PakAlumni Worldwide: The Global Social Network

Growing access to smartphones and Internet connectivity is transforming the lives of women in rural Pakistan. They are acquiring knowledge, accessing healthcare and finding economic opportunities. A recent UNDP report titled "DigitAll: What happens when women of Pakistan get access to digital and tech tools? A lot!" written by Javeria Masood describes the socioeconomic impact of technology in Pakistan in the following words:

"The world as we know it has been and is rapidly changing. Technology has proven to be one of the biggest enablers of change. There has been a significant emphasis on digital trainings, tech education, and freelancing in the last several years especially during the pandemic, through initiatives from the government, private and development sectors. Covid-19 acted as a big disrupter and accelerated the digital uptake many folds. In Pakistan, we saw the highest number of digital wallets, online services, internet-based services and adaptability out of need and demand".

|

| Pakistani Women in South Punjab. Photo by Shuja Hakim UNDP Pakistan |

Digital Transformation:

The report cites the example of Ayesha Abushakoor from Zawar Wala in South Punjab who is a Quran teacher. She is teaching students remotely in and outside Pakistan. She uses digital wallets to receive payments. The same report also cites the case of Samina, from Muzafargharh, who is getting training online to start a livestock business. Another woman Mujahida Perveen from UC Pega in Dera Ghazi Khan is managing her thyroid disease by watching YouTube videos.

Telehealth is helping more women access healthcare in remote areas of Pakistan. Startups like Sehat Kahani are employing women doctors who work from home to provide healthcare services. Sehat Kahani was founded by Dr. Sara Khurram and Dr. Iffat Zafar who raised seed funding of US$ 500,000 in 2018, followed by a pre-series of $1 million in March 2021.

Expansion of Digital Services:

The year 2022 was a very rough year for Pakistan. The nation was hit by devastating floods that badly affected tens of millions of people. Macroeconomic indicators took a nose dive as political instability reached new heights. In the middle of such bad news, Pakistan saw installation of thousands of kilometers of new fiber optic cable, inauguration of a new high bandwidth PEACE submarine cable connecting Karachi with Africa and Europe, and millions of new broadband subscriptions. Broadband penetration among 140 million (59% of 236 million population) Pakistanis in the 15-64 years age group reached almost 90%. This new digital infrastructure helped grow technology adoption in the country.

|

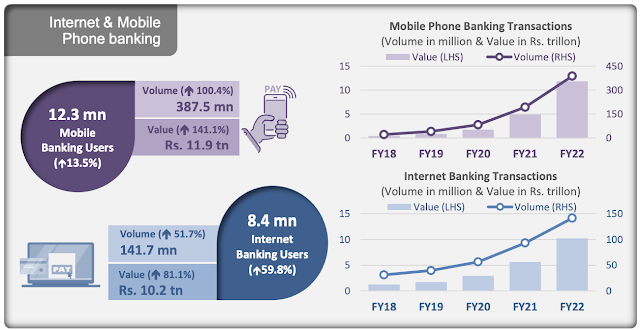

| Internet and Mobile Phone Banking Growth in 2021-22. Source: State Bank of Pakistan |

Fintech:

Mobile phone banking and internet banking grew by 141.1% to Rs. 11.9 trillion while Internet banking jumped 81.1% to reach Rs10.2 trillion. E-commerce transactions also accelerated, witnessing similar trends as the volume grew by 107.4% to 45.5 million and the value by 74.9% to Rs106 billion, according to the State Bank of Pakistan.

|

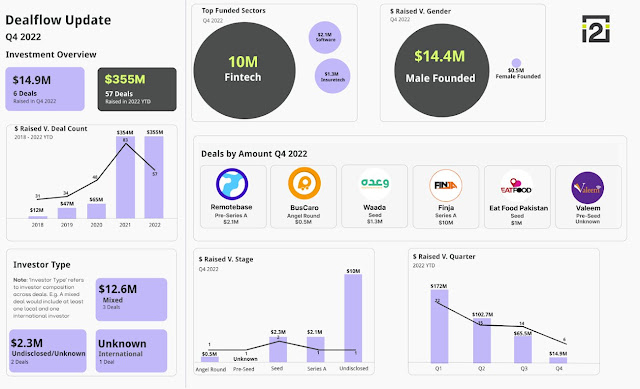

| Pakistan Startup Funding in 2022. Source: i2i Investing |

Fintech startups continued to draw investments in the midst of a slump in venture funding in Pakistan. Fintech took $10 million from a total of $13.5 million raised by tech startups in the fourth quarter of 2022, according to the data of Invest2Innovate (i2i), a startups consultancy firm. In Q3 of 2022, six out of the 14 deals were fintech startups, compared to two deals of e-commerce startups. Fintech startups raised $38 million which is 58% of total funding ($65 million) in Q3 2022, compared to e-commerce startups that raised 19% of total funding. The i2i data shows that in Q3 2022, fintech raised 37.1% higher than what it raised in Q2 2022 ($27.7 million). Similarly, in Q2 2022, the total investment of fintech was 63% higher compared to what it raised in Q1 2022 ($17 million).

|

| E-Commerce in Pakistan. Source: State Bank of Pakistan |

E-Commerce:

E-commerce continued to grow in the country. Transaction volume soared 107.4% to 45.5 million while the value of transactions jumped 75% to Rs. 106 billion over the prior year, according to the State Bank of Pakistan.

|

| Pakistan Among World's Top 10 Smartphone Markets. Source: NewZoo |

PEACE Cable:

Pakistan and East Africa Connecting Europe (PEACE) cable, a 96 TBPS (terabits per second), 15,000 km long submarine cable, went live in 2022. It brought to 10 the total number of submarine cables currently connecting or planned to connect Pakistan with the world: TransWorld1, Africa1 (2023), 2Africa (2023), AAE1, PEACE, SeaMeWe3, SeaMeWe4, SeaMeWe5, SeaMeWe6 (2025) and IMEWE. PEACE cable has two landing stations in Pakistan: Karachi and Gwadar. SeaMeWe stands for Southeast Asia Middle East Western Europe, while IMEWE is India Middle East Western Europe and AAE1 Asia Africa Europe 1.

|

| Mobile Data Consumption Growth in Pakistan. Source: ProPakistan |

Fiber Optic Cable:

The first phase of a new high bandwidth long-haul fiber network has been completed jointly by One Network, the largest ICT and Intelligent Traffic and Electronic Tolling System operator in Pakistan, and Cybernet, a leading fiber broadband provider. The joint venture has deployed 1,800 km of fiber network along motorways and road sections linking Karachi to Hyderabad (M-9 Motorway), Multan to Sukkur (M-5 Motorway), Abdul Hakeem to Lahore (M-3 Motorway), Swat Expressway (M-16), Lahore to Islamabad (M-2 Motorway) and separately from Lahore to Sialkot (M-11 Motorway), Gujranwala, Daska and Wazirabad, according to Business Recorder newspaper.

Mobile telecom service operator Jazz and Chinese equipment manufacturer Huawei have commercially deployed FDD (Frequency Division Duplexing) Massive MIMO (Multiple Input and Output) solution based on 5G technology on a large scale in Pakistan. Jazz and Huawei claim it represents a leap into the 4.9G domain to boost bandwidth.

|

| Pakistan Telecom Indicators November 2022. Source: PTA |

|

| Pakistan's RAAST P2P System Taking Off. Source: State Bank of Pakistan |

Broadband Subscriptions:

Pakistan has 124 million broadband subscribers as of November, 2022, according to Pakistan Telecommunications Authority. Broadband penetration among 140 million (59% of 236 million) Pakistanis in 15-64 years age bracket is 89%. Over 20 million mobile phones were locally manufactured/assembled in the country in the first 11 months of the year.

|

| Bank Account Ownership in Pakistan. Source: Karandaaz |

|

| Financial Inclusion Doubled In Pakistan in 5 Years. Source: Karandaaz |

Documenting Pakistan Economy:

Pakistan's unbanked population is huge, estimated at 100 million adults, mostly women. Its undocumented economy is among the world's largest, estimated at 35.6% which represents approximately $542 billion at GDP PPP levels, according to World Economics. The nation's tax to GDP ratio (9.2%) and formal savings rates (12.72%) are among the lowest. The process of digitizing the economy could help reduce the undocumented economy and increase tax collection and formal savings and investment in more productive sectors such as export-oriented manufacturing and services. Higher investment in more productive sectors could lead to faster economic growth and larger export earnings. None of this can be achieved without some semblance of political stability.

Related Links:

2021: A Banner Year For Tech Startups in Pakistan

Pakistan Projected to Be World's 6th Largest Economy By 2075

Digital Pakistan 2022: Broadband Penetration Soars to 90% of 15+ Population

Working Women Seeding a Silent Revolution in Pakistan

Socioeconomic Impact of New Infrastructure in Rural Pakistan

Pakistan Gets First Woman Supreme Court Judge

Pakistan at 75

Growing Presence of Pakistani Women in Science and Technology

Riaz Haq's Youtube Channel

Riaz Haq

Pakistan imposes widespread internet and social media bans • The Register

Outage-watching org NetBlocks has analyzed the performance of Pakistan's networks in recent days and substantiated reports of outages.

"NetBlocks metrics confirm the disruption of Twitter, Facebook and YouTube on multiple internet providers in Pakistan on Tuesday 9 May 2023. Additionally, total internet shutdowns have been observed on mobile networks in some regions," the outfit stated.

Digital rights advocacy organization Access Now has called for connectivity to be restored.

"People rely on the internet to obtain healthcare, education, and even earn their livelihoods," said the org’s Asia-Pacific policy director Raman Jit Singh Chima. "Hitting the kill switch is neither necessary nor proportionate, and can never be justified. Pakistani authorities must scrap their go-to tool used to quash political protests over the last year."

Chima's point about livelihoods applies to Pakistan itself: the nation promotes the use of freelance remote work platforms as a way for residents to earn a living and to improve services exports.

This round of lockdowns has, however, seen prominent freelance platform Fiverr warn users that workers in the nation are at risk, per the screenshot below.

May 12, 2023

Riaz Haq

Pakistan's financial gender gap aggravates chronic poverty

https://asia.nikkei.com/Spotlight/The-Big-Story/Pakistan-s-financia...

This week's Big Story examines Pakistan's financial gender gap. According to the World Bank's Global Findex Database, which tracks the use of financial services, only 13% of Pakistani women have their own bank accounts, compared with 28% of men. The story takes an in-depth look at what is still keeping women away from financial institutions and how this is hindering the growth of Pakistan's economy.

-----------

LAHORE -- Only 13% of women in Pakistan own bank accounts, the fourth-lowest proportion in the world.

When she was growing up, Mashal Wali watched her mother, Nasreen Muzaffar, put away a little money every week, storing it in a safe in their home. She would bring it with her when she went to the jamatkhana, a prayer hall for people from the Ismaili subsect of Shiite Islam. There, Muzaffar would contribute the money to a group savings account organized by managers at the adjacent community center near her home in the Gilgit-Baltistan region of northern Pakistan.

