PakAlumni Worldwide: The Global Social Network

The year 2022 was a very rough year for Pakistan. The nation was hit by devastating floods that badly affected tens of millions of people. Macroeconomic indicators took a nose dive as political instability reached new heights. In the middle of such bad news, Pakistan saw installation of thousands of kilometers of new fiber optic cable, inauguration of a new high bandwidth PEACE submarine cable connecting Karachi with Africa and Europe, and millions of new broadband subscriptions. Broadband penetration among 140 million (59% of 236 million population) Pakistanis in the15-64 years age group reached almost 90%. This new digital infrastructure helped grow technology adoption in the country.

|

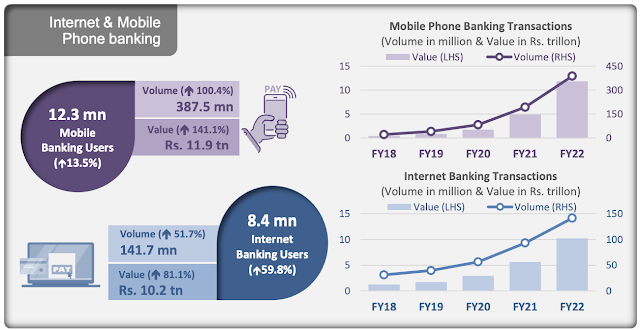

| Internet and Mobile Phone Banking Growth in 2021-22. Source: State Bank of Pakistan |

Fintech:

Mobile phone banking and internet banking grew by 141.1% to Rs. 11.9 trillion while Internet banking jumped 81.1% to reach Rs10.2 trillion. E-commerce transactions also accelerated, witnessing similar trends as the volume grew by 107.4% to 45.5 million and the value by 74.9% to Rs106 billion, according to the State Bank of Pakistan.

|

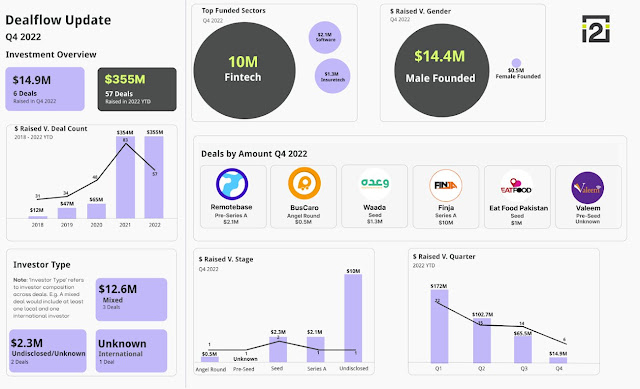

| Pakistan Startup Funding in 2022. Source: i2i Investing |

Fintech startups continued to draw investments in the midst of a slump in venture funding in Pakistan. Fintech took $10 million from a total of $13.5 million raised by tech startups in the fourth quarter of 2022, according to the data of Invest2Innovate (i2i), a startups consultancy firm. In Q3 of 2022, six out of the 14 deals were fintech startups, compared to two deals of e-commerce startups. Fintech startups raised $38 million which is 58% of total funding ($65 million) in Q3 2022, compared to e-commerce startups that raised 19% of total funding. The i2i data shows that in Q3 2022, fintech raised 37.1% higher than what it raised in Q2 2022 ($27.7 million). Similarly, in Q2 2022, the total investment of fintech was 63% higher compared to what it raised in Q1 2022 ($17 million).

|

| E-Commerce in Pakistan. Source: State Bank of Pakistan |

E-Commerce:

E-commerce continued to grow in the country. Transaction volume soared 107.4% to 45.5 million while the value of transactions jumped 75% to Rs. 106 billion over the prior year, according to the State Bank of Pakistan.

|

| Pakistan Among World's Top 10 Smartphone Markets. Source: NewZoo |

PEACE Cable:

Pakistan and East Africa Connecting Europe (PEACE) cable, a 96 TBPS (terabits per second), 15,000 km long submarine cable, went live in 2022. It brought to 10 the total number of submarine cables currently connecting or planned to connect Pakistan with the world: TransWorld1, Africa1 (2023), 2Africa (2023), AAE1, PEACE, SeaMeWe3, SeaMeWe4, SeaMeWe5, SeaMeWe6 (2025) and IMEWE. PEACE cable has two landing stations in Pakistan: Karachi and Gwadar. SeaMeWe stands for Southeast Asia Middle East Western Europe, while IMEWE is India Middle East Western Europe and AAE1 Asia Africa Europe 1.

|

| Mobile Data Consumption Growth in Pakistan. Source: ProPakistan |

Fiber Optic Cable:

The first phase of a new high bandwidth long-haul fiber network has been completed jointly by One Network, the largest ICT and Intelligent Traffic and Electronic Tolling System operator in Pakistan, and Cybernet, a leading fiber broadband provider. The joint venture has deployed 1,800 km of fiber network along motorways and road sections linking Karachi to Hyderabad (M-9 Motorway), Multan to Sukkur (M-5 Motorway), Abdul Hakeem to Lahore (M-3 Motorway), Swat Expressway (M-16), Lahore to Islamabad (M-2 Motorway) and separately from Lahore to Sialkot (M-11 Motorway), Gujranwala, Daska and Wazirabad, according to Business Recorder newspaper.

Mobile telecom service operator Jazz and Chinese equipment manufacturer Huawei have commercially deployed FDD (Frequency Division Duplexing) Massive MIMO (Multiple Input and Output) solution based on 5G technology on a large scale in Pakistan. Jazz and Huawei claim it represents a leap into the 4.9G domain to boost bandwidth.

|

| Pakistan Telecom Indicators November 2022. Source: PTA |

|

| Pakistan's RAAST P2P System Taking Off. Source: State Bank of Pakistan |

Broadband Subscriptions:

Pakistan has 124 million broadband subscribers as of November, 2022, according to Pakistan Telecommunications Authority. Broadband penetration among 140 million (59% of 236 million) Pakistanis in 15-64 years age bracket is 89%. Over 20 million mobile phones were locally manufactured/assembled in the country in the first 11 months of the year.

|

| Bank Account Ownership in Pakistan. Source: Karandaaz |

|

| Financial Inclusion Doubled In Pakistan in 5 Years. Source: Karandaaz |

Documenting Pakistan Economy:

Pakistan's unbanked population is huge, estimated at 100 million adults, mostly women. Its undocumented economy is among the world's largest, estimated at 35.6% which represents approximately $542 billion at GDP PPP levels, according to World Economics. The nation's tax to GDP ratio (9.2%) and formal savings rates (12.72%) are among the lowest. The process of digitizing the economy could help reduce the undocumented economy and increase tax collection and formal savings and investment in more productive sectors such as export-oriented manufacturing and services. Higher investment in more productive sectors could lead to faster economic growth and larger export earnings. None of this can be achieved without some semblance of political stability.

Related Links:

Riaz Haq

Financial inclusion in Pakistan increases to 30% - Profit by Pakistan Today

https://profit.pakistantoday.com.pk/2023/02/08/financial-inclusion-...

https://portal.karandaaz.com.pk/dataset/financial-digital-inclusion...

KARACHI: Financial inclusion in Pakistan has increased by 9 basis points from 2020 to 2022 and women’s access, specifically has hit a double-digit percentage for the first time, as recorded by a survey conducted by Karandaaz Pakistan.

As defined by the World Bank, “financial inclusion means that individuals and businesses have access to useful and affordable financial products and services that meet their needs – transactions, payments, savings, credit and insurance – delivered in a responsible and sustainable way.” This means conducting transactions through banks, mobile money and fintech.

The Karandaaz Financial Inclusion Survey (K-FIS) measures the percentage of adults above the age of 15 who report having at least one account in their name with an institution that offers a full range of financial services that is also documented by the government of Pakistan.

Following a significant jump in financial inclusion between 2017 and 2020, K-FIS recorded a substantial rise in the level of financial inclusion from 21% in 2020 to 30% of adults in 2022. Registered mobile money users more than doubled with an increase from 9% to 19%, while registered bank users also increased by 4 basis points over the same period.

By region, Islamabad Capital Territory (ICT) recorded the highest level of financial inclusion at 45%, followed by Gilgit Baltistan at 35% and Azad Jammu & Kashmir at 34%.

