PakAlumni Worldwide: The Global Social Network

The year 2022 was a very rough year for Pakistan. The nation was hit by devastating floods that badly affected tens of millions of people. Macroeconomic indicators took a nose dive as political instability reached new heights. In the middle of such bad news, Pakistan saw installation of thousands of kilometers of new fiber optic cable, inauguration of a new high bandwidth PEACE submarine cable connecting Karachi with Africa and Europe, and millions of new broadband subscriptions. Broadband penetration among 140 million (59% of 236 million population) Pakistanis in the15-64 years age group reached almost 90%. This new digital infrastructure helped grow technology adoption in the country.

|

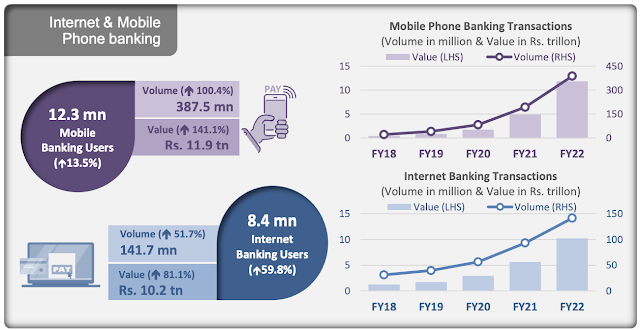

| Internet and Mobile Phone Banking Growth in 2021-22. Source: State Bank of Pakistan |

Fintech:

Mobile phone banking and internet banking grew by 141.1% to Rs. 11.9 trillion while Internet banking jumped 81.1% to reach Rs10.2 trillion. E-commerce transactions also accelerated, witnessing similar trends as the volume grew by 107.4% to 45.5 million and the value by 74.9% to Rs106 billion, according to the State Bank of Pakistan.

|

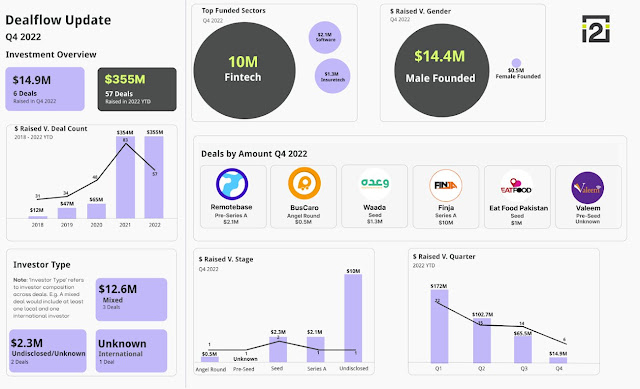

| Pakistan Startup Funding in 2022. Source: i2i Investing |

Fintech startups continued to draw investments in the midst of a slump in venture funding in Pakistan. Fintech took $10 million from a total of $13.5 million raised by tech startups in the fourth quarter of 2022, according to the data of Invest2Innovate (i2i), a startups consultancy firm. In Q3 of 2022, six out of the 14 deals were fintech startups, compared to two deals of e-commerce startups. Fintech startups raised $38 million which is 58% of total funding ($65 million) in Q3 2022, compared to e-commerce startups that raised 19% of total funding. The i2i data shows that in Q3 2022, fintech raised 37.1% higher than what it raised in Q2 2022 ($27.7 million). Similarly, in Q2 2022, the total investment of fintech was 63% higher compared to what it raised in Q1 2022 ($17 million).

|

| E-Commerce in Pakistan. Source: State Bank of Pakistan |

E-Commerce:

E-commerce continued to grow in the country. Transaction volume soared 107.4% to 45.5 million while the value of transactions jumped 75% to Rs. 106 billion over the prior year, according to the State Bank of Pakistan.

|

| Pakistan Among World's Top 10 Smartphone Markets. Source: NewZoo |

PEACE Cable:

Pakistan and East Africa Connecting Europe (PEACE) cable, a 96 TBPS (terabits per second), 15,000 km long submarine cable, went live in 2022. It brought to 10 the total number of submarine cables currently connecting or planned to connect Pakistan with the world: TransWorld1, Africa1 (2023), 2Africa (2023), AAE1, PEACE, SeaMeWe3, SeaMeWe4, SeaMeWe5, SeaMeWe6 (2025) and IMEWE. PEACE cable has two landing stations in Pakistan: Karachi and Gwadar. SeaMeWe stands for Southeast Asia Middle East Western Europe, while IMEWE is India Middle East Western Europe and AAE1 Asia Africa Europe 1.

|

| Mobile Data Consumption Growth in Pakistan. Source: ProPakistan |

Fiber Optic Cable:

The first phase of a new high bandwidth long-haul fiber network has been completed jointly by One Network, the largest ICT and Intelligent Traffic and Electronic Tolling System operator in Pakistan, and Cybernet, a leading fiber broadband provider. The joint venture has deployed 1,800 km of fiber network along motorways and road sections linking Karachi to Hyderabad (M-9 Motorway), Multan to Sukkur (M-5 Motorway), Abdul Hakeem to Lahore (M-3 Motorway), Swat Expressway (M-16), Lahore to Islamabad (M-2 Motorway) and separately from Lahore to Sialkot (M-11 Motorway), Gujranwala, Daska and Wazirabad, according to Business Recorder newspaper.

Mobile telecom service operator Jazz and Chinese equipment manufacturer Huawei have commercially deployed FDD (Frequency Division Duplexing) Massive MIMO (Multiple Input and Output) solution based on 5G technology on a large scale in Pakistan. Jazz and Huawei claim it represents a leap into the 4.9G domain to boost bandwidth.

|

| Pakistan Telecom Indicators November 2022. Source: PTA |

|

| Pakistan's RAAST P2P System Taking Off. Source: State Bank of Pakistan |

Broadband Subscriptions:

Pakistan has 124 million broadband subscribers as of November, 2022, according to Pakistan Telecommunications Authority. Broadband penetration among 140 million (59% of 236 million) Pakistanis in 15-64 years age bracket is 89%. Over 20 million mobile phones were locally manufactured/assembled in the country in the first 11 months of the year.

|

| Bank Account Ownership in Pakistan. Source: Karandaaz |

|

| Financial Inclusion Doubled In Pakistan in 5 Years. Source: Karandaaz |

Documenting Pakistan Economy:

Pakistan's unbanked population is huge, estimated at 100 million adults, mostly women. Its undocumented economy is among the world's largest, estimated at 35.6% which represents approximately $542 billion at GDP PPP levels, according to World Economics. The nation's tax to GDP ratio (9.2%) and formal savings rates (12.72%) are among the lowest. The process of digitizing the economy could help reduce the undocumented economy and increase tax collection and formal savings and investment in more productive sectors such as export-oriented manufacturing and services. Higher investment in more productive sectors could lead to faster economic growth and larger export earnings. None of this can be achieved without some semblance of political stability.

Related Links:

Riaz Haq

Increasing optic fibre penetration

IT benefits cannot be enjoyed unless country has robust telecom infrastructure

https://tribune.com.pk/story/2373645/increasing-optic-fibre-penetra...

One measure of optic fibre penetration in a country is the percentage of towers connected with the fibre. In Pakistan, it is 10%. For comparison, in Thailand, it is about 90%, in Malaysia about 50%, in India about 30%, and in Bangladesh 27%.

In Pakistan, every city is connected with optic fibres, and thanks to the efforts of PTA (obligating new/ renewal of fixed-line licensees to lay fibre cables) and USF (obligating subsidy winners to lay fibres), the fibres connecting cities and villages are increasing. But fibre penetration is poor within smaller towns and relatively less affluent localities of larger cities.

In Islamabad, many streets have up to three optic fibres buried in parallel (where only one would more than suffice). In contrast, large Mohallahs even in the neighbouring Rawalpindi have no optic fibres.

This is understandable, as all fibre investors are Internet Service Providers (ISPs) who must fiercely compete with each other. They cannot share the capacity of their fibres. They would rather lay their own fibres.

Consequently, the fibre-to-the-premises (FTTP) in Pakistan is very low. Out of 119 million broadband subscriptions, only 2 million are fibre connected. It reflects negatively on Pakistan’s ranking on various global indices, where Pakistan is lagging behind all the regional countries (except Afghanistan).

A significant cause of low overall performance is also the unusually high telecom taxes, and the process and cost of Right of Way (RoW). Telecom operators have been clamouring for the government to address these for years. Addressing these demands would undoubtedly speed up investments.