The cash Wali's mother saved was leftover pocket money that she had received from her husband for household expenses and food. Muzaffar's contributions, along with savings from other women in her community, went into a joint bank account that she or her neighbors could draw from when they needed money for big expenses. This system helped her save up for personal items as well as gifts for her children, including a bike and a camera.

In Pakistan, community savings systems like the one Muzaffar uses are a mainstay, in part because many people do not have bank accounts of their own.

Pakistan has one of the lowest financial inclusion rates in the world, with 79% of its 231 million people operating outside of the formal banking system, according to the World Bank's Global Findex Database, which tracks the use of financial services. But women are disproportionately on the wrong side of this financial divide: only 13% of Pakistani women have their own bank accounts, compared to 28% of men. In a World Bank survey of over 135 countries and territories, Pakistan finished fourth from the bottom for female financial inclusion. In Asia, it was the third-lowest, after Afghanistan and Yemen. Outside Asia, only South Sudan has a lower level of account ownership by women.

The unbanked deal in cash, borrow from friends and family, and save through community groups built by social networks and trust. It is a system nurtured by communities for generations but rife with local politics and family drama, all of which women must negotiate to make use of informal community savings.

Part of the reason for their lack of access to finance is that roughly 75% of Pakistan's women are not formally employed, according to the World Bank. Many are labeled housewives and homemakers and completely reliant on the incomes of their husbands and other male relatives.

Even formally employed Pakistani women are excluded from banking, with only 16% maintaining their own personal account instead of operating from someone else's account. That compares to an average of 68% of women in developing countries globally who have accounts, according to data from the World Bank.

Pakistan's low rates of financial inclusion for women reflect a societywide issue of gender inequality. The country ranks second-lowest in the world in terms of gender parity, at 145th out of 146 economies in the World Economic Forum's Global Gender Gap Index from 2022. Afghanistan ranks 146th.

The index studies economic participation, education, health and political empowerment. "[In Pakistan], women and men are really standing in very different places," said Shazreh Hussain, an independent social development and gender consultant in Islamabad.

May 12, 2023

Riaz Haq

Pakistan's financial gender gap aggravates chronic poverty

https://asia.nikkei.com/Spotlight/The-Big-Story/Pakistan-s-financia...

"The ability for women to independently maintain money, spend money, conduct transactions and get paid for their labor and to control the funds that are theirs, that ability is severely dented or compromised because their engagement with formal banking channels is through men," said Mosharraf Zaidi, founder of Tabadlab, a policy research institute in Islamabad.

In Gilgit, Wali said many women of her mother's generation -- Muzaffar is 51 -- spend their days at home, apart from a weekly trip to the jamatkhana. Community saving there is the easiest choice -- women do not have to make a separate trip to the bank and can trust the financial managers at the nearby community center to handle the details for them.

"Most of the women are illiterate and have never ever been to a school or any learning platform so they don't know anything about how to run normal bank accounts," Wali said, referring to women her mother's age. Education levels are considerably higher for younger generations of women from her area.

The case for improving women's financial inclusion in Pakistan is substantial. The World Bank recognizes women's financial inclusion as a key factor in achieving at least seven out of 17 United Nations Sustainable Development Goals. Women's participation in the labor force in Pakistan has more than doubled during the past three decades, and by some estimates, boosting women's financial inclusion could increase the nation's gross domestic product by 33%.

Getting women involved in finance has also been shown to increase gender equality; a 2022 study by researchers at the University of Groningen found women who are financially included tend to be more independent and have more bargaining power in the household.

Experts say including women in formal financing will help them contribute to Pakistan's economy -- generating activity the cash-strapped country sorely needs. "To make them part of the financial market is the first step towards actually making them part of economic growth," said Fareeha Armughan, a research fellow at the Sustainable Development Policy Institute, a think tank in Islamabad, who specializes in financial inclusion and governance.

Roadblocks to closing the gap

Pakistan is improving access to financial services. The country launched a National Financial Inclusion Strategy in 2015, and the State Bank of Pakistan adopted a Banking on Equality Policy in 2021 to address gendered obstacles to banking. The policy acknowledged how far Pakistan needs to go to close the gender gap in its financial system.

But tackling issues of gender in financial inclusion is a challenge in Pakistan, since reasons for exclusion are often complex -- both social and socio-economic. According to data from Tabadlab, the most common reason cited by Pakistanis for staying out of the formal financial net was insufficient funds. The second most common reason was lack of documentation -- a problem that is frequently faced by women and people from lower socioeconomic backgrounds.

"So much of how we understand Pakistan is actually caught up in a lot of cultural and sociological and societal and political ... analysis," Tabadlab's Zaidi said. "What it ignores is the base foundation for all the dysfunction, which is economic."

In Pakistan, 38% of adults are illiterate and more than 37% of the population lives in poverty, according to Tabadlab. The institute found men are two times more likely than women to be financially included, and residents of urban areas are 1.5 times more likely to be included in formal financing than those of rural areas.

May 12, 2023

Riaz Haq

Pakistan's financial gender gap aggravates chronic poverty

https://asia.nikkei.com/Spotlight/The-Big-Story/Pakistan-s-financia...

Armughan said these factors marginalize certain groups in Pakistan, especially women in rural areas, and keep them from seeking out formalized financial services. "Financial exclusion is actually part of a larger phenomenon of service exclusion," she said, adding that service exclusion is an extension of social exclusion.