Looking at the division by gender, male registration accounted for the bulk of financial account registrations in 2022 with 47% having at least one registered financial account. Comparatively, only 13% of women are recorded to have at least one registered financial account. Although women’s percentage accounts for less than half of their male counterparts, the financial account registration for women has reached double digits for the first time.

Overall, the largest increase was seen in mobile money wallet users, as active usage increased from 8% in 2020 to 16% in 2022. Active usage also saw an increase in bank account holders, indicating an increase from 12% in 2020 to 14% in 2022.

Addressing the webinar held by Karandaaz Pakistan on February 7, 2023, Noor Ahmed, Director of the Agri Finance and Financial Inclusion Department of the State Bank of Pakistan (SBP) said, “Over the years, there has been significant progress on financial inclusion. Key initiatives such as RAAST have been transformative in furthering the inclusion of the marginalised.”

Karandaaz Pakistan is a not-for-profit special-purpose vehicle set up under Section 42 in August 2014. The company is the implementation partner of the Enterprise and Asset Growth Programme (EAGR) and Sustainable Energy and Economic Development (SEED) programme of the UK’s Foreign, Commonwealth & Development Office (FCDO).

Mar 2, 2023

Riaz Haq

The Challenges of Pakistan’s Digital Banking Reality - Aurora

https://aurora.dawn.com/news/1144694

The much-anticipated wait for the coveted digital banking licenses from the State Bank of Pakistan (SBP) is finally over. The five recipients (out of 20) must now lead the way and showcase how effective digitally enabled banking can be in solving the financial inclusion conundrum (digital and otherwise) of the unserved and underserved segments of Pakistan.

They will also be expected to possess/create better digital strategies, architectures and approaches to benefit the financial services industry, and given that no local bank got the go-ahead (at least in this round), it will be interesting to see how many of those revert to applying again or opting for Plan B and protect their market share by digitally enhancing themselves, re-evaluating their HR strategies, aligning the right percentage points for the right products and services, taking a deeper look at their digital architecture, and renewing their go-to market approach.

Traditionally, leading digital outlets are mapped internally and externally and have the right processes and tools to make digital channels available for bank customers and their various divisions. They also will have to learn from fintechs (or partner with them) to enable new digital customer journeys and user experiences by leveraging automated/paperless workflows and environments for better acquisition, retention and growth. Unfortunately, in the Pakistani context, success in digital banking (thus far and for most) equates to their banking apps on mobiles, where one can pay bills or another. Beyond this, for all other banking needs, the parameters of real digital banking success are still hard to define, given that the public still relies on hard cash rather than digits on a screen.

So, who are these digital banking leaders? In my view, out of 33 operating banks, six have demonstrated at the very least a decent digital vision and the ability to lead, if not total prowess on their strategies, customer focus, and the value of their services through innovative channels. Bank Alfalah, HBL and Meezan Bank seem to be the clear market leaders, followed by Allied Bank, Standard Chartered Pakistan and United Bank. Another three to four are trying to up their game to stay digitally relevant. Time will tell if they succeed.

The top ones are better placed than the others in terms of digital capability, governance structures, and professional decision-making (as opposed to seth or state-driven) and have an overarching ‘doer’ attitude that is reflected in their products/services. They also have stronger working digital partnerships with the SBP; they try out new, technologically advanced techniques and comply with the requisite investments in digital and hire on mandated appointments to advise on, and lead, IT initiatives. Their leveraging of the Covid-19 pandemic as an opportunity to explore new digital methods, address customer needs and focus on banking initiatives such as Raast and Roshan Digital Accounts are also commendable.

The remaining digital laggards seem to have their own reasons for doing the bare minimum on this front. For them, going digital (in the true sense) is time-consuming, expensive and the ROI of effort versus the reward does not make strategic sense given their lack of experience in monetising digital channels. Their best option will be to opt for profitability through traditional branch deposits, knowing fully well that cost centre models that typically flow down from branch banking are the most expensive, followed by ATMs – digital channels being the cheapest.

Mar 2, 2023

Riaz Haq

The Challenges of Pakistan’s Digital Banking Reality - Aurora

https://aurora.dawn.com/news/1144694

In their quest to go completely digital, banks are also struggling in the following areas.

Customer Ownership: In the digital sense, customer journeys stemming from apps/digital channels that leverage the banking services and products available to them will be a challenge. And since HR structuring is done in an old-fashioned way, the back-end reconciliation is often not only an operational challenge, it becomes an office politics one.

Parallel Digital Structures: Many banks have opted for a parallel albeit small(er) digital infrastructure to test the digital waters (perhaps they were advised to do this). The jury is still out on this approach because many of them preferred to digitally transform themselves completely and achieve overall digital excellence, rather than do it for one division and then connect others to it. This often creates a caste system within banks, which can also be a cultural challenge to solve for the leadership.

Skill Sets and Talent: Digital thinking at banks is often led by a tech-savvy board member, a digital banking leader and a CIO – all of whom are not always in sync, partly because they rose in different working environments and sectors. CIOs have risen in the ‘networking’ or ‘application’ route and are a non-business-savvy tech resource at best. Digital banking leaders are typically non-bankers and the board member is a foreigner (no formal board-level technology governance education exists in Pakistan) and is not, therefore, always up to speed in terms of Pakistan knowledge. This challenge exists across the board, especially because digital talent is still being cultivated (including junior ranks) and it often opts for start-ups and freelancing so that banks are even more challenged when it comes to attracting/retaining top talent.

Tech Architecture: Digital prowess requires stellar digital architectures, and to my knowledge, none of the banks has conducted a deep forensic audit of their existing tech stacks in order to uncover vulnerabilities and test the strengths on which the digital architecture is to stand. Untested architectures can be exposed and insecure and as dimensions of digital apps/tools/security are added to the volumes of transactions and data that a modern digital bank enables, they can fall (and fail).

Tech Tools: T24 by Temenos seems to be a core banking darling among CIOs. Enterprise Resource Planning exists for accounting and finance mechanisms, and CRM is widely missing as they don’t see the value somehow (shocking). Furthermore, internet banking architectures are different from those of mobile banking and back-end integration on a single connected stack for efficiency is missing. The SBP’s latest framework to outsource to cloud service providers is a welcome gesture, but to leverage it, banks will have to rethink their architecture and stop relying on band-aid approaches.

What next? Regardless of how the new digital licensees do, local banks should transform customer journeys at the branch level by digitising end-to-end digital loan disbursements/underwriting and all human/paper-intensive areas. This will involve constant upgrading of their digital vision, automating processes/workflows, focusing on customer centricity, upgrading the tech stacks, and integrating and mimicking digital channels with traditional branches. There will also have to be a meticulous focus on employee training in new-era banking, data gathering, intelligent decision-making and coming up with out-of-the-box customer and culturally relevant products that Pakistanis need to survive and grow.

Javaid Iqbal is CCO (and Member and Executive Director), Special Technology Zones Authority, Cabinet Division, Government of Pakistan. The thoughts reflected in this article are entirely his own and do not represent the views of the government. He can be followed on http://linkedin.com/in/jiqbal and @jdiq

Mar 2, 2023

Riaz Haq

Pakistan in midst of digital census, ‘unprecedented’ change in data policies

https://www.biometricupdate.com/202303/pakistan-in-midst-of-digital...

Officials with Pakistan’s National Database and Registration Authority are boasting of a new service intended to put people in charge of their biometric data.

NADRA, as the authority is more commonly known, now offers a service call Ijazat Aap Ki decentralizes citizen data, at least to some extent. People will be able to give their consent – or refuse it – before a transaction requiring their Pakistani ID card, for example.

The government is calling the move, making personal information just like any other precious personal possession, unprecedented. For the government, according to officials, it means the creation of a “digital consent regime.”

Verification transactions now require that a six-digit code be sent to a mobile phone registered to a citizen. Having the code is authentication and will be a person’s agreement for a third party to get verification of their ID number.

People will have to update NADRA when they change their phone numbers.

The same agency is promoting what it says is Pakistan’s first digital census, the deepest and broadest collection of personal information most people will ever experience.

At least 121,000 so-called enumerators are crisscrossing the rugged country for the monthlong harvesting period of the census. Regrettably, 86,000 police and “thousands” of military personnel will travel with the enumerators in an effort to prevent violence to the government workers.

Those people will use apps on Android devices that validate collected data. The results of their work are expected April 20.

