PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan's Choice: CAREC or SAARC or Both?

Ideally, Pakistan should be a major player in both vibrant regions. However, Indian Prime Minister Narendra Modi's policy of attempting to isolate Pakistan has essentially forced it to choose.

First, Mr. Modi decided to boycott this year's SAARC summit that was scheduled to take place in Islamabad, Pakistan. Then, he unsuccessfully attempted to hijack the BRICS economic summit in India to use it as a political platform to attack and isolate Pakistan. The signal to Pakistan was unmistakable: Forget about SAARC.

Central Asia Regional Economic Cooperation (CAREC):

CAREC is a growing group of nations that is currently made up of 11 members, including China and a list of STANs. The current membership includes Afghanistan (joined CAREC in 2005), Azerbaijan (2003), People's Republic of China (1997), Georgia (2016), Kazakhstan (1997), Kyrgyz Republic (1997), Mongolia (2003, Pakistan (2010), Tajikistan (1998), Turkmenistan (2010) and Uzbekistan (1997).

The last ministerial meeting of CAREC nations was held in Islamabad in October, 2016. The conference theme was “Linking connectivity with economic transformation".

Welcoming fellow ministers, Pakistan's Finance Minister Ishaq Dar talked about the importance of the China-Pakistan Economic Corridor (CPEC) to improve trade flow within the region and with the rest the rest of the world.

Dar said CPEC offered a massive opportunity for connectivity between Central Asia, Middle East and Africa and was bound to play a defining role in economic development of the regions.

Dar said improving the transport corridor was not an end in itself but it was an investment in establishing sound infrastructure and complementary frameworks for shared prosperity of the present and future generations in the region, according to a report in Pakistani media.

CAREC Corridors:

CAREC region is building six economic corridors to link Central Asian nations. Six multi-national institutions support the CAREC infrastructure development, including the Asian Development Bank (ADB), United Nations Development Program (UNDP), International Monetary Fund (IMF), World Bank, Jeddah-based Islamic Development Bank and European Bank for Reconstruction & Development, according to Khaleej Times.

Out of the total $27.7 billion CAREC infrastructure investment so for, $9.9 billion or 36 per cent was financed by ADB, a senior officer of the Manila-based multinational bank told Khaleeej Times.

He said other donors had invested $10.9 billion while $6.9 billion was contributed by CAREC governments. Of these investments, transport got the major share with $8 billion or 78 per cent. Asian Development Bank Vice President Wencai Zhang said: "There are huge financing requirements in Carec for transport and trade facilitation, for which 108 projects have been identified at an investment cost of $38.8 billion for the period 2012-2020. Investment for the priority energy sector projects will be $45 billion in this period."

CPEC North-South Corridor:

China Pakistan Economic Corridor (CPEC) is a major part of the north-south corridor that will allow trade to flow among CAREC member countries, many of which are resource-rich but landlocked nations. The corridor will enable the group to access to the Pakistani seaports in Gwadar and Karachi as part of the new maritime silk route (MSR) as envisioned by China and Pakistan.

Pakistan's Finance Minister Dar says the CPEC would complement the regional connectivity initiatives of CAREC. "Once the six CAREC corridors and mega ports, now under construction, start operating, they will provide access to global markets. They will deliver services that will be important for national and regional competitiveness, productivity, employment, mobility and environmental sustainability. All of us should gear our national policies to achieve these targets."

CPEC consists of transport and communication infrastructure—roads, railways, cable, and oil and gas pipelines—that will stretch 2,700 kilometers from Gwadar on the Arabian Sea to the Khunjerab Pass at the China-Pakistan border in the Karakorams.

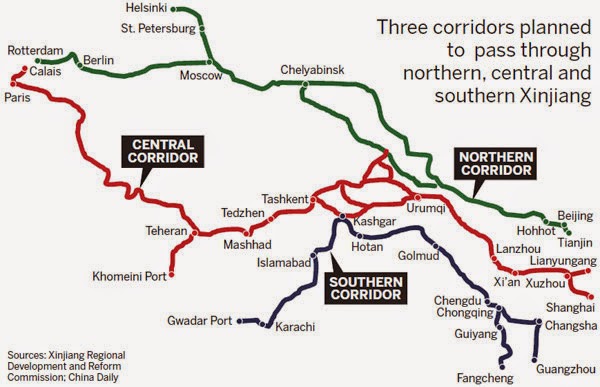

China and Pakistan are developing plans for an 1,800 kilometer international rail link from the city of Kashgar in the Xinjiang Uygur autonomous region in Western China to Pakistan's deep-sea Gwadar Port on the Arabian Sea, according to Zhang Chunlin, director of Xinjiang's regional development and reform commission.

