/News/world/archives/2022/12/09/2003790430

Saudi Arabia plans to provide Pakistan with financial support, Saudi Minister of Finance Mohammed al-Jadaan said, as the kingdom looks to help shore up alliances with countries struggling with the effects of rising inflation.

The Saudi Arabian government is to “continue to support Pakistan as much as we can,” al-Jadaan said at a news conference in Riyadh.

The kingdom has taken several steps to provide financial support to countries in the region as it looks to bolster allies and cement new relationships.

Earlier this month, it extended the term of a US$3 billion deposit to boost foreign currency reserves and help Pakistan overcome economic repercussions of the COVID-19 pandemic.

Saudi Arabia is also looking to make more investments in Egypt and is planning to initiate deals in Turkey, al-Jadaan said.

“Our relationship with Turkey is improving greatly, and we hope to have investment opportunities,” he said. “We have started investing aggressively in Egypt and we will continue to look at investment opportunities and that is more important than deposits. Deposits can be pulled, but investments stay.”

Saudi Arabia is in the final stages of agreeing to deposit US$5 billion at Turkey’s central bank, the finance ministry said last month, a major boost for Turkish President Recep Tayyip Erdogan’s bid to keep the country’s currency stable ahead of presidential elections next year.

The agreement would crown a recent rapprochement that ended years of hostility between the Turkish and Saudi Arabian governments.

It also extended the maturity of a US$5 billion deposit with Egypt’s central bank last month, and the kingdom’s Public Investment Fund is also looking into US$10 billion of potential investments in Egypt’s healthcare, education, agriculture and financial sectors, the Egyptian Cabinet said in a statement.

The momentum of talks between the countries’ central banks comes after a joint effort by Saudia Arabia and Turkey to mend ties that were ruptured after the murder of Saudi Arabian journalist Jamal Khashoggi in 2018 at the kingdom’s Istanbul consulate.

Dec 8, 2022

Riaz Haq

Path to 2075

https://www.goldmansachs.com/insights/pages/gs-research/the-path-to...

First, there is a large gap between the largest three economies (China, India and the US) and all other economies (although the Euro area represents a fourth economic

superpower, if it is treated as a single economy). Thus, although Indonesia, Nigeria

and Pakistan are projected to be fourth, fifth, and sixth in the 2075 GDP rankings each of them are projected to be less that one-third of the size of China, India and

the US.

Second, while China and India are projected to be larger than the US by 2075, our

projections imply that the US will remain more than twice as rich as both (and five

times as rich as countries such as Nigeria and Pakistan).

Pakistan Economic Growth

Actual:

2000-2009 4.7%

2009-2019 4.0

Projected:

2019-2029 5.0

2024-2029 6.0

2030-2039 5.9

2040-2049 5.3

2050-2059 4.7

2060-2069 4.0

2070-2079 3.4

Pakistan GDP in Trillion US$

2000 0.1

2010 0.2

2020 0.3

2030 0.6

2040 1.6

2050 3.3

2060 6.1

2070 9.9

2075 12.3

Dec 8, 2022

Riaz Haq

Path to 2075

https://www.goldmansachs.com/insights/pages/gs-research/the-path-to...

Pakistan Per Capita Income in thousands of 2021 US$

2000 0.9

2010 1.3

2020 1.4

2030 2.2

2040 4.8

2050 9.0

2060 14.9

2070 22.5

2075 27.1

Dec 8, 2022

Riaz Haq

The Path to 2075

https://www.goldmansachs.com/insights/pages/gs-research/the-path-to...

Country GDP % Growth Rate by decades 2000-2009 to 2070-2079

Pakistan 4.7 4.0 5.0 6.0 5.9 5.3 4.7 4.0 3.4

China 10.3 7.7 4.2 4.0 2.5 1.6 1.1 0.9 0.5

India 6.9 6.9 5.0 5.8 4.6 3.7 3.1 2.5 2.1

Korea 4.9 3.3 2.0 1.9 1.4 0.8 0.3 -0.1 -0.2

Bangladesh 5.6 6.6 6.3 6.6 4.9 3.8 3.0 2.5 2.0

---------------------

Country GDP in Trillions of U$ from 2000 to 2075

Pakistan 0.1 0.2 0.3 0.6 1.6 3.3 6.1 9.9 12.3

China 1.8 7.4 15.5 24.5 34.1 41.9 48.6 54.8 57.0

India 0.7 2.1 2.8 6.6 13.2 22.2 33.2 45.8 52.5

Korea 0.9 1.4 1.7 2.0 2.6 3.1 3.3 3.4 3.4

Bangladesh 0.1 0.2 0.4 0.8 1.7 2.8 4.1 5.5 6.3

-------------------

Country Per Capita Income in thousands of US$ by Decade-ends 2000 to 2075

Pakistan 0.9 1.3 1.4 2.2 4.8 9.0 14.9 22.5 27.1

China 1.4 5.5 10.9 17.3 24.7 31.9 40.3 50.4 55.4

India 0.7 1.7 2.0 4.3 8.2 13.3 19.6 27.1 31.3

Korea 18.7 28.8 33.0 39.3 53.6 67.7 81.8 95.2 101.8

Bangladesh 0.7 1.1 2.3 4.4 8.4 13.5 19.7 26.9 31.0

Dec 8, 2022

Riaz Haq

#Pakistan's top court endorses #Canadian mining giant Barrick Gold's $10 billion #investment at Reko Diq in #Balochistan. It is one of the world's largest underdeveloped sites of #copper and #gold deposits.

https://www.reuters.com/markets/asia/pakistans-court-endorses-settl...

Pakistan's Supreme Court endorsed on Friday a settlement for Barrick Gold (ABX.TO) to resume mining at the Reko Diq project, one of the world's largest underdeveloped sites of copper and gold deposits, it said in an order.

The endorsement was a condition of the settlement for Barrick to resume work on the project in the southwestern province of Balochistan, bordering Afghanistan and Iran, in which it will invest $10 billion.

Chief Justice Umar Ata Bandial, the head of a five-judge panel, read out the operative part of the brief order in court.

"The agreements ... have not been found by us to be unconstitutional or illegal on the parameters and grounds spelt out," read the order seen by Reuters.

President Arif Alvi had asked the court to review the deal.

In an out of court agreement this year, Barrick Gold ended a long-running dispute with Pakistan, and agreed to restart development.

Under the deal, the company withdrew its case in an international arbitration court, which had slapped a penalty of $11 billion on Pakistan for suspending the contracts of the company and its partners in 2011.

The company's licence to mine the untapped deposits was cancelled after the Supreme Court ruled illegal the award granted to it and its partner, Chile's Antofagasta (ANTO.L).

Antofagasta had agreed to exit the project, saying its growth strategy was focused on production of copper and by-products in the Americas.

Pakistan's mineral-rich province of Balochistan is home to both Islamist militants and separatist Baloch insurgents, who have engaged in insurgency against the government for decades, demanding a greater share of the region's resources.

Dec 9, 2022

Riaz Haq

The Path to 2075

https://www.goldmansachs.com/insights/pages/gs-research/the-path-to...