According to the News Agency of Nigeria, past allegations of miscounting and underrepresentation was motivation to update how the census was conducted.

Mar 2, 2023

Riaz Haq

Pakistan launches its first-ever digital census

The Pakistan's Bureau of Statistics is conducting the census amid tight security

https://www.thehindu.com/news/international/pakistan-launches-its-f...

A police officer, right, stands guard as a government worker collects data from a man during census, in Peshawar, Pakistan, Wednesday, March 1, 2023. Pakistan launched its first-ever digital population and housing census to gather demographic data on every individual ahead of the parliamentary elections which are due later this year, officials said. | Photo Credit: AP

Pakistan Wednesday launched its first-ever digital population and housing census, with Prime Minister Shehbaz Sharif saying that it will help future planning and efficient utilisation of resources ahead of this year's general elections.

"Today marks the launch of Pakistan's very first Digital Census'23. This transparent system of data collection will feed into informed decision-making, future planning & efficient utilisation of resources. Congrats to all the organisations for designing this system indigenously," Mr. Shehbaz said in a tweet.

------------

Pakistan launches its first-ever digital census

https://sarkaripariksha.com/current-affairs/pakistan-launches-its-f...

Pakistan launched its first-ever digital population and housing census in an effort to securely gather demographic data on every individual ahead of this year's parliamentary elections.

The digital count will provide data for policy decisions, which now are based on the 2017 census that counted the population at 207 million people.

The digital census is being carried out by the PBS. It has the support of the National Technology Council (NTC), National Database and Registration Authority (NADRA), provincial governments as well as the armed forces.

For the first time, transgender people will be calculated in the census, the Pakistani government said.

Mar 3, 2023

Riaz Haq

The federal government on Friday extended the date for self-enumeration as part of census 2023 after it received requests from the masses.

https://www.geo.tv/latest/474067-census-2023-govt-extends-date-for-...

A Pakistan Bureau of Statistics (PBS) spokesperson confirmed Geo News that the date for self-enumeration for the seventh census has been extended by seven days (March 10).

The development comes days after Muttahida Qaumi Movement-Pakistan (MQM-P) objected to the time allotted for carrying out the census while calling for extending the time specified for the three phases of self-enumeration, house enumeration and census.

The decision to extend the date for the self-enumeration of the country's first digital census — which was initially scheduled to end tonight (March 3) at 12am — was taken during the relevant committee’s meeting.

The spokesperson maintained that the date has been extended keeping in view the convenience of the people.

The spokesperson said the authorities are also mulling over extending it beyond a week. He added that the website is also down repeatedly as a lot of people are accessing it.

"Till now, eight million people have self-enumerated themselves. The process of self-enumeration began on February 20," the spokesperson added.

Mar 4, 2023

Riaz Haq

Pakistani fintech startup Trukkr raises $6.4 mln, gets lending licence | Reuters

https://www.reuters.com/markets/asia/pakistani-fintech-startup-truk...

KARACHI, Pakistan, March 7 (Reuters) - Trukkr, a fintech platform for Pakistan’s trucking industry, said on Tuesday it had raised $6.4 million in a funding round and also received a non-banking financial company (NBFC) licence.

Trukkr offers Pakistan’s small- and medium-sized trucking companies a transport management system and supply chain solutions, and is unique in providing fintech to digitise the largely unbanked and undocumented industry.

The seed funding round was led by U.S. based Accion Venture Lab and London based Sturgeon Capital. Haitou Global, Al Zayani Venture Capital and investor Peter Findley also participated in the round, Trukkr said in a statement.

The company's business model is similar to Kargo in Indonesia, Solvento in Mexico and Kobo 360 in Africa, but has been adapted to the market in Pakistan.

Trukkr said less than 5% of trucking companies using its platform have access to financial services, often having to wait up to 90 days for payments and leaving them unable to cover expenses such as fuel, tolls and truck maintenance.

Sheryar Bawany, Trukkr CEO and co-founder, told Reuters that it was looking to launch financial products at a "reasonable risk adjusted spread" to the benchmark Karachi Interbank Offered Rate (KIBOR).

Co-founder Mishal Adamjee said there are some 20,000 drivers on Trukkr's platform, servicing 100 of the biggest companies in the country including Shan Foods, Artistic Milliners, International Industries Limited and Lucky Cement.

Adamjee told Reuters that Pakistan's $35 billion a year trucking industry is growing at 10% annually despite limited rail and water freight infrastructure.

Investor Accion Venture Lab said the Covid pandemic had shown how much the world relied on global supply chains.

"We want to bet on a company striving to tackle inefficiencies in a market filled with opportunities," it said in the statement.

According to Pakistan’s Board of Investment, projected demand for freight transport will double by 2025 and increase six-fold by 2050 to 600 billion freight tonnes-kilometre, particularly as the China Pakistan Economic Corridor kicks in.

Other freight marketplace startups in Pakistan include Truck It In, BridgeLinx and Freightix.

Mar 7, 2023

Riaz Haq

Pakistan approves blockchain-based national eKYC banking platform

https://www.kitco.com/news/2023-03-06/Iran-advances-its-digital-ria...

In other crypto-related developments out of the MENA region, the Pakistan Banks’ Association (PBA) has signed off on the development of a blockchain-based Know Your Customer (KYC) platform with the goal of strengthening the country’s Anti-Money Laundering (AML) capabilities in a bid to counter the financing of terrorism.

According to a report from the Daily Times, the PBA, which is comprised of 31 traditional banks operating in Pakistan, signed off on the project to develop Pakistan’s first blockchain-based national eKYC banking platform on Thursday at the behest of the State Bank of Pakistan (SBP), the country’s central bank.

Included in the list of member banks are multiple international behemoths such as the Industrial and Commercial Bank of China, Citibank and Deutsche Bank.

The new blockchain-based eKYC platform – dubbed “Consonance” – will also reportedly improve operational efficiencies, which are primarily aimed at improving customer experience during onboarding.

Consonance will be developed by the Avanza Group, and the platform will be used by member banks to standardize and exchange customer data via a decentralized and self-regulated network.

Mar 8, 2023

Riaz Haq

Pakistan Telecommunication : DE-CIX and PTCL partner to establish Internet Exchange in Pakistan | MarketScreener

https://www.marketscreener.com/quote/stock/PAKISTAN-TELECOMMUNICATI...

Frankfurt am Main (Germany)/Islamabad (Pakistan), 8 March 2023. DE-CIX, the world's leading Internet Exchange (IX) operator, and Pakistan Telecommunication Company Limited (PTCL), the largest integrated Information Communication Technology (ICT) company of Pakistan, today signed a strategic partnership to establish an Internet Exchange (IX) in Pakistan. The IX will be housed as a redundant setup in the data centers of PTCL. As a world-class interconnection platform in the populous South Asian country, it will be operated by DE-CIX under the DE-CIX as a Service (DaaS) model, and built on DE-CIX's award-winning interconnection infrastructure, including the full set of peering, cloud connectivity, and other interconnection services. Technical implementation is planned in 2023. The interconnection platform is set to serve as a hub for regional connectivity, enabling local networks low-latency interconnection and localization of global content, while increasing network stability, scalability, and security.

"With a population of over 200 million people and Internet usage growing incredibly fast, Pakistan needs local interconnection, and its Internet connectivity will be strongly enhanced through this partnership. We want to serve the great demand for increasing the speed, quality, and stability of Internet connectivity to guarantee the best experience possible for end users and businesses in the market," commented Ivo Ivanov, CEO of DE-CIX, after the signing ceremony at the telecoms event Capacity Middle East. "This will also attract more national and international Internet and cloud service providers to do business there and grow a vibrant local digital ecosystem, to offer the people in Pakistan the best access to local and international information, content, and services," Ivanov continued.

-------

Pakistan Internet Exchange point (PKIXP): How a collaborative effort helps keep Internet traffic local and makes the Internet faster and affordable in the country.

Learn more about how we're supporting technical communities strengthen their local infrastructure:

https://www.internetsociety.org/issues/infrastructure-and-community...

https://youtu.be/mXDVoWwesrg

Mar 10, 2023

Riaz Haq

Survey shows improvement in financial inclusion - Business - DAWN.COM

https://www.dawn.com/news/1736315

Overall, 10pc of adult Pakistanis have used Raast, the survey showed. Its users are predominantly men (13pc). Urban areas have a higher percentage of Raast users (14pc) compared to rural areas (7pc).

