PakAlumni Worldwide: The Global Social Network

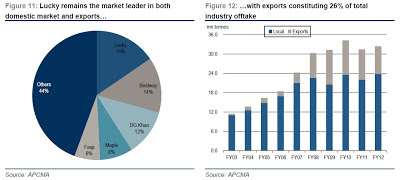

Renewed construction boom in Pakistan has helped the nation's cement producers significantly increase their sales and profits. Year-over-year, income at Lucky Cement, Pakistan's largest producer of building materials, is up 33% while DG Khan Cement, second largest cement company, has quadrupled its profits.

|

| Source: Credit Suisse Report on Pakistan Cement Sector |

Cement production, an important barometer of national economic activity, was up 8% in 2011-12, according to a research report compiled by a Credit Suisse analyst.

CS analyst Farhan Rizvi says in his report that "higher PSDP (Public Sector Development Program) spending has led to a resurgence in domestic cement demand in FY12 (+8%) and with increased PSDP allocation for FY13 (+19%) and General Elections due in Feb-Mar 2013, domestic demand is likely to remain robust over the next six-nine months".

|

| Nagan Chowrangi Interchange in Karachi |

Ongoing public sector projects include new large and small dams, irrigation canals, power plants, highways, flyovers, airports, seaports, etc. Most of these were already in the pipeline when the PPP government assumed control in 2008. Recent pre-election increases in PSDP funding allowed work to resume on these projects in 2011-12.

In addition to public sector infrastructure projects, there is a lot of privately funded real estate development activity visible in all major cities of the country. Big real estate developers like Bahria Town and Habib Construction are developing both commercial and housing projects in Islamabad, Karachi and Lahore. Other cities like Faisalabad, Hyderabad, Larkana, Multan, Mirpur, Peshawar and Quetta are also seeing new housing communities, golf courses, hotels, office complexes, restaurants, shopping malls, etc.

|

| Artist's Rendering of Sheraton Islamabad Golf City Resort |

Credit Suisse is bullish on Pakistan's cement sector in particular and Pakistani shares in general.

CS analyst Farhan Rizvi has initiated coverage with "an OVERWEIGHT stance, as we believe compelling valuations, improving domestic demand outlook, better pricing power and easing cost pressures make the sector an attractive investment proposition. Despite better growth prospects (3-year CAGR of 17% over FY12-15E) and improving margins, the sector trades at an attractive FY13E EV/EBITDA of 3.8x, 49% discount to the historical average multiple of 7.4x. Moreover, FY13E EV/tonne of US$74 is approximately 29% discount to historical average EV/tonne of US$104 and 50% discount to the region".

Another CS analyst Farrukh Khan, based in Credit Suisse’ Asia Pacific

headquarters in Singapore,says in his research report that “liquidity in 2012 has been concentrated in stocks offering positive

earnings surprises (e.g., United Bank, Lucky Cement, DG Khan Cement and

Bank Alfalah), enabling them to be strong outperformers. With further improvements in

liquidity, we expect a broad-based price discovery to take hold in

attractively valued oil and fertilizer stocks as well.”

A string of strong earnings announcements by Karachi Stock Exchange

listed companies and the Central Bank's 1.5% rate cut have already helped the KSE-100 index gain 32% in US dollar terms year to date.

Related Links:

Haq's Musings

Strong Earnings Propel KSE-100 to 4 Year High

Development in Pakistan-Defence.pk

Credit Suisse on Pakistan Cement Sector

Credit Suisse Research Report on Pakistan Equities

Tax Evasion Fosters Aid Dependence

Poll Finds Pakistanis Happier Than Neighbors

Pakistan's Rural Economy Booming

Pakistan Car Sales Up 61%

Resilient Pakistan Defies Doomsayers

Land For Landless Women in Pakistan

Riaz Haq

SHAH BANDAR, Pakistan — In his dreams, Pakistani President Asif Ali Zardari sees a spectacular metropolis rising up from the vast stretches of mangrove swamp and sea-salted wasteland along the mighty Indus River Delta.

High-speed rail zips people from place to place. Vacationers soak up the South Asian sun at seaside resorts. Universities, factories and a new seaport pump vitality into the region. Miles of bike lanes crisscross the city, whose population would eventually reach 10 million.

Zardari wants to call his jewel Zulfikarabad, after Zulfikar Ali Bhutto, the founder of the country's ruling party, a prime minister and president, and the father of Zardari's slain wife, former premier Benazir Bhutto.

That's a lot of dreaming for a country struggling with a dizzying array of afflictions: Millions of Pakistanis are dirt poor, struggling to find clean water, contending with unreliable electricity and living in fear of violent extremists. In addition, the president has continued jousting with Pakistan's Supreme Court over long-standing graft allegations lodged years ago by Swiss authorities.

Such realities have put Zardari's popularity in a tailspin.

Many observers suspect that the president's enthusiasm for Zulfikarabad may be rooted in a burning desire to leave a legacy for this country of 180 million people. He's seeking an enduring achievement, they say, by an administration widely viewed as rife with failure.

Government officials won't place a price tag on the president's lofty vision, which is bound to cost tens of millions of dollars. They say only that the government's share would be limited to the construction of roads, bridges and other infrastructure, with the rest shouldered by investors.

Officials also say they consider the proposed city a desperately needed engine for jobs and economic growth.

Karachi, the country's largest city with a population of 18 million, is bloated with overcrowding and traffic jams, and needs a nearby city that can serve as a relief valve, they say.

"Karachi is getting choked," said Iftikhar Hussain Shah, managing director of the Zulfikarabad Development Authority. "It's going to suffer paralysis because there's no more room. So the people who are trying to look for setting up industries, they are looking for space.

----------

On a recent afternoon in Shah Bandar, a fishing village not far from where ground was broken this summer for a $39-million Zulfikarabad bridge, a group of sweat-soaked fishermen thumbed through a brochure promoting the city. They weren't too ruffled because they remembered a similar idea laid out by Bhutto's administration years ago to turn a nearby fishing hamlet, Keti Bandar, into a major sea port.

"Bhutto said it would happen," said Wali Mohammed, a 30-year-old Shah Bandar fisherman, "but years passed and nothing was built."

http://www.latimes.com/news/nationworld/world/la-fg-pakistan-new-ci...

Nov 3, 2012

Riaz Haq

Here's a News report on Pak current account surplus in Q1 of FY 2012-13:

KARACHI: Pakistan’s current account posted a surplus of $432 million during the first quarter of the current fiscal year, giving some respite to government confronting fast pace of foreign exchange reserves and weak foreign investment inflows, according to the State Bank of Pakistan (SBP) on Thursday.

The country experienced a current account deficit of $1.339 billion during the same period last year, it said.

A modest surplus in the current account balance is in line with the expectations of the economic analysts and experts, which have already indicated that the current account would remain in the green zone for the first quarter of FY13 in the wake of $1.2 billion Coalition Support Fund (CSF) reimbursements transferred by the United States to the services account of the country earlier in August this year.

Despite slowdown in the financial inflows and moderate pace of exports, the analysts attributed the current account surplus to two major developments, external account witnessed a decent growth in workers’ remittances and military aid from the United States under the CFS.

This is the second consecutive surplus in the current account balance as it recorded a surplus of $919 million in July-August FY13.

Analysts said the CSF put positive impact on both, current and fiscal deficits of the country.

“The position of the balance of payments will be highly dependent on the pace of dollar inflows and international oil prices in the second quarter of this fiscal year,” said Sayem Ali, an economist at a foreign bank.

“Oil prices and large debt repayments are likely to pose significant risk to the balance of payments position in FY13,” said Ali.

The country is expected to record small level of current account deficit in anticipation of another $600 million payment by the United States administration under the head of CSF by November, he said. This will help contain the current account deficit and cushion forex reserves to some extent, he added.

“The full-year FY13 current account deficit is likely to be $3.5 billion, or 1.5 percent of GDP as compared to the deficit of $4.6 billion (two percent) reported in the last fiscal year,” he said. The current account witnessed a deficit of $331 million during September 2012 as against the surplus of $1.084 billion for August this year.

The current account during July-September stood at 0.7 percent of GDP as compared to a deficit of 2.3 percent of GDP in the same period last year, it said.

