PakAlumni Worldwide: The Global Social Network

The Global Social Network

Is Modi's "Make in India" All Hype?

Some of Prime Minister Narendra Modi's supporters claim that his "Make in India" campaign has brought India to the verge of becoming a manufacturing behemoth 69 years after the nation's independence. Others claim India is already a manufacturing powerhouse. Let's examine these claims based on data.

Manufacturing Ranking:

While India now ranks 6th in the world in terms of total manufacturing output, it still sits at a very low 142nd position terms of manufacturing value added per capita, according to the United Nations Industrial Development Organization's Industrial Development Report 2016. Pakistan's manufacturing value added is ranked 146th by the same report.

Manufacturing Output:

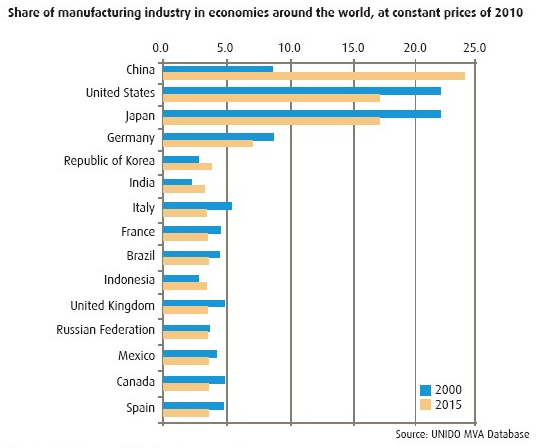

India's 3% share of the world's total manufacturing output puts it at a distant sixth position behind China's 24%, United States' 17%, Japan's 16%, Germany's 7% and South Korea's 4%.

The UNIDO data shows that India's manufacturing value added (MVA) per capita at constant 2005 prices increased from US$155.73 in 2005 to $168.42 in 2014. However, as percentage of GDP at constant 2005 prices in US$, India's MVA decreased from 15.10% in 2005 to 13.85% in 2014

UNIDO reports that Pakistan manufacturing value added (MVA) per capita at constant 2005 prices increased from US$135.03 in 2005 to $143.84 in 2014. Its MVA as percentage of GDP at constant 2005 prices in US$ decreased from 18.05% in 2005 to 17.41% in 2014.

India's manufacturing output declined 0.7% in April-June 2016-17 |

Make in India:

Prime Minister Narendra Modi has recognized how far behind India is in the manufacturing sector. His government's highly publicized "Make in India" is designed to Change that.

What does India, or for that matter any other developing country, need to boost its manufacturing output? Most experts agree on two essential pre-requisites for industrial development:

1. Energy and Infrastructure

2. Skilled Manpower

China's rapid industrialization over the last few decades has shown that the focus must be on the above two to achieve desired results. Has India learned from the Chinese experience? Let's examine this question.

Energy and Infrastructure Development:

"Infrastructure is the biggest hurdle to the ambitious Make in India program of the government," Standard and Poor Global Ratings Credit Analyst Abhishek Dangra told reporters on a conference call, according to India's Economic Times publication.

"The government is scaling up spending, but its heavy debt burden could derail its ambitions to improve public infrastructure," the Standard and Poor report said.

India suffers from huge energy deficit. Over 300 million of India’s 1.25 billion people live without electricity. Another 250 million get only spotty power from India’s aging grid, with availability limited to three or four hours a day, according to an MIT Energy Report. The lack of electricity affects rural and urban areas alike, limiting efforts to advance both living standards and the country’s manufacturing sector.

Skilled Manpower:

“India doesn’t have a labor shortage—it has a skilled labor shortage,” said Tom Captain, global aerospace and defense industry leader at Deloitte Touche Tohmatsu, according to a Wall Street Journal report.

The WSJ report said that over 80% of engineers in India are “unemployable,” according to Aspiring Minds, an Indian employability assessment firm that did a a study of 150,000 engineering students at 650 engineering colleges in the country.