KARACHI: Three of every 10 adult Pakistanis are financially included, a measure that more than doubled between 2017 and 2022.

The recently released Karandaaz Financial Inclusion Survey 2022 shows financial inclusion increased from 14pc in 2017 to 21 per cent in 2020 and reached 30pc in 2022. Financially included individuals are those who have an account in their name with a full-service financial institution.

As for banking activities and attitudes, 19pc of adult Pakistanis have registered a bank account, according to the survey. The most common use of bank accounts is depositing money into one’s account (95pc), followed by withdrawal of money (38pc) and receiving wages (27pc).

About 81pc of Pakistani adults do not have bank accounts. Their main reason is “do not need one and have never thought of using one,” as reported by 68pc of those without a bank account.

Registered users for mobile money — which involves the use of a mobile phone to transfer funds, deposit or withdraw funds or pay bills — as a percentage of Pakistani adults also increased from 9pc in 2020 to 19pc in 2022.

About 45pc of mobile money wallet users recommended their use to others. Of these, 37pc recommended a specific mobile money wallet service. JazzCash was the most recommended service (69pc), followed by Telenor Easypaisa (24pc). The top reasons for recommending Easypaisa were “easier to transact with me” (69pc), “easier to use” (27pc) and “cheaper to transact with me” (26pc).

In comparison, JazzCash was recommended because of “lower transaction fees” (34pc) and “used by people I socialise with” (32pc).

The survey showed only 11pc of adult Pakistanis knew about Raast, which is the instant payment system that settles small-value retail payments in real-time while providing a universal access to all institutions in the financial industry. There’s is a “significant gender gap” in awareness about Raast as 16pc of men were aware of it versus only 5pc women.

Overall, 10pc of adult Pakistanis have used Raast, the survey showed. Its users are predominantly men (13pc). Urban areas have a higher percentage of Raast users (14pc) compared to rural areas (7pc).

The survey showed trust levels have increased for all types of financial institutions in the last nine years. The largest increase can be noticed for mobile money. Its level of trust has increased from 39pc in 2013 to 82pc in 2022. Trust in mobile money agents also increased from 37pc in 2013 to 77pc in 2022. Trust in the hundi/hawala system remained stagnant over the last nine years.

According to the survey, knowledge of different types of insurance products varied significantly among adult Pakistanis. About 50pc of them were either “very familiar” or “familiar” with life insurance. Familiarity with health insurance was reported by 37pc of the surveyed. The lowest level of awareness was about crop insurance (19pc).

Overall, 9pc of Pakistani adults have insurance policies. As is the case with using bank accounts and mobile money wallets, a gender gap also exists in the adoption of insurance policies: 12pc men versus only 6pc women have insurance policies, the survey showed.

Mar 11, 2023

Riaz Haq

Scams Are Ruining Pakistan’s Digital Economy

Ecommerce is booming, but as one gaming group found out, there are few protections for buyers.

https://www.wired.com/story/pakistan-scams-digital-economy-gaming/

IT TOOK SAMAIN Abid, 26, nearly two years to scrape together the 120,000 rupees ($454) he needed to buy a PlayStation 5. Before he bought it, he combed through reviews and asked friends for advice. Finally, in January last year, he placed an order with ZipTech, a gaming equipment company that had by then become the supplier of choice for Pakistan’s gamers.

The company’s appeal was clear. It was cheaper than the competition, offering longer delivery times in exchange for below-market prices on imported goods. It also came highly recommended in the Facebook groups that make up the core of Pakistan’s ecommerce industry. It even had a celebrity endorsement from Junaid Akram, a comedian and streamer with more than 924,000 subscribers on YouTube. And finally, it had a charismatic owner, Muhammad Hassan, known in the community as Major Zippy.

But a year after he ordered it, Abid’s PlayStation still hasn’t arrived. At least 260 people, according to a spreadsheet circulating in the Pakistani PC Gamers group, claim to have been scammed by ZipTech, to a total of 67 million rupees—around $290,000. Zippy, too, has disappeared. Calls to Major Zippy’s cell phone went unanswered, as did emailed requests for comment. “It was a huge betrayal,” Abid says. “He gave us hope and then took it away.”

--------

“A large percentage of merchants prefer to stay in the gray economy and not come into the tax net and so they don’t adopt online payment options,” says Misbah Naqvi, cofounder of i2i Ventures, a VC firm investing in early-stage startups in Pakistan. “This impacts the growth of the ecommerce ecosystem in Pakistan.”

During the pandemic, a lot of sellers did move online, but they often did so on social media and messaging platforms, arranging deals directly with customers. Facebook groups such as Packr, for instance, began to thrive when the country placed an import ban on luxury items in May 2022, allowing customers to sidestep hefty customs and import duties by getting imported products shipped to their doorstep via passengers returning from abroad.

This has meant that Facebook communities have an outsize influence on how people buy online in Pakistan, and who they buy from.

--------

Whatever the resolution to the legal case, Major Zippy has wrecked the community he was once a part of. “There is a trust deficit now, between sellers and buyers,” Khan says. “If you’re not doing a face-to-face deal, no one trusts you. On the whole, this fiasco has cost the gaming community a lot. Irreparable damage.”

Mar 14, 2023

Riaz Haq

Internet Startup Maqsad Scores Pakistan’s Biggest Edtech Round

https://www.bloomberg.com/news/articles/2023-03-16/internet-startup...

European seed investor Speedinvest leads round by Karachi firm

Company bets on rising demand for after-school tutoring

Pakistan’s Maqsad raised the nation’s largest funding round by an education technology provider, showing that some startups in the nascent market are attracting investors despite a global venture financing slump.

The Karachi-based company raised $2.8 million in an oversubscribed seed round led by Speedinvest GmbH, one of Europe’s largest seed investors, and existing backer Indus Valley Capital, according to co-founder Rooshan Aziz. Stellar Capital, Alter Global and angel investors also participated.

Mar 16, 2023

Riaz Haq

Internet Startup Maqsad Scores Pakistan’s Biggest Edtech Round

https://finance.yahoo.com/news/internet-startup-maqsad-scores-pakis...

European seed investor Speedinvest leads round by Karachi firm

Company bets on rising demand for after-school tutoring

Pakistan’s Maqsad raised the nation’s largest funding round by an education technology provider, showing that some startups in the nascent market are attracting investors despite a global venture financing slump.

The Karachi-based company raised $2.8 million in an oversubscribed seed round led by Speedinvest GmbH, one of Europe’s largest seed investors, and existing backer Indus Valley Capital, according to co-founder Rooshan Aziz. Stellar Capital, Alter Global and angel investors also participated.

Pakistan’s venture funding was little changed at about $350 million last year, but startups including AdalFi and Truckrr have raised sizable rounds for the market this year. The nation has the world’s fifth-largest population with a high proportion of young people.

“The ecosystem is going through a bit of a shake, but the companies which you know are solving fundamental basic problems, they’ll survive,” Aziz said in an interview. Maqsad’s operations are relatively lean and scalable and its education content always remains relevant, Aziz said.

Education spending in Pakistan is estimated at $37 billion by 2032 with a quarter of this going to after-school academic support, the target market for Maqsad, according to the startup. The mobile-only service targets students on grades nine to twelve and offers cheaper rates than brick-and-mortar tutoring companies. Its services include a feature that allows students to take a photo of a question and receive an answer instantly.

The app has been downloaded more than a million times and it has answered 4 million queries in the past 6 months. The startup can impact millions of students and become one of the most successful businesses in Pakistan, said Philip Specht, a partner at Speedinvest, which has one edtech unicorn in its portfolio.

The startup was founded by high-school friends Taha Ahmed and Aziz, who went to the London School of Economics and worked in the city before returning to Karachi to start the venture. The startup will start monetization in the coming months and may partner with other public and private institutions, Aziz said.

“This is an interesting time for edtech because globally the hype has kind of settled down after Covid,” said Ahmed. “So only serious companies are being funded in this space.”

Mar 16, 2023

Riaz Haq

Tech Destination Pakistan: Showcasing IT Prowess at LEAP 2023 in Saudi Arabia

https://propakistani.pk/2023/02/21/tech-destination-pakistan-showca...