Still, where every ISP has to lay its own fibres, it may take another 25 to 30 years to serve a considerable part of the population.

Jan 4, 2023

Riaz Haq

Good things come to those who wait and for Pakistan’s tech ecosystem, the wait finally seemed to be over in 2021. Funding surged over 5x to $366 million and tech exports crossed $2 billion. Big shot investors entered the market, things were on the go and optimism was all abound.

https://www.dawn.com/news/1729409

But that cliched saying doesn’t really mention anything about good things lasting, and that’s exactly what happened in 2022. Despite a solid start which saw almost $173m raised in Q1, investment activity plunged and reached a 10-quarter low. The annual total still came in at over a healthy $351m, but the slowdown was glaringly obvious.

The change in global macros and the subsequent carnage in venture capital cut short the newfound love for Pakistani startups among foreign investors, as the country’s risk premium became too high for the available return potential. The doomsday peddlers and default mongers would tell you this might be the end of a rather short-lived era. And perhaps we might not return to the 2021-2022 levels, but would still stay reasonably above our 2020 total of around $65m.

However, for the near future, the deal flow will remain depressed, especially for relatively later-stage startups — as per Pakistani standards, those looking for Series A or further. Based on this criteria, there are at least 14 companies that might need to raise follow-on rounds soon (ignoring all those who had seed deals in 2021). For the remaining, the deals might still continue, albeit at much lower valuations and at a slower pace.

One reason to believe that while investment value plunged by a massive 79 per cent year-on-year in Q4-2022, the deal count fell by relatively less to eight. That too because a number of investment rounds actually went unreported and the small base amplifies the decline in percentage terms. The source of early-stage capital could tilt towards accelerators, whose $100,000-$250,000 cheques might have seemed like peanuts to some founders during the good times.

That said, the cycles do change, even if the gloom today might not seem like it, as did the optimism from last year. Markets often have amnesia and move on sentiments — which will improve sooner or later. Well, at least as far as the global macros are concerned, if not Pakistan’s. Beyond the venture funding environment — which honestly takes up an outsize share in tech-related discussion — there is one missed theme from 2022. One that is a little concerning.

In Q1-2021, Pakistan’s digitally paid e-commerce transactions fell to 9.1m, from 136m in the preceding period. While the number did recover to over 10.1m in the second quarter, it still spells trouble, especially considering how our macroeconomic situation worsened from July onwards. For example, inflation peaked in August and the past few months have been marred by complete chaos for anyone trying to run a business. It’s not just the data. Market talks paint a pretty bleak picture as major e-commerce stores see declines in orders. Last year, the situation was the exact opposite — almost everyone struggled to keep up with the demand and supply squeezed. Now, the players are reportedly sitting on excess capacity, which has its own overheads, or trying to renegotiate terms with partners.

According to Hammad Khan, the co-founder of AlphaVenture — the digital agency behind the price comparison website Pakistanistores.com, sales have declined around 10-15pc this year compared to 2021 despite more people coming online. “Even though our website traffic went up 5pc year-on-year in November 2022, it hasn’t necessarily translated into more orders for stores as major players in the industry are having a relatively slower period.”

“But more than demand, supply has been the issue as almost all sectors — regardless of online or traditional channels — struggle to source products. If companies cannot source products in the first place, how are they even going to fulfil orders?”

Jan 4, 2023

Riaz Haq

Changing times for tech

https://www.dawn.com/news/1729409

The troubles are now coming for e-commerce transactions to foreign merchants, as banks have to settle them by first purchasing dollars from the open market. This is making payments to vendors like hosting providers, software etc — a necessity in any tech-enabled business — even more expensive.

On the technology exports side, things are a bit more unclear. Not the part where proceeds have slowed down — that much is clear enough, but rather the why of it. After all, till mid-2022, telecom group exports were growing monthly at upwards of 20pc year-on-year but then declined to single digits. In certain periods, not even that.

These pages have explored that topic in more detail and discussed how the political and economic uncertainty, especially with regard to paying for services in dollars, is discouraging companies from bringing money back to Pakistan.

And that theme will most likely continue in the near future as we don’t seem to be heading near stability anytime soon. In fact, the heavy-handedness and panic of policymakers might even leave deeper scars and do more long-lasting damage.

Jan 4, 2023

Riaz Haq

2023 PPP GDPs, according to IMF

Pakistan $1.62 trillion

Bangladesh $1.48 trillion

Egypt $1.8 trillion

https://www.imf.org/external/datamapper/PPPGDP@WEO/PAK/BGD/EGY

Jan 5, 2023

Riaz Haq

Informal Savings in Pakistan

https://www.dawn.com/news/1725956

According to research by Oraan, around 41pc Pakistanis saved via committees (or Rosca), whereas Karandaaz puts that figure at 34pc. Assuming the informal economy accounts for roughly 30pc, as suggested by research from the Pakistan Institute of Developing Economics, it translates into annual committees of Rs4 trillion at base prices, using conservative inputs.

While this back-of-the-envelope calculation is far from scientific, it helps contextualise how big the informal savings market really is. Everyone from a widow looking to save up for her children’s education to young adults trying to save up for their marriage, committees are what they turn to.

This phenomenon is not exclusive to Pakistan. According to a note by Middle East Venture Partners (one of the investors in Bykea), “the global market is largely untapped and ripe for disruption with 2.4 billion people using money circles through traditional channels.”

They recently participated in the Egyptian digital committees’ startup MoneyFellows’ $31m Series B.

Apart from the traditional financial institutions’ general apathy towards the customer, committees appeal to an average Pakistani for several reasons: they are a community-based instrument with some level of flexibility and there is no interest involved.

Most importantly, it helps them manage cash flow better due to habitual change. For women, the product enjoys particular popularity since the former financial services are largely inaccessible.

However, since committees are primarily cash-based with virtually no money trail involved, it poses massive risks, as we saw recently when a girl, Sidra Humaid, who ran a network of committees through social media, defaulted on Rs420m of payments.

----

Even beyond this, committees have flaws by design, only amplified by Pakistan’s macros. For instance, the person receiving the first lump sum amount will always be at an advantage since their instalments in the subsequent months would be worth less due to both inflation and rupee depreciation. The recipient of the last payment would see the amount’s purchasing power eroded substantially by the time they get it.

Moreover, due to the community-based nature of the product, the risk of network defaulting is higher as people of usually similar risk profiles would be pooling in their money.

For example, if employees from an organisation have running office committees, delayed salaries or layoffs within the organisation would lead to a bad equilibrium, creating losses for the rest of the group, often resulting in default.

However, there are ways to address some of those challenges. First of all, to (partially) protect your lump sum from depreciation or devaluation, you can enter a committee with a duration of up to 10 months. Given Pakistan’s macros of late, you’d still lose money in real terms but to be fair, that’d most likely be the case in any other instrument as well, including the risk-free government papers.

In fact, contrary to popular perception, there are certain ways to further alleviate the inflation problem. Digital committees have an option of gamifying the experience by rewarding good payment behaviour through loyalty programs and/or brand partnerships to provide discounts on utilities-based services and products.

Secondly, digital committees help create a trail of money which, coupled with a centralised authority (the platform itself), brings in accountability and recourse in the event of a default. The receipt and/or ledger helps with basic accounting in committees creating transparency for people within the group.

The third benefit of digital committees is the security factor. The participant has to go through a know-your-customer and credit check process to make sure there is no fraudulent behaviour that could negatively impact the group, along with the participant’s ability and willingness to pay to create an overall environment for responsible finance.

Jan 5, 2023

Riaz Haq

Plotistan: The mystery of low savings rate

https://profit.pakistantoday.com.pk/2022/02/27/plotistan-the-mystery-of-low-savings-rate/

Economic agents are not rational, and neither are government policies often driving the interplay of savings and investments

There is a lot of noise regarding the savings rate, and how a transition towards the formal economy would enhance the savings rate. This is indeed a novel idea, and recent digitization measures would certainly boost savings rate as an increasing number of transactions flow through the system, while the size of the informal economy contracts. Over the last ten years, Pakistan has had a savings rate of 14.5 percent, stooping to a low of 12.5 percent only a few years back. Savings rate in Pakistan has gradually dropped in this century, after hitting a peak of 23 percent in 2004.