On the supply side, commercial banks have few incentives to serve women, who are seen as a credit risk if they do not have a steady income stream from a job of their own or if they make up the 1% of Pakistani women who are entrepreneurs.

Strict documentation rules at financial institutions in Pakistan meant to stop money laundering and terror financing can make opening a standard bank account a tedious process for men, and even more so for women, who often are less likely to have official documents, such as land deeds, in their name.

On the demand side, economic marginalization and geographic isolation in rural areas keep both women and men out of formal financing because it is difficult to access banks. Lack of documentation and low literacy rates can also make banking an intimidating and confusing proposition for people from lower social strata. Financial scams in Pakistan often prey on these knowledge gaps among people who are new to formal banking.

Distrust in formal financial systems because of economic uncertainty also plays a role in the scale of Pakistan's informal economy. "[Fewer] people today are confident about savings instruments at banks than they were five years ago, 10 years ago," Zaidi told Nikkei.

Social and religious traditions surrounding gender roles also contribute to the financial gender gap. Men are seen as the primary breadwinners in most families, making it less likely for mothers, wives and daughters to have separate bank accounts. Women in Pakistan are also engaged in unpaid care work at home and in the agricultural sector, keeping them out of the formal financial system because they do not earn salaries in these roles. According to a U.N. Women report published in 2019, Pakistani women spend 11 hours on unpaid care and domestic work for every one hour their male counterparts spend on it.

Simple factors like the distance it takes to walk to a bank or fears of harassment on the way can act as deterrents."[Men] go to offices. They openly walk on the roads, but women don't do this," Wali from Gilgit said, referring to the experiences of women from her mother's generation. These risks contribute to women's preference for saving at the community center, where they already go every week with their families.

Community is key

The pandemic stretched household finances in Pakistan to the breaking point and put informal community financial pools under severe strain. With many unemployed, families had to borrow money to make ends meet, and those debts are starting to fall due.

The country's ongoing economic crisis has also fueled record levels of inflation, which hit 35% in March, making basic necessities considerably more expensive. This has compounded the hardships of those people who were already recovering from financial challenges during the pandemic.

In Molvi Suleman Jat, a village in the district of Thatta in the southern province of Sindh, less than a handful of women have their own bank accounts and most deal entirely in cash-pooling leftover money into a community savings fund used for medical treatments and other emergency expenses. When someone from the group needs cash, group members give from their savings in the form of a loan, deciding on the repayment terms together.

May 12, 2023

Riaz Haq

Pakistan's financial gender gap aggravates chronic poverty

https://asia.nikkei.com/Spotlight/The-Big-Story/Pakistan-s-financia...

These types of group saving systems revolve around the idea of social collateral, where the basis of trust is the strength of the ties between group members. In Molvi Suleman Jat, women say they had no conception of saving before a system was started in 2019 through a development program from the Sindh Rural Support Organization funded by the Sindh government. Most women in the village earn through daily labor or by producing and selling local crafts, which allows them to save a minimum of 100 rupees (around 35 cents) per month.

Inez Murray, the CEO of the Financial Alliance for Women, a nonprofit organization focused on women's involvement in financial markets, told Nikkei community savings models are used around the world because of the way they help people in poor communities build up a lump sum. "[It is] a way of putting a barrier between your pocket and somebody else, which is the challenge if you're poor because you just don't have enough resources," she said. "[There are] always competing interests for your money."

People partaking in these systems, however, also often do so because they are excluded from financial services, playing into a cycle of informal borrowing and community financing. Over half of the world's unbanked population is comprised of women, and rates of financial inclusion for women in the developing world have remained largely unchanged for more than a decade despite global efforts to close the gender gap in banking.

Pakistan has targeted women for its national welfare initiative, the Benazir Income Support Programme, through which eligible women receive cash payments through cards issued by the program.

Women-focused programs around the globe have become especially popular in the world of microfinance. Murray says the focus on women in microfinance specifically stems from research that shows women are more trustworthy borrowers than men. "The loan repayment rates in every loan category in every country are better for women," she told Nikkei.

Microfinance is the practice of providing financial services to low-income groups that do not generally have access to them. In her book "Poverty Capital," Ananya Roy describes how the microfinance model, first conceived by Bangladeshi economist Muhammad Yunus, saw women as an important conduit for financing because of their perceived likeliness to use finances for social development, including schooling and investments in the household. The microfinance model, which initially focused on group-based or "solidarity lending," was premised on the idea that social pressure in communal settings encourages women to repay their loans.

Because they became the focus for microfinance loans, however, women also become victims of predatory lending tactics that can increase debt. Murray of the Financial Alliance for Women says such tactics took root when the sector began looking to lower transaction costs to achieve scale and sustainability. "[It became] much more about the loan officer taking the payments back," she said.

Pakistan's microfinance industry has also faced challenges. In 2012, the World Bank found that between 50% and 70% of microfinance loans to women in Pakistan were actually going to male relatives, while women remained responsible for the transaction costs and the stress of repayment. "Women were borrowing money across groups, and it became very difficult to know who was using money at the end of the day," said Roshaneh Zafar, founder of the Kashf Foundation, the first women-focused microfinance institution in Pakistan. "There were men who had also been pipelined the money."

May 12, 2023

Riaz Haq

Pakistan's financial gender gap aggravates chronic poverty

https://asia.nikkei.com/Spotlight/The-Big-Story/Pakistan-s-financia...

