PakAlumni Worldwide: The Global Social Network

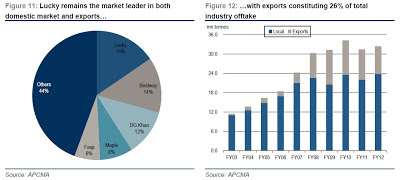

Renewed construction boom in Pakistan has helped the nation's cement producers significantly increase their sales and profits. Year-over-year, income at Lucky Cement, Pakistan's largest producer of building materials, is up 33% while DG Khan Cement, second largest cement company, has quadrupled its profits.

|

| Source: Credit Suisse Report on Pakistan Cement Sector |

Cement production, an important barometer of national economic activity, was up 8% in 2011-12, according to a research report compiled by a Credit Suisse analyst.

CS analyst Farhan Rizvi says in his report that "higher PSDP (Public Sector Development Program) spending has led to a resurgence in domestic cement demand in FY12 (+8%) and with increased PSDP allocation for FY13 (+19%) and General Elections due in Feb-Mar 2013, domestic demand is likely to remain robust over the next six-nine months".

|

| Nagan Chowrangi Interchange in Karachi |

Ongoing public sector projects include new large and small dams, irrigation canals, power plants, highways, flyovers, airports, seaports, etc. Most of these were already in the pipeline when the PPP government assumed control in 2008. Recent pre-election increases in PSDP funding allowed work to resume on these projects in 2011-12.

In addition to public sector infrastructure projects, there is a lot of privately funded real estate development activity visible in all major cities of the country. Big real estate developers like Bahria Town and Habib Construction are developing both commercial and housing projects in Islamabad, Karachi and Lahore. Other cities like Faisalabad, Hyderabad, Larkana, Multan, Mirpur, Peshawar and Quetta are also seeing new housing communities, golf courses, hotels, office complexes, restaurants, shopping malls, etc.

|

| Artist's Rendering of Sheraton Islamabad Golf City Resort |

Credit Suisse is bullish on Pakistan's cement sector in particular and Pakistani shares in general.

CS analyst Farhan Rizvi has initiated coverage with "an OVERWEIGHT stance, as we believe compelling valuations, improving domestic demand outlook, better pricing power and easing cost pressures make the sector an attractive investment proposition. Despite better growth prospects (3-year CAGR of 17% over FY12-15E) and improving margins, the sector trades at an attractive FY13E EV/EBITDA of 3.8x, 49% discount to the historical average multiple of 7.4x. Moreover, FY13E EV/tonne of US$74 is approximately 29% discount to historical average EV/tonne of US$104 and 50% discount to the region".

Another CS analyst Farrukh Khan, based in Credit Suisse’ Asia Pacific

headquarters in Singapore,says in his research report that “liquidity in 2012 has been concentrated in stocks offering positive

earnings surprises (e.g., United Bank, Lucky Cement, DG Khan Cement and

Bank Alfalah), enabling them to be strong outperformers. With further improvements in

liquidity, we expect a broad-based price discovery to take hold in

attractively valued oil and fertilizer stocks as well.”

A string of strong earnings announcements by Karachi Stock Exchange

listed companies and the Central Bank's 1.5% rate cut have already helped the KSE-100 index gain 32% in US dollar terms year to date.

Related Links:

Haq's Musings

Strong Earnings Propel KSE-100 to 4 Year High

Development in Pakistan-Defence.pk

Credit Suisse on Pakistan Cement Sector

Credit Suisse Research Report on Pakistan Equities

Tax Evasion Fosters Aid Dependence

Poll Finds Pakistanis Happier Than Neighbors

Pakistan's Rural Economy Booming

Pakistan Car Sales Up 61%

Resilient Pakistan Defies Doomsayers

Land For Landless Women in Pakistan

Riaz Haq

Here's an ET report on KSE-100 hitting a new high today:

KARACHI:

As investors shrugged off lethargy from the long Eidul Azha weekend, the stock market rebounded amid greater investor participation to close at a new historic high.

“With renewed buying interest from institutional clients and foreign fund managers, the market closed at yet another historic high,” said Topline Securities equity dealer Samar Iqbal. “Investors anticipate lower inflation figures for the month of October, due [to be announced] tomorrow. Bullish sentiments were further augmented after better-than-expected result announcements from Pakistan Petroleum and the Hub Power Company.”