Country GDP % Growth Rate by decades 2000-2009 to 2070-2079

United States 1.9 2.3 1.7 1.9 1.7 1.5 1.4 1.3 1.2

Germany 0.8 2.0 0.7 1.2 1.3 1.1 0.9 0.9 1.0

France 1.5 1.4 1.2 1.7 1.5 1.3 1.2 1.2 1.1

Italy 0.5 0.3 0.9 1.4 1.0 0.7 0.6 0.5 0.5

Japan 0.5 1.2 0.6 0.9 0.8 0.7 0.7 0.6 0.5

United Kingdom 1.6 2.0 1.4 2.0 1.9 1.6 1.5 1.3 1.2

Australia 3.1 2.6 2.3 2.5 2.4 2.1 1.8 1.7 1.5

Canada 2.1 2.3 1.7 2.1 2.0 1.9 1.7 1.6 1.6

Indonesia 5.3 5.4 3.8 4.3 3.6 3.0 2.6 2.3 2.0

Thailand 4.3 3.6 1.9 2.8 2.4 1.9 1.4 1.1 0.9

Philippines 4.5 6.4 4.4 6.0 4.9 4.1 3.5 3.1 2.7

Malaysia 4.7 5.4 2.9 3.6 3.5 2.9 2.2 1.8 1.5

Russia 5.5 2.1 0.3 1.2 1.6 1.2 1.2 1.3 1.1

Turkey 4.0 5.9 4.2 3.5 2.9 2.1 1.7 1.4 1.1

Kazakhstan 8.6 4.4 2.7 3.1 3.2 2.8 2.8 2.8 2.5

South Africa 3.6 1.7 1.8 2.8 3.6 3.4 2.9 2.6 2.2

Nigeria 8.3 3.8 3.6 4.6 6.3 6.1 5.4 4.6 3.9

Ghana 5.3 6.7 4.3 5.0 5.2 4.9 4.5 4.1 3.6

Ethiopia 8.6 9.6 8.6 10.7 8.2 6.6 5.5 4.7 4.0

------

Country GDP in Trillions of U$ from 2000 to 2075

United States 15.6 18.5 21.8 27.0 32.0 37.2 42.8 48.6 51.5

Germany 3.0 4.2 4.0 4.4 5.3 6.2 6.9 7.7 8.1

France 2.1 3.3 2.7 3.2 3.9 4.6 5.4 6.1 6.5

Italy 1.7 2.6 2.0 2.3 2.7 3.1 3.4 3.6 3.8

Japan 7.5 7.1 5.2 4.4 5.2 6.0 6.7 7.2 7.5

United Kingdom 2.5 3.1 2.9 3.3 4.3 5.2 6.1 7.1 7.6

Australia 0.6 1.5 1.4 1.8 2.3 2.8 3.3 3.9 4.3

Canada 1.1 2.0 1.7 2.3 2.8 3.4 4.1 4.8 5.2

Indonesia 0.3 0.9 1.1 2.2 4.0 6.3 9.0 12.1 13.7

Thailand 0.2 0.4 0.5 0.7 1.2 1.7 2.2 2.6 2.8

Philippines 0.1 0.3 0.4 0.7 1.4 2.5 3.9 5.6 6.6

Malaysia 0.2 0.3 0.4 0.6 1.2 1.8 2.5 3.2 3.5

Russia 0.4 2.0 1.5 2.8 3.7 4.5 5.4 6.4 6.9

Turkey 0.4 1.0 0.8 1.3 2.2 3.1 4.0 4.8 5.2

Kazakhstan 0.0 0.2 0.2 0.3 0.6 0.9 1.3 1.8 2.1

Egypt 0.2 0.3 0.4 0.8 1.9 3.5 5.8 8.8 10.4

Saudi Arabia 0.3 0.7 0.7 1.5 2.4 3.5 4.5 5.6 6.1

Pakistan 0.1 0.2 0.3 0.6 1.6 3.3 6.1 9.9 12.3

South Africa 0.2 0.5 0.4 0.5 0.9 1.4 2.1 2.8 3.3

Nigeria 0.1 0.5 0.4 0.8 1.6 3.4 6.2 10.4 13.1

Ghana 0.0 0.1 0.1 0.1 0.3 0.5 0.8 1.2 1.5

Ethiopia 0.0 0.0 0.1 0.3 0.7 1.6 2.9 4.9 6.2

-------------

Country Per Capita Income in thousands of US$ by Decade-ends 2000 to 2075

United States 55.1 59.5 64.8 76.7 87.3 99.2 112.3 125.5 132.2

Germany 36.3 51.5 48.6 53.2 65.9 78.6 90.7 104.2 111.6

France 35.3 52.2 42.6 48.3 59.2 70.5 82.9 96.1 102.8

Italy 30.6 44.0 33.1 39.6 49.6 59.2 70.2 82.2 88.0

Japan 59.4 55.3 41.8 36.8 47.0 57.5 68.9 81.2 87.6

United Kingdom 42.9 48.9 42.9 47.9 60.2 72.5 85.7 99.8 106.6

Australia 31.9 70.1 55.1 64.4 75.1 86.7 98.8 112.3 119.4

Canada 36.8 58.6 45.2 56.4 64.7 74.5 85.4 97.0 103.1

Indonesia 1.3 3.8 4.1 7.5 12.9 19.8 28.2 38.0 43.4

Thailand 3.0 6.1 7.3 10.1 17.0 25.0 34.0 44.0 49.3

Philippines 1.6 2.7 3.4 5.5 9.9 15.7 23.1 32.1 37.3

Malaysia 6.8 11.1 10.6 17.0 29.5 44.2 59.2 75.1 83.5

Russia 2.9 14.0 10.6 19.9 27.2 34.1 42.1 52.1 57.2

Turkey 6.5 13.1 8.9 14.3 23.2 32.1 41.3 51.5 56.7

Kazakhstan 1.8 11.0 9.4 16.1 25.5 35.4 47.4 62.5 70.5

Egypt 2.2 3.2 3.7 6.3 12.9 22.0 33.5 47.1 54.6

Saudi Arabia 13.3 22.1 20.4 36.1 54.2 71.9 90.2 110.5 120.6

Pakistan 0.9 1.3 1.4 2.2 4.8 9.0 14.9 22.5 27.1

South Africa 4.9 9.9 6.0 8.0 12.9 19.3 27.3 37.2 42.6

Nigeria 0.8 2.8 2.1 2.9 5.1 8.9 14.4 22.0 26.5

Ghana 0.9 2.1 2.3 3.3 5.5 8.7 13.2 19.4 23.1

Ethiopia 0.2 0.4 0.9 1.9 4.0 7.3 11.8 18.1 21.9

Dec 9, 2022

Riaz Haq

The Path to 2075

https://www.goldmansachs.com/insights/pages/gs-research/the-path-to...

The 10 years following the creation of the BRICs acronym in 2001 represented a golden

era for emerging market economic and financial market outperformance. Between the

early 2000s and the 2007/08 Global Financial Crisis (GFC), growth was unusually strong

in most economies and especially so in EMs, fuelled by exceptionally rapid globalisation.

And, while the Global Financial Crisis drove developed economies into a deep and

lengthy recession, the majority of EMs weathered that storm relatively well. For most

economies and in most respects, our first set of BRICs projections underestimated the

speed of EM convergence over the subsequent 10 years.

The same was not true for the 10 years after that. In Exhibit 7 we compare actual GDP

growth for the period 2010-2019 with our 2011 projections.4

GDP growth has undershot

our 2011 estimates by an average of 0.6 percentage points per year (based on a

PPP-weighted average). The most notable underperformers have been Russia, Brazil,

and Latin America more generally. That said, the cross-country performance has been

mixed, with the world’s two largest economies – the US and China – matching our

projections and India slightly surpassing them.

Country GDP % Growth Rate by decades 2000-2009 to 2070-2079

Brazil 3.4 1.4 1.9 2.4 2.8 2.5 2.1 1.7 1.5

Mexico 1.5 2.7 1.8 3.0 3.0 2.6 2.2 1.7 1.4

Argentina 2.6 1.4 2.6 3.3 3.1 2.6 2.2 1.8 1.5

Colombia 3.9 3.7 3.4 3.4 3.3 2.7 2.2 1.7 1.4

Chile 4.2 3.3 2.1 2.3 2.4 2.0 1.6 1.4 1.2

Peru 5.0 4.5 3.3 4.2 4.0 3.5 2.9 2.5 2.1

------------

Country Per Capita Income in thousands of US$ by Decade-ends 2000 to 2075

Brazil 5.7 13.8 7.1 10.4 15.3 21.3 28.3 36.3 40.8

Mexico 11.0 11.6 9.0 14.3 21.2 29.5 39.2 50.0 55.7

Argentina 13.0 12.7 9.0 15.2 20.9 27.2 34.5 42.5 46.7

Colombia 3.8 7.9 5.5 9.8 16.4 24.4 33.3 43.1 48.5

Chile 7.7 15.7 13.6 18.3 26.2 35.0 44.0 54.2 59.8

Ecuador 2.2 5.7 5.9 7.8 11.2 15.5 21.0 27.6 31.4

Peru 2.9 6.3 6.4 9.8 15.5 22.7 31.1 41.0 46.5

-----------

Country GDP in Trillions of U$ from 2000 to 2075

Brazil 1.0 2.7 1.5 2.3 3.5 4.9 6.4 8.0 8.7

Mexico 1.1 1.3 1.1 1.9 3.0 4.2 5.6 6.9 7.6

Argentina 0.5 0.5 0.4 0.7 1.0 1.4 1.8 2.2 2.4

Colombia 0.2 0.4 0.3 0.5 0.9 1.4 1.9 2.4 2.6

Chile 0.1 0.3 0.3 0.4 0.5 0.7 0.9 1.1 1.2

Ecuador 0.0 0.1 0.1 0.2 0.2 0.3 0.5 0.6 0.7

Peru 0.1 0.2 0.2 0.4 0.6 1.0 1.4 1.8 2.1

Dec 10, 2022

Riaz Haq

India Can’t Dethrone China as the World’s Manufacturing Power

https://nationalinterest.org/blog/buzz/india-can%E2%80%99t-dethrone...