"The 1,800-kilometer China-Pakistan railway is planned to also pass through Pakistan's capital of Islamabad and Karachi," Zhang Chunlin said at the two-day International Seminar on the Silk Road Economic Belt in Urumqi, Xinjiang's capital, according to China Daily.

"Although the cost of constructing the railway is expected to be high due to the hostile environment and complicated geographic conditions, the study of the project has already started," Zhang said. "China and Pakistan will co-fund the railway construction. Building oil and gas pipelines between Gwadar Port and China is also on the agenda," Zhang added.

Pakistan is making a serious effort to stabilize Afghanistan, a member of CAREC. A trilateral conference of China, Russia and Pakistan is scheduled this month in Moscow as part of this effort. Afghan instability has prevented Pakistan from connecting with other STANs for commerce and trade. Now the development of CPEC will enable Pakistan to bypass Afghanistan, if necessary, to connect with Central Asia region through Western China.

Summary:

History shows that growth of regional and global trade in East Asia, Europe and North America regions has been a major driver of economic opportunity and prosperity. Unfortunately, SAARC has been a huge disappointment for Pakistanis. With the development of CPEC and CAREC, Pakistan can now begin to participate in the growth of regional and global trade that will benefit the people of Pakistan. The path to Pakistan's participation in SAARC will open up if or when India-Pakistan relations improve.

Here's a National Geographic Documentary on CPEC:

https://youtu.be/q2lWYxbIBCs

Related Links:

Haq's Musings

1800 Km Pak-China Rail Link

China Pakistan Economic Corridor

CPEC to Create Over 2 Million Jobs

Modi's Covert War in Pakistan

ADB Raises Pakistan GDP Growth Forecast

Gwadar as Hong Kong West

China-Pakistan Industrial Corridor

Indian Spy Kulbhushan Yadav's Confession

Ex Indian Spy Documents RAW Successes Against Pakistan

Pakistan FDI Soaring with Chinese Money for CPEC

-

Comment by Riaz Haq on December 25, 2022 at 4:34pm

-

CAREC ENERGY OUTLOOK 2030

https://www.adb.org/sites/default/files/publication/850111/carec-en...

Total installed power generation capacity in Pakistan is 34.5 gigawatts (GW), and consists

mostly of thermal generation, reaching around 66% of the total. The significance of thermal

generation is expected to decrease in the future, since the government has set a course to shift

toward increasing renewable energy (including hydropower) generation. Pakistan’s massive

renewable energy potential—about 3.0 terawatts (TW)—is one of the key drivers of this shift

(Figure 66).

• Pakistan’s domestic energy production consists of oil, natural gas, and coal. However,

insufficient investment in exploration and development activities has made the country

rely heavily on imports—nearly 40% of its total primary energy supply is imported. Having

insufficient cross-border infrastructure and no operating cross-border pipelines for the transit

of natural gas and oil, Pakistan imports energy sources mostly via coastal terminals.

• Final energy demand in Pakistan was about 96 million tons of oil equivalent (toe) in 2018, and

is projected to reach 108–126 million toe in 2030, depending on the scenario. Natural gas is

expected to increase its share in the total energy supply, while reliance on biomass will decrease,

leading toward a cleaner future for residential consumers.

• The country has vast renewable energy resources, with total technical potential reaching

2,900 GW for solar, 340 GW for wind, and 60 GW for hydropower (Faizi 2020; UNIDO 2016).

Increasing the share of hydropower could help in terms of grid balancing, solving the issue of

solar and wind intermittency.

• In addition to the development of renewable energy and alternative sources, such as nuclear

power, priority investments in Pakistan include the introduction of smart metering and smart

grids, as well as energy efficiency measures.

• Further development of the transmission and distribution (T&D) network is crucial for

the country, as 25% of the population is not grid-connected and thus has no access to the

electricity network.

• Total investment needs for the energy sector vary significantly across all three scenarios—

from $62 billion to $155 billion—illustrating the significant requirements for transitioning

to more sustainable sources of energy generation and implementing extensive energy

efficiency measures.

• Pakistan’s energy sector presents significant investment opportunities because of its efforts

to transition to a more competitive energy market structure, its continued support for private

projects, and the government’s commitment to significantly develop renewable energy sources

in the future.

• Several challenges need to be addressed to introduce a more favorable investment climate,

including circular debt issues, and the overall condition and coverage of the T&D grid.

-

Comment by Riaz Haq on December 25, 2022 at 4:34pm

-

CAREC ENERGY OUTLOOK 2030

https://www.adb.org/sites/default/files/publication/850111/carec-en...