NPR's Julie McCarthy reported recently that ten million Indians enter the workforce every year. But according to the Labour Bureau, eight labor-intensive sectors, including automobiles, created only 135,000 jobs last year, the lowest in seven years.

Impact on Agriculture:

Prime Minister Modi's focus on manufacturing is talking away resources and attention from India's farmers who are killing themselves at a rate of one every 30 minutes.

Majority of Indian farmers depend on rain to grow crops, making them highly vulnerable to changes in weather patterns. As a comparison, the percentage of irrigated agricultural land in Pakistan is twice that India.

More than half of India's labor force is engaged in agriculture. Value added per capita is among the lowest in the world. Pakistan's agriculture value added per capita is about twice India's. This is the main cause of high levels of poverty across India.

Chinese Experience:

China has shown that it is possible to make huge strides in manufacturing while at the same time achieve high productivity levels in agriculture.

On the manufacturing front, China has taken care of the basics like energy, infrastructure and skilled manpower development to achieve phenomenal growth.

As part of the China-Pakistan Economic Corridor (CPEC) development, Pakistanis are learning from the Chinese to replicate success in manufacturing.

The first phases of CPEC are focused on building power plants, gas pipelines, rail lines, roads and ports at a cost of $46 billion. At the same time, China and Pakistan are also focussing on skills training via vocational schools and Pakistan-China Education Corridor. These projects will lay the foundation necessary to ramp up manufacturing in Pakistan.

Summary:

Both India and Pakistan want to emulate the success of China in the manufacturing sector. The Chinese experience has shown that development of energy, infrastructure and skilled labor are essential to achieve their manufacturing ambitions. The South Asians must move beyond hype to do the hard work necessary for it. Pakistan is working with China via CPEC to make progress toward becoming a manufacturing powerhouse.

Related Links:

Auto Industry in India and Pakistan

UN Industrial Development Report 2016

China-Pakistan Economic Corridor

-

Comment by Riaz Haq on January 6, 2023 at 10:29am

-

India will soon overtake China as the world’s most populous country

But it will struggle to reap the benefits of a young workforce

https://www.economist.com/graphic-detail/2023/01/05/india-will-soon...

You might expect production to shift to labour-rich India. That is especially so as relations between China and the West become more hostile. But companies, especially in more advanced industries, tend to set up production in places where there are already suppliers and skilled workers. That is where India has a problem.

India’s development has relied less on industry than that of other emerging economies. Manufacturing generates 14% of Indian GDP, compared with 27% in China. What industry India does have clusters in the relatively prosperous south and west. But it is the poorer northern states that are making more babies (see map). Uttar Pradesh, for instance, is home to 17% of India’s population but has only 9% of its industrial jobs. That mismatch will hamper India’s economic growth.

Internal migration would help. Road, rail and air connections are improving. The government is investing massively in digitisation, which should encourage people to move by helping them to hold on to their ID cards, welfare benefits and voting rights and to communicate with their families at home.

Yet these efforts will take years, maybe decades, to pay dividends. Even as India’s population grows, it will struggle to capitalise on the potential of its young workforce.

-

Comment by Riaz Haq on January 7, 2023 at 6:44pm

-

Ritesh Kumar Singh

@RiteshEconomist

While domestic #demand is hampered by high taxes on both vehicles, fuels, motor insurance and repair and maintenance as well as traffic congestion that jack up the cost of owning #vehicles relatively stronger rupee is hurting #Exports, for instance, of 2W.

https://twitter.com/RiteshEconomist/status/1611901898642321409?s=20...Two-wheeler sales stuttering, how long before it gets better?

After signs of recovery, two-wheeler sales slipped in December showing weakness in domestic demand as well as exports. Expectations are that improving rural demand will drive sales, albeit after a couple of quartershttps://www.moneycontrol.com/news/opinion/two-wheeler-sales-stutter...

ighlights December saw leading two-wheeler firms report a sales drop both year-on-year and month-on-month Domestic demand is yet to grow beyond 2019 pre-pandemic levels Rural sentiment is turning positive but yet to translate into two-wheeler purchases Exports were hit due to devaluation in currencies of importing markets After a couple months of improvement, a weak December for two-wheeler (2W) sales is a setback for forecasts of recovery in 2023. This auto segment registered a marginal year-on-year (yoy) sales rise, while declining compared to the previous...