According to the data, the trade balance remained negative as it amounted to $3.634 billion during the first three months of the current fiscal year as compared to $4.158 billion in July-September FY13.

During the period July-September 2012, services account saw a surplus of $2.120 billion as compared to $1.190 billion in the same period last year.

Total exports stood at $5.994 billion against $6.142 billion, while imports reached $9.628 billion against $10.30 billion during the corresponding period a year ago.

http://www.thenews.com.pk/Todays-News-3-138178-Current-account-posts-$432m-surplus-in-first-quarter

Nov 3, 2012

Riaz Haq

Here's an ET report on the performance of a Swedish fund investing in Pakistan:

The company is currently in the process of trying to find a distributor for the British market, where a large Pakistani expatriate population would form a natural investor base. DESIGN: ESSA MALIK

KARACHI:

One of the best performing mutual funds that invests in Pakistani stocks is based in Sweden.

The Tundra Pakistanfond, run by Stockholm-based asset management company Tundra Fonder, was launched in October 2011, within one month of the firm’s founding, and currently has the equivalent of over $40 million in assets under management, belonging to nearly 20,000 Swedish individual investors. Uniquely for European asset managers, Tundra’s Pakistan fund constitutes roughly 80% of the company’s total assets under management, tying its fortunes very closely to the Pakistani economy, or at least European investor interest in it.

But perhaps what is interesting is the fact that the fund is one of the best-performing funds that invests in Pakistan, returning approximately 21.3% in Swedish krone over the past year (about 20.2% in US dollars). That performance handily beats the MSCI Pakistan index, which rose by about 13.1% in US dollar terms during that period. The KSE-100 Index has yielded a 20.7% return in US dollars during that period.

Yet that is not Tundra’s only impressive feat. According to data provided by the Mutual Funds Association of Pakistan, Tundra’s performance, when taking into account the impact of the rupee’s depreciation, would beat all but five of the equity funds managed by firms based in Karachi, placing the Tundra Pakistanfond comfortably in the top one-third of all funds that invest in the Pakistani equity markets.

So how does Tundra do it? Its founder and CEO, Mattias Martinsson, appears to have had substantial experience in investing in emerging and frontier markets. Martinsson, 39, began his career in 1996 at a company called Hagströmer & Qviberg which specialised in offering Russian stocks to Swedish investors. That interest in Russia continues to this day, with Tundra’s only other country-specific fund being a Russia-focused fund.....

This remarkable understanding of the Pakistani market appears to come from a long-abiding interest in the country on the part of Martinsson.

“I came across Pakistan in 2005. At that time I, as most other people today, I had a lot of prejudice. I thought that Pakistan was an underdeveloped equity market, ruled by a military dictator. What I found was something very much different: IFRS [accounting standards], good corporate governance (for emerging markets), good disclosure and a well functioning equity market. In 2007, I attended a frontier markets conference in Singapore and met with ten or so Pakistani companies. Comparing them to the other attendees, I concluded that they were so far ahead, not only compared to their peers in frontier markets but also many emerging markets. I then visited Karachi, Lahore, and Islamabad in early 2008 and came back excited looking for a fund to invest in. There was none. Since then it has been a dream to launch a Pakistan fund.”

While it is not the only European mutual investing exclusively in Pakistan, it appears to be the largest. And given its compliance with UCITS IV European regulations, it is eligible to be marketed throughout the European Union. The company is currently in the process of trying to find a distributor for the British market, where a large Pakistani expatriate population would form a natural investor base.

Given Tundra’s astute investment decisions so far, European investors would be wise to keep an eye on its Pakistan fund.

http://tribune.com.pk/story/459989/frontier-markets-betting-on-paki...

Nov 3, 2012

Riaz Haq

Here's Daily Times on KSE-100 crossing 16000 level:

Hopes for cut in policy rate boost KSE by 289 points

KARACHI: The Karachi stock market witnessed a historic trading week by breaching the psychological level of 16,000 points on back of hopes for further decline in the State Bank of Pakistan’s policy rate after consumer price index (CPI) inflation figures for October 2012 clocked in at 7.66 percent.

The Karachi Stock Exchange (KSE) 100-share index gained 288.83 points or 1.82 percent to close at 16,101.55 points as compared to 15,812.72 points of the previous week.

Analysts said investor sentiment was upbeat at the market throughout the week on expectations that October 2012 CPI figure will slide further.

The market opened on Tuesday after prolonged Eidul Azha vacations on a negative note as Hurricane Sandy that lashed US East Coast triggered uncertainty in global markets and propelled local investors to offload their holdings. The 100-share index shed 16.79 points or 0.11 percent to close at 15,795.93 points as compared to 15,812.72 points.

On Wednesday the market made another historic high level of 15,910 points as hopes for lower inflation for the month of October and better-than-expected earnings of Pakistan Petroleum Ltd and Hubco triggered across-the-board buying. The 100-share index gained 114.18 points or 0.72 percent to close at 15,910.11 points.

The record-breaking spree continued at the market on Thursday as investors went for buying on hopes that lower inflation figure will force the State Bank of Pakistan to reduce the policy rate. The 100-share index gained 52.26 points or 0.33 percent to close at 15,962.37 points

The market continued its record-breaking streak on the last trading day of the week Friday by crossing the psychological level of 16,000 points. The 100-share index gained 139.18 points or 0.87 percent to close at 16,101.55 points. The weekly turnover went up by 40.79 percent and traded 191.49 million shares compared to previous weeks 136.01 million shares.

“Market expectations were realised on Friday with October 2012 CPI clocking in at 7.66 percent as against 8.79 percent in September 2012, thus raising hopes of another rate cut in the next monetary policy (due in December),” said JS Sec analyst Furqan Ayub. “Investors’ interest was concentrated in the cement and textile sectors with Lucky Cement and Nishat Mills outperforming the market by 1.1 percent and 3.6 percent, respectively.”

Net buying by foreigners this week amounted to $12.6 million, he added.

Analysts said the market is at a historic high level and any untoward development can drag the market into the red zone, analysts said and added that technical correction is, however, due next week as usually when the 100-share index breaches psychological levels consolidation is seen and with this historic high it is evident.

http://www.dailytimes.com.pk/default.asp?page=2012\11\04\story_4-11-2012_pg5_16

Nov 4, 2012

Riaz Haq

Here's a Business Recorder report o Pakistan's cement industry:

There are signs of recovery of cement industry, which had generally recorded stagnant sales for the past four years or so, resulting in huge financial losses. The industry suffered a net loss of Rs 337 million in the first half of 2010-11 but earned a net profit of Rs 4,300 million in the first half of 2011-12. According to latest reports, total sales during fiscal year 2011-12 increased to a record level of 32.515 million tons, showing an increase of 8.84% in domestic sales and overall 3.45% increase compared to previous year as exports declined by 9.12%.

This trend of domestic sales is expected to remain in momentum in future, given the present conditions. The 2012-13 federal budget has provided more incentives and relief to cement industry such as excise duty has been slashed by Rs 200 per ton and the GST by one percent. These measures will encourage construction activities in the country.

Cement demand in any country is inextricably linked to the growth in GDP. Pakistan's 3.70 GDP in 2011-12 was lowest in the region but it is projected as 4.30 in the current financial year, following some strong prospects of economic revival. Major driver for cement consumption is infrastructure development and house-building projects. There has been an allocation of Rs 873 billion under the Public Sector Development Programme (PSDP). A number of mega water and power sector projects are in pipeline, including Diamer Bhasha multipurpose project and two additional Chashma Nuclear Power projects, while almost 12 other large projects are planned for initiation during this financial year. Construction of a project of the size of Diamer Bhasha is estimated to create an additional cement demand in the range of 8 to 9 million tons. PSDP allocation to Wapda is to the level of Rs 76.85 billion.

There are 56 housing and works projects covered under the PSDP, besides the ongoing reconstruction and rehabilitation activities nation-wide that would be accelerated, whereas National Highway Authority will get Rs 50.73 billion. Demand of cement is thus projected to grow by more than 20% this year and in subsequent years. Currently, per capita consumption of cement in Pakistan is 131-kg, one of the lowest even among developing countries, while world average is 273-kg. To ensure future economic growth, Pakistan will need to invest considerably in its infrastructure development, despite the economic challenges it faces.