Total installed power generation capacity in Pakistan is 34.5 gigawatts (GW), and consists

mostly of thermal generation, reaching around 66% of the total. The significance of thermal

generation is expected to decrease in the future, since the government has set a course to shift

toward increasing renewable energy (including hydropower) generation. Pakistan’s massive

renewable energy potential—about 3.0 terawatts (TW)—is one of the key drivers of this shift

(Figure 66).

• Pakistan’s domestic energy production consists of oil, natural gas, and coal. However,

insufficient investment in exploration and development activities has made the country

rely heavily on imports—nearly 40% of its total primary energy supply is imported. Having

insufficient cross-border infrastructure and no operating cross-border pipelines for the transit

of natural gas and oil, Pakistan imports energy sources mostly via coastal terminals.

• Final energy demand in Pakistan was about 96 million tons of oil equivalent (toe) in 2018, and

is projected to reach 108–126 million toe in 2030, depending on the scenario. Natural gas is

expected to increase its share in the total energy supply, while reliance on biomass will decrease,

leading toward a cleaner future for residential consumers.

• The country has vast renewable energy resources, with total technical potential reaching

2,900 GW for solar, 340 GW for wind, and 60 GW for hydropower (Faizi 2020; UNIDO 2016).

Increasing the share of hydropower could help in terms of grid balancing, solving the issue of

solar and wind intermittency.

• In addition to the development of renewable energy and alternative sources, such as nuclear

power, priority investments in Pakistan include the introduction of smart metering and smart

grids, as well as energy efficiency measures.

• Further development of the transmission and distribution (T&D) network is crucial for

the country, as 25% of the population is not grid-connected and thus has no access to the

electricity network.

• Total investment needs for the energy sector vary significantly across all three scenarios—

from $62 billion to $155 billion—illustrating the significant requirements for transitioning

to more sustainable sources of energy generation and implementing extensive energy

efficiency measures.

• Pakistan’s energy sector presents significant investment opportunities because of its efforts

to transition to a more competitive energy market structure, its continued support for private

projects, and the government’s commitment to significantly develop renewable energy sources

in the future.

• Several challenges need to be addressed to introduce a more favorable investment climate,

including circular debt issues, and the overall condition and coverage of the T&D grid.

-

Comment by Riaz Haq on December 25, 2022 at 4:35pm

-

CAREC ENERGY OUTLOOK 2030

https://www.adb.org/sites/default/files/publication/850111/carec-en...

Energy Sector Profile

Country Profile

Pakistan is the world’s fifth most populous country, with a population of more than 225 million people

and a $264 billion nominal gross domestic product (GDP), as of 2020. Pakistan’s population and economy

have grown at a steady pace, with the GDP growing annually by 4%–6%, and the population by 2%, since

2015. While the coronavirus disease (COVID-19) pandemic has slowed down economic growth to

0.5% in 2020, Pakistan is expected to recover, with a projected economic annual growth rate of nearly 6%

until 2025.

Pakistan’s energy sector is highly dependent on fossil fuel imports. Due to insufficient exploration and

development activities, the country is a major importer of fossil fuels, such as oil and coal. Moreover, issues

with ever-increasing demand and an inability to meet needs with existing power generation capacities

have forced consumers to use biomass as means of cooking and heating, especially in the agriculture

sector, which makes up most of the GDP. On the other hand, being one of the largest countries in the

region, Pakistan has vast renewable resources, such as hydropower, solar photovoltaic (PV), and wind, as

well as experience in power generation from nuclear power. However, the share of electricity production

from renewables has been decreasing since 2015, with fossil-fuel based generation on an upward trend in

development (Figure 67). This has led to increases in carbon intensity, putting Pakistan in 95th position

out of 172 countries in 2018. Energy efficiency measures in Pakistan require further development and

implementation. The country was ranked the 87th most energy-intensive economy in the world in 2018.

--------

Energy Sector and Technologies Assessment

Conventional Fuel Production

Pakistan’s domestic energy production consists of oil, natural gas, and coal. The country also has significant

undeveloped oil and gas potential. However, insufficient investment in exploration and development

activities due to pricing policies has limited Pakistan’s ability to achieve security of supply through domestic

energy production.

Domestic oil production in the country amounted to around 4 million tons in 2019, while total import

volume was more than 10 million tons. The main production sites are located in Punjab and Sindh

provinces. The country is also planning to expand its refinery capacities to meet growing demand,

with a target capacity of 48 million tons per year by 2030. In 2019, total natural gas production stood at

33 billion cubic meters (bcm), slightly lower than domestic demand. The Sui Gas field is the largest natural

gas field in Pakistan, accounting for 10% of total domestic production (Pakistan Petroleum Limited).