Due to its insufficient labor quality and infrastructure investment, fractured society, market restrictions, and trade protectionism, the South Asian nation is unlikely to replace China.

With everything seemingly going right for India, can it really replace China on the global supply chain? Unfortunately for India, due to its insufficient labor quality and infrastructure investment, fractured society, market restrictions, and trade protectionism, the South Asian nation is unlikely to replace China in the global manufacturing supply chain anytime soon.

To begin with, India’s labor quality and infrastructure availability fall far behind China’s. Many people consider India’s low labor costs a key advantage vis-à-vis China. Indeed, India’s daily median income in urban areas in 2017 was $4.21, roughly sixteen years behind China’s, which was $12.64. However, what good are low labor costs if the benefits are also relatively low? Despite India’s laudable development achievements in the past few decades, its capability enhancements have lagged far behind China’s. India’s share of stunted children today is roughly the same as China’s over two decades ago, its life-expectancy growth is twenty-five years behind China’s, and its adult literacy rate is roughly three decades behind.

Not to mention, India’s state capacity is less extensive than China’s, and many Indians who grow up in slums live their entire lives without government files. Therefore, India’s lag in labor capability enhancement behind China is likely worse than what official data suggest. These factors affect workers’ efficiency on factory floors and their ability to advance their careers in manufacturing over the long term. Low labor costs might not make up for these low labor qualities. In fact, if India cannot deal with these capability deficits effectively, its surging population might undermine India’s social stability, although the Modi administration has done well so far in this respect.

Besides labor, manufacturing also requires capital, especially infrastructure. Few developing countries can compete with China in this regard, and India is no exception. To be clear, when foreign investors chose China to be their manufacturing hub, it was, to a certain extent, a coincidence. In 1994, China reformed its tax system to enhance the central government’s control over the country’s fiscal revenues. The reform forced local governments to look for new sources of tax income and ultimately resort to local government financing vehicles (LGFVs). Because the land appreciation tax went to local governments, they began to encourage construction, sell rights to land use, and use tracts of land as collateral to fund infrastructure in the form of LGFVs. The LGFVs led to an abundance of investments and many empty industrial parks. When Western investors started to look overseas for places to build factories around the same period, China seemed especially appealing due to its availability of capital.

-------

Despite its many advantages and Western countries’ support, it is unlikely that India can replace China in the global manufacturing supply chain for the foreseeable future. Economically, despite its low labor costs, the low quality of India’s labor pool that stems from its deficits in capability development offset its labor advantages, and inadequate infrastructure investments put India at a disadvantage regarding capital costs. Socially, India’s fractured multi-dimensional society creates different economic demands for various groups, undermining the advantages of India’s large population. Politically, India’s market restrictions make its business environment less favorable and decrease its industrial labor supply. Meanwhile, protectionist traditions hinder India’s ability to adopt an export-oriented growth model and integrate itself into the global supply chain.

Dec 11, 2022

Riaz Haq

Rotation of #G20 presidency from #Indonesia to #India may have met with indifference in the rest of the world.But in #Modi's India, it has been emblazoned on billboards & front-page advertisements in newspapers & breathlessly discussed on TV channels. #BJP https://www.washingtonpost.com/business/india-is-in-danger-of-missi...

The euphoria over India's G20 presidency shows that Hindu nationalists still need and often crave outside validation. This creates an insoluble problem for them

This month’s rotation of the G-20 presidency from Indonesia to India may have met with indifference in much of the world. In India, however, the news has been emblazoned on billboards and front-page advertisements in newspapers, and is breathlessly discussed on television channels.

The common theme of these celebrations is that the “mother of democracy” — in Prime Minister Narendra Modi’s phrase — is about to become a vishwa-guru, or teacher to the world. As the winter session of India’s parliament opened earlier this month, Modi asked its members to project a responsible face to the world in the months leading up to the next G-20 leaders’ summit in September 2023.

There is no question that for a few days that month, the eyes of the world’s media will be on India. But what will they see? And what international image does India want to project?

The common theme of these celebrations is that the “mother of democracy” — in Prime Minister Narendra Modi’s phrase — is about to become a vishwa-guru, or teacher to the world. As the winter session of India’s parliament opened earlier this month, Modi asked its members to project a responsible face to the world in the months leading up to the next G-20 leaders’ summit in September 2023.

There is no question that for a few days that month, the eyes of the world’s media will be on India. But what will they see? And what international image does India want to project?

Certainly, the emergence of a multipolar world opens up fresh opportunities for India to deploy its unused moral and intellectual capital. Preoccupied with internal troubles, the United States and Europe have left vast tracts of the Global South open to Chinese and Russian influence.

In particular, China dominates Asia, Africa and Latin America with its economic power. Last week, Chinese President Xi Jinping hailed a “new era” in his country’s relationship with Gulf nations as he met Saudi Arabia’s Crown Prince Mohammed Bin Salman in Riyadh. According to Xi, China and the Gulf countries “respect each other’s history and cultural traditions.”

Modi would have a hard time making a similar claim: He was forced to apologize earlier this year to Gulf rulers for the Islamophobic rants of one of his spokespersons. And even in countries with which India shares a Hindu-Buddhist heritage and trading links — Nepal, Sri Lanka, Thailand, Malaysia and Indonesia — India now plays second fiddle to China.

Dec 13, 2022

Riaz Haq

Nor has Modi seized the intellectual leadership of the Global South — a vacancy that is rapidly being filled by Brazil’s President Luiz Inacio Lula da Silva. Emerging from years in prison, Lula has moved fast to reposition Brazil in the avant garde of the global fight against climate change. He is on his way to affirming Barack Obama’s 2009 characterization of him as “the most popular politician on earth.”

In power for nearly a decade, Modi is still struggling to make a similar impact internationally, despite his bear-hugging of world leaders. And that is because the gap between what he says abroad and what he does at home is too wide and too obvious.

Modi is not wrong to claim that India’s core philosophy is vasudev kutamban — the idea that the world is one family. India is arguably the world’s most enduring experiment in cultural pluralism. Those culture-warriors who today belligerently police boundaries of race, religion and gender could learn a great deal from the long Indian experience of multiple, overlapping identities.

Modi’s Bharatiya Janata Party has been relentlessly hostile to this older idea of India, however, as it tries to recast India as a Hindu nation. In a recent study by the Pew Research Center, India fared worse than Taliban-ruled Afghanistan in an index measuring social hostilities involving religion. On other recent rankings — ranging from press freedom to hunger — the mother of democracy has fared equally poorly.

Not surprisingly, the international media has become more critical of India in recent months. Modi now routinely features together with Donald Trump, Boris Johnson, Rodrigo Duterte and Jair Bolsonaro in a gallery of elected demagogues (though perhaps a recent snub of Vladimir Putin may soften the Indian leader’s image somewhat).

Within India, such Western reports are attacked in unison by politicians, bureaucrats, media personalities, film actors and sports stars. These remarkably well-organized and successful campaigns suggest that the silo of fake news and sectarian opinion in India is more impenetrable than anything created by Trump and Fox News.

Nevertheless, the current euphoria over India’s G-20 presidency shows that Hindu nationalists still need — and often crave — outside validation. This creates an insoluble problem for them, as their heavily Hinduized idea of India hasn’t been endorsed by many people outside the country. Evidence came only last month, when Israeli director Nadav Lapid, invited to judge an international film festival in Goa, publicly ridiculed a controversial anti-Muslim film that had been zealously promoted by Modi’s government.

Under attack from Hindu nationalist trolls, Lapid dug in and amplified his scorn. It was then echoed by his fellow foreign jurors. Israeli diplomats got involved. Thus, some small commotion at a film festival blew up into an entirely unnecessary international incident.