-

Comment by Riaz Haq on January 27, 2023 at 9:13pm

-

Two-wheeler volumes drop to FY 10/12 levels. Huge drop in entry level Motorcycle sales indicate pain in rural/semi-urban areas. Experts say at least 50% capacity lying idle at two-wheeler factories.

Point to deeply worrying economic realities.

#India 2-Wheeler Sales Volume Declines to 2012 Level: 12.2 Million in 2022. Capacity utilization down to 50%. #Modi #MakeInIndia #Manufacturing #Unempolyment #economy https://timesofindia.indiatimes.com/auto/bikes/two-wheeler-market-s...

https://timesofindia.indiatimes.com/auto/bikes/two-wheeler-market-s...

https://twitter.com/haqsmusings/status/1619198354780733441?s=20&...

-

Comment by Riaz Haq on February 15, 2023 at 7:34am

-

#Apple’s #manufacturing shift from #India to #India hits stumbling blocks. Only 1 out of every 2 components coming off the #Indian casing production line is in good enough shape to eventually be sent to Foxconn for assembly. #MakeinIndia #Modi #Quality https://www.ft.com/content/0d70a823-0fba-49ae-a453-2518afcb01f9

Apple is hitting stumbling blocks in its effort to increase production in India, as the US tech giant faces pressure to cut its manufacturing reliance on China.

The iPhone maker has been sending product designers and engineers from California and China to factories in southern India, to train locals and help establish production, according to four people familiar with the operations.

It comes as Apple attempts to unwind its dependence on a China-centred supply chain strategy, following months of Covid-19 disruption that led to it reporting its first decline in quarterly revenues in three and a half years earlier this month.

Apple is building up nascent operations in India in an overdue diversification strategy, following the blueprint it set in China two decades ago, with engineers and designers often spending weeks or months at a time in factories to oversee manufacturing.

While Apple has been producing lower-end iPhones in India since 2017, last September was significant with Indian suppliers building flagship models within weeks of their launch in China, where virtually all iPhones and other Apple hardware are made.

But its experience in recent months has demonstrated the scale of the work to be done in the country.

At a casings factory in Hosur run by Indian conglomerate Tata, one of Apple’s suppliers, just about one out of every two components coming off the production line is in good enough shape to eventually be sent to Foxconn, Apple’s assembly partner for building iPhones, according to a person familiar with the matter.

This 50 per cent “yield” fares badly compared with Apple’s goal for zero defects. Two people that have worked in Apple’s offshore operations said the factory is on a plan towards improving proficiency but the road ahead is long.

Jue Wang, consultant at Bain, said Apple is at the start of its expansion into India. “We’re not talking the same scale of the Zhengzhou factory” — a factory hub in China known as “iPhone City” that employs some 300,000 workers — “and everybody acknowledges there will be different efficiency, but it is happening”, she said.

In China, suppliers and government officials took a “whatever it takes” approach to win iPhone orders. Former Apple employees describe instances in which they would estimate a certain task might take several weeks, only to show up the next morning to find it already completed at inexplicable speed.

Operations in India are not running at that sort of pace, said a former Apple engineer briefed on the matter: “There just isn’t a sense of urgency.”

A person involved in Apple operations said the process of expanding to India is slow in part because of logistics, tariffs and infrastructure. This person said Apple’s diversification into south-east Asia has been smoother thanks to the Regional Comprehensive Economic Partnership, a free trade agreement among 10 regional nations.

Mark Zetter, president of Venture Outsource, a consultancy for the contract electronics industry, said such inertia has been a problem for years.

Five years ago, when Zetter did research for the Indian think-tank Gateway House, he found contract manufacturers would “frequently claim they can fulfil any need” for an electronics client. But in reality they would be “slow to respond to customer concerns after the deal is signed” and “lack flexibility” to respond to changes.