A traditional national income identity, where cumulative GDP for a country is a function of consumption, investment, government expenditure, and net exports (negative if imports are higher), suggests that as savings in an economy increases, overall investment also increases. The underlying assumption is that rational agents in an economy would save for a certain rate of return, which they would get by investing in the economy. As the overall stock of savings increases, the overall investment also increases. The overall increase in investment enhances the overall national income, with a spillover effect on increasing consumption (higher employment, and higher disposable income), as well as higher exports – if investments are routed towards export-oriented activities.

However, the real world is slightly different. Economic agents are not rational, and neither are government policies often driving the interplay of savings and investments. National accounts often consider what can be measured, or what is formal, and disregard the informal, or the shadow economy. Savings that either result in an increase in bank deposits, stock of national savings, or flow into the capital markets, among other avenues can be counted as savings in national accounts, eventually being routed as investments – with banks lending into the real economy (or back to the government), while various businesses raise capital in the primary and secondary markets, and so on. However, if the same capital is simply redeployed in a multitude of real estate schemes, which are not developed and simply operate secondary market of ‘plot files’, then that truly is savings – but isn’t really an investment that would be recognized in national accounts.

The last ten years have resulted in emergence of plotistan. An economy which encourages investment in plots (whether legal, or illegal) for accumulation of wealth, rather than allocating that capital towards more productive areas of the economy. The capital markets have barely seen a sliver of fresh retail capital flowing into it, depressing valuations, and discouraging businesses from fresh listings given unattractive valuations. Meanwhile, the value of plots in cities across the country have grown multifold.

A marginal, and negligible taxation regime, massive distortion in reported value and transaction value of real estate, and amnesty schemes to further accelerate scarce capital to move towards real estate rather than actual productive enterprise has ensured that plots remain a safe haven for preservation of grey capital. A largely cash based market also ensures that fire sales are far and few in between, as investors (or plot-ists) as they like to call themselves are fine with staying underwater as that still remains a more tax efficient structure than investing in the formal economy. A drop in savings rate during the last ten years has been accompanied by an increase in cash in circulation as a % of GDP, signifying how an increasing number of economic activity is being conducted in cash, rather than through formal financial institutions.

Jan 5, 2023

Riaz Haq

The size of the informal economy in Pakistan is much larger.

https://www.southasiainvestor.com/2021/12/has-bangladesh-really-lef...

Pakistan's service sector which contributes more than 50% of the country's GDP is mostly cash-based and least documented. Compared to Bangladesh and India, there is a lot more currency in circulation as a percentage of overall money supply in Pakistan. According to the State Bank of Pakistan (SBP), the currency in circulation has increased to Rs. 7.4 trillion by the end of the financial year 2020-21, up from Rs 6.7 trillion in the last financial year, a double-digit growth of 10.4% year-on-year. Currency in circulation (CIC), as percent of M2 money supply and currency-to-deposit ratio, has been increasing over the last few years. The CIC/M2 ratio is now close to 30%, according to the State Bank of Pakistan. The average CIC/M2 ratio in FY18-21 was measured at 28%, up from 22% in FY10-15. This 1.2 trillion rupee increase could have generated undocumented GDP of Rs 3.1 trillion at the historic velocity of 2.6, according to a report in The Business Recorder. In comparison to Bangladesh (CIC/M2 at 13%), Pakistan’s cash economy is double the size. Even a casual observer can see that the living standards in Pakistan are higher than those in Bangladesh and India.

Jan 5, 2023

Riaz Haq

Pakistan Economic Survey 2021-22

Chapter 5: Money and Credit

https://www.finance.gov.pk/survey/chapter_22/PES05-MONEY&CREDIT...

Currency in Circulation (CiC)

During the period 01stJuly-29th April, FY2022 CiC witnessed an expansion of Rs 991.7

billion (growth of 14.4 percent) as compared to expansion of Rs 673.0 billion (growth of

11.0 percent) during same period last year. Currency-to-M2 ratio reached 30.7 as on

29thApril, 2022 against 30.2 percent during same period last year. Significant growth in

CiC has been observed particularly in the month of April, 2022 on account of cash

demand during Ramzan and Eid Festive.

Jan 5, 2023

Riaz Haq

Although Pakistani startups posted a 36% decline in third quarter (July-September) of calendar year 2022 compared to the previous quarter, the financial technology (fintech) showed rising graph during the same period.

https://www.nation.com.pk/10-Nov-2022/unbanked-population-helping-p...

According to the data of Invest2Innovate (i2i), a startups consultancy firm, six out of the 14 deals that took place in Q3 2022 were fintech startups, compared to two deals of e-commerce startups. Fintech startups raised $38 million which is 58% of total funding ($65 million) in Q3 2022, compared to e-commerce startups that raised 19% of total funding. The i2i data shows that in Q3 2022, fintech raised 37.1% higher than what it raised in Q2 2022 ($27.7 million). Similarly, in Q2 2022, the total investment of fintech was 63% higher compared to what it raised in Q1 2022 ($17 million).

Sumbal Qureshi, a fintech consultant, told WealthPK that political situation has an impact on the economic situation of the country due to which a lot of foreign fintech companies have held back their initiatives. This situation is also a challenge for local fintech firms. The unusual growth is just because the existing fintechs and more established companies are trying to survive at the moment. They are trying to overcome the situation by continuing to invest in the fintech sector.

Imran Jattala, a well-known IT expert, told WealthPK that 5% of the world’s unbanked population lives in Pakistan. About 18,000 people are crossing the age of 18 every day in Pakistan, and unbanked population and those under 18 use fintech for their financial affairs. So fintech and digital banking is going to thrive despite a decrease in startup funding.

According to data of Pakistan Telecommunication Authority (PTA), over the years, branchless/mobile banking has shown tremendous growth based on the telco-banks-fintech nexus, contributing significantly to financial inclusion. The m-banking network has expanded to over 534,460 m-banking agents and 74.6 million m-wallet accounts. This network enabled more than 2.2 billion annual transactions worth over Rs8 trillion in 2021. Despite these developments, cash still dominates economic activities and there is scant use of electronic payments, especially by micro and small retailers. Cash is the predominant payment method in Pakistan as it is considered ‘safe’ by the majority of retailers and suppliers. Many wages and salaries are also paid through cash.

The importance and usage of electronic banking and alternative delivery channels has increased during the post-Covid-19 period. Realising this, the State Bank of Pakistan further incentivised the use of digital financial channels by instructing banks to waive all inter-bank and intra-bank charges on digital transactions. This resulted in a substantial annual increase of 206% in inter-bank transfers and 122% in intra-bank transfers through internet banking. For mobile banking, the impact was even higher, with a three-fold increase in mobile banking inter-bank transfers from Rs765 billion in FY 2020 to Rs2.346 trillion in FY 2021.

Jan 5, 2023

Riaz Haq

The app (Sehat Kahani) was brought into the (Pakistani) federal government's 'Digital Pakistan' drive and used in 65 intensive care units (ICUs) across Pakistan under a project with UNDP, Health Services Academy and the federal and provincial governments. This allowed health workers to access critical care consultation through a Virtual Critical Care Specialist (VCCS).

https://www.gavi.org/vaccineswork/sehat-kahani-showing-pakistan-dig...

n connection with that project, and in collaboration with WHO and the federal government of Pakistan, six clinics were launched in hard-to-reach areas of Pakistan during the COVID-19 pandemic, and a specific focus on sexual and reproductive healthcare services was also added to this project.

"Around 1,500 doctors across Baluchistan, KPK, and Punjab were trained in sexual reproductive services, primary healthcare, and telemedicine," says Dr Saeed.

"Telehealth services have the potential to bridge the gap between patients and physicians in Pakistan. However, poor education, illiteracy in rural areas, lack of resources, poor internet connectivity, excessive loadshedding, etc., have limited the accessibility of qualified doctors to reach to the population in remote areas," says Dr Zahid.

-----------

Sehat Kahani, established in 2017, is a leading initiative in this regard. Its founder, Dr Sara Saeed, is a medical doctor whose mission is to help shore up Pakistan's fragile healthcare system by bridging the gap between patients and physicians through digitalisation.

"As per recent statistics, around 210 million people in Pakistan don't have access to basic healthcare facilities. To address this, Sehat Kahani connects a vast network of predominantly female doctors to patients in far-flung areas of Pakistan," says Dr Saeed. She and cofounder Dr Iffat Zafar Agha managed to raise seed funding of US$ 500,000 in 2018, followed by a pre-series of $1 million in March 2021.