Such embarrassments, likely as the world examines India more closely next year, are easily avoided. In the months ahead, the government could end its pressure on dissenters, abandon its dog-whistle rhetoric against Muslims and restore the independence of democratic institutions from the media to the judiciary.

Certainly, those claiming to have mothered democracy need to narrow the great gap between propaganda and reality. For India’s timeless moral — that the world is one family — is unlikely to resonate when broadcast by people trapped in silos.

Dec 13, 2022

Riaz Haq

During the year 2022 (November), 765,172 Pakistanis proceeded abroad for the purpose of employment.

https://beoe.gov.pk/?__cf_chl_jschl_tk__=b1b4890b1c9705af3b244646c1...

Dec 13, 2022

Riaz Haq

The Asian Development Bank (ADB) said on Wednesday that Pakistan’s economic outlook for the fiscal year ending in June 2023 has “deteriorated under heavy flooding” while the “economy was already struggling to regain macroeconomic and fiscal stability”.

https://www.dawn.com/news/1726307

In the supplement report titled ‘Asian Development Outlook 2022 Supplement’, ADB said flood disruption and damage in the country are “expected to slow real Gross Domestic Product (GDP) growth in combination with a tight monetary stance, high inflation, and an un-conducive global environment”.

------------

the ADB report highlighted that flood damage in Pakistan threatened the upcoming agricultural season as well, as wheat is usually planted from mid-October.

It said the flooding is expected to have spillover effects on industry — notably textiles and food processing — and on services, in particular wholesale trade and transportation.

The report added that the floods had adversely affected cotton, rice and other important crops that are grown in the country.

The fiscal year 2023 forecast for Pakistan has been revised to reflect a “weaker currency [and] higher domestic energy prices” along with “flood-related crop and livestock losses and supply disruption, which have caused transitory food shortages and price spikes”, ADB elaborated in the report.

It further explained that transportation difficulties had “exacerbated these shortages and disrupted other domestic supply chains, broadening inflationary pressures and imposing production challenges”.

Growth and inflation outlook in South Asia

According to the ADB, South Asia is on track to meet the growth forecast of 6.5pc in 2022 but the forecast for 2023 has been downgraded slightly from 6.5pc to 6.3pc.

It further said sub-regional revision for 2023 largely reflected “lower forecasts for Bangladesh and Pakistan” as recovery in Bangladesh was also “hampered by external imbalances and unexpectedly high inflation”.

It projected inflation for South Asia — comprising of Afghanistan, Bangladesh, Bhutan, India, Maldives, Nepal, Pakistan and Sri Lanka — to increase from 8.1pc in September to 8.2pc in the recent December update.

However, the estimated inflation figures for the year 2023 had a more substantial increment from 7.4pc to 7.9pc.

The report said that the sub-regional revision for 2023 largely reflects higher inflation forecasts for Bangladesh, Nepal, Pakistan and Sri Lanka.

Inflation forecasts for elsewhere in the sub-region in 2023 remained unchanged while inflation in India is expected to rise to 6.7pc before falling back to 5.8pc in the fiscal year 2022.

Dec 14, 2022

Riaz Haq

Chinese president’s Saudi visit to boost investment in China-Pakistan corridor project: Experts

https://www.arabnews.com/node/2212576/world

Saudi Arabia and China were expected to sign more than 20 initial agreements worth more than $29.3 billion during Xi’s trip. The two countries were also discussing a plan to harmonize the implementation of Vision 2030 and China’s Belt and Road Initiative.

CPEC, a $65 billion economic corridor in Pakistan that connects China to the Arabian Sea and is part of Beijing’s infrastructure initiative, was also expected to feature in Xi’s meetings with the crown prince.

“Saudi Arabia is interested in becoming part of CPEC by investing heavily in it and also interested in BRI and this visit will improve things in this regard as China is the main initiator of both mega projects,” Pakistan’s former ambassador to China, Naghmana Hashmi, told Arab News.

Saudi Arabia, alongside the UAE and Germany, is among countries that have expressed interests in investing in CPEC. In 2019, the Kingdom announced plans to set up a $10 billion oil refinery in Pakistan’s deep-water port of Gwadar on the Arabian Sea.

CPEC is a sprawling package that includes everything from road construction and power plants to agriculture. In the South Asian nation, it has been billed as a massive development program that will bring new prosperity, where the average citizen lives on just $125 a month.

“The growing friendship between China and Saudi Arabia will benefit Pakistan as the country has very good relations with both, and both are pillars of strength for us,” Hashmi said.

International relations expert Zafar Jaspal told Arab News that the visit would have a “constructive and positive impact on CPEC” and “open the way for Saudi investment.”

Xi’s trip to Riyadh could serve as a “great convergence point” between Pakistan, China, and Saudi Arabia, according to Dr. Huma Baqai, an international relations expert and rector of the Millennium Institute of Technology and Entrepreneurship in Karachi.

“The visit can give the requisite push and momentum to the intended Saudi investment in the flagship project of the BRI,” she told Arab News.

Dec 14, 2022

Riaz Haq

#China is #SaudiArabia’s largest #trading partner, with #Chinese exports to #KSA reaching $30.3 billion in 2021 & Saudi exports at $57 billion in the same year. #Saudi #oil makes up 18% of #Beijing’s total crude #oil imports — worth about $55.5 billion January-October in 2022.

https://twitter.com/haqsmusings/status/1603108539383263232?s=20&...

https://www.vox.com/2022/12/10/23502903/china-saudi-arabia-united-s...

“The oil market, and by extension the entire global commodities market, is the insurance policy of the status of the dollar as reserve currency,” economist Gal Luft, co-director of the Washington-based Institute for the Analysis of Global Security, told the Journal at the time. “If that block is taken out of the wall, the wall will begin to collapse.”

------------------

Saudi Arabia, meanwhile, has great ambitions to diversify its economy, which has for decades relied on crude oil output. But in order to do that, it needs money — oil money. That’s at least part of why Saudi Arabia limited production in the midst of a global oil crisis and prices for crude oil remain high.

Both nations also tout ambitious infrastructure projects. The Belt and Road initiative, China’s effort to create a 21st-century Silk Road international trade route by providing the finances to develop series of ports, pipelines, railroads, bridges, and other trade infrastructure to nations across Asia and Africa, is a milestone effort for Xi. It’s also received major criticism for potentially exploiting poor nations by essentially loaning them money they can’t pay back, in some cases granting China control over these critical hubs.

Xi’s presence in Saudi Arabia, both with MBS and as part of a larger summit with Arab and Gulf Cooperation Council (GCC) nations, present multiple opportunities to strengthen ties with a host of nations in the region — and to make sure that in the global power competition, those nations are, at least, not aligned with the US, as Shannon Tiezzi wrote in The Diplomat Wednesday.

Critically, Saudi Arabia knows it cannot depend on generous US weapons sales under Biden, so China is an increasingly viable alternative. In fact, Reuters reported, Saudi Arabia is thought to have signed $30 billion in defense contracts at this summit with China.

In forging their alliance, both nations get a strong trading partner who won’t question their policies; Saudi Arabia gets a more predictable relationship in Xi than it has seen in the switch from former President Donald Trump to Biden.

How does this affect the US and its global position as a superpower?

The US-Saudi relationship is longstanding. It officially started toward the end of World War II, and the basic oil-for-security trade has lasted for decades, becoming increasingly important to the kingdom between Iraq’s invasion of Kuwait in the 1990s and the increasing influence of regional rival Iran. Despite Saudi repression and alleged human rights abuses, Riyadh could count on US weapons, and the US could almost always count on cheap Saudi oil.

Of course, there have been tensions in the relationship before. The 1973 oil embargo in retaliation for the US decision to resupply the Israeli military during the Arab-Israeli War, as well as Saudi involvement in the terror attacks on September 11, 2001, tested the alliance, but US leadership maintained that the kingdom was a key regional partner nonetheless.

Under Trump, the relationship between the two nations was somewhere between transactional and downright chummy — Trump even reportedly bragged that he defended MBS against criticism from Congress over Khashoggi’s death.

But the relationship has become the most strained it has been in recent memory due to MBS’s abuses and Biden’s criticism. In March, after Russia’s invasion of Ukraine sparked a fuel shortage, MBS refused to take Biden’s calls to negotiate increased oil production and help ease prices. When they finally met in July, Biden was extremely uncomfortable — and he left almost empty-handed.