The Apple engineers have also, at times, been housed at city-centre hotels in Chennai, the capital of the southern Indian state of Tamil Nadu, two hours away from the factories where they are working. This requires four hours of daily commuting, with occasionally poor WiFi connections along the route.

-

Comment by Riaz Haq on March 5, 2023 at 5:00pm

-

Ritesh Kumar Singh

@RiteshEconomist

Most of incentives and #tax breaks funded by the Indian taxpayers are being used to buy Chinese materials and parts to assemble in #India, be it #Electronics #EVs or #SOLAR power #equipment

#PLI #exports #imports #GreenEnergy

https://twitter.com/RiteshEconomist/status/1632237841370566656?s=20

-

Comment by Riaz Haq on May 28, 2023 at 6:06pm

-

UNIDO Report 2022 Industrial Stats (Manufacturing Value Added Per Capita)

https://www.unido.org/publications/international-yearbook-industria...

Afghanistan $28

Bangladesh $356

Brazil $875

China $3,076

Germany $8,270

India $331

Indonesia $776

Iran $712

Iraq $123

Japan $8,110

Kenya $145

Nepal $48

Malaysia

Pakistan $176

Philippines $656

Russia $1,394

Turkey $2,271

UK $4,202

USA $7,343

-

Comment by Riaz Haq on June 1, 2023 at 8:58pm

-

#Modi's #semiconductor #manufacturing plan flounders as firms struggle to find #tech partners. Modi has made it top priority for #India's economic strategy to "usher in new era in electronics manufacturing" by luring global companies. #MakeInIndia

https://www.reuters.com/world/india/india-chip-plan-stalls-after-to...

NEW DELHI/OAKLAND, California, June 1 (Reuters) - Big companies including a Foxconn joint venture that bid for India's $10 billion semiconductor incentives are struggling due to the lack of a technology partner, a major setback for Prime Minister Narendra Modi's chipmaking ambitions.

A planned $3 billion semiconductor facility in India by chip consortium ISMC that counted Israeli chipmaker Tower as a tech partner has been stalled due to the company's ongoing takeover by Intel, three people with direct knowledge of the strategy said.

A second mega $19.5 billion plan to build chips locally by a joint venture between India's Vedanta and Taiwan's Foxconn is also proceeding slowly as their talks to rope in European chipmaker STMicroelectronics (STMPA.PA) as a partner are deadlocked, a fourth source with direct knowledge said.

Modi has made chipmaking a top priority for India's economic strategy as he wants to "usher in a new era in electronics manufacturing" by luring global companies.

India, which expects its semiconductor market to be worth $63 billion by 2026, last year received three applications to set up plants under the incentive scheme. They were from the Vedanta-Foxconn JV; a global consortium ISMC which counts Tower Semiconductor (TSEM.TA) as a tech partner; and from Singapore-based IGSS Ventures.

The Vedanta JV plant is to come up in Modi's home state of Gujarat, while ISMC and IGSS each committed $3 billion for plants in two separate southern states.

The three sources said ISMC's $3 billion chipmaking facility plans are currently on hold as Tower could not proceed to sign binding agreements as things remain under review after Intel acquired it for $5.4 billion last year. The deal is pending regulatory approvals.

Talking about India's semiconductor ambitions, India's deputy IT minister Rajeev Chandrasekhar told Reuters in a May 19 interview ISMC "could not proceed" due to Intel acquiring Tower, and IGSS "wanted to re-submit (the application)" for incentives. The "two of them had to drop out," he said, without elaborating.

Tower is likely to reevaluate taking part in the venture based on how its deal talks with Intel pan out, two of the sources said.

-

Comment by Riaz Haq on June 6, 2023 at 9:05am

-

Bridge under construction in #India has collapsed - for the second time in just over a year, once again raising questions about the quality of its construction. #BridgeCollapse #infrastructure #Modi #BJP #Hindutva #Islamophobia #Corruption https://www.cnn.com/2023/06/06/india/india-bihar-bridge-collapse-in...