However, major oil and natural gas fields in the country are in the later stages of their lifecycle, with

gradually declining production volumes.

Coal in Pakistan is mainly produced in Balochistan, Punjab, and Sindh provinces. While production was

only 3.3 million tons in 2015, the country expanded its production to nearly 6.8 million tons in 2019.

However, the country still imported approximately 15 million tons of coal to satisfy demand. Overall, coal

resources in Pakistan are estimated at more than 3 billion tons.

-

Comment by Riaz Haq on December 25, 2022 at 4:35pm

-

CAREC ENERGY OUTLOOK 2030

https://www.adb.org/sites/default/files/publication/850111/carec-en...

Energy Sector Profile

Country Profile

Pakistan is the world’s fifth most populous country, with a population of more than 225 million people

and a $264 billion nominal gross domestic product (GDP), as of 2020. Pakistan’s population and economy

have grown at a steady pace, with the GDP growing annually by 4%–6%, and the population by 2%, since

2015. While the coronavirus disease (COVID-19) pandemic has slowed down economic growth to

0.5% in 2020, Pakistan is expected to recover, with a projected economic annual growth rate of nearly 6%

until 2025.

Pakistan’s energy sector is highly dependent on fossil fuel imports. Due to insufficient exploration and

development activities, the country is a major importer of fossil fuels, such as oil and coal. Moreover, issues

with ever-increasing demand and an inability to meet needs with existing power generation capacities

have forced consumers to use biomass as means of cooking and heating, especially in the agriculture

sector, which makes up most of the GDP. On the other hand, being one of the largest countries in the

region, Pakistan has vast renewable resources, such as hydropower, solar photovoltaic (PV), and wind, as

well as experience in power generation from nuclear power. However, the share of electricity production

from renewables has been decreasing since 2015, with fossil-fuel based generation on an upward trend in

development (Figure 67). This has led to increases in carbon intensity, putting Pakistan in 95th position

out of 172 countries in 2018. Energy efficiency measures in Pakistan require further development and

implementation. The country was ranked the 87th most energy-intensive economy in the world in 2018.

--------

Energy Sector and Technologies Assessment

Conventional Fuel Production

Pakistan’s domestic energy production consists of oil, natural gas, and coal. The country also has significant

undeveloped oil and gas potential. However, insufficient investment in exploration and development

activities due to pricing policies has limited Pakistan’s ability to achieve security of supply through domestic

energy production.

Domestic oil production in the country amounted to around 4 million tons in 2019, while total import

volume was more than 10 million tons. The main production sites are located in Punjab and Sindh

provinces. The country is also planning to expand its refinery capacities to meet growing demand,

with a target capacity of 48 million tons per year by 2030. In 2019, total natural gas production stood at

33 billion cubic meters (bcm), slightly lower than domestic demand. The Sui Gas field is the largest natural

gas field in Pakistan, accounting for 10% of total domestic production (Pakistan Petroleum Limited).

However, major oil and natural gas fields in the country are in the later stages of their lifecycle, with

gradually declining production volumes.

Coal in Pakistan is mainly produced in Balochistan, Punjab, and Sindh provinces. While production was

only 3.3 million tons in 2015, the country expanded its production to nearly 6.8 million tons in 2019.

However, the country still imported approximately 15 million tons of coal to satisfy demand. Overall, coal

resources in Pakistan are estimated at more than 3 billion tons.

-

Comment by Riaz Haq on December 25, 2022 at 4:36pm

-

CAREC ENERGY OUTLOOK 2030

https://www.adb.org/sites/default/files/publication/850111/carec-en...

Electricity Generation

Pakistan’s electricity sector has a total installed capacity of 34.5 GW, with thermal generation dominating

the power mix, having a share of 66% (National Transmission and Despatch Company 2020). Gas-fired

plants are the main source of power, having an installed capacity of almost 9.3 GW, while oil-fired power

plants have 6.5 GW installed capacity and coal-fired plants have 4.6 GW. Since the regulatory framework

allowed independent power producers to develop generation projects, multiple new thermal power

plants were constructed. As the country’s oil and natural gas reserves are diminishing, further growth in

alternative energy sources is needed.