Cement industry comprises 24 cement plants with an annual installed capacity of producing 44.22 million tons of cement. Key players of the industry are Lucky Cement with combined installed capacity of 7.712 million tons of cement annually, Bestway Cement having a combined capacity of 5.914 million tons, DG Khan Cement of 4.220 million tons, Fauji Cement of 3.433 million tons, Maple Leaf Cement of 3.370 million tons and Askari Cement of 2.675 million tons. These six groups of companies represent 62% of total installed capacity for cement production in the country. While these groups have been making substantial profits, small cement producers continue to struggle to recover their operating costs...

http://www.brecorder.com/articles-a-letters/187/1222558/

Here's an excerpt of Pakistan cement and minerals case study by ABB of Switzerland:

The consumption of cement increased from 70 kg in 2003 to 120 kg/capita in 2008, a 70% increase in 5 years.

Pakistan’s cement consumption per capita is comparable to that of India’s, which is at 132 kg.

Pakistan has 28 different cement producers, 22 of which are registered on the Karachi Stock

Exchange.

Production of cement

North region, Punjab and NWPT:

approximately.

30 million tpa.

South region, Sindh and Baluchistan:

approximately 10 million tpa.

minerals

http://www05.abb.com/global/scot/scot244.nsf/veritydisplay/e7af7737...$File/CH_EMR_2009.pdf

Nov 4, 2012

Riaz Haq

Here are a couple reports related to cement demand:

1. Business Recorder on PSDP funds release:

ISLAMABAD: The Planning Commission of Pakistan has so far released Rs87.3 billion under its Public Sector Development Programme (PSDP) against the total allocations of Rs233 billion for the fiscal year 2012-13.

Out of total Rs51.5 billion have been released for 344 infrastructure development projects while Rs33 billion for 673 social sector projects, according to the latest data of the Planning Commission.

Similarly,Rs08 billion have been released for 68 other projects and Rs2 billion for Earthquake Reconstruction and Rehabilitation Authority (ERRA).

According to data, these releases have been made against Rs233 PSDP allocations.

It is pertinent to mention here that the total size of the PSDP for the year 2012-13 is Rs360, including Rs100 billion foreign aid, which is managed by Economic Affairs Division and Rs27 billion special programmes, release of which are made by Cabinet Division or Finance Division.

According to break up details total cost of 344 infrastructure projects has been estimated at Rs2346.4 billion, out of which Rs210.9 billion have been earmarked in the 2012-13 budget that include Rs85.6 as foreign aid.

Likewise, the total cost of social sector projects is Rs547.1, of which Rs136.2 billion have been allocated in the current PSDP with foreign aid of Rs8.4 percent.

The cost of other projects has been estimated at Rs40.6 billion out of which Rs3 billion have been earmarked in the PSDP 2012-13 while Rs10 billion have been earmarked for ERRA in the current development programme.

http://www.brecorder.com/pakistan/general-news/89070-873bn-released...

2. Daily Times on decline i cement exports:

Cement exports declined by 20.59% in October

* Exports to India also decline by 37.5 percent

Staff Report

KARACHI: Overall despatches of cement for the month of October 2012 declined by 5.87 percent mainly due to a drastic decline of 20.59 percent in export of cement.

Revealing the data for the month of October 2012, a spokesman of the All Pakistan Cement Manufacturers Association said that the cement industry despatched 2.767 million tonnes of cement in October 2012 that was 5.87 percent less than 2.939 million tonnes despatched in the corresponding month of 2011.

He said in October 2012 the local cement despatches was 2.086 million tonnes, which were up by 0.19 percent as compared to 2.082 million tonnes despatched in October 2011.

He said in the first four months of this fiscal the total cement despatches stood at 10.474 million tonnes, which was slightly higher than the total despatches of 10.436 million tonnes achieved during corresponding period of last year. He said overall gain in despatches was only 0.37 percent. The capacity utilisation of the industry during July-October 2012 period stood at 70.19 percent.

He said cement exports continued their downward trend in October 2012 as well declining by a massive 20.59 percent from the exports achieved in October 2011. Pakistan exports cement to Afghanistan, India and other destinations through sea. During the period from July-October 2012, exports to Afghanistan declined by 9.46 percent to 1.634 million tonnes.

The exports to India he added declined by 37.51 percent to 0.158 million tonnes and exports to other destinations through sea increased by 2.34 percent to 1.161 million tonnes.

http://www.dailytimes.com.pk/default.asp?page=2012\11\06\story_6-11-2012_pg5_10

Nov 5, 2012

Riaz Haq

Here's PakistanToday on the latest PSDP funds release by Planning Commission:

ISLAMABAD - The Planning Commission of Pakistan released Rs 88.8 billion under its Public Sector Development Programme (PSDP) against the total allocations of Rs 233 billion for the fiscal year 2012-13.

Out of the total Rs 51.5 billion had been released for 344 infrastructure development projects while Rs 34.5 billion had been set aside for 673 social sector projects, according to the latest data of the Planning Commission.

Similarly, Rs 0.8 billion had been released for 68 other projects and Rs 2 billion for Earthquake Reconstruction and Rehabilitation Authority (ERRA).

According to the data, these releases had been made against Rs 233 PSDP allocations up to November 8.

The total size of the PSDP for the year 2012-13 was Rs 360, including Rs 100 billion foreign aid, which was managed by the Economic Affairs Division and Rs 27 billion special programmes, release of which were made by the Cabinet Division or Finance Division.

According to break up details the total cost of 344 infrastructure projects had been estimated at Rs 2346.4 billion, out of which Rs 210.9 billion had been earmarked in the 2012-13 budget that included Rs 85.6 as foreign aid.

The total cost of social sector projects was Rs 547.1 billion, of which Rs 136.2 billion had been allocated in the current PSDP with foreign aid of Rs 8.4 percent.

The cost of other projects had been estimated at Rs 40.6 billion, out of which Rs 3 billion had been earmarked in the PSDP 2012-13 while Rs 10 billion had been earmarked for ERRA in the current development programme.

The Planning Commission of Pakistan had been following a proper mechanism for the release of funds and accordingly funds are released as per given mechanism.

http://www.pakistantoday.com.pk/2012/11/13/city/islamabad/planning-...

Nov 12, 2012

Riaz Haq

Finance Minister Dr Abdul Hafeez Sheikh has said that Pakistan’s economy continues to show signs of recovery with improvement in key macroeconomic indicators. Despite major external and internal shocks, the economy has shown resilience and is projected to grow by 4.3 percent in FY13 after a healthy growth of 3.7 percent in FY12. Exports continue to show a healthy growth, remittances remain strong keeping foreign exchange reserves stable and most importantly inflation has continued to show a declining trend.

The goal is to build on these positive trends and insulate the economy against any potential external shocks such as a rise in oil prices and global contagion, Sheikh said while addressing the inaugural sesson of PSDE on “ Economic Reforms for Productivity, Innovation and Growth” on Tuesday.

He said the Government has successfully doubled the tax collection from Rs.1 trillion to Rs.2 trillion in the last four years; remittances have more than doubled from US$ 6.4 billion in 2007-08 to US$ 13 billion by year end 2011-12. Inflation has moderated to 8.8% in the first four months of FY13. Exports are likely to cross the target of US$ 26bn in FY13. Hard budget constraints are being ensured to maintain fiscal discipline and expenditure has been curtailed to 35% of the budget in the first four months of FY13.

Sheikh said fiscal austerity measures of Rs15bn including freezing of non salary current expenditures and ban on new recruitments are currently under implementation. Austerity measures have been deepened under which current expenditures is being curtailed. Fiscal deficit is projected to be contained at 4.7% of GDP during FY13.

-----------

The finance minister said the government initiated important mega projects in energy and infrastructure sector which would provide the economy a base for sustainable economic growth in future. Some of the initiatives include: Neelum-Jhelum Hydropower Project, Diamer-Bhasha Dam, 4th Tarbela Extension Project; Chashma Nuclear Power Projects 3 and 4, Lyari Expressway, Mekran Coastal Road, M4 Motorway from Faisalabad to Khanewal, KKH Skardu Road and Realignment of KKH Road due to Attabad Lake. Mega projects completed during the period include Chashma Nuclear Power Project 2, Mangla Raising Project, Mirani Dam Project, Islamabad Peshawar Motorway and Islamabad Muzaffarabad Expressway. Overall, 650 projects worth Rs. 300 billion have been launched.