In 2019, the app launched with about 60 doctors. Today, Sehat Kahani comprises a large network of more than 7,000 doctors.

Ninety percent of those 7,000 doctors are women. Approximately 50% of them are home-based female doctors who have returned to practice after leaving when they got married and had children.

Jan 5, 2023

Riaz Haq

Digital census to start tomorrow

By News desk -January 6, 2023

https://pakobserver.net/digital-census-to-start-tomorrow/

The training program of circle supervisors and enumerators for Pakistan’s first digital census in Sialkot district will be started tomorrow from January 7, while the seventh national census campaign will continue from February,1 to March 4, 2023. In this regard, Census Support Centers have been established in the offices of the Assistant Commissioners (ACs) of the Sialkot’s four tehsils.

Deputy Commissioner Sialkot Abdullah Khurram Niazi expressed these views while reviewing the arrangements for the 7th National Digital Census 2023 here on Thursday. District Police Officer (DPO) Sialkot Kamran Faisal, Pakistan Army officers and local officials of the concerned departments attended the meeting.

Addressing the meeting participants, Deputy Commissioner Abdullah Khurram Niazi said that according to the instructions of the Pakistan Bureau of Statistics, local officials and staff of the district administration, Pakistan Army, Police and other relevant departments would perform their duties as a national responsibility to mark the census campaign successful. He said that the five days training of 258 circle supervisors and 1689 enumerators were being started at the tehsil level in Sialkot district from January 7, 2023.

Deputy Commissioner said that 3368 blocks had been established in Sialkot district, including 49 Cantonment Board blocks. He directed the Assistant Commissioners (ACs) to personally supervise the training sessions.

------------

https://www.nadra.gov.pk/local-projects/social-protection/digital-c...

For the first time in Pakistan, NADRA proposed a comprehensive “IT Solution” to carry out 7th Population and Household Census of Pakistan, “THE DIGITAL CENSUS”. Span of this activity is covering the whole country, in 628 Tehsils comprising approx. 185,000 Census blocks. The activity shall be performed using android based smart devices, equipped with android based house listing and enumeration application synchronized with GPS & GIS.

----------------

PBS organized an extensive training for census enumerators in 27 districts across Pakistan to ensure uniformity & quality through the process.

Pakistan’s first digital census will provide valuable information about population growth, urban-rural ratio, gender, age, literacy, languages, religion, disability, migration, ethnicity, and economic activities.

https://www.globalvillagespace.com/pakistans-first-digital-census-pbs/

Jan 6, 2023

Riaz Haq

Zong forays into Pakistan’s digital payments sector with PayMax launch

https://www.electronicpaymentsinternational.com/news/zong-digital-p...

Telecom company Zong has entered into the Pakistani digital payments market with the introduction of PayMax, reported Dawn.

The digital financial application has been rolled out by Electronic Commerce Company (ECCL), a fully-owned subsidiary of Zong’s parent company China Mobile Pakistan (CMPAK).

The move allows Zong to compete with various services, including JazzCash and EasyPaisa, provided by other telecom providers.

It comes shortly after Zong 4G began the tests of PayMax last month.

PayMax will initially facilitate peer to peer (P2P) money transfer, utility bills payments, mobile loads, online payment gateway as well as retail payments, among others, according to ECCL CEO Syed Naveed Akhtar.

These services will initially be offered to account holders of 1-Link connected banks.

Besides, PayMax aims to include additional vendors and solutions providers into its platform from various sectors to deliver several financial products, such as nano loans, handset financing, cross border payments along with insurance and merchant financing.

Zong primarily aims to provide PayMax services to its customers living in rural areas.

PayMax represents the second fintech solution introduced by Zong in Pakistan, with ‘Timepey Service’ being the first one.

Timepey Service was launched in partnership with Askari Bank in 2012. However, the mobile-based banking service ceased to exist since 2016.

Products launched by Zong are compliant with Electronic Money Institutions (EMIs) regulations of State Bank of Pakistan (SBP) 2019, under the Payment Systems and Electronic Fund Transfers Act, 2007.

Jan 6, 2023

Riaz Haq

Start ups bringing Pakistan's farming into digital age

https://phys.org/news/2022-01-ups-pakistan-farming-digital-age.html

Until recently, "the most modern machine we had was the tractor", Aamer Hayat Bhandara, a farmer and local councillor behind one such project told AFP in "Chak 26", a village in the agricultural heartland of Punjab province.

Even making mobile phone calls can be difficult in many parts of Pakistan, but since October, farmers in Chak 26 and pilot projects elsewhere have been given free access to the internet—and it is revolutionising the way they work.

Agriculture is the mainstay of Pakistan's economy, accounting for nearly 20 percent of gross domestic product and around 40 percent of the workforce.

It is estimated to be the world's fifth-largest producer of sugarcane, seventh-largest of wheat and tenth-biggest rice grower—but it mostly relies on human labour and lags other big farming nations on mechanisation.

Cows and donkeys rest near a muddy road leading to a pavilion in Chak 26, which is connected to a network via a small satellite dish.

This is the "Digital Dera"—or meeting place—and six local farmers have come to see the computers and tablets that provide accurate weather forecasts, as well as the latest market prices and farming tips.

"I've never seen a tablet before," said Munir Ahmed, 45, who grows maize, potatoes and wheat.

"Before, we relied on the experience of our ancestors or our own, but it wasn't very accurate," added Amjad Nasir, another farmer, who hopes the project "will bring more prosperity".

Apps and apples

Communal internet access is not Bhandara's only innovation.

A short drive away, on the wall of a shed, a modern electronic switch system is linked to an old water pump.

A tablet is now all he needs to control the irrigation on part of the 100 hectares (250 acres) he cultivates—although it is still subject to the vagaries of Pakistan's intermittent power supply.

This year, Bhandara hopes, others will install the technology he says will reduce water consumption and labour.

"Digitising agriculture... and the rural population is the only way to prosper," he told AFP.

At the other end of the supply chain, around 150 kilometres (90 miles) away in Lahore, dozens of men load fruit and vegetables onto delivery bikes at a warehouse belonging to the start-up Tazah, which acts as an intermediary between farmers and traders.

After just four months in operation, the company delivers about 100 tonnes of produce every day to merchants in Lahore and Karachi who place orders via a mobile app.

"Before, the merchant had to get up at 5 am or 5:30 am to buy the products in bulk, at the day's price, and then hassle with transporting them," said Inam Ulhaq, regional manager.

"Tazah brings some order to the madness."

In the Tazah office, several employees manage the orders, but for the time being, purchases are still made by phone, as the part of the application intended for farmers is still in development.

The young company is also tackling a "centuries-old" system that stakeholders are reluctant to change, explains co-founder Abrar Bajwa.

Record investment

Fruit and vegetables often rot during their journey along poorly organised supply chains, says partner Mohsin Zaka, but apps like Tazah make the whole system more efficient.

In addition to Lahore, Tazah is already operating in the largest city, Karachi, and is preparing to move into the capital, Islamabad.

A $20 million fundraising campaign is underway, the co-founder told AFP, at a time when investments are pouring into Pakistani start-ups.

Foreign investment in Pakistan startups exceeded $310 million last year—five times the 2020 level and more than the previous six years combined, according to several reports.

Further down the chain, Airlift—which provides grocery deliveries—raised $85 million in a record-breaking prospectus for the country in August.

Jan 6, 2023

Riaz Haq

Pak Optical Fiber Cable Project inked between Chinese Companies

https://pakobserver.net/pak-optical-fiber-cable-project-inked-betwe...

A Nationwide Optical Fiber Cable Network Project has been signed between PowerChina and Hunan Sunwalk Group, according to Gwadar Pro on Friday.

Phase 1, Lot 1 of the said project will aim to improve Pakistan’s telecommunication infrastructure for better interconnection with its neighboring countries.

Talking to Gwadar Pro, business manager Sunwalk Group said that the company plans to spend several billion dollars on Pakistan’s Tier-2 and Tier-3 cities to establish telecom infrastructure and fiber industry.

The nation’s broadband adoption will be increased for the digital revolution, which will benefit not only the business-to-business sector but also the government, enterprise firms, and end consumers, the official added.

Previously, Sunwalk Group CEO Pakistan, Lan held a meeting with Federal Minister of IT and Telecom, Syed Amin ul Haque. Lan informed the Minister regarding investment plans for establishing a statewide optical fiber network and facilitating the growth of broadband in Pakistan.