Historically, hydropower was one of the main sources of electricity generation in Pakistan. The total

hydropower resource potential is estimated at 60 GW (Faizi 2020). However, with the expansion of

thermal power, its share in electricity has declined significantly and currently holds a 29% share of total

installed capacity. The country has 30 hydropower plants in operation, with a total installed capacity

of 9.9 GW, including 17 categorized as major hydropower and 13 as small hydropower units operating

mainly as a run-of-river units. The three main projects are Tarbela Dam (4.8 GW installed capacity),

Ghazi–Barotha (1.4 GW), and Mangla Dam (1.1 GW). Tarbela and Mangla dams, commissioned in the

1970s, are considered the main contributors to hydropower generation. To enhance the quality and

reliability of supply, Mangla Dam is planned for refurbishment, and Tarbela Dam for extension.

Pakistan’s first nuclear power plant, Karachi Nuclear Power Plant (KANUPP), began operations in 1970,

with a capacity of 100 megawatts (MW). Since then, nuclear power generation has experienced active

growth, and current capacity is 2.5 GW. Cross-country cooperation is a cornerstone of Pakistan’s strategy

to reach its goal of 8,800 MW of nuclear installed capacity by 2030. Currently, one new reactor of

1,100 MW is being built.

The country’s renewable energy potential has been realized to only a limited extent. The theoretical

potential of total wind energy is estimated at 340 GW, with the southern wind corridors being the most

auspicious—the Gharo–Keti Bandar wind corridor has over 50 GW of potential alone. However, only

around 1.1 GW of wind energy capacity is currently in operation. Likewise, solar power has tremendous

potential—as high as 2,900 GW, only about 0.4 GW of which is installed as of 2021. Although projects such

as the Quaid-e-Azam Solar Park (0.4 GW capacity) were successfully implemented, the lack of political

commitment, land availability, and the lower performance of outdated PV plants installed earlier are among

the reasons for limited development of renewable energy. Additional potential solutions include offshore

wind, floating solar PV in existing hydropower reservoirs, and wind farms near hydropower plants with

integration into existing grid infrastructure.

Country Outlooks 2030—Pakistan 1

Power generation during fiscal year 2020 reached 121,691 GWh: 32% by hydroelectric plants, 57% by

thermal plants, 8% by nuclear plants, and 3% by renewable energy power plants.

-

Comment by Riaz Haq on December 25, 2022 at 4:36pm

-

CAREC ENERGY OUTLOOK 2030

https://www.adb.org/sites/default/files/publication/850111/carec-en...

Electricity Generation

Pakistan’s electricity sector has a total installed capacity of 34.5 GW, with thermal generation dominating

the power mix, having a share of 66% (National Transmission and Despatch Company 2020). Gas-fired

plants are the main source of power, having an installed capacity of almost 9.3 GW, while oil-fired power

plants have 6.5 GW installed capacity and coal-fired plants have 4.6 GW. Since the regulatory framework

allowed independent power producers to develop generation projects, multiple new thermal power

plants were constructed. As the country’s oil and natural gas reserves are diminishing, further growth in

alternative energy sources is needed.

Historically, hydropower was one of the main sources of electricity generation in Pakistan. The total

hydropower resource potential is estimated at 60 GW (Faizi 2020). However, with the expansion of

thermal power, its share in electricity has declined significantly and currently holds a 29% share of total

installed capacity. The country has 30 hydropower plants in operation, with a total installed capacity

of 9.9 GW, including 17 categorized as major hydropower and 13 as small hydropower units operating

mainly as a run-of-river units. The three main projects are Tarbela Dam (4.8 GW installed capacity),

Ghazi–Barotha (1.4 GW), and Mangla Dam (1.1 GW). Tarbela and Mangla dams, commissioned in the

1970s, are considered the main contributors to hydropower generation. To enhance the quality and

reliability of supply, Mangla Dam is planned for refurbishment, and Tarbela Dam for extension.

Pakistan’s first nuclear power plant, Karachi Nuclear Power Plant (KANUPP), began operations in 1970,

with a capacity of 100 megawatts (MW). Since then, nuclear power generation has experienced active

growth, and current capacity is 2.5 GW. Cross-country cooperation is a cornerstone of Pakistan’s strategy

to reach its goal of 8,800 MW of nuclear installed capacity by 2030. Currently, one new reactor of

1,100 MW is being built.

The country’s renewable energy potential has been realized to only a limited extent. The theoretical

potential of total wind energy is estimated at 340 GW, with the southern wind corridors being the most

auspicious—the Gharo–Keti Bandar wind corridor has over 50 GW of potential alone. However, only

around 1.1 GW of wind energy capacity is currently in operation. Likewise, solar power has tremendous

potential—as high as 2,900 GW, only about 0.4 GW of which is installed as of 2021. Although projects such

as the Quaid-e-Azam Solar Park (0.4 GW capacity) were successfully implemented, the lack of political

commitment, land availability, and the lower performance of outdated PV plants installed earlier are among

the reasons for limited development of renewable energy. Additional potential solutions include offshore

wind, floating solar PV in existing hydropower reservoirs, and wind farms near hydropower plants with

integration into existing grid infrastructure.