----------

He said major restructuring and reforms in Public Sector Enterprises (PSEs) and energy sector have been undertaken to reduce burden on budget and improve service delivery. Government has undertaken key structural reforms in the power sector under the Power Sector Reform Plan targeted at improving governance and legal framework and ensuring financial sustainability. In addition 3,334 MW has been added since 2008. Ongoing reforms have resulted in relative stability in the power sector and power shortages have been minimized along with reduction in line losses and improved recovery of arrears.

He said import of LNG and natural gas from neighbouring countries are being pursued to overcome the energy crisis. Extensive work is being done on turn-around plans of key PSEs. Restructuring plans of PIA, Pakistan Railways and Pakistan Steel Mills are under implementation and consequently haemorrhaging has been curtailed in these PSEs along with improvement in service delivery. Measures are being strengthened to restructure key PSEs with sound governance structures and professional management.

http://www.nation.com.pk/pakistan-news-newspaper-daily-english-onli...

Nov 13, 2012

Riaz Haq

Here's a News report on Deputy Chairman of Planning Commission criticizing economists at Pak Society of Development Economists (PSDE) conf:

Deputy Chairman Planning Commission, Dr Nadeem Ul Haq, on Thursday lambasted technocrats and economists for giving bad policy advice to politicians in Pakistan. He said that advisers did not focus on government expenditures and only concentrated on increasing revenue through funding from multilateral donors. Wasteful expenditures ballooned as subsidies alone were consuming approximately Rs500 billion per annum, he said.

“As a nation, we failed to increase tax to GDP ratio since independence,” said Haq while chairing the concluding session of a three-day conference that was organised by PIDE in collaboration with HEC, FES, IGC and WWF-CCaP-EU.

He asked why economists do not look at the expenditure side of government operations. Economists blamed politicians for not implementing the desired reform agenda but on the flip side, economists themselves were not presenting the correct agenda to the politicians, he said.

“There has been no growth in the economy as it has followed a dysfunctional model,” he said. Further, everyone was talking about macro stability as the first step and then taking care of growth, he said. “Why can’t we prefer growth? – and I am advocating this despite being affiliated with the IMF in my carrier,” he added. There has been a trade off between two objectives and the economists should come forward to devise a future course of action. Pakistanis built universities without teachers and research, built offices without required officers and built infrastructure without thought, he said. The politicians did not have the ability and understanding to grasp these issues and followed what technocrats advised them to do, he said.

-----------

Former Governor State Bank of Pakistan, Dr. Ishrat Husain, said that the nature of reforms that Pakistan should undertake contain two components – stabilisation and long-term structural reforms. He examined the record of the last 65 years with respect to those reforms as well as political and economic developments.

The incumbent government could not manage the lingering crisis in 2009 forcing Pakistan to approach the IMF in November 2009. A homegrown reform package, consisting mainly of mobilising additional taxes to bring fiscal deficit under control, was agreed upon, he said.

Lack of political consensus on General Sales Tax (GST) and Agriculture Income Tax (AIT) among the coalition partners led to the breaking down of the agreement with the Fund – but only after incurring a heavy financial obligation of eight billion dollars, to be repaid in 2012 and 2013, he said....

http://www.thenews.com.pk/Todays-News-3-143061-Economists-come-unde...

Nov 17, 2012

Riaz Haq

Here's a News report on Oct jump in FDI in Pakistan:

Pakistan’s foreign direct investment (FDI) climbed sharply to $125.4 million during October, providing some relief to the deteriorating balance of payments position, according to the data released by the State Bank of Pakistan (SBP) on Thursday.

The FDI inflows increased to $125.4 million just in the single month of October as compared to $59.6 million during the same month last year, depicting a significant jump of $71.2 million, or 131 percent, it said.

The increase in FDI inflows was evident from the fact that foreign companies invested $187.1 million in various sectors of the economy during October as compared to $186.4 million during the corresponding month last year.

Nonetheless, the FDI outflows, including divestments and repatriation from the foreign investors stood at $61.7 million as against the outflows of $126.8 million during October 2011.

Oil and gas exploration, trade, electrical machinery and transport were the main sectors, which attracted a significant amount of foreign direct investment in the country during the last month.

Economic experts say that improvement in the FDI inflows is a positive sign for the economy, showing revival in investors’ confidence in Pakistan.

The inflows of FDI in Pakistan plummeted by 24.2 percent to $244.4 million during the first four months of the current fiscal year as against $322.7 million during the same period last year.

The fall in FDI inflows during July-October FY13 amounted to $638.5 million as compared to $766.6 million a year ago.

The provisional figures released by the Satate Bank of Pakistan showed that foreign private investment attracted $370.8 million during July-October FY13.

The net inflows of foreign investment in Pakistan stood at $365.2 million as compared to $221.2 million a year ago, showing a growth of 65.1percent.

The portfolio investment at the Karachi Stock Exchange stood at $126.4 million as against the outflow of $74.9 million during the corresponding period last year.

During October, the portfolio investment was recorded at $30.1 million as against the outflow of $28 million last month.

Of the total FDI of $244.4 million, major investment was made in the oil and gas exploration sector followed by IT services and information technology, and the transport sectors.

http://www.thenews.com.pk/Todays-News-3-143063-FDI-rises-to-$1254m-in-October

Nov 17, 2012

Riaz Haq

Barron is reporting that Vanguard has set up an ETF for FTSE emerging market index that includes KSE-100 stocks Abbott Pakistan and Unilever Pakistan.

Pakistan and the United Arab Emirates are probably two markets many U.S. investors haven't given much thought to, but that's beginning to change after news that one of the most popular emerging-market ETFs will have some exposure to these countries.

Vanguard recently said it would start tracking the FTSE Emerging Markets index rather than the MSCI Emerging Markets index for its popular Vanguard MSCI Emerging Markets ETF (ticker: VWO), which will soon be renamed. That means the fund won't have exposure to Korea, which FTSE doesn't consider an emerging market, and it will now have some holdings in Pakistan and the UAE. With those countries combined only making up about half a percentage point of the index, investors won't exactly be loading up on the Middle East. But the switch is already attracting interest to a region that has largely been ignored by investors.

That attention may be warranted. Despite the turmoil in Syria and concerns about Iran, the region has plenty to offer investors, including some of the world's best-capitalized banks, a young population, and governments spurred by the Arab Spring to invest in infrastructure and try to address high unemployment. So says Julie Dickson, equity product manager for emerging-markets specialist Ashmore Investment, which oversees $68 billion in assets. The MSCI Pakistan index is up 20% this year; MSCI UAE is up 21%.

Even with the run-up, Andrew Brudenell, manager of the HSBC Frontier Markets fund (HSFAX) in London, says Pakistan is one of the cheapest markets he follows, at about seven times earnings. He notes that earnings growth has kept pace with the market. The firms, he adds, are typically cash-rich, boast strong return on equity levels in the 20% range, and pay good dividends.

In Pakistan, the informal, cash-based economy for goods and services is larger than the formal economy. Consumer-oriented firms can tap into that demand, so they are a favored play for managers, especially subsidiaries of well-respected global firms like Abbott Pakistan (ABOT.Pakistan) and Unilever Pakistan (ULEVER.Pakistan) that give them more comfort about governance.

While the story attracting investors to Pakistan is domestic, the United Arab Emirates is more of a play on the rest of the Middle East, since it is increasingly a trade and financial hub and has recently acted as a safe haven for people elsewhere in the region. Many people associate the UAE with lavish construction projects and a property bubble, but that bubble popped and the industry is on the mend, with occupancy rates beginning to rise. The country's firms are also well managed and attractively priced, says Brudenell, who favors property developers, banking-service firms and global-ports operator DP World (DPW.Dubai).

http://online.barrons.com/article/SB5000142405274870452610457811502...

Nov 17, 2012

Riaz Haq

Here's ET on Saudi Arabian group planning $1b investment in Cement, Energy, Autos in Pakistan:

ISLAMABAD: Al-Qarnain Group of Saudi Arabia has said it is planning to invest $1 billion in the areas of energy, construction, hospitality and automobiles in Pakistan over the medium term.