He stated that his organization is prepared to invest approximately $2 billion over the next 8 to 10 years.

Jan 7, 2023

Riaz Haq

Pakistan to Procure 126,000 Tablets From China for 7th Digital Population Census

https://propakistani.pk/2022/08/19/pakistan-to-procure-126000-table...

Pakistan will procure 126,000 tablets from China for the upcoming 7th Population and Household Digital Census by 11 December 2022.

The delivery of tablets will start on 20 August and will be completed in eight batches by 11 December 2022, according to official documents available with ProPakistani.

The National Database Regulatory Authority (NADRA) had earlier proposed a comprehensive IT Turn-Key Solution for the 7th Population and Household Census. As proceedings stand, the digital census will be carried out across the country in 628 Tehsils comprising approximately 200,000 Census Blocks. The activity shall be performed using android-based smart devices equipped with House Listing and Enumeration Application synchronized with Global Positioning System (GPS) and Geographic Information System (GIS).

Of the 126,000 tablets to be procured from China, the first batch of 500 tablets will arrive on 20 August, followed by three batches of 18,500 each in October, and two batches of 18,500 each in November, the documents reveal. Two batches of 18,500 and 14,500 will arrive in Pakistan on 1 and 15 December, respectively. For carrying out pilot digital census and training in 83 tehsils, NADRA has already arranged 600 tablets from BISP on loan.

Jan 7, 2023

Riaz Haq

Pakistan Pursuing Ambitious Program to Build Digitized Social Safety Net

https://www.riazhaq.com/2022/01/pakistan-pursuing-ambitious-program...

Pakistan's PTI government has built South Asia’s first digital National Socio-Economic Registry (NSER) as a part of its ambitious effort to build a basic social safety net. The Ehsaas (also known as BISP- Benazir Income Support)) program's socio-economic registry includes household information by geography, age, income, education, health, disability, employment, energy consumption, land and livestock holdings etc. Ehsaas Programs include both Unconditional Cash Transfers (UCT) and Conditional Cash Transfers (CCT). Unconditional Cash Transfers are made only to people living in extreme poverty or distress. Conditional Cash Transfers like Waseela-e-Taleem and Nashonuma are given for education and nutrition respectively. In addition, there are feeding centers (langars) for the hungry and shelters (panahgahs) for the homeless.

The National Socio-economic Registry will be regularly updated to keep it current and deliver services to the Pakistanis most in need. The effort started in earnest in 2020 to hand out Rs. 12,000 per family to 3 million most affected by the COVID19 lockdown. Here's how a Pakistani government website describes the digital registry architecture:

"The Cognitive API architecture for Ehsaas’ National Socio-Economic Registry 2021 is one of the six main pillars of ‘One Window Ehsaas’. With the survey, which is building the registry currently 90.5% complete nationwide, Ehsaas is firming up its plans to open data sharing and data access services for all executing agencies under Poverty Alleviation and Social Safety Division (PASSD). Data sharing will be done through the Cognitive API Architecture approach. The deployment of Ehsaas API architecture for data sharing will allow executing agencies to access data from the unified registry in real-time to validate beneficiary information. This will empower them to ascertain eligibility of potential beneficiaries".

Jan 7, 2023

Riaz Haq

Pakistan Pursuing Ambitious Program to Build Digitized Social Safety Net

https://www.riazhaq.com/2022/01/pakistan-pursuing-ambitious-program...

Pakistan's PTI government has built South Asia’s first digital National Socio-Economic Registry (NSER) as a part of its ambitious effort to build a basic social safety net. The Ehsaas (also known as BISP- Benazir Income Support)) program's socio-economic registry includes household information by geography, age, income, education, health, disability, employment, energy consumption, land and livestock holdings etc. Ehsaas Programs include both Unconditional Cash Transfers (UCT) and Conditional Cash Transfers (CCT). Unconditional Cash Transfers are made only to people living in extreme poverty or distress. Conditional Cash Transfers like Waseela-e-Taleem and Nashonuma are given for education and nutrition respectively. In addition, there are feeding centers (langars) for the hungry and shelters (panahgahs) for the homeless.

The National Socio-economic Registry will be regularly updated to keep it current and deliver services to the Pakistanis most in need. The effort started in earnest in 2020 to hand out Rs. 12,000 per family to 3 million most affected by the COVID19 lockdown. Here's how a Pakistani government website describes the digital registry architecture:

"The Cognitive API architecture for Ehsaas’ National Socio-Economic Registry 2021 is one of the six main pillars of ‘One Window Ehsaas’. With the survey, which is building the registry currently 90.5% complete nationwide, Ehsaas is firming up its plans to open data sharing and data access services for all executing agencies under Poverty Alleviation and Social Safety Division (PASSD). Data sharing will be done through the Cognitive API Architecture approach. The deployment of Ehsaas API architecture for data sharing will allow executing agencies to access data from the unified registry in real-time to validate beneficiary information. This will empower them to ascertain eligibility of potential beneficiaries".

Jan 7, 2023

Riaz Haq

Wharton, Berkeley, NYU Offering Online M.B.A.s for the First Time

More elite business schools try virtual degrees to lure graduate students

https://www.wsj.com/articles/online-mba-wharton-berkeley-nyu-george...

Starting next year, executive M.B.A. students at the Wharton School of the University of Pennsylvania can earn the $223,500 degree from their living rooms.

After years of resistance, some of the country’s top business schools are starting virtual M.B.A. programs that require only a few days of in-person instruction. Wharton and Georgetown University’s McDonough School of Business said they would include options for executive and part-time M.B.A. students to take most coursework online in 2023.

This fall, part-time M.B.A. students at New York University’s Stern School of Business and the University of California, Berkeley’s Haas School of Business were given an online option for most of their classes. All of the programs will charge online students the same tuition as those who attend in person, and those online students will get the same degree and credential as on-campus counterparts.

The move to give students flexible location options comes as demand for two-year, full-time traditional M.B.A. programs has been dropping amid a competitive job market and growing concern about the cost of college.

“The pandemic definitely accelerated this in every industry,” said Brian Bushee, who leads teaching and learning at Wharton and also teaches accounting. “I would be surprised in 10 or 20 years if there were schools that only did in-person and did nothing online.”

Between 2009 and 2020 the number of online M.B.A.s at accredited business schools in the U.S. more than doubled, and schools added more fully online M.B.A. degrees over the past two years during the pandemic, according to the Association to Advance Collegiate Schools of Business. Recent announcements by Wharton and others mark a turning point for adoption of the degrees even at highly ranked campuses, school leaders say.

-------

At Stern, even the students who choose online courses are required to take nine in-person credits, which can be completed on nights or weekends, or by doing an intensive weeklong session.

Boston University’s Questrom School of Business, which announced its online M.B.A. in 2019, graduated its first online M.B.A. students in August. The degree, which costs $24,000, follows a completely separate curriculum and costs far less than the traditional M.B.A. program. Online M.B.A students watch live broadcasts of professors and talk in small groups or on a virtual online forum. A 2021 survey of students found that 35% received a promotion since enrolling.

Many schools are still reluctant to make a reduced-price online degree because they fear such a product might eat up demand for their traditional M.B.A. programs, said Paul Carlile, who leads online learning at Questrom.

Halley Kamerkar, 36 years old, finished her online Questrom coursework in August and said hearing from fellow M.B.A. candidates in South Africa, Ireland and Miami was valuable.

Ms. Kamerkar, of Salem, Mass., said she thought about graduate school for a long time, but a study guide she bought for the Graduate Management Admission Test gathered dust until she learned about Questrom’s program with its $24,000 price tag. Ms. Kamerkar works in the nonprofit sector and only recently paid back her undergraduate loans.

“I did not want to give up my full-time career to take a step back and pursue education,” she said.

Jan 7, 2023

Riaz Haq

Pakistan's largest tech conference and expo Future Fest 2023 inaugurated - Daily Times

https://dailytimes.com.pk/1048501/pakistans-largest-tech-conference...

Dedicated to using technology to pave the way for the future of Pakistan, the event is bringing together leaders from more than 50 industries to foster discussion on the future of life itself. Entrepreneurs, decision makers, policymakers, thought leaders, investors, and innovators will discuss the most important aspects of current times and how technology can play a positive role to #SaveTheFuture.