The Karachi Stock Exchange’s (KSE) benchmark 100-share index gained 0.72% or 114.18 points to end at the 15,910.11 points level. Trade volumes surged to 136 million shares compared with Tuesday’s tally of 85 million shares. The value of shares traded during the day was Rs4.96 billion.

“Pakistan stocks closed at their highest-ever, led by oil and cement stocks, as global commodities and stocks rally in the aftermath of Hurricane Sandy,” commented Arif Habib Corp analyst Ahsan Mehanti. He also attributed the market’s optimism to the positive current account balance for the first quarter of the fiscal year, and speculation that the State Bank might announce yet another cut in its policy rate next month.

“Major activity was again seen in the cement sector with DG Khan Cement and Lucky Cement gaining 2.0% and 3.1% respectively,” reported JS Global analyst Shakir Padela. “This is likely on the back of October cement dispatch numbers due to be announced in the coming days.”

DG Khan Cement was the volume leader with 14.98 million shares gaining Rs1.04 to finish at Rs52.91. It was followed by Azgard Nine with 9.00 million shares gaining Rs0.46 to close at Rs6.97 and Askari Bank with 7.73 million shares losing Rs0.07 to close at Rs16.57.

“The Oil and Gas Development Company also managed to close the day up by 2.2% on the back of foreign buying in the script,” added Padela.

Foreign institutional investors were net buyers of Rs264.33 million, according to data maintained by the National Clearing Company of Pakistan Limited.

http://tribune.com.pk/story/459038/market-watch-cement-oil-stocks-t...

Oct 31, 2012

Riaz Haq

Those who keep raising BOP crisis alarm should read the following from Business Recorder:

ABU DHABI: Pakistan expects that strong double-digit growth in remittances from Gulf region will help achieve its overall target of $15 billion in the current fiscal year 2012-13.

Remittances from Gulf Cooperation Council GCC states to Pakistan may hit $10 billion in current fiscal year as the government is confident of having positive results from fresh measures it announced to boost inflows from UAE and Saudi Arabia. Overseas Pakistanis residing in GCC countries sent home a record $8 billion in remittances in financial year 2011-12, reflecting 60.77% share in total remittances of $13.18 billion. About four million overseas Pakistanis residing in Gulf States remitted $6.573 billion in fiscal year 2010-11.

The remittances inflow from Gulf states rose about 21.71% in last fiscal year. Remittances from GCC may reach between $9.5 billion and $10 billion in current fiscal year amid hopes that same growth trend will continue. Remittances from GCC states rose to $730.56 million in July 2012 compared to $677.60 million in same month last year. Total remittances also climbed 9.89% to $1.20 billion last month, indicating a strong growth for rest of the year.

"Pakistan has been witnessing a growing surge in remittances since present democratic government took over in 2008. From mere $6.4 billion remittances in 2008, fiscal year 2011-12 saw record remittances of $13.18 billion. Hopefully, we expect to achieve $15 billion remittances target for the year 2012-13," Pakistan Ambassador to the UAE Jamil Ahmed Khan told Khaleej Times.

Saudi Arabia remained a leading source of remittances for Pakistan in Gulf region with a leading share of $349.66 million in July. The remittances inflow from UAE stood at $240.54 million and other GCC states contributed $140.36 million last month.

---

Remittances witnessed 17.67% annual growth in last fiscal year inviting attention of economic managers to exploit opportunity for enhancing remittances to the maximum.

--------

Analysts say rising foreign remittances has not only brought stability to value of Pakistani rupee, but also played key role in narrowing down gap between foreign payments and receipts. The rising remittances, second major source of foreign exchange earnings after exports, practically helped the country with record foreign exchange reserves despite high oil prices and costly imports.

According to World Bank data, Pakistan has become fifth largest remittances recipient developing country in 2011 after India ($58 billion), China ($57 billion), Mexico ($24 billion), and the Philippines ($23 billion). World Bank estimated that remittance flows are expected to continue growing, with global remittances expected to exceed $593 billion by 2014, of which $441 billion will flow to developing countries.

http://www.brecorder.com/top-news/1-front-top-news/75569-pakistan-e...

Nov 3, 2012