Despite the prevailing economic crunch and challenges put forward by the uncertain situation, Pakistan’s IT sector made waves with its notable presence at LEAP 23 in Riyadh under the banner of ‘TechDestination Pakistan’.

This was very encouraging from an economic and business opportunities standpoint. PSEB’s renewed approach to branding Pakistan as a lucrative tech destination and enhancing its international presence has been exemplary.

With success at LEAP, Pakistan has proven that it is ready to take on the world and is open for business.

LEAP is an unparalleled tech event that brings together the brightest minds in the industry from across the globe, providing a dynamic platform for tech innovators, industry leaders, and top experts to collaborate, explore new innovations, establish valuable partnerships, and engage with influential mentors and investors.

The convention generated over $9 billion in business and was attended by over 172,000 individuals, including global tech leaders, IT professionals, speakers, tech gurus, and investors, making it the fastest-growing tech event in the world.

The Pakistan Pavilion, organized by the Trade Development Authority of Pakistan (TDAP) and the Pakistan Software Export Board (PSEB), featured 18 top IT/ITeS companies from various verticals

These included 10 start-ups showcasing cutting-edge solutions in areas such as AI, IoT, blockchain & crypto, robotics, 3D printing, space and satellites, biotech, quantum, fintech, 5G, open source, unmanned systems, and data services.

The pavilion was launched by His Excellency Ambassador Ameer Khurram Rathore, and six MoUs were signed between Pakistani IT companies and international companies.

Pakistani startup, SnapRetail, made it to the final round of the Rocket Fuel Startup Pitch competition, demonstrating the true potential and innovation capabilities of Pakistan’s IT industry.

PSEB’s Managing Director, Mr. Junaid Imam, encouraged Pakistani IT companies to participate in future LEAP events, leveraging it as a platform for networking and showcasing their presence in the IT sector.

Additionally, PSEB Director Business Development and Partnerships, Mr. Shahbaz Hameed, shared the organization’s ambitious vision of positioning Pakistan as a leading tech destination and striving to enhance Pakistan’s brand image internationally.

PSEB provided great assistance to the IT industry at LEAP, including organizing B2B sessions with prominent Saudi Companies to promote business expansion and foster new partnerships.

The success of LEAP Riyadh has created a ripple effect of businesses and investments for Pakistani IT companies, and they look forward to their participation in the upcoming editions.

PASHA, the independent IT association, assisted PSEB in yielding maximum mileage from the LEAP exhibition.

Pakistan sees this as a perfectly timed opportunity to showcase its IT/ITeS companies on an international trade platform and expand business in the Middle East market, especially in Saudi Arabia, which is undergoing transformation by implementing its Vision 2030.

Saudi Arabia’s economy is the largest in the Middle East and among the top twenty economies in the world, with a significant share of the tech industry.

Despite facing challenges, Pakistan has managed to make a mark in the tech industry with its participation in this mega event.

Mar 16, 2023

Riaz Haq

Digital census process continues smoothly: PBS

https://www.pakistantoday.com.pk/2023/03/16/digital-census-process-...

ISLAMABAD: The process of the 7th Population and Housing Census, being conducting digitally for the first time in the country’s history, has been going on smoothly all across the country, the Pakistan Bureau of Statistics (PBS) reported here on Thursday.

“The overall progress and speed of the census process is very encouraging and satisfactory,” PBS said in a press statement issued here.

The process includes an option for self-enumeration, which was made available from February 20, 2023, till March 10, 2023, and field operations of house listing and enumeration commenced from March 01, 2023, that will continue till April 4, 2023.

Conducting a census digitally ensures transparency, data-driven procedures, real-time monitoring of progress through geo-tagging using GIS systems, and wider acceptability of census results, said PBS press statement.

It said structures were listed from March 1st to March 10, 2023, during which all the residential and economic units were geotagged along with the classification of economic activities as per international standards.

It said, the self-enumeration portal was very well received by people who have enumerated themselves using the portal launched and this method was optional.

Currently, the final phase of the census i.e. enumeration is ongoing starting from March 12, 2023, and would continue till April 4, 2023. In this phase, the data about household members and their demographic characteristics, various Socio-Economic Indicators, as well as Housing characteristics, are being collected.

PBS technical team is analyzing and assessing the data and trends on a day-to-day basis to ensure the quality of the data and progress in identified 291 blocks all over Pakistan. Physical verification and digital monitoring are being used for quality assurance.

PBS has established 495 Census Support Centers (CSC) at the Census District level and 495 Census Support Centers (CSC) at the tehsil level where over 1,095 IT experts of NADRA and PBS team are available 24/7 for technical assistance and facilitation of field staff.

The control room has been established at the CSC level which facilitates census field staff during field operation and for this purpose, NADRA technical teams are available to redress all IT-related issues.

A call center is operating 24/7 for facilitation, assistance and suggestions through the toll-free number 0800-57574.

It said, certain quarters were spreading false and misinformation, adding information shared on the PBS website and official social media should be believed and considered.

Mar 16, 2023

Riaz Haq

Headcount of 40m population completed

PBS chief statistician says NADRA, NTC playing important role in securing data

https://tribune.com.pk/story/2406445/headcount-of-40m-population-co...

Pakistan Bureau of Statistics (PBS) chief statistician Dr Naeemuz Zafar said on Thursday that counting of 40 million people in 8 million houses was completed, so far, during the ongoing seventh national census.

Talking to the media along with census spokesperson Sarwar Gondal, the PBS chief statistician said that the citizenship of the Kashmiri people was ‘Pakistani’, adding that the Sindh government lacked confidence in the process.

He said that March 31 had been set as the deadline to complete the census.

For the planning purposes, the country had been divided into 185,509 blocks, while listing of 167,578 blocks had been completed so far, out of a total of 183,048 blocks.

“The listing could not be started in 2,664 blocks, so far. There are security issues in 201 blocks,” Zafar told reporters, while adding that “listing could not be done due to security issues in former Fata [Federally-Administered Tribal Areas].”

It is pertinent to note that the counting of people started on March 12.

In the first phase, house listings and all buildings have been geo-tagged and so far, 40 million buildings have been geo-tagged across the country.

Responding to a question, Dr Naeemuz Zafar said that work on this digital census had been going on for the last two years, adding that 121,000 people were trained for the census exercise.

“It is a digital household and economic census. NADRA and the NTC are playing an important role in securing the census data, which will help in the economic planning in the country,” he added.

Responding to another question, Dr Naeemuz Zafar said that there had been attacks on two census teams in Khyber-Pakhtunkhwa, while the Sindh government lacked confidence in the process, while adding that “the Sindh government can monitor our entire work.”

Mar 16, 2023

Riaz Haq

#DigitalPakistan: #Mastercard (MA) to Aid #Pakistan #Agriculture Sector Digitization. The expansive footprint of Digitt+ across the agricultural sector of Pakistan makes it an apt partner to complement MA’s endeavor. #Farm #Finance https://www.nasdaq.com/articles/mastercard-ma-to-aid-pakistan-agric...

Mastercard Incorporated MA recently inked a deal with Pakistan-based Aktkar Fuiou Technologies ("AFT") as a result of which AFT can take part in the Mastercard Community Pass Program. The program is a shared and interoperable digital technology platform, which aims to counter infrastructural headwinds, such as lack of secure connectivity or low smartphone usage, often encountered while digitizing rural communities.

As a result of the abovementioned deal, Digitt+, the country’s agri-fintech company, backed by AFT, will be entrusted to introduce Mastercard Commerce Pass across Pakistan. Commerce Pass is a digital payment solution that falls under MA’s Community Pass suite.

An offline and stored-value account product, Commerce Pass paves way for the safe storage and transfer of digital funds. Thereby, consumers and micro, small, and medium-sized enterprises ("MSMEs") of Pakistan are made aware of digitization benefits and the hassles of cash storage and transferring are minimized.

The recent tie-up reinforces Mastercard’s sincere efforts to integrate digital solutions within the underserved agricultural markets of the country. And the expansive footprint of Digitt+ across the agricultural sector of Pakistan makes it an apt partner to complement MA’s endeavor.

The move seems to be a time opportune one as a significant portion of Pakistan’s population is employed in agriculture and widespread measures are being adopted across the globe to integrate digitization in every sphere of life. But the agricultural sector of Pakistan grapples with ineffective infrastructure thereby creating roadblocks in the way of financial service providers to cater to agricultural workers.