Group’s Chief Executive Officer Eyad Al-Baaj, in a meeting with officials of the Board of Investment (BOI), apprised the Pakistani authorities of their investment plans, according to an announcement made by BOI here on Tuesday.

He discussed with BOI Chairman Saleem H Mandviwalla and Secretary Shaikh Anjum Bashir investment opportunities in various sectors of mutual interests of Saudi Arabia and Pakistan.

Al-Baaj said the group would invest $400 million in the first couple of years and increase the investment to over $1 billion in five years. These funds would become part of foreign direct investment in Pakistan and the group was interested in investing in energy, building and construction, hotel and automobile sectors, he added.

“The group is also entering into joint venture with Pakistani cement company Dandore. Current capacity of Dandore is 350 tons a day, which will be enhanced up to 7,500 tons,” he said.

The CEO stressed that the group was aware of the energy problems in Pakistan and was interested in constructing independent power plants with production capacity of 150 to 200 megawatts. The group is also keen on producing solar panels, their installation and back-up services to consumers.

Al-Qarnain, which is one of the biggest construction groups of Saudi Arabia, has also submitted proposals for construction of low-cost housing schemes in Pakistan.

In the automobile sector, the group plans to establish a state-of-the-art assembly plant for heavy trucks and buses with a comprehensive licence from Belarus. The CEO hopes that the plant will meet domestic demand, but its main target is to export vehicles to Gulf states, African countries and other buyers around the globe

http://tribune.com.pk/story/438694/saudi-arabian-group-planning-1b-...

Nov 20, 2012

Riaz Haq

Here's an ET story on Unilever targeting Pakistan market as a priority:

It is a global food and consumer goods giant that serves over 2 billion consumers every day in more than 180 countries around the world, but Unilever’s global management team is convinced that the key to their future success lies in 16 emerging markets, of which Pakistan is one.

Paul Polman, the CEO of Unilever, and Harish Manwani, the chief operating officer, visited Pakistan on Tuesday in what appears to be part of their global push to gear the company’s growth strategy towards emerging markets. “We want to be in every market with more than 100 million consumers,” said Manwani. “And we want to be in every market where the purchasing power of the consumer is growing. Pakistan meets both of those criteria, the first one by quite a lot.”

About 56% of Unilever’s revenues come from emerging markets, a number that Manwani says could rise to as high as 75% over the next few years. In Pakistan, the company operates two subsidiaries, Unilever Pakistan and Unilever Pakistan Foods, both of which are publicly listed on the Karachi Stock Exchange. For the year 2011, the company’s Pakistani subsidiaries earned combined gross revenue of over Rs73 billion, or about 1.3% of the global total for Unilever.

Growth in Pakistan is significantly higher. While Unilever’s global revenues grew by around 5%, revenues in Pakistan grew by a much stronger 9.9%, even when taking into account the rupee’s depreciation against the euro, the company’s global reporting currency. In Pakistani rupees, gross revenues of both companies grew by nearly 17%.

But it is not just the current growth figures that appear to be attracting Unilever’s attention to Pakistan, but rather what is clearly a rapid expansion of the Pakistani middle class, which is causing purchasing power – and thus the propensity to buy branded products – to rise among a wide and diverse array of Pakistani consumers. Unilever is increasingly finding that it is selling its products to everyone from the bank CEO who works on Karachi’s II Chundrigar Road to the small shop owner in rural Sanghar to the grain merchant in a small town outside Sialkot.

------------

Malik said that the company is actively trying to reach consumers in small towns and rural areas, well beyond the larger cities in the country. The company reaches 50,000 retailers in rural areas, said Malik, a number that keeps on expanding rapidly.

That focus on rural consumers appears to be part of the global strategy: Paul Polman said that Unilever’s connection to farmers and rural communities is part of its efforts to integrate its business strategy with social responsibility. “Over 40% of the world’s population is in agriculture. We want to integrate over 500,000 of them into our global supply chain. They tend to be more reliable suppliers and help us reduce our volatility. In turn, we provide them with a better livelihood,” said Polman.

Unilever’s global CEO was effusive in his praise of the team in Pakistan. “The water conservation techniques pioneered in Pakistan will now be replicated in Unilever factories around the world,” he said. “Pakistan has always provided us with talent, and is in fact exporting talent. Over 55 Pakistanis are now working in senior positions in Unilever all over the world.”...

http://tribune.com.pk/story/469350/food-consumer-goods-unilever-tar...

Nov 21, 2012

Riaz Haq

Here's a BR report on Sheraton's expansion in Pakistan:

"Two new Sheraton properties are under construction in Islamabad", revealed Antoine Joignant in a recent interview with BR Research. He elaborated that one site is located on the Islamabad-Murree road, called Sheraton Golf & Country Club; while the other overlooks the Rawal Lake in Islamabad.

"The Sheraton Golf & Country Club shall be the most spectacular property in the country, as it has been designed by the same architects that designed the Atlantis in Dubai. This 367-room hotel shall include an 18-hole golf course with many other amenities for guests," he said. He also revealed that the Sheraton Islamabad shall be a 180-room hotel primarily catering to business travelers.

--.

According to Antoine Joignant, being a part of the Starwood group provides an edge to the Sheraton Karachi over its competitors. One key differentiator is our ability to personalise our services and guest experience through various Starwood online tools which allow real-time tracking of maintenance work and guests' feedback.

As is the norm at most hotels, guests would previously fill out survey cards at the end of a typical stay which would then be sent to be compiled by the relevant department. But the system in place at Starwood Hotels allows guests to offer their feedback online, which is then compiled automatically.

"Now instead of receiving survey results at the end of the month like other hotels, we are receiving guest responses instantaneously. That is revolutionary as it gives us the ability to address clients' requests while they are still at our hotel, instead of waiting for them to come back the next time," he explained.

"We already have a programme in place for our most frequent clients, whom we call ambassadors, whereby a dedicated member of our team helps make arrangements for them according to their personal preferences, he said. The system not only sends clients' comments to hotel management in real-time; it also provides live scores for each location against the hotel chain's benchmarks allowing the hotel management to follow their relative performance. "Globally, we are the only hotel chain to have such a system in place, which is why our service is distinguishable from competitors", he summed up.

PAKISTAN: THE DIAMOND IN THE ROUGH "Pakistan is a treasure trove of culture, natural beauty and mouth-watering cuisines for world travelers," says Antoine. A long list of attractions ranging from the pristine beaches of Karachi and Balochistan, awe-inspiring peaks of the Northern Areas, local art and handicrafts; to the historic sites of Moenjodaro and Harappa, rolled off his tongue like that of a well-traveled local.

"It is very unfortunate that the image that has become attached with this beautiful country is set in violence and unrest," he said. He highlighted recent events such as the Grand Opera, Peshawari Night and food festivals that the hotel conducted to attract international travelers and locals alike; pledging grander functions in the future. He expressed hope that these attractions will play a part in countering negative international perceptions regarding Pakistan.

Antoine Joignant also highlighted that the value for money which guests receive in Pakistan is much higher than that provided by hotels in other countries in the region. He admitted that the local hotel industry is facing tough times given the subdued flow of foreign tourists to the country, but he stressed that occupancy rates have been on the rise for Sheraton Karachi over the past three years.

http://www.brecorder.com/brief-recordings/0/1262726/

Nov 29, 2012

Riaz Haq

Here's Dawn on KSE continuing rally to set ew records:

Pakistani stocks hit a record high for the fourth day in a row on Friday, closing the week up nearly 3 per cent, driven by a rally in cement shares and expectations that the central bank will ease rates next week.

The Karachi Stock Exchange’s (KSE) benchmark 100-share index surged as high as 16,651.10 in intraday trading.

It closed at 16,573.86, up 0.28 per cent or 46.78 points from the previous session.

“Investors remained bullish in cement stocks, while the textile sector also joined the bandwagon,” said Samar Iqbal, an equity dealer with Topline Securities.

“With the end of the year approaching, there was also renewed interest in the banking sector.” Fauji Cement rose 2.05 per cent, or 0.14 rupees, to 6.98 per share, while National Bank was up 4.99 per cent, or 2.37 rupees, to 49.87 per share.