Country Outlooks 2030—Pakistan 1

Power generation during fiscal year 2020 reached 121,691 GWh: 32% by hydroelectric plants, 57% by

thermal plants, 8% by nuclear plants, and 3% by renewable energy power plants.

-

Comment by Riaz Haq on December 25, 2022 at 4:37pm

-

CAREC ENERGY OUTLOOK 2030

https://www.adb.org/sites/default/files/publication/850111/carec-en...

Transmission and Distribution

Pakistan’s power T&D system is suffering from significant energy losses and disruptions. In 2020, 19.8%

of energy was lost during its transmission, distribution, and delivery to end consumers. Among the

10 distribution companies, losses vary greatly from 9% to 39% (NEPRA 2020). On average, the country

experienced 81 interruptions (system average interruption frequency index) lasting nearly 5,300 minutes

(system average interruption duration index) in 2020. The poor performance can be attributed to a

variety of factors, including poor technical conditions, insufficient collection rate of accounts receivable,

and issues with circular debt present in the country.

Pakistan had 7,470 kilometers (km) of 500 kilovolts (kV) and 11,281 km of 220 kV T&D lines in 2020.

Distribution companies are responsible for T&D activities below 132 kV. Importantly, only 74% of Pakistan’s

population is connected to the power grid. With high electricity losses and frequent outages, Pakistan is

planning to introduce advanced grid management infrastructure and metering. Advanced conductors and

other smart grid upgrades could help reduce T&D losses.

There are two operators in Pakistan’s natural gas T&D system: Sui Northern Gas Pipelines Limited

(SNGPL), covering the central and northern regions of the country; and Sui Southern Gas Company

Limited (SSGCL), covering the southern regions. Total grid losses accounted for nearly 17% by SSGCL and

11% by SNGPL in 2020. According to estimates, average leakage rate is 4.9 leaks per km for SSGCL, and

2.2 leaks per km for SNGPL (for comparison, this value equals 0.2 in Germany and 0.4 in Massachusetts, on

average). The gas pipeline systems require a major overhaul and modernization to increase the efficiency

of transportation and to reduce leakages.

Cross-Border Infrastructure

In terms of cross-border power interconnections, Pakistan has one operational line as of 2021:

Mand–Jakigur, connecting Pakistan and Iran, with a capacity of 104 MW. In addition, Pakistan,

Afghanistan, the Kyrgyz Republic, and Tajikistan, have launched the Central Asia–South Asia (CASA-1000)

project, a mega power interconnection project of 1,300 MW. Pakistan’s part of CASA-1000 is currently

under construction, and is expected to transport electricity from Tajikistan and the Kyrgyz Republic. The

uncertain political situation in Afghanistan, through which CASA-1000 will transit to reach Pakistan, has

rendered difficult any predictions as to when and if the project can be successfully commissioned.

Natural gas is imported via sea terminals, mainly through two terminals located in the Qasim and Karachi

ports, with a cumulative capacity of 12 bcm annually. As of 2021, there are no operating cross-border

natural gas pipelines in Pakistan. However, in response to growing demand, the government has been

planning the construction of natural gas pipelines to increase import capacity, with the Iran–Pakistan

pipeline expected to be commissioned by 2025. The Turkmenistan–Afghanistan–Pakistan–India (TAPI)

pipeline has been discussed since more than a decade, but its realization remains uncertain given the

situation in Afghanistan and other political tensions between the participating countries. Further efforts to

bridge the supply and demand gap are planned with the construction of two additional terminals, bringing

total import capacity to nearly 18 bcm per annum.

-

Comment by Riaz Haq on December 25, 2022 at 4:37pm

-

CAREC ENERGY OUTLOOK 2030

https://www.adb.org/sites/default/files/publication/850111/carec-en...

Transmission and Distribution

Pakistan’s power T&D system is suffering from significant energy losses and disruptions. In 2020, 19.8%

of energy was lost during its transmission, distribution, and delivery to end consumers. Among the

10 distribution companies, losses vary greatly from 9% to 39% (NEPRA 2020). On average, the country

experienced 81 interruptions (system average interruption frequency index) lasting nearly 5,300 minutes

(system average interruption duration index) in 2020. The poor performance can be attributed to a

variety of factors, including poor technical conditions, insufficient collection rate of accounts receivable,

and issues with circular debt present in the country.

Pakistan had 7,470 kilometers (km) of 500 kilovolts (kV) and 11,281 km of 220 kV T&D lines in 2020.