Dec 14, 2022

Riaz Haq

CPEC special economic zones to generate huge job opportunities in Pakistan: official

https://english.news.cn/20221215/e0172b03c8b5487d806730149fd7b5fb/c...

Four special economic zones (SEZs) being set up under the framework of the China-Pakistan Economic Corridor (CPEC) are likely to generate about 575,000 direct and over 1 million indirect jobs in Pakistan, a senior official said on Thursday.

The economic zones being established in the country's Khyber Pakhtunkhwa (KP), Punjab, Sindh and Balochistan provinces would bring about immense opportunities for Pakistani people in job and business sectors, Chairman of Special Economic Zones Authority S.M. Naveed said.

"We have conducted a study to assess job opportunities in four out of nine SEZs, including KP's Rashakai, Sindh's Dhabeji, Punjab's Allama Iqbal and Balochistan's Bostan, to find out potential jobs and industries in the SEZs," the official said, adding that the SEZs offer employment in different fields for which the local youth would be trained before the initiation of the industrial phase.

The trained and skilled labor and engineers would not only get good jobs in the economic zones but also enable Chinese and local companies to recruit skilled professionals from local areas, he added.

The potential industries being set up in the CPEC special economic zones include food processing, cooking oil, ceramics, gems and jewelry, marble, minerals, agriculture machinery, iron and steel, motorbike assembling, electrical appliances and automobiles.

Launched in 2013, CPEC is a corridor linking Pakistan's Gwadar Port with Kashgar in northwest China's Xinjiang Uygur Autonomous Region, which highlights energy, transport and industrial cooperation. ■

Dec 15, 2022

Riaz Haq

Morgan Stanley's Ridham Desai, Chetan Ahya and Upasana Chachra: India is on track to become the world’s third largest economy by 2027, surpassing Japan and Germany, and have the third largest stock market by 2030, thanks to global trends and key investments the country has made in technology and energy.

https://www.morganstanley.com/ideas/investment-opportunities-in-india

India is already the fastest-growing economy in the world, having clocked 5.5% average gross domestic product growth over the past decade. Now, three megatrends—global offshoring, digitalization and energy transition—are setting the scene for unprecedented economic growth in the country of more than 1 billion people.

“We believe India is set to surpass Japan and Germany to become the world’s third-largest economy by 2027 and will have the third-largest stock market by the end of this decade,” says Ridham Desai, Morgan Stanley’s Chief Equity Strategist for India. “Consequently, India is gaining power in the world order, and in our opinion these idiosyncratic changes imply a once-in-a-generation shift and an opportunity for investors and companies.”

All told, India’s GDP could more than double from $3.5 trillion today to surpass $7.5 trillion by 2031. Its share of global exports could also double over that period, while the Bombay Stock Exchange could deliver 11% annual growth, reaching a market capitalization of $10 trillion in the coming decade.

In a new Morgan Stanley Research Bluepaper, analysts working across sectors look at how this new era of economic development could bring about staggering changes: boosting India’s share of global manufacturing, expanding credit availability, creating new businesses, improving quality of life and spurring a boom in consumer spending.

“In a world that is currently starved of growth, the opportunity set in India must be on global investors’ radar,” says Chetan Ahya, Morgan Stanley’s Chief Asia Economist. “India will be one of only three economies in the world that can generate more than $400 billion annual economic output growth from 2023 onward, and this will rise to more than $500 billion after 2028.”

Global Offshoring Creates a Workforce for the World

Companies around the world have been outsourcing services such as software development, customer service and business process outsourcing to India since the early days of the Internet. Now, however, tighter global labor markets and the emergence of distributed work models are bringing new momentum to the idea of India as the back office to the world.

“In a post-Covid environment, CEOs are more comfortable with both work from home and work from India,” says Desai. In the coming decade, he notes, the number of people employed in India for jobs outside the country is likely to at least double, reaching more than 11 million, as global spending on outsourcing swells from $180 billion per year to around $500 billion by 2030.

India is also poised to become the factory to the world, as corporate tax cuts, investment incentives and infrastructure spending help drive capital investments in manufacturing.

“Multinationals are now buoyant about the prospects of investing in India, and the government is helping their cause by investing in infrastructure as well as supplying land for building factories,” says Upasana Chachra, Chief India Economist. Morgan Stanley data shows that multinational corporations’ sentiment on the investment outlook in India is at an all-time high. Manufacturing’s share of GDP in India could increase from 15.6% currently to 21% by 2031—and, in the process, double India’s export market share.

India's Share of Manufacturing is expected to increase to 21% of GDP by 2031

Dec 19, 2022

Riaz Haq

In mid-April, India is forecast to surpass China as the world's most populous country.

https://www.bbc.com/news/world-asia-india-63957562

The Asian giants already have more than 1.4 billion people each, and for over 70 years have accounted for more than a third of the global population.

China's population is likely to begin shrinking next year. Last year, 10.6 million people were born, a little more than the number of deaths, thanks to a rapid drop in fertility rate. India's fertility rate has also fallen substantially in recent decades - from 5.7 births per woman in 1950 to two births per woman today - but the rate of decline has been slower.

So what does India overtaking China as the most populous country in the world mean?

China reduced its population growth rate by about half from 2% in 1973 to 1.1% in 1983.

Demographers say much of this was achieved by riding roughshod over human rights - two separate campaigns promoting just one child and then later marriages, longer gaps between children and fewer of them - in what was a predominantly rural and overwhelmingly uneducated and poor country,

India saw rapid population growth - almost 2% annually - for much of the second half of the last century. Over time, death rates fell, life expectancy rose and incomes went up. More people - especially those living in cities - accessed clean drinking water and modern sewerage. "Yet the birth rate remained high," says Tim Dyson, a demographer at the London School of Economics.

India launched a family planning programme in 1952 and laid out a national population policy for the first time only in 1976, around the time China was busy reducing its birth rate.

But forced sterilisations of millions of poor people in an overzealous family planning programme during the 1975 Emergency - when civil liberties were suspended - led to a social backlash against family planning. "Fertility decline would have been faster for India if the Emergency hadn't happened and if politicians had been more proactive. It also meant that all subsequent governments treaded cautiously when it came to family planning," Prof Dyson says.

East Asian countries such as Korea, Malaysia, Taiwan and Thailand, which launched population programmes much later than India, achieved lower fertility levels, cut infant and maternal mortality rates, raised incomes and improved human development earlier than India.

India has added more than a billion people since Independence in 1947, and its population is expected to grow for another 40 years. But its population growth rate has been declining for decades now, and the country has defied dire predictions about a "demographic disaster".

So India having more people than China is no longer significant in a "concerning" way, say demographers.

Rising incomes and improved access to health and education have helped Indian women have fewer children than before, effectively flattening the growth curve. Fertility rates have dipped below replacement levels - two births per woman - in 17 out of 22 states and federally administered territories. (A replacement level is one at which new births are sufficient to maintain a steady population.)

The decline in birth rates has been faster in southern India than in the more populous north. "It is a pity that more of India could not have been like south India," says Prof Dyson. "All things being equal, rapid population growth in parts of north India have depressed living standards".

Dec 23, 2022

Riaz Haq

In mid-April, India is forecast to surpass China as the world's most populous country.

https://www.bbc.com/news/world-asia-india-63957562

It could, for example, strengthen India's claim of getting a permanent seat in the UN Security Council, which has five permanent members, including China.

India is a founding member of the UN and has always insisted that its claim to a permanent seat is just. "I think you have certain claims on things [by being the country with largest population]," says John Wilmoth, director of the Population Division of the UN Department of Economic and Social Affairs.

The way India's demography is changing is also significant, according to KS James of the Mumbai-based International Institute for Population Sciences.

Despite drawbacks, India deserves some credit for managing a "healthy demographic transition" by using family planning in a democracy which was both poor and largely uneducated, says Mr James. "Most countries did this after they had achieved higher literacy and living standards."

More good news. One in five people below 25 years in the world is from India and 47% of Indians are below the age of 25. Two-thirds of Indians were born after India liberalised its economy in the early 1990s. This group of young Indians have some unique characteristics, says Shruti Rajagopalan, an economist, in a new paper. "This generation of young Indians will be the largest consumer and labour source in the knowledge and network goods economy. Indians will be the largest pool of global talent," she says.

India needs to create enough jobs for its young working age population to reap a demographic dividend. But only 40% of of India's working-age population works or wants to work, according to Centre for Monitoring Indian Economy (CMIE).