Karachi Electric fell 0.72 per cent, or 0.05 rupees, to 6.88 per share.

The market also found support from expectations that the State Bank of Pakistan will cut its discount rate with inflation under control.

The government will publish November inflation figures on Monday, while the central bank meets later in the week to decide on monetary policy.

In the currency market, the Pakistani rupee strengthened to 96.49/96.54 to the dollar, compared to Thursday’s close of 96.54/96.59.

Overnight rates in the money market remained flat at 9.50 per cent.

http://dawn.com/2012/11/30/pakistani-stocks-hit-fresh-record-high-r...

Nov 30, 2012

Riaz Haq

Here's a BR story on rising cement demand in Pakistan:

KARACHI - The decline in the cement exports to India continues unabated where the uptake of Pakistani cement reduced by 38.50 percent during the first five months of the current fiscal year, 2012-2013. During July-Nov 2011 last year, Pakistan exported 298,214 tons of cement to India which reduced to 183,387 tons this year.

Although cement sector posted a healthy export growth of 11.71 percent in November 2012,India was the only exporting destination where exports declined in November as well.Pakistan exported 45,096 tons of cement to India in November 2011 which declined alarmingly to only 25,207 tons in November 2012. The cement sector of Pakistan otherwise showed healthy growth in the month of November, as for the first time this fiscal, both domestic consumption and cement exports posted double digit growth, on year to year basis. Total cement dispatches at 2.649 million tons during the month of November were, however, lower than dispatch of 2.766 million tons, a month earlier. However, when compared to November 2011 when the total cement dispatches were 2.255 million tons, the sales in the month of November 2012 were higher by 19.63%. Traditionally, cement dispatches in October are higher than in November. The market analysts term the current domestic market situation encouraging as during past five months of this fiscal, the local consumption has increased in four months and declined only in August by 3.41 percent. The local uptake of the commodity increased in two months out of five during this fiscal by over 19 percent. The first time it posted over 19 percent growth was in September 2012 and the second time in November 2012. The overall growth in local dispatches during the first 5 months of this fiscal was 6.78 percent. The cement exports from South zone during July-Nov 2011 were 0.986 million tons that declined in July-Nov 2012 to 0.837 million tons depicting an overall reduction of 15.06 percent. The cement exports from North zone declined nominally by 0.64 percent during this period to 2.804 million tons from 2.823 million tons in the first five months of this fiscal.

http://www.pakistantoday.com.pk/2012/12/04/news/profit/cement-conju...

Dec 3, 2012

Riaz Haq

Here are a few excerpts of State Bank Governor Yasin Anwar's interview with Dawn:

Q. What is the outlook for inflation?

A. As you very well know, inflation has declined considerably over the past five to six months; from 12.3 per cent in May 2012 to 7.7 per cent in October 2012. Also, the pace of decline in inflation has been faster than our earlier estimates. Therefore, we are quite confident that inflation may remain below the target of 9.5 per cent for FY13. We discussed this assessment in the monetary policy statement of October 2012 as well. Currently, we are in the process of updating our inflation outlook in the light of latest developments. All I can say is that the likelihood of meeting the inflation target for FY13 remains quite high.

Q. Without additional foreign inflows, and IMF repayments, is the BOP situation under control?

A. In the first four months of FY13, balance of payment position has shown significant improvement over the last year.

Particularly, the external current account balance has turned into a surplus; $258 million, against a deficit of $1.7 billion in the corresponding period of last year. In the remaining months of FY13, we are expecting a deficit in the external current account.

However, this would remain moderate compared to both international standards and Pakistan’s own economic history.

The developments that need to be monitored carefully are those related to financial inflows. For the overall health of balance of payments, it is important that all the budgeted financial flows materialise. In case of shortfall or delays, the BOP may experience some stress, but, at this point in time, we expect the position to remain manageable during FY13. We do not foresee any difficulty in the repayment of IMF loans and other debt obligations that have already been factored in.

Q. Why, then, is the rupee constantly under pressure?

A. Like in most emerging economies, the day-to-day value of the currency in Pakistan is essentially determined by market forces of demand and supply of foreign exchange. While export receipts, remittances and financial inflows are the main sources of supply of foreign exchange; import payments, financial outflows and debt repayments influence the demand. The overall macroeconomic conditions such as inflation relative to trading partners and other factors like perceptions of economic stability also influence the behaviour of participants in the foreign exchange market. The SBP does not target any specific level of exchange rate. Our interventions in the foreign exchange market are essentially geared towards dealing with excessive volatility to ensure smooth functioning of the market.

As I have mentioned earlier, the trade balance together with remittances is in surplus during the first four months of FY13. It is the weak financial inflows that are creating some pressure in the foreign exchange market. As the budgeted financial inflows are realized in the coming months, the situation would become more manageable.

http://dawn.com/2012/12/02/sbp-in-control-defends-easing/

Dec 5, 2012

Riaz Haq

Here's a PakObserver report on Pak-South Korean deal for Malakand Tunnel project:

Pakistan and South Korea Wednesday inked two agreements for the Malakand Tunnel Construction Project and for development of water resources infrastructure including dams. The agreement on Malakand Tunnel Construction Project was signed during meeting of President Asif Ali Zardari with Kim Yong-Hwan‚ Chairman Export Import Bank of Korea‚ who called on him at the local hotel in Seoul‚ Korea Wednesday.

Under the Malakand Tunnel Loan Agreement‚ an amount of US $78 million will be provided for the project. The Korea Eximbank is an official export credit agency providing comprehensive export credit and guarantee programs to support Korean enterprises in conducting overseas business.

Malakand tunnel will provide a short route not only to people of Dir‚ Malakand and Swat and adjacent localities but would also be an easy access to central Asian states‚ providing the market access to the country for its products. Malakand Pass lies between Dargai-Batkhela and is situated at an altitude of 470 metres and 663 metres‚ respectively.

The South Korean government pledged the $78 million funding through the Economic Development Co-operation Fund (EDCF) for the construction of Malakand Tunnel project in Khyber Pakhtunkhwa province. The 9.7 km project also includes approach roads on both sides of the tunnel and three bridges.

The initial feasibility study of the tunnel has already been completed by South Korean consultants in collaboration with National Highway Authority Pakistan‚ which is also the Project executing agency.

http://pakobserver.net/detailnews.asp?id=185709

Dec 5, 2012

Riaz Haq

In an Express Tribune article titled "Pakistan's tarred reputation", Pak economist Javed Burki paints a grim picture of Pakistani economy and references media stories of violence published in The Economist and The New York Times as a deterrent to foreign investors, governments and IFIs like IMF and World Bank.

http://tribune.com.pk/story/477347/pakistans-tarred-reputation/

What Brurki doesn't say (or maybe he doesn't understand?) is that governments, investors and corporations who do their own research know that Pakistan is too big and important a country which they can not afford to ignore for long.

Pakistan has a large and growing consumer base as well as a growing stockpile of sophisticated nuclear weapons. It can be highly profitable or highly dangerous depending how the world chooses to deal with it.

That's why the total foreign currency inflows into Pakistan have continued to grow for over a decade. Decline in FDI has been more than made up by growing remittances, grants and loans as well as significant increase in exports.

Dec 9, 2012

Riaz Haq

Here's an interesting Huffington Post piece by investment adviser Dan Solin:

Pakistan is often in the news and usually in unflattering terms. The relationship between the U.S. and Pakistan is troubled, characterized by deep mutual distrust and conflicting goals.

The economy of Pakistan is equally troubled. According to the Heritage Foundation, its economy has been plagued by "political instability and violence." Much needed economic reform has been stalled by bureaucratic delays and lack of political will. Property rights in Pakistan are "compromised." The rule of law is "fragile." Taxation is "poorly administered." Its public debt is over 50 percent of total domestic output. Foreign investment is declining. Its overall ranking on economic freedom is below the world and even regional averages, placing it in the category of "mostly unfree" economies. To put this in perspective, there is more economic freedom in Yemen, Senegal and Nigeria than in Pakistan. Its unemployment rate is a staggering 15 percent. Its inflation rate is 11.7 percent.

Does this country seem like a good place to invest to you?

Now for the shocker: Year-to-date returns for the stock market of Pakistan were 46.73 percent. That's not a typo. Year-to-date returns for the U.S. during the same period were 11.90 percent.