Deemed to be a perfect fit in the prevailing scenario, Commerce Pass will offer a record of transactions that will make availing credit and other financial services easier for the country’s agricultural employees. The Mastercard solution is expected to offer financial flexibility to a considerable population of Pakistan that resides in rural areas and resorts to informal lending channels.

Mastercard follows a public-private partnerships strategy in Pakistan and works in unison with the government or private sector companies to infuse digitization across various sectors of the economy. Last year, MA collaborated with LMK Resources Pakistan (Private) Limited ("LMKR") to execute the first open-loop payment solution, powered by MA’s advanced technology, across the country’s transit system. The move was undertaken to infuse digitization within the country’s travel sector. By virtue of such remarkable initiatives, Mastercard occupies a significant share of the digital payments market in Pakistan.

Mar 17, 2023

Riaz Haq

How Maqsad’s Mobile Education Can Help More Pakistani Students Learn

https://www.forbes.com/sites/davidprosser/2023/03/16/how-maqsads-mo...

Maqsad aims to make education more accessible to 100 million Pakistani students through a learning platform delivered via a mobile app. The platform offers teaching and testing, and can respond to queries. It seeks to disrupt the country’s out-of-school education sector, which largely consists of expensive tuition services that most families can’t afford.

---------

Growing up in Pakistan, high-school friends Rooshan Aziz and Taha Ahmed, the founders of edtech start-up Maqsad, were very conscious of their good fortune. Aziz struggled with dyslexia but his parents were able to afford after-school academic support that enabled him to complete his education. Ahmed, meanwhile, benefited from a series of academic scholarships that gave him a headstart in life.

Fast forward to the Covid-19 pandemic, Aziz and Ahmed were both working in London, and watched with horror as Pakistan tried to move to online learning, but found itself unable to scale up a technology platform capable of supporting large numbers of students. The crisis acted as an impetus to launch Maqsad, which is today announcing a $2.8 million funding round as it reaches 1 million users only six months after its launch.

-------

“Maqsad offers an exceptional after-school learning experience for students at a fraction of the cost of existing alternatives,” Ahmed explains. “Our focus on student problems is at the core of our mission, and we’ve collected feedback from over 20,000 students and teachers across Pakistan to ensure learning outcomes are being achieved.”

Certainly, the company has grown remarkably quickly. Since its launch last year, the Maqsad app has been downloaded more than 1 million times and is consistently ranked as the number one education app in Pakistan on the Google Play Store. The app provides access to high-quality content developed by experienced teachers, but also uses artificial intelligence tools to offer personalised learning.

Aimed initially at students aged 15 to 19 – often preparing for board or university entrance exams – the platform aims to have real impact in a market where student-teacher ratios, at 44:1, are among the highest in the world. Maqsad – the name is the Urdu word for “purpose” – offers a freemium model, enabling students to access a range of features and services at little or no cost. Over time, it plans to offer more content aimed at younger students.

From an investment perspective, the business offers exposure to an education market that is worth $37 billion in Pakistan. While other technology-enabled providers are also targeting the market – including Abwaab and Nearpeer – Maqsad regards its primary competitors as the providers of physical tuition centres. These are unaffordable for many students, it points out, or simply inaccessible for those who do not live in urban locations where such centres are located.

Mar 18, 2023

Riaz Haq

US investment coming to Pakistan more and more every year, says US Ambassador Blome

https://www.dawn.com/news/1743320

US Ambassador Donald Blome has said that the US is Pakistan’s largest export market, and the US investment is seen coming to Pakistan more and more every year.

He was speaking at the US-Pakistan Innovation Expo in Islamabad that showcased the success stories of US government-sponsored Pakistani startups.

------

Senior Adviser for the Asia Foundation Pakistan Haris Qayyum expressed appreciation for the ongoing collaboration with the US embassy and National Incubation Centre to highlight success of Pakistani startups.

He said the US-Pakistan Innovation Expo was an endorsement of Pakistan’s dynamic tech entrepreneurs. It exemplifies Pakistan-US bilateral trade, foreign direct investment and technological innovation.

“The Asia Foundation is committed to collaborative efforts supporting Pakistan’s tech ecosystem, as we continue. The Asia Foundation is honoured to partner on initiatives that value entrepreneurship and innovation. It is our goal to support Pakistan’s sustainable development and inclusive growth,” he said.

The expo featured a speaker session for venture capitalists and angel investors led by an American expert. Business leaders and investors from Pakistan, the Middle East and the United States attended the event and discussed opportunities and challenges in the Pakistani startup ecosystem.

Project Director at the National Incubation Centre Parvez Abbasi said he was thrilled to see the US-Pakistan Innovation Expo come to fruition.

He said the event was a demonstration of the power of collaboration between the two nations and the endless possibilities “that arise when we combine our talents and resources”.

The delegates at the expo showed great enthusiasm for the event and expressed confidence that it would encourage further investment opportunities and potential trade partnerships between the US and Pakistan.

Mar 22, 2023

Riaz Haq

#Starlink #Satellite #Broadband is Now Officially Registered in #Pakistan. It could potentially revolutionize Pakistan’s #telecommunications industry by providing faster and more affordable internet services, even in remote areas. https://propakistani.pk/2023/03/22/starlink-satellite-broadband-is-...

https://propakistani.pk/2023/03/22/starlink-satellite-broadband-is-...

In a significant development for Pakistan’s IT and Telecommunication sector, Director of Global Licensing and Market Activation at SpaceX, Ryan Goodnight, called on the Federal Minister of Information Technology and Telecommunication, Syed Aminul Haq, to discuss the registration of SpaceX’s Starlink in Pakist

According to the Minister, Starlink has registered itself with the Securities and Exchange Commission of Pakistan (SECP).

The meeting was aimed at exploring how Starlink’s fastest and cheapest satellite internet services could pave the way for affordable broadband services in every corner of Pakistan.

The Minister expressed his optimism that Starlink’s services could significantly reduce the operational costs of telecom operators, even in remote areas where inactive mobile towers could be activated at low cost.

“Our main objective is to provide broadband services to every corner of Pakistan at affordable tariffs,” said the Minister, adding, “Starlink can play an important role in this regard.”

Ryan Goodnight thanked the Minister for his full cooperation and appreciated Pakistan’s progress in the IT and Telecommunication sector. “Basic steps are complete, and now we are ready to go fast,” Ryan added.

This development could potentially revolutionize Pakistan’s telecommunications industry by providing faster and more affordable internet services, even in remote areas. The successful implementation of Starlink’s services in Pakistan could be a significant step towards achieving the goal of a connected Pakistan.

Mar 23, 2023

Riaz Haq

#Pakistani delivery #startup Trax raises $3.7 million in early seed #investment, seeking to benefit from growth in the country’s nascent #ecommerce market. Round led by #US-based Amaana Capital and Tricap Investments of #UAE. PNO Ventures also invested.

https://www.bloomberg.com/news/articles/2023-03-24/pakistan-logisti...

Trax, a logistics-based startup for the digital economy, announced on Friday that it raised $3.7 million in seed funding from a consortium of strategic investors.

The round was co-led by US-based Amaana Capital, making its second direct investment into Pakistan, and UAE-based Tricap Investments. PNO Ventures committed to the round along with angel investors including Omer Ismail (CEO of One, a Walmart-backed fintech) and Jahanzeb Sherwani (a Silicon Valley tech entrepreneur).

Pakistan to produce a unicorn by 2025: Endeavor Managing Partner Allen Taylor

The company aims to use the investment to accelerate the growth of its logistics services alongside introduction of new business verticals such as fintech and technology solutions for its customers.

“We have built Trax with hard work and passion while funding ourselves because of our strong belief in the model,” said Trax Founder and CEO Hassan Khan.

“This funding will allow us to accelerate our journey as we continue to solve problems for the e-commerce and logistics industry through our tech solutions,” he said.

“Our new partners will help open doors for us to markets outside Pakistan and guide us to launch new verticals as we take the firm from a logistics company to one that solves connectivity issues and enhances financial inclusion in Pakistan.”

This partnership will also enable the firm to take all of this learning to the regional and then the global stage and make Trax a brand that Pakistanis are truly proud of, he said.