More women would need jobs as they spend less time in their working age giving birth and looking after children. The picture here is bleaker: only 10% of working-age women were participating in the labour force in October, according to CMIE, compared with 69% in China.

Then there's migration. Some 200 million Indians have migrated within the country - between states and districts - and their numbers are bound to grow. Most are workers who leave villages for cities to find work. "Our cities will grow as migration increases because of lack of jobs and low wages in villages. Can they provide migrants a reasonable living standard? Otherwise, we will end up with more slums and disease," says S Irudaya Rajan, a migration expert at Kerala's International Institute of Migration and Development.

Demographers say India also needs to stop child marriages, prevent early marriages and properly register births and deaths. A skewed sex ratio at birth - meaning more boys are born than girls - remains a worry. Political rhetoric about "population control" appears to be targeted at Muslims, the country's largest minority when, in reality, "gaps in childbearing between India's religious groups are generally much smaller than they used to be", according to a study from Pew Research Center.

And then there's the ageing of India

Demographers say the ageing of India receives little attention.

In 1947, India's median age was 21. A paltry 5% of people were above the age of 60. Today, the median age is over 28, and more than 10% of Indians are over 60 years. Southern states such as Kerala and Tamil Nadu achieved replacement levels at least 20 years ago.

"As the working-age population declines, supporting an older population will become a growing burden on the government's resources," says Rukmini S, author of Whole Numbers and Half Truths: What Data Can and Cannot Tell Us About Modern India.

"Family structures will have to be recast and elderly persons living alone will become an increasing source of concern," she says.

Dec 23, 2022

Riaz Haq

Indian economy grew 8.7% in last fiscal year to surpass pre-Covid levels, IMF says

Growth expected to moderate to 6.8% in current year amid tighter financial conditions

https://www.thenationalnews.com/business/economy/2022/12/23/indian-...

India’s real gross domestic product grew by 8.7 per cent in the 2021-2022 fiscal year, boosting its total output above pre-coronavirus levels despite global macroeconomic headwinds, the International Monetary Fund has said.

India, Asia's third-largest economy and the world's fifth largest, rebounded from the deep pandemic-induced downturn on the back of fiscal measures to address high prices and monetary policy tightening to address elevated inflation, the Washington-based lender said in a report on Friday.

“Economic headwinds include inflation pressures, tighter global financial conditions, the fallout from the war in Ukraine and associated sanctions on Russia, and significantly slower growth in China and advanced economies,” the fund said.

“Growth has continued this fiscal year, supported by a recovery in the labour market and increasing credit to the private sector.”

In October, the IMF cut its global economic growth forecast for next year, amid the Ukraine conflict, broadening inflation pressures and a slowdown in China, the world’s second-largest economy.

The fund maintained its global economic estimate for this year at 3.2 per cent but downgraded next year's forecast to 2.7 per cent — 0.2 percentage points lower than its July forecast.

There is a 25 per cent probability that growth could fall below 2 per cent next year, the IMF said in its World Economic Outlook report at the time.

Global economic growth in 2023 is expected to be as weak as in 2009 during the financial crisis as a result of the Ukraine conflict and its impact on the world economy, according to the Institute of International Finance.

Economic growth in India is expected to moderate, reflecting the less favourable outlook and tighter financial conditions, the IMF said.

Real GDP is projected to grow at 6.8 per cent for the current financial year to the end of March, and by 6.1 per cent in 2023-2024 fiscal year, according to the fund's estimates.

Reflecting broad-based price pressures, inflation in India is forecast at 6.9 per cent in the 2022-2023 fiscal year and expected to moderate only gradually over the next year.

Rising inflation can further dampen domestic demand and affect vulnerable groups, according to the fund.

India’s current account deficit is expected to increase to 3.5 per cent of GDP in the 2022-2023 fiscal year as a result of both higher commodity prices and strengthening import demand, the lender said.

“A sharp global growth slowdown in the near term would affect India through trade and financial channels,” it said.

“Intensifying spillovers from the war in Ukraine can cause disruptions in the global food and energy markets, with significant impact on India. Over the medium term, reduced international co-operation can further disrupt trade and increase financial markets’ volatility.”

However, the successful introduction of wide-ranging reforms or greater-than-expected dividends from the advances in digitalisation could increase India’s medium-term growth potential, the IMF said.

Additional monetary tightening should be carefully calibrated and communicated, it said.

“The exchange rate should act as the main shock absorber, with intervention limited to address disorderly market conditions,” the report said.

The IMF also recommended that India’s financial sector policies should continue to support the exit of non-viable companies and encourage banks to build capital buffers and recognise problem loans.

Reforms to strengthen governance and reduce the government’s footprint are needed to support strong medium-term growth, it said.

The lender also highlighted the need for structural reforms to promote resilient, green and inclusive growth.

Dec 24, 2022

Riaz Haq

Arvind Panagariya cautions against cutting trade ties with China

https://www.thehindu.com/business/arvind-panagariya-cautions-agains...

“Engaging China in a trade war at this juncture will mean sacrificing a considerable part of our potential growth... purely on economic grounds, it will be unwise to take any action in response to it (transgressions on the border),” the eminent economist told PTI.

Amid demands for snapping trade ties with China for its transgressions on the border, former NITI Aayog Vice-Chairman Arvind Panagariya has opined that cutting trade ties with Beijing at this juncture would amount to sacrificing India's potential economic growth.

Instead, Mr. Panagariya suggested that India should try to enter into free trade agreements (FTA) with countries such as the U.K. and the European Union to expand its trade.

------

Mr. Panagariya, currently a professor of economics at Columbia University, said both countries can play the trade sanctions game but the ability of a $17 trillion economy (China) to inflict injury on a $3 trillion economy (India) is far greater than the reverse.

"Now, there are some who want trade sanctions on China to 'punish' it for its transgressions on the border... if we try to punish China, it will not sit back, as amply illustrated by its response to sanctions by even the mighty United States," he observed.

----------

Mr. Panagariya pointed out that even a large economy such as the U.S. has not been very successful with its sanctions either against China or even Russia.

"Its close ally, EU, has had to pay a very high price of the sanctions against Russia. So, this is a very slippery slope," he observed.

The trade deficit, the difference between imports and exports, between India and China touched $51.5 billionduring April-October this fiscal. The deficit during 2021-22 had jumped to $73.31 billion as compared to $44.03 billion in 2020-21, according to the latest government data According to the data, imports during April-October this fiscal stood at $60.27 billion, while exports aggregated at $8.77 billion.

Dec 24, 2022

Riaz Haq

Pakistan: Top Performing Sectors And Scrips Of 2022 – OpEd

https://www.eurasiareview.com/26122022-pakistan-top-performing-sect...

Let me and you accept the harsh reality that 2022 was a bad year for Pakistan’s capital market. Market value (market capitalization) of companies listed at Pakistan Stock Exchange (PSX) declined 17% to RKR6.4 trillion. In US$ terms it plummeted 35% to US$28 billion. Still there are some islands of excellence.

Real Estate Investment Trust (REIT), Synthetic & Rayon, and Sugar were the top performing sectors in 2022 as their market cap increased by 12%, 6% and 5% respectively, despite bad market conditions.

Technology sector was up 2% and outperformed the market despite fall in global listed technology stocks.

As against these, Engineering, Automobile Parts, and Miscellaneous sectors remained the worst performing sectors posting decline of 45%, 41% and 34% respectively.

REIT sector that has only one listed company gained in 2022 due to stable dividend yield coupled with changes in regulations on REITs investment for banks. To recall, State Bank of Pakistan (SBP) recently allowed banks to count their investments in shares issued by REIT towards achievement of housing and construction finance targets.

Synthetic & Rayon also posted strong performance led by rally in Ibrahim Fiber Limited (IBFL).

Sugar sector performance was led by JDW Sugar Mills (JDWS) that announced buy back.

Engineering sector (mainly steel related companies) was badly impacted due to economic slowdown and subdued construction activity.

Automobile parts sector also remained amongst worst performing sectors primarily due to import restrictions, high financing rates and lackluster demand.

For its analysis, Pakistan’s leading brokerage house, Topline Securities assumed sectors with minimum market capitalization of US$100 million adjusted for new listings including Adamjee Insurance (AICL), and Telecard Limited (GEMSNL).