-----

Pakistan’s largest tech conference and expo, Future Fest, was inaugurated today at Expo Lahore. The event is open to the public till 8th January 2023.

Future Fest 2023 is hosting more than 250 speakers, 150 international guests from 15 countries, 100+ key partners and 20+ activities, and over 50,000 attendees.

Dedicated to using technology to pave the way for the future of Pakistan, the event is bringing together leaders from more than 50 industries to foster discussion on the future of life itself. Entrepreneurs, decision makers, policymakers, thought leaders, investors, and innovators will discuss the most important aspects of current times and how technology can play a positive role to #SaveTheFuture.

This year, the conference is hosting a historic delegation of Saudi startups and venture capitalists who will meet Pakistani companies and key stakeholders to explore investments, partnerships, acquisitions, and talent recruitment. This delegation and interest in Pakistan’s future indeed comes at an important time for Pakistan’s economy.

At the opening ceremony, the President of the Islamic Republic of Pakistan, Dr. Arif Alvi, Chief Guest delivered a virtual message, welcoming the delegates to the country and highlighting the great investment opportunities that the budding local tech industry has to offer.

This was followed by keynote talks focused on the importance of investing in tech for our economy. Additional keynote talks were given by Dr. Arslan Khalid, Special Adviser to CM Punjab on IT, CIO Imarat Group of Companies, Azam Malik, Managing Director Ejad Labs & Chairman Pakistan Digital Media Association, and Arzish Azam, CEO Ejad Labs / Future Fest. There was also a Fireside Chat with Abdel Karim Samakie, Innovation Driven Enterprise Director – Digital Cooperation Organization, Rizwan Saeed Sheikh, Additional Foreign Secretary for Middle East -Ministry of Foreign Affairs Islamabad, and Faisal Sultan, VP & Managing Director, Lucid. In attendance was also Mr. Emran Akhtar, former Advisor to the Foreign Minister of Pakistan who initiated and led Pakistan’s joining of the Digital Cooperation Organisation as Founder Member in 2020.

Jan 8, 2023

Riaz Haq

Pakistan's largest tech conference and expo Future Fest 2023 inaugurated - Daily Times

https://dailytimes.com.pk/1048501/pakistans-largest-tech-conference...

Later in the day, there were more than 50 keynotes, master classes, fireside chats, and panel sessions from top industry leaders who talked about diverse subjects ranging from web3, scaling tech, worldview, gaming, storytelling, policy and governance.

A few highlight sessions from the day one of Future Fest 2023 included; Gaming by Waqas Ahmed, CTO – Hazel Mobile, The Art & Science of Communications by Selina Saadia Rashid Khan, CEO – Lotus Client Management & Public Relations; World View with Ahmad Mukhtar, Senior Economist – Food and Agriculture Organization of the United Nations; Junaid Qurashi, President – OPEN Silicon Valley; Saeed Mohammed Alhebsi, Advisor and Project Manager – Ministry of Human Resources and Emiratisation. A keynote by Dr. Umar Saif, Founder & CEO – Survey Auto.

Experts like Aisha Sarwari, Director Public Relations, Communications, and Sustainability – Coca-Cola; Abid Cheema, Board member, and Executive Director Business Development – FDHL gave keynotes on policy & governance.

Jan 8, 2023

Riaz Haq

RAAST revolutionises digital payment system in Pakistan

https://www.nation.com.pk/08-Jan-2023/raast-revolutionises-digital-...

The Covid-19 pandemic has necessitated and increased the use of digital banking in Pakistan. The country has seen an ‘exponential’ growth in digital payment methods during the past few years. Paying bills, transferring money, and conducting business online have all grown ‘tremendously’.

Pakistan has also launched a micro payment gateway called ‘RAAST’, which is the country’s first instant payment system, enabling end-to-end digital transactions among individuals, businesses and government bodies. People with bank accounts now have the option to easily send money to others via this service. RAAST offers a simple, fast and secure way to transfer money from one bank account to another. Talking to WealthPK in this regard, Daniyal, a banking officer in an MCB bank branch, said that the State Bank of Pakistan had achieved an important milestone in digital banking by launching RAAST. “Now customers can receive their payments directly into their bank accounts without going to physical branches.” “Due to this integration with RAAST, customers can receive their payments in bank accounts in a simple, free, fast and secure way. RAAST can also serve as a platform for accelerating the growth of Pakistan by facilitating small and medium enterprises and individuals.” “RAAST is aimed at providing rapid and free people-to-people payment services to enhance digital financial services and financial inclusion.

Bank users can use RAAST to transfer and receive funds in their accounts by using their bank’s mobile app.” The MCB banking officer further said that customers can use RAAST facility by using their RAAST ID for sending or receiving funds. “They can also use their IBANs if they do not have a RAAST ID. Customers can be able to use their registered mobile numbers as their RAAST IDs and link them to any of their bank accounts to receive cash more effortlessly.”

Talking about the features of RAAST, Daniyal said the instant payment system is quick because it offers users real-time payment experience. “Unlike other payment systems, RAAST is free. It is meant to offer an instant, reliable and zero-cost digital payment system to customers. It is available on all banking channels. If customers are not satisfied with the service of a bank, they can change their account by delinking the RAAST ID and can connect with another bank to avail the best banking features.” According to WealthPK, the SBP’s move is part of the efforts to ensure Pakistan’s transition from being a cash-based economy to a digital economy. RAAST can serve as a driver for revolutionising Pakistan’s financial infrastructure.

Jan 8, 2023

Riaz Haq

It’s winter, not doomsday

The global funding slump has been front and center in conversations across startup ecosystems in South Asia. But many believe it’s only temporary.

https://restofworld.org/2023/newsletter-south-asia-its-winter-not-d...

Words like “layoffs,” “shutdowns,” and “funding crunch” have become synonymous with the tech startup world in recent months. As data about startup funding in 2022 trickles in, these trends have only been reinforced.

In 2022, startup funding in India fell by 40% year on year, according to Inc42’s startup funding report. Pakistan’s startup funding fell to $15.15 million during Q4 of 2022, making it the worst quarter since Q1 of 2020, according to Data Darbar, a Pakistan-based data intelligence platform.

These figures must make entrepreneurs across the region nervous and anxious. But some early-stage investors I spoke to last week gave me hope.

Yagnesh Sanghrajka, co-founder and chief financial officer of seed-stage venture capital fund 100X.VC, said that what’s happening right now is partly a correction after the euphoria of 2021 and early 2022, when many Indian startups raised back-to-back funding rounds, with their valuations increasing substantially each time.

“In every [business] cycle, there are corrections that happen, and this correction cycle is being called funding winter,” Sanghrajka said. “But it’s a winter, right? It’s not doomsday! So after winter, you always get sunshine.”

Kalsoom Lakhani, co-founder of Pakistan-focused VC fund i2i Ventures, also thinks that not all hope is lost. “In 2023, the funding slowdown will likely continue, though our belief is that good companies with strong business models (i.e., not burning lots of cash indefinitely) will still be able to raise in the coming year,” Lakhani wrote in i2i Ventures’ year-end roundup.

Both Sanghrajka and Lakhani, in fact, believe this funding winter may eventually have at least one upside: more realistic valuations.

Lakhani wrote that startup valuations in Pakistan will “go down to match the Pakistan market realities, which will be necessary given the waning international investor appetite.”

“These are very good times to actually invest in good founders,” Sanghrajka said. “If you are a smart investor … [you know that] the best investments happen in such times. You actually get good companies at better valuations than you would have otherwise gotten if it was not winter. So though people are taking more time to do diligence, they are deploying and they will deploy.”

Jan 10, 2023

Riaz Haq

State Bank of Pakistan issues NOCs to five applicants for establishing digital bank

https://www.brecorder.com/news/40220082

Central bank expects after commencement of operations, digital banks will promote financial inclusion by providing affordable/cost effective digital financial services to unserved and underserved segments

The State Bank of Pakistan (SBP) on Friday said that it has issued no-objection certificates (NOC) to five applicants for establishing digital banks in the country.

The following are the ones issued the NOC:

I) Easy Paisa DB (Telenor Pakistan B.V & Ali Pay Holding Ltd.),

II) Hugo Bank (Getz Bros & Co., Atlas Consolidated Pte. Ltd. and M & P Pakistan Pvt. Ltd.);

III) KT Bank (Kuda Technologies Ltd., Fatima Fertilizer Ltd. and City School Pvt. Ltd.);

IV) Mashreq Bank (Mashreq Bank UAE); and

V) Raqami (Kuwait Investment Authority through – PKIC and Enertech Holding Co.)