Distribution companies are responsible for T&D activities below 132 kV. Importantly, only 74% of Pakistan’s

population is connected to the power grid. With high electricity losses and frequent outages, Pakistan is

planning to introduce advanced grid management infrastructure and metering. Advanced conductors and

other smart grid upgrades could help reduce T&D losses.

There are two operators in Pakistan’s natural gas T&D system: Sui Northern Gas Pipelines Limited

(SNGPL), covering the central and northern regions of the country; and Sui Southern Gas Company

Limited (SSGCL), covering the southern regions. Total grid losses accounted for nearly 17% by SSGCL and

11% by SNGPL in 2020. According to estimates, average leakage rate is 4.9 leaks per km for SSGCL, and

2.2 leaks per km for SNGPL (for comparison, this value equals 0.2 in Germany and 0.4 in Massachusetts, on

average). The gas pipeline systems require a major overhaul and modernization to increase the efficiency

of transportation and to reduce leakages.

Cross-Border Infrastructure

In terms of cross-border power interconnections, Pakistan has one operational line as of 2021:

Mand–Jakigur, connecting Pakistan and Iran, with a capacity of 104 MW. In addition, Pakistan,

Afghanistan, the Kyrgyz Republic, and Tajikistan, have launched the Central Asia–South Asia (CASA-1000)

project, a mega power interconnection project of 1,300 MW. Pakistan’s part of CASA-1000 is currently

under construction, and is expected to transport electricity from Tajikistan and the Kyrgyz Republic. The

uncertain political situation in Afghanistan, through which CASA-1000 will transit to reach Pakistan, has

rendered difficult any predictions as to when and if the project can be successfully commissioned.

Natural gas is imported via sea terminals, mainly through two terminals located in the Qasim and Karachi

ports, with a cumulative capacity of 12 bcm annually. As of 2021, there are no operating cross-border

natural gas pipelines in Pakistan. However, in response to growing demand, the government has been

planning the construction of natural gas pipelines to increase import capacity, with the Iran–Pakistan

pipeline expected to be commissioned by 2025. The Turkmenistan–Afghanistan–Pakistan–India (TAPI)

pipeline has been discussed since more than a decade, but its realization remains uncertain given the

situation in Afghanistan and other political tensions between the participating countries. Further efforts to

bridge the supply and demand gap are planned with the construction of two additional terminals, bringing

total import capacity to nearly 18 bcm per annum.

-

Comment by Riaz Haq on December 25, 2022 at 4:37pm

-

CAREC ENERGY OUTLOOK 2030

https://www.adb.org/sites/default/files/publication/850111/carec-en...

Oil is also currently imported via sea terminals. Oil terminals (the Karachi port, the Qasim port, and the

Balochistan refinery single-point mooring terminal) are located near Karachi and have a total import

capacity of 51 million tons per year (Table 6).

Energy Consumption

Pakistan’s industry is dominated mostly by small and medium-sized enterprises in sectors such as

leather, textiles, and food processing. Most entities use fossil fuels as feedstock and run on outdated and

inefficient equipment. Cement and brick industries in Pakistan have historically been the two main energy

consumer groups. The combined potential of energy efficiency measures for these industries represents

about 40% of the total industry energy savings potential. Key levers include switching to multistage dry

kilns for cement or the introduction of modern designs, such as zig-zagging for brick kilns. The National

Energy Efficiency and Conservation Authority (NEECA) has been a main driver of progress, having

recently implemented a mandatory energy efficiency policy for electric motors, showing the government’s

commitment to increasing energy savings. The NEECA also plays a prominent role in promoting energy

audits in various industrial sectors. As a result of these efforts, Pakistan’s energy intensity declined

from 5.1 megajoules (MJ) per dollar of GDP in 2007 to 4.4 MJ per dollar of GDP in 2015. Despite these

developments, the institutional framework for energy efficiency requires significant further development

to achieve higher levels of efficiency across the board.

Energy efficiency measures in Pakistan often require region-specific optimization, especially in building

structures (for example, buildings in southern parts require more cooling than heating). One of the key

challenges is the inadequate energy performance standards of the Building Energy Code of Pakistan. The

Code focuses mainly on efficiency in commercial buildings, which was last updated in 2011, and failed to

introduce modern efficiency standards. For instance, the measures that might have the largest impact

in terms of energy savings include building envelope insulation and efficient lighting. Some efforts to

improve consumption efficiency can, however, already be observed—for example, the distribution of free

compact fluorescent lamps to replace inefficient incandescent bulbs and promote more energy-efficient

solutions for artificial lighting.