295 start-ups incubated since inception: NIC Islamabad helped attract over Rs7bn in investment

Launched in mid-2017, Trax is one of the logistics players in the Pakistani e-commerce sector.

Trax has built the third-largest delivery network in Pakistan with access to 95% of the population, served through over 100 warehouses, hubs, and retail centers nationwide.

The company also has a by-road fast-transit line haul system for e-commerce improving lead times while reducing costs for their clients.

Trax works with over 7,000 ecommerce merchants and also has clients in the banking, pharmaceuticals, FMCG and manufacturing industries with a team of almost 2,000 individuals.

Suleman Soorani, Partner at Tricap Investments, said: “We are impressed with Trax’s innovative approach to logistics and their commitment to providing high quality solutions to their customers. Trax has an exceptional leadership team and a proven track record of delivering scale.”

Aziz Hashim, Managing Partner at Amaana Capital, echoed similar sentiments. “We are confident that Trax’s strong leadership team, coupled with our investment, will enable the company to continue to expand its operations and become the leading logistics player in Pakistan.

Mar 24, 2023

Riaz Haq

PM launches ‘Teleschool Pakistan’ for free online education

https://tribune.com.pk/story/2407321/pm-launches-teleschool-pakista...

Teleschool Pakistan is a mobile application developed by the Ministry of Federal Education to provide free online education to students of all grades.

Addressing the ceremony, the prime minister observed that teachers’ training in the country was not up to the mark which was unfortunate and cited his experience in Punjab province.

He said that he had directed for steps to improve the quality of about 40 training centres in the province during his tenure as the chief minister.

-------

Secretary for Federal Education and Professional Training Waseem Ajmal presented an overview of the initiative.

He said digital contents would be created and made available on different medium. A total of six digital channels were being launched for different ages.

He said after the Covid pandemic, 6,000 quality videos were prepared.

Teachers would also be properly trained under the professional development initiative, he added.

Under the initiative, 150 chrome books were being distributed among the students while another 6,000 chrome books would be distributed soon, he added.

Mar 25, 2023

Riaz Haq

Purpose driven life: How top London school graduates quit lucrative jobs to provide millions of Pakistani students a lifeline | Pakistan – Gulf News

https://gulfnews.com/world/asia/pakistan/purpose-driven-life-how-to...

Islamabad: As the once-in-a-century pandemic brought unprecedented changes to the world of education, two Pakistani entrepreneurs, Rooshan Aziz and Taha Ahmed, found their purpose and built an edtech (educational technology) platform called Maqsad, which is the Urdu word for “purpose”.

Ahmed and Aziz, graduates of the London School of Economics, left their jobs in strategy consulting and investment banking in London and returned to Karachi to pursue their shared aspiration of making a meaningful impact back in Pakistan.

Being aware of the challenges of the Pakistani education system, the two childhood friends seized the opportunity during the pandemic disruption and founded Maqsad in 2021 with a mission to provide a lifeline for millions of students and allow them to access educational resources from their homes.

Within the last six months, the Maqsad app reached 1 million, has answered 4 million queries, and continues to be ranked as the top education app in Pakistan on the Google app store. But that is only the beginning. Maqsad aims to make education more accessible to 100 million Pakistani students through its mobile-only learning platform.

Features of learning platform

“Maqsad is a very comprehensive learning platform that does three things for students: Explain concepts, test knowledge and answer queries,” the co-founder Rooshan Aziz explained to Gulf News. The app provides comprehensive after-school academic content in both English and Urdu.

It offers teaching, testing, and query resolution for grades 9-12 students, focusing on the content of local educational boards - Sindh, Punjab, and Federal boards currently but aims to expand its reach to more boards and grades in the future.

The app’s query-solving technology and interactive testing provide a valuable solution for students who lack access to quality instructors. With the app’s enhanced assessment feature, students can confidently self-evaluate, resulting in a consistent month-on-month growth of 150 per cent in the number of questions attempted by students, Aziz shared.

Personalised after-school academic support

The mobile app is emerging as a potential solution to help reduce reliance on private tuition in Pakistan. Many students, including those studying in private schools, often turn to private tuition to provide individualised attention and support to help them keep up with the curriculum.

The Maqsad co-founders understand these challenges very well. Aziz struggled with dyslexia (learning disability) and largely depended on after-school academic support to complete his education. When he grew up, Aziz realised that this support was largely out of reach for the majority of students in Pakistan. Ahmed, who comes from a middle-class background, recalled that his family dedicated over half of the family’s income towards education, and securing scholarships helped alter the course of his life.

Mar 25, 2023

Riaz Haq

Purpose driven life: How top London school graduates quit lucrative jobs to provide millions of Pakistani students a lifeline | Pakistan – Gulf News

https://gulfnews.com/world/asia/pakistan/purpose-driven-life-how-to...

“Maqsad serves as a substitute for offline tuition, which may be inaccessible or unaffordable for many families. This is a major concern for girls who face accessibility issues due to limited public transport infrastructure and reliance on other family members,” said the Maqsad co-founder Ahmed. Another goal of the platform is to address Pakistan’s unequal education landscape, where poor education standards prevail for a large number of students, he says.

‘Game-changer’ for students

Maqsad app has been hailed as a “game-changer” for students who struggle to receive personalised support due to the country’s highest student-teacher ratios in the world with only 1 teacher for every 44 students. Ahmed emphasises that “focus on student problems is at the core of our mission, and we have collected feedback from over 20,000 students and teachers across Pakistan to ensure learning outcomes are being achieved”.

The app has been particularly beneficial for female students allowing them to receive the support they need to excel academically. A ninth-grade female student, who recently scored an impressive 73 out of 75 in Maths, attributed her success to the personalised support at Maqsad available free of cost.

Medical student Nimra Khan (student’s name changed upon request) said she used the app to prepare for college admission test and was able to join her dream university “thanks to high-quality services by Maqsad, which were provided for free, unlike other learning applications that charged significant amounts of money.” The app provides free access to the majority of the lessons but there are also paid options for advanced content at a fraction of the price of comparable alternatives.

Many teachers are also reportedly using the app as a source of knowledge and to offer after-school support who don’t have direct access to the app or Internet.

Maqsad secures $2.8 million in seed funding

The leading edtech, Maqsad, recently raised $2.8 million in a seed funding round led by Speedinvest, one of Europe’s largest seed investors, and returning investor Indus Valley Capital. Philip Specht, a partner at Speedinvest, said the firm invested because of Maqsad’s “potential to disrupt the education ecosystem and touch the lives of millions of students”. They believe that Maqsad is “on track to be one of the most successful businesses in Pakistan.

Indus Valley Capital, a Pakistan-focused early-stage venture capital fund, has increased its investment in Maqsad due to its compelling vision for education in Pakistan. This investment has raised Maqsad’s total capital to $4.9 million, solidifying its position as the best-funded edtech platform in Pakistan.

Future goals

The Maqsad team will use funding “to invest in more content for younger classes and cutting-edge technologies to make learning more personalised” and introduce AI-based solutions to enhance the platform’s capabilities and expand the subject offerings. “We are laser-focused on delivering a personalised learning experience at scale and have a number of exciting AI-based initiatives in the pipeline,” he said.

The edtech startup is also exploring potential partnerships with schools and is currently running a pilot with one of the largest school networks in the country. Sharing the long-term vision, Aziz said Maqsad aims to transform the country’s education ecosystem with content and technology solutions that are not limited by constraints such as financial issues or unavailability of teachers in rural regions.

Mar 25, 2023

Riaz Haq

Education Technology in Pakistan | EdTech Hub

https://edtechhub.org/where-we-work/pakistan/

EdTech Hub develops and delivers evidence in EdTech. We work in partnership with researchers and stakeholders in-country to find specific, effective solutions to education challenges.

Since 2020, EdTech Hub has been assisting many players in Pakistan’s education sector. Because the education sector in Pakistan is very decentralised, EdTech Hub’s work requires close collaboration with the Government at the federal and provincial levels, as well as local partners, EdTech entrepreneurs and policy think tanks.

More specifically, EdTech Hub works with the Pakistani Ministry of Federal Education and Professional Training (MoFEPT), the Federal Directorate of Education (FDE), the FCDO, World Bank, and UNICEF to achieve large-scale impact.

Mar 25, 2023

Riaz Haq

OneWeb secures Pakistan distribution | Advanced Television

https://advanced-television.com/2021/11/08/oneweb-secures-pakistan-...