In January 2022, the SBP introduced a licensing and regulatory framework for digital banks.

“The Framework was the first step towards introducing full-fledged digital banks in Pakistan. The digital banks are expected to provide all the banking services through digital means without any need for their customers to visit the bank branches physically,” said the SBP.

Race to digital banking – final round

In response to SBP’s Licensing and Regulatory Framework for digital banks, the central bank received twenty (20) applications from a diverse range of interested players such as commercial banks, microfinance banks, electronic money institutions and Fintech firms by March 31, 2022.

“Further, a number of foreign players including venture capital firms already operating in the digital banking space also expressed their interest to venture into Pakistani market directly or in collaboration with local partners. The five (05) applicants were selected after a thorough and rigorous assessment process as per the requirements of the Framework.

Bank Alfalah launches QR payment solution with SnapRetail

“Applicants were assessed on various parameters that included fitness and propriety, experience and financial strength; business plan; implementation plan; funding and capital plan; IT and cybersecurity strategy and outsourcing arrangements, etc. Further, all the applicants were given the opportunity to present their business case to SBP.

“Going forward, each of these five applicants will incorporate a public limited company with the Securities and Exchange Commission of Pakistan. Afterwards, they will approach SBP for In-Principle Approval for demonstrating operational readiness and for commencement of operations under the pilot phase. Subsequently, they will commercially launch their operations after obtaining SBP’s approval.”

The SBP said it expects that after commencement of their operations, these digital banks will promote financial inclusion by providing affordable/cost effective digital financial services including credit access to unserved and underserved segments of the society.

Jan 13, 2023

Riaz Haq

Pakistan: Five major issues to watch in 2023

Madiha Afzal

https://www.brookings.edu/blog/order-from-chaos/2023/01/13/pakistan...

1. POLITICAL INSTABILITY, POLARIZATION, AND AN ELECTION YEAR

Politics will likely consume much of Pakistan’s time and attention in 2023, as it did in 2022. The country’s turn to political instability last spring did not end with a dramatic no-confidence vote in parliament last April that ousted then Pakistani Prime Minister Imran Khan from office. Instability and polarization have only heightened since then: Khan has led a popular opposition movement against the incumbent coalition government and the military, staging a series of large rallies across the country through the year.

2. A PRECARIOUS ECONOMIC SITUATION

Pakistan’s economy has been in crisis for months, predating the summer’s catastrophic floods. Inflation is backbreaking, the rupee’s value has fallen sharply, and its foreign reserves have now dropped to the precariously low level of $4.3 billion, enough to cover only one month’s worth of imports, raising the possibility of default.

3. FLOOD RECOVERY

A “monsoon on steroids” – directly linked to climate change – caused a summer of flooding in Pakistan so catastrophic that it has repeatedly been described as biblical. It left a third of the country under water – submerging entire villages – killed more than 1,700, destroyed homes, infrastructure, and vast cropland, and left millions displaced.

4. MOUNTING INSECURITY

The Pakistani Taliban (or TTP), the terrorist group responsible for killing tens of thousands of Pakistanis from 2007 to 2014, have been emboldened – predictably so – by a Taliban-ruled Afghanistan, and once again pose a threat to Pakistan, albeit in a geographically limited region (for now). The group engaged in at least 150 attacks in Pakistan last year, mostly in the northwest. Because the TTP have sanctuary in Afghanistan, the Pakistani state increasingly finds itself out of options when it comes to dealing effectively with the group. The state’s negotiations with the TTP have failed repeatedly, as they are bound to, because the group is fundamentally opposed to the notion of the Pakistani state and constitution as it exists today. The Afghan Taliban have, unsurprisingly, also not proved to be of help in dealing with the TTP – and Pakistan’s relations with the Afghan Taliban have deteriorated significantly at the same time over other issues, including the border dividing the two countries.

5. CIVIL-MILITARY RELATIONS

Pakistan has a new chief of army staff as of November 29 last year. General Asim Munir replaced General Qamar Javed Bajwa, who had held the all-powerful post for six years (due to a three-year extension). The appointment of the army chief was a subject of considerable political contention last year; a major part of the reason Khan was ousted from power was his falling out with the military on questions over the appointments of top army officials.

Jan 14, 2023

Riaz Haq

Pakistan set for digital census with tablets supplied by NADRA

The last batch of 17,600 tablets powered by an indigenous solution from Pakistan’s National Database and Registration Authority (NADRA) has been received by the chief statistician of the Pakistan Bureau of Statistics (PBS) Naeem uz Zafar ahead of a planned digital population and housing census.

This brings the total number of tablets supplied for the exercise to 126,000.

------

The last batch of 17,600 tablets powered by an indigenous solution from Pakistan’s National Database and Registration Authority (NADRA) has been received by the chief statistician of the Pakistan Bureau of Statistics (PBS) Naeem uz Zafar ahead of a planned digital population and housing census.

This brings the total number of tablets supplied for the exercise to 126,000.

According to an agency announcement, NADRA also played an important role in distributing the tablets to all the 495 districts, braving the odds to complete the exercise within a period of nine days.

The digital ID authority also made available about 100 experts to help in the training of over 90,000 enumerators who will be deployed on the field when the census begins.

After handing over the tablets, NADRA Chairman Tariq Malik also visited the facility offering some technical services to the census preparation process at the PBS.

Malik hailed the census as a huge step further towards a digital Pakistan: “The digital census is a step that pulls Pakistan out of ancient past and opens doors of a modern future. From scribbled responses on millions of paper sheets to real time validated data in apps on secure devices with satellite imagery – is a step towards digital Pakistan. Big data from digital census will become the foundational system for evidence based policy making for Pakistan.”

The solution from NADRA was developed in just three weeks and includes an Android-based house listing and enumeration application synchronized with GPS and GIS systems, data center and call center services, a web portal and other associated services.

NADRA is the official technology partner of the PBS for the upcoming population and housing census which is the 7th in the country but the first-ever to be done through digital means.

Biometric vehicle registration

NADRA also recently concluded a deal to henceforth conduct biometric checks on vehicle owners as part of efforts to combat fraud in vehicle transfer and ownership processes.

The deal sealed between NADRA and the Sindh Department of Excise and Taxation and Anti-Narcotics will be carried out through the ‘Sahulat Program,’ according to reporting by The Nation.

The first phase of the biometric program will run for three years.

Sindh Excise and Taxation and Anti-Narcotics Minister Mukesh Kumar Chawla praised the partnership saying it will help curb the phenomenon of vehicles operating with fake documents.

NADRA recently partnered with telecoms operators for a new fingerprint system to register SIM cards in Pakistan.

Jan 15, 2023

Riaz Haq

Pakistan’s productivity growth averaged 1.5pc in 2010s: study

https://www.dawn.com/news/1731884

The study — titled Sectoral Total Factor Productivity in Pakistan and conducted by the planning ministry and the think tank Pakistan Institute of Development Economics (PIDE) — says that the growth of productivity is a crucial determinant of an economy’s growth that has to be pushed higher to over 3pc.

https://pide.org.pk/wp-content/uploads/rr-057-sectoral-total-factor...

---------

Significantly low to achieve required GDP growth of 7-8pc

• High-productivity growth sectors mostly based on services or technology

---------

The services sector could also be more productive because of digitisation. Similarly, flexibility in technology adoption could be another factor. It is often observed that Pakistani firms in the manufacturing sector are primarily family-owned and managed, and are in general averse to modern management practices, a factor that inhibits productivity growth, the study says.

---------------

Dividing the 61 sectors into three categories — i.e., high TFP growth (above 3pc), medium to low TFP growth (between 0pc and 2.9pc), and negative TFP growth (below 0pc) — the study found that most sectors with high TFP growth are either related to services or tech.

Most sectors in the medium to low TFP growth category are in manufacturing. Two export-designated sectors, i.e. sports goods and textile composite, also feature in medium to low-growth sectors.

Most negative growth sectors are also in the manufacturing category, which captures three export-designated sectors (textile spinning, textile weaving, and leather and tanneries) amongst other salient industries such as fertiliser and automobiles.