Lotte Chemical (LOTCHEM) doubled while Airlink was down substantially in 2022. LOTCHEM was the top performing stock of the market in 2022 where the scrip gained more than 100%. Investors were excited over potential sell off by Lotte Chemical Corporation South Korea (parent company of LOTCHEM) and subsequent public offer for minority shareholders.

LOTCEHM was followed by Faysal Bank (FABL) and Unilever Pakistan Foods (UPFL). The strong stock performance by FABL is on announcement to convert into an Islamic Bank followed by a special dividend.

Similarly, UPFL stock was up 34% as the company posted strong profitability growth of 33%YoY in 9M2022.

Systems Limited (SYS), Pakistan’s largest listed IT firm remained amongst the top performing stocks for the third consecutive year as the company continued to post strong profitability growth in spite of economic challenges.

Air Link Communication (AIRLINK) declined 54% due to low profits led by lower volumetric sales.

Gul Ahmed Textile Mills (GATM) also reported decline by 52% amid slowdown in textile exports.

Searle Company Limited (SEARLE) was down 52% due to lower profits led by falling gross margins driven by significant jump in raw material cost and company’s inability to immediately pass full impact on to consumers.

Dec 25, 2022

Riaz Haq

Unlocking Pakistan’s digital potential: The economic opportunities of digital transformation and Google’s contribution

https://alphabeta.com/our-research/unlocking-pakistans-pkr97-trilli...

Pakistan’s vibrant technology sector has grown significantly in recent years and is well-positioned for further growth. The country produces over 20,000 Information Technology (IT) graduates each year, has nurtured over 700 tech start-ups since 2010, and has the fourth highest earning IT workforce in the world. Pakistan’s technology sector also has a large export element, with annual revenue from exports of IT and IT-enabled Services (ITeS) accounting for USD1.4 billion in 2020 – having grown at 10.8 percent per year since 2010. Furthermore, the government has identified the creation of a holistic digital ecosystem – most prominently in its “Digital Pakistan Policy” – as one of the key levers of economic growth.

Despite these significant achievements, the country can go further in its digital transformation journey. Pakistan’s online population has grown rapidly at 68 percent per annum from 2016 to 2019, and the Internet penetration rate reached 35 percent in January 2020. However, the country faces several hurdles to full digital transformation. For example, the World Economic Forum’s “Global Competitiveness Index 2019” ranked Pakistan as 73rd out of 141 countries on the ability of the active working population to possess and use digital skills. Digital transformation will also be important to boost its economic recovery efforts and enhance the long-term resilience of businesses in adapting to future “black swan” events in the post-pandemic era.

There is a significant economic prize attached to accelerating Pakistan’s digital transformation. AlphaBeta’s study (commissioned by Google) finds that digital technologies can unlock PKR9.7 trillion (USD59.7 billion) worth of annual economic value in Pakistan by 2030.

Key messages from the research include:

There is a significant economic prize attached to accelerating Pakistan’s digital transformation. If fully leveraged by 2030, digital technologies could create up to PKR9.7 trillion (USD59.7 billion) in economic value. This is equivalent to about 19 percent of the country’s GDP in 2020. The sectors projected to be the largest beneficiaries are agriculture and food; consumer, retail and hospitality; and education and training. For example, machine learning algorithms have shown to be beneficial for the agricultural and food sector, where AI-powered technologies can monitor ecological conditions to determine whether crops need irrigation or not, reducing water use.

There are three areas of action required for Pakistan to fully capture its digital opportunity: i) develop infrastructure to support the local tech ecosystem; ii) create a conducive environment for IT exports, and iii) promote innovation and digital skills. A range of policies by the Pakistani government has already been introduced to accelerate digital transformation such as “Right of Way” policy, which expedites the expansion of telecom infrastructure, and the “Brand Pakistan” campaign, which promotes the country’s exports via digital platforms. However, there is further scope of actions for Pakistan to consider such as increasing Internet availability through infrastructure investments, especially in rural areas (e.g., Thailand’s “Net Pracharat” programme to expand the national broadband network), creating an accommodative tax framework and ease restrictive data policies, and forging close public-private partnerships to improve the relevance of skills trainings (e.g., “Philippines Talent Mapping Initiative” which involved Philippines’ Department of Labour and Employment consulting with employers to create a framework to analyse the competencies of Filipinos).

Dec 29, 2022

Riaz Haq

The year 2023 marks a historic turning point for Asia's demography: For the first time in the modern era, India is projected to surpass China as the most populous country.

https://asia.nikkei.com/Spotlight/Asia-Insight/Old-Japan-young-Indi...

Besides China (1.426 billion) and India (1.417 billion), five other Asian countries had over 100 million people as of 2022, the U.N. figures show. Indonesia had 276 million, Pakistan's population was at 236 million, Bangladesh counted 171 million, Japan had 124 million and the Philippines had 116 million. Vietnam, with 98 million, is expected to join the club soon.

------------

Even though economists expect India's gross domestic product to grow around 7% in 2023 -- the highest among major economies -- and although the worst of the COVID-19 pandemic appears to be over, India continues to face high unemployment rates of around 8%, according to the Center for Monitoring Indian Economy, a local private researcher. That shows the country is not creating enough jobs to support the growing population.

---------

Kumagai also said that India's growing demand for food could be felt beyond its borders.

"The challenge for India concerning food is that the production of agricultural products is easily affected by the weather," he said. "On the other hand, domestic demand is increasing rapidly. As such, when production is low, domestic supply is prioritized, which eventually may lead to restrictions on exports, just as India restricted wheat exports in 2022, which could cause food problems in other countries as well."

--------

While the South Asian nation's growing and youthful population spells opportunities for development, it also creates layers of challenges, from poverty reduction to education. Experts say soaring demand for food could affect India's trade with other countries, while the World Bank recently estimated that India will need to invest $840 billion into urban infrastructure over the next 15 years to support its swelling citizenry.

"This is likely to put additional pressure on the already stretched urban infrastructure and services of Indian cities -- with more demand for clean drinking water, reliable power supply, efficient and safe road transport amongst others," the bank's report said.

India's dilemmas are only part of a complex and diverging Asian population picture -- split between young, growing countries and aging, declining ones. Humanity's latest milestone turns a spotlight on this gap and the problems on both sides of it.

---

Reaching a world of 8 billion people signals significant improvements in public health that have increased life expectancy, the U.N. said. But it also pointed out, "The world is more demographically diverse than ever before, with countries facing starkly different population trends ranging from growth to decline."

Nowhere is this more apparent than in Asia. The region has young countries with a median age in the 20s, such as India (27.9 years old), Pakistan (20.4) and the Philippines (24.7), as well as old economies with median ages in the 40s, including Japan (48.7) and South Korea (43.9). The gap between the young and the old has gradually widened over the past decades.

While India faces a lack of jobs and infrastructure to support its growing population, Japan faces a serious reduction in births, accelerated by the COVID-19 pandemic, which its government says is a "critical situation." Either way, the population trends are increasingly impacting economies and societies.

Even though economists expect India's gross domestic product to grow around 7% in 2023 -- the highest among major economies -- and although the worst of the COVID-19 pandemic appears to be over, India continues to face high unemployment rates of around 8%, according to the Center for Monitoring Indian Economy, a local private researcher. That shows the country is not creating enough jobs to support the growing population.

Jan 3, 2023

Riaz Haq

Sadanand Dhume

@dhume

Contrary to all the hype, India’s market for consumer goods remains very small. The Chinese buy about 8X more iPhones and nearly 100X more BMWs than Indians. Starbucks has 20X as many outlets in China as in India. [My take] v

@WSJopinion

https://www.wsj.com/articles/india-middle-class-free-trade-modi-tar...

https://twitter.com/dhume/status/1611155691540217858?s=20&t=FIh...

Sadanand Dhume

@dhume

This column has set off a mini firestorm here, so let me quickly respond to some of the objections. First, people point out that obviously China is a larger market than India. After all, it’s a larger economy. Chinese GDP in 2021: $17.73T. Indian GDP: $3.18T. 1/n

https://twitter.com/dhume/status/1611369521146732553?s=20&t=FIh...