Here are some other interesting facts. The stock markets in Nigeria and Kenya

were 27.26 percent and 26.56 percent, respectively. What about the returns in fast-growing economies like Brazil and China? Brazil was an anemic 1.43 percent. China was a loss of 10.20 percent.

If you are a typical investor, you believe paying attention to the financial news is important to your investing success. You read the financial media. You watch CNBC and pay special attention to the fund managers who "explain" the stock markets to you and encourage you to follow their advice (often by investing with their firms). Maybe you follow the stock picks served up by Jim Cramer, who appears to have an encyclopedic knowledge of all things financial.

Let me ask you this question. Did any source of financial news advise you to invest in the stock markets of Pakistan, Nigeria or Kenya? Or Turkey, which topped the list with returns of 47.31 percent? How about your broker or financial adviser? They make it appear they have special insight into the financial markets. Did they advise you to invest in any of the countries reporting returns higher than the U.S.?

The average returns of the 77 countries is a positive return of 8.47 percent. In 2011, the average was a negative 14.15 percent and the list of top performers was markedly different, with Venezuela, Jamaica and Botswana turning in stellar results, along with Pakistan which came in second.

Trying to predict which country will perform best in 2013 is a crapshoot. So is trying to pick stocks that are mispriced, or betting on which asset class will outperform. Yet the securities industry continues to thrive by persuading you to pay its members fat fees for dispensing precisely this kind of "advice."

The next time your broker peers into his crystal ball and makes a recommendation, ask this question: Did you predict stellar returns in Pakistan, Nigeria or Kenya for 2012?

http://www.huffingtonpost.com/dan-solin/you-learn-investors-pakista...

Dec 11, 2012

Riaz Haq

Here's a Bloomberg report on central bank rate cut in Pakistan:

Pakistan cut its benchmark interest rate to the lowest level in five years as policy makers seek to stimulate an economy battered by an energy crisis and insurgency that is likely to need more International Monetary Fund aid.

The State Bank of Pakistan reduced the discount rate by 50 basis points to 9.5 percent, Syed Wasimuddin, spokesman, told reporters in Karachi yesterday. The decision was predicted by 14 of 15 economists surveyed by Bloomberg News. One saw no change.

Pakistan’s economy will probably expand 3.5 percent in the 12 months through June, the IMF forecast Nov. 29, less than the 4.3 percent predicted by the government. Fighting with militants along the nation’s northwest border is sapping the budget and undermining confidence among businesses that are already struggling with record power outages that have shut factories and left thousands of people jobless.

“Pakistan is likely to go back to the IMF for another loan next year,” Hamad Aslam, head of research at Lakson Investments Ltd in Karachi who predicted yesterday’s decision, said before the announcement.

Pakistan is scheduled to repay about $7.5 billion to the Washington-based IMF between 2012 and 2015, with $1.2 billion due in June. A partially disbursed $11.3 billion loan program expired in September 2011.

The central bank’s reduction reflects inflation slowing to a 41-month low of 6.93 percent in November. Today’s cuts add to 2 percentage points of easing since August. The new rate will be effective from Dec. 17.

“Deceleration in inflation is faster than the projected path and credit extended to private businesses remains muted,” the State Bank said in its monetary policy statement yesterday. Average inflation for the year ending June will be below the 9.5 percent target, it said.

While the central bank has scope for a larger cut, it may opt for a conservative approach amid IMF repayments, Uzma Taslim, an analyst at Alfalah Securities Pvt. Ltd. in Karachi, said before the announcement.

The rupee traded at a record high against the dollar this week, after falling 9 percent earlier this year.

“Government finances are also under pressure,” Moody’s Investors Service said in November. “The budgeted deficit of 4.7 percent for the year ending June is likely to see slippage due to optimistic revenue and expenditure assumptions.”

Pakistan recorded the highest budget deficit in two decades in the fiscal year ended June.

www.bloomberg.com/news/2012-12-14/pakistan-cuts-key-rate-to-5-year-...

Dec 15, 2012

Riaz Haq

Here's a Daily Times report on a new steel mill starting production in Karachi:

Pakistan’s largest steel producing mill in private sector Tuwairqi Steel Mills Limited (TSML) is ready for commercial production in the first week of January 2013.

It would cater not only the steel needs of the country but would be able to export value-added products to other countries.

The setting up of such a mega project would entice foreign investors in the country despite the fact that local investors are also shifting their entities abroad because of bad law and order situation and energy crisis.

TSML mega project over $350 million is mainly sponsored by Saudi Arabian-based Al-Tuwairqi Company (ISPC) and Posco of South Korea.

TSML Director Project Zaigham Adil Rizvi at a seminar on Monday said this state-of-the-art Direct Reduction route of Iron (DRI) making plant would be starting commercial production but financial crunch put the project so late.

Posco-South Korean steel giant have invested $16 million to make this mega project keep going.

A revolution of industrial growth is in the offing as TSML is ready for commercial production in coming January. It is Pakistan’s first private sector integrated environment-friendly steel manufacturing project.

TSML will serve as a catalyst for the industrial growth in the country as steel has basic and vital role in the economic development of any country.

He said DRI technology is the latest in the world and is being used in not only developed countries but also in our region like Iran and India, so consistent highly quality of product can be achieved through this state-of-the-art technology, he said adding that this technology is environment-friendly.

Rizvi divulged TSML’s DRI plant after commercial production, would not only meet country’s steel requirements but would also create job opportunities for technical and skilled labour force for local people.

He said his team along with Posco delegates has started searching raw material in Balochistan and hoped they would not spend huge foreign reserves in importing raw material rather they would use the local material.

He claimed country’s workforce, especially the youth was not only dedicated and committed but also hard work, so the future of Pakistan was very bright.

Pakistan’s largest steel capacity of 1.28 million tonnes per annum plant would not only cater country’s requirements but also provide job opportunities to skilled and unskilled people.

Other countries including Korea wanted to purchase total production of TSML but TSML management has decided in principal that we would prefer to distribute all our products within the country and in this regard we have selected Lahore-based Shajarpak Company, as our sole distributor.

Khawaja Usman of Shajarpak said currently Pakistan was depending on imports for the production of heavy mechanical structures and engineering goods but after producing high-quality steel at TSML plant, Pakistan would be able to manufacture such heavy equipment locally.

India is giving more importance to its industrial sector while concerned authorities in Pakistan are least bother in this regard.

He hoped raw material from Balochistan would help steel industry to sell its products on low price.

http://www.dailytimes.com.pk/default.asp?page=2012\12\18\story_18-12-2012_pg5_7

Dec 17, 2012

Riaz Haq

Here's Daily Times on Twariqi Steel Mill plant inauguration in Karachi:

KARACHI: Tuwairqi Steel Mills Limited (TSML) Pakistan’s first private sector integrated environment-friendly steel manufacturing complex of Al-Tuwairqi Holding (ATH)/ISPC of the Kingdom of Saudi Arabia inaugurated by Prime Minister Raja Pervez Ashraf at Port Qasim Karachi on Saturday.

The plant in its first phase has the capacity to produce up to 1.28 million tonnes of high quality Direct Reduced Iron (DRI), which is evidently steel’s most versatile metallic and a preferred raw material for quality steel making worldwide.

Raja Pervez Ashraf congratulated the entire team of TSML on the successful completion of the first phase and committed to extend all possible support from the government for the expansion plans of ATH and POSCO in Pakistan. He said, “It is a matter of great pride for us Pakistan has now started producing DRI, with the completion of the first phase of TSML. We are committed to transform our country into an industrial hub and for that we seek more projects-especially in the steel sector, since steel is the backbone of the industrial growth. TSML in poised to serve as a catalyst for the industrial growth of Pakistan.”

He was of the view currently Pakistan was among the countries that rely mostly on imports when it comes to heavy mechanical structures and engineering goods. By producing high quality steel within Pakistan we can manufacture such equipment locally by value addition with the help of downstream industries, he concluded.

He distributed shields among outstanding employees of TSML as a token of appreciation of their hard work and dedication to successfully complete the first phase.