The newly formed OneWeb/NEOM Tech & Digital JV will bring high-speed satellite connectivity to NEOM, Saudi Arabia, the wider Middle East and neighbouring countries including Pakistan.

The OneWeb/NEOM Tech & Digital JV has exclusive rights to distribute OneWeb services in these regions for seven years, and is expected to commence operations in 2023.

The OneWeb/NEOM Tech & Digital JV is looking to transform businesses and communities, stimulating enterprise across the region, with gateways and Points of Presence (POPs) in the Middle East providing security, speed and low latency data to sectors such as finance and retail, as well as schools and hospitals.

The JV says it will offer a seamless solution to infrastructural hurdles in Pakistan, where mobile operators and local loop operators will be able to leverage the service to expand their coverage areas, offering dependable low-cost internet access.

Matthew Johnson, Interim CEO of the OneWeb/NEOM Tech & Digital JV, said: “LEO satellites not only mean we can reach absolutely everyone everywhere, but with reliable and rapid speeds – connectivity at 100 megabits per second and more without the need for techniques such as trenching or placement of 5G equipment and fiber optics. This partnership with REDtone highlights how this technology presents an incredible growth opportunity for the wider region.”

Mar 27, 2023

Riaz Haq

Unregulated and forbidden, crypto still thrives in Pakistan

https://tribune.com.pk/story/2349633/unregulated-and-forbidden-cryp...

Bitcoin and cryptocurrency mining were flourishing in Pakistan until April 2018 when the government banned trading and mining the virtual currencies. There is still a growing mining industry despite the fact that many mining farms have been shut down since this ban was implemented. Bitcoin mining pools like ViaBTC, Braiins and Slush Pool saw an increase in the number of people mining bitcoin and other crypto currencies at home as a result of the ban. The cryptocurrency market is highly volatile, and because of its high volatility, we’ve seen a lot of hesitation from businesses, regulators, and consumers in embracing the asset. There’s no doubt that crypto currencies are a highly risky asset class, which is why more and more exchanges are thriving in countries with least favorable circumstances.

-------

Pakistan is one of the fastest-growing economies with a youth bulge of 65 per cent, rapid technology adaptation, and a government trying to enable a business-friendly legislative framework. The latest data from Sensor Tower shows that Binance, KuCoin, Crypto Blockfolio, OKeX, and are the top cryptocurrency exchanges in Pakistan, among Android and iOS users. These exchanges haven’t taken any proactive measures to capitalise on this huge opportunity presented by the sixth most populous country with the third-highest global crypto adoption. Most exchanges operate either through ghost partners without any regulatory effort. As many as a thousand Pakistani traders are listed on cryptocurrency exchanges based outside of Pakistan. Localbitcoins.com is one of the leading platform on crypto exchanges, which facilitates a bulk of Pakistanis.

Bitcoin and cryptocurrency mining were flourishing in Pakistan until April 2018 when the government banned trading and mining the virtual currencies. There is still a growing mining industry despite the fact that many mining farms have been shut down since this ban was implemented. Bitcoin mining pools like ViaBTC, Braiins and Slush Pool saw an increase in the number of people mining bitcoin and other crypto currencies at home as a result of the ban. The cryptocurrency market is highly volatile, and because of its high volatility, we’ve seen a lot of hesitation from businesses, regulators, and consumers in embracing the asset. There’s no doubt that crypto currencies are a highly risky asset class, which is why more and more exchanges are thriving in countries with least favorable circumstances.

The adoption of cryptocurrencies has begun to gain traction in the country. For the first time, Pakistan has been ranked third on Chainalysis' 2021 Global Crypto Adoption Index. Plans for cryptocurrency mining farms were announced earlier this year by Khyber Pakhtunkhwa province. A committee has been set up at the federal level to look into the regulation of crypto-currencies. These are encouraging signs. However, there is still much to be done, and there is only a brief window of opportunity to do so.

Crypto currencies regulations in Pakistan

DeFi (Decentralized Finance)is transforming industries and job roles, opening up new markets for businesses to tap into. DeFi will continue to face obstacles in the form of legal, logistical, and regulatory obstacles to overcome. Block chain technology closes the gaps in security, transparency, authentication, and automation that currently exist in our current systems. Despite the fact that it is still speculative, cryptocurrency is a thriving financial industry in South Asia; especially in India, following the same steps by Pakistan.

Mar 29, 2023

Riaz Haq

Camelback counters trek wilderness for Pakistan (first digital) census

https://www.dawn.com/news/1745167

“We even have to live for days out in the mountains among the people we're counting," says census supervisor.

Plodding over the horizon of Balochistan, camel-riding officials spy on a far-flung cluster of rough wooden homes and start tallying its tribespeople as the national census gets underway.

Beyond the reach of roads, power lines and TV signals in central Balochistan, this arid settlement of five reed huts has no name and hosts barely 15 nomads — three families herding goats and sheep.

“We ride for hours,” said local census supervisor Faraz Ahmad. “We even have to live for days out in the mountains among the people we’re counting.”

In cities and towns, teams wend their way from door to door on motorbikes. But in rural Balochistan, the tarmac gives way to craggy trails that then dissolve altogether in a wilderness of khaki rockland.

A fleet of gurning camels is the only option to get the job done.

“It takes a while to convince them to share their details,” census taker Mohammad Junaid Marri told AFP in Kohlu district, 210 kilometres east of Quetta and one hour by camel from the nearest discernible road.

“In some cases, it’s kind of funny. Since every census team has a security escort, sometimes people run away,” the 30-year-old said after his garlanded camel Bhoora bowed to let him slide off its hump and start peppering families with questions.

Between five and 10 per cent of Kohlu residents live in areas so inaccessible that camels are the only practical transport, estimates 34-year-old Ahmad.

They are rented for 1,000 rupees a day and the price includes a cameleer — a man trudging ahead to lead the bristly beasts on a leash.

In a nation divided along ethnic lines, enumerating citizens — 207 million at last count and an estimated 220m today — is a politically charged act that can alter claims to power and scant state resources.

The data will also be used to outline constituencies in future elections. Balochistan — Pakistan’s largest and least populous province — is rich in natural resources but poor by all other measures.

A separatist insurgency has long simmered in the region, fuelled by the grievance that Islamabad has failed to share the spoils of wealth extracted from Balochistan.

As Marri and Ahmad approach the hamlet on one camel — trailed by another carrying a guard wielding a weathered machine gun — they are eyed by a teenager through a pair of binoculars as children in traditional red floral dresses gather around.

“There’s a lack of awareness among people about the census — they don’t understand the benefits and downsides,” said Ahmad. “They don’t trust us and fear we may cheat them.”

Elsewhere, police guarding census teams in the nation’s remote and restive northwest have been killed by the Taliban.

Despite the decidedly low-tech mode of transport, this is the first time Pakistan’s census will be compiled digitally — on tablets rather than reams of paper. Nonetheless, the old grievances remain.

“What benefits will we get from the census?” asked Mir Khan, 53, in another nearby speck of a settlement at the foot of mountains.

“We will get nothing. The influential people snatch everything the government wants to distribute to the poor.”

“We have never seen any support from the government,” grumbles his cousin Pando Khan, 58. “We see people when they’re campaigning for us to vote for them, and later they never return.”

However, after swapping their personal details with families according to local tribal customs, Ahmad and Marri convince them to answer 25 questions to give them a clearer picture of present-day Pakistan.

Mar 31, 2023

Riaz Haq

HugoBank Appoints Atyab Tahir as CEO to Build a Digital Bank in Pakistan

https://finance.yahoo.com/news/hugobank-appoints-atyab-tahir-ceo-02...

Atyab Tahir brings over 2 decades of local and international experience in fintech and digital financial services to help build a digital bank in Pakistan

HugoBank expects to increase Pakistan's bank account penetration rate to over 80% and to open 34 million new accounts by 2027

SINGAPORE, March 27, 2023 /PRNewswire/ -- HugoBank, Pakistan's latest digital bank led by a Singapore Consortium, today announced the proposed appointment of Atyab Tahir as Chief Executive Officer, subject to the State Bank of Pakistan's fit and proper assessment. Following the company's incorporation, Atyab will set-up and lead HugoBank in Pakistan to offer digital banking services to people and small businesses across the country.