Sadanand Dhume

@dhume

But this doesn’t refute my central point—that contrary to popular belief India’s market is small by global standards. We should ask how China pulled so far ahead. In 1990 Chinese GDP ($360b) was similar to Indian GDP ($321b). Now China’s economy is 5.6X larger than India’s. 2/n

Sadanand Dhume

@dhume

Over the past decade, the gap between China and India has not shrunk. It has grown. In 2012, the Chinese economy was 4.7X larger than India’s. 3/n

Sadanand Dhume

@dhume

Moreover, as I show in my piece, mere GDP figures are misleading. For many consumer goods, the gap between the Chinese market and the Indian market is LARGER than the gap between Chinese and Indian GDP. 4/n

Sadanand Dhume

@dhume

Now to the second major objection: “Don’t talk about Starbucks, iPhones and Netflix subscriptions. These are luxury goods.” My response: The fact that they are luxury goods in India proves my point. If Indians had more disposable income they would not be seen as luxury goods. 5/n

Sadanand Dhume

@dhume

Or take cars, a middle class good in much of the world. In 2021, the Chinese bought 26.3m cars. Indians bought 3.7m cars. The Chairman of Maruti Suzuki recently pointed out that it could take 40 years for the Indian car market to catch up with China’s. 6/n

India will take 40 yrs to draw level with China's car penetration: Bhargava

As a result, the small car market has been shrinking as two-wheeler customers shelve or delay plans to upgrade to a four-wheeled drive

https://www.business-standard.com/article/companies/india-to-take-1...

Jan 7, 2023

Riaz Haq

India's nominal GDP growth is likely to fall in 2023-24, hurting tax collections and putting pressure on the federal government to reduce the budget gap by cutting expenses ahead of national elections in 2024.

https://www.reuters.com/world/india/fall-india-nominal-gdp-growth-f...

Nominal GDP growth, which includes inflation, is the benchmark used to estimate tax collections in the upcoming budget to be presented on Feb. 1. It is estimated to be around 15.4% for the current financial year.

At least four leading economists expect nominal GDP growth to come in between 8% and 11% as inflation slows and real GDP growth eases from an estimated 7% this year, when pandemic-related distortions and pent-up demand pushed up growth rates.

A lower tax revenue will limit the government's ability to spend and support the economy as the country heads to national elections in 2024. It will also strain efforts to bring down the fiscal deficit towards the medium-term target of 4.5% of GDP by 2025/26.

Jan 9, 2023

Riaz Haq

Saudi Arabia is considering providing up to $11 billion to #Pakistan, a potential lifeline to a country facing default. #Qatar and #UAE are likely to join #SaudiArabia for up to $22 billion package of #loans and #investments for the country.

https://www.wsj.com/articles/saudi-arabia-signals-it-could-provide-...

ISLAMABAD, Pakistan—Saudi Arabia said Tuesday that it was considering providing up to $11 billion to Pakistan, a potential lifeline to a country facing default.

The United Arab Emirates and Qatar in recent months have said they might also offer help to Pakistan, with potential loans and investments from Gulf nations now totaling at least $22 billion after the latest announcement from Riyadh. Gulf countries have said they could extend a similar level of support to Egypt, which is also struggling economically.

The support from Saudi Arabia could strengthen Pakistan’s hand in negotiating a restart to a stalled bailout from the International Monetary Fund. Islamabad has so far been unwilling to agree to the IMF’s terms for a deal, which include raising electricity and gasoline prices and increasing taxes.

The country’s foreign-currency reserves are fast running out, with financial markets hoping that the IMF program can be put back on track within days.

Pakistan has only around $4.5 billion in official foreign-currency reserves, financial analysts estimate. In January and February this year it is due to repay debt of $6.4 billion, according to figures from the central bank. By December, it must repay a further $12.8 billion, according to the central bank.

Saudi Arabia said Tuesday that it would study increasing its investment plans for Pakistan to $10 billion from $1 billion and would also study raising its loan deposit with Pakistan’s central bank to $5 billion from the current $3 billion, “confirming the Kingdom’s position supportive to the economy of the Islamic Republic of Pakistan and its sisterly people.”

The news followed a visit by Pakistan’s new army chief, Gen. Asim Munir, to Saudi Arabia, where he met Crown Prince Mohammad bin Salman. In the meeting, “they reviewed bilateral relations and the ways of enhancing them,” Riyadh said Monday.

Pakistan is a close partner to Saudi Arabia, including providing soldiers for guarding sites and training Saudi troops. Millions of Pakistanis work in Saudi Arabia.

Pakistan has also drawn in recent months on its other close allies, in the Gulf and China, as it struggles to repay loans taken out over the last decade.

Pakistani Prime Minister Shehbaz Sharif will visit the U.A.E. later this week, and Islamabad hopes his hosts will roll over a $2 billion loan due to mature shortly and provide additional financing. The U.A.E. pledged last year to invest around $2 billion in Pakistan. Qatar has said it would invest $3 billion in Pakistan.

None of the Gulf nations’ investment plans, mostly likely to involve the purchase of state-owned enterprises, have so far materialized. Saudi Arabia has also floated the idea of building a large oil refinery in Pakistan.

China has provided a $4 billion loan deposit with Pakistan’s central bank. Around a third of Pakistan’s debt is held by Beijing. In recent years, Beijing has carried out a multibillion-dollar infrastructure-building program in the country, a showcase for its global Belt and Road Initiative, which seeks to spread Chinese influence through large construction projects.

There are few ready investment opportunities in Pakistan for Gulf nations, while its cash needs are immediate, said Samiullah Tariq, head of research at Pakistan Kuwait Investment Company, a local financing group. Despite the Saudi announcement, Pakistan still needs the IMF, he said.

“There is a liquidity crunch,” said Mr. Tariq. “We need the money right away.”

Jan 10, 2023

Riaz Haq

World Bank Cuts 2023 Global Growth Projection as Inflation Persists

China and Ukraine inject uncertainty into world economy

https://www.wsj.com/articles/world-bank-cuts-2023-global-growth-pro...

The forecast growth rate only narrowly keeps the global economy out of recession territory. The international development organization cited a coalescence of high inflation, rising interest rates, lower investment and Russia’s invasion of Ukraine as threats to growth, along with pandemic-related disruptions in China and stress in its real-estate sector.

“Global growth has slowed to the extent that the global economy is perilously close to falling into recession,” the World Bank said in its latest report on global economic prospects. World Bank President David Malpass told reporters Tuesday he is “deeply concerned that the slowdown may persist.”

----

“Inflation won’t quite go down the way people expected,” Mr. Dimon said. “But it will definitely be coming down a bit.”

Some economists have projected that both the U.S. and parts of Europe could slip into a recession for a portion of 2023. A global recession, defined as a contraction in annual global per capita income, is more rare because China and emerging markets often grow faster than more developed economies. Essentially the world economy is considered to be in recession if economic growth falls behind population growth.

For all of 2023, the World Bank forecasts U.S. gross domestic product will increase 0.5% from the prior year, and expects no growth for the eurozone. The bank predicts China’s GDP will increase 4.3% in 2023 from the prior year, an uptick from an estimate of 2.7% growth last year. Emerging market and developing economies are projected to expand 3.4%, a steady rate of growth from 2022’s expansion.

Russian GDP is forecast to contract 3.3% after falling 3.5% in 2022, as sanctions continue to weigh on spending and investment, the bank said.

Elevated inflation is keeping pressure on global central banks to tighten monetary policy, which subsequently slows investment and the broader economy.

The World Bank called on global central banks to remain alert to the risk that aggressively tightening monetary policy to fight inflation could spill across borders. The new report called for discussions between central bankers to “help mitigate risks associated with financial stability and avoid an excessive global economic slowdown in the pursuit of inflation objectives.”

Federal Reserve Chairman Jerome Powell, speaking in Stockholm Tuesday, reiterated the central bank’s commitment to bringing down inflation, even though he said interest-rate increases could fuel political blowback.

“Price stability is the bedrock of a healthy economy and provides the public with immeasurable benefits over time,” Mr. Powell said. “But restoring price stability when inflation is high can require measures that are not popular in the short term as we raise interest rates to slow the economy.”

Central banks rapidly raised interest rates last year to combat high inflation, and are expected to fine-tune their approach this year as rates reach levels that are likely to weigh on economic growth. In the U.S., the labor market remained strong through 2022’s end, suggesting the Federal Reserve rapid rate rises haven’t yet significantly cooled demand.

---------

The World Bank has previously said that developing countries have amassed high levels of debt that could be difficult to repay as the global economy slows and interest rates rise.