Zafar said the global financial crisis of 2008, which caused high rates of inflation and led communities to default on loans, pushed the microfinance industry in Pakistan to shift away from group lending. Since then, the uptake of the CNIC national ID card system, the creation of the Credit Information Bureau, and other forms of digitization helped regulate the market and made it easier for lenders to keep track of where the money was going, she said. Still, the financial crisis brought to light the risks of group financing and the continued challenges of female financial access. "Many of us had to rethink and realign models," Zafar said.

Technological solutions

As Pakistan tries to fix its problem of female financial exclusion, the country's state bank has told commercial instructions to step up their efforts to create products and offer services that cater to women, under the 2021 Banking on Equality Policy. Meanwhile, financial technology startups and development organizations are looking at preexisting models of saving to provide clues about how to get women more involved in financial matters.

Potential product revenue from financial services in the women's market in Pakistan is estimated to be around $652 million per year, according to the Women's Financial Inclusion Data Partnership. Many new models addressing female financial inclusion use mobile applications as an alternative to brick-and-mortar banks, which are often difficult for women to access. The State Bank of Pakistan aims to get 20 million digital banking accounts operating for women by the end of this year.

Mobile banking applications like Easypaisa and JazzCash have become increasingly popular across Pakistan and can be used by anyone with a mobile phone. However, there is also a gender gap in phone ownership, with 50% of women owning a cellphone compared to 81% of men, according to the GSMA, an organization that represents mobile telecommunications operators.

Mobile banking options are becoming increasingly popular among Pakistani women, although only half of the female population owns a mobile phone. © AFP/Jiji

In Molvi Suleman Jat, where many of the women are illiterate, dealing in cash is a much better system than mobile banking, which is still an unknown concept. "We lack skills to use smartphones because we never went to school," said Rukiya Jat, a manager for one of the village savings groups. "We are learning. We have the curiosity to be part of the world, so our girls are going to [learn how to] use technology."

Reza Baqir, the former Governor of the State Bank of Pakistan, told Nikkei that none of the conventional explanations related to religion or culture seemed to account for the gender gap he was seeing in Pakistan's finances. Getting commercial banks to see women's accounts as profitable seemed to Baqir the most critical strategy in addressing the gender gap. "It was clearly a case of market failure where the market was not rising up to this opportunity," he said. The State Bank's policy includes a section that requires all banks to create and invest in a specialized banking department for women's products.

Numerous commercial banks in Pakistan -- including Habib Bank Ltd. (HBL), Allied Bank and Bank Alfalah -- have launched women-specific bank accounts to attract more female customers. Accounts like HBL's Nisa Asaan account, which is geared toward low-income women, can be opened with only a national identity card and has no minimum account balance.

May 12, 2023

Riaz Haq

Pakistan's financial gender gap aggravates chronic poverty

https://asia.nikkei.com/Spotlight/The-Big-Story/Pakistan-s-financia...

Shazia Gul, head of the Women Market at HBL, said these types of initiatives are meant to help get women financially included by removing the barriers to entry that exist for standard accounts. "We've done that to encourage women and develop a more enabling environment for them so that they're able to become part of the system on easy terms," Gul said. HBL launched its first women's account in 2016. Gul said the Banking on Equality Policy has given an added impetus to focus on women's products and policies. "It's not just about encouraging new accounts for us," Gul said. "It's about activating the existing [accounts] and also encouraging activity."

Some fintech companies in Pakistan have looked to community financing as the first step in getting women banked. Halima Iqbal, the founder of Oraan, a financial services startup, saw business potential in digitizing ballot committees -- a popular form of community savings -- when she returned to Pakistan in 2017 after working in Canada as an investment banker.

Iqbal and her team have helped dozens of women open bank accounts. According to Oraan's research, more than 40% of Pakistanis use the committee system for savings. Iqbal said committees are something women already feel comfortable using, which is why they were willing to try using the digital system. "There's a very deep-rooted cultural, social, religious aspect around it, right, like my mother did it, my grandmother did it," she said.

Oraan thought up a way to digitize committees by creating a platform that could organize the process and give people a trustworthy way to join committees outside of their immediate community. "Very quickly, we started recognizing that people don't necessarily want a better system," Iqbal said. "What they want is access to maybe a larger audience." By expanding on the committee model, Iqbal said Oraan's products seek to decentralize the risk in case certain communities experience a financial shock.

In December, a scam based out of Karachi brought risks of informal financing to life for Mariam Fareed, who'd begun paying into a community savings committee she'd read about in a Facebook group. The group has 35,000 members and in it, women post about their businesses, their homes and their lives.

Fareed started paying 7,500 rupees a month to secure her spot in the committee organized by an active member of the Facebook group, a woman she knew only by name and reputation. After four months, she started reading posts about the organizer, who'd failed to pay out thousands of collective dollars to dozens of members. Fareed got her money back but learned a lesson about blind trust of informal financing. "She didn't give me her details and I guess I also didn't give mine and that's my mistake," Fareed said.

Maham Alavi, who runs a Facebook page with the intention of helping women learn the basics of investing, said this is something she encounters often with women in her network who are only beginning to manage their own finances. Many worry that if they make a mistake investing, they will draw ire from family members, who won't trust them with finances in the future. Alavi said many women in her network lack basic financial literacy or confidence to do anything with their money besides stashing it somewhere in their homes.

May 12, 2023

Riaz Haq

Pakistan's financial gender gap aggravates chronic poverty

https://asia.nikkei.com/Spotlight/The-Big-Story/Pakistan-s-financia...