A four-lane concrete bridge being built across the River Ganges in the east Indian state of Bihar has collapsed for the second time in just over a year, once again raising questions about the quality of its construction.

Video shows the 3-kilometer (1.8-mile) bridge dramatically crashing into the river on Sunday, sending a plume of debris and dust into the sky and waves rippling across the holy river.

The Sultanganj Bridge has collapsed twice since construction began in 2017, the first time in April last year before Sunday’s catastrophic failure. It’s not clear why the bridge collapsed last year or if those problems had been rectified.

Crowds of people on the river bank can be seen filming the bridge and shouting as it tumbles down. CNN has not been able to confirm reports of any injuries.

On Monday, Bihar’s chief minister Nitish Kumar said he had ordered an inquiry into the incident.

In a statement Monday, the Canadian design and engineering firm behind the bridge, McElhanney, it was aware of the “partial collapse” of the bridge and is “deeply concerned” about the safety and well-being of those affected by the incident.

The company will “cooperate with any investigation,” the statement added.

CNN has reached out to SP Singla Constructions, who was building the bridge, but did not receive an immediate response.

According to McElhanney, the bridge was expected to include four lanes of traffic and a footpath, providing “an important new link across the Ganges.”

It was also expected to ease congestion on the state’s three existing road bridges, the firm said on its website.

The Sultanganj Bridge is not the only one to have collapsed in India in the last year. Last October, a suspension bridge gave way in the town of Morbi in Gujarat, killing 135 people.

-

Comment by Riaz Haq on June 8, 2023 at 9:57am

-

Chris Kay

@christopherkay

The more India tries to ramp up production, the more it depends on China for components and raw materials, report

@vrishtibeniwal

https://www.bloomberg.com/news/articles/2023-06-08/modi-s-make-in-i...

https://twitter.com/christopherkay/status/1666641446869544960?s=20

----------------

Fun Zoo Toys is an Indian manufacturing success story. The maker of heart-shaped cushions and “Little Ganesha” dolls started out as a family business in 1979 and has grown to be one of the nation’s major manufacturers of fluffy toys.

Sales doubled after Prime Minister Narendra Modi’s Made-in-India push saw import duties on toys ramped up from 20% to 70% over three years to 2023. But that’s just half of the story: the production surge to meet those sales wouldn’t have been possible without raw materials like metallic pins, integrated circuits and LEDs imported from China.

--------------

The Make in India dream keeps colliding with the Chinese reality

Read more at:

https://economictimes.indiatimes.com/news/economy/policy/the-make-i...

Last month, External Affairs Minister S. Jaishankar said Indian businesses need to stop looking for a "China fix", while terming the Make in India programme a strategic statement to spur the country's manufacturing.

Jaishankar was voicing the general sentiment that China's cheap imports de-industrialise India, take away millions of jobs and keep it dependent on China, therefore India's trade imbalance with China calls for more local manufacturing. India's trade gap with China widened to $83.2 billion in the last fiscal as against $72.91 billion in 2021-22. Exports to China dipped by about 28 per cent to $15.32 billion in 2022-23, while imports rose by 4.16 per cent to $98.51 billion in the last fiscal.

The solar dilemma

India's solar industry is an example of how India faces a complex challenge to fulfill its Make in India ambition. India might cut its import duties on solar panels to half, Reuters has reported recently. The renewable energy ministry has held talks with the finance ministry to approve its request to cut the import tax on solar panels from 40% to 20%,

India's nascent solar modules industry, which has been growing in the shelter of high tariffs, dread such a steep cut in import duties. The duty cut will deliver a blow to India's ambition of quickly expanding local production.

But local plants can’t keep up with rising demand and India must import solar modules to fill the gap. India is aiming to install 280 gigawatts of solar generation by 2030, compared to about 64 gigawatts now, as it overhauls its coal-dominated power grid, according to news agency Blomberg. That would require the addition of 27 gigawatts of capacity every year for the rest of the decade — more than double the volume installed last year.