The first phase has been completed with an investment of over $350 million. The plant spreads over an area of 220 acres at Bin Qasim Karachi and employs the world’s most advanced DRI technology of the MIDREX process owned by Kobe Steel of Japan. ATH/ISPC and POSCO have signed a memorandum of understanding (MoU) with the government of Pakistan for the backward and forward integration with an estimated investment 3 times higher than of the DRI plant. Forward integration would be a further value addition through a Melt Shop, producing world standard steel grades, while backward integration would be to the extent of exploring iron ore locally in Balochistan, its beneficiation and pelletisation as well.

Dr Hilal Hussain Al-Tuwairqi, Chairman Al-Tuwairqi Holding appreciated the efforts of TSML employees. He said Al-Tuwairqi’s vision was to participate in the development of national economy in order to have a long sustaining growth of Pakistan.

“We are looking forward to create for our younger generations, ample job opportunities to build a strong and prosperous nation on the face of this plant. Al-Tuwairqi sees Pakistan as a land of opportunities and we are very clear in our perception that Pakistan as a country has to grow and we are determined to play an instrumental role in its development, he remarked.

Joon Yang Chung Chairman and CEO POSCO of South Korea congratulated the entire team of TSML. He said it was heartening to learn that TSML has increased the production capacity of Pakistan by 1.28 million tonnes per annum, which would help meet the ever growing demands of steel in Pakistan.

Zaigham Adil Rizvi Director (Projects) TSML said TSML has massive expansion and modernisation plans not only to enhance production capacity at an exponential rate but also to improve productivity and efficiency, matching the highest global standards. Pakistan’s current per capita steel consumption is only 40 kilogramme, which is exuberantly low, when compared with the global average of 215 kilogramme. This establishes a dire need increased emphasis on achieving international benchmarks to become a modern and an efficient economy.

http://www.dailytimes.com.pk/default.asp?page=2013\01\13\story_13-1-2013_pg5_2

Jan 12, 2013

Riaz Haq

Here's an ET report on cement sales in July-Dec 2012 period in Pakistan:

Cement consumption in the country increased 11% to 2.24 million tons in December 2012, the highest-ever sales for the month, industry people say.

However, a slump in exports persisted with overseas shipments declining by 10.55% to 580,000 tons in December.

The numbers were released by the All Pakistan Cement Manufacturers Association here on Friday.

In a statement, a spokesman for the association said cement sales in the domestic market rose 7.61% to stand at 11.728 million tons in the first six months (July-December) of financial year 2012-13. Exports remained under pressure, dropping by 5.28% to 4.22 million tons.

In southern parts of the country, sales of cement units in the first half registered a growth of 7.98% in the domestic market, but exports fell by 16.34%.

In the north, where most of the cement is produced, the industry posted a growth of 7.52% in domestic sales while exports edged down 1.31%.

The spokesman was the view that despite much hype, trade with India had not significantly benefitted the cement industry as sales to the neighbour stood at only 209,000 tons in the past six months, down a whopping 40.41%. “This is well below expectations of the cement sector,” he commented.

In fact, he said, exports to India had been on a constant decline ever since the two countries opened their borders for liberal trade. “The decline is not due to lack of demand, but because of very stringent non-tariff barriers imposed by our neighbour,” he said and pointed out that Pakistan’s cement was preferred by the Indians because of better quality.

Stressing that cement exporters have a potential to export a big quantity to the Indian market, he said they were facing strict resistance with barriers still in place even after discussions on the matter in different rounds of official and unofficial talks between the two countries.

Setting aside India, Afghanistan’s market has proved to be quite lucrative for the cement industry. In the past six months, the industry exported 2.41 million tons to the neighbour, where demand stood high in the wake of reconstruction work.

Exports to other destinations through sea also remained stable in the period under review.

http://tribune.com.pk/story/489137/cement-sales-grow-7-exports-lag-...

Jan 12, 2013

Riaz Haq

Here's a SteelFirst report on steel imports in Pakistan:

Pakistan's imports of iron and steel products were 13% higher year-on-year in November, as troubles at state-owned Pakistan Steel continued to encourage purchasing from outside the country.

Imports reached 155,517 tonnes in November, up from 137,548 tonnes a year earlier and a little down from 156,427 tonnes in October this year.

The struggling Pakistan Steel, the country's main producer with 1.1 million tpy of capacity, has been operating at an average utilisation of 20% during 2012 because of financial troubles. Steelmakers in Pakistan also faces higher costs and problems with intermittent power supply.

Both these factors have kept output restrained, encouraging more imports of finished products to fill the gap.

At the same time, the production problems have led to much lower scrap import volumes.

Inbound shipments of ferrous scrap in November dropped to 100,673 tonnes, down 48% on the month and 25% year-on-year.

http://www.steelfirst.com/Article/3134894/Pakistans-steel-imports-u...

Jan 13, 2013

Riaz Haq

New shopping mall to open in Islamabad, reports The Nation:

ISLAMABAD (PR) - The Centaurus Mall, Pakistan’s mega shopping and entertainment destination, is all-set to open its doors by the middle of next month, says a press release.

“We are all set to make a soft launch. Quite a few brands have confirmed their readiness by the date we have communicated to them, and others are working day in and day out to make sure they don’t miss out on this opportunity,” the release stated.

The Centaurus Mall, located at the heart of federal capital, is a multi-facility complex featuring a deluxe mega shopping mall (covering 400,000 sq. ft), 5-screen Cineplex, a state-of-the-art kids entertainment area, and food court offering a variety of cuisines.

“The word is out now, and we are mulling the date of 17th February to make this luxurious dream become a reality. Dozens of top-of-the-line brands are going to be there and the rest of the mall features like Cineplex, and kids play area, health club etc will be up and ready within 20 days of the launch, ShahbazRana, Head Business Development of The Centaurus confirmed.

The multi-billion project is a joint venture of Al-Tamimi Group of Saudi Arabia and Sardar Builders of Pakistan.

http://www.nation.com.pk/pakistan-news-newspaper-daily-english-onli...

Jan 22, 2013

Riaz Haq

Here's PakistanToday on a new skyscraper in Karachi:

KARACHI - City’s tallest building, which has been constructed at a huge investment of Rs 7 billion, is all set to open its doors to the public and corporate sector with the objective to spur business and commercial activities in safe, secure and world class environment.

The high-rise project named Ocean Tower was set to break the record of being the tallest building in the country with 393-feet height and 28 floors, whereas the record was currently being held by a private bank building with a height of 370-feet containing 24 floors, situated on II Chundrigar Road.

Ocean Tower had been built according to international architectural standards and had state-of-art shopping centre and business centre. We have gathered a world of business and entertainment under one roof in the tallest building of the country in which top international brands of clothing, cosmetics, toiletries, food and cinema were available for the masses, said Siddiq Sons CEO Tariq Rafi, the company responsible for building Ocean Tower.

Ocean Tower would welcome a large number of shoppers from across the country, where they could buy goods related to food, health and entertainment, Tariq said. It was a premier place for conducting business and engaging in shopping, he added.

Furthermore, he said that all leading multinational companies and the country's business tycoons have set up their offices in Ocean Tower because they were facilitated into a dream corporate life in which business meetings, seminars and dinners could be arranged in one building while the companies could gain a good image in their relevant industries, he added.

Moreover, Tariq said that Ocean Tower had been built by keeping in mind the demands of modern and luxury lifestyle. The security system would be managed efficiently by man and machines, while uninterrupted power supplies and fire security compliances were also installed for the benefit of investors, he added.

Ocean Tower had been designed and built in such a way that it could effectively withstand earthquake jolts of 8.5 on Richter scale, which was well above the limit of any quake shocks experienced by the country so far. In addition to this, Ocean Tower had been equipped with UFLM fire safety standard, Tariq said, while adding that the building had 4,500 square feet dedicated space for car parking where more than a 1,000 cars could be easily parked.

http://www.pakistantoday.com.pk/2013/01/24/city/karachi/pakistans-t...

Jan 23, 2013

Riaz Haq

Here's the latest cement report on Pakistan:

The All Pakistan Cement Manufacturers Association reported a 10.10% increase in domestic cement consumption in January. The country, which has almost 45 million t of cement capacity, has seen exports fall in recent years as expansion programmes increase capacity in Pakistan’s traditional export markets and new exporters have joined the competition. However, domestic demand is on the rise, hitting an all-time high of almost 24 million t in FY11/12.