Alavi also tries to encourage women to put their money into investments other than committees, which she sees as less productive than stocks and other financial ventures. Still, if community financing helps women start taking control of their own money, Alavi sees the system as worthwhile because it would give them some protection in unstable living situations. "They just need to have that financial independence that God forbid, if something happens, they have something with them."

Efforts to increase financial inclusion for women in Pakistan have shown signs of progress. From 2017 to 2021, account use by women almost doubled. HBL said the bank's specialized women's accounts now make up 29% of total accounts in branch banking, and 23% of their branchless banking accounts are registered to women.

Wali from Gilgit said there is less desire to use community financing among people from her generation, who are moving away from rural areas to study and work. The 19-year-old has her own bank account, which she uses to pay her accommodation fees for university. "I go to the bank," she said, "so I don't need to use [community savings] because the [other options] are more convenient for me."

Armughan of the Sustainable Development Policy Institute said convenience is one key to getting more women involved. She believes high rates of informal financing should not be seen as a sign that women do not want to be included in formal banking. Instead, it should suggest that formal banking still has a way to go to serve them.

"This market is not designed for [women]," she said. "The products are not tailored for them."

May 12, 2023

Riaz Haq

‘Digital Pakistan’ in a coma: What is the cost of the broadband shut down?

https://profit.pakistantoday.com.pk/2023/05/11/digital-pakistan-in-...

One of the immediate groups that were affected were gig workers. These are daily workers that earn their money on platforms such as Careem, Foodpanda, and Indrive. These people require stable internet access through mobile phone data to do their jobs. Over these days, Foodpanda and services such as Careem were out of service because their captains and riders had no way of accepting rides/orders or of following maps. To put things in context, there are over 13000 foodpanda and Bykea riders, 30,000 Uber and Careem captains, and around 12,000 Foodpanda home chefs whose daily wages are dependent on broadband data.

Similarly, the shut down also had a serious impact on freelancers. A large number of Pakistanis work for foreign clients remotely on platforms such as Fivver and Upwork providing services ranging from coding to content writing and search engine optimization.

The gig-economy is an emerging sector in Pakistan. Freelancers in the country earned around $400 million in both 2021 and in 2022 which accounts for about 15% of Pakistan’s total $2.6 billion ICT (information-communication-technology) exports.

Almost immediately after the shutdown, both platforms put up signs next to the profiles of Pakistani users saying that the service providers belonged to a country that was experiencing internet outages which could delay their projects. The warning sign was not an exaggeration. A lot of these freelancers depend on broadband data to get their work done. On top of this, the freelancing world is brutal. Clients are very picky and small interruptions can very quickly sour client relationships that take years to build sometimes.

If this were not enough, the dream of a Digital Pakistan took another blow in the form of the Point-of-Sale machines also being out of service. A lot of the terminals you see at stores that are used to accept card payments come with in-built sims that connect them to the internet. As a result, Pakistan’s retail and grocery sector was operating entirely on cash. Even the country’s Federal Board of Revenue uses the data from these machines for tax calculation purposes.

Point of Sale (POS) machines, often known as debit/credit card machines, use sims to establish a network connection and make digital payments. The severance of mobile internet signals has rendered these machines temporarily obsolete, limiting everyone to cash payments only.

Reuters reported that Pakistan’s main digital payment systems fell by around 50% the day after former Prime Minister Imran Khan’s arrest. Data shared with Reuters by 1LINK on POS through its platform showed international payment card transactions were down on Wednesday by 45% in volume, from a daily average of 127,000 during the week of May 1 to 7 to approximately 68,000 on May 10. Ali Habib, spokesperson at HBL, Pakistan’s largest bank, said that it had seen a decline of 60% in the throughput of the POS machines.

May 13, 2023

Riaz Haq

Point-of-sale (POS) transactions routed through Pakistan’s main digital payment systems fell by around 50 per cent the day after former prime minister Imran Khan’s arrest ignited countrywide protests and prompted authorities to shut down mobile internet services, data showed on Thursday.

https://www.dawn.com/news/1752340

The reason for the slump was primarily the mobile broadband suspension, in addition to lower footfall at the limited number of stores opened due to the political turmoil, the two largest payments system operators, 1LINK and Habib Bank Limited (HBL), told Reuters.

The violent protests that followed Imran’s arrest on Tuesday by the country’s anti-graft agency have hit commercial activity in Pakistan hard.

Mobile data services have remained shut since Tuesday night on the orders of the interior ministry — the longest such continuous shutdown in a country that often suspends communications as a tool to quell unrest.

Many major roads and businesses have also remained shut, mainly in Lahore, the country’s second-largest city.

Data shared with Reuters by 1LINK on POS through its platform showed international payment card transactions were down on Wednesday by 45pc in volume, from a daily average of 127,000 during the week of May 1 to 7 to approximately 68,000 on May 10.

The daily value of transactions using international payment cards was down 46pc, from Rs606 million to Rs330m on May 10.

1LINK is Pakistan’s major facilitator of POS digital payment transactions for international platforms such as Visa and Mastercard.

Transactions on Pakistan’s only domestic payment scheme, PayPak, were down 52pc in volume to 18,000 transactions on Wednesday, and 56pc down in value to roughly Rs62m.

Ali Habib, spokesperson at HBL, Pakistan’s largest bank, said that it had seen a decline of 60pc in the throughput of the POS machines.

“HBL processes over 30pc of the entire throughput of the POS machines in Pakistan. This is the largest share in the market,” he added.

The State Bank of Pakistan did not immediately respond to questions sent by Reuters.

Cash transactions still dominate Pakistan’s commercial dealings, with much of the market undocumented, but digital payments have been growing fast in the country of 220 million. Many retailers and industrialists across Pakistan have also said their activities had ground to a halt since the protests started on Tuesday.