While its local industry can't meet the rising demand, India must import more solar modules. But that imperils its nascent domestic industry which must grow to support the solar energy targets. “Such volatile changes in government policy show that businesses can’t be dependent on policy support,” Vinay Rustagi, MD at Bridge To India, a renewable energy consulting firm, told Bloomberg recently. “It’s a dampener for domestic manufacturing prospects.”

The China conundrum

Even when India tries to become more self-reliant by increasing local manufacturing capacity, it still has to depend on China for critical intermediate inputs. Take the case of Apple's iPhones made in India by Tata. Almost 90% components used for Apple phones by Tata are sourced from Mainland China, even as Apple looks to shift manufacturing to India, ET has reported recently. Items such as brackets, industrial glues, screws, mesh, pressure sensitive adhesives and metal parts are all shipped from China as per Apple’s instructions.

-

Comment by Riaz Haq on June 8, 2023 at 9:58am

-

The Make in India dream keeps colliding with the Chinese reality

The China conundrum

Even when India tries to become more self-reliant by increasing local manufacturing capacity, it still has to depend on China for critical intermediate inputs. Take the case of Apple's iPhones made in India by Tata. Almost 90% components used for Apple phones by Tata are sourced from Mainland China, even as Apple looks to shift manufacturing to India, ET has reported recently. Items such as brackets, industrial glues, screws, mesh, pressure sensitive adhesives and metal parts are all shipped from China as per Apple’s instructions.

Only Apple’s old-time vendors such as Foxconn, Pegatron and Wistron manufacture “end-to-end” phones in India. In FY23, India accounted for 5% of iPhone’s total global production and exported phones worth $5 billion, a near four-fold surge compared with a year ago.

Localisation of manufacturing, the domestic value addition, however, can't happen before manufacturing achieves critical mass. Till then, India will have to depend on China for imports of intermediate goods. If you add to it the import of finished items where India cannot compromise growth, such as in the solar sector, it indicates a heavy reliance on China. It means India's project to become self-reliant in manufacturing must depend on imports from China, at least initially.

Many electric two-wheeler companies cornering subsidies, aimed at promoting domestic manufacturing to meet the ambitious green mobility goals, from the government without fulfilling the localisation requirements is a case in point. Many parts are imported from China due to lack of sufficient local manufacturing.

What are the prospects?

Global supply chains are not easy to shift from countries where they got embedded in a vast local manufacturing ecosystem. The countries trying to do that must develop comparable ecosystems which can't happen overnight. Meanwhile, they will have to depend on imports from China. Tariffs alone can't help local industries.

But India's concerted push for self-reliance in manufacturing, powered by hefty production-linked incentives, is not without results. India's imports of electronic goods such as laptops, personal computers, integrated circuits and solar cells from China declined during 2022-23, according to a report by economic think tank Global Trade Research Initiative (GTRI). The fall in imports is notable in electronic items where the incentives scheme is operational. Import of medical equipment declined 13.6 per cent to $2.2 billion last fiscal year as compared to 2021-22. Similarly, import of solar cells, parts, diodes slumped 70.9 per cent to $1.9 billion in 2022-23.

However, import of lithium-ion batteries surged about 96 per cent to $2.2 billion last fiscal year. India's green mobility goals will only increase these imports steeply. For India to keep its growth steady, meet its energy goals and expand its manufacturing base, the Make in India must be supported by Make in China.

Read more at:

https://economictimes.indiatimes.com/news/economy/policy/the-make-i...

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistanis' Insatiable Appetite For Smartphones

Samsung is seeing strong demand for its locally assembled Galaxy S24 smartphones and tablets in Pakistan, according to Bloomberg. The company said it is struggling to meet demand. Pakistan’s mobile phone industry produced 21 million handsets while its smartphone imports surged over 100% in the last fiscal year, according to …

ContinuePosted by Riaz Haq on April 26, 2024 at 7:09pm

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network