The analysis also precipitates a trend between sectors that receive subsidies and medium to low TFP growth or negative TFP growth categories. Similarly, the export share of each of these sectors, barring the textile sector, in global exports is less than 1pc in their respective category.

According to the analysis, services have higher TFP growth on average than manufacturing. One plausible reason for this could be greater competition in services. Besides, the manufacturing sector is protected in Pakistan, which insulates them from the competition by retarding any incentive to improve efficiency.

The services sector could also be more productive because of digitisation. Similarly, flexibility in technology adoption could be another factor. It is often observed that Pakistani firms in the manufacturing sector are primarily family-owned and managed, and are in general averse to modern management practices, a factor that inhibits productivity growth, the study says.

Jan 16, 2023

Riaz Haq

First-ever digital population census in March

https://www.thenews.com.pk/print/1030135-first-ever-digital-populat...

ISLAMABAD: Without having the requirement of Computerised National Identity Cards (CNICs) for verification purposes, Pakistan’s first-ever digital Population Census will collect data from 185,000 blocks in March 2023 whereby a 40-point questionnaire covering eight important areas’ details would be sought.

The 40-point questionnaire will seek information about eight broad areas in the upcoming population census exercise, including households, basic amenities, demography, education, health, employment, disability and migration.

Chief Statistician Pakistan Bureau of Statistics (PBS) Dr Naeem Uz Zafar said that Pakistan’s Census in 2023 is going to be digital for the first time ever in the country’s history. All the preparations are rolled out and the team is now ready for the gigantic task. “The effort is entirely indigenous; all the systems devised and the tools created are by our own experts,” he said.

He was addressing a seminar, themed “Census 2023: All You Want to Know About” at the Pakistan Institute of Development Economics (PIDE) Islamabad on Thursday. He said census is an important national activity that is linked with resource allocation to provinces, representation in National/Provincial assemblies and the delimitation process. Therefore, the credibility of the census is of utmost importance. This is what called for comprehensive introspection leading to a solution acceptable to all i.e. digital census.

He apprised the audience that after the results of latest Census 2017 were approved in the 45th CCI meeting held on 12th April 2021, the Council of Common Interests (CCI) gave directions for the next census to start as early as possible and which should be according to international best practices by using the latest technology. The Government of Pakistan then constituted a committee of renowned demographers and experts with comprehensive TORS to bring transparency, credibility, and wider acceptability of census processes and results. For this, a board-based stakeholders’ engagement was carried out in order to have ownership of the process.

Earlier, in his opening remarks, Dr Nadeem ul Haque, Vice Chancellor, PIDE, said that censuses remain controversial in Pakistan, at times delayed for over a decade. Now that we are moving toward the new census, it is time to raise all the concerns and questions we have.

“The Pakistan Bureau of Statistics (PBS) has estimated that there will be a total funding requirement of Rs34 billion for holding census exercise out of which Rs10 billion have been provided to PBS while they have requested the Finance Ministry to release the remaining amount of Rs24 billion,” said the top official sources while talking to The News here on Thursday.

Sources said for the first time, self enumeration facility will also be made available. Household geotagging will be done to accomplish the exercise. There will be 126,000 enumerators collecting data from 185,000 blocks from all over the country.

The army personnel will provide foolproof security to 90,000 enumerators while police personnel will also accompany the enumerators to provide security at the first stage. Then the army will deploy its Quick Response Force to ensure overall supervision of foolproof security of the whole census exercise all over the country.

Each enumerator will be responsible to collect data from two blocks in 30 days of March 2023. The PBS has already held a consultation with Director General Military Operation (DGMO) and the army showed its readiness to spare personnel for providing security.

The population census will be done on a de-jure basis as everyone will be counted where he or she stayed in the last six months and hold a plan to continue staying in the same place for the next six months.

Jan 18, 2023

Riaz Haq

SBP

@StateBank_Pak

#SBP journey of digitization achieves another significant milestone, as the Raast Person to Person (P2P) payments cross PKR 1 trillion in a span of just 11 months. SBP thanks all stakeholders who are part of this journey and especially the customers for using #Raast.

https://twitter.com/StateBank_Pak/status/1616098619668439043?s=20&a...

Jan 19, 2023

Riaz Haq

#India's #Internet Growth is Stalling! #Mobile internet subscriber growth has slipped to single digits from scorching double digits between 2016 and 2020. Sale of #mobilephones fell to 151 million units last year, down from a peak of 168 million in 2021. https://www.bbc.com/news/world-asia-india-64293857

By Soutik Biswas

With more than a billion users, India boasts the world's second largest mobile phone market.

Yet, internet growth in this vast market appears to have stalled.

In October 2022, the country's telecom regulator counted 790 million wireless broadband subscribers, people who access the internet on mobile phones. That was barely a million more subscribers than what it recorded in August 2021. Growth in mobile internet subscribers has now slipped to single digits from scorching double digits between 2016 and 2020.

Smartphones are the main gateway to go online - and this is where growth is flattening. India currently has some 650 million smartphone users but the pace of growth has slowed. Sale of mobile phones fell to 151 million units last year, down from a peak of 168 million in 2021, according to Counterpoint, a market research firm. A single-digit growth in sales is predicted this year.

Up until three years ago, users were buying a new smartphone every 14-16 months, according to IDC, another market research firm. But now they are looking for an upgrade every 22 months or so.

One reason is that smartphone prices have gone up since the pandemic because of rising component costs, a weakening rupee and supply chain disruptions involving China, the world's largest smartphone maker. Nearly 90% of the more than 300 components in India-made smartphones are imported.

At home, a slowing economy, loss of jobs and a resultant squeeze on incomes means less money in the wallet for a pricier new phone. "The slowdown in internet growth should be seen as an indicator of the state of the economy," says Nikhil Pahwa, a digital rights campaigner.

The average price of a smartphone is now around 22,000 rupees ($269; £220), up from 15,000 rupees two years ago, according to Navkendar Singh of IDC. For a market of its size, India is remarkably price sensitive: 80% of the devices sold here cost less than 20,000 rupees. "This is a real cause of concern. The world's second largest mobile phone market has a smartphone penetration which is nowhere close to China, which has the largest market," says Mr Singh.

Some like Anuj Gandhi, founder of Plug and Play Entertainment, wonder whether India's smartphone market has hit the buffers. "Where will more growth come from when there are so many people still living in poverty?" he says.

India has more than 350 million users of "dumbphones" - basic handsets, or feature phones - who can potentially move to smartphones if they can afford it. Almost half of these people use devices that cost less than 1,500 rupees.

Stung by higher prices of devices and data, only 35 million Indians upgraded from feature to smartphones in 2022, compared to 60 million every year before Covid struck, according to Tarun Pathak of Counterpoint. "The feature to smart phone migration has slowed down considerably," he says.

What is not always accounted for is a thriving and informal second-hand [refurbished phones] market that could be fulfilling the need for "cheap" smartphones. "The second-hand market is meeting some of this demand. But we are not really growing the base," says Mr Singh.

----

A slowdown in internet growth isn't good news for India. Without a smartphone, it becomes difficult for many to access government welfare benefits, rations and vaccines, among other things. More than 250 million transactions are being made every day this month alone on the Unified Payments Interface (UPI), a government-backed real-time cashless transaction platform using mobile applications. India's central bank talks about a "less-cash, less-card society" by 2025.

Jan 22, 2023

Riaz Haq

Here’s how emerging economies are investing in a digital future | World Economic Forum

https://www.weforum.org/agenda/2023/01/davos2023-digital-fdi-initia...

Digital transformation is rapidly taking place, and we need the right governance frameworks to maximize its positive contribution and enable societies to prosper.

The World Economic Forum and the Digital Cooperation Organization have launched a collaboration – the Digital FDI Initiative – to identify the biggest challenges to growing the digital economy by helping implement policies and measures that will create “digital-friendly” investment climates.

Pakistan and Rwanda will be the first two countries to be supported by this new initiative to create an enabling environment for their digital future. More countries are in the pipeline to join the initiative and will be announced in the near future soon.

-----------

With unemployment rates raised by COVID-19, the digital economy presents an opportunity to create innovative new jobs and stimulate entrepreneurialism in new subsectors of the economy, like e-commerce and fintech.

Key to these solutions will be development of digital infrastructure and empowering populations with the tools to participate in the digital economy. Access to the internet is regarded as one of these metrics. In 2020, however, only 53% of people, and 16% of the world’s poorest, had access to the internet.