More than 1,600 people have been arrested while at least five have been killed and hundreds injured in riots, including more than 160 policemen.

On Tuesday, the Pakistan Telecommunication Authority (PTA) suspended mobile broadband services across the country.

Social media platforms such as Facebook, Youtube and Twitter were also down, resulting in demand for virtual private networks to surged by 1,329pc on Wednesday compared with the average, according to Simon Migliano, Head of Research at Top10VPN.

Migliano calculates that the suspension of mobile broadband and social media platforms has cost nearly $100m so far.

May 13, 2023

Riaz Haq

For four days last week, Pakistan’s tech industry lost between $3 million and $4 million a day as internet services across the world’s fifth-most populous nation were shut down amid political turmoil.

https://restofworld.org/2023/south-asia-newsletter-political-turmoi...

On May 9, Pakistan’s former prime minister and popular politician Imran Khan was arrested in Islamabad on charges of corruption. This led to widespread protests across the country, and the government imposed an “indefinite” internet shutdown in several regions. On May 12, the Supreme Court ruled Khan’s arrest illegal, and he was subsequently released. Internet services in Pakistan have now been restored, but the damage has already been done.

The shutdown was a “massive setback” for the country’s IT industry, the Pakistan Software Houses Association (P@SHA) said in a tweet on May 11. “This is an alarming situation, and action needs to be taken urgently to address this issue,” it said in another tweet. “P@SHA demands immediate action to resolve the problem.”

Careem, inDrive, Foodpanda, and Bykea were among the companies that took the worst hit from the internet suspension, reported independent news platform ProPakistani.

Pakistan’s telecomms industry also lost $5.4 million in revenue due to the shutdown, a source told Al Jazeera on May 12. “The devastating effect on the economy is quantifiable but the inconvenience to people is incalculable,” tweeted Aamir Hafeez Ibrahim, CEO of mobile network operator Jazz.

In a letter to the government last week, Pakistan-focused venture capital association VCAP said such “restrictions have an immediate and adverse impact on Pakistan’s startups, which are reliant on such platforms for new user acquisition and growth. The suspension of mobile broadband also greatly impacts Pakistani citizens, who are mobile-first, and use these digital solutions for financial services, mobility, food, commerce, and more.”

Meanwhile, freelance workers in the country also lost access to the outside world during the shutdown. Pakistan is the third-largest global supplier of freelance work, and IT services make up a large chunk of it. Employers seeking Pakistani workers on freelance marketplace Fiverr were met with a note that read: “This freelancer is in a location currently experiencing internet disruptions. As a result, they may not be able to fulfill orders as quickly as usual.”

The crisis could not have come at a worse time for Pakistan’s tech workers, and the industry as a whole. The country has been dealing with a massive economic crisis, with dwindling forex reserves. It is currently waiting on a $1.1 billion loan from the International Monetary Fund. Pakistan’s foreign direct investment (FDI) plunged 44% in the first seven months of the 2023 financial year.

Calling it “absolutely nonsense from the international point of view,” Wille Eerola, chairman of the Finland Pakistan Business Council, said the internet shutdown is “only harming — or even destroying — the image of Pakistan as a country for international business and FDI.”

May 21, 2023

Riaz Haq

Laying the digital foundations for a brighter future

https://dailytimes.com.pk/1095721/laying-the-digital-foundations-fo...

by Khurram Sultan

The Government of Pakistan has launched the Smart Village Pakistan project with the support of Huawei to overcome the extreme disparity between the urban and rural development indicators. The Smart Village project aims to achieve digital transformation in remote rural areas by closing the gap in access to technology and services between urban and rural areas – a transformation that is made possible through Huawei’s expertise and expansion of wireless broadband network coverage.

The first village to experience the digital transformation is the Gokina Smart Village, a small hamlet near Islamabad. There, Huawei provides cutting edge technical solutions to connect the unconnected, allowing partners in education and health to serve the previously underserved community.

The Smart Village Pakistan project aims to digitally transform remote and rural communities by connecting them and empowering the citizens with better access to a range of digital services that can meaningfully improve their wellbeing and livelihoods in accordance with the government’s vision of Digital Pakistan. Reduced inequality will lead to improved well-being and access to better jobs through digital services. This approach involves a new design and implementation framework that is demand-driven, user-centric, flexible, and is focused on sustainability, scalability, and multi-sector collaboration.

Huawei continues to be the leader in Pakistan in expanding outreach in rural areas under the broader Huawei TECH4ALL commitment to enable an inclusive and sustainable digital world. Aligned with the UN SDGs and Huawei’s vision and mission, TECH4ALL is a long-term digital inclusion initiative and action plan to innovating technologies and solutions that make the world a more inclusive and sustainable space for all.

Approximately half the world population is digitally connected while the other half is not, a division that has implications that became glaring apparent during the global pandemic when digital networks and access to the internet meant continued access to fundamental rights and critical services like health and education.

TeleTaleem is a social enterprise focused on enhancing quality of education services at the grassroots level, through innovative use of technology. While TeleTaleem has reached a good mix of users in urban and rural settings – reaching out to 60 different districts across all four provinces and the AJK, covering 4,000+ schools and directly impacting skillset of more than 6,000 teachers and 1,000,000+ children, one of its proudest accomplishments is the recent partnership with Huawei and the International Telecommunication Union (ITU) under the Smart Village Program.