While the transport sector plays a leading role in the country’s economic activity, it is also the biggest

contributor to air pollution, with the transport sector making up more than 40% of total emissions.

Importantly, Pakistan has been experiencing a rapid growth in the number of vehicles in use, as the

share of households owning a car increased from 6% to 9% in 2021. Recognizing challenges related to

imports of oil products, the government actively promotes the use of electric vehicles (EVs). For instance,

the recently approved National Electric Vehicle Policy introduced tax incentives for imports and

production, and also set ambitious EV targets for 2030 (30% of newly sold cars and trucks, and 50%

of buses and two- and three-wheelers, to be EVs). In terms of railway transport, Pakistan relies solely

on diesel locomotives as of 2021—the country used to have 16 electric locomotives in the early 2000s,

but the government closed the lines and stopped using them after frequent copper theft incidents at

different points along the tracks. Still, Pakistan has continued efforts to improve efficiency by replacing old

locomotives, leading to substantial energy savings of 3.5 million liters of diesel in 2019.

-

Comment by Riaz Haq on December 25, 2022 at 4:37pm

-

CAREC ENERGY OUTLOOK 2030

https://www.adb.org/sites/default/files/publication/850111/carec-en...

Oil is also currently imported via sea terminals. Oil terminals (the Karachi port, the Qasim port, and the

Balochistan refinery single-point mooring terminal) are located near Karachi and have a total import

capacity of 51 million tons per year (Table 6).

Energy Consumption

Pakistan’s industry is dominated mostly by small and medium-sized enterprises in sectors such as

leather, textiles, and food processing. Most entities use fossil fuels as feedstock and run on outdated and

inefficient equipment. Cement and brick industries in Pakistan have historically been the two main energy

consumer groups. The combined potential of energy efficiency measures for these industries represents

about 40% of the total industry energy savings potential. Key levers include switching to multistage dry

kilns for cement or the introduction of modern designs, such as zig-zagging for brick kilns. The National

Energy Efficiency and Conservation Authority (NEECA) has been a main driver of progress, having

recently implemented a mandatory energy efficiency policy for electric motors, showing the government’s

commitment to increasing energy savings. The NEECA also plays a prominent role in promoting energy

audits in various industrial sectors. As a result of these efforts, Pakistan’s energy intensity declined

from 5.1 megajoules (MJ) per dollar of GDP in 2007 to 4.4 MJ per dollar of GDP in 2015. Despite these

developments, the institutional framework for energy efficiency requires significant further development

to achieve higher levels of efficiency across the board.

Energy efficiency measures in Pakistan often require region-specific optimization, especially in building

structures (for example, buildings in southern parts require more cooling than heating). One of the key

challenges is the inadequate energy performance standards of the Building Energy Code of Pakistan. The

Code focuses mainly on efficiency in commercial buildings, which was last updated in 2011, and failed to

introduce modern efficiency standards. For instance, the measures that might have the largest impact

in terms of energy savings include building envelope insulation and efficient lighting. Some efforts to

improve consumption efficiency can, however, already be observed—for example, the distribution of free

compact fluorescent lamps to replace inefficient incandescent bulbs and promote more energy-efficient

solutions for artificial lighting.

While the transport sector plays a leading role in the country’s economic activity, it is also the biggest

contributor to air pollution, with the transport sector making up more than 40% of total emissions.

Importantly, Pakistan has been experiencing a rapid growth in the number of vehicles in use, as the

share of households owning a car increased from 6% to 9% in 2021. Recognizing challenges related to

imports of oil products, the government actively promotes the use of electric vehicles (EVs). For instance,

the recently approved National Electric Vehicle Policy introduced tax incentives for imports and

production, and also set ambitious EV targets for 2030 (30% of newly sold cars and trucks, and 50%

of buses and two- and three-wheelers, to be EVs). In terms of railway transport, Pakistan relies solely

on diesel locomotives as of 2021—the country used to have 16 electric locomotives in the early 2000s,

but the government closed the lines and stopped using them after frequent copper theft incidents at

different points along the tracks. Still, Pakistan has continued efforts to improve efficiency by replacing old

locomotives, leading to substantial energy savings of 3.5 million liters of diesel in 2019.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistanis' Insatiable Appetite For Smartphones

Samsung is seeing strong demand for its locally assembled Galaxy S24 smartphones and tablets in Pakistan, according to Bloomberg. The company said it is struggling to meet demand. Pakistan’s mobile phone industry produced 21 million handsets while its smartphone imports surged over 100% in the last fiscal year, according to …

ContinuePosted by Riaz Haq on April 26, 2024 at 7:09pm

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network