Upon visiting the school in Gokina, TeleTaleem discovered a pressing need for science teachers, particularly for students in grades 8, 9, and 10. Specializing in the design and delivery of e-learning systems and services, using a variety of delivery mechanisms and blended learning platforms, TeleTaleem has implemented multiple interventions, covering a broad spectrum of primary to secondary school systems, teacher education and training institutions in both public and private sectors.

The solution for Gokina was TeleTaleem’s Online Teaching Model, which provides the school with two digital classrooms equipped with internet connectivity from Jazz and power backup systems. Through this setup, the school was connected with specialist science teachers based at TeleTaleem. Now, the students in Gokina are benefitting from daily science classes, including subjects like chemistry and biology, along with regular assessments of their learning activities.

May 24, 2023

Riaz Haq

Laying the digital foundations for a brighter future

https://dailytimes.com.pk/1095721/laying-the-digital-foundations-fo...

by Khurram Sultan

This initiative aims to bring quality education to remote rural areas, and the foundation of innovative, tech-based solutions are digital connectivity. The Smart Village project aligns with the TeleTaleem vision to provide quality education where it is needed the most under our “Education without Boundaries” approach.

The project has received an overwhelmingly positive response from both students and teachers. The school head has been incredibly cooperative and supportive throughout the implementation of these activities. The Federal Directorate of Education, responsible for the school, and the Ministry of Federal Education & Professional Training have expressed their great appreciation for the efforts of TeleTaleem, Huawei, and ITU in selecting Gokina School as a pilot site under the Smart Village program.

While the challenges of infrastructure are real, the opportunities are immense. In Pakistan, the young, underserved population spread across vast rural tracts is the ideal target and ultimate beneficiary of enhanced digitalization and increased usage of telecom services.

Around 37% of employment in Pakistan is in agricultural, forestry, or the fishery sector and COVID-19 has disrupted conventional business operations and led to closure of many traditional markets. Not only so, but 13% of the youth from these areas do not enroll in secondary school, and only 15% of households have access to a computer at home for e-learning. The literacy rate of female youth (ages 15-24) is more than 14 percent lower than male youth literacy rate. Additionally, the employment rate is around 11% higher for women than it is for men. With access to connectivity and ICT, the Smart Village Project looks to tackle all of these issues.

Inclusive digital transformation can be a crucial enabler for rural development and with Huawei laying the foundations for social enterprises and service providers to reach the unserved, the future is bright.

The author is the Director Program at TeleTaleem, a social enterprise delivering innovative solutions for improved educational services at the grassroot level.

May 24, 2023

Riaz Haq

USF Approves Rs. 21 Billion for New Optical Fiber and Broadband Projects

https://propakistani.pk/2022/09/25/usf-approves-rs-21-billion-for-n...

The Universal Service Fund (USF) Board has approved the award of 10 contracts worth approximately Rs. 21 billion for the unserved and under-served communities of Baluchistan, Punjab, Sindh, and Khyber Pakhtunkhwa (KP).

The high-speed mobile broadband projects, highways and motorways projects, and optical fiber cable projects will provide 4G LTE connectivity and backhaul connectivity to around 3.5 million people by connecting 187 Union Councils (UCs) with 1,554 kilometers (kms) of optical fiber cable and provide seamless connectivity to 622 km of unserved road segments on M-8 motorway and N-35 highway.

Additional Secretary (Incharge) IT & Telecommunication and Chairman USF Board Mohsin Mushtaq Chandna chaired the 83rd Board of Directors meeting of USF on Thursday.

While addressing the meeting, Chandna said that USF has delivered a record productive performance in the past 4 years by contracting 79 projects worth approximately Rs. 62.7 billion in subsidy. This is a testament to our absolute commitment to improving the lives and livelihoods of the unserved and underserved communities of Pakistan.

He also highlighted the importance of infrastructure, affordability, and accessibility of the internet and pledged to work with all stakeholders to achieve the vision of Digital Pakistan.

USF Chief Executive Officer Haaris Mahmood Chaudhary apprised the Board members of the progress of the current projects and the restoration of the flood-affected USF network. He said that these projects will empower around 3.3 million people living in far-flung and backward areas across Pakistan, enabling them to access e-services across various spheres, ranging from financial services like banking and loans to accessibility towards various government services and benefits.

According to the details, the Board approved the award of 5 high-speed mobile broadband contracts worth approximately Rs. 7.1 billion for providing 4G LTE services in the rural and remote districts of Punjab, Sindh, and Balochistan. These projects will benefit people living in 262 unserved muazas of Dera Ghazi Khan, Layyah, Muzaffargarh, Multan, and Rajanpur districts in Punjab, Jamshoro in Sindh, and Barkhan, Musakhel, Sherani, and Sibi in Balochistan covering an approximate unserved area of 12,784.91 sq. km.

Furthermore, the Board also approved the award of two high-speed mobile broadband projects for National Highways and Motorways worth Rs. 6 billion for providing 4G LTE services to commuters on unserved road segments of 622.68 km on M-8 motorway and N-35 highway respectively.

Similarly, the USF Board also approved the award of three optical fiber cable projects worth approximately Rs. 7.7 billion for providing backhaul connectivity to 187 Union Councils (UCs) of Punjab and KP. Under these projects, USF will deploy a total of 1,554 km of optical fiber cable that will benefit over 3.3 million people in the districts of Attock, Sheikhupura, and Nankana Sahib in Punjab and Bannu and Lakki Marwat in KP. These projects are designed to connect 684 educational institutions, 223 government offices, and 268 health institutions along with mandatory connectivity of 408 BTS towers.

